Asia Pacific Flexible Packaging Market Size, Trends, Share and Innovations

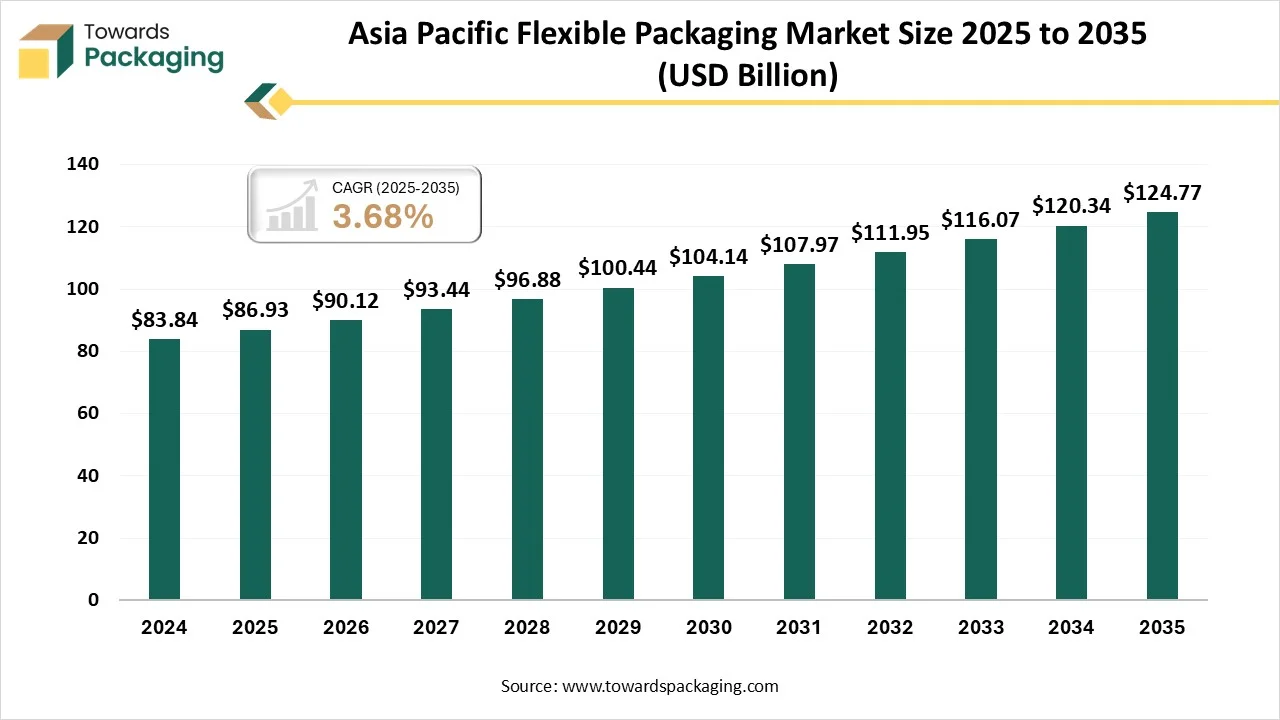

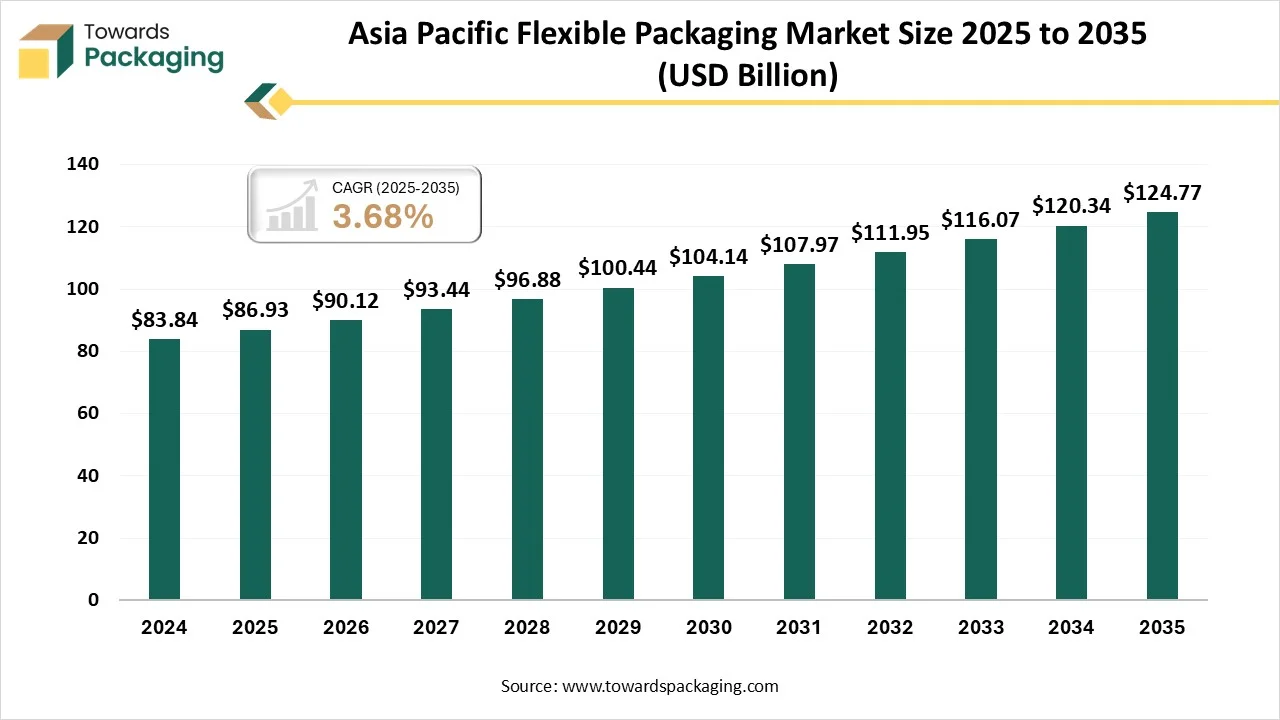

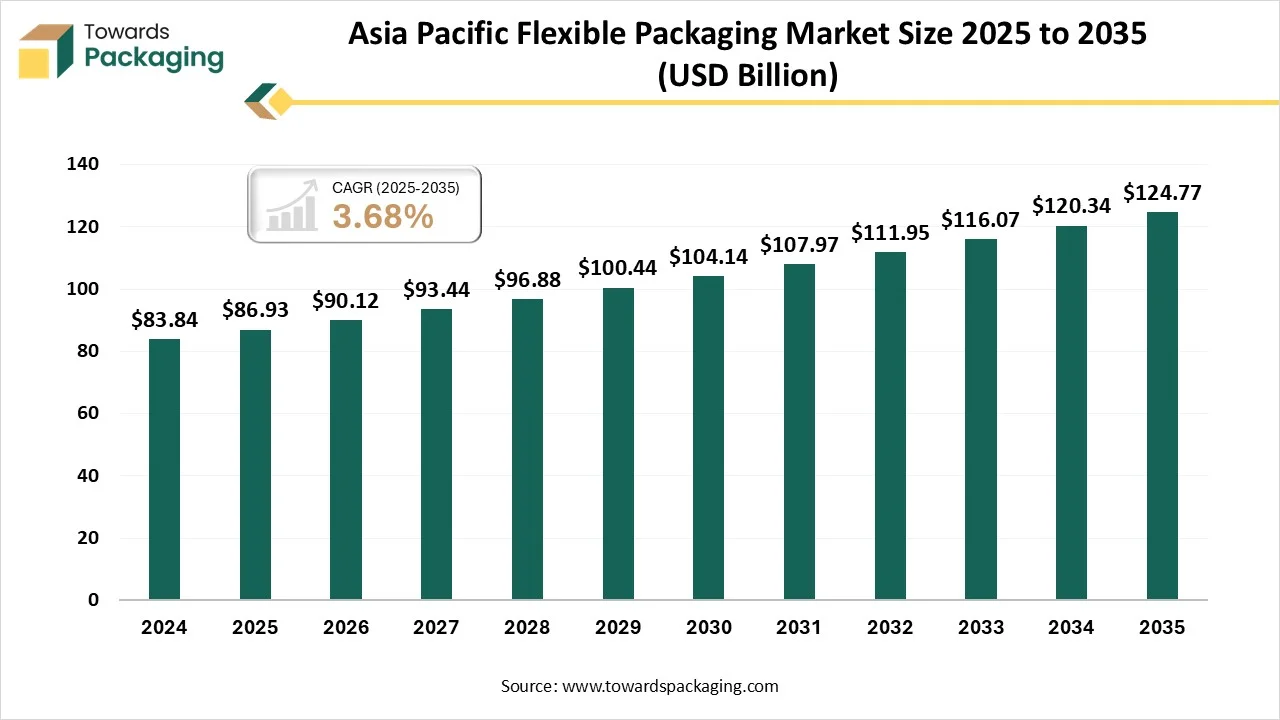

The flexible packaging market is projected to grow from USD 90.12 billion in 2026 to USD 124.77 billion by 2035, expanding at a CAGR of 3.68% during 2026–2035. The report provides comprehensive insights including market size analysis, segment data, company profiles, competitive analysis, value chain analysis, trade statistics, and manufacturers and suppliers data. Market growth is supported by increasing demand for advanced packaging technologies, rising e-commerce activities, growing urbanization, and higher disposable incomes. The report also highlights how the expansion of food delivery and online retail has increased the demand for lightweight, durable, and protective packaging solutions.

