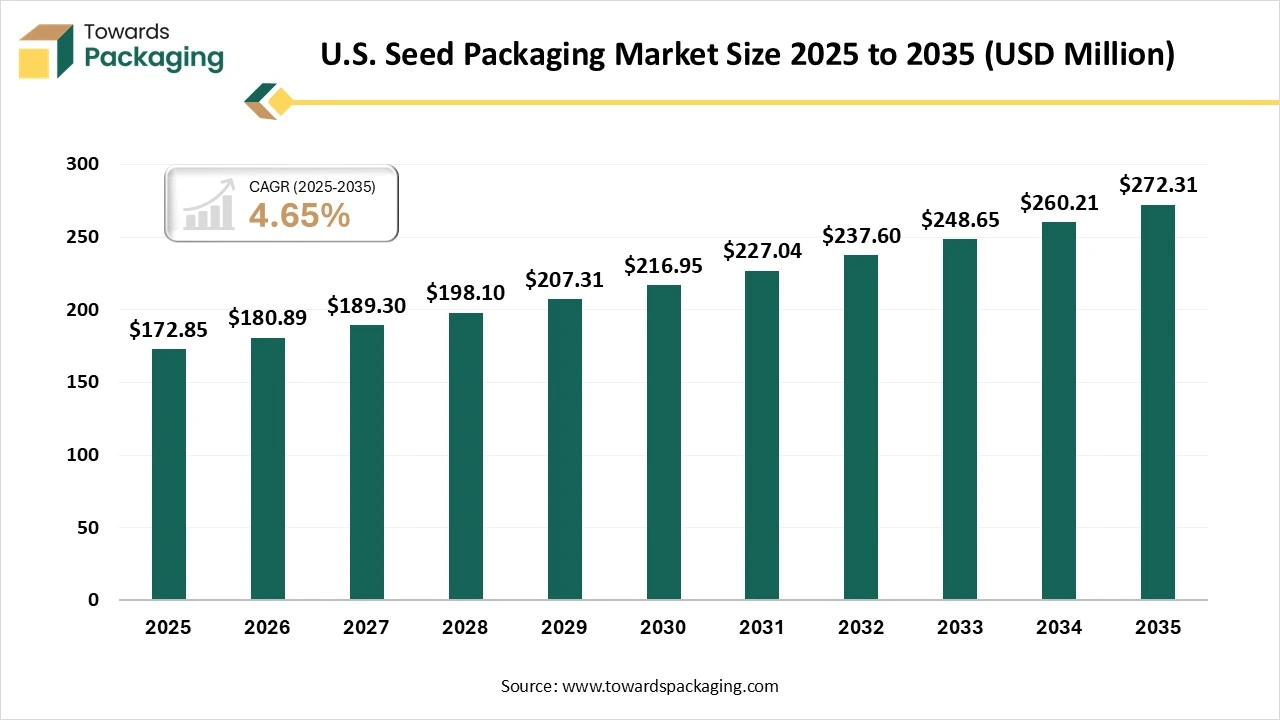

The U.S. seed packaging market is forecasted to expand from USD 180.89 million in 2026 to USD 272.31 million by 2035, growing at a CAGR of 4.65% from 2026 to 2035. Rising demand for sustainable and superior-barrier packaging in home gardening and agriculture. Development of the market is majorly contributed by advancement in seed coatings, recyclable materials, eco-friendly, and biodegradability.

U.S. seed packaging involves the manufacturing of specialized protective solutions such as multi-wall paper bags, woven sacks, and barrier-coated pouches designed to preserve the genetic purity and germination viability of seeds. These systems protect against moisture, UV degradation, and physical damage across the commercial farming, horticulture, and retail gardening supply chains.

Technological transformation in the U.S. seed packaging market plays a significant role by traditional plastics to biodegradable, recyclable, and eco-friendly packaging. Major innovation comprises active packaging to improve IoT-enabled, branded, and traceable packaging. Enhanced usage of enhanced, customized, flexible pouches, and clear labelling has fuelled the demand for advanced technology in this market. Integration of hybrid and genetically advanced seeds for increasing agriculture and gardening strategies has fuelled the demand for advancement in this market.

