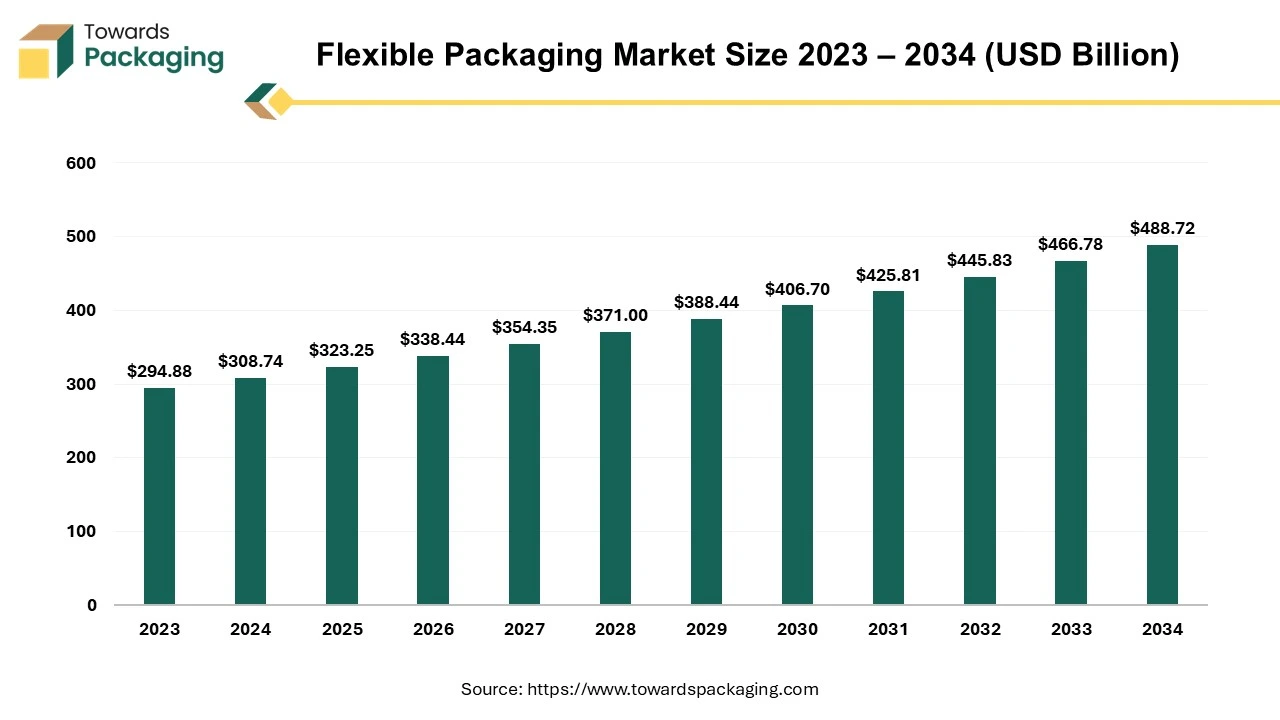

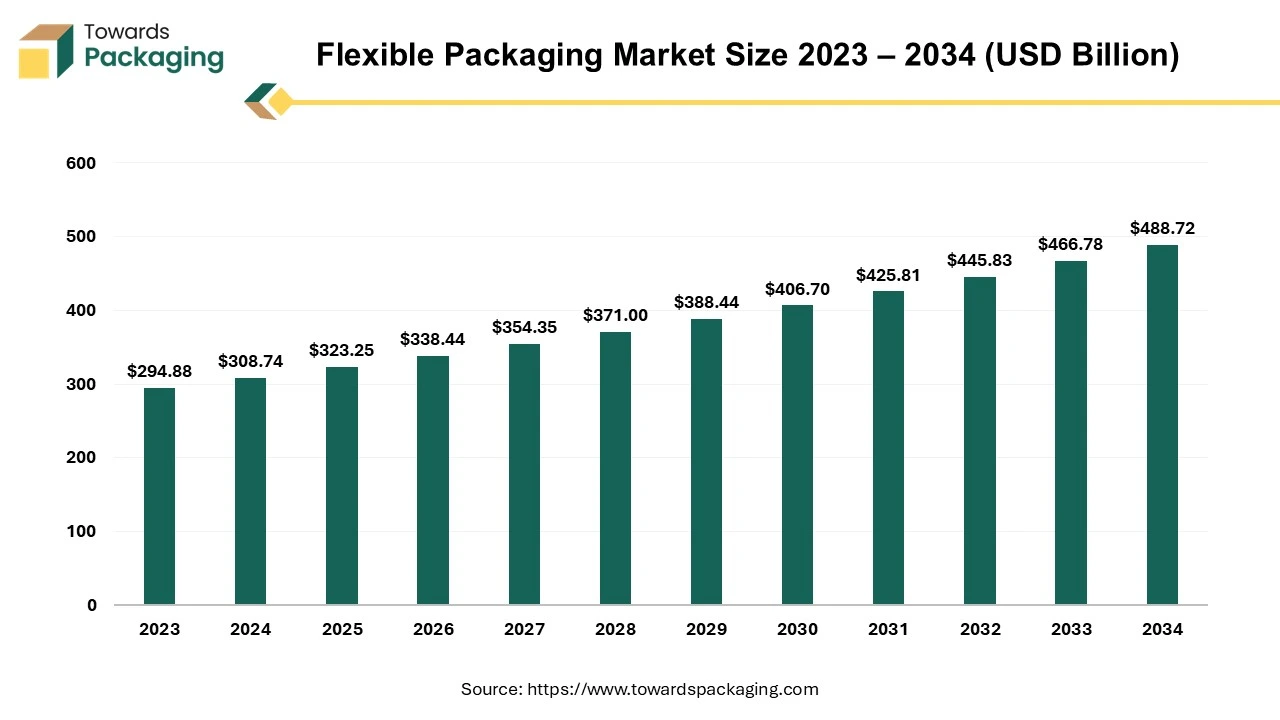

The flexible packaging market is expected to increase from USD 338.44 billion in 2026 to USD 511.69 billion by 2035, growing at a CAGR of 4.7% throughout the forecast period from 2026 to 2035. This report explores key market drivers, including innovations in technology, AI integration, and the growing adoption of sustainable materials across industries like food & beverages, pharmaceuticals, and personal care. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

Rising environmental issue such as global warming, resource depletion, etc. has increased emphasis on sustainable packaging solutions. The companies are focusing on reducing plastic usage and improving recyclability to meet environmental regulations and consumer demand.

Increasing innovations in packaging technologies, including the integration of AI and automation, are enhancing efficiency and minimizing waste in packaging processes.

The industry is witnessing consolidation, with significant mergers aimed at expanding market share and capabilities. For instance, Amcor’s acquisition of Berry global group is set to create the world’s largest plastic packaging company.

The companies are under increasing pressure from both regulators and consumers to adopt environmentally friendly practices, leading to a focus on minimizing single-use plastics and enhancing sustainability efforts.

The Stand-up pouches, the staple of flexible packaging, have completely changed the packaging industry. They readily stand upright on store shelves because to their self-supporting construction, drawing attention with their seductive appearance. Stand-up pouches provide lots of room for product details and branding, enabling you to visually engage customers while telling brand's narrative. They work well for a variety of goods, including coffee, snacks, pet food, and personal hygiene products.

Lay flat pouches are especially designed for single-serve foods, spices, and powders. Their small size guarantees that little material is wasted, which makes them an environmentally friendly packaging option.

The consumers are demanding high-end flexible packaging as well as manufacturer want to showcase their brand, which has risen the demand for the customization. Customizable colors, typography and logos to reinforce brand identity. Eye-catching graphics and patterns to stand out on shelves. Unique pouch shapes (e.g., stand-up, spouted, or resealable) for differentiation. Custom die-cut designs for enhanced user experience.

The flexible packaging sector is progressively using artificial intelligence. Al is capable of streamlining supply chain management, quality assurance, and production procedures. It facilitates data analysis to increase productivity, cut waste, and improve product design. Al-powered devices can also help with predictive machinery maintenance, which lowers costs and boosts output.

Based on criteria including longevity, sustainability, affordability, recyclable nature, and biodegradability, it chooses the best materials for plastic packaging. Interactive elements like QR codes may be made possible by Al-powered packaging, providing customers with more interesting and educational experiences. Implementing Al in the market also has the benefit of gathering consumer behavior patterns and market data to help with decision-making on plastic packaging designs and tactics.

| Rank | Manufacturer | 2024 Share (est.) |

| 1 | Amcor | 9–11% |

| 2 | Berry Global | 5–7% |

| 3 | Mondi | 3–4% |

| 4 | Sealed Air | 2.5–3.5% |

| 5 | Huhtamaki | 2–3% |

| 6 | Sonoco | 1.5–2.5% |

| 7 | TC Transcontinental Packaging | 1–2% |

| 8 | Constantia Flexibles | 1–2% |

| 9 | UFlex | 0.8–1.2% |

| 10 | ProAmpac | 0.8–1.2% |

Booming E-commerce Use for Grocery Shopping

The rise of online shopping requires durable, lightweight, and cost-effective packaging for shipping. Flexible packaging reduces shipping costs due to its lower weight compared to rigid alternatives. Flexible packaging reduces shipping costs compared to rigid alternatives because it is lightweight and compact. Lower material usage means reduced production costs and more efficient storage. Groceries, especially perishables, require high-barrier packaging to protect against moisture, oxygen, and light. Vacuum-sealed pouches and modified atmosphere packaging (MAP) help maintain freshness. Many e-commerce grocery platforms prefer recyclable, biodegradable, and compostable packaging to reduce environmental impact. Mono-material flexible packaging is gaining traction due to its easier recyclability.

Flexible packaging is the rapidly growing sector of the global packaging industry and is one of the best solutions for the e-commerce applications. By using flexible packaging, retailers may accomplish e-commerce shipping that is affordable, effective, and lightweight. Flexible packaging typically uses less energy during production and transportation, produces less product waste, which lowers greenhouse gas emissions, and uses less landfill space. This is because flexible packaging makes it possible to use resources efficiently and hence widely adopted by the e-commerce sector. Thus, the e-commerce flexible packaging market is anticipated to witness significant growth during the forecast period.

Competition from Rigid Packaging & Limited Barrier Properties Compared to Rigid Packaging

The key players operating in the flexible packaging market are facing issue due to competition from rigid packaging & fluctuating raw material costs. Flexible packaging may have lower resistance to extreme temperatures, punctures, and impact compared to rigid alternatives. Some products (e.g., carbonated drinks) require stronger barrier protection that flexible packaging cannot always provide. Prices of plastic resins, aluminium foils, and biodegradable films can be volatile due to supply chain disruptions. Dependence on petroleum-based raw materials makes the industry vulnerable to oil price fluctuations.

Eco-Friendly & Sustainability Packaging Trends

May e-commerce grocery platforms prefer recyclable, biodegradable, and compostable packaging to minimize environmental impact. Mono-material flexible packaging is gaining traction due to its easier recyclability. Hence, the increasing innovation and launch of the sustainable flexible packaging, which has estimated to create opportunity for the growth of the flexible packaging market in the near future.

For instance, in February 2025, Proquimia and Mondi, a world leader in environmentally friendly paper and packaging, have partnered to introduce paper-based stand-up pouches for dishwashing tabs in Spain and Portugal. In comparison to the previous plastic solution, the new solution has substantially fewer CO2 emissions from cradle to gate, according to Modi's internal product impact evaluation. There are twenty water-soluble dishwashing tablets in the flexible stand-up pouches. The new solution, which replaces the previously utilized plastic solution, was made using Mondis re/cycle FunctionalBarrier Paper 95/5.

| Company Name | Ticker / Exchange | Country | Market Cap (USD B) | P/E Ratio | Price-to-Sales (P/S) | EV / EBITDA | Dividend Yield (%) | Revenue (Last FY) | EBITDA (Last FY) | Flexible-Packaging Focus |

| Amcor plc | AMCR (NYSE) / AMC (ASX) | Switzerland / Australia | 19 | 21.3× | 1.07× | 10.5× | 4.60% | USD 14.7 B | USD 1.40 B | Flexible & rigid plastic packaging |

| Mondi plc | MNDI (LSE) | United Kingdom | 4.5 | 12.8× | 0.80× | 7.80× | 5.00% | £6.14 B | £880.94 M | Flexible packaging (focus on paper-based) |

| Huhtamäki Oyj | HUH1V (OMXHEX) | Finland | 3 | 14.2× | 0.76× | 8.18× | 3.65% | €4.8 B | €587 M | Flexible packaging & food packaging |

| Ergis S.A. | ERG (GPW) | Poland | ~0.03 | 11.5× | 0.41× | 13.20× | 1.20% | PLN 320 M | PLN 24 M | Flexible packaging |

