Cash Transport Security Bags Market Size, Demand, and Trends

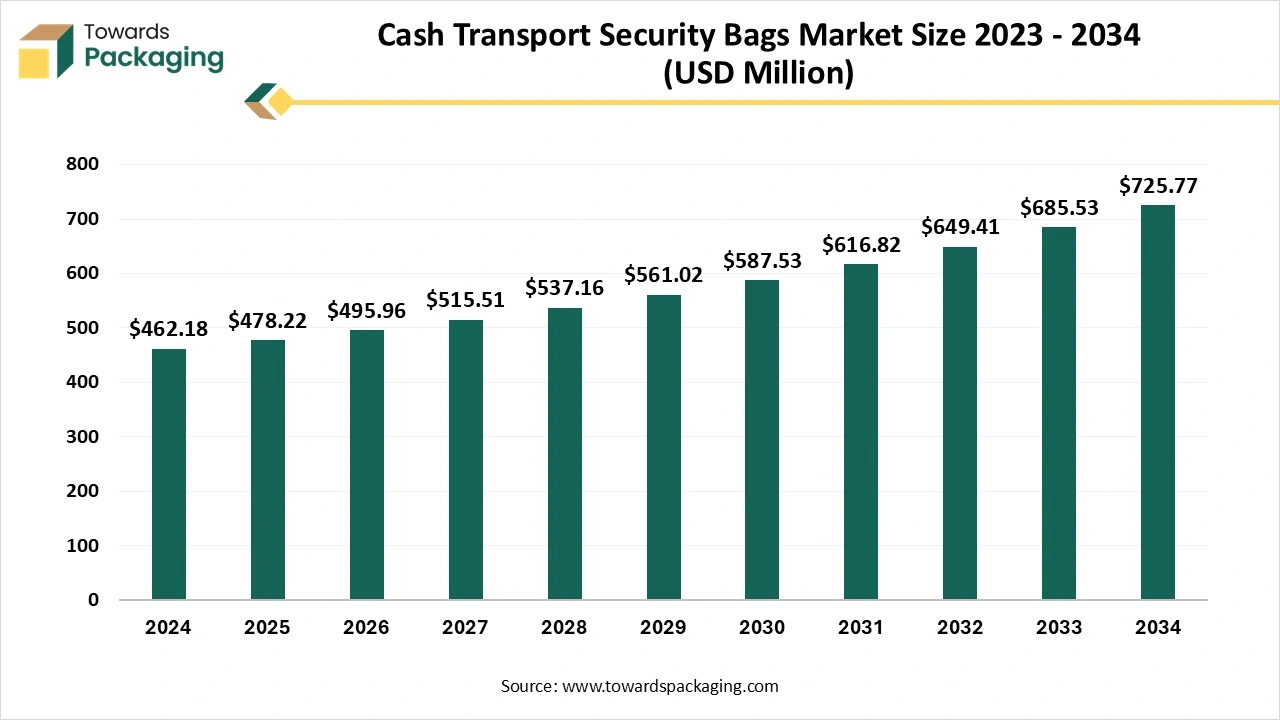

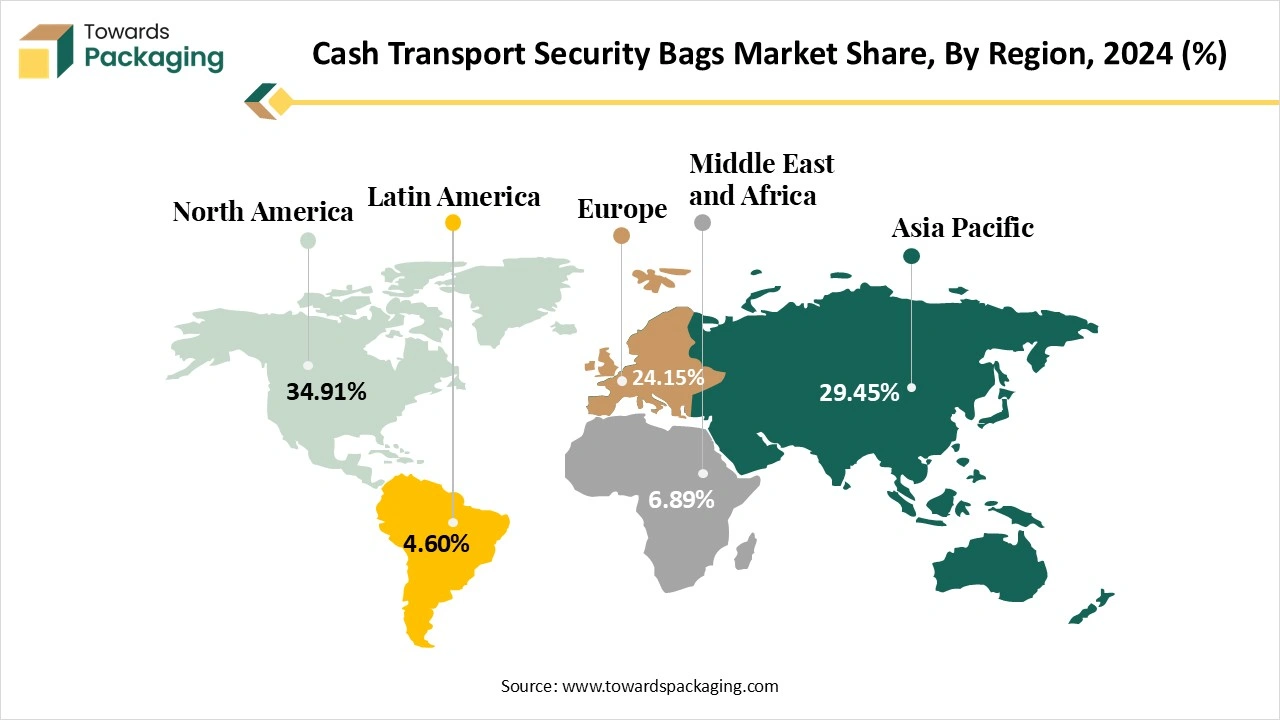

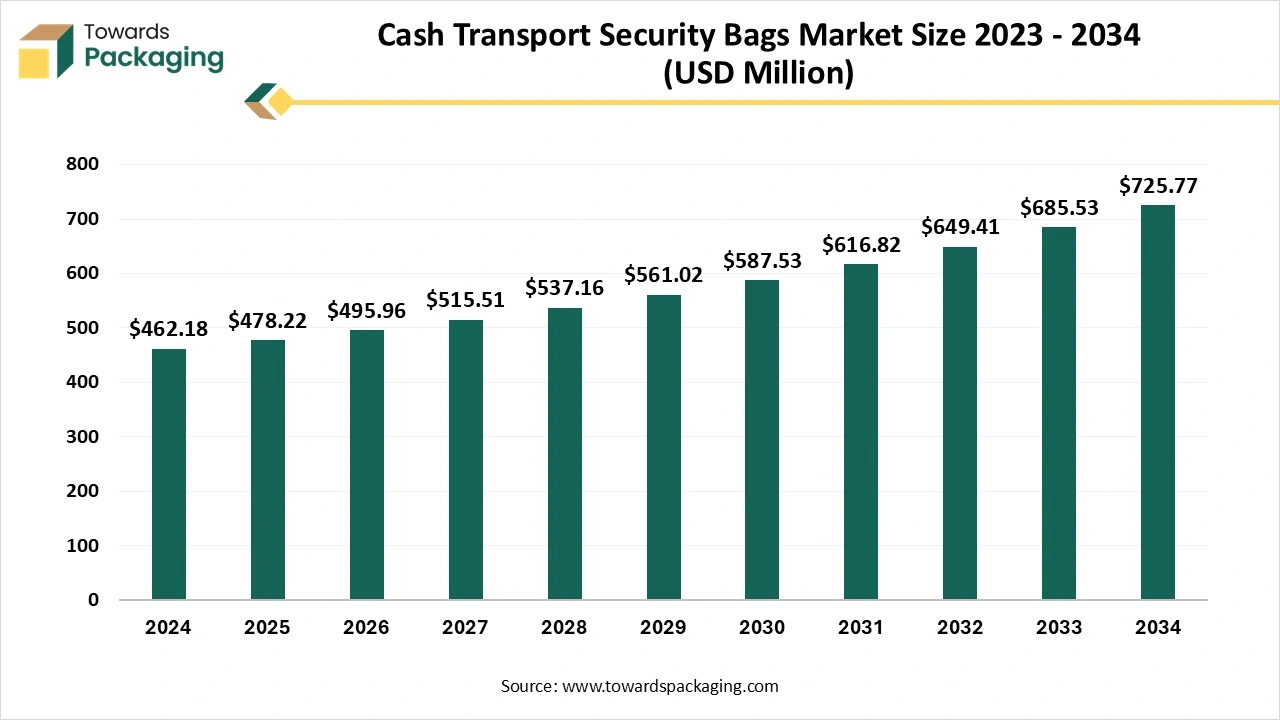

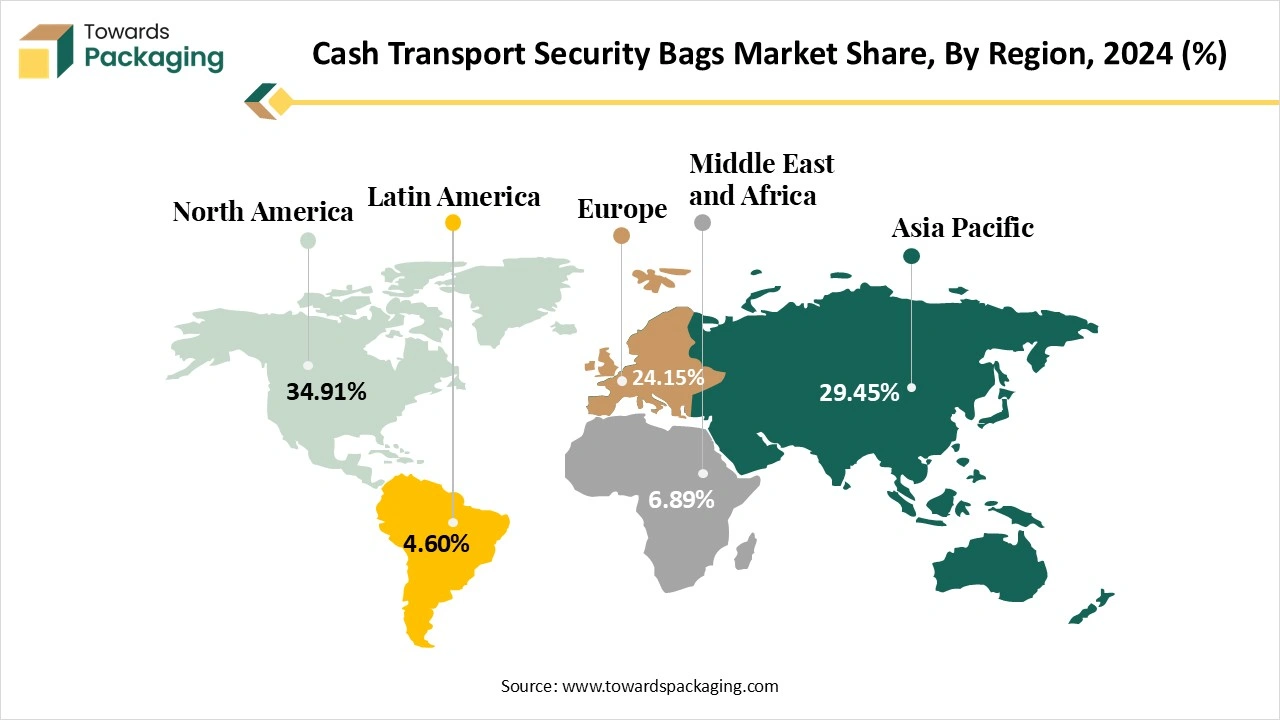

The cash transport security bags market is forecasted to expand from USD 507.03 billion in 2026 to USD 769.22 billion by 2035, growing at a CAGR of 4.74% from 2026 to 2035. It includes segment-level data, such as the plastic material segment holding 60.15% share and deposit bags dominating with 35.54%, along with regional performance, including North America’s 34.91% share in 2024 and Asia-Pacific’s fastest 7.20% CAGR, complemented by trade flow, supplier mapping, and global value chain analysis.