The major raw materials utilized in this market are polyethylene (PE), polypropylene (PP), paper, paperboard, jute, and mesh bags.

The component manufacturing in this market comprises flexible pouches and bags, BOPP Laminated PP Woven Bags, Paper and Cardboard.

This segment ensures managing seasonal and complex supply and plays an important role by protecting seed viability.

The plastic segment dominated the market with highest share of approximately 46% in 2025 due to its cost-effective and unique physical properties. These materials provide excellent barrier from moisture and adverse ecological condition. These are highly durable and flexible which enhance the demand for plastic seed packaging in the U.S. Highly ecological concern consumers in Chicago has boosted the demand for eco-friendly packaging. Major plastic seed packaging options include elevate packaging, custom paper tubes, ocean waste plastics, and greenseed contract packaging.

The paper & paperboard segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to changing consumer preference, rapid technological innovation, and ability-influenced guidelines. Rising sustainability and guidelines compliance has fuelled the demand for this segment. Increasing inclination towards eco-label packaging of both agricultural cooperatives and consumers has raised the adoption for paperboard & paper packaging.

The bags segment dominated the market with highest share of approximately 45% in 2025 due to its superior durability, cost-efficacy, and high-volume capacity. Huge demand for enhanced protection of the seeds from pests and moisture has enhanced the demand for such bags packaging. Paper bags and polypropylene bags are highly influenced in this industry as these are eco-friendly options available. Major industries such as JBM Packaging and Green Seed Contract Packaging have boosted the development in utilization of these packaging.

The pouches segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to convenience, sustainability, portability, cost-efficiency, and product protection. These are lightweight packaging which decreases transportation and shipping charges. High portability demand from agriculture industry has boosted the demand for this segment. Enhanced product protection due to the presence of multiple layers barrier in the packaging.

The agriculture segment dominated the market with highest share of approximately 60% in 2025. Increasing demand for staple crops such as soybeans, wheat, rice, and corn has raised the demand for these packaging in the agriculture sector. Rising advanced farming practices has boosted the demand for safety in packaging of seeds. Presence of strict guidelines in the agriculture industry has fuelled the utilization of special packaging to protect its quality in adverse condition.

The gardening segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to rapid shift in retail technology and consumer behaviour. A noteworthy shift in the direction of organic and non-organic genetically modified organism has raised the need for specialized seeds. Such specialized seeds require special packaging to protect the integrity of the seeds. These special seeds develop a high demand for resealable and small-format packaging. This segment majorly serves to nurseries, urban farming buffs, and home gardeners. Similarly bulk agricultural packing, gardening seed packing characteristically shows smaller amounts with a robust emphasis on visual attraction, brand diversity, reseal ability, and consumer-friendly pattern.

The U.S. seed packaging market is expanding due to advanced agriculture technology. Continuous advancement in the agricultural infrastructures has fuelled the huge production of these packaging. Increasing genetically modified seeds has raised agriculture sector and enhanced concern for safe packaging for storage. There is a rapid advancement in smart packaging of these seeds that help in tracking the quality of the seeds while stored and transported.

Rising number of home gardening has fuelled the demand for the market in Chicago. Increasing agriculture efficacy has also enhanced the need for specialized packaging of seeds to maintain the quality of it. This is a major hub of agribusiness which pushed the production process of seed packaging. These packaging are moisture-resistant which maintain the seeds quality. Consumers are highly demanding small, appealing, and specialized packaging for the storage and transportation of seeds.

Rising concern for consumer convenience has boosted the demand for the market in Boston. Presence of major market players has fuelled the innovation process which encouraged its adoption. It also enhanced customization option of these packaging and printing facility improve branding option with these packaging. High durability and usage of eco-friendly materials have raised its adoption profoundly.

By Material

By Product Type

By End-Use

February 2026

February 2026

February 2026

February 2026