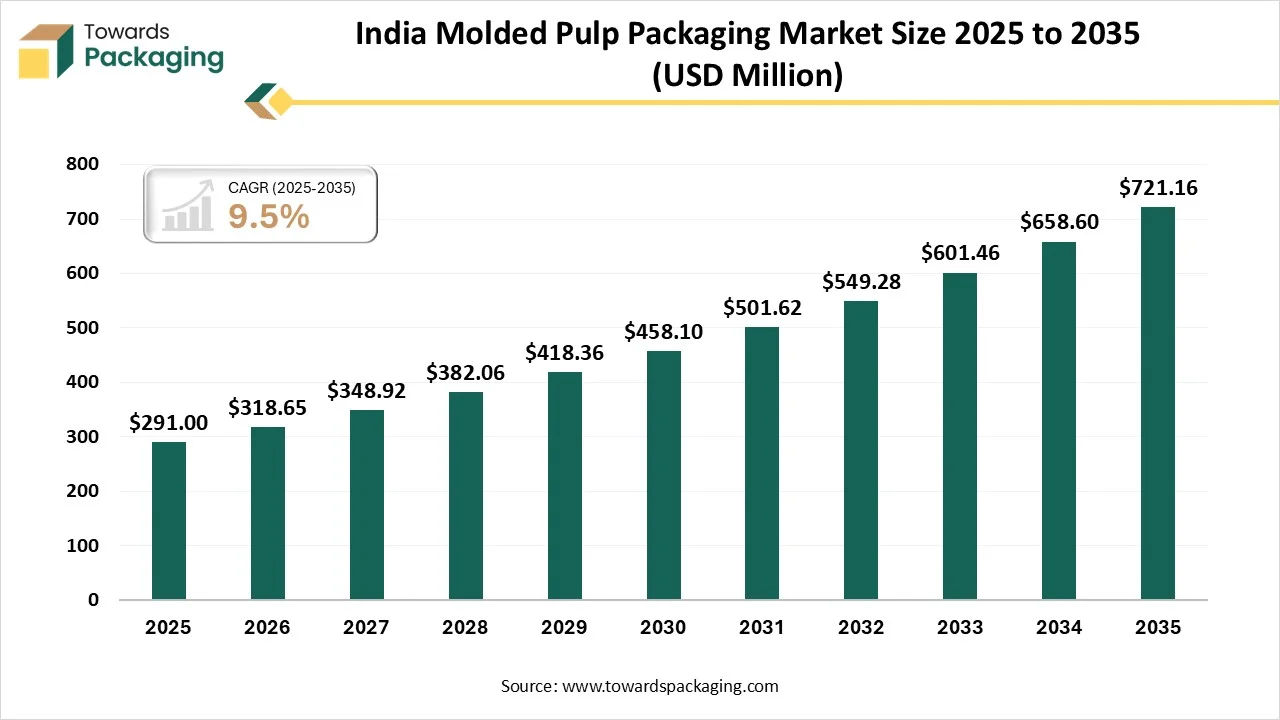

The India molded pulp packaging market is forecasted to expand from USD 318.65 million in 2026 to USD 721.16 million by 2035, growing at a CAGR of 9.5% from 2026 to 2035. Strict guidelines for single-use plastics, sustainable packaging, and biodegradable packaging have fuelled the demand for the market. These are widely utilized by the electronics, agriculture, and food service industries with rising consumption demand.

The molded pulp packaging refers to the manufacturing of eco-friendly, biodegradable containers and protective materials such as egg trays, food containers, and electronic buffers from fibrous materials like recycled paper or agricultural waste (bagasse). It serves as a sustainable alternative to plastic and expanded polystyrene (EPS) within the circular economy.

Technological transformation in the India molded pulp packaging market plays a significant role in molding traditional packaging into advanced high molded packaging. Usage of advanced thermoforming has fuelled the demand for this sector due to its smoother and aesthetic finish. Huge demand for automation in manufacturing process has boosted its reliability over various other. Incorporation of advanced technology fuel water-resistance potential of the molded pulp packaging.

The major raw materials utilized in this market are bagasses, bamboo pulp, virgin pulp, recycled paper and cardboard.

The component manufacturing in this market comprises dry pressing and wet pressing.

This segment emphasizing on distributing lightweight, shock-absorbent, and sustainable packaging.

The wood pulp segment dominated the market with highest share of approximately 72% in 2025 due to its superior strength and high biodegradability. Superior tensile strength, versatility and stacking capacity has fuelled the adoption of this material for the manufacturing of packages. It offers excellent protection in sectors such as food service, electronics, and agriculture. With the expansion of e-commerce sector there is a huge growth in the packaging of the products.

The non-wood pulp (bagasse, wheat straw) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to high availability and strict government guidelines. There is a huge production of wheat straw, and sugarcane bagasse. These are widely utilized due to its natural resistance properties from oil and water.

The transfer molded segment dominated the market with highest share of approximately 37% in 2025 due to high versatility and cost-effectiveness. These are suitable for high-volume transportation of products from a wide range of industries. It offers superior protection and cushioning to delicate products which influence the adoption of this segment.

The thermoformed segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to superior surface finish and highly biodegradable. These are widely used in industries from electronics and cosmetics due to high production efficacy. This is suitable for bulk packaging of products with light weight which make it cost-effective solution.

The trays segment dominated the market with highest share of approximately 41% in 2025 due to its high versatility and protective properties. It is influenced by rising inclination towards biodegradable pulp trays. Increasing demand for eco-friendly packaging has pushed the development of this market for high production with accuracy. These trays require high customization options which can be easily done in this industry.

The bowls & cups segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to rapid switch towards food service sector. High demand for hygienic, versatile, and leak-proof packaging has raised the adoption of this market. Rapid growth in fast-food chain has raised the demand for molded pulp material for packaging. High heat-sealing properties has pushed the demand for molded pulp packaging.

The food packaging segment dominated the market with highest share of approximately 52% in 2025 due to rising consumption of packaged food products. There is a huge demand for breathable, moisture-resistance, and protective packaging has fuelled the demand for this market. Increasing demand for organic and portable packaging pushed the demand for molded pulp packaging. These packaging are safe for storage of both hot and cold food packaging which enhance the adoption for such packaging.

The healthcare & medical devices segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to rising demand for sterile and protective packaging solution. Strict guidelines to decrease the generation of wastage in the packaging sector. Increasing concern for patient safety and hygienic packaging has pushed this sector to grow significantly.

India is witnessing rapid growth in the market, due to rising growth in logistics and e-commerce sector. There is a huge demand for safe and protective packaging which raised the production advancement in this sector. Huge raw material availability is one of the major factors behind the growth of this industry. Presence of expanded food and beverage industry pushed this sector to grow rapidly. It provides excellent cushioning effect for the safety of fragile materials which make this sector a suitable choice for various sectors. High technological advancement has pushed the demand for this market. Presence of major market players has a noteworthy impact on the development of this market with compostable packaging.

By Source

By Molded Type

By Product Type

By End-User Industry

February 2026

February 2026

February 2026

February 2026