Mono-material Flexible Food Packaging Films Market Trends, Growth and Market Size Analysis

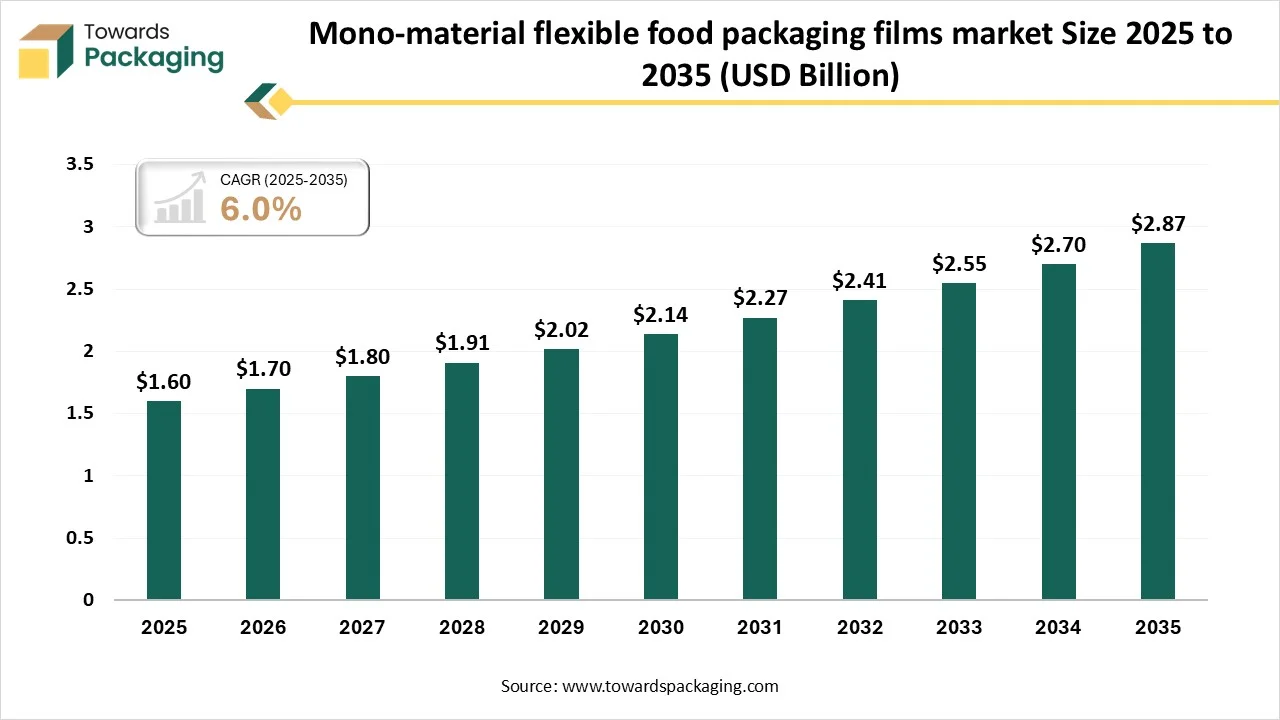

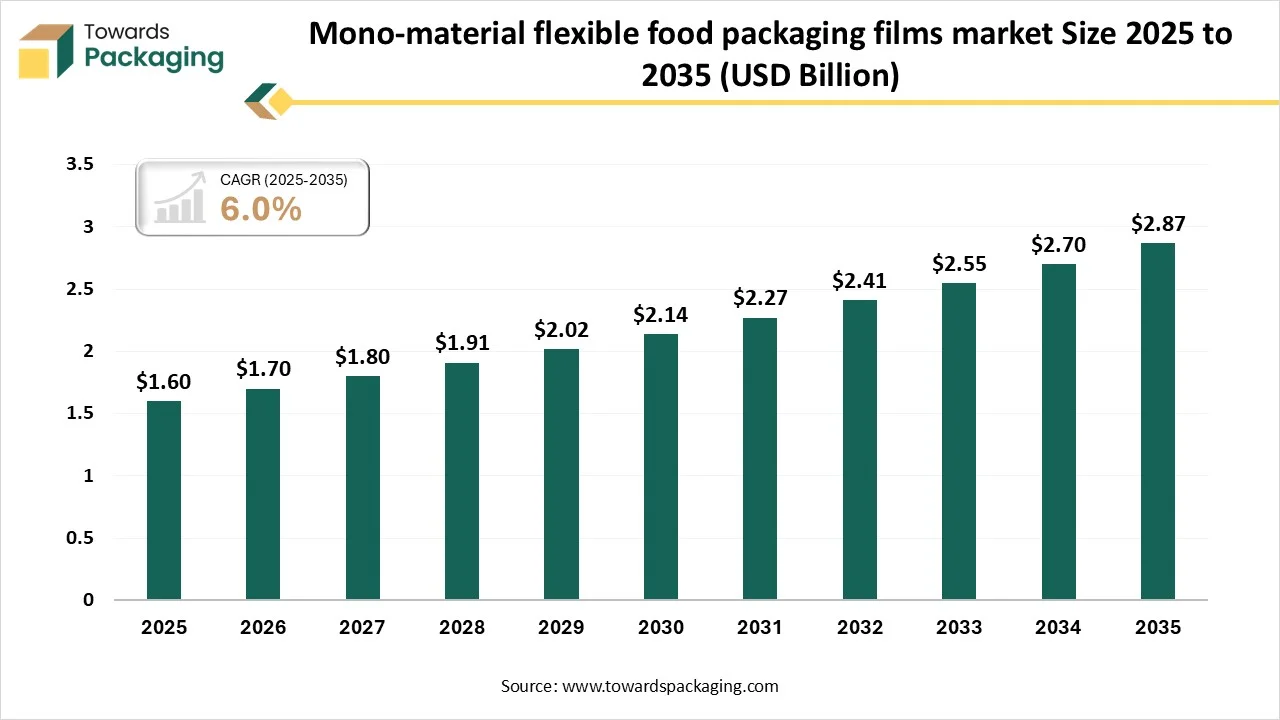

The mono-material flexible food packaging films market is forecasted to expand from USD 1.7 billion in 2026 to USD 2.87 billion by 2035, growing at a CAGR of 6.0% from 2026 to 2035. The market is experiencing rapid growth due to increasing demand for sustainable packaging and also due to rapid innovation in the packaging sector.

Major Key Insights of the Mono-material Flexible Food Packaging Films Market

- In terms of revenue, the market is valued at USD 1.6 billion in 2025.

- The market is projected to reach USD 2.87 billion by 2035.

- Rapid growth at a CAGR of 6.0% will be observed in the period between 2026 and 2035.

- By region, Europe dominated the global market by holding highest market share in 2025.

- By region, Asia Pacific is expected to grow at a fastest CAGR from 2026 to 2035.

- By material type, the polyethylene (PE) mono-films segment contributed the biggest market share in 2025.

- By material type, the polypropylene (PP) mono-films segment will be expanding at a significant CAGR in between 2026 and 2035.

- By film structure, the multi-layer mono structures segment contributed the biggest market share in 2025.

- By film structure, the single-layer mono-films segment will be expanding at a significant CAGR in between 2026 and 2035.

- By packaging format, the pouches (stand-up, flat, zipper) segment contributed the biggest market share in 2025.

- By packaging format, the vacuum & modified atmosphere packaging (map) films segment will be expanding at a significant CAGR in between 2026 and 2035.

- By food category / application, the snacks & confectionery segment contributed the biggest market share in 2025.

- By food category / application, the frozen & refrigerated foods segment will be expanding at a significant CAGR in between 2026 and 2035.

What are Mono-material Flexible Food Packaging Films?

Mono-material flexible food packaging films are sustainable substitutes to old-style multi-layer packaging films, generated from a single polymer such as Polypropylene (PP) or Polyethylene (PE), shortening recycling by removing the requirement to discrete mixed resources, while still providing crucial food protection such as moisture and oxygen barrier and performance like strength & flexibility with advanced processing which is making them important for circular economy creativities.

Mono-material Flexible Food Packaging Films Market Trends

- Market Growth Overview: The market is experiencing strict packaging guidelines and increasing demand for sustainable packaging.