The cash transport security bags market is set for steady growth during the estimated timeframe. Cash transport security bags are high-security bags that are specifically made to carry cash, checks, coins and other items of value from one place to the other place. To guarantee that its contents remain secure during travel, they consist of a variety of security elements such as tracking devices, locks, strengthened materials, and tamper-evident seals.

Organizations that frequently transport money amongst offices, stores, storage facilities, vaults and banks utilize the high-quality currency in transit bags. Considering the risks of carrying the cash, these bags deliver an essential degree of protection and comfort. These bags provide numerous advantages that greatly exceed their price such as increased security features, theft prevention, and regulatory compliance as well as increased operational efficiency.

The rising concerns over the financial security and theft prevention is expected to augment the growth of the cash transport security bags market during the forecast period. Furthermore, the technological advancements such as RFID tags, GPS tracking and smart seals along with the growth of the banking and financial services sector are also anticipated to augment the growth of the market. Additionally, the expansion of the retail sector and ATM networks as well as the strict regulatory requirements and compliance standards around secure cash handling coupled with the rising incidents of cybercrime is also projected to contribute to the growth of the market in the near future.

Key Trends and Findings

- There is currently a growing shift towards sustainability with the increasing demand for the eco-friendly and reusable products across the globe. Manufacturers are focusing on the development of bags that made-up pf biodegradable and 100% recyclable materials to minimize the environmental impact. This shift supports the global sustainability initiatives as well as the corporate responsibility goals, encouraging innovation in the green packaging solutions. As organizations seek to reduce their carbon footprint, the adoption of the sustainability security bags is expected to become a key differentiator in the competitive landscape.

- An important trend in the industry is the growing inclination for the customized solutions. Organizations are gradually utilizing bags as branding tools through incorporating company logos, unique designs as well as the specialized security features. This not only improves the brand recognition during transit but also helps companies to modify bags as per their specific operational needs. The trend represents a move towards personalized and strategic application of security packaging to increase both security and company image.

- A transformative trend that is being adopted across industries is the implementation of the advanced digital technologies. Manufacturers are integrating RFID tags and GPS tracking systems into bags. These smart features gives real-time visibility, streamline logistics as well as strengthen protection against the theft and tampering. Through supporting precise tracking and operational transparency, tech-improved security bags are redefining how organizations manage and safeguard cash in transit, marking a key change toward intelligent, responsive security solutions.

- North America held substantial market share of 34.91% in 2024. This is due to the advanced financial infrastructure, high volume of cash transactions along with the stringent security regulations.

- Asia-Pacific is expected to grow at a fastest CAGR of 7.20% due to the growing ATM network and rising retail and banking activities in countries like China, India and Indonesia as well as the increased awareness about the cash security.

Market Drivers

Surge in Online Fraud and Cybercrime

The increasing prevalence of online fraud and cybercrime owing to the increasing digital transformation across sectors, widespread use of smartphones, digital wallets, and online banking is anticipated to support the growth of the cash transport security bags market during the estimated timeframe. As digital threats increase, financial institutions, retailers and service providers are revisiting their security strategies, placing renewed focus on the secure physical cash handling. While the adoption of the digital payment systems continues to rise, so does the sophistication of the cybercriminals.

Online fraud consists of a range of malicious activities such as identity theft, phishing and unauthorized transactions. Based on the current banking data, fraud victims in the United Kingdom lost an enormous £571.7 million to the fraudsters in the first half of 2024. As compared to 2023, this shows a 16% rise in the fraud instances. In 2023, consumers in the United States lost almost $10 billion because of fraud, with impostor schemes accounting for the most common attack, according to the data by the Federal Trade Commission. Also, the European Banking Authority (EBA) and European Central Bank (ECB) revealed in their 2024 report on payment fraud that the EU's overall fraud losses in 2022 and 2023 were 4.3 billion euros ($4.64 billion) and 2 billion euros ($2.15 billion), respectively.

These high-profile breaches such as online payment systems, customer data theft and banking fraud have made organizations increasingly cautious, leading most of them to maintain their dependence on the physical cash. Consumers and businesses are more comfortable with tangible transactions, increasing the volume of cash that needs to be securely transported and stored. As a result, the demand for tamper-evident traceable and certified cash-in-transit (CIT) bags has surged.

