Pharmaceutical Packaging Laminates Market Trends, Growth and Market Size Analysis

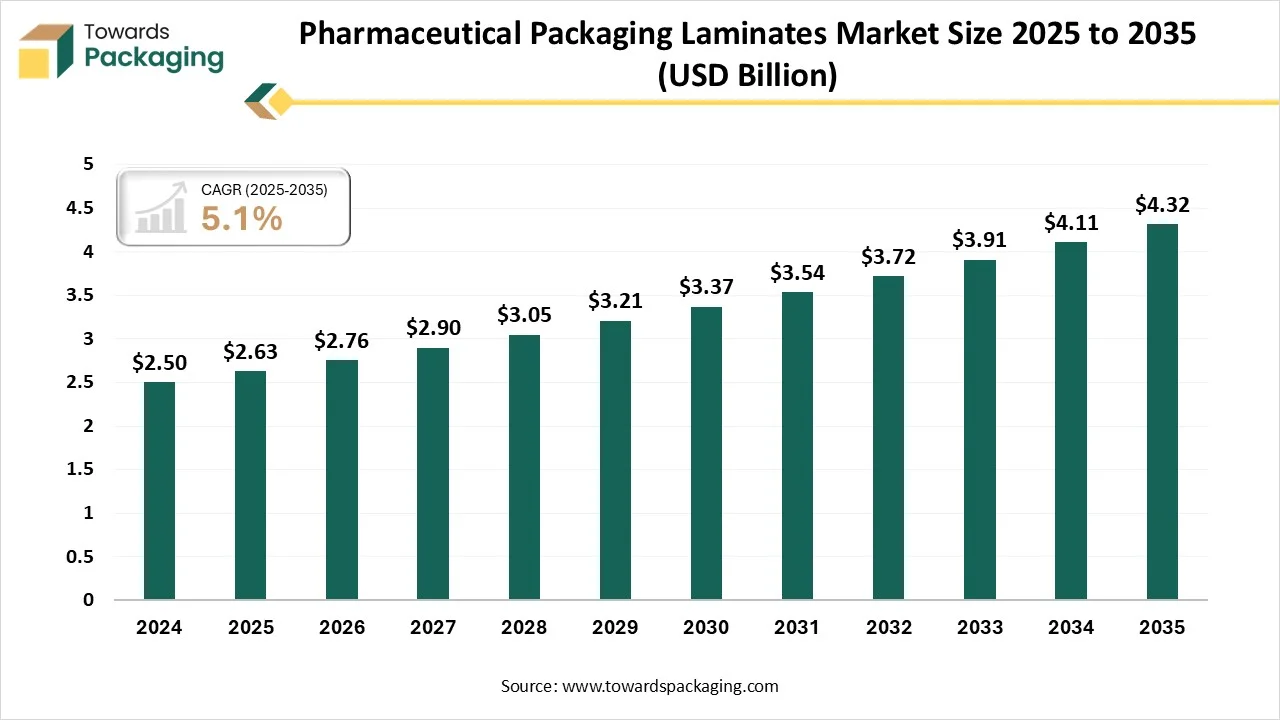

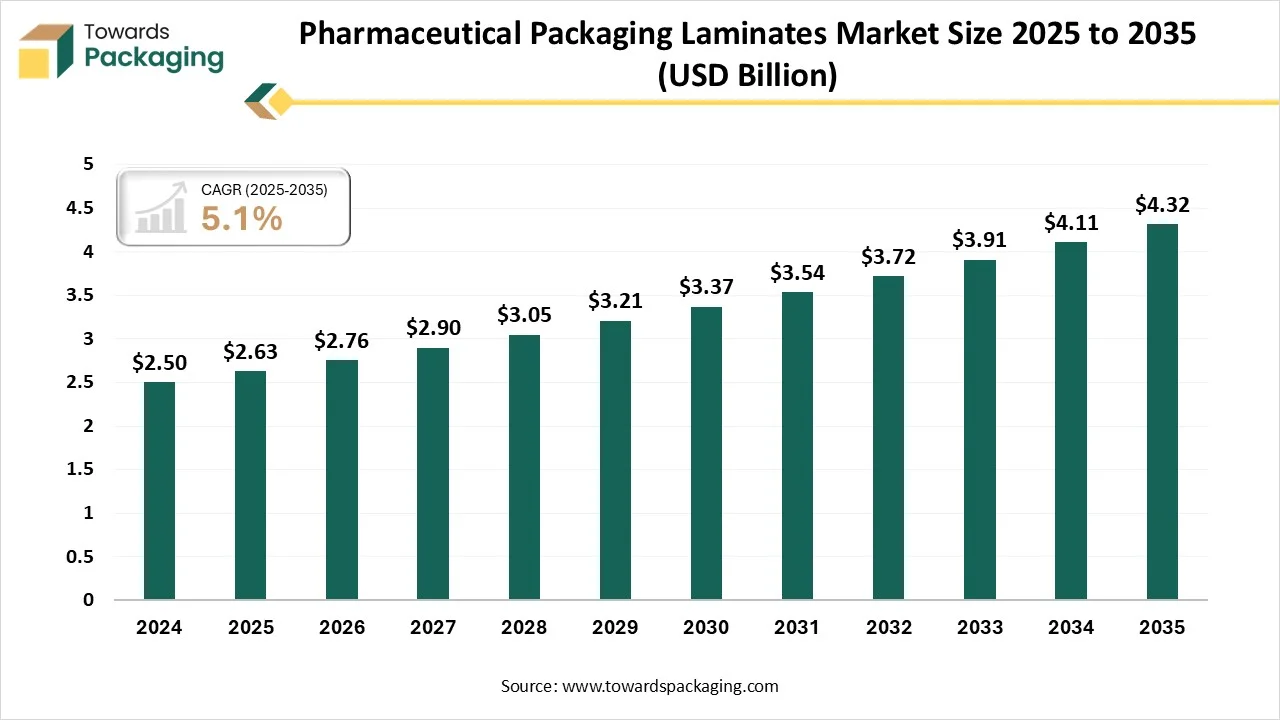

The pharmaceutical packaging laminates market is expected to increase from USD 2.76 billion in 2026 to USD 4.32 billion by 2035, growing at a CAGR of 5.1% throughout the forecast period from 2026 to 2035. The demand for lamination assists in making a strong barrier between oxygen, moisture, light, and pollutants, which ensures the product's freshness and extends the shelf life.

Major Key Insights of the Pharmaceutical Packaging Laminates Market

- In terms of revenue, the market is valued at USD 2.76 billion in 2026.

- The market is projected to reach USD 4.32 billion by 2035.

- Rapid growth at a CAGR of 5.1% will be observed in the period between 2026 and 2035.

- By region, North America dominated the global market by holding the highest market share in 2025.

- By region, the Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By material type, the aluminum-based laminates segment has contributed to the biggest market share in 2025.

- By material type, the aluminum-plastic composite laminates segment will be expanding at a significant CAGR between 2026 and 2035.

- By application, the blister packaging segment contributed the biggest market share in 2025.

- By application, the unit-dose and child-resistant packaging segment will be expanding at a significant CAGR between 2026 and 2035.

- By drug form, the solid oral drugs segment dominated the market share in 2025.

- By drug form, the biologics & specialty drugs segment will be expanding at a significant CAGR between 2026 and 2035.

- By end-user, the pharmaceutical manufacturers segment is dominated the market share in 2025.

- By end-user, the biopharmaceutical companies segment is expected to have the fastest growth in the market during the forecast period.

What is the Pharmaceutical Packaging Laminates?

Pharmaceutical packaging laminates are multi-layer and flexible materials made by the bonding of two or more substrates, such as paper, plastic films, and aluminum foil, using adhesives or extrusion procedures. The outcome of mixed material serves mechanical, good protection, and the aesthetic qualities as compared to surfaces. The sachets and pouches are being used for liquids, powders, or multi-dose medications that frequently include resealable closures.

Pharmaceutical Packaging Laminates Market Trends

- Market Growth Overview: The pharmaceutical packaging laminates sector is expanding because of elements like the demand for developed product protection, the development of the global pharmaceutical sector, rigid regulatory compliance, and the rising importance of sustainability.

- Global Expansion: The global expansion of pharmaceutical packaging laminates is due to the development of e-commerce and direct-to-patient delivery designs, which urge lightweight, durable, and protective packaging that can withstand complicated supply chains. Unit-dose formats like blister packs and pre-filled syringes serve compliance and ease, which are in high demand.

- Major Market Players: The main market players in the pharmaceutical packaging laminates industry include Gerresheimer AG, Amcor plc, AptarGroup Inc., West Pharmaceutical Services Inc., and SCHOTT AG.

- Startup Ecosystem: The startup ecosystem surrounding the pharmaceutical packaging laminates is being classified by main inventions, rigid market development, and the sharp concentration on two main areas, such as developed product sustainability and protection. The complete pharmaceutical market is predicted to grow twice in the future years, which serves as a sensitive platform for the latest entrants.

Technological Developments in the Pharmaceutical Packaging Laminates Market

In the minutely managed industry of pharmaceutical packaging laminates, the thermal lamination stick out as a quiet sentinel protecting the morality of the medical products with the unrivaled precision, It expands instructional crayons, leaflets and the blister cards against the surrounding reliability, pollutant and bruise characteristics that make sure life-saving formulas remain safe, clean and displayed with the clinical expertise and the cultural delicacy too.

Trade Analysis of Pharmaceutical Packaging Laminates Market: Import & Export Statistics

- Worldwide, the leading three importers of the pharmaceutical packaging lamination are Ghana, India, and Colombia. India has topped the globe in terms of pharmaceutical packaging lamination, which has officially imported 501 shipments, followed by Ghana with 272 shipments, and Colombia, which has taken the third position with 181 shipments.

- The globe has imported most of its Pharmaceutical packaging lamination from China, India, and Thailand.

- As per the global import data, the world has imported 712 shipments of pharmaceutical packaging lamination during the period May 2024 to April 2025. These imports were being supplied by the 9 exporters to the 116 Global buyers, which marked an overlap rate of 44% as compared to the leading twelve-month period.

Pharmaceutical Packaging Laminates Market - Value Chain Analysis

Raw Material Sourcing: Pharma-grade bags are among the most important laminated materials in the pharmaceutical sector. These tailored bags are crafted and produced to align with the high standards that healthcare and pharmaceutical users need and demand. Medicines frequently need to be transported from one location to another for different reasons, and this procedure carries the danger of pollution because of changing moisture levels in various surroundings.

- Key Players: Tekni-Plex, Inc., EPL Limited ( formerly Essel Prospack), and UFlex Ltd.

Component Manufacturing: Multi-layer laminates are made by collaborating various layers of materials such as PE, PET, aluminium foil, BOPP, nylon films, and the BOPP. Every layer delivers a different property to the laminate, which is flexibility, strength, moisture opposition, and printability too. When they are mixed, they create a packaging design that is not smooth and durable but also visually attractive.

- Key Players: Huhtamaki Oy, Berry Global Group plc, and Klockner Pentaplast, too.

Logistics and Distribution: In the pharmaceutical sector, distribution and logistics depend extremely on the tailored laminate packaging materials to ensure product integrity that aligns with strong regulatory needs and demands, and allows smooth traceability and handling too. Laminates serve as a necessary barrier protection against the surrounding factors during storage and transit.

- Key Players: Mondi plc, Constantia Flexibles, and Amcor plc.

Material Type Insights

Why the Aluminium-Based Laminates Segment Dominated the Pharmaceutical Packaging Laminates Market In 2025?

The aluminium-based laminates have dominated the market in 2025 as aluminum blister packaging is a widely used sealed packaging feature in the sector of pharmaceuticals. Its main characteristics are the application of the aluminium foil material to receive high barrier protection and properties too. Aluminum blister packaging is a safe multi-layer packaging solution that is crafted to protect unit-dose items, particularly in pharmaceuticals.

The aluminum-plastic composite laminates segment is expected to experience the fastest CAGR during the forecast period. Laminated tubes are perfect for the packaging of pharmaceuticals, which are created from the multi-layer laminated foil with an aluminum or plastic barricade location kept between the outer and inner layers of the tube. This design ensures a hygienic, safe, and reliable packaging solution that serves as a smooth barrier against the blow-up of unpredictable elements and protects from UV rays.

Application Insights

Why the Blister Packaging Segment Dominated the Pharmaceutical Packaging Laminates Market In 2025?

The blister packaging segment dominated the pharmaceutical packaging laminates market in 2025, as blister packaging is a widely used procedure in the pharmaceutical sector that is crafted to prevent doses of medication from environmental factors like light, moisture, and contamination. It coincides with a plastic cavity, which is generally created from materials like PVC (polyvinyl chloride) or PET (polyethylene terephthalate) that securely carries the pharmaceutical item.

The unit-dose and child-resistant packaging segment is expected to experience the fastest CAGR during the forecast period. The initial function of the unit-dose packaging is important for patient safety and the product integrity that protects the medication from the surrounding elements, like physical damage, temperature, and pollutants. Characterizations such as tamper-evident seals and serialization (unique identification codes) have assisted in protecting against counterfeiting and ensuring product checking through the supply chains. Child-resistant packaging is also being updated with cutting-edge mechanisms and closures that protect young children from accidental ingestion, while ensuring convenience for adults. Likely, the senior-friendly packaging goal is to solve the demands of the older patients by including features like easy-to-read labels, big fonts, etc, to make sure that all the medications are securely available to all, regardless of physical abilities or age.

Why Did The Solid Oral Drugs (Tablets & Capsules) Segment Dominated The Pharmaceutical Packaging Laminates Market In 2025?

The solid oral drugs have dominated the pharmaceutical packaging laminates market in 2025 because pharmaceutical organizations are heavily seeking to expand their presence in developing markets, which has driven the urge for cost-effective and convenient transportable OSD formulations. The addition of the telemedicine services is encouraging the OSD market and developing demand for the formulations, which are perfect for remote management and patient care. Furthermore, there is a developing concentration on the protective healthcare methods, which is growing the urge for OSD formulations that are crafted for long-term usage in tracking the chronic conditions and to protect against disease development.

The biologics & specialty drugs Segment is expected to witness the Fastest CAGR during the Forecast Period. Biologics in pharma are a category of drugs that come from living organisms or their elements, Microorganisms and animals. Such biological items are being classified by their complicated molecular structures that frequently have sugars, proteins, or nucleic acids. There are various types of biologics like vaccines, monoclonal antibodies, recombinant hormones and proteins, cell therapies, and gene therapy. On the other hand, specialty drugs are being crafted to align with the demands of the complicated medication formulations that need high-level protection against the surrounding factors like human error and contamination.

End-User Insights

Why the Pharmaceutical Manufacturers Segment Dominated the Pharmaceutical Packaging Laminates Market In 2025?

The pharmaceutical manufacturers segment has dominated the market in 2025 as packaging services ensure drug safety, patient trust, and regulatory compliance, too. More than just surrounding a product, the packaging secures the drug integrity that tracks the sterility and serves precise dosing. From the clinical trials to the corporate distribution, each platform of the drug growth relies on the pharmaceutical packaging services to protect against counterfeiting, pollution, and errors in the administration.

The biopharmaceutical companies segment is predicted to experience the fastest CAGR during the forecast period. In the manufacturing of pharmaceutical items, adhering to rigid rules like Current Good Manufacturing Practices requires certifications from the FDA( Food and Drug Administration) and EMA (European Medicines Agency) that ensure the safety and quality of drug materials and medical devices, too. Likely, the packaging of the biologics should be served with strict attention by the servers to make sure production procedure, transport, and storage are followed, as the threat of pollutant or product loss can endanger its reliability and the fertility.

Regional Insights

How North America is Dominating in the Pharmaceutical Packaging Laminates Market?

North America has dominated the market in 2025 as the increasing number of chronic diseases, such as cancer, diabetes, and a rising elderly demographic, has led to a higher urge for medical devices and pharmaceuticals, too, thus boosting the demand for packaging solutions. The growth of the production for both the complicated biologics and the smooth generic drugs needs tailored and reliable packaging. There is a growing pressure from users and regulators for recyclable, sustainable, and bio-based laminated materials that drives the invention in the industry.

- In November 2025, Zydus Lifesciences is a top invention-driven life sciences organization, and the SIG, which is a leading packaging solution server, has entered into an agreement with the current packaging of liquid cough and cold medication in terms of single-serve spouted pouches that have the leashed spout solution named SIG Motion Servo 3.2 filling technology.

How is the Pharmaceutical Packaging Laminates Market Growing in Canada?

The pharmaceutical packaging laminates market in Canada is developing as the initial driver is the necessary demand for packaging that ensures drug stability, protects against pollution, and serves the tamper-evident and child-resistant characteristics to have elements to track patient safety and smoothness. Laminates, which are filled with several layers of aluminum foil and plastics, serve superior barrier properties against oxygen, light, and moisture.

- In May 2025, Emcutix Biopharmaceuticals, in partnership with Canada-based Mantra Pharma, which includes Emcure Pharmaceuticals, has disclosed the pan-India launch of Ureaderm 10% and 20%, which is a urea-dependent moisturizer in terms of cream formulation.

Why is the Pharmaceutical Packaging Laminates Market Growing Rapidly in the Asia Pacific?

Asia Pacific is the fastest-growing region in the pharmaceutical packaging laminates market in 2025. The urge for this sector in this region is witnessing fast and major development, which is being driven by the development of the pharmaceutical sector, growing healthcare funding, and growing regulatory urges for the packaging which is protective and high-barrier packaging. The mixing of digital identifiers, such as smart labels and RFID tags for the track-and-trace potential, become necessary, which drives funding in linked packaging methods.

Why is India Using Pharmaceutical Packaging Laminates Market Importantly?

Heightened has urged the development of the manufacturing-linked investment outlays, digital therapeutics acceptance, and strong sustainability regulations. There are potential additions at the export-originated plants, which are boosting the absorption of perfectly production-practice aligned closures and containers too. Sustainability is compulsory with the demanding 30% recycled content in the strong designs, which are shaping the material selections with the recycled polyethylene terephthalate and post-consumer recycled materials that have gained attention.

- In October 2025, German inks and coatings supplier Siegework revealed a series of mineral-oil-free inks whose goal is the Indian Pharmaceutical packaging industry. The latest inks are being formulated without the mineral oils as deliberately added substances, and their performance is supported by the raw material revelation procedure that is reviewed by Siegework's complete product safety team.

The pharmaceutical packaging laminates market in the Europe region is developing as the European Medicines Agency and the EU surrounding directives have made a compulsion for the strict regulatory needs for product safety, and major sector-wide moves have been shifted to high-barrier, sustainable, and traceable packaging solutions. The European Medicines Agency and the EU eco-friendly instructions have standards for the packaging. This has driven the urge for good-quality laminates that ensure sterility and serve as perfect barricade elements.

- In November 2025, Sharp Services, which is top in terms of pharmaceutical packaging, sterile manufacturing, and clinical trial services production, revealed an investment of USD100 million across its worldwide facility network to solve developing market demand for the discovered and latest medicines.

Germany Pharmaceutical Packaging Laminates Market Solution

The German pharmaceutical packaging laminates sector runs in the highly regulated surroundings that is directed by both the EU directives and the national standards. Particularly, the European Medical Device Regulation and the Packaging and Packaging Waste Directive have officially imposed strong demands on the recyclability, traceability, and medical safety. The EU MDR has given importance to sterilization and biocompatibility methods, which directly affect the laminated tube formulations utilised in medical uses.

- In October 2025, Stevanto Group S.p.A is a top global server of the drug pollutant, diagnostic solutions, and drug delivery for the biotechnology, life sciences, and the pharmaceutical sectors, which has revealed the important launch of its drug delivery system that has further expanded its overall footprint to align with the sector’s growing demands.

The pharmaceutical packaging laminates market in the Middle East &Africa (MEA) region is developing as pharmaceuticals, particularly sensitive biologics, so demand for precise security against the rigid regulations is needed to manage efficiency and shelf life. The Pharmaceutical Packaging Laminates Market in the Middle East &Africa (MEA) region is developing as pharmaceuticals , particularly sensitive biologics , so demand for precise security against the rigid regulations is needed to manage efficiency and shelf life.

UAE Pharmaceutical Packaging Laminates Market Trend

The UAE is actively seeking to grow its pharmaceutical sector, which pushes the multinational drug creators to make operations that directly develop the demand for good-quality packaging materials, such as laminates. The regions’ logistics and climate need strong packaging with good barrier properties against moisture, oxygen, and UV light to manage the drug stability and stability.

- In November 2025, Borouge plc, a top petrochemical company, revealed the initiative in the launch of the UAE’s initially and locally manufactured low-density polyethylene (LDPE) for healthcare uses during the ADIPEC 2025.

In South America, the pharmaceutical packaging laminates market is growing steadily as multinational and local organizations are developing manufacturing in the region, specifically for biologics, generics, and over-the-counter medicines that need a relevant supply of high-quality packaging. The current population and the development of chronic diseases need constant medical care that boosts the urge for pharmaceuticals and following their packaging.

Brazil Pharmaceutical Packaging Laminates Market Trend

Brazil has the biggest healthcare and pharmaceutical sector in South America, which has a significant local production and a big demand for both innovative and generic medicines. The Brazilian Health Regulatory Agency (ANVISA) has enforced rigid regulations that are sterile, safe, traceable, and the usage of high-performance laminates in uses like blister packs and sterile pouches, too. The market is seeking developed acceptance of the high-level materials and smart packaging technologies, such as sensors and RFID tags, to develop supply chain transparency and patient safety.

Recent Developments

- In December 2025, ACG, which is the globe’s top mixed server of solid-dosage and packaging solutions, revealed the launch of DryPod™, a future-generation desiccant-dependent cold-design laminate that has been crafted to protect the highly moisture-sensitive drug molecules.

- In June 2025, Honeywell recently disclosed that Evertis is a top manufacturer of film for packaging that has chosen the Aclar Film to be utilized by the Evercare pharmaceutical brand.

- Gualapack Pharma is contesting the latest sector standards with its innovative digital printing solutions for the aluminum and PVC blister foil manufacturing. This inventive technology serves unparalleled benefits that ensure flexibility, quality, and speed align with the energetic urges of the pharmaceutical packaging industry.

- In April 2025, Neipak Corporation, a top worldwide producer of packaging solutions for the diagnostic, medical device, and pharmaceutical drug delivery, revealed it is developing its loyalty to service the users in the Asia-Pacific region on the current basis and with the help of its selected partners.

Top Companies in the Pharmaceutical Packaging Laminates Market

- Tekni-Plex, Inc.: It is a U.S. dependent organization that serves barrier films and tubing for pharmaceutical and medical usage.

- ACG: It is an India-based company with a film and foil separation that has served the specialty packaging films, anti-counterfeiting solutions, and high-barrier films that meet international standards.

- Uflex Limited: It is one of the biggest flexible packaging producers in India that serves a huge array of products, which includes aluminum foil laminates and PVC blister packs.

- Essel Propack Ltd: A main worldwide manufacturer that is notably the globe's biggest producer of the laminated plastic tubes utilised extensively for pharmaceutical uses.

- Amcor plc: A top leader that is known for its huge range of flexible packaging, including high-barrier and sustainable laminates for the pharmaceuticals.

- Berry Global: It serves a variety of packaging solutions, which include non-woven films and the laminated solutions that align with strict quality standards.

- Huhtamaki Oyj: It is personalized in focused medical packaging films, tube laminates, and the high-barrier laminates for the powdery products with a rigid importance on the product safety and environmental responsibility.

- Mondi plc: It concentrates on paper and high-level material crafting, serving flexible packaging films and the laminated solutions that meet strict quality standards.

- Constantia Flexibles Group GmbH: It is classified for its huge series of laminated and flexible medical films, as the organization actively makes mono-material (recyclable) films, which are laminated films and the aluminium foil-dependent items for the blister packs.

- Amcor plc: A top leader that is known for its growing and huge range of flexible packaging, which includes sustainable and high-barrier laminates for the pharmaceuticals.

Pharmaceutical Packaging Laminates Market Segments Covered

By Material Type

- Aluminum-based laminates

- Plastic-based laminates (PVC, PVDC, PET, PP) – Significant share

- Paper-based laminates – Niche usage

- Aluminum-plastic composite laminates

By Application

- Blister packaging

- Strip packaging

- Sachets & pouches

- Bags & liners

- Unit-dose and child-resistant packaging

By Drug Form

- Solid oral drugs (tablets & capsules)

- Liquid drugs

- Topical drugs

- Injectable drugs

- Biologics & specialty drugs

By End User

- Pharmaceutical manufacturers

- Contract packaging organizations (CPOs)

- Contract development & manufacturing organizations (CDMOs)

- Biopharmaceutical companies

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA