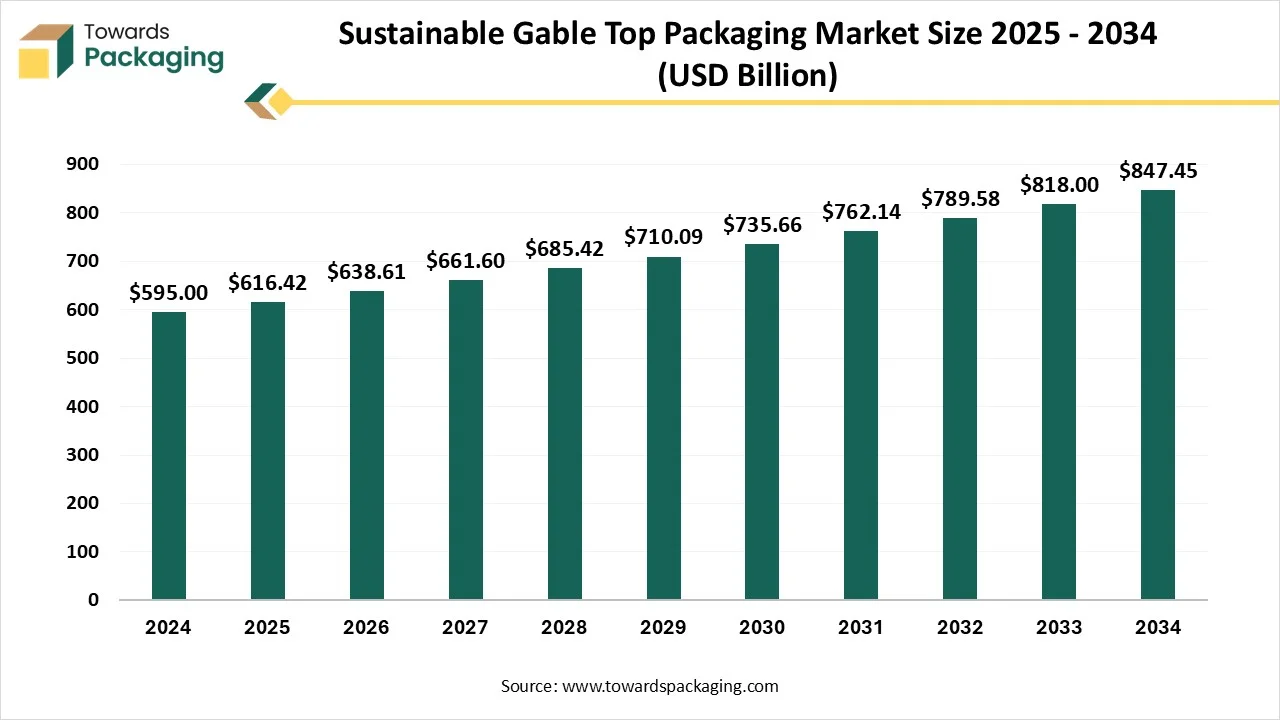

Revenue, 2024

595.00 Bn

Forecast, 2034

847.45 Bn

CAGR, 2025 - 2034

3.60%

Report Coverage

Worldwide

The global sustainable gable top packaging market is projected to grow from US$ 595 billion in 2024 to US$ 847.45 billion by 2034, reflecting a CAGR of 3.6%.

Sustainable gable top packaging, an innovative form of sustainable packaging, provides an eco-conscious alternative to traditional liquid and food cartons. Designed with recyclable and renewable materials, these cartons maintain durability, convenience, and brand visibility while reducing environmental impact.

The market is expanding across dairy, beverage, food, and even personal care segments as companies prioritize circular economy models and reduced plastic dependency. However, fluctuating U.S. tariffs are reshaping international competition and disrupting cross-border supply chains, forcing global packaging players to adapt with counterstrategies and regional sourcing realignments.

Leading companies such as Tetra Pak, Elopak, Nippon Paper Industries, Parksons Packaging, Italpack Cartons, and Pactiv Evergreen dominate the market, supported by emerging innovators like EcoEnclose and Semcorp that emphasize sustainable packaging solutions.