| UPM-Kymmene Oyj | UPM (OMXHEX) | Finland | 11.5 | 16.7× | 0.73× | 8.40× | 4.30% | €10.48 B | €1.25 B | Paper-based & flexible packaging |

| Smurfit Kappa Group plc | SKG (Euronext Dublin) | Ireland | 11.8 | 14.9× | 0.85× | 6.9× | 3.10% | €12.85 B | €1.86 B | Corrugated & flexible packaging |

| DS Smith plc | SMDS (LSE) | United Kingdom | 7.2 | 13.1× | 0.70× | 7.25× | 4.90% | £8.22 B | £1.08 B | Paper-based & flexible packaging |

| Sealed Air Corp. | SEE (NYSE) | USA | 5.8 | 13.2× | 5.4× | 8.7× | N/A | 5.6 B | 16,300 | Protective & flexible films |

| Berry Global Group Inc. | BERY (NYSE) | USA | 7.1 | 15.8× | 2.7× | 7.9× | 74% | USD 13.3 B | 46,000 | Extensive flexible packaging |

| Sonoco Products Co. | SON (NYSE) | USA | 6.2 | 12.5× | 1.8× | 7.4× | 100% | USD 7.26 B | 22,000 | Paper-based & flexible packaging |

| Transcontinental Inc. | TCL.A (TSX) | Canada | 1.1 | 11.4× | 0.9× | 5.8× | 55% | 2.11 B | 8,000 | Flexible packaging & printing |

| Winpak Ltd. | WPK (TSX) | Canada | 2.5 | 22.4× | 2.4× | 11.6× | 209% | 1.2 B | 2,600 | Rigid & flexible packaging films |

| Graphic Packaging Holding Co. | GPK (NYSE) | USA | 8.7 | 10.6× | 2.1× | 6.9× | 77% | 9.3 B | 24,000 | Cartonboard & flexible wraps |

| WestRock Co. | WRK (NYSE) | USA | 11.9 | 15.1× | 0.8× | 7.0× | N/A | 20.33 B | 56,000 | Paperboard & flexible solutions |

| Packaging Corp. of America | PKG (NYSE) | USA | 17.5 | 17.2× | 3.5× | 9.8× | 1.48% | USD 8.76 B | 15,000 | Carton & corrugated + some flexible packaging |

| International Paper Co. | IP (NYSE) | USA | 14.8 | 19.6× | 2.2× | 7.1× | 0.78% | 18.8 B | 39,000 | Paper & flexible products blend |

| Avery Dennison Corp. | AVY (NYSE) | USA | 17.7 | 20.8× | 9.1× | 13.2× | 1.92% | 7.23 B | 36,000 | Labels & adhesive flexible films |

| Dow Inc. | DOW (NYSE) | USA | 42.9 | 18.3× | 2.1× | 7.6× | 0.82% | 45 B | 35,900 | Polyethylene film & packaging materials |

