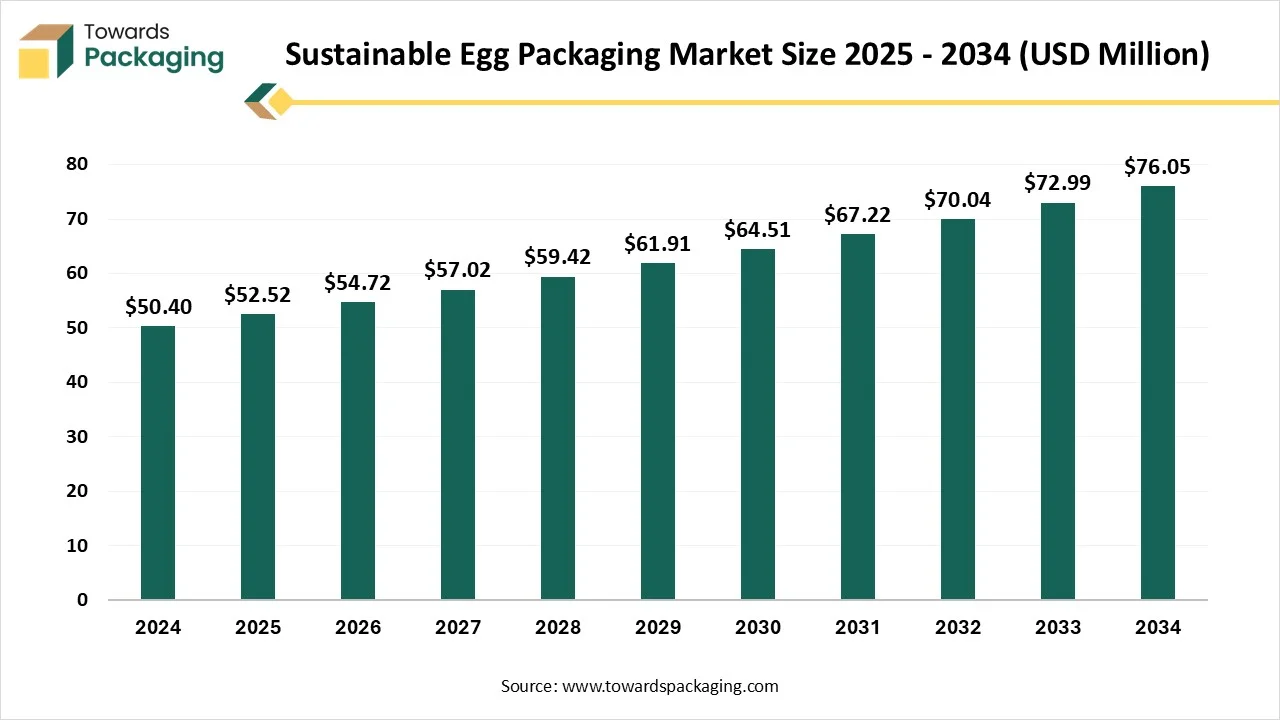

Revenue, 2024

50.40 Bn

Forecast, 2034

76.05 Bn

CAGR, 2025 - 2034

4.20%

Report Coverage

Worldwide

The global sustainable egg packaging market is growing steadily, projected to rise from US$ 50.4 million in 2024 to US$ 76.05 million by 2034, with a CAGR of 4.2% (2025–2034).

Sustainable egg packaging uses environmentally friendly solutions like molded pulp, starch-based materials, PLA, and recycled content to reduce carbon emissions, minimize waste, and support circular economy goals. These sustainable packaging formats ensure safe egg transport and display while meeting global environmental standards and consumer demand for greener products.

In 2024, global production reached 328 million units, priced at about US$ 0.15 per unit. Manufacturers such as RedFroq, Tosca Ltd, Paperfoam, Huhtamaki, DS Smith, TekniPlex, Ovotherm, and Hartmann Packaging lead the market, with the top five holding a significant revenue share. Demand is strongest in retail and distribution channels, where eco-conscious packaging drives industry adoption.

Key Highlights

- Market Size Growth: From US$ 49.2M (2024) → US$ 76.05M (2034) at 4.2% CAGR.

- Production Volume: ~328M units in 2024; avg. price US$ 0.15/unit.

- Competitive Landscape: Top five players dominate global revenue; RedFroq leads sales in 2024.

- Drivers: Green regulations, rising retail adoption, circular economy practices, consumer eco-preferences.

- Challenges: U.S. tariff policies creating trade-cost volatility and supply-chain risks.

- Regional Outlook:

- North America: Steady growth, strong U.S. retail demand.

- Asia-Pacific: Fastest expansion, led by China, Japan, and South Korea.

- Europe: Stable growth, with Germany as a key contributor.

Sustainable Egg Packaging Market Share, By Type, 2024 (%)

| Packaging Type | Share in 2024 (%) |

| Molded Pulp Packaging | 55.98% |

| Starch-Based Packaging | 9.01% |

| PLA (Polylactic Acid) Packaging | 10.98% |

| Recycled Packaging | 24.03% |

Reason:

- Molded Pulp Packaging holds the largest share (55.98%) due to its dominant presence in the egg packaging market. It is widely used for its eco-friendly and biodegradable properties, which align with consumer demands for sustainable packaging.

- Recycled Packaging has a substantial share (24.03%), driven by increasing awareness of recycling and demand for packaging solutions that reduce environmental impact.

- PLA (Polylactic Acid) Packaging (10.98%) is gaining traction as a renewable material, but it is still in the growth phase compared to molded pulp.

- Starch-Based Packaging has a smaller share (9.01%) due to its relatively new adoption in the sector compared to the other types.

Sustainable Egg Packaging Market Share, By Application, 2024 (%)

| Application Segment | Share in 2024 (%) |

| Retail | 61.97% |

| Distribution & Transportation | 38.03% |

Reason:

- Retail holds the largest share (61.97%) as a key application area. Most sustainable egg packaging is used directly in consumer-facing retail environments like grocery stores and supermarkets, making it the dominant application.

- Distribution & Transportation (38.03%) also has a significant share, as packaging for eggs is crucial during transportation to prevent damage and preserve product quality. However, it is secondary to retail in terms of overall demand.

Sustainable Egg Packaging Market Share, By Region, 2024 (%)

| Region | Share in 2024 (%) |

| North America | 27.99% |

| Europe | 30.02% |

| Asia-Pacific | 30.00% |

| Latin America | 6.00% |

| Middle East & Africa | 5.99% |

Reason:

- Europe (30.02%) and Asia-Pacific (30.00%) hold the largest shares, as both regions have strong demand for sustainable packaging due to a growing consumer preference for environmentally friendly products and stricter regulations on packaging waste.

- North America (27.99%) has a significant market due to rising sustainability initiatives and strong consumer awareness in countries like the U.S. and Canada.

- Latin America (5.99%) and Middle East & Africa (5.99%) have smaller shares due to less widespread adoption of sustainable packaging, but they are still gradually increasing their market presence.

Sustainable Egg Packaging Market Segments

By Type

- Molded Pulp Packaging

- Starch-Based Packaging

- PLA (Polylactic Acid) Packaging

- Recycled Packaging

By Application

- Retail

- Distribution & Transportation

By Region

- North America: U.S., Canada, Mexico

- Europe: Germany, France, UK, Italy, etc.

- Asia Pacific: China, Japan, South Korea, Southeast Asia, India

- Latin America: Brazil

- Middle East & Africa: Turkey, GCC, Africa

Tables & Figures

By Type

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Molded Pulp Packaging | 28.22 | 29.10 | 29.99 | 30.90 | 31.85 | 32.81 | 33.80 | 34.82 | 35.85 | 36.93 | 38.02 |

| Starch-Based Packaging | 4.54 | 4.88 | 5.25 | 5.65 | 6.06 | 6.50 | 6.97 | 7.46 | 7.99 | 8.54 | 9.13 |

| PLA (Polylactic Acid) Packaging | 5.54 | 5.99 | 6.46 | 6.96 | 7.49 | 8.05 | 8.64 | 9.28 | 9.95 | 10.66 | 11.41 |

| Recycled Packaging | 12.10 | 12.55 | 13.02 | 13.51 | 14.02 | 14.55 | 15.10 | 15.66 | 16.25 | 16.86 | 17.49 |

| Total | 50.40 | 52.52 | 54.72 | 57.02 | 59.42 | 61.91 | 64.51 | 67.22 | 70.04 | 72.99 | 76.05 |

