Transparent Plastic Packaging Market Trends, Growth and Market Size Analysis

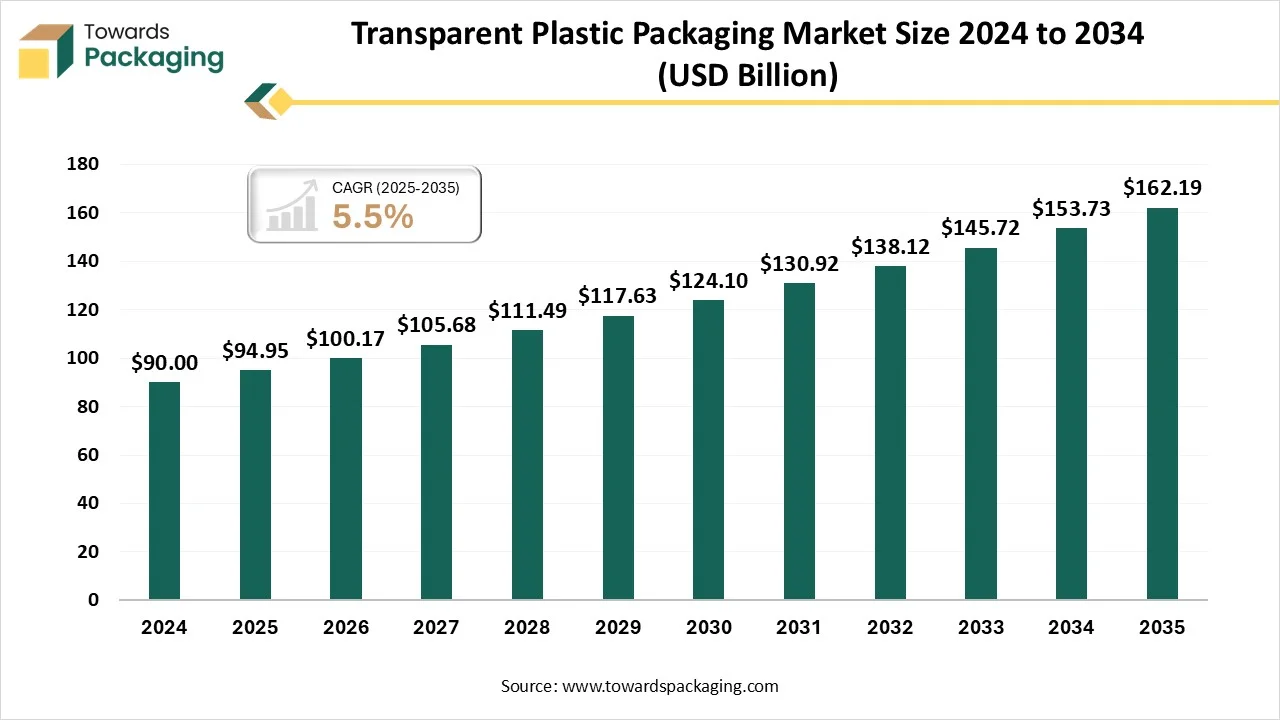

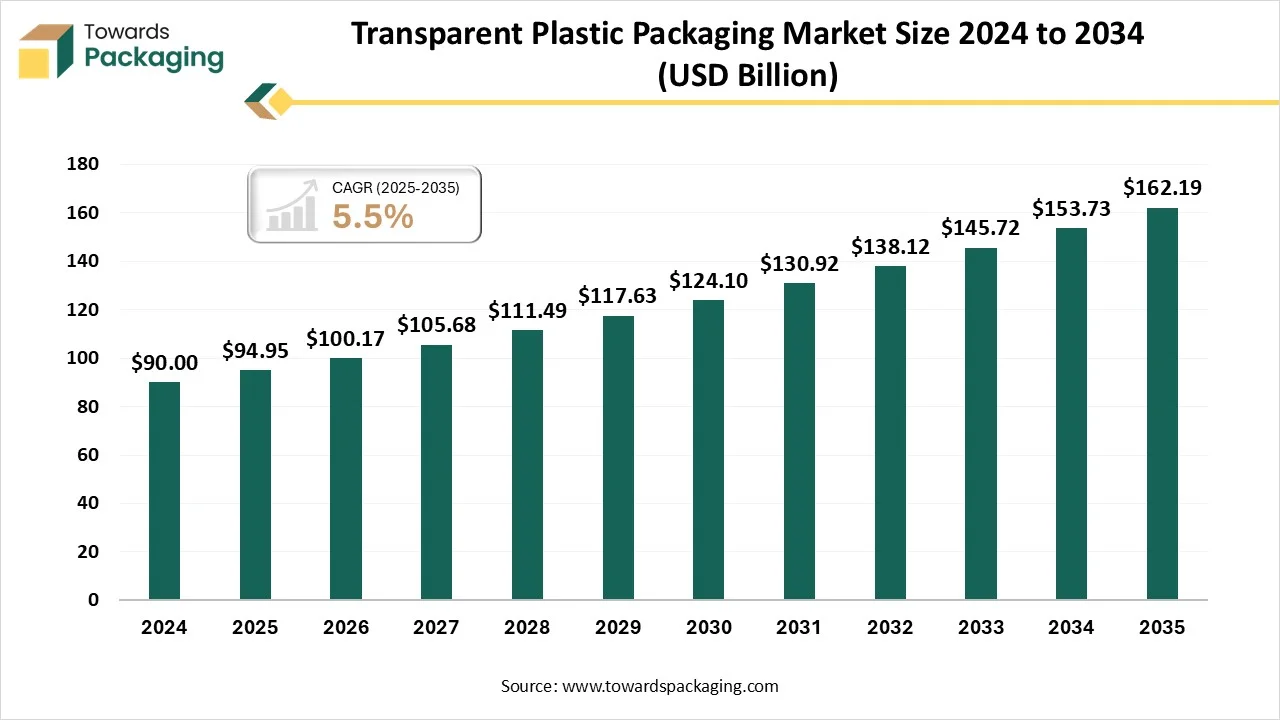

The transparent plastic packaging market is valued at USD 100.17 billion in 2026 and is projected to reach USD 162.19 billion by 2035, growing at a CAGR of 5.5% during 2026-2035. This report provides in-depth analysis of material types (PET, PP, PVC, PE, PS), product formats (bottles & jars, pouches & bags, trays & containers, films), end-use industries, and thickness/form factors. It delivers comprehensive regional insights across North America, Europe, Asia Pacific (43.3% share), Latin America, and the Middle East & Africa, along with country-level market value, production volumes, trade data, value chain structure, cost & EBITDA benchmarks, and detailed profiles of leading manufacturers, suppliers, and global players such as Amcor, Berry Global, Sealed Air, Sonoco, and Huhtamaki.

This market is experiencing robust growth, driven mainly by demand for visually appealing and functional packaging across sectors such as pharmaceuticals and food & beverage. Major drivers include customer preference for goods that can be observed before purchase, growth in e-commerce, and the use of transparent plastics in both rigid and flexible applications in electronics, automotive, and healthcare.

Major Key Insights of the Transparent Plastic Packaging Market

- In terms of revenue, the market is valued at USD 100.17 billion in 2026.

- The market is projected to reach USD 162.19 billion by 2035.

- Rapid growth at a CAGR of 5.5% will be observed in the period between 2025 and 2035.

- By region, Asia Pacific dominated the global market by holding the highest market share of 43.3% in 2024.

- By region, Asia Pacific is expected to grow at a notable 7% CAGR from 2025 to 2035.

- By material type, the polyethylene terephthalate (PET) segment contributed the biggest market share of 32.2% in 2024.

- By material type, the polypropylene (PP) segment will be expanding at a significant CAGR of 6% between 2025 and 2035.

- By product type, the bottles & jars segment contributed the biggest market share of 34.4% in 2024.

- By product type, the pouches & bags segment will be expanding at a significant 6% CAGR between 2025 and 2035.

- By end-use industry, the food & beverage segment contributed the biggest market share of 42.5% in 2024.

- By end-use industry, the personal care & cosmetics segment will be expanding at a significant 6.3% CAGR between 2025 and 2035.

- By thickness/form factor, the thick/rigid sheets segment contributed the biggest market share of 57.8% in 2024.

- By thickness/form factor, the thin-gauge films segment is expanding at a significant 6% CAGR between 2025 and 2035.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2026 |

USD 100.17 Billion |

| Projected Market Size in 2035 |

USD 162.19 Billion |

| CAGR (2026 - 2035) |

5.5% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material Type, By Product Type, By End-Use Industry, By Thickness / Form Factor and By Region |

| Top Key Players |

Amcor plc, Berry Global Inc., Sealed Air Corporation, Sonoco Products Company, Huhtamaki Oyj |

What is Transparent Plastic Packaging?

Transparent plastic packaging uses clear, polymer-based materials that provide product visibility, protection, and branding appeal for a range of consumer and industrial goods. It includes rigid and flexible formats made from PET, PVC, PP, PE, and other plastics used in food, beverages, pharmaceuticals, personal care, and electronics. The market’s growth is driven by increasing demand for convenience packaging, aesthetic presentation, extended shelf life, and sustainability innovations such as lightweight, recyclable, and bio-based transparent packaging solutions.

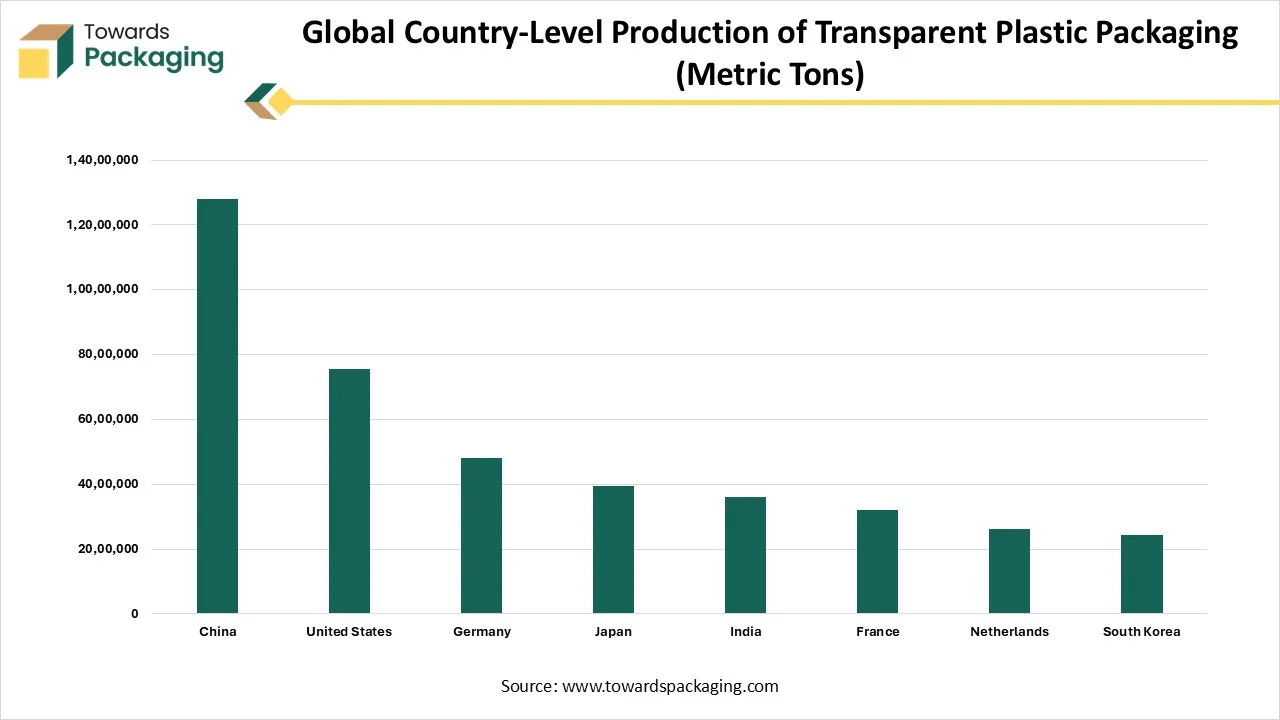

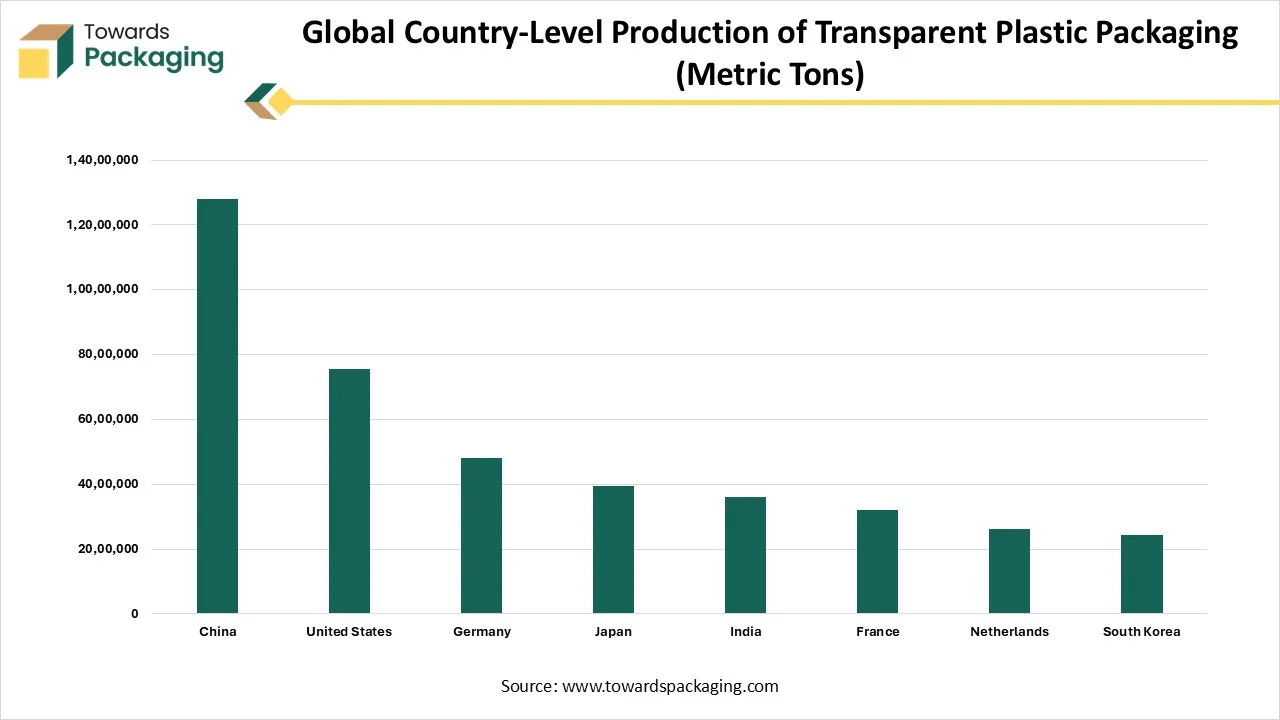

Global Country-Level Production of Transparent Plastic Packaging (Metric Tons)

Where global supply is actually made

| Country |

Production (MT) |

| China |

12,800,000 |

| United States |

7,570,000 |

| Germany |

4,800,000 |

| Japan |

3,950,000 |

| India |

3,600,000 |

| France |

3,220,000 |

| Netherlands |

2,610,000 |

| South Korea |

2,450,000 |

Transparent Plastic Packaging Market Outlook

- Market Growth Overview: The transparent plastic packaging market is expanding due to increasing demand from the packaging industry for food & consumer goods, accompanied by increasing usage in construction and automotive because of functional and aesthetic advantages such as recyclability, lightweight, and durability.

- Global Expansion: Regions such as Latin America, North America, Asia Pacific, Europe, South America, the Middle East & Africa are witnessing rising demand from the cosmetics, pharmaceuticals, food & beverages sector. Major drivers comprise suitability, product perceptibility, and functional advantages such as barrier properties and lightweight pattern, though development is also toughened by the requirement for more sustainable packing solutions

- Major Market Players: The transparent plastic packaging market includes Amcor, SABIC, Berry Global, BASF, Dow, Sealed Air Corporation, and DuPont.

- Startup Ecosystem: The startup industries play an important role in smart technology integration, regulatory compliance, sustainability, e-commerce and logistics, and modularity and flexibility.

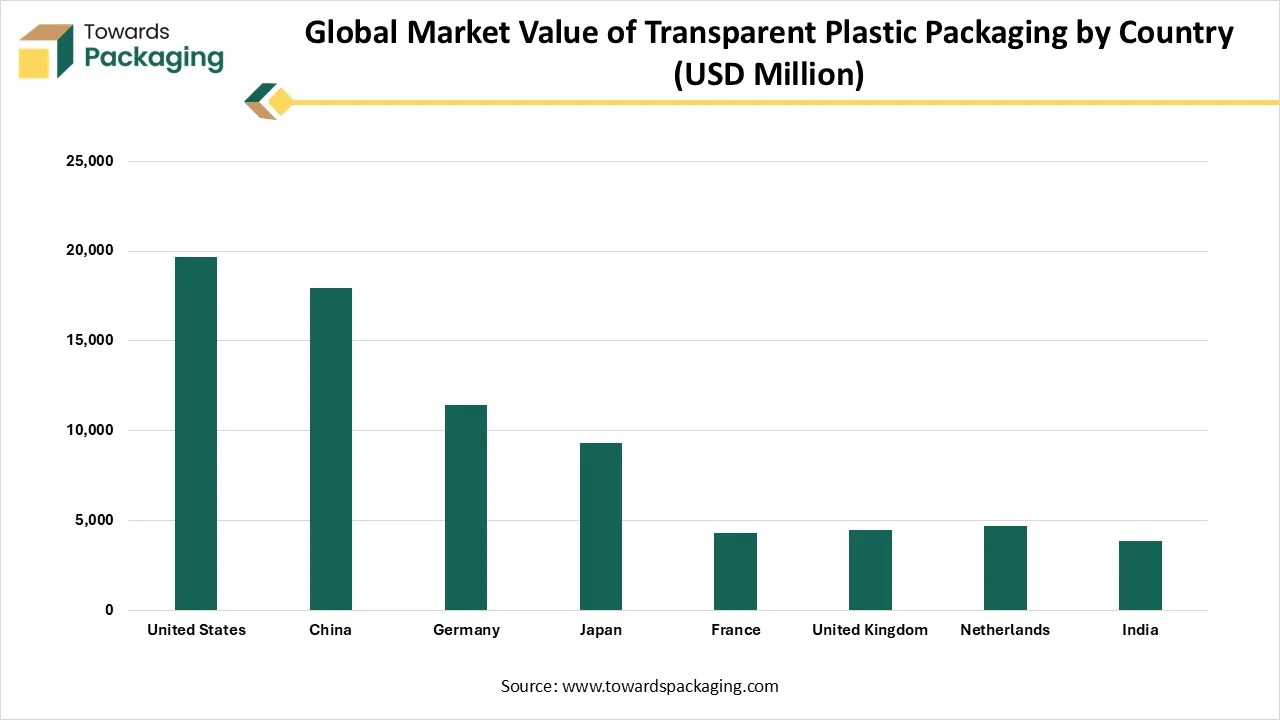

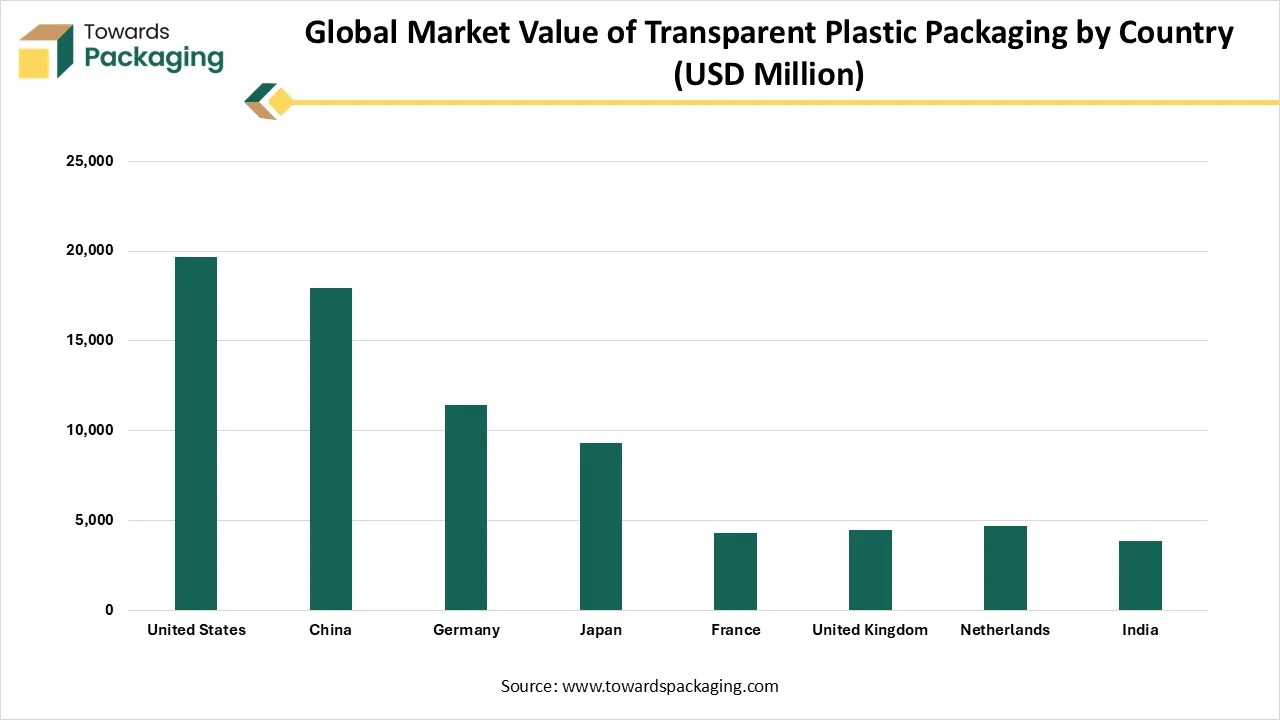

Global Market Value of Transparent Plastic Packaging by Country (USD Million)

Revenue concentration & pricing power

| Country |

Market Value |

| United States |

19,682 |

| China |

17,950 |

| Germany |

11,420 |

| Japan |

9,300 |

| France |

4,320 |

| United Kingdom |

4,450 |

| Netherlands |

4,682 |

| India |

3,850 |

The growing demand for integrating smart technology and optimized manufacturing processes has driven advancements in the transparent plastic packaging market. Technology is enabling the formation of mono-material packaging, which is easier and more effective to recycle than intricate multi-layered plastics. Progressive chemical recycling processes are also evolving, proficient at breaking down mixed plastics into their constituent chemicals for reuse.

- Trade Analysis of Transparent Plastic Packaging Market: Import & Export Statistics

- India: It is considered the largest exporter of transparent plastic boxes with 16,212 export shipments.

- China: It is second second-largest exporter of transparent plastic boxes with 1,669 shipments.

- Vietnam: It has marked approximately 473 shipments of transparent plastic boxes.

Transparent Plastic Packaging Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are Polyethylene Terephthalate (PET), Polypropylene (PP), Polyethylene (PE), and Polyvinyl Chloride (PVC).

- Key Players: Dow Chemical Company, BASF SE

Component Manufacturing

The component manufacturing in this market comprises Polyethylene Terephthalate (PET), Polycarbonate (PC), Polymethyl Methacrylate (PMMA), and Polystyrene (PS).

- Key Players: Jindal Poly Films Limited, UFlex Limited

Logistics and Distribution

This segment is growing focus on sustainability and technological integration.

- Key Players: Blue Dart Express, XpressBees

Global Trade Leaders in Transparent Plastic Packaging (Exports & Imports, USD Million)

Cross-border influence and supply-chain leverage

| Country |

Exports |

Imports |

| China |

9,800 |

6,400 |

| United States |

8,400 |

6,900 |

| Germany |

5,850 |

4,920 |

| Netherlands |

3,420 |

2,850 |

| Japan |

2,980 |

2,150 |

| South Korea |

2,650 |

1,980 |

| Italy |

1,640 |

1,320 |

Material Type Insights

Why Polyethylene Terephthalate (PET) Segment Dominate the Transparent Plastic Packaging Market In 2024?

The polyethylene terephthalate (PET) segment dominated the market, accounting for a 32.2% share in 2024, due to its barrier properties, clarity, and superior strength. This segment is dominating because of its lightweight, shatter-resistant properties, which offer a cost-effective substitute for glass, and its excellent recyclability and the ability to be formed into several shapes. It is indeed clear, permitting customers to look at the product inside as it is a key benefit for food & beverage packing. It effectively preserves the freshness and flavour of goods, extending shelf life, an important feature for food items.

The polypropylene (PP) segment is expected to grow at the fastest 6% CAGR during the forecast period of 2025 to 2034. This segment is growing due to superior mechanical properties. These films offer superior moisture barrier properties, helping protect products from contamination and extending shelf life. It is a cost-effective resource, primarily for large-scale use, and offers a good balance of presentation and cost compared to several other plastics. These polypropylene films are utilized in packaging cosmetics, toiletries, and various other personal care products.

Polyvinyl chloride (PVC) is the fastest-growing material in the packaging nets market, as it offers cost-efficiency, durability, and excellent transparency. It has a higher degree of intelligibility, allowing products to be clearly visible through the packaging. Its durability and impact strength also protect packaged items. It can be produced in both flexible and rigid forms, making it suitable for a wide range of packaging applications, from flexible films to rigid containers and shrink wraps.

Product Type Insights

Why Bottles & Jars Segment Dominated the Transparent Plastic Packaging Market In 2024?

The bottles & jars segment dominated the market with a 34.4% share in 2024, driven by its versatility and strength. These bottles and jars are sturdy and durable, making them suitable for a wide range of products. These transparent packaging permits customers to see the product inside, which can improve its appeal. It offers convenience by managing, storing, and porting. This segment is widely accepted due to its ability to showcase products, durability, and strength.

The pouches & bags segment is expected to grow at the fastest 6% CAGR during the forecast period of 2025 to 2034. This segment is growing due to less resource consumption and its versatility. The growing popularity of ready-to-consume and single-serving food products has driven increased demand for appropriate pouches and bags. These typically use fewer resources than rigid packing, reducing production and transportation costs. The durability or flexibility of the pouches makes them suitable for transportation, which is important for direct-to-consumer and online grocery markets.

The trays & containers segment is the fastest-growing in the packaging nets market, driven by product visibility and transparency. Bakery & confectionery are major consumers of trays & containers, using them for a range of products, from individual candies to pastries. Transparent plastic trays and containers allow customers to see the contents, which can increase purchasing options. This is mainly significant for prepared meals, fresh food, and other products that benefit from visual appeal.

End-Use Industry Insights

Why the Food & Beverages Segment Dominated the Transparent Plastic Packaging Market In 2024?

The food & beverages segment dominated the market, accounting for 42.5% of the market share in 2024, driven by rising concerns about food safety and protection. Plastic packaging is important for shielding food & beverages from pollution and extending shelf life, and it is a main customer and business concern. Transparent packaging allows customers to see the goods inside, which helps build trust and can increase sales. This is mainly crucial for ready-to-consume meals & snacks. The increasing popularity of suitability and on-the-go food products means that there is a huge demand for easily transportable, durable packaging, and plastic is well-suited to fulfil this need.

The personal care & cosmetics segment is expected to grow at the fastest 6.3% CAGR during the forecast period of 2025 to 2034. This segment is growing due to its cost-effectiveness and versatility. Transparent plastic containers let customers observe the goods’ quality, color, and texture, which enhances brand image and can build customer confidence. Plastic is cost-effective, lightweight, and sturdy, making it a functional choice for a wide range of cosmetic & personal care products, from jars to squeeze bottles.

The pharmaceuticals & healthcare sector is the fastest-growing in the packaging nets market, as it is due to product visibility and protection concerns. Plastics can be moulded into various sizes and shapes, making them suitable for a range of products such as injectables, pills, and syrups. Their sturdiness and shatter resistance ensure pharmaceutical quality. Inventions such as tamper-evident seals, child-resistant closures, and built-in droppers improve patient safety and ease of use.

Why Did the Thick / Rigid Sheets Segment Dominate the Transparent Plastic Packaging Market In 2024?

The thick/rigid sheets segment dominated the market, accounting for the highest share of 57.8% in 2024, driven by the expansion of the e-commerce sector. This packaging segment offers excellent strength and robustness, providing better protection for products during transportation and storage, thanks to its flexible, matching parts. The growing demand for packaged food & beverages, the expansion of the e-commerce sector, and customers' fondness for product visibility are major influencers in this segment. These transparent plastics are widely used in packaging and several other key industries, such as healthcare, building & construction, and automotive, due to their durability and clarity.

The thin-gauge films segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to customer preference and sustainability. Thin films need fewer resources to manufacture in comparison with rigid counterparts as it shows results in lower producing and transit charges. The rapid expansion of e-commerce is driving demand for protective, lightweight packaging, a necessity that thin, flexible films fulfil efficiently.

Medium-gauge films are the fastest-growing in the packaging nets market due to their moisture resistance, low charge, and flexibility. These plastic films of various gauges are widely used, with the food & beverage sector as the primary application, driven by the need for a longer shelf life and improved product visibility.

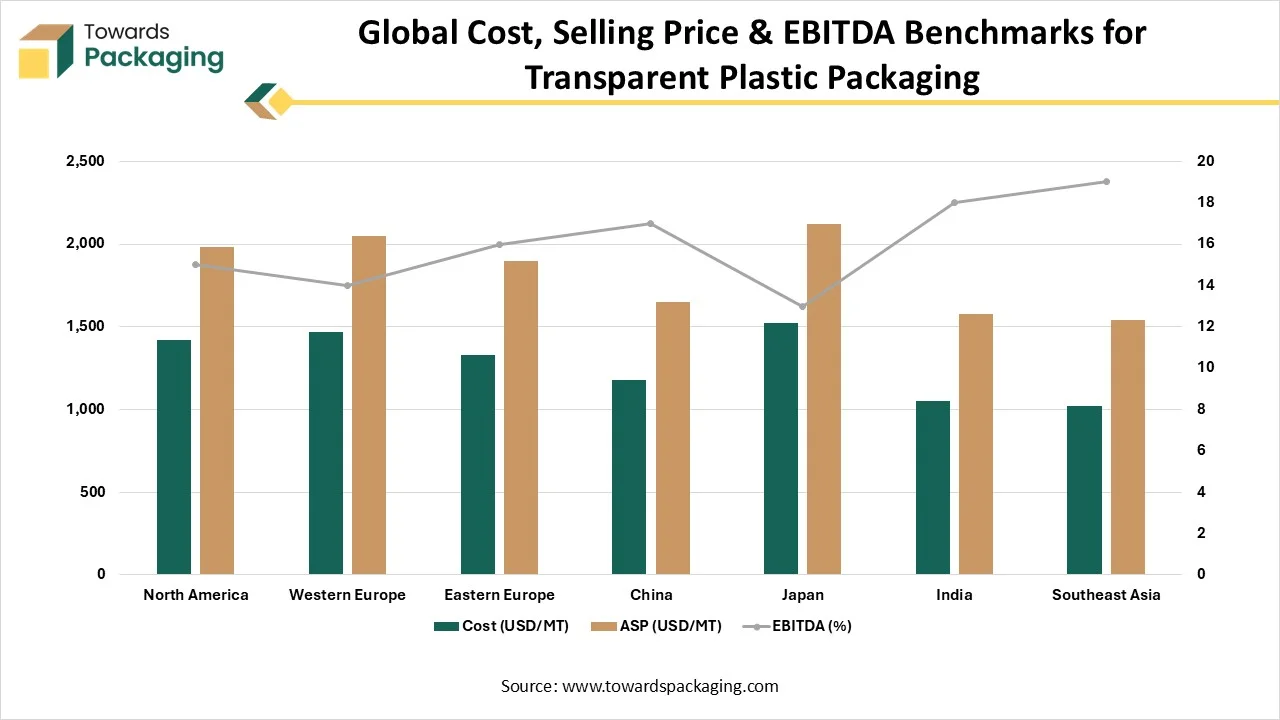

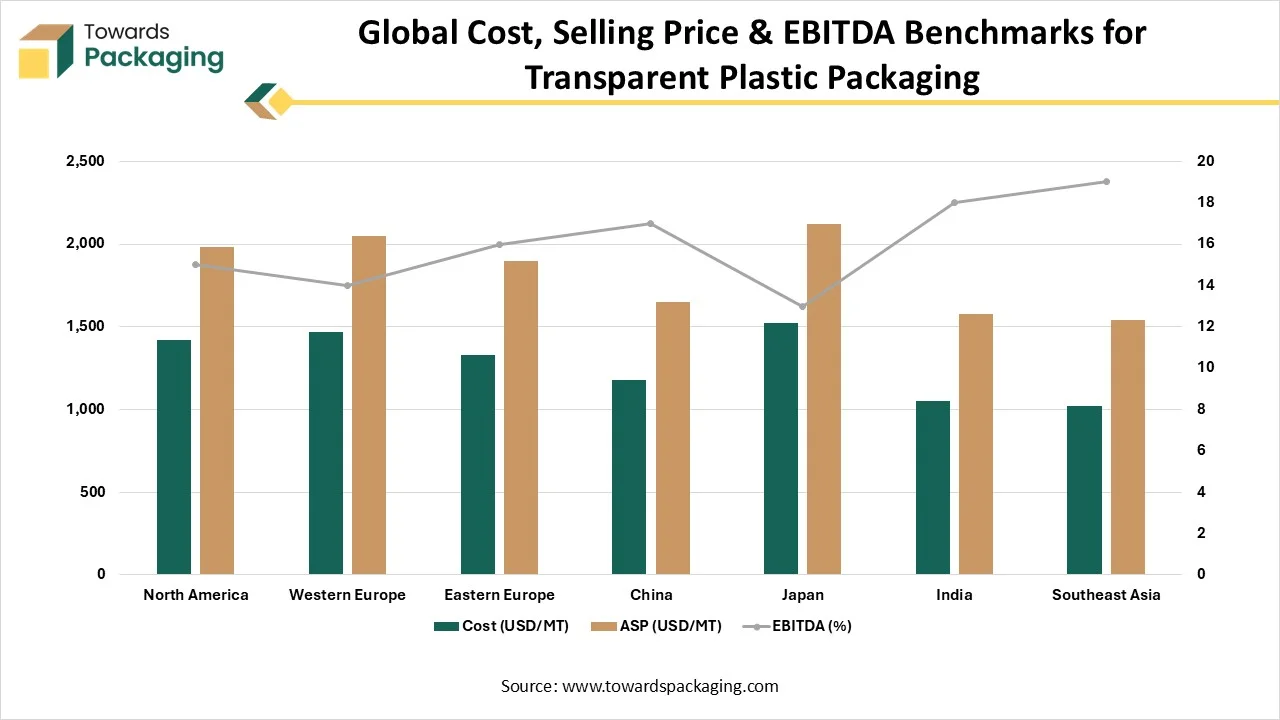

Global Cost, Selling Price & EBITDA Benchmarks for Transparent Plastic Packaging

| Region |

Cost (USD/MT) |

ASP (USD/MT) |

EBITDA (%) |

| North America |

1,420 |

1,980 |

15 |

| Western Europe |

1,470 |

2,050 |

14 |

| Eastern Europe |

1,330 |

1,900 |

16 |

| China |

1,180 |

1,650 |

17 |

| Japan |

1,520 |

2,120 |

13 |

| India |

1,050 |

1,580 |

18 |

| Southeast Asia |

1,020 |

1,540 |

19 |

Regional Insights

How is Asia Pacific Dominating the Transparent Plastic Packaging Market?

Asia Pacific held the largest share of 43.3% in the transparent plastic packaging market in 2024, driven by growth in the healthcare and electronics sectors. This is further reinforced by a growing customer base, urbanization, and a rising e-commerce industry, which drive demand for convenience and cost-effective packaging options. The region's rapid urbanization and industrialization are important influencers for the development of its electronics, packaging, and healthcare industries. A huge and rising population with increasing disposable earnings, mainly in countries such as Japan, China, and India, is driving up demand for packaged products. The expansion of e-commerce also underscores the need for robust, efficient packaging for transport.

Why Is Transparent Plastic Packaging Market Dominating in China?

The presence of a huge consumer base and manufacturing facilities has driven the demand for transparent plastic packaging in China. Its massive population drives high consumption of packaged products, particularly cosmetics, personal care, and food & beverages, generating an enormous demand for a wide range of packaging, including transparent plastics. The country's huge e-commerce industry and rapid industrialization require significant packaging for consumer products and industrial goods, driving demand for plastics.

Why Is Transparent Plastic Packaging Market Growing Rapidly in Europe?

Rising food and pharmaceutical demand has raised the demand for transparent plastic packaging market. The expansion of online shopping and planned retail arrangements has significantly increased demand for various types of plastic packaging, including flexible and protective options. Development in the pharmaceutical and food & beverage sectors, influenced by factors such as heightened health consciousness and an aging population, is a key driver of the market's expansion. Inventions in production procedures are resulting in new and enhanced transparent plastic packaging choices.

How Is Transparent Plastic Packaging Market Expanding in Germany?

Advancements in the manufacturing process for packaging have boosted development in the transparent plastic packaging market in Germany. The rapid growth of e-commerce in Germany has increased demand for protective, durable packaging to prevent damage during shipping. There is a rising customer preference for convenient, flexible, and lightweight packaging, leading to a shift away from rigid and flexible setups. There is a notable push to use more environmentally friendly and recycled plastic, driven by customer demand and government guidelines.

Which Factor is Responsible for Notable Growth of Transparent Plastic Packaging Market in North America?

The major factors influencing the growth of transparent plastic packaging market are increasing consumer preferences, product visibility, the extension of the e-commerce sector, sustainability, and recyclability. The rapid increase in online shopping for personal care, cosmetics, food, and other products has increased demand for safe, lightweight, and durable packaging that withstands the challenges of delivery while keeping contents safe. Inventions in plastic production and recycling are enhancing the performance, cost-efficiency, and environmental impact of transparent plastics, thereby accelerating their adoption over traditional materials like metal or glass.

Why the U.S. is Utilizing these Packaging Significantly?

The rising initiatives and guidelines in the U.S. which fuelled the development of the transparent plastic packaging market. The rapid development of the e-commerce segment in the U.S. has enhanced the requirement for lightweight yet strong and shielding packaging resolutions that can endure the rigors of transport, further influencing the demand for transparent plastic packaging. Plastics provide superior barrier properties against contaminants, moisture, and oxygen, which extend the shelf life of food & beverage goods and safeguard hygiene and security, particularly for medical equipment and pharmaceuticals. Their breaking-resistant properties also decreases product damage at the time of transit.

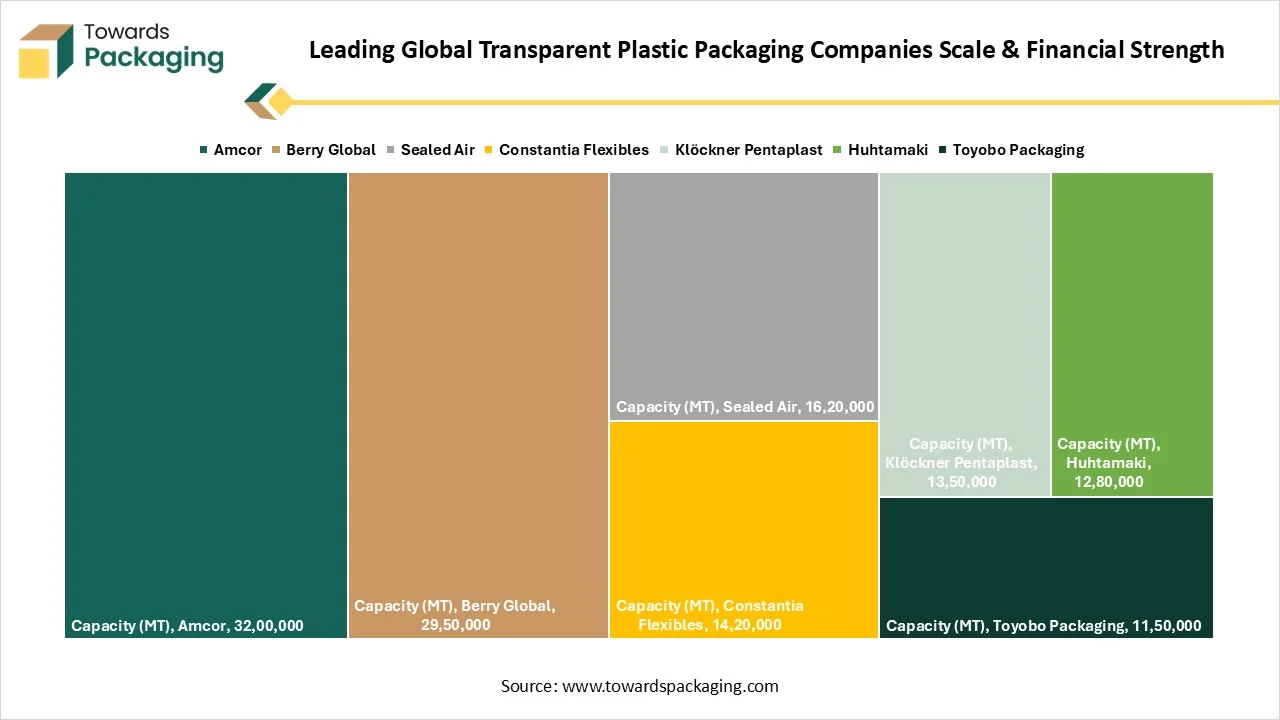

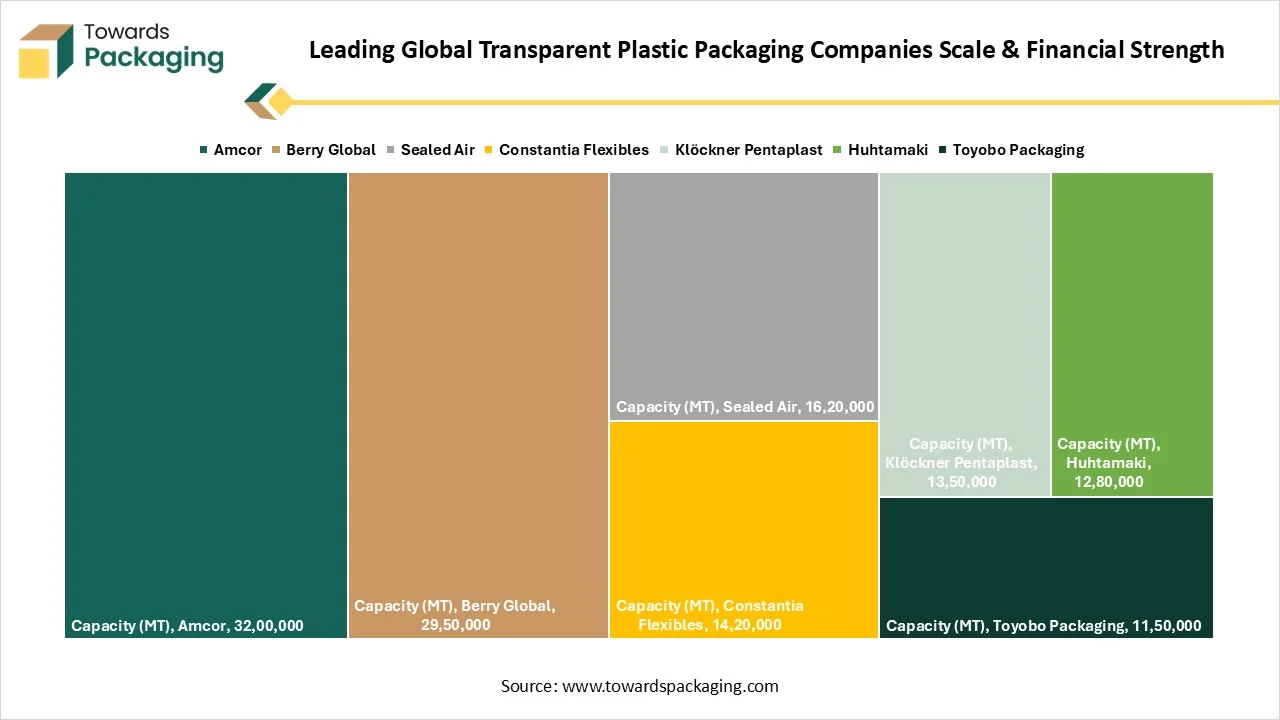

Leading Global Transparent Plastic Packaging Companies Scale & Financial Strength

| Company |

Capacity (MT) |

Revenue (USD Million) |

Countries of Operation |

| Amcor |

3,200,000 |

14,700 |

40 |

| Berry Global |

2,950,000 |

13,200 |

35 |

| Sealed Air |

1,620,000 |

5,500 |

30 |

| Constantia Flexibles |

1,420,000 |

3,100 |

22 |

| Klöckner Pentaplast |

1,350,000 |

2,300 |

19 |

| Huhtamaki |

1,280,000 |

4,300 |

37 |

| Toyobo Packaging |

1,150,000 |

2,800 |

15 |

Top Companies in the Transparent Plastic Packaging Market

- Amcor plc – Amcor is a global leader in transparent plastic packaging, offering innovative rigid and flexible packaging solutions for food, beverage, healthcare, and personal care industries. The company focuses on lightweight, recyclable, and high-clarity plastic films and containers, driving sustainability through its “Amcor LifeCycle” program and commitment to fully recyclable packaging by 2025.

- Berry Global Inc. – Berry Global produces a wide range of clear rigid containers, films, and flexible packaging solutions made from recyclable and bio-based polymers. Its transparent packaging is designed for durability, product visibility, and sustainability, serving customers in food, cosmetics, and healthcare sectors.

- Sealed Air Corporation – Sealed Air offers high-performance transparent packaging for food and e-commerce applications, emphasizing freshness preservation and visibility. Its innovations include Cryovac® food packaging and sustainable solutions integrating recycled content to reduce environmental footprint.

- Sonoco Products Company – Sonoco provides clear plastic packaging and thermoformed containers for food, beverages, and personal care products. The company’s emphasis on recyclable PET packaging and eco-friendly designs aligns with its sustainability goals and circular economy initiatives.

- Huhtamaki Oyj – Huhtamaki manufactures transparent rigid and flexible plastic packaging primarily for the foodservice and consumer goods industries. Its offerings include PET cups, containers, and lids, with a focus on bioplastic and recyclable materials for sustainable packaging solutions.

- ALPLA Werke Alwin Lehner GmbH & Co KG – ALPLA is a major producer of transparent bottles, containers, and closures made from PET and HDPE. The company invests heavily in recycling infrastructure and circular economy technologies, producing sustainable transparent packaging for food, beverage, and personal care products.

- Constantia Flexibles Group GmbH – Constantia Flexibles offers clear flexible packaging films and laminates for food and pharmaceutical applications. Its transparent packaging solutions provide strong barrier protection and high shelf appeal while incorporating mono-material recyclability.

- Bemis Company, Inc. (Amcor) – Now part of Amcor, Bemis was known for its innovative flexible and semi-rigid transparent packaging films. The brand’s legacy continues under Amcor’s portfolio, focusing on clarity, shelf impact, and sustainability in packaging design.

- Gerresheimer AG – Gerresheimer develops clear plastic containers, bottles, and vials for the pharmaceutical, cosmetics, and food industries. Its transparent packaging emphasizes precision molding, recyclability, and compliance with strict industry standards for safety and quality.

- Mondi plc – Mondi produces transparent flexible packaging such as films, laminates, and pouches made from recyclable polymers. The company’s “EcoSolutions” platform promotes sustainable plastic packaging with optimized clarity, strength, and environmental performance.

- UFlex Ltd. – UFlex is India’s largest multinational flexible packaging company, offering high-clarity and high-barrier transparent films. Its BOPET and BOPP films are widely used in food, FMCG, and healthcare packaging, and the company focuses on closed-loop recycling and biodegradable film development.

- RPC Group plc (Berry Global) – Now part of Berry Global, RPC Group specializes in rigid transparent packaging made from PET, PP, and HDPE. Its products include bottles, containers, and closures designed for food, pharmaceutical, and cosmetic applications with strong sustainability credentials.

- Plastipak Holdings, Inc. – Plastipak designs and manufactures clear rigid plastic containers and preforms, mainly using PET and HDPE resins. The company is a major player in the beverage and household packaging industries and operates one of the world’s largest closed-loop plastic recycling systems.

- Coveris Holdings S.A. – Coveris provides flexible and rigid transparent packaging solutions that enhance product visibility and protection. The company focuses on high-performance recyclable films and lightweight rigid plastics for food, medical, and industrial packaging.

- DS Smith plc – DS Smith, primarily known for fiber-based packaging, also offers hybrid and transparent plastic packaging solutions for e-commerce and retail display. The company’s strategy integrates sustainability and recyclability, combining paper and plastic innovations to optimize packaging efficiency and product presentation.

Recent Developments

- In September 2025, TIPA Compostable Packaging declared the launch of high-barrier film and laminate products. It offers compostable substitutes without compromising on presentation, barrier, or machine compatibility.

- In November 2024, Visipak declared to announced its innovative new product line: Recyclapak. It is a new product line that helps the company to use 100% clear PET.

Transparent Plastic Packaging Market Segments

By Material Type

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polystyrene (PS)

- Others (PLA, EVOH, etc.)

By Product Type

- Bottles & Jars

- Trays & Containers

- Pouches & Bags

- Clamshells & Blisters

- Films & Wraps

- Others (Lids, Tubes)

By End-Use Industry

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Household Products

- Electronics & Industrial Goods

By Thickness / Form Factor

- Thin-gauge Films (<50 microns)

- Medium-gauge Films (50–200 microns)

- Thick / Rigid Sheets (>200 microns)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- Frequently Asked Questions