Revenue, 2024

470.00 Bn

Forecast, 2034

787.74 Bn

CAGR, 2025 - 2034

5.30%

Report Coverage

Worldwide

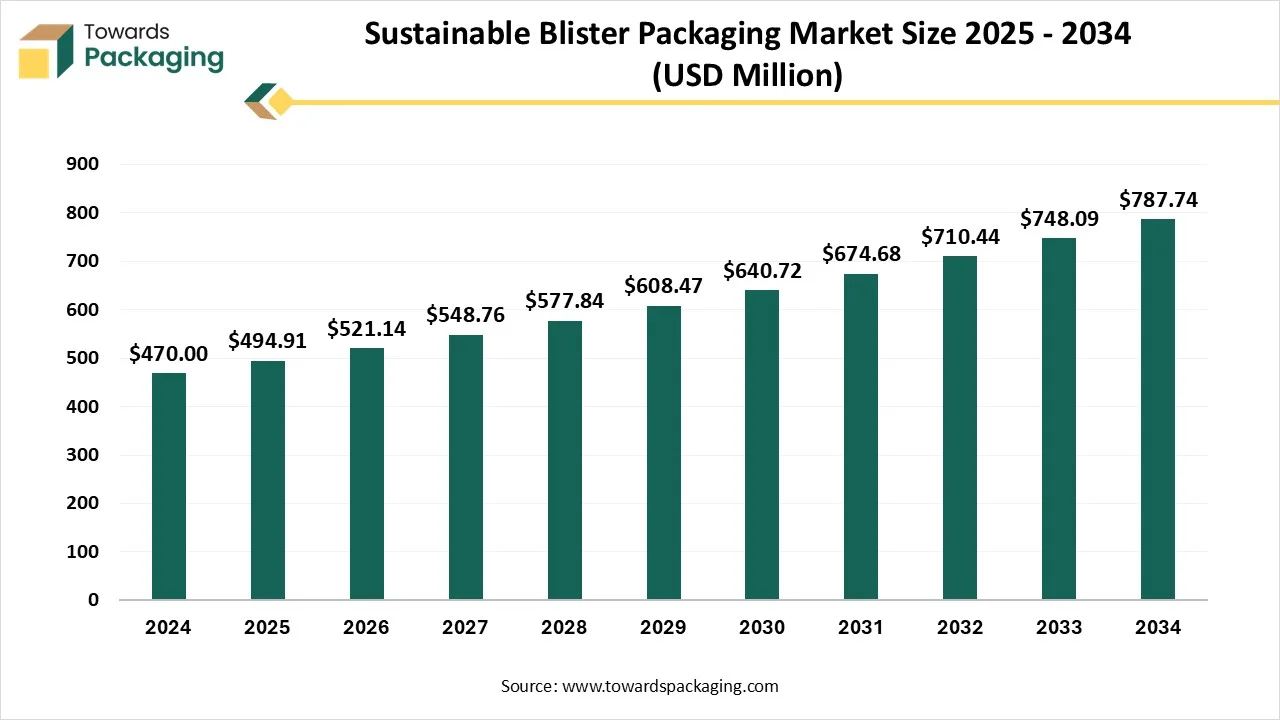

The global sustainable blister packaging market was valued at US$ 470 million in 2024 and is projected to reach US$ 787.74 million by 2034, expanding at a CAGR of 5.3% (2025-2034).

Sustainable blister packaging delivers the same product protection and display benefits as traditional blister packs but relies on eco-friendly, recyclable, and compostable materials such as paperboard, fibers, and biodegradable plastics. These sustainable packaging solutions are gaining momentum worldwide, particularly in the U.S. market, where rising environmental awareness and preference for green packaging have accelerated adoption.

Blister packaging typically involves a plastic cavity (blister) sealed onto a cardboard backing, widely used in pharmaceuticals, medical devices, and consumer goods. Sustainable alternatives, supplied by key companies such as Huhtamäki, Sonoco, PulPac, Borealis AG, Südpack Medica, WestRock, and Constantia Flex, are helping manufacturers balance performance with reduced environmental impact.

This report provides a comprehensive analysis of global sustainable blister packaging trends, covering sales volume, revenues, company shares, competitive rankings, regional demand, and forecasts through 2034, enabling businesses to align with sustainability-driven market growth.

Key Highlights

- Market Growth: Expanding from US$ 470M (2024) to US$ 787.74M (2034) at 5.2% CAGR.

- Consumer Shift: Strong demand in the U.S. for eco-conscious and plant-based packaging.

- Material Innovation: Increased use of paperboard, biodegradable plastics, and fibers in blister packs.

- Competitive Landscape: Leading players include Huhtamäki, Sonoco, PulPac, Borealis AG, Südpack Medica, WestRock, and Constantia Flex.

- Applications: Pharmaceuticals remain the largest user, followed by food and consumer goods.

- Regional Outlook:

- North America: Strong growth led by U.S. adoption.

- Europe: Regulatory push driving eco-friendly packaging compliance.

- Asia-Pacific: Rapidly growing demand across China, Japan, India, and Southeast Asia.

- South America & MEA: Emerging opportunities in food and healthcare sectors.

Sustainable Blister Packaging Market Share, By Type, 2024 (%)

| Type | Share (%) |

| Paper | 40% |

| Polypropylene | 60% |

Reason:

- Polypropylene holds 60% due to its widespread use in packaging due to cost-effectiveness, durability, and flexibility.

- Paper holds 40%, reflecting its sustainable nature but limited application compared to polypropylene, which often outperforms paper in terms of protection and cost for many packaging solutions.