By Application

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Retail | 31.25 | 32.35 | 33.49 | 34.67 | 35.89 | 37.15 | 38.45 | 39.79 | 41.18 | 42.63 | 44.11 |

| Distribution & Transportation | 19.15 | 20.17 | 21.23 | 22.35 | 23.53 | 24.76 | 26.06 | 27.43 | 28.86 | 30.36 | 31.94 |

| Total | 50.40 | 52.52 | 54.72 | 57.02 | 59.42 | 61.91 | 64.51 | 67.22 | 70.04 | 72.99 | 76.05 |

By Region

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 14.11 | 14.60 | 15.10 | 15.62 | 16.16 | 16.72 | 17.29 | 17.88 | 18.49 | 19.12 | 19.77 |

| Europe | 15.13 | 15.65 | 16.20 | 16.76 | 17.35 | 17.95 | 18.58 | 19.23 | 19.89 | 20.58 | 21.29 |

| Asia-Pacific | 15.12 | 15.92 | 16.75 | 17.63 | 18.55 | 19.51 | 20.51 | 21.58 | 22.70 | 23.87 | 25.11 |

| Latin America | 3.02 | 3.20 | 3.39 | 3.59 | 3.80 | 4.02 | 4.26 | 4.50 | 4.76 | 5.04 | 5.32 |

| Middle East & Africa | 3.02 | 3.15 | 3.28 | 3.42 | 3.56 | 3.71 | 3.87 | 4.03 | 4.20 | 4.38 | 4.56 |

| Total | 50.40 | 52.52 | 54.72 | 57.02 | 59.42 | 61.91 | 64.51 | 67.22 | 70.04 | 72.99 | 76.05 |

List of Figures & Tables

List of Figures

- Sustainable Egg Packaging Market Size Growth (2024–2034) – US$ 50.4M (2024) → US$ 76.05M (2034) at 4.2% CAGR

- Production Volume and Average Price per Unit in 2024 – 328M units, priced at US$ 0.15/unit

- Sustainable Egg Packaging Market Share, By Type in 2024 – Molded Pulp Packaging (55.98%), Recycled Packaging (24.03%), PLA (Polylactic Acid) Packaging (10.98%), Starch-Based Packaging (9.01%)

- Sustainable Egg Packaging Market Share, By Application in 2024 – Retail (61.97%), Distribution & Transportation (38.03%)

- Sustainable Egg Packaging Market Share, By Region in 2024 – Europe (30.02%), Asia-Pacific (30.00%), North America (27.99%), Latin America (6.00%), Middle East & Africa (5.99%)

List of Tables

- Sustainable Egg Packaging Market Size and Growth (2024–2034) – 2024: US$ 50.4M, 2034: US$ 76.05M, CAGR (2025–2034): 4.2%

- Production Volume and Average Price in 2024 – Production Volume: 328M units, Average Price: US$ 0.15/unit

- Sustainable Egg Packaging Market Share, By Type in 2024 – Molded Pulp Packaging (55.98%), Recycled Packaging (24.03%), PLA (Polylactic Acid) Packaging (10.98%), Starch-Based Packaging (9.01%)

- Sustainable Egg Packaging Market Share, By Application in 2024 – Retail (61.97%), Distribution & Transportation (38.03%)

- Sustainable Egg Packaging Market Share, By Region in 2024 – Europe (30.02%), Asia-Pacific (30.00%), North America (27.99%), Latin America (6.00%), Middle East & Africa (5.99%)

Frequently Asked Questions

Proceed To Buy

Make Every Move Strategic. Get Insights, Fully Customized

- On-Demand Metrics & KPIs

- Industry-Specific Dashboards

- Quick Turnaround, No Compromises

Quick Contact

- sales@towardspackaging.com

- NA : +1 804 441 9344

- APAC : +91 9356 9282 04

- EU : +44 7782 560 738

Our Client

Sustainable Egg Packaging Market Size and Statistics

The global Sustainable Egg Packaging market is growing steadily, projected to rise from US$ 50.4 million in 2024.