Key Highlights

- Market Growth: Rising from US$ 592M (2025) to US$ 847.45M (2034) at 3.6% CAGR.

- Trade Impact: U.S. tariff volatility introduces supply chain risks and realignment pressures.

- Sustainability Push: Strong demand from food, dairy, and beverage industries for renewable packaging.

- Competitive Landscape: Established players (Tetra Pak, Elopak, Nippon Paper) face competition from eco-focused startups.

- Regional Dynamics:

- North America: Driven by dairy and beverage demand; tariff policies influencing market costs.

- Europe: Strict environmental regulations fueling rapid adoption.

- Asia-Pacific: Strong growth in China, India, and Southeast Asia due to expanding dairy and beverage sectors.

- Latin America & MEA: Gradual adoption with potential in food and personal care packaging.

Sustainable Gable Top Packaging Market Share, By Type, 2024 (%)

| Type | Share |

| Small Capacity (≤ 500 ml) | 24.0% |

| Medium Capacity (500 ml – 1000 ml) | 44.0% |

| Large Capacity (> 1000 ml) | 32.0% |

Reasoning:

- Medium Capacity (500 ml – 1000 ml) holds the largest share, as it is the most commonly used size in the packaging of beverages and dairy products, which dominate the market.

- Small Capacity (≤ 500 ml) has a solid share due to its wide usage in personal care products and small beverage containers.

- Large Capacity (> 1000 ml) holds a smaller share, primarily used in specialized applications like industrial or bulk packaging, which limits its demand.

Sustainable Gable Top Packaging Market Share, By Application, 2024 (%)

| Application | Share |

| Dairy | 40.0% |

| Beverages | 21.0% |

| Food | 13.0% |

| Personal Care | 7.0% |

| Other | 6.0% |

Reasoning:

- Dairy holds the highest share, as gable top packaging is highly prevalent in dairy products such as milk, cream, and juices, which are staple items in most households.

- Beverages follow closely, as gable top packaging is used extensively for beverages like juice, tea, and flavored drinks.

- Food has a moderate share, as gable tops are used for some processed food items, but not as commonly as for dairy and beverages.

- Personal Care and Other have smaller shares, with personal care products using less gable top packaging and "Other" representing miscellaneous segments with less volume.

Sustainable Gable Top Packaging Market Share, By Region, 2024 (%)

| Region | Share |

| North America | 24.0% |

| Europe | 27.0% |

| Asia-Pacific | 36.0% |

| Latin America | 7.0% |

| Middle East & Africa | 6.0% |

Reasoning:

- Asia-Pacific has the largest share, driven by the rapidly growing populations and expanding consumer goods markets, leading to high demand for packaging, especially in countries like China and India.

- Europe follows closely, with strong demand for gable top packaging in food, beverages, and dairy across many developed markets.

- North America holds a significant share as well, mainly driven by high consumption rates in dairy, beverages, and personal care.

- Latin America and Middle East & Africa have smaller shares, with lower market penetration and slower adoption rates in these regions compared to more developed areas.

Segments

By Type

- Small Capacity (≤ 500 ml)

- Medium Capacity (500 ml – 1000 ml)

- Large Capacity (> 1000 ml)

By Application

- Dairy

- Beverages

- Food

- Personal Care

- Other

By Region

- North America: U.S., Canada, Mexico

- Europe: Germany, France, UK, Italy, etc.

- Asia Pacific: China, Japan, South Korea, Southeast Asia, India

- Latin America: Brazil

- Middle East & Africa: Turkey, GCC, Africa

Tables & Figures

By Type

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Small Capacity (≤ 500 ml) | 166.60 | 170.13 | 173.70 | 177.31 | 180.95 | 184.62 | 188.33 | 192.06 | 195.82 | 199.59 | 203.39 |

| Medium Capacity (500 ml – 1000 ml) | 309.40 | 322.39 | 335.91 | 349.99 | 364.64 | 379.90 | 395.78 | 412.32 | 429.53 | 447.45 | 466.10 |

| Large Capacity (> 1000 ml) | 119.00 | 123.90 | 129.00 | 134.31 | 139.83 | 145.57 | 151.55 | 157.76 | 164.23 | 170.96 | 177.96 |

By Application

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dairy | 273.70 | 279.85 | 286.10 | 292.43 | 298.84 | 305.34 | 311.92 | 318.57 | 325.31 | 332.11 | 338.98 |

| Beverages | 142.80 | 149.17 | 155.82 | 162.75 | 169.98 | 177.52 | 185.39 | 193.58 | 202.13 | 211.04 | 220.34 |

| Food | 89.25 | 93.08 | 97.07 | 101.22 | 105.55 | 110.06 | 114.76 | 119.66 | 124.75 | 130.06 | 135.59 |

| Personal Care | 47.60 | 51.78 | 56.20 | 60.87 | 65.80 | 71.01 | 76.51 | 82.31 | 88.43 | 94.89 | 101.69 |

| Other | 41.65 | 42.53 | 43.43 | 44.33 | 45.24 | 46.16 | 47.08 | 48.01 | 48.95 | 49.90 | 50.85 |

By Region

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 142.80 | 146.71 | 150.71 | 154.81 | 159.02 | 163.32 | 167.73 | 172.24 | 176.87 | 181.60 | 186.44 |

| Europe | 160.65 | 165.20 | 169.87 | 174.66 | 179.58 | 184.62 | 189.80 | 195.11 | 200.55 | 206.14 | 211.86 |

| Asia-Pacific | 214.20 | 224.38 | 235.01 | 246.12 | 257.72 | 269.84 | 282.49 | 295.71 | 309.51 | 323.93 | 338.98 |

| Latin America | 41.65 | 43.46 | 45.34 | 47.30 | 49.35 | 51.48 | 53.70 | 56.02 | 58.43 | 60.94 | 63.56 |

| Middle East & Africa | 35.70 | 36.68 | 37.68 | 38.70 | 39.75 | 40.83 | 41.93 | 43.06 | 44.22 | 45.40 | 46.61 |

List of Figures & Tables

List of Figures

- Sustainable Gable Top Packaging Market Share, By Type (2024): Small Capacity (≤ 500 ml) – 24.0%, Medium Capacity (500 ml – 1000 ml) – 44.0%, Large Capacity (> 1000 ml) – 32.0%

- Sustainable Gable Top Packaging Market Share, By Application (2024): Dairy – 40.0%, Beverages – 21.0%, Food – 13.0%, Personal Care – 7.0%, Other – 6.0%

- Sustainable Gable Top Packaging Market Share, By Region (2024): North America – 24.0%, Europe – 27.0%, Asia-Pacific – 36.0%, Latin America – 7.0%, Middle East & Africa – 6.0%

List of Tables

- Sustainable Gable Top Packaging Market Share, By Type (2024): Small Capacity (≤ 500 ml) – 24.0%, Medium Capacity (500 ml – 1000 ml) – 44.0%, Large Capacity (> 1000 ml) – 32.0%

- Sustainable Gable Top Packaging Market Share, By Application (2024): Dairy – 40.0%, Beverages – 21.0%, Food – 13.0%, Personal Care – 7.0%, Other – 6.0%

- Sustainable Gable Top Packaging Market Share, By Region (2024): North America – 24.0%, Europe – 27.0%, Asia-Pacific – 36.0%, Latin America – 7.0%, Middle East & Africa – 6.0%

Frequently Asked Questions

Proceed To Buy

Make Every Move Strategic. Get Insights, Fully Customized

- On-Demand Metrics & KPIs

- Industry-Specific Dashboards

- Quick Turnaround, No Compromises

Quick Contact

- sales@towardspackaging.com

- NA : +1 804 441 9344

- APAC : +91 9356 9282 04

- EU : +44 7782 560 738

Our Client

Sustainable Gable Top Packaging Market Size and Statistics

The global Sustainable Gable Top Packaging market is projected to grow from US$ 595 million in 2024.