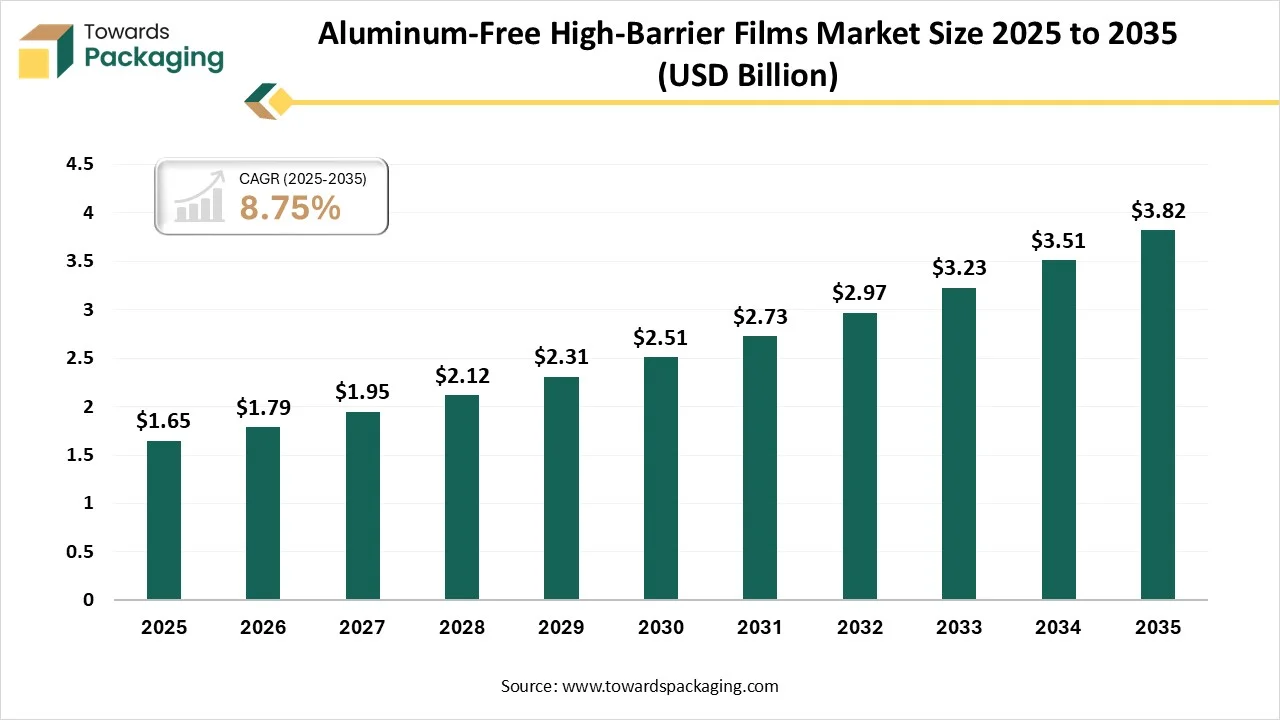

The aluminum-free high-barrier films market is forecasted to expand from USD 1.79 billion in 2026 to USD 3.82 billion by 2035, growing at a CAGR of 8.75% from 2026 to 2035. The rising demand for cost-effective, product transparency, and sustainable packaging has enhanced the development in the market.

Aluminum-free high-barrier films are progressive plastic packaging resources with extraordinary resistance to moisture and oxygen, replacing old style aluminum foil to encompass product shelf life while providing microwave, transparency, and recyclability compatibility for cosmetics, foods, and pharmaceuticals.

Technological transformation in the market plays a significant role in its development. Mono-material barrier solution provides high recyclability option which has enhanced the adoption of these films in packaging industry. Integration of nanotechnology provide enhanced barrier from moisture and oxygen. Advance technology ensures coating homogeneity and high adhesion which is useful in enhancing the shelf-life of the food products.

The major raw materials utilized in this market are silicon oxide, aluminum oxide, polyethylene, and polypropylene.

The component manufacturing in this market comprises substrates such as MDO-PE (Machine Direction Oriented Polyethylene), barrier layers such as aluminum oxide, and sealant layers such as LLDPE (Linear Low-Density Polyethylene).

This segment ensures storage and handling and reduce transportation charges. It ensures safe transportation of sensitive goods such as medical devices, coffee, and various others.

The multilayer co-extruded barrier films (no aluminum) segment dominated the market with highest share in 2025 due to high barrier performance. These are highly versatile, recyclable, and cost-effective solution which enhance the demand for this segment. High-performance barrier properties of these films have pushed the utilization of this segment. Increasing demand for cost-efficient and advanced technology films are highly appealing to the consumers.

The bio-based / compostable barrier films segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to massive consumers’ demand. Strict government guidelines for eco-friendly packaging have influenced the growth of the segment. These are effective in protecting and storing snacks for longer period.

The EVOH (Ethylene Vinyl Alcohol)-based barriers segment dominated the market with highest share in 2025 due to excellent oxygen barrier performance. It provides excellent transparency and gloss which is meeting the demand of the consumers. These are eco-friendly solution and provide barrier from gases, oxygen, and aromas which enhance its demand. This packaging barrier technology is widely used in pharmaceutical blister packs and flexible pouches.

The SiOx / AlOx coatings (non-aluminum oxide) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to excellent combination of recyclability, high barrier performance, and optical transparency. These are important for the extension of shelf life of diary products, processed, and frozen food. It preserves the quality of the food products for a longer period which raise the adoption of this segment.

The pouches (stand-up, flat, zipper) segment dominated the market with highest share in 2025 due to rapid shift towards sustainable packaging. The increasing demand for convenience for consumers has influenced the production of pouches with high-barrier films. It decreases transportation charges which increase its adoption in various sectors. Rapid consumption of processed food has raised the demand for such packaging.

The lidding films segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing demand for ready-to-eat food. It helps in keeping products safe while transporting to a longer distance. These are also cost-effective packaging solution which raise its adoption in various sectors.

The food & beverage segment dominated the market with highest share in 2025 due to changing lifestyle and rapid shift towards urban areas. Increasing concern to reduce food waste and extend distribution has evolved these packages. These are lightweight packaging solution ideal in place of traditional rigid glass packages. It makes transportation process easy and allow wider distribution of food products.

The pharmaceutical & healthcare segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to strict packaging guidelines and sustainability mandates. Increasing demand for blister packaging and unit-dose demand in healthcare sector has influenced the demand for this sector. Rising need for highly protective packaging options to fulfil worldwide standard.

Europe held the largest share in the market share in 2025, due to strong regulatory demand for sustainable packaging. Enhanced consumer demand for environment-friendly packaging has pushed the demand for this packaging sector. Rapid innovation of highly recyclable packaging of major market players has pushed the utilization of these films. These films are widely used in personal care, food, and pharma sector.

Germany Aluminum-Free High-Barrier Films Market Trends

Rising shift towards recyclable packaging film have raised the demand for market in Germany. It is considered as innovation hub due to production of a wide variety of packaging films. Rising convenience for online grocery shopping, enhanced consumption of high-barrier films. Rapid shift towards transparent barrier films and solvent-free coatings.

Asia Pacific expects the fastest growth in the market during the forecast period. Rapid urbanization and growing e-commerce sector have influenced the demand for the market. Increasing concern towards eco-friendly packaging has influenced the demand for this films industry. Rising consumption of packaged food products has raised the demand for high-barrier films packaging to preserve the integrity of the food products. Significant change in the lifestyle of wide range of consumers has fuelled the growth of this sector.

China Aluminum-Free High-Barrier Films Market Trends

Rising number of working individuals and changing lifestyle have driven the demand of the market in China. Increasing demand for lightweight packaging has influenced the production process of high-barrier films. Rising preferences for clear and transparent packaging has pushed innovation in this market. Advancement of biodegradable or bio-based films has fuelled the demand for this industry.

The major factors influencing the growth of market are increasing sustainability push, innovation in barrier technology, enhanced convenience concern and rapidly growing e-commerce sector. Rising demand for development of packaging which are convenient for consumers travelling has pushed this industry significantly. Increasing focus towards development of advanced barrier coating has fuelled the demand for these films.

The U.S. Aluminum-Free High-Barrier Films Market Trends

Presence of huge manufacturing capacity has influenced the development of the market. Presence of major market players has pushed this market to develop significantly. Increasing demand for ready-to-eat food products has fuelled the development of this market. Incorporation of smart packaging films has boosted the utilization of these packages that help to track the products quality while transporting.

The South America aluminum-free high-barrier films market is growing steadily, driven by rising demand for sustainable, recyclable packaging in food, beverage, pharmaceutical, and consumer goods applications. Brand owners and converters are increasingly shifting away from aluminum foil and metallized structures toward multi-layer polymer films using materials such as EVOH, PE, and PP, which provide strong oxygen and moisture barriers while improving recyclability and product visibility.

Brazil Aluminum-Free High-Barrier Films Market Trends

Brazil expects the notable growth in the market. The market is expanding rapidly as food, beverage, and pharmaceutical companies seek sustainable, high-performance packaging options. Brazil is the largest and fastest-growing barrier film market in South America, driven by strong domestic consumption, a large food processing industry, and rising demand for packaging that extends shelf life while supporting recycling and circular-economy goals.

By Film Type / Material

By Barrier Technology

By Packaging Format

By End-Use Industry

By Region

January 2026

January 2026

December 2025

November 2025