Market Restraints

Shift toward Digital and Contactless Payments

The shift towards digital and contactless payment methods is expected to limit the growth of the cash transport security bags market during the estimated timeframe. As the technology advances and internet penetration increases, consumers as well as organizations are opting for convenient, secure and fast digital transactions. The growing popularity of the mobile wallets, Unified Payments Interface (UPI) systems, QR code-based payments, and near-field communication (NFC) technologies has substantially decreased dependence on physical cash, specifically in urban areas and industrialized nations.

According to the Federal Reserve Financial Services (FRFS) survey, 80% of the millennials (aged between 26–41) and Generation Z (ages 18–25) feel that being able to pay using a mobile device is important and over half of them currently use digital wallets as of 2023. Almost 74 percent of the consumers utilized a quicker payment service in the previous 12 months that is in line with the research from 2022. Additionally, 57 percent of the customers are expected to utilize faster payment choices more frequently in the future due to the increased accessibility to digital commerce and payments. In 2023, the utilization of digital wallets (such as Google Wallet, Apple Wallet, etc.) increased 32% (from 25% to 33%), while the usage of bank mobile applications increased by 8 percent (from 37% to 40%) and that of other nonbank mobile apps (such as PayPal, Cash App, etc.) increased by 3 percent (from 53% and 55%).

Governments and financial institutions are actively supporting cashless economies to increase transparency, minimize the circulation of the black money, as well as reduce the expenses associated with the currency printing and management. This transformation is gradually decreasing the requirement for cash-in-transit (CIT) bags in areas where digital infrastructure is firmly established. As more organizations adopt the electronic point-of-sale systems and consumers' preferences change, the demand for the physical cash transfer alternatives may decrease, posing a risk to the growth of the market during the forecast period.

Market Opportunities

Expansion of the Banks and ATM Networks

The continued expansion of the banks and ATM networks is likely to create immense opportunities for the growth of the cash transport security bags market in the near future. As financial inclusion becomes a top priority for the governments and global financial institutions, banks are aggressively expanding their physical presence through new branches, microfinance outlets, and mobile banking units.

For instance

- In November 2024, PNC Bank declared its plans to increase its branch investments by $500 million in order to refurbish 200 more current sites nationwide and construct more than 100 new branches. According to the announcement, the bank would invest a total of about $1.5 billion over the next five years to open more than 200 new branch sites in 12 cities throughout the United States and finish renovating 1,400 current branches.

- In May 2024, FCTI revealed the expansion and extension of their long-standing partnership with 7-Eleven. By the end of 2025, FCTI anticipates having 11,600 ATMs, up from roughly 8,600 now. As part of this development, FCTI intends to test and roll out a number of new services for 7-Eleven patrons and its ATM users. The convenience of customers would be improved by these offerings.

Each of these facilities deals with regular cash deposits and withdrawals, requiring tamper-evident and traceable cash transport security bags to minimize the theft as well as the operational risks. Moreover, as banking infrastructure evolves, so does the complexity of of cash handling. The integration of the ATM kiosks, point-of-sale terminals and branchless banking models means cash must travel through multiple touch-points—further amplifying the need for secure transport options. Cash security bag manufacturers are capitalizing on this growth through providing customizable options for the modern banking needs. As the banking networks continue to grow, the demand for the dependable cash transport security bags are also likely to increase in the future.

Artificial Intelligence (AI) Impact on the Market

Artificial intelligence (AI) is expected to reshape the cash transport security bags market through improving the security with the real-time monitoring capabilities. One of the important features will be the integration of the AI tracking systems into the logistics chain, where smart sensors are likely to be embedded in the bags that can communicate the real-time data to the centralized monitoring systems. AI algorithms can analyze this data to detect the anomalies such as route deviations, tampering attempts as well as unauthorized access, assisting in taking swift action to prevent the theft. Furthermore, AI predictive analytics can also help the companies to forecast the potential security breaches based on the historical data, behavioral patterns and threat intelligence. This approach reduces the risk and optimizes the route planning along with the resource allocation.

AI is also improving inventory and cash flow management through automating the reconciliation processes and reducing the manual errors that are important for the large-scale operations in banking, retail and government institutions. Additionally, AI may support the customization of the security protocols. For example, machine learning models can determine the optimal level of the bag security needed based on the transaction value, location risk as well as the client requirements. This enables better cost efficiency without compromising safety. As AI technology continues to advance, its application in the smart packaging, facial recognition at access points and robotic assistance for cash sorting and dispatch is expected to revolutionize the market and make the cash transport safer and smarter.

Key Segment Analysis

Material Segment Analysis Preview

The plastic segment held largest share of 60.15% in the year 2024. This is due to its properties like affordability, durability and adaptability. Unlike other material, plastic provides high resistance to tampering, moisture as well as physical damage and makes it ideal for protecting cash and sensitive documents during transit. Its lightweight nature also reduces the transportation costs and flexibility supports the integration of the advanced security features such as tamper-evident seals, barcodes and RFID tags. Furthermore, plastic bags are easier and cheaper to produce in bulk. This makes them a cost-effective option for the organizations that need large volumes of the secure packaging. Additionally, owing to the growing environmental awareness, many manufacturers now provide recyclable plastic options and help the organizations to maintain the security standards without compromising on the sustainability. This combination of performance, protection and sustainable innovation maintains dominance of plastic in the global cash transport security bag market within the estimated timeframe.

Bag Type Segment Analysis Preview

The deposit bags segment held largest share of 35.54% in the year 2024. Deposit bags provide a secure convenient option for handling and transporting cash, checks as well as sensitive documents. Their tamper-evident design helps prevent theft along with the unauthorized access and makes them important for the daily operations. These bags consists of the unique serial numbers, barcodes, writable surfaces, and secure seals, helping for traceability and accountability throughout the cash handling process. Additionally, deposit bags are easy to use and are available in both disposable and eco-friendly versions to suit various operational needs. Their reliability in guaranteeing tamper-proof transport makes deposit bags an ideal choice for multiple industries, strengthening their position as the dominant segment in the cash transport security bags market.

Regional Insights

North America held considerable market share of 34.91% in the year 2024. This is due to the presence of big retail chains, casinos and expansion of the leading financial institutions as well as ATMs across the region. For instance, in September 2024, Bank of America (BofA) announced plans to open more than 165 additional branches by the end of 2026 as part of its branch network expansion. Similarly, in February 2024, Chase revealed plans to refurbish around 1,700 facilities and build more than 500 additional branches to better serve more communities and customers nationwide. Furthermore, the stringent state-level regulatory requirements are also expected to support the regional growth of the market. Additionally, the growing interest in the recyclable and reusable bags is also further expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at a considerable CAGR of 7.20% during the forecast period. This is due to the presence of high cash-dependent economies such as India, Indonesia and the Philippines in the region. Additionally, the increase in the use of cash-on-delivery (COD) in e-commerce is also expected to contribute to the regional growth of the market. According to the Internet in India Report 2024 by the Internet and Mobile Association of India (IAMAI), the cash on delivery (COD) payment mode has been growing in India with 105 million users selecting COD. Furthermore, the growth of organized retail chains and aggressive ATM deployment as well as urbanization and infrastructure growth are likely to contribute to the regional growth of the market.

Recent Developments by Key Market Players

- In August 2024, AGD Bank introduced its new recyclable cash bags. This effort is an important step in the company's continuous commitment to sustainability, demonstrating its aim in minimizing its impact on the environment while improving its client's banking experiences. With the words, "I am a biodegradable cash bag; please reuse me. Reuse me or dispose of me properly" imprinted on every bag, the bank hopes to encourage its clients to live more responsibly every day.

- In November 2022, CONTROLTEK introduced the EcoLOK4, a novel tamper-evident cash security bag made-up of post-consumer recycled (PCR) materials. PCR plastic makes about 90% of the film utilized to create EcoLOK4. Without sacrificing durability or security, this is the most sustainable cash deposit bag available. This is revolutionary for the industry as it minimizes the environmental impact of cash handling operations and, in the end, protects the planet while supporting organizations to maintain confidence in the security of their cash in transit.

Key Market Players

Global Cash Transport Security Bags Market Segment

By Bag Type

- Deposit Bags

- Shipping Bags

- Coin Bags

- Custom Bags

- Others

By Material

By End-User

- Retail

- Financial Institutions

- Hospitals

- Casinos

- Others

By Region

- North America

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa