Colorless Polyimide Films Market Growth with Logistics & Distribution Solutions

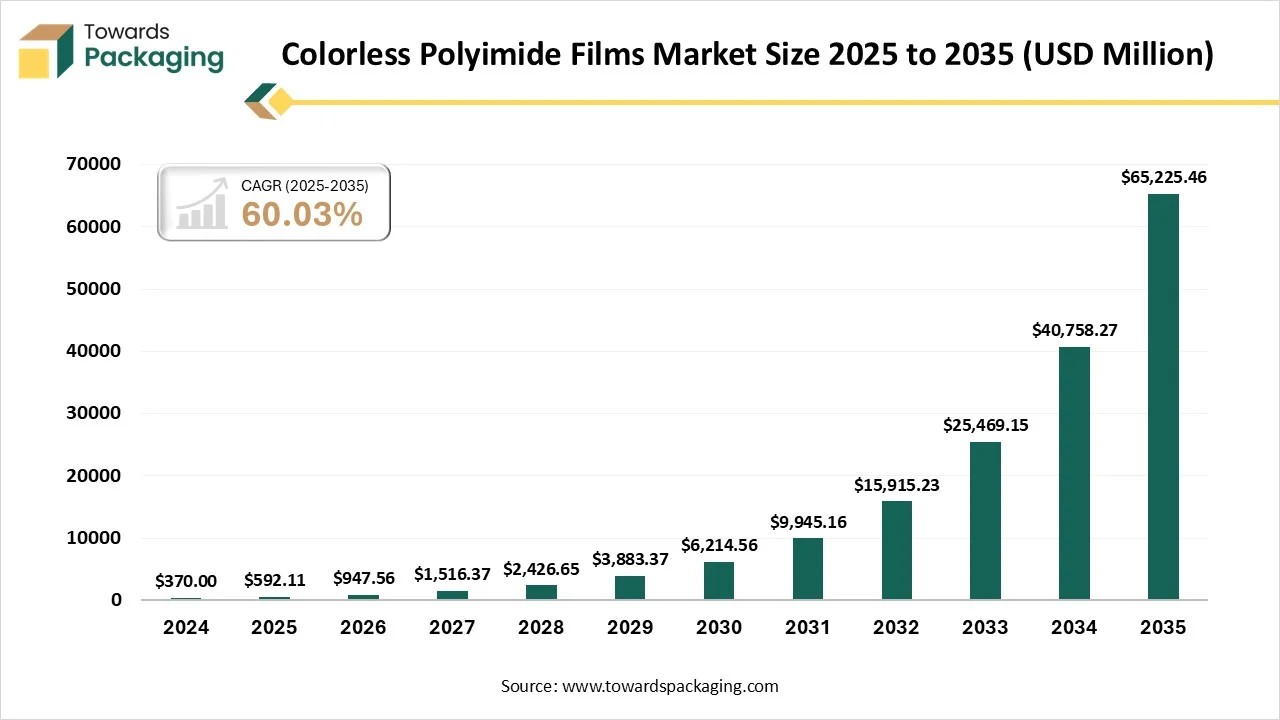

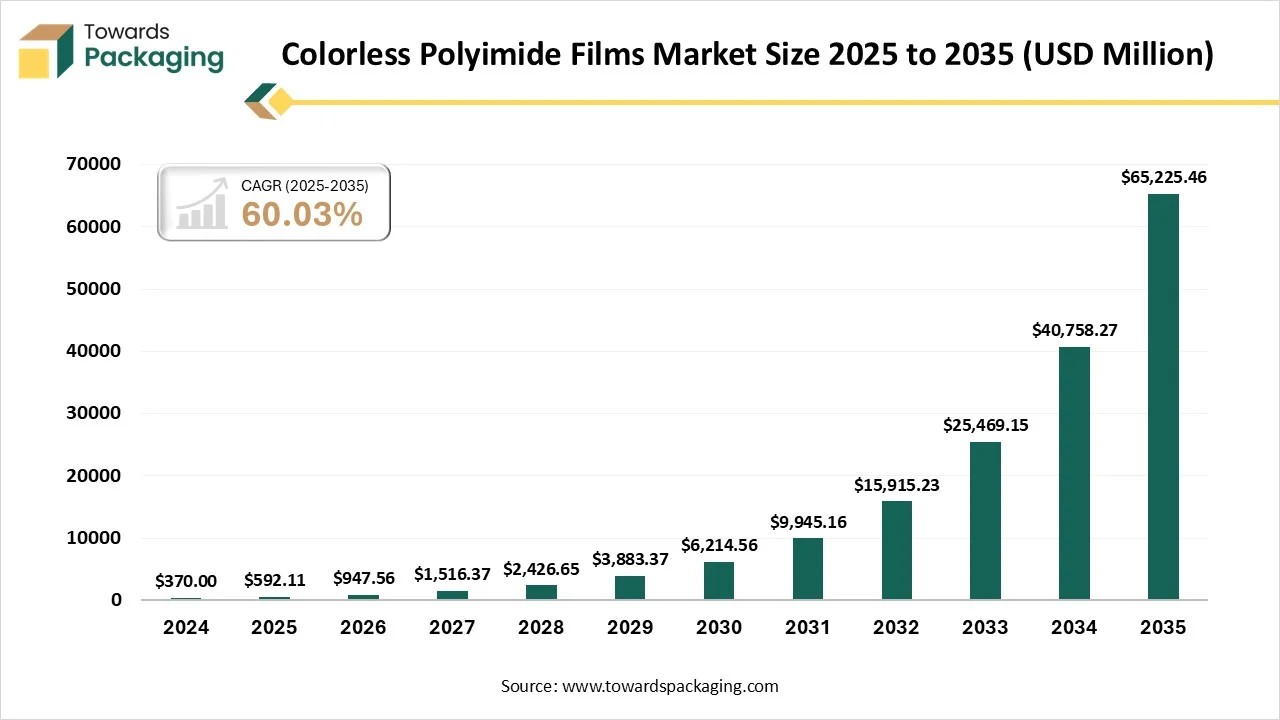

The colorless polyimide films market is projected to grow from USD 947.56 million in 2026 to USD 65,225.46 million by 2035, registering a CAGR of 60.03% during 2026–2035. The report provides comprehensive insights including market size, segment data, regional trends, company profiles, competitive analysis, value chain analysis, trade statistics, and detailed manufacturers and suppliers data. Increasing demand for flexible displays in foldable smartphones, laptops, and tablets is a key growth driver, as these films offer high transparency, superior thermal stability, chemical resistance, and strong mechanical performance.

Major Key Insights of the Colorless Polyimide Films Market

- In terms of revenue, the market is valued at USD 947.56 million in 2026.

- The market is projected to reach USD 65225.46 million by 2035.

- Rapid growth at a CAGR of 60.03% will be observed in the period between 2026 to 2035.

- by region, Asia Pacific dominated the global market by holding highest market share in 2025.

- By region, North America is expected to grow at a fastest CAGR from 2025 to 2034.

- By application, the flexible displays segment contributed the biggest market share in 2025.

- By application, the flexible printed circuit boards segment will be expanding at a significant CAGR in between 2026 to 2035.

- By end user type, the electronics segment contributed the biggest market share in 2025.

- By end user type, the solar energy segment will be expanding at a significant CAGR in between 2026 to 2035.

What are Colorless Polyimide Films?

Colorless polyimide films include high-presentation, transparent, and colorless plastic films with exceptional thermal steadiness, flexibility and mechanical strength. Contrasting old-style polyimide films, these are yellow, these are precisely manufactured to be optically transparent and are utilized as alternate for solar cells, flexible displays, and several other optoelectronics. Their exclusive properties create them suitable for usages in customer aerospace, electronics, and various other requesting sectors where high sturdiness and transparency are crucial.

Colorless Polyimide Films Market Outlook

- Market Growth Overview: Colorless polyimide films market is expanding due to growing demand for electronics, aerospace, automotive, and solar industries. This market is highly influenced by flexible printed circuit boards, flexible displays, and flexible solar cells.

- Global Expansion: Regions such as Latin America, North America, Asia Pacific, Europe, South America, Middle East & Africa are witnessing rising demand for healthcare device safety, advancement in packaging technology, and various other factors.

- Major Market Players: The market includes 3M company, NeXolve Holding Company, Industrial Summit Technology, Kolon Industries, Toray Industries, and many other.

- Startup Ecosystem: The startup industries play an important role in research and development process and increasing strategic partnership to introduce innovation in this sector.

Major Transformation in Technology of the Colorless Polyimide Films Market

Technological transformation in market plays a significant role in coating technique and advanced processing. Advanced technology resolves the issues with functionality and durability, ensure longer lifespans suitable for flexible devices such as wearables, laptops, and foldable smartphones. The major shift includes operating the molecular construction of polyimides to generate a balance among robust thermal/mechanical properties and high optical transparency. The increasing demand for sustainable manufacturing methods and flexible electronics has raised the adoption of high skilled technology.

Trade Analysis of Colorless Polyimide Films Market: Import & Export Statistics

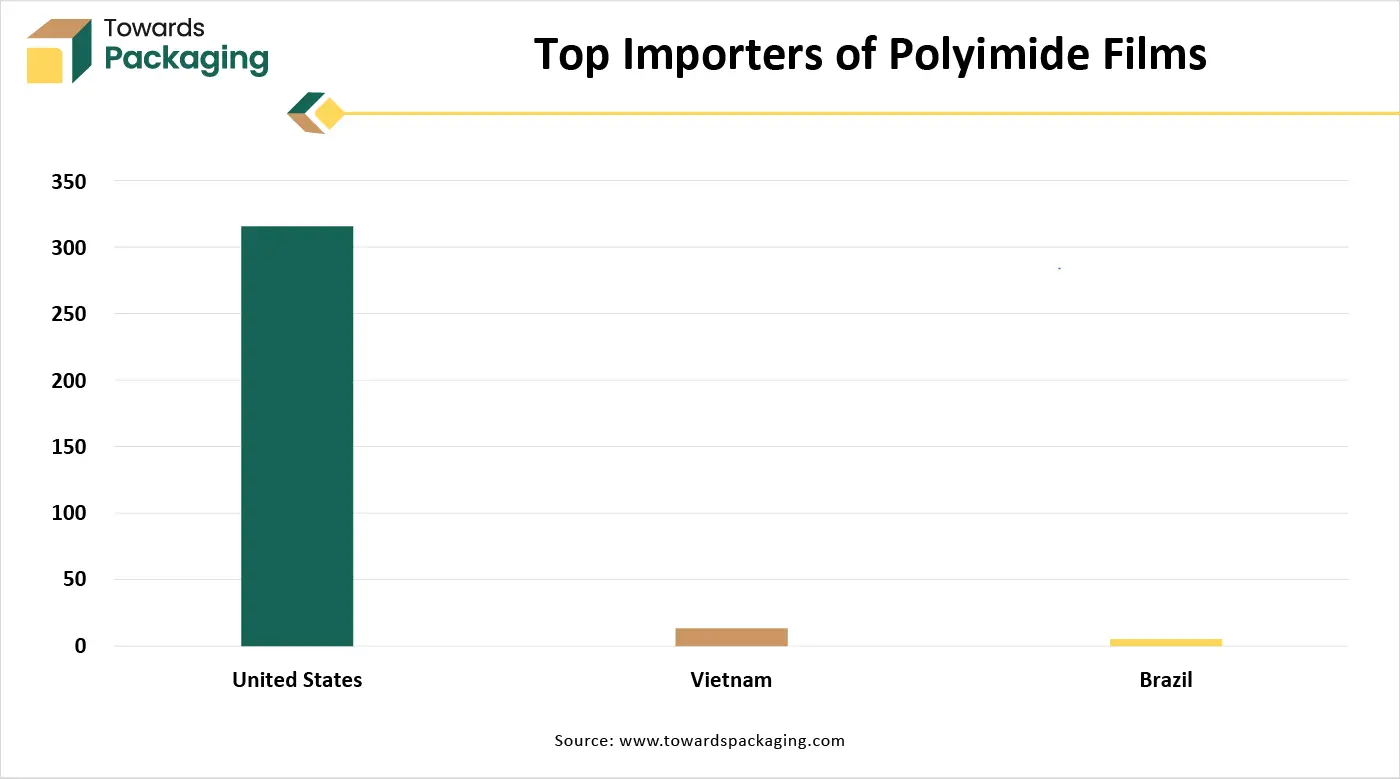

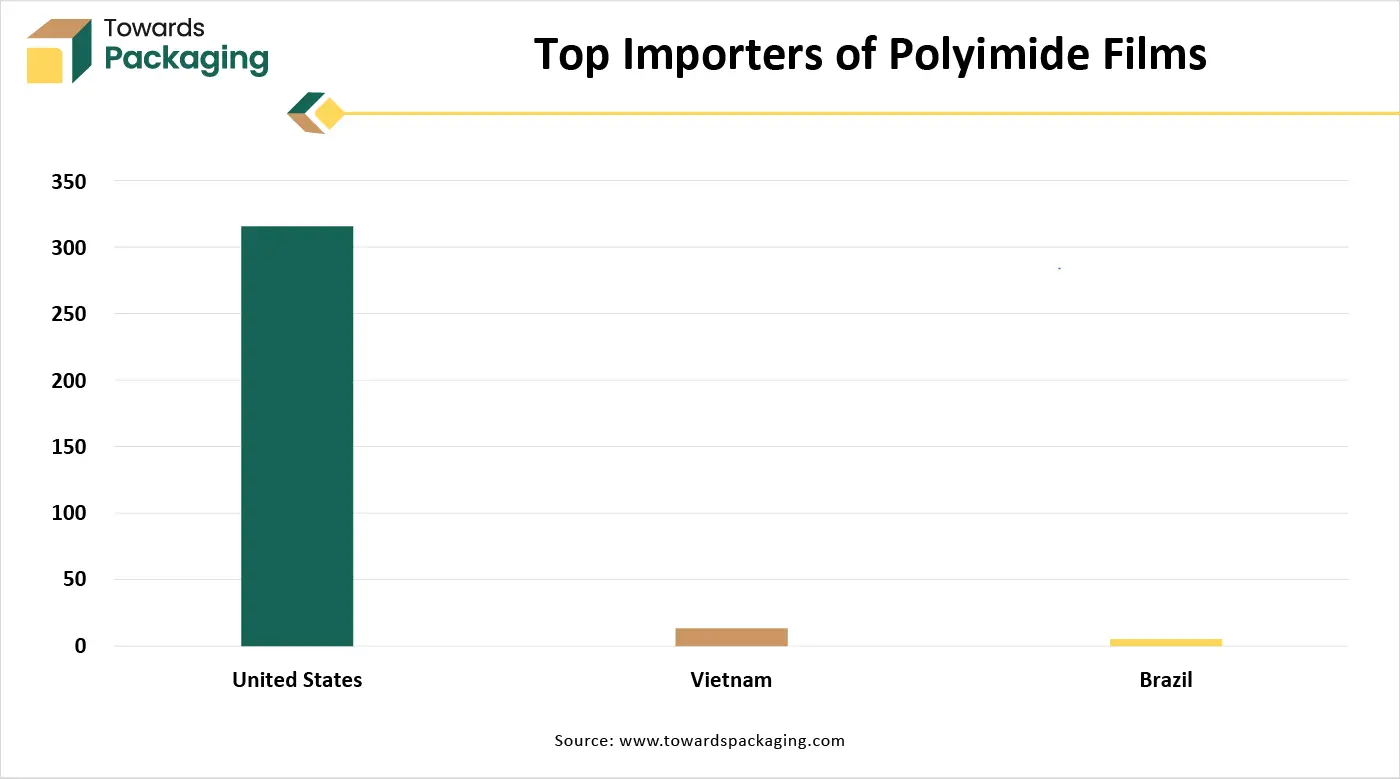

- China: It is the top-most exporter of polyimide films worldwide with 271 shipments.

- South Korea: It stands in second position as an exporter of polyimide films with 47 shipments worldwide.

- Hong Kong: It is in the third position as a worldwide exporter of polyimide films with 33 shipments.

Colorless Polyimide Films Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are Oxydianiline (ODA) and Pyromellitic Dianhydride (PMDA).

- Key Players: DuPont, Toray Industries Inc.

Component Manufacturing

The component manufacturing in this market comprises process such as polyamic acid (PAA) route.

- Key Players: Kolon Industries Inc., Kaneka Corporations

Logistics and Distribution

This segment is growing focus on strict managing protocols and direct supply chains to electronics producers.

- Key Players: Sumitomo Chemical Co., Kaneka Corporation

Product Type Insights

Why Flexible Displays Segment Dominated the Colorless Polyimide Films Market In 2025?

The flexible displays segment dominated the market with highest share in 2024 due to increasing demand for portable, thinner, and lighter devices. The enhancing demand is influenced by the requirement for durable, lightweight, and foldable electronic devices such as wearables, smartphones, and tablets. These are utilized as transparent and defensive cover plates for solar cells. These films offer crucial benefits such as thermal stability and high transparency, and are important for presentation in high-tech usages. Constant increasing demand for environment-friendly and operative adhesive options is aligning them for possible development.