Major Key Insights of the Asia Pacific Flexible Packaging Market

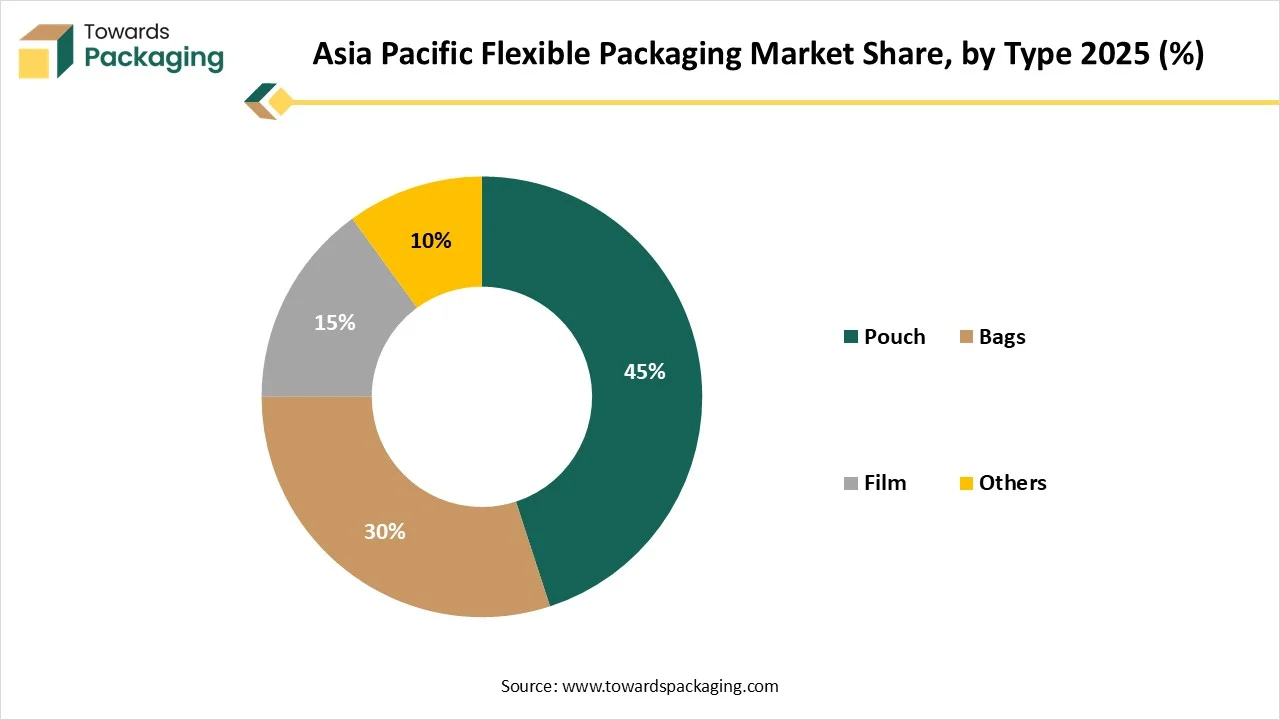

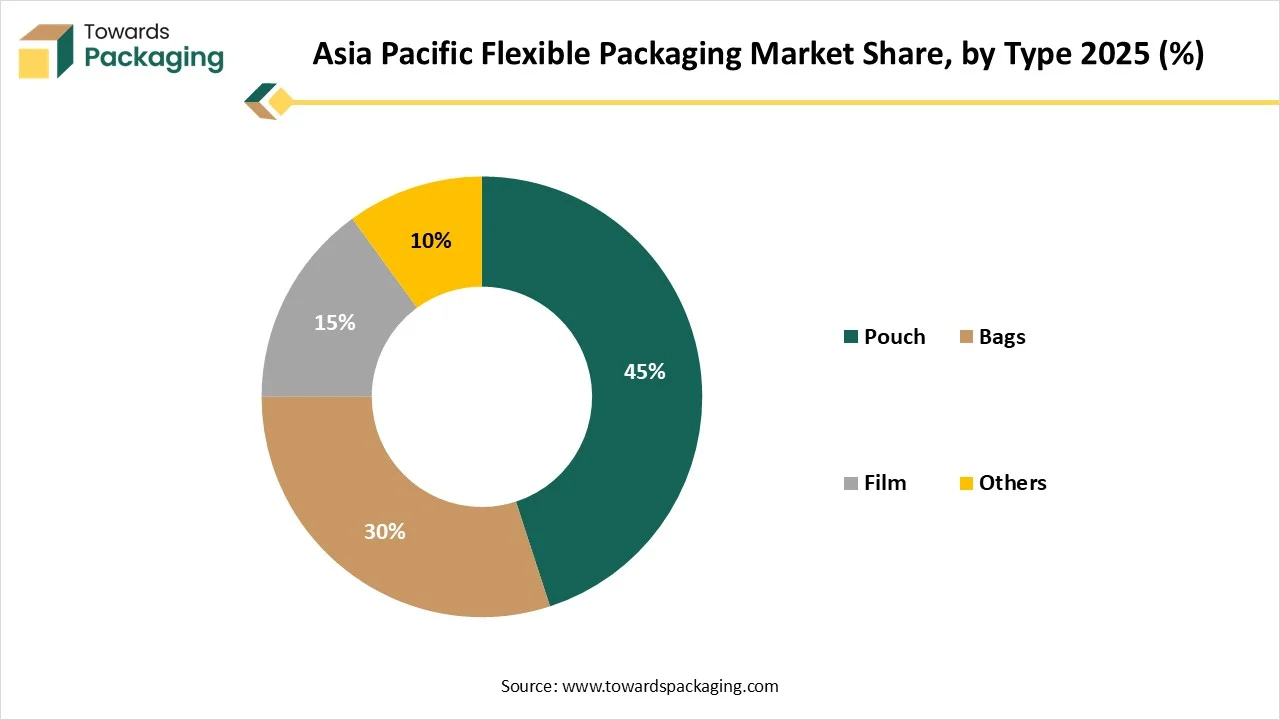

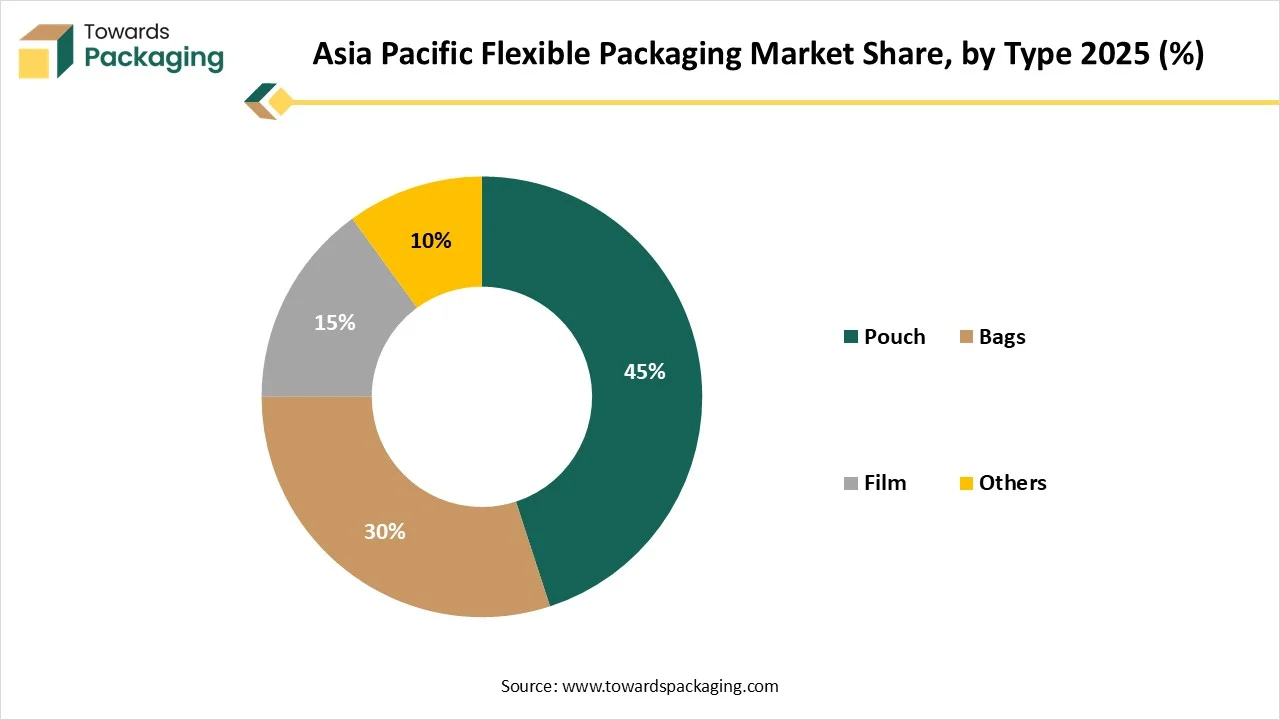

- By type, the pouch segment contributed the biggest market share in 2025.

- By type, the bags segment will be expanding at a significant CAGR in between 2026 and 2035.

- By material, the plastic segment contributed the biggest market share in 2025.

- By material, the paper segment will be expanding at a significant CAGR in between 2026 and 2035.

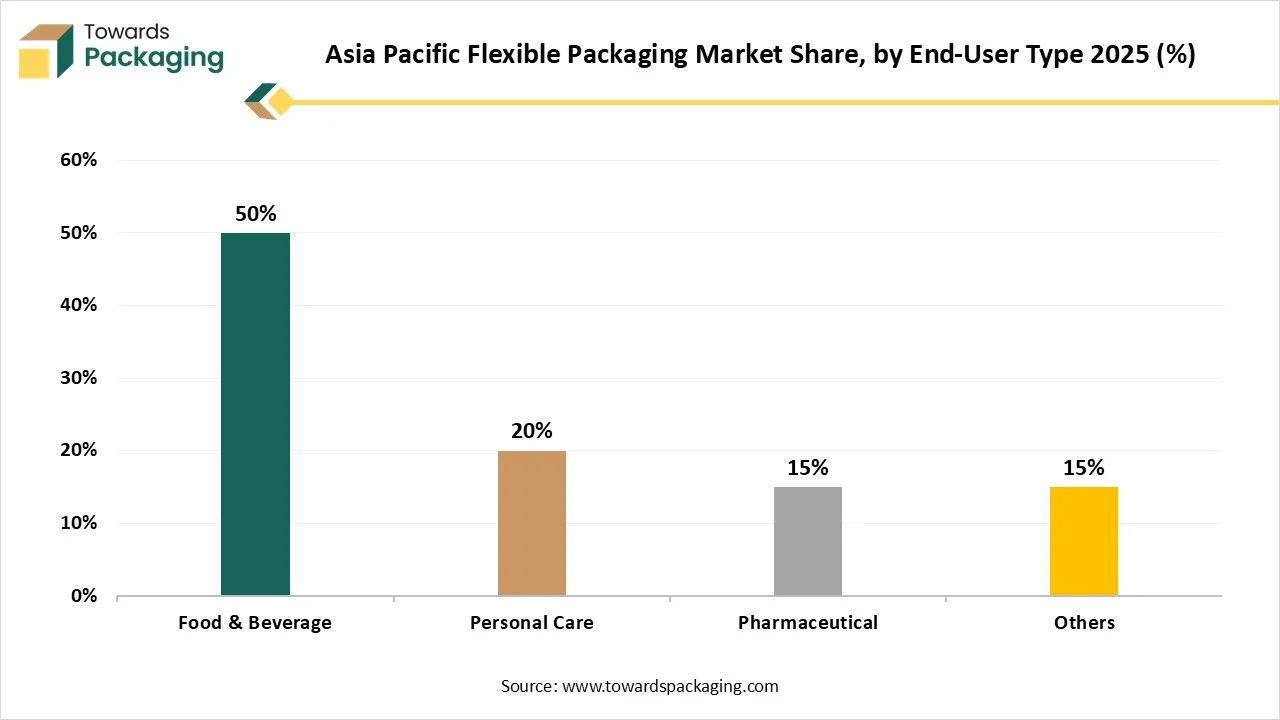

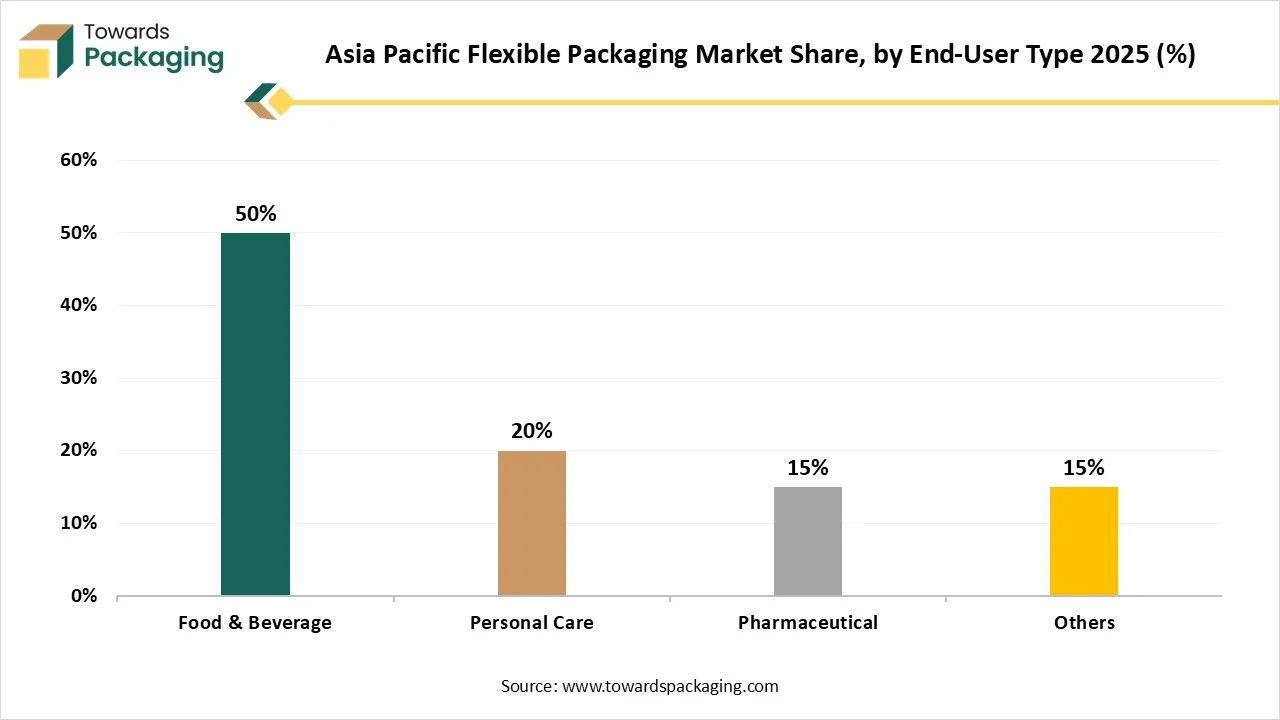

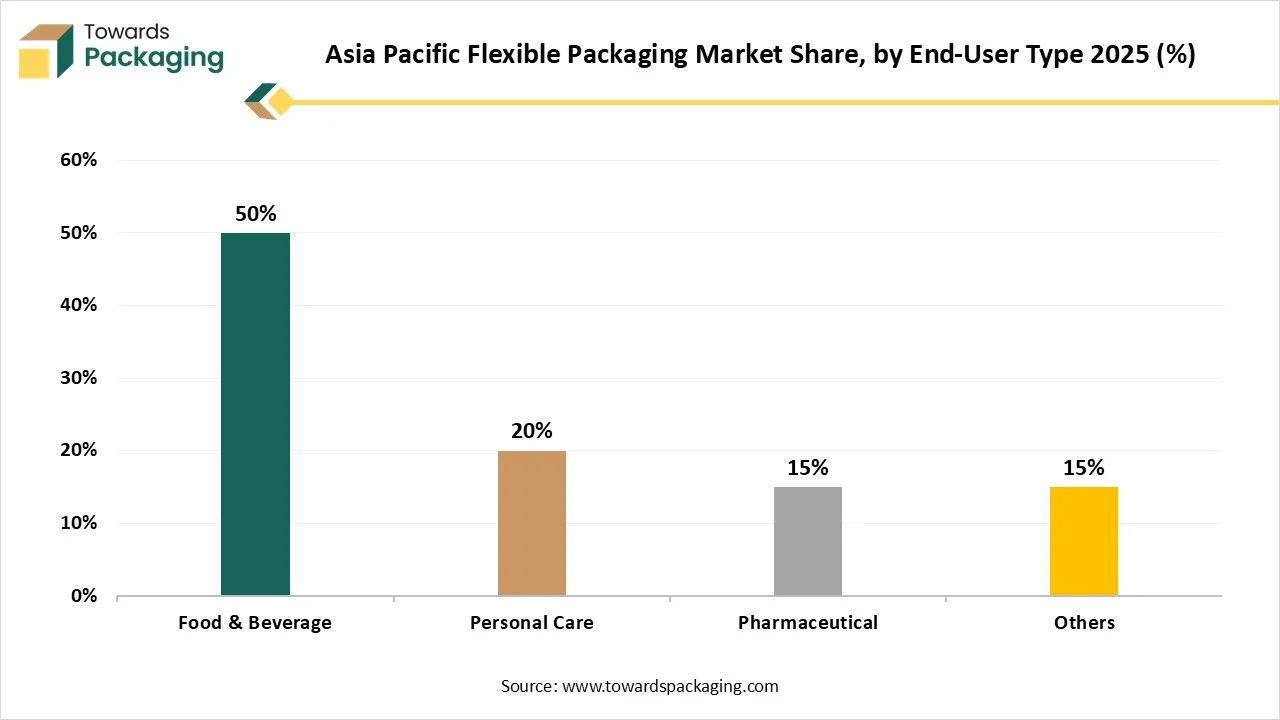

- By end-user, the food & beverage segment contributed the biggest market share in 2025.

- By end-user, the personal care & cosmetics segment will be expanding at a significant CAGR in between 2025 and 2034.

What is Asia Pacific Flexible Packaging?

Asia Pacific flexible packaging includes the utilized of adjustable, lightweight resources such as paper, plastic films, and foils to wrap goods in the Asia-Pacific. This market is rising rapidly because of its cost-effectiveness, capability to enlarge shelf life, and suitability for customers, mainly in the personal care, food & beverage, and pharmaceuticals sectors. Major factors comprise e-commerce development, changing customer demand, and a rising emphasis on smart and sustainable packaging choices.

Asia Pacific Flexible Packaging Market Outlook

- Market Growth Overview: The Asia Pacific flexible packaging market is growing because of increasing demand from e-commerce sector, changing lifestyle and rising urbanization. Several other factors such as versatility, sustainability, and cost-effectiveness have influenced the growth of the market.

- Global Expansion: Regions such as Latin America, North America, Asia Pacific, Europe, South America, Middle East & Africa are witnessing economic growth, industry growth, enhanced investment and manufacturing, sustainability has raised the demand for this market.

- Major Market Players: The market includes Graphic Packaging International, Berry Global, Amcor Plc, Sonoco Products Company, Sealed Air Corporation, Constantia Flexibles, and many other.

- Startup Ecosystem: The startup industries play an important role in developing e-commerce sector, sustainability packaging, bio-based and recyclable resources, and smart packaging process.

Technological transformation in Asia Pacific flexible packaging market plays a significant role in its extension. The incorporation of advanced technology such as automation and AI has enhanced the adoption of flexible packaging across a wide range of industries. Major market players are progressively utilizing AI-driven packing appearances and digital advancement control arrangements to enhance production efficiency, speed, and accuracy. Inventions in smart packing are being advanced to fulfil the requirements of e-commerce sector, such as improving the unboxing practice and shielding products at the time of transportation.

Trade Analysis of Asia Pacific Flexible Packaging Market: Plastic & Paper Statistics in India

- Flexible Packaging Consumption in India

- India has now third-largest packaging market worldwide by crossing Japan.

- The huge consumption of packaged food is estimated to grow up to Rs. 29,563 crore (US$ 3.4 billion) by 2027.

- Paper and paperboard import is estimated to reach approximately 9.92 lakh tonnes in FY25.

- There is investment around Rs. 880 crore (US$ 106 million) during 2023 to 2025 for the development of its first antiseptic carton packaging in Ahmedabad.

Asia Pacific Flexible Packaging Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are polyethylene, polypropylene, metal, bioplastic, and various other materials.

- Key Players: UFlex, International Paper

Component Manufacturing

The component manufacturing in this market comprises pouches, bags, containers, and various other.

- Key Players: Mondi Group, Rengo co. ltd.

Logistics and Distribution

This segment is growing focus on efficient logistics and direct sales of the packaging.

- Key Players: Berry Global Inc., Mondi Group

Type Insights

Why Pouch Segment Dominated the Asia Pacific Flexible Packaging Market In 2025?

The pouch segment dominated the Asia Pacific flexible packaging market with highest share in 2025 due to its low-cost, versatility, and convenience. These are lightweight, easy for shipping, and are suitable for on-the-go carrying of snacks and ready-to-consume food products. They are commonly inexpensive to manufacture than other rigid packaging such as metal or glass cans. It offers superior-quality modification and printing, which improves their visual appearance on retail drops and supports products show up. They are utilized across a huge variety of industries, comprising personal care, food, beverages, and pharmaceuticals.

The bags segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing medical and healthcare infrastructures. The rise in online spending has amplified the need for bags utilized to transport and shield products which is making them an important group in the industry. These are important for packaging of one-time utilization of medical equipment, confirming sterility and comfort of usage, which is a noteworthy development aspect. These are an adaptable and versatile product category, offering to their top position in the industry.

The film is the fastest-growing in the market, as it comprises excellent sealing properties. BOPP and PE films are widely utilized in packaging for beverages, snacks, and various other food products, influenced by high feeding rates in this region. This segment has the largest stake because of its low charge, light weight, and exceptional heat-sealing abilities, making it suitable for generating leak-proof and airtight packaging.

Material Insights

| Material Segments |

Market Share 2025(%) |

| Plastic |

55% |

| Paper |

25% |

| Aluminum |

10% |

| Others |

10% |

Why Plastic Segment Dominated the Asia Pacific Flexible Packaging Market In 2025?

The plastic segment dominated the market with highest share in 2025 due to its versatility, durability, and cost-efficacy. Polyethylene (PE) has the highest market share because of its less production charge, high flexibility, and strength making it suitable for an extensive variety of applications. It is widely utilized in manufacturing packaging such as films, pouches, and sachets, mainly influenced by the enormous demand from the food & beverage sector in this region. Plastic packaging is highly flexible as well as adaptable system of packaging as it permits producers to tailor its style, shape, and size as per their consumers’ necessities.

The paper segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its versatility, strength, and durability of the material. Its potential makes it an ideal choice for the growth of e-commerce sector. These are easy-to-transport, versatile, and lightweight pattern manufactured for packaging of a wide range of products. The rising need for convenient packaging, rapid urbanization, and changing lifestyle of individual has influenced the growth of this market.

The aluminum is the fastest-growing in the market, as it comprises cost-effectiveness and versatility. It is a top-most resource for metalized flexible packing, valued for its superior barrier belongings against oxygen, moisture, and light, which enlarge shelf life of products such as pharmaceuticals and food. It is important for packaging products which is required to stay fresh, like ready meals, confectionery, dairy products, and coffee.

End-User Insights

Why Food & Beverages Segment Dominated the Asia Pacific Flexible Packaging Market In 2025?

The food & beverages segment dominated the market with highest share in 2025 due to its capacity to extend shelf life of packaged products. A huge population with increasing disposable earning result in high need of wrapped food & beverages across this region. Its exceptional barrier potential shield food from spoilage and contamination, confirming product safety and quality. These can be utilized for an extensive variation of products, from ready-to-consume food products to snacks, and is appropriate for both flexible and rigid set-ups. The cost-efficiency and efficacy of producing flexible packaging offer to its extensive usage in this region.

The personal care segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing consumer demand and packaging versatility. Amplified purchasing supremacy and relocation to cities are influencing the demand for personal care goods as well as their packaging. It is suitable for a wide range of personal care goods, from pouches to sachets, and is easy to utilize and transport. It permits for superior-quality and vivacious printing, which improves product performance and consumer demand.

The pharmaceutical is the fastest-growing in the market, as it comprises huge need for safety, ensure drug quality, and maintain shelf life of the products. Pharmacy companies are investing profoundly for advancement of the drug packaging to fulfil the desired standard of the packaging. Producers are integrating patient-friendly services and anti-imitation resolutions into packing to enhance security and operator experience. There is a rising change towards progressive resources that provide better presentation for exact pharmaceutical supplies.

Country Insights

How Japan is Dominating in the Asia Pacific Flexible Packaging Market?

Japan held the largest share in the market in 2025, due to rising emphasis towards sustainability, aesthetics, and convenience. The increasing research and development, resulting towards innovations in sectors such as smart packaging, mono-resource films, and solvent-free lamination. The development of e-commerce has formed a huge demand for safe and material-effectual flexible packaging choices that can endure the rigors of delivery. A sturdy national emphasis on recycling and sustainability, maintained by government creativities, inspires the change in environment-friendly packaging resources and options.

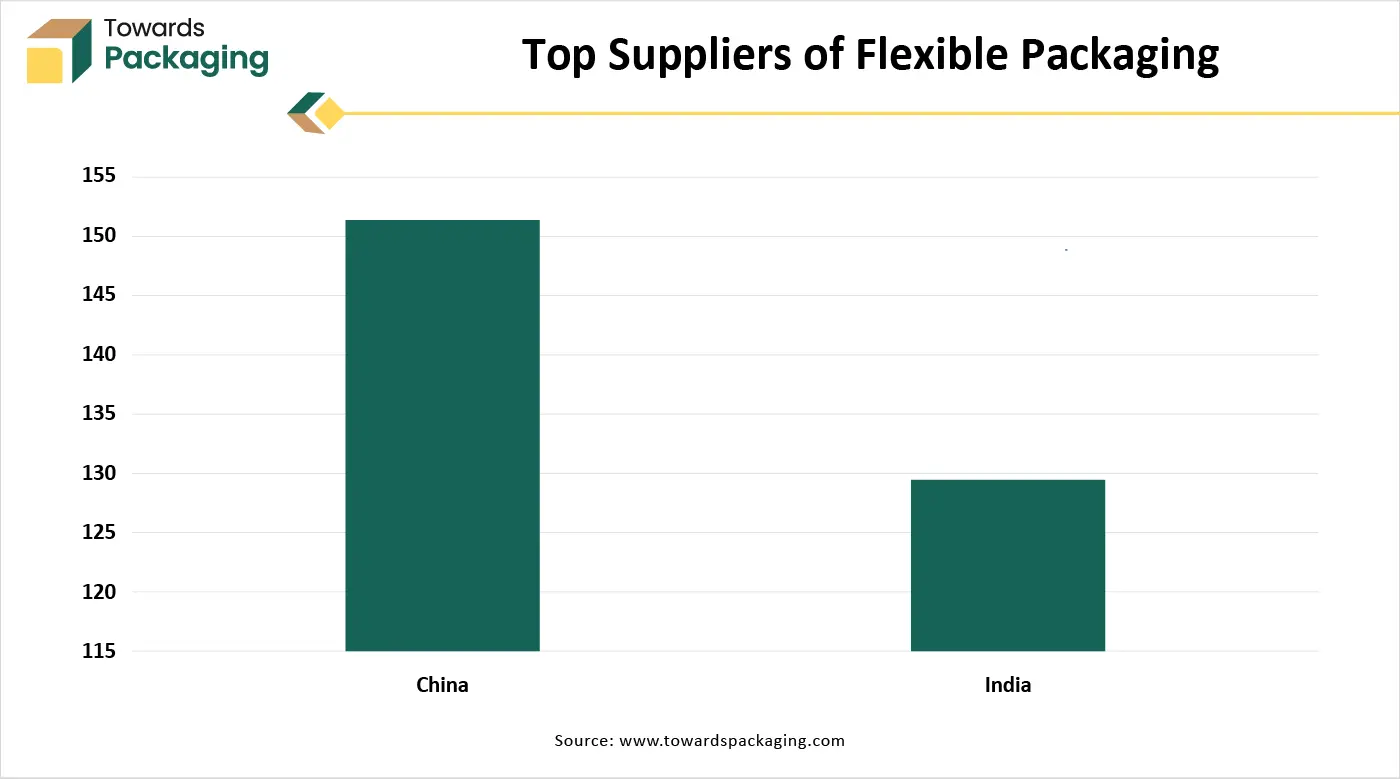

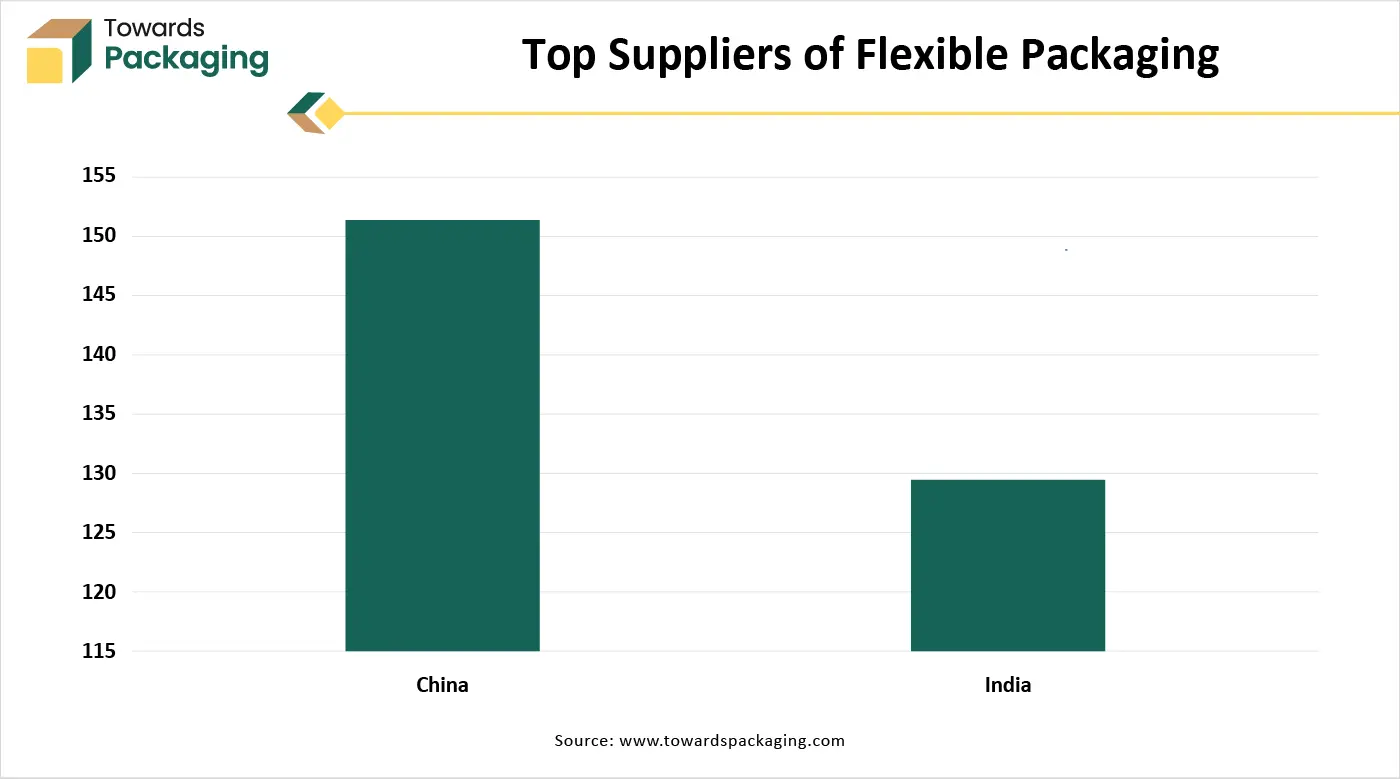

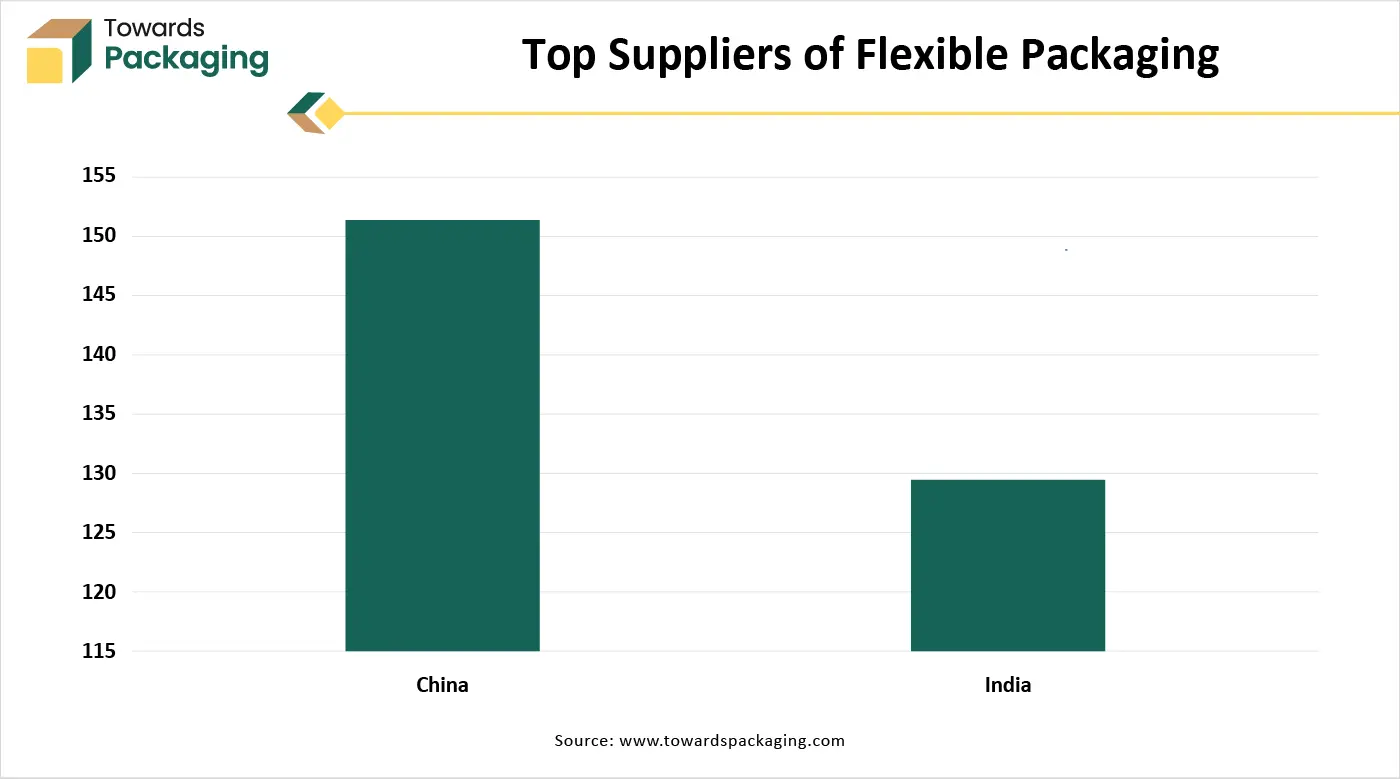

Why Asia Pacific Flexible Packaging Market is Growing Rapidly in China?

Presence of massive manufacturing industries has raised the demand for the market. It is influenced by government initiatives endorsing sustainable wrapping and progressions in recycling and sturdy demand for appropriate, lightweight, and shielding packaging for customer goods and food items. The extension of online marketing and food delivery facilities needs a huge quantity of flexible packaging for transportation and safe handling. The extension of hypermarkets, supermarkets, and the nation's durable food production industry are main customers of flexible packaging to confirm product integrity and shelf life.

Which Factor is Responsible for Notable Growth of Asia Pacific Flexible Packaging Market in India?

The major factors influencing the growth of market are rising consumer convenience demand, increasing disposable earning, growing e-commerce industry, and continuous technological advancement. The upsurge in food delivery facilities and online shopping needs cost-effective, lightweight, and durable packaging which can endure the severities of transportation, which flexible packaging offers proficiently. Increasing ecological consciousness and government guidelines has raised the growth of this market. The extension of current retail and a huge, aspiring middle class boost this demand. Shifting lifestyles and busy built-up lists have amplified the demand for packed, ready-to-consume, and on-the-go food & beverage goods.

Recent Developments

- In June 2025, TIPA and Presto Product’s Fresh Lock announced the launch of home-compostable pouch zippers. TIPA has collaborated for sustainable closure by using hard-to-recycle packaging components.

- In August 2023, Mitsui Chemicals Tohcello and Mitsui Chemicals announced the launch of model testing for straight recycling published BOPP film back to flexible packaging film.

Top Companies in the Asia Pacific Flexible Packaging Market

Uflex Limited

Corporate Information

- Name: UFlex Limited

- Headquarters: Noida, Uttar Pradesh, India

- Business Lines: Flexible packaging, packaging films, aseptic liquid packaging (Asepto), chemicals (inks, adhesives, coatings), holography (brand protection), printing cylinders, and engineering (packaging & converting machinery).

- Global Footprint: Manufacturing facilities in India, UAE, Mexico, Egypt, USA, Poland, Russia, Nigeria, Hungary.

History and Background

- Founded in 1985.

- Originally named Flex Industries Ltd, later renamed to UFlex (in 2007).

- It started with flexible packaging and, over time, expanded into films, printing, holography, and engineering.

Key Developments and Strategic Initiatives

- Sustainability / Recycling: UFlex is heavily investing in recycling. For example, it's setting up a large recycling facility in Noida.

- Capacity Expansion: In November 2025, announced a ₹700+ crore investment to expand packaging film capacity in Dharwad, Karnataka (adding ~54,000 MTPA capacity).

Mergers & Acquisitions

- Based on publicly available data, no major recent acquisitions stand out (unlike some global packaging giants). UFlex seems to focus more on organic expansion, capacity build-up, and strategic investments (recycling, new facilities) rather than M&A.

Partnerships & Collaborations

- Sustainability Alliances: Active in circular-economy work; working with regulatory bodies on EPR (extended producer responsibility) guidelines in India.

- Export / Government Link: Collaboration with APEDA (Agricultural & Processed Food Products Export Development Authority) for packaging technology (e.g., MAP) to export perishables.

- Joint Power Venture: As noted, JV for solar power with AMPIN C&I Power.

Product Launches / Innovations

- Asclepius™: BOPET film with high PCR (post-consumer recycled) content up to 100% PCR.

- 4D Bags: Brick-shaped, re-closable, with a handle. Combines stand-up feature + flexible packaging. Useful for rice, pet food, coffee, etc.

- Modified Atmospheric Packaging (MAP): Technology for preserving fresh produce (e.g., litchis) for up to ~30 days.

Key Technology Focus Areas

- Recycling / Circular Economy: Significant focus on recycling mixed plastic waste, rPET, rPE, rPP.

- Barrier Films: High-performance films (like metallized, barrier) to replace rigid packaging in some use-cases.

- Sustainable Inks & Coatings: Water-based inks, specialty coatings.

R&D Organisation & Investment

- UFlex has an R&D centre recognized by the Department of Science & Technology, Government of India.

- The R&D setup is quite advanced and focuses on polymer science, barrier materials, recycling, and packaging design.

SWOT Analysis

Strengths

- Vertically integrated across the packaging value chain (films, laminates, inks, machinery).

- Global footprint across key geographies.

- Strong innovation capability (R&D, recycling, MAP, PCR films).

- Sustainability credentials: recycling infrastructure, USFDAapproved rPET, netzero ambitions.

- Diversified product portfolio (food, FMCG, pharma, engineering)

Weaknesses

- High capital expenditure needs (recent big investment in capacity & recycling) which could stress cash flows / debt.

- Competitive pressure from global flexible packaging giants.

- Reliance on regulatory frameworks (e.g., EPR) to scale recycled content demand.

- Execution risk in global expansions (e.g., Egypt, Mexico)

- Fluctuation in raw material (polymer) costs

Opportunities

- Greater demand for sustainable packaging, EPR-driven recycled content.

- Growing fresh-produce exports: MAP packaging can be a game-changer.

- Expansion into emerging markets (Africa, Latin America) via new plants.

- Brand protection demand using holography / security films.

- Collaborations on circular economy with governments / corporates.

Threats

- Regulatory risk: plastic bans or stricter packaging waste regulations.

- Volatility in polymer prices or supply chain disruptions.

- Technological disruption: new bio-based packaging alternatives.

- Currency risk in its global operations.

- Intense competition, especially from multinationals with greater scale.

Recent News & Strategic Updates

- USFDA Approval: UFlex received approval for its recycling process to convert PE (and other polymers) into food-grade recycled content.

- ₹700+ Crore Investment: It is investing heavily in its Karnataka plant (Dharwad) to expand film manufacturing capacity.

Other Top Companies

- Amcor Plc: It is a top-most worldwide packaging firm with a significant existence in the Asia Pacific market.

- Mondi Group: It is a worldwide leader in paper and packaging, with a huge footprint in this region.

- Huhtamaki Oyj: It is a Finnish firm offering packaging options, comprising for food, with a sturdy occurrence in Asia Pacific.

- Berry Global Inc.: It is a significant player in both rigid and flexible packaging market.

- Sealed Air Corporation: It offers food security and product safety solutions worldwide.

- Others: Sonoco Products Company, Constantia Flexible, and Graphic Packaging International, LLC.

Asia Pacific Flexible Packaging Market Segments Covered

By Type

By Material

By End-User

- Food & Beverage

- Personal care

- Pharmaceutical

- Others