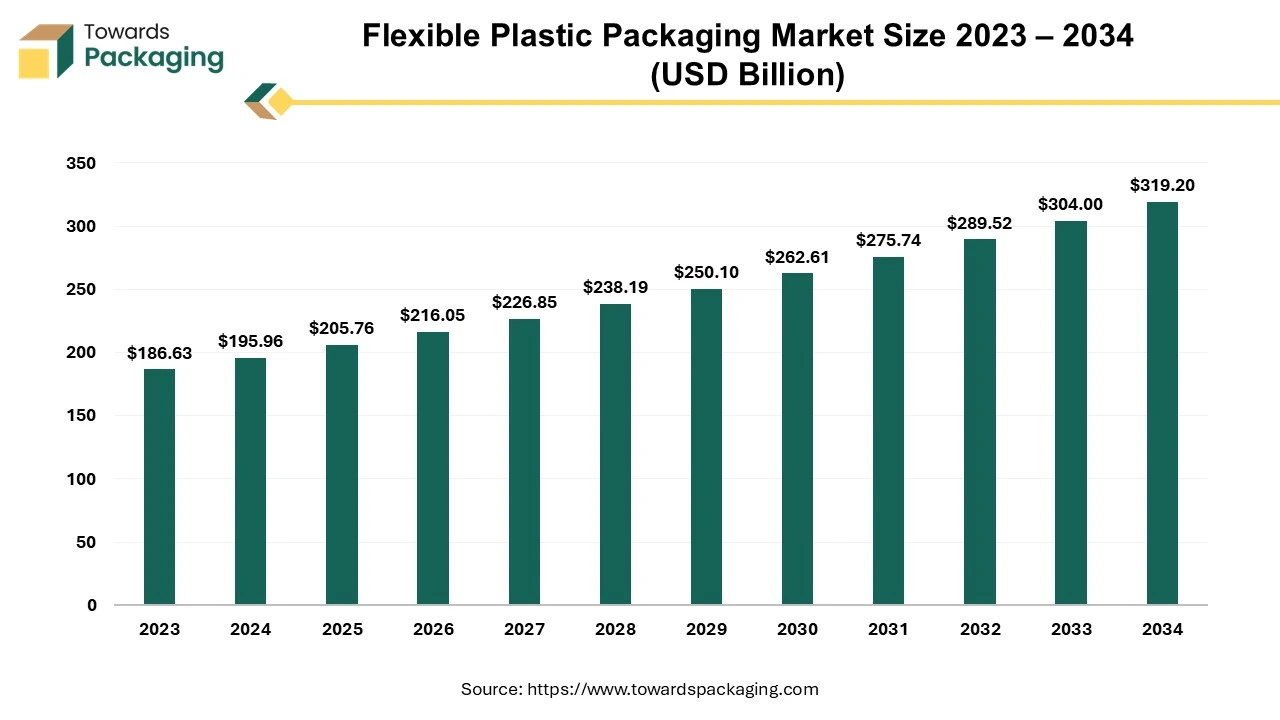

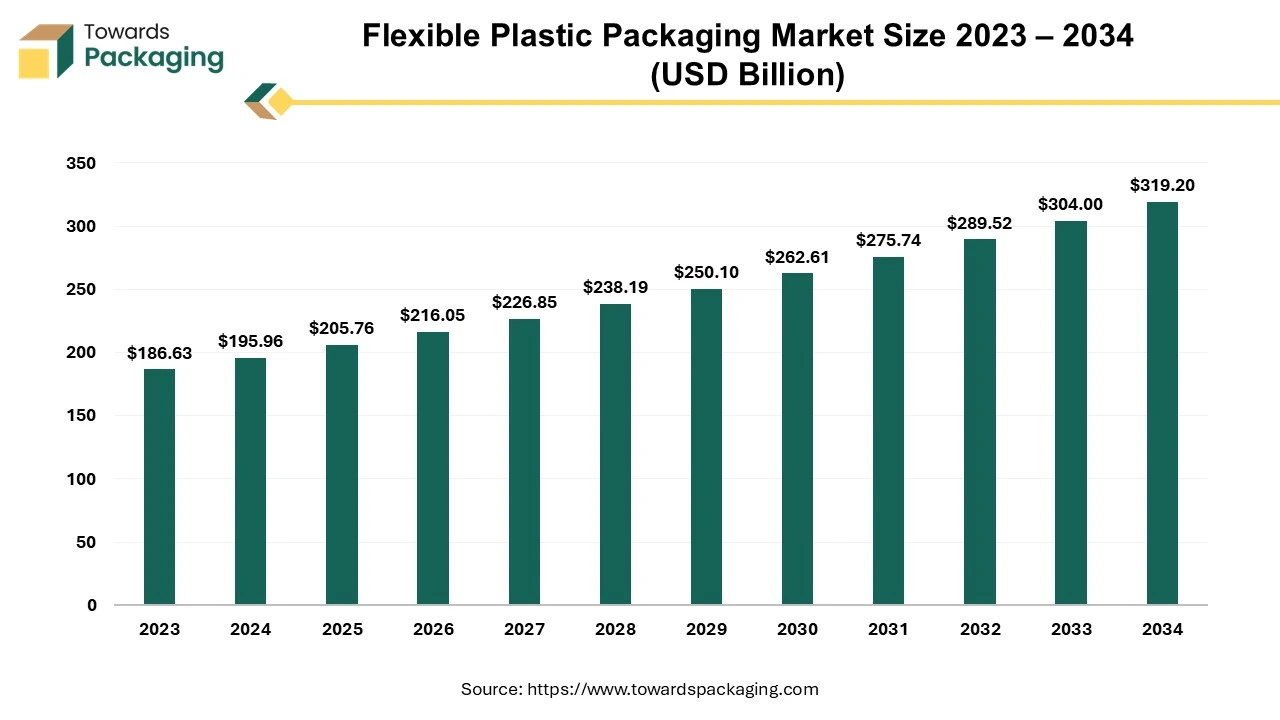

The plastics segment dominated the flexible packaging market in 2024. Plastic is cheaper to produce and transport compared to alternatives like glass and metal. Plastics offer high strength-to-weight ratios, reducing shipping costs. Plastic material can be molded into various forms like pouches, wraps, and films. Plastic material allows for high-quality printing and branding customization. Flexible plastics offer tamper-proof and secure packaging solutions.

The flexible plastic packaging market is projected to reach USD 319.20 billion by 2034, growing from USD 205.76 billion in 2025, at a CAGR of 5.0% during the forecast period from 2025 to 2034.

Packaging materials composed of various flexible plastic materials that may conform to the shape of the item being packaged are referred to as flexible plastic packaging. It consists of a variety of plastic packaging shapes, mostly meant for home use, that are flexible or semi-flexible, like bags, films, pouches, and tubes. Because of their cost-effectiveness and versatility in the supply chain, plastic polymers generated from fossil hydrocarbons are commonly used to create these packaging solutions.

The pouches segment accounted for a significant share of the market in 2024. Pouches use less material than rigid packaging, reducing manufacturing and transportation costs. Multi-layered films of pouches offer strong protection against moisture, oxygen, and contaminants. Many pouches are now made with recyclable or biodegradable materials. Mono-material pouches improve recyclability and meet regulatory demands. Flexible and durable, reducing risk of damage during shipping. Pouches are ideal for direct-to-consumer brands and online grocery markets.

The flexography segment led the global flexible packaging market. Flexography printing technology Works on a wide range of substrates like plastic films, paper, foil, and biodegradable materials. Faster printing process compared to other methods like gravure. Flexography printing technology is ideal for printing on flexible packaging formats like pouches, bags, and wraps. It is water-based and UV-curable inks which reduce environmental impact. Flexography printing technology supports special effects like metallic finishes and matte-gloss combinations. Flexography printing technology ensures strong adhesion on flexible surfaces, making prints resistant to smudging or wear. Flexography printing supports special effects like metallic finishes and matte-gloss combinations. Works well with sustainable and recyclable packaging materials.

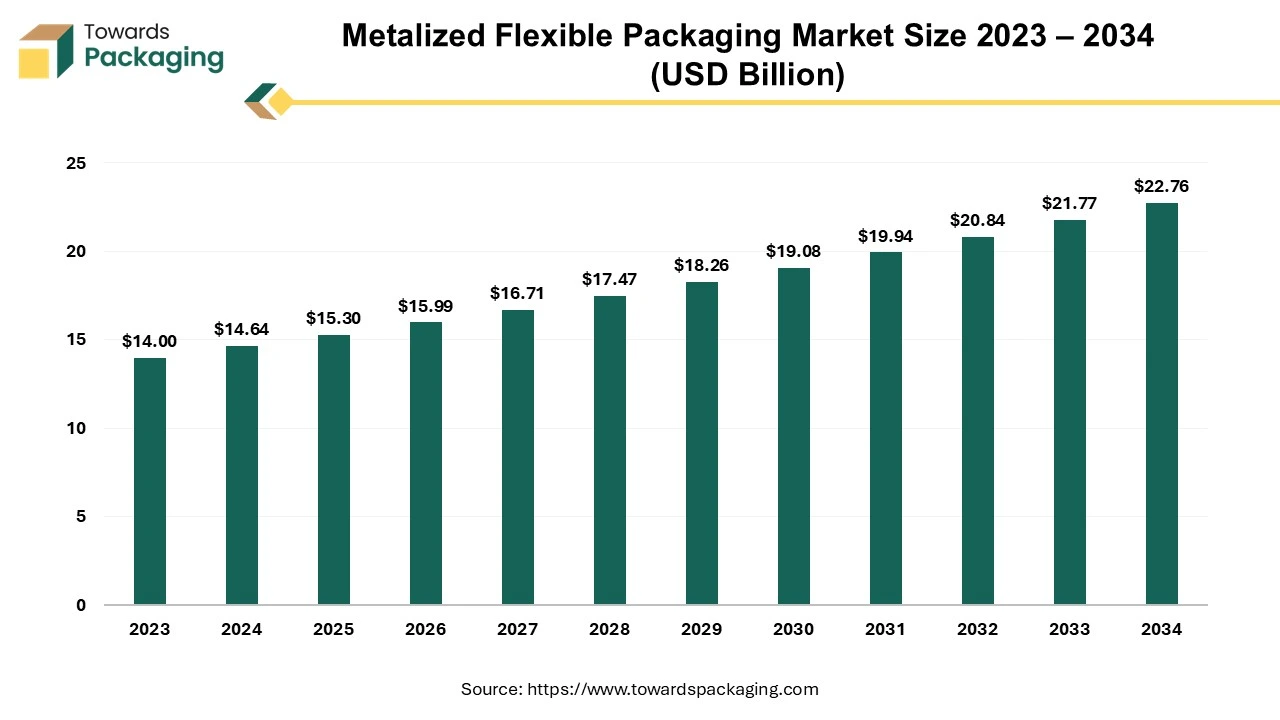

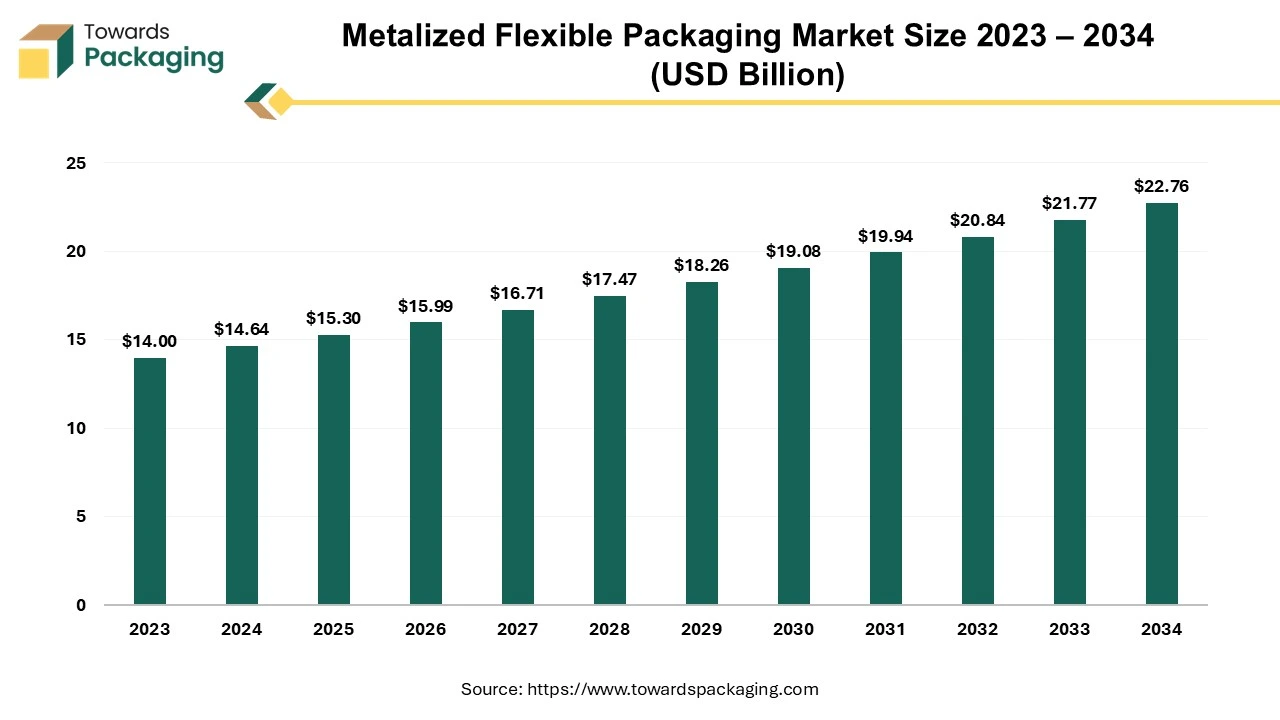

Growth Opportunities in the Metalized Flexible Packaging Market

The global metalized flexible packaging market size reached USD 15.30 billion in 2025 and is projected to hit around USD 22.76 billion by 2034, expanding at a CAGR of 4.55% during the forecast period from 2025 to 2034.

Metalized flexible packaging typically comprises a metal-coated polymer film, with aluminium being the most commonly used metal. However, chromium and nickel are also employed in this process. These films are generally produced by heating metals in a vacuum, leading to the condensation of metal droplets on polymer films and the formation of metalized films. Like aluminium foils, metalized flexible films exhibit a shiny metallic surface and are highly combustible. However, they are lighter and more cost-effective due to their significantly thinner profile than aluminium foils. The industry's widespread adoption of flexible packaging and films is attributed to various technological advancements.

The food & beverage segment dominated the flexible packaging market globally. Urbanization and changing lifestyles in developing countries drive demand for packaged foods. Flexible packaging provides an affordable and efficient solution for local and multinational food brands. Flexible packaging allows high-quality printing and design customization to enhance brand appeal. Online grocery shopping and food delivery services require flexible, tamper-proof, and secure packaging. Flexible packaging solutions like pouches, sachets, and wraps enhance portability and shelf life. Growth in ready-to-eat meals, snacks, and frozen foods increases the need for lightweight, durable packaging.

Growth of Flexible Packaging for Beverage Market

The flexible packaging for beverage market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The increasing consumers preferences due to convenience and transportability has influenced the development of market. In 2024, Asia Pacific led with 36% share, while North America is set for strong growth. Stand-up pouches (46%), PET/PE films (39%), and juices/dairy drinks (42%) dominated, with retail packaging at 54%, and emerging segments poised for high CAGR by 2034.

The flexible packaging for beverage market focuses on the design, production, and use of lightweight, flexible packaging formats that serve as primary packaging-directly containing and preserving beverages. These formats include stand-up pouches, spouted pouches, stick packs, sachets, and occasionally lidding films. This market segment is driven by increasing consumer demand for convenience, single-serve and on-the-go beverages, as well as the industry’s push toward sustainable, low-waste packaging. Flexible packaging offers benefits such as reduced material usage, better shelf appeal, lower carbon footprint in transportation, and greater barrier performance.

Asia Pacific region held the largest share of the flexible packaging market in 2024, owing to expanding pharmaceutical industry and rise in demand for convenient packaging. Asia-Pacific serves as a major exporter of flexible packaging materials and finished products. Countries like China, India, and Japan dominate global flexible packaging supply chains. Increasing penetration of online shopping in Asia Pacific region fuels demand for lightweight, durable, and tamper-proof packaging. Expanding middle class with increasing disposable income boosts consumption of branded and convenience products. The flexible packaging lower production and labor costs make Asia-Pacific a global hub for flexible packaging production.

China Flexible Packaging Market Trends

China flexible packaging market is growing due to booming Ecommerce sector in the region. China is the world’s largest e-commerce market, driving demand for secure, lightweight, and durable packaging. China is a global hub for flexible packaging production with well-established supply chains. China is a leading exporter of flexible packaging materials and finished products. Foreign companies investing in China’s packaging industry to cater to domestic and international markets.

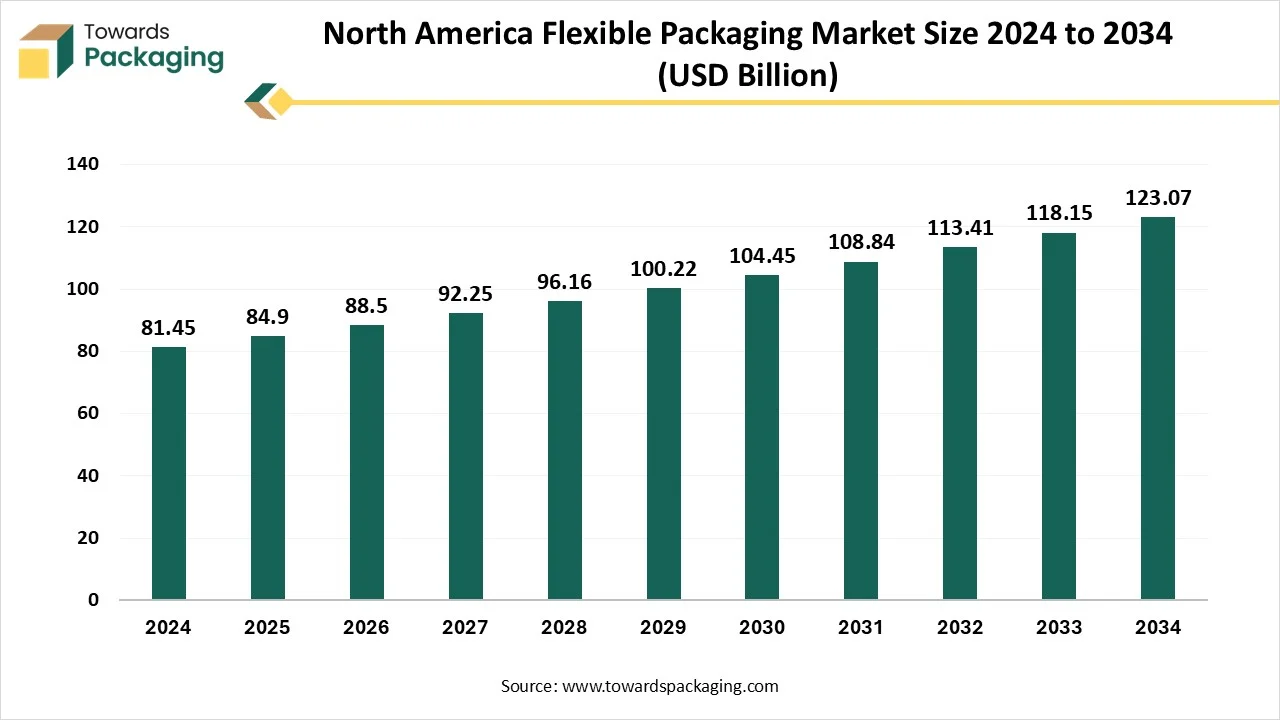

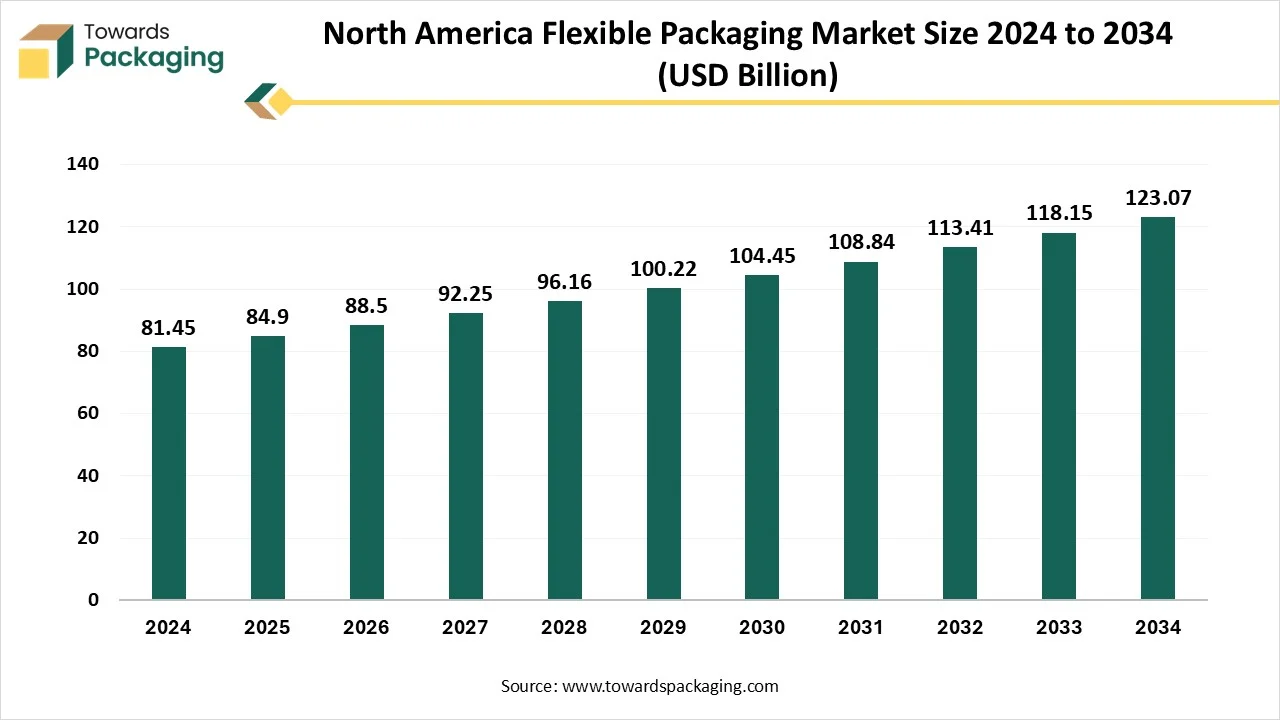

North America region held the largest share of the flexible packaging market in 2024, owing to growing food & beverage industry in the region. High demand for packaged, processed, and convenience foods in North America has driven the market growth. Growth of ready-to-eat meals, frozen foods, and snack segments. Demand for resealable pouches, single-serve packs, and easy-to-use packaging. Major packaging companies like Amcor, Sealed Air, Berry Global, and Mondi are headquartered or have significant operations in North America. Well-established logistics and transportation networks support packaging production and distribution.

U.S. Flexible Packaging Market Trends

U.S. flexible packaging market is growing at fastest rate due to strong food & beverage industry. U.S. regulations promoting recyclable, compostable, and biodegradable packaging. Growth in frozen foods, ready-to-eat meals, snacks, and beverage packaging in the U.S. region. Adoption of smart packaging with QR codes, NFC, and RFID for product tracking and authentication. Strong R&D and advancements in printing, coatings, and laminates in U.S. region to drive the market growth.

North America Flexible Packaging Market Size, Demand and Trends Analysis

The North America flexible packaging market is expected to increase from USD 84.9 billion in 2025 to USD 123.07 billion by 2034, growing at a CAGR of 4.23% throughout the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing flexible packaging which is estimated to drive the North America flexible packaging market over the forecast period. The North America flexible packaging market is experiencing steady growth, driven by rising consumer demand for convenience, sustainability, and innovation in packaging solutions.

Flexible packaging is widely used in the food and beverage sector, which remains the dominant end-user due to its cost-effectiveness and extended shelf life benefits. Technological advancements, such as recyclable mono-materials and high-barrier films, are supporting eco-friendly trends. Additionally, the rapid expansion of e-commerce and regulatory emphasis on sustainable practices continue to shape the future of this dynamic industry.

European is seen to grow at a notable rate in the foreseeable future. EU Regulations strict environmental laws, such as the European Green Deal and Single-Use Plastics Directive, push companies toward recyclable, biodegradable, and compostable flexible packaging. Growing eco-consciousness in Europe region drives demand for packaging with lower carbon footprints. The European food industry, particularly in snacks, ready-to-eat meals, and frozen foods, relies on flexible packaging to enhance shelf life, convenience, and portability. The European Plastics Pact and country-specific recycling targets promote investment in recyclable flexible materials. Companies are focusing on monomaterial packaging (e.g., 100% polyethylene or polypropylene) for easier recycling.

PPWR establishes explicit goals for recycled content and requires that all packaging be 100% recyclable by 2030. It also emphasizes how crucial it is to guarantee that all elements of the packaging value chain smoothly interact with recycling infrastructure.

Recycling Flexible Packaging Market Size and Regional Production Analysi

The recycling flexible packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The growing awareness among consumers to use eco-friendly packaging of the products they use or reusable packaging has raised the demand for such recycling in the flexible packaging market.

Recycling flexible packaging comprises collecting and processing resources such as pouches, bags, and bottles into new products. This procedure sometimes distinguishes the resources from separate impurities and removes them before redesigning them into a different material. It is a process that reduces the waste materials from the landfills. It is estimated that around 50% of flexible packaging is recyclable in the U.S. All the plastic used in grocery bags, bread bags, and other products is made up of polyethylene, which can easily be recycled. These types of packaging require non-rigid resources that permit more customizable and economical options.

Germany Flexible Packaging Market Trends

Germany flexible packaging market is growing owing to stringent regulatory laws imposed by the German government in the country. Germany is the margest market in Europe for flexible packaging, driven by strong manufacturing and food industries. The Germany country is pioneer in recycling with strict packaging waste laws (e.g., VerpackG law). Growth in biodegradable and recyclable films due to high environmental awareness. Major investments in smart and active packaging (e.g., temperature-sensitive and antimicrobial films).

Germany Flexible Packaging Market Growth

The Germany flexible packaging market is expected to increase from USD 14.65 billion in 2025 to USD 21.30 billion by 2034, growing at a CAGR of 4.25% throughout the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing flexible packaging. The Germany Flexible Packaging Market refers to the industry engaged in the production and distribution of packaging materials that are non-rigid in nature, such as pouches, bags, wraps, and films.

These materials offer advantages like lightweight properties, extended shelf life, cost efficiency, and sustainability. Widely used across food & beverages, pharmaceuticals, cosmetics, personal care, and industrial applications, the German market emphasizes eco-conscious solutions driven by strict environmental regulations and high consumer awareness around recyclability and circular packaging models.

| Country | Trade Flow | Trade Value (US$) | Net Weight (kg) | Quantity (kg) |

| Argentina | M | $101,660,177 | 20,492,193.40 | 20,492,193 |

| Argentina | X | $1,393,925 | 333,034.30 | 333,034 |

| Brazil | M | $323,343,749 | 83,736,678.70 | 83,736,679 |

| Brazil | X | $85,896,382 | 18,655,744.40 | 18,656,332 |

| Colombia | M | $98,855,759 | 38,517,315.10 | 38,517,315 |

| Colombia | X | $120,232,084 | 22,466,363.90 | 22,466,364 |

| Country | Trade Flow | Trade Value (US$) | Net Weight (kg) | Quantity (kg) |

| Australia | M | $308,208,007 | 0 | 65,316,137 |

| Australia | X | $29,091,182 | 6,725,854.20 | 6,725,854 |

| China | M | $1,367,340,759 | 84,254,225.70 | 84,254,226 |

| China | X | $3,849,780,663 | 1,455,041,438.10 | 1,455,041,438 |

| Sri Lanka | M | $33,105,560 | 14,354,863 | 14,354,863 |

| Sri Lanka | X | $1,124,433 | 554,539 | 554,539 |

| India | M | $513,823,230 | 236,313,373.20 | 236,313,373 |

| India | X | $413,164,533 | 152,637,969.40 | 152,637,969 |

| Singapore | M | $181,856,740 | 0 | 0 |

| Singapore | X | $140,801,297 | 16,375,296.20 | 16,375,296 |

| Country | Trade Flow | Trade Value (US$) | Net Weight (kg) | Quantity (kg) |

| Belgium | M | $546,528,071 | 0 | 0 |

| Belgium | X | $921,383,254 | 217,492,948.30 | 217,492,948 |

| France | M | $1,463,286,490 | 300,817,864 | 300,817,864 |

| France | X | $1,108,088,488 | 0 | 0 |

| Germany | M | $2,003,297,930 | 0 | 0 |

| Germany | X | $3,928,847,242 | 675,846,754.40 | 675,846,754 |

| Greece | M | $130,995,356 | 37,551,601.40 | 37,551,601 |

| Greece | X | $191,776,865 | 40,497,734.20 | 40,497,734 |

| Italy | M | $867,696,514 | 186,030,278.60 | 186,030,279 |

| Italy | X | $2,129,268,135 | 425,938,714.10 | 425,938,714 |

| Country | Trade Flow | Trade Value (US$) | Net Weight (kg) | Quantity (kg) |

| Israel | M | $109,122,000 | 19,747,729.20 | 19,747,729 |

| Israel | X | $136,790,000 | 28,357,067.10 | 28,357,067 |

| Saudi Arabia | M | $297,559,876 | 115,419,414.40 | 115,419,414 |

| Saudi Arabia | X | $77,052,085 | 40,110,490 | 40,110,490 |

| Turkey | M | $330,831,746 | 66,625,269 | 66,625,269 |

| Turkey | X | $735,873,951 | 235,880,633 | 235,880,633 |

| Country | Trade Flow | Trade Value (US$) | Net Weight (kg) | Quantity (kg) |

| Canada | M | $926,249,546 | 180,904,202.20 | 180,904,202 |

| Canada | X | $702,635,828 | 126,621,252.70 | 126,621,253 |

| USA | M | $3,383,750,579 | 536,523,540.20 | 536,523,540 |

| USA | X | $3,849,952,928 | 482,628,050.40 | 482,628,050 |

| Country | Trade Flow | Trade Value (US$) | Net Weight (kg) | Quantity (kg) |

| South Africa | M | $161,153,189 | 0 | 30,014,532 |

| South Africa | X | $34,303,353 | 5,838,852.70 | 5,838,853 |

| Egypt | M | $254,431,245 | 48,315,347.40 | 48,315,347 |

| Egypt | X | $69,255,736 | 11,306,626.30 | 11,306,626 |

| Country | Trade Flow | Trade Value (US$) | Net Weight (kg) | Quantity (kg) |

| Luxembourg | M | $47,892,530 | 9,768,081.30 | 9,768,081 |

| Luxembourg | X | $18,780,745 | 2,878,988.70 | 2,878,989 |

| Switzerland | M | $426,690,207 | 66,671,855.60 | 66,671,856 |

| Switzerland | X | $402,035,158 | 82,844,201.50 | 82,844,202 |

Greenback Recycling Technologies has installed its first Enval recycling module in the UK at Amcor’s Heanor facility in Derbyshire. The six-month commissioning and trial phase will mainly process household post-consumer flexible packaging waste, generating insights for scaling circular solutions.

The technology turns flexible packaging waste into pyrolytic oil, which can then be used to produce food-grade plastics. Greenback tracks the entire process through its eco2Veritas platform, which uses AI and IoT devices to log every step from receiving waste to producing oil. Each batch of oil comes with a digital certificate of provenance, enabling transparent mass-balance allocation when the oil is converted into recycled plastics.

Philippe von Stauffenberg, CEO of Greenback, said hosting the module at Amcor’s site will allow experts to provide real-time feedback and help refine the system before wider rollout. Andrew Green, Vice President at Amcor Flexibles EMEA, added that combining Greenback’s innovation with Amcor’s operational expertise strengthens circularity for soft plastics and supports customers in meeting their sustainability goals.

Napco Investment LLC, a Dubai-based subsidiary of Napco National, has completed the strategic acquisition of Arabian Flexible Packaging from the Ghurair Group, effective 1 August 2025. This move expands Napco’s regional footprint, boosts operational capabilities, and supports the UAE’s local content and In-Country Value (ICV) initiatives, reinforcing our commitment to sustainable growth and delivering added value to customers and partners across the region.

With this expansion, Napco aims to unlock new synergies, enhance innovation, and extend our service reach to even more customers across the Middle East, Africa, and Europe. Together, we are shaping the future of flexible packaging.

| Metric | FY 2024 | FY 2025 | Change (Reported) |

|---|---|---|---|

| Net Sales | $3,353M | $5,745M | +71% |

| Net Income | $191M | $262M | — |

| Diluted EPS (US cents) | 13.2 | 11.3 | — |

| Metric | FY 2024 | FY 2025 | Change (Reported) | Change (Constant Currency) |

|---|---|---|---|---|

| Net Sales | $3,353M | $5,745M | +71% | +68% |

| EBITDA | $466M | $909M | +95% | +92% |

| EBIT | $365M | $687M | +88% | +85% |

| Net Income | $234M | $448M | +91% | +88% |

| Diluted EPS (US cents) | 16.2 | 19.3 | +20% | +18% |

| Free Cash Flow | -$395M | -$343M | — | — |

| Metric | FY 2024 | FY 2025 | Reported Change | Constant Currency Change |

|---|---|---|---|---|

| Net Sales | $2,552M | $3,257M | +28% | +25% |

| Adjusted EBIT | $329M | $426M | +29% | +28% |

| EBIT Margin | 12.9% | 13.1% | — | — |

| Metric | FY 2024 | FY 2025 | Reported Change | Constant Currency Change |

|---|---|---|---|---|

| Net Sales | $801M | $2,488M | +211% | +205% |

| Adjusted EBIT | $62M | $295M | +377% | +365% |

| EBIT Margin | 7.7% | 11.9% | — | — |

| Category | Amount |

|---|---|

| Total Q1 Synergies | ~$38M |

| Impact to EBIT | ~$33M |

| Impact to Interest Expense | ~$5M |

| Expected Total FY26 Synergies | ≥ $260M |

| Total Identified Synergies by FY28 | $650M |

| Detail | Value |

|---|---|

| New Quarterly Dividend | 13.0 cents per share |

| Prior Year Q1 Dividend | 12.75 cents |

| ASX Holder Payment | 19.78 AUD cents |

| Ex-Dividend Dates | Nov 27 (ASX), Nov 28 (NYSE) |

| Record Date | Nov 28, 2025 |

| Payment Date | Dec 17, 2025 |

| Metric | FY26 Guidance |

|---|---|

| Adjusted EPS | 80–83 cents (12–17% growth) |

| Free Cash Flow | $1.8–$1.9B |

| Capex | $850–$900M |

| Net Interest Expense | $570–$600M |

| Effective Tax Rate | 19–21% |

| Expected FY26 Synergies | ≥ $260M |

By Raw Material

By Packaging Type

By Printing Technology

By Application

By Region:

February 2026

February 2026

February 2026

February 2026