The flexible printed circuit boards segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its optical transparency, flexibility, and thermal stability. These are utilized as a durable, and lightweight alternate in the manufacturing of the lightweight as well as flexible solar panels. Rising demand for high-performance, miniaturized, and lightweight devices has raised the demand for this segment. The excellent heat resistance which enhanced its adoption in electronics manufacturing industry.

The flexible solar cells are the fastest-growing in the market, as it comprises flexible and lightweight substrate. Huge support from governmental bodies for the adoption of solar electronic devices has raised its protection concern among manufacturing bodies. It has high clarity and thermal stability which enhance its demand in several sectors. Increasing adoption for portable devices has majorly raised the demand for this segment.

End Use Industry Insights

| End Use Industry Segments | Market Share 2025(%) |

| Electronics | 55% |

| Solar Energy | 25% |

| Medical | 10% |

| Others | 10% |

Why Electronics Segment Dominated the Colorless Polyimide Films Market In 2024?

The electronics segment dominated the market with highest share in 2024 due to enhancing wearable technology and lighting equipment. These are utilized in automotive usages for instrument, displays, and touchscreens panels because of their reliability and durability. The development of wearable equipment such as health monitors and smartwatches boosts the demand for durable, lightweight, and flexible resources has raised this segment. Several other noteworthy electronics claims comprises wearable technology, semiconductor packing, automotive electronics, and lighting devices.

The solar energy segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to enhanced usage of flexible solar cells and solar street lighting. A worldwide change in the direction of renewable energy are enhancing the demand for efficient and versatile solar technologies. The significant shift towards enhanced performance and cost-operative options, which further helps market extension.

The medical segment is the fastest-growing in the market, as it comprises high optical quality and thermal stability. The exclusive mixture of high clarity, optical worth, thermal stability and flexibility made these films suitable for a huge variety of medical usages. These are utilized in medical devices partly because of their proven reliability and biocompatibility. The increasing reliance of healthcare industry on reliable and durable resources for new technologies helps the development of this segment.

Regional Insights

How Asia Pacific is Dominating in the Colorless Polyimide Films Market?

Asia Pacific held the largest share in the market in 2024, due to the presence of strong manufacturing industries of various sectors such as electronics, pharmaceutical, and various others. Continuous advancement and increasing demand for miniature products has raised the safety concern among producers. This region is the major manufacturing centre for products such as foldable smartphones and various other flexible displays, that result in enhancing the demand for these colorless films. Increasing household earnings and a huge customer base for electronics products in developing economies within this region have boosted noteworthy demand for flexible devices.

Why Colorless Polyimide Films Market Is Dominating In China?

Rising demand for durable, clear, and flexible films has enhanced the demand for colorless polyimide film in China. It is influenced by its huge electronics products ecosystem, mainly for flexible devices and displays, together with government support towards R&D, a robust drive for electric vehicles (EVs). Continuously growing domestic customer demand for high-tech devices. Major factors such as increasing disposable earnings, rapid industrialization, and increasing population have raised a huge demand for customers electronics in China. It has noteworthy production potential in associated fields like nanotechnology, printed electronics, and optoelectronics, which is directly associated with flexible electronic equipment.

Why Colorless Polyimide Films Market is Growing Rapidly in North America?

Presence of hi-tech industries like renewable energy, flexible electronics, and aerospace has enhanced the demand for the market. The demand for advanced consumer electronics like foldable smartphones, tablets, laptops with flexible screens, and wearable devices is a primary driver. These films are substituting traditional, more delicate glass films and thicker plastic substrata as they provide excellent toughness, transparency, and the capacity to twist repeatedly without causing any damage. The change toward renewable energy source and sustainable films has enhanced the demand for durable, lightweight, and flexible materials in solar panels.

How Colorless Polyimide Films Market Is Expanding In The U.S.?

Growing electronics, automotive, and aerospace sector has boosted the development of the market in the U.S. The rapid advancement in the manufacturing process of the films has influenced the growth of this market. Incorporation of AI in manufacturing are enhancing efficacy, product integrity, and allowing faster invention, which offers to market extension. A rising range of usages, like flexible printed circuit boards, flexible solar panels, and lighting equipment, is intensifying the market's potential. The growing production of electric vehicles and increasing demand for lightweight resources are boosting this development.

Which Factor Is Responsible For Notable Growth Of Colorless Polyimide Films Market In Europe?

The major factors influencing the growth of market are increasing industries of electronics, automotive, and aerospace. Increasing emphasis on advanced manufacturing and sustainability initiatives has raised the need for advanced films. Lightweighting enterprises to enhanced boost efficacy and complete presentation of vehicles. The demand for high-presentation, durable, and lightweight resources in the defense and aerospace industries offers suggestively to market development. Producers are emphasizing on rising sustainable constructing processes and recyclable monomers to fulfil these values, which influences invention in the market.

Why Germany Is Utilizing Colorless Polyimide Films Market Significantly?

The strong medical device, automotive, and electronics manufacturing has fuelled the development of the market. It needs transparent materials, high-performance, and durable films which can enhance the protection. This market is growing because of their electrical insulation and superior thermal stability properties. These are important for making lighter, thinner, and more compressed electronic machineries like wearable devices, smartphones, and laptops.

What Are the Key Growth Drivers for the Colorless Polyimide (CPI) Film Market in the Middle East & Africa (MEA)?

The market for colourless polyimide (CPI) films in the Middle East and Africa (MEA) is still small but growing rapidly, driven by rising demand from renewableenergy, electronics, aerospace and infrastructure sectors. Growth is concentrated in Gulf countries (like UAE, Saudi Arabia) and South Africa where solarenergy projects, lightweight electronics, flexible circuits, and advanced industrial / aerospace uses are increasingly adopted.

How Is the UAE Leading the Adoption of Colorless Polyimide Films in Electronics, Aerospace, and Renewable Energy?

In the United Arab Emirates (UAE), the market for Colorless Polyimide Film (CPI film) or more broadly polyimide films is small but gaining traction as the country pushes modernization and diversification beyond oil. The broader Middle East & Africa (MEA) region counts UAE among the leading adopters, driven by growth in electronics, renewableenergy (solar), aerospace and telecom infrastructure all usecases where CPI’s heatresistance, durability and flexibility make it attractive.

What Is Driving the Gradual Growth of the Colorless Polyimide Film Market in South America?

In South America, the colorless polyimide film market is gradually growing, driven by increasing industrialization, electronics imports, automotive expansion, and rising demand for advanced materials. Key demand drivers include growth in the automotive sector (including emerging electric vehicle initiatives), increasing use of electronics (consumer devices, flexible circuits), and modest but rising adoption in infrastructure, industrial systems, and renewableenergy applications.

How Are Electronics, Automotive, and Industrial Sectors Contributing to the Growth of Colorless Polyimide Films in Brazil?

In Brazil, the colorless polyimide film market remains modest but shows promising growth as electronics, automotive and industrial sectors adopt advanced materials. Demand is driven by Brazil’s expanding electronics manufacturing, growing automotive and EVrelated production (which uses PI films for battery management systems, wire insulation, and flexible circuits), and increasing interest in highperformance insulation or substrate materials.

Recent Developments

- In December 2024, Arkema introduced world's first non-stretched ultra-thin polyimide film which has thickness of 4 micrometers (μm). It has confirmed its unparalleled film-making technology on a worldwide scale.

- In February 2023, OPPO introduced FindN2Flip for the first time outside China. Foldable phones with enhanced protection films are highly in demand.

Top Companies In The Colorless Polyimide Films Market

DuPont

Corporate Information

- DuPont is an American multinational chemical and materialsscience company.

- Founded in 1802 (originally as E. I. du Pont de Nemours & Company) by Éleuthère Irénée du Pont, DuPont began as a gunpowder and explosives manufacturer.

- Headquarters: Wilmington, Delaware, USA.

- As of 2024/2025, DuPont employs ~24,000–34,000 people globally (numbers vary with scope) and serves markets worldwide.

History and Background

- 1802–1900s: Founded to produce gunpowder and explosives; grew to become a major supplier for U.S. military and industry.

- Early 20th century: Diversified into chemical manufacturing nitrocellulose plastics, lacquers, dyes, heavy chemicals, etc.

- 1920s–1930s: Entered polymer and syntheticfiber research. Invented materials like neoprene (synthetic rubber), nylon marking its shift toward materials science and synthetics.

Key Developments and Strategic Initiatives

- More recently (2025), DuPont executed a major restructuring: it spun off its Electronics business into a new independent public company Qnity Electronics, Inc. effective November 1, 2025.

- Concurrently, DuPont agreed to divest its Aramids business (which includes legacy brands like Kevlar® and Nomex®) in a deal announced August 29, 2025, to be completed in early 2026.

Mergers & Acquisitions

- In 2015, DuPont merged with Dow Chemical Company to form DowDuPont a large conglomerate combining their strengths.

- The plan was always to split into three independent companies (agriculture, materials science, specialty products). For DuPont, the result was that post–2019, it refocused on specialty products / advanced materials / highvalue segments.

Key Technology Focus Areas

- Highperformance polymers and films historically DuPont has been a pioneer in polyimide films (e.g., their well-known polyimide film brand Kapton). Kapton developed by DuPont remains a benchmark polyimide film for hightemperature, flexible electronics, flexible PCBs, aerospace (space blankets), and advanced electronics manufacturing.

Product Launches / Innovations

- In March 2025, Pyralux ML won the 2025 NPI (New Product Introduction) Award in the “Laminates” category from Circuits Assembly / PCEA, recognizing it as one of the most innovative new products in electronics assembly judged by independent industry engineers.

R&D Organisation & Investment

- DuPont has a long tradition of materialsscience innovation from early synthetic fibers (nylon, neoprene) to advanced polymers and specialty plastics.

- The company has historically invested heavily in R&D: by mid1980s, it had over 6,000 scientists/engineers and spent more than US$ 1 billion annually.

- In 2016, DuPont was named one of the top 100 global innovators by Clarivate Analytics (for several years in a row), underscoring its patent activity, global reach, and invention influence.

SWOT Analysis

Strengths

- Strengths Strong Brand & Legacy Expertise

- Over 220 years of experience in polymers, films, specialty chemicals, and materials science.

- Renowned for Kapton® polyimide films, a benchmark in high-performance and flexible electronics applications.

- Robust R&D Capabilities

- Multiple R&D 100 Awards and innovation recognitions (2025) for advanced materials, electronics, water, and sustainability solutions.

- Deep expertise in high-performance polymers, specialty films, adhesives, and interconnect materials.

Weaknesses

- Reduced Diversification Due to Spin-Offs

- 2025 spin-off of Electronics business into Qnity and divestiture of Aramids reduces scale and product diversity.

- Exposure to Commodity & Raw Material Costs

- Polyimide films and chemicals are raw-material-intensive; cost volatility can affect margins.

Opportunities

- Growing Demand for CPI & Advanced Films

- Flexible displays, foldable smartphones, transparent OLED substrates, EVs, and aerospace applications.

- Expansion in Asia-Pacific Markets

- Increasing demand in China, South Korea, and Japan for electronics, 5G, and EV sectors.

Threats

- Intense Competition

- Regional competitors (Kolon Industries, SKC/SK Innovation, Sumitomo, Kaneka) in CPI / polyimide films, especially in Asia.

- Economic & Geopolitical Risks

- Global supply chain disruptions, trade tensions, or economic downturns can impact raw material access and demand.

Recent News & Strategic Updates

- November 3, 2025: DuPont completed the separation of its Electronics business into independent public company Qnity Electronics (NYSE ticker “Q”).

- August 29, 2025: DuPont announced sale of its Aramids business (Kevlar®, Nomex®) to Arclin for about US$ 1.8 billion part of portfolio simplification.

Other Top Companies

- Kaneka Corporations: It is a Japanese company that is a major player in CPI, specializing in films for mobile and communication applications.

- Kolon Industries: It is a South Korean company that supplies CPI films for applications like foldable smartphones and flexible displays.

- SK Innovation: It is well-known for its CPI films through its subsidiary, SK IE Technology.

- Sumitomo Chemical Co., Ltd.: It is a major worldwide player in the CPI film market

- Others: NeXolve, Wuhan Yimaide New Materials, Wuxi Shunxuan New Materials, Industrial Summit Technology Corporation, and Dr. Dietrich Muller GmbH.

Colorless Polyimide Films Market Segments Covered

By Application

- Flexible Displays

- Flexible Solar Cells

- Flexible Printed Circuit Boards

- Lighting Equipment

- Others

By End Use Industry

- Electronics

- Solar Energy

- Medical

- Others

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Austria

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Tags

FAQ's

Select User License to Buy

Figures (2)