- Major Market Players: Mono-material flexible food packaging films market comprises ProAmpac, Huhtamaki, Mondi Group, Berry Global, UFlex, and many other.

- Startup Ecosystem: The startup industries are majorly focusing on development of high-barrier technology, functional coating, innovation in material, and biodegradable or compostable packaging options.

Major Transformation in Technology of the Mono-material Flexible Food Packaging Films Market

Technological transformation in the mono-material flexible food packaging films market plays a significant role in its growth. Advanced barrier properties to extended shelf life of the products have influenced the growth of the market. Usage of ultrathin film of silicon or aluminum help in protection of food products from moisture or oxygen. Progression in barrier coating technology shift various packaging brands to adapt these types of packaging.

Trade Analysis of Mono-material Flexible Food Packaging Films Market: Import & Export Statistics

- China is considered as the top-most exporter of the food packaging films with 10,621 shipments worldwide.

- Taiwan is the second leading exporter of the food packaging films with 1,248 shipments globally.

- Russia stands in the third position as an exporter of the food packaging films with 944 shipments.

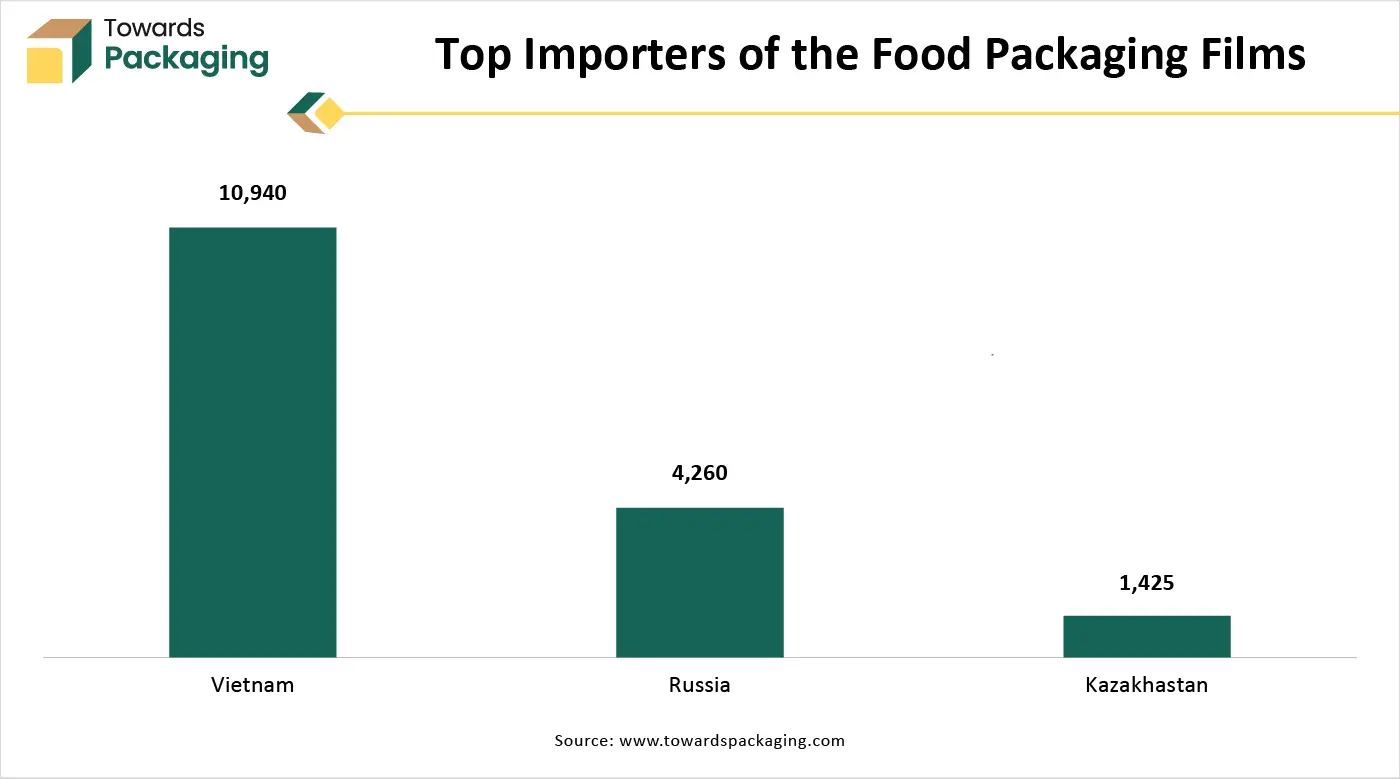

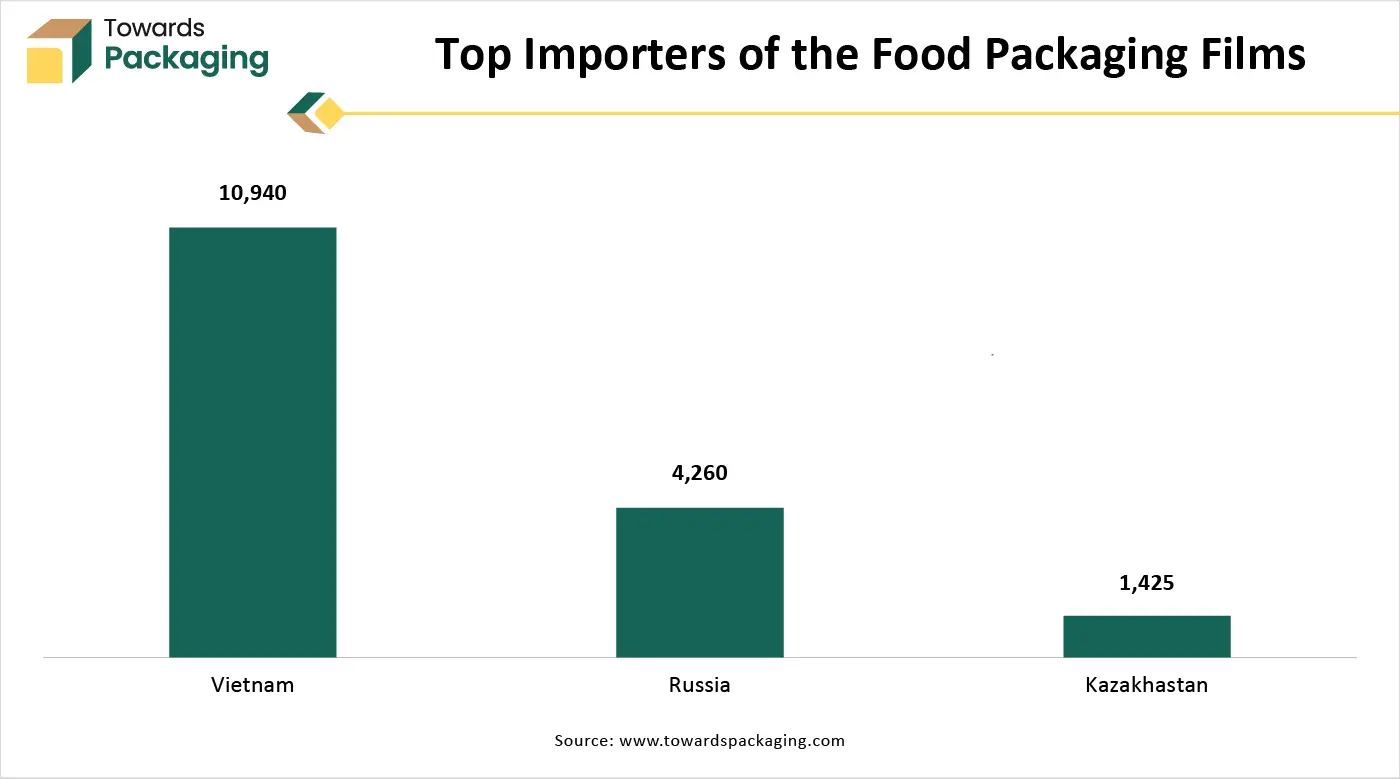

Top Importers of Mono-material Flexible Food Packaging Films Market

Mono-material Flexible Food Packaging Films Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are polyethylene Terephthalate, polyethylene and polypropylene.