Sustainable Blister Packaging Market Share, By Application, 2024 (%)

| Application | Share (%) |

| Pharmaceutical | 55% |

| Food | 30% |

| Others | 15% |

Reason:

- Pharmaceuticals dominate with 55%, driven by the high demand for blister packaging in the pharmaceutical industry, where product protection and sterility are crucial.

- Food applications contribute 30%, as the demand for sustainable packaging in food packaging is increasing, but still not as prevalent as pharmaceutical use.

- Other applications make up 15%, reflecting smaller sectors using blister packaging for specialized or niche markets.

Sustainable Blister Packaging Market Share, By Region, 2024 (%)

| Region | Share (%) |

| North America | 28% |

| Europe | 27% |

| Asia-Pacific | 32% |

| Latin America | 7% |

| Middle East & Africa | 6% |

Reason:

- Asia-Pacific leads with 32%, driven by large-scale manufacturing, increasing demand for sustainable packaging solutions, and significant investments in the regions packaging industry.

- North America and Europe each contribute around 28% and 27% respectively, driven by strong consumer awareness and adoption of sustainable packaging solutions.

- Latin America and Middle East & Africa hold smaller shares (7% and 6%, respectively), reflecting emerging markets with slower adoption rates but growing interest in sustainability.

Sustainable Blister Packaging Market Segments

By Type

- Paper

- Polypropylene

By Application

- Pharmaceutical

- Food

- Others

By Region

- North America: U.S., Canada, Mexico

- Europe: Germany, France, UK, Italy, etc.

- Asia Pacific: China, Japan, South Korea, Southeast Asia, India

- Latin America: Brazil

- Middle East & Africa: Turkey, GCC, Africa

Tables & Figures

By Type

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Paper | 188.00 | 202.91 | 218.88 | 235.97 | 254.25 | 273.81 | 294.73 | 317.10 | 341.01 | 366.56 | 393.87 |

| Polypropylene | 282.00 | 292.00 | 302.26 | 312.79 | 323.59 | 334.66 | 345.99 | 357.58 | 369.43 | 381.53 | 393.87 |

| Total | 470.00 | 494.91 | 521.14 | 548.76 | 577.84 | 608.47 | 640.72 | 674.68 | 710.44 | 748.09 | 787.74 |

By Application

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Pharmaceutical | 258.50 | 269.73 | 281.42 | 293.59 | 306.26 | 319.45 | 333.17 | 347.46 | 362.32 | 377.78 | 393.87 |

| Food | 141.00 | 150.95 | 161.55 | 172.86 | 184.91 | 197.75 | 211.44 | 226.02 | 241.55 | 258.09 | 275.71 |

| Others | 70.50 | 74.23 | 78.17 | 82.31 | 86.67 | 91.27 | 96.11 | 101.20 | 106.57 | 112.22 | 118.16 |

| Total | 470.00 | 494.91 | 521.14 | 548.76 | 577.84 | 608.47 | 640.72 | 674.68 | 710.44 | 748.09 | 787.74 |

By Region

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 131.60 | 137.58 | 143.83 | 150.36 | 157.17 | 164.29 | 171.71 | 179.46 | 187.56 | 196.00 | 204.81 |

| Europe | 126.90 | 132.64 | 138.62 | 144.87 | 151.40 | 158.20 | 165.31 | 172.72 | 180.45 | 188.52 | 196.93 |

| Asia-Pacific | 150.40 | 159.86 | 169.89 | 180.54 | 191.84 | 203.84 | 216.56 | 230.07 | 244.39 | 259.59 | 275.71 |

| Latin America | 32.90 | 35.14 | 37.52 | 40.06 | 42.76 | 45.64 | 48.69 | 51.95 | 55.41 | 59.10 | 63.02 |

| Middle East & Africa | 28.20 | 29.69 | 31.28 | 32.93 | 34.67 | 36.50 | 38.45 | 40.48 | 42.63 | 44.88 | 47.27 |

| Total | 470.00 | 494.91 | 521.14 | 548.76 | 577.84 | 608.47 | 640.72 | 674.68 | 710.44 | 748.09 | 787.74 |

List of Figures & Tables

List of Figures

- Global Sustainable Blister Packaging Market Size and Forecast (2024-2034): Market growth from US$ 470 million (2024) to US$ 787.74 million (2034) at a 5.3% CAGR.

- Sustainable Blister Packaging Market Share by Type (2024): Paper (40%), Polypropylene (60%).

- Sustainable Blister Packaging Market Share by Application (2024): Pharmaceutical (55%), Food (30%), Others (15%).

- Sustainable Blister Packaging Market Share by Region (2024): North America (28%), Europe (27%), Asia-Pacific (32%), Latin America (7%), Middle East & Africa (6%).

List of Tables

- Sustainable Blister Packaging Market Share by Type (2024): Paper (40%), Polypropylene (60%).

- Sustainable Blister Packaging Market Share by Application (2024): Pharmaceutical (55%), Food (30%), Others (15%).

- Sustainable Blister Packaging Market Share by Region (2024): North America (28%), Europe (27%), Asia-Pacific (32%), Latin America (7%), Middle East & Africa (6%).

Frequently Asked Questions

Proceed To Buy

Make Every Move Strategic. Get Insights, Fully Customized

- On-Demand Metrics & KPIs

- Industry-Specific Dashboards

- Quick Turnaround, No Compromises

Quick Contact

- sales@towardspackaging.com

- NA : +1 804 441 9344

- APAC : +91 9356 9282 04

- EU : +44 7782 560 738

Our Client

Sustainable Blister Packaging Market Size and Statistics

The global sustainable blister packaging market was valued at US$ 470 million in 2024 and is projected to reach US$ 787.74 million by 2034.