- Key Players: LyondellBasell, DOW

Component Manufacturing

The component manufacturing in this market comprises polymer selection, extrusion, orientation, barrier engagement, printing & laminating, and formation.

- Key Players: Amcor Plc, Uflex Limited

Logistics and Distribution

This segment is designed to fulfil circular economy goals by maintaining high-barrier, printing, or sealing.

- Key Players: Goglio S.p.A., UFlex

Segmental Insights

Material Type Insights

Why Polyethylene (PE) Mono-films Segment Dominated the Mono-material Flexible Food Packaging Films Market In 2025?

The polyethylene (PE) mono-films segment dominated the market with highest share in 2025 due to excellent moisture and chemical resistance. Its high flexibility and strong sealing properties has made it an ideal choice for packaging of food products. These are inexpensive solution available for the packaging of food. These can be easily customized into various shapes and sizes which attract a huge consumer towards this segment.

The polypropylene (PP) mono-films segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to their superior barrier, recyclability, strength, and transparency. Enhanced food safety concern among consumers has raised the utilization of this material. This segment plays an important role in preserving the freshness of the food products packed for a longer period.

Film Structure Insights

Why Multi-Layer Mono-film Structures (co-processed/laminated mono) Segment Dominated the Mono-material Flexible Food Packaging Films Market In 2025?

The multi-layer mono-film structures (co-processed/laminated mono) segment dominated the market with highest share in 2025 as it offers high functionality. It has high mechanical strength and excellent oxygen and moisture barrier. It has advanced adhesives, nanocoating, and high-performance potential which increase shelf life of the food products. It is efficient in e-commerce sector as it has multiple-layers to protect from adverse ecological factors.

The single-layer mono-films segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its easy recyclability. Rising brands’ commitment for eco-friendly packaging has enhanced the demand for such packaging. Strict regulatory pressure has raised the utilization of single-layer mono-films packaging. These are cost-effective solution available for food industry which offer excellent safety to the food products.

Packaging Format Insights

Why Pouches (stand-up, flat, zipper) Segment Dominated the Mono-material Flexible Food Packaging Films Market In 2025?

The pouches (stand-up, flat, zipper) segment dominated the market with highest share in 2025 due to rising concern for consumers convenience. The increasing demand for zipper pouches which are convenient for consumers while travelling raised the adoption of these materials. Rapid change in lifestyle of the consumers has evolved the packaging choices with leakage-proof and reseal ability. These packaging films are highly versatile and excellent visibility which promote market players to use this type of packages.

The vacuum & modified atmosphere packaging (map) films segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to presence of strict sustainability guidelines. Increasing demand for packaged vegetables, raw food such as meat, fish, and sea foods has influenced the demand for this segment. Progressive polymer technology has raised the demand for these films for storage of frozen food products.

Food Category / Application Insights

Why Snacks & Confectionery Segment Dominated the Mono-material Flexible Food Packaging Films Market In 2025?

The snacks & confectionery segment dominated the market with highest share in 2025 due to rising shift for aesthetic and branding strategies. Huge barrier demand against moisture and oxygen has promoted these mono-material packaging films. These can be easily customized according to the requirement which enhance the adoption of these films. These films have high quality printability which attract huge consumers towards this market.

The frozen & refrigerated foods segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to presence of strict sustainability guidelines. These packages maintain the quality of the food products in zero-degree temperature as well which raise its adoption extensively. These are well-known for prevention of food waste due to its high barrier properties.

Regional Insights

How Europe is Dominating in the Mono-material Flexible Food Packaging Films Market?

Europe held the largest share in the market share in 2025, due to huge consumers demand with increasing shift towards urban areas. Rising processed food availability and e-commerce industry has influenced the development of this market. Presence of strict government regulation for packaging of food products has influenced the demand for this packaging. Strong demand for cost-effective packaging in the food industry has influenced the demand for this packaging films.

Germany Mono-material Flexible Food Packaging Films Market Trends

Anti-plastic packaging policy have raised the demand for market in Germany. The rising innovation in the recycling technology has influenced the demand for this mono-material packaging. Increasing concern for eco-friendly packaging has raised these packaging as these can be recycled for multiple times. Consumption of dairy, bakery, meat, seafood, and various other products has raised the demand for this sector.

Asia Pacific Mono-material Flexible Food Packaging Films Market Trends

Asia Pacific expects the fastest growth in the market during the forecast period. Preference for eco-friendly packaging have influenced the demand for the market. Increasing sustainable packaging has raised the demand for this market due to mono-materials usage in its manufacturing. Enhanced demand for packaged food consumption has raised the requirement for high-quality packaging of food products. These protect food products from adverse ecological condition while transporting which has raised the usage of these packages.

China Mono-material Flexible Food Packaging Films Market Trends

Increasing demand for convenient packaging of food products have driven the demand of the market in China. Rising awareness towards safety of food products has evolved the manufacturing process of these films. These packaging are highly adapted to decrease landfill waste which has raised advancement in this sector. Major brands are actively switching towards recyclable and bio-based packaging which increase the production demand for these packaging.

North America Mono-material Flexible Food Packaging Films Market Trends

The major factors influencing the growth of market are strict packaging regulation, circular economy, consumer demand, and cost efficiency. Increasing preference for eco-friendly and sustainable packaging has influenced the demand for this market. Single polymer packaging films decrease landfill taxes and transport charges which offer economic advantages. Integration of digital tracking process has attracted huge consumers towards this market.

The U.S. Mono-material Flexible Food Packaging Films Market Trends

Presence of strict ecological laws has influenced the development of the mono-material flexible food packaging films market. These packaging are widely used due to its high barrier properties that protect food from contamination. Increasing demand for lightweight protective and durable packaging has influenced the demand for innovation in this sector. Recycled packaging is low cost which allow a wide range of business to adapt such packages.

Recent Development

- In November 2025, TOPPAN Inc. announced the launch of hybrid line manufacturing biaxially-oriented polyethylene (BOPE) and biaxially-oriented polypropylene (BOPP) film.

- In July 2025, Innovia Films announced the mono material packaging with BOPP films for packaging. These are advanced mono-material polypropylene options that are Packaging and Packaging Waste Regulation (PPWR).

Top Companies in the Mono-material Flexible Food Packaging Films Market

- Berry Global Group, Inc.: It is specialized in material engineering for food packaging, specifically in bakery, beverage, and frozen food sectors.

- Amcor PLC: It is a global leader in responsible packaging, with a strong focus on developing mono-material solutions.

- Sonoco Products Company: It is a leader in sustainable packaging, particularly through its "Better Packaging.

- Sealed Air Corporation: It is known for its Cryovac® brand, focuses on high-barrier, recycle-ready films for food applications.

- Bemis Company (now part of Amcor): It is strengthened its position in flexible packaging.

- Others: Mondi Group, Coveris Holdings S.A., Uflex Limited, Cosmo Films Ltd, and many others.

Mono-material Flexible Food Packaging Films Market Segments Covered

By Material Type

- Polyethylene (PE) Mono-films

- Linear Low-Density PE (LLDPE)

- Low-Density PE (LDPE)

- High-Density PE (HDPE)

- Polypropylene (PP) Mono-films

- Oriented PP (OPP)

- Cast PP (CPP)

- Polyethylene Terephthalate (PET) Mono-films

- Bio-based / Compostable Mono-films

By Film Structure

- Single-Layer Mono-films

- Multi-Layer Mono-film Structures (co-processed/laminated mono)

By Packaging Format

- Pouches (stand-up, flat, zipper)

- Shrink & Stretch Films

- Lidding Films

- Wraps & Bags

- Vacuum & Modified Atmosphere Packaging (MAP) Films

By Food Category / Application

- Snacks & Confectionery

- Frozen & Refrigerated Foods

- Bakery & Ready-to-Eat

- Meat, Poultry & Seafood

- Dairy & Cheese

- Fruit & Vegetable Packaging

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Tags

FAQ's

Select User License to Buy

Figures (2)