Beverage Packaging Market Outlook Scenario Planning & Strategic Insights for 2034

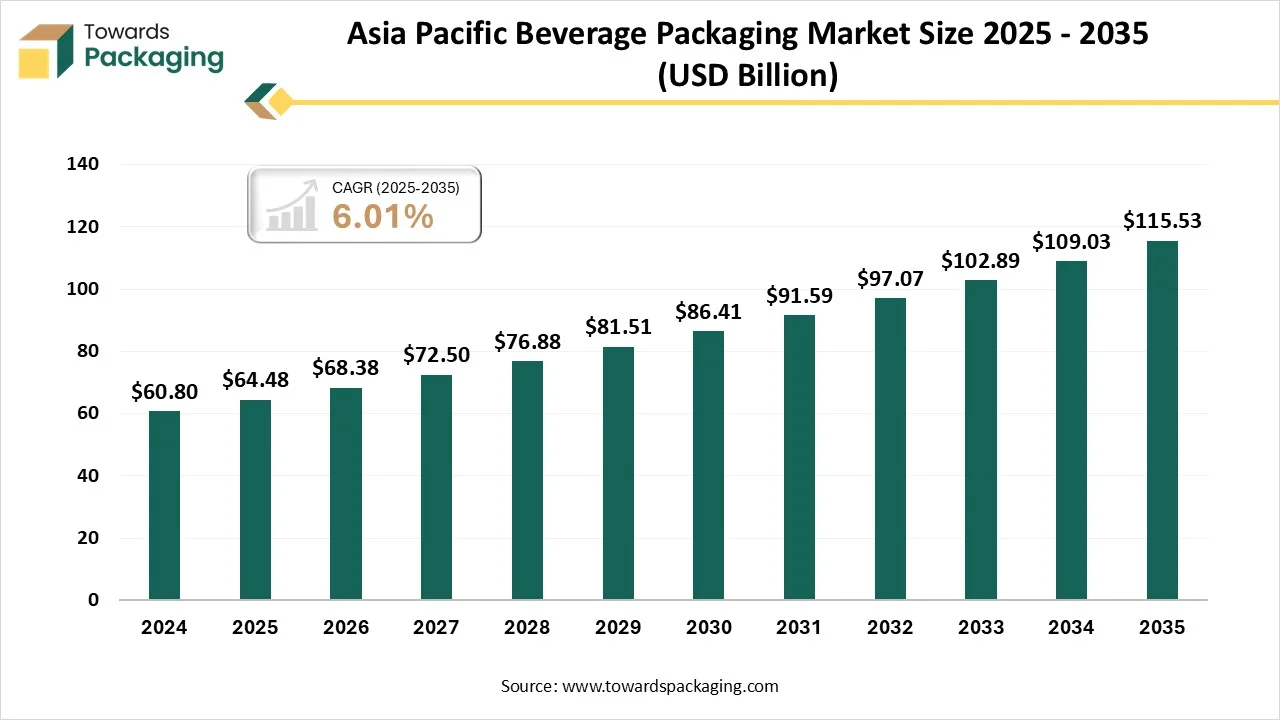

The beverage packaging market is projected to grow from USD 176.57 billion in 2026 to USD 275.09 billion by 2035, at a CAGR of 5.05%. Our report covers the entire ecosystem including material segments (plastic leading in 2024), product types (bottles & jars dominant), and applications (alcoholic beverages largest share). It also provides regional insights across APAC (largest), North America, Europe, Latin America, and MEA, along with competitive profiling of Ball Corporation, Crown Holdings, and other key suppliers, plus value chain mapping, trade data, manufacturer listings, and distributor networks.

Major Key Insights of the Beverage Packaging Market

- Asia Pacific dominated the beverage packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By material, the plastic segment dominated the market with the largest share in 2024.

- By product, the bottle & jar segment registered its dominance over the global beverage packaging market in 2024.

- By end user, the alcoholic beverages segment dominated the beverage packaging market in 2024.

Beverage Packaging Market Overview

Beverage packaging is known as any sort of packaging developed to hold liquids for consumption. These products serve several purposes, including protecting the beverage from contamination, maintaining freshness, providing convenience for storage and transport, and offering a platform for branding and product information.

Glass bottles are a traditional type of packaging solutions made from limestone soda ash, and melted sand. Frequently utilized for alcoholic beverages (like beer, wine, and spirits), soft drinks, and sometimes for juices and water. Non-reactive, maintaining the original taste of the beverage. They are also reusable and recyclable.

Key Metrics and Overview

| Metric | Details |

| Market Size in 2024 | USD 168.08 Billion |

| Projected Market Size in 2034 | USD 275.09 Billion |

| CAGR (2025 - 2034) | 5.05% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Product, By Application and By Region |

| Top Key Players | Bemis Company, Inc., Sonoco Products Company, Scholle IPN, Mondi, Amcor plc, Reynolds Group Ltd., Crown. |

Market Trends

Eco-friendly and Sustainable Packaging Solutions

The key players in the market are focusing on using recycled content and biodegradable alternatives to reduce environmental impact. For instance, Ball Corporation reported that 70% of its beverage packaging globally contains recycled content, with plans to increase this to 85% by 2030. There's a move away from single-use plastics towards materials like metal, glass, or compostable options. Bacardi Limited announced plans to utilize 100% biodegradable plastic packaging manufactured with plant-based oils for all its brands by 2024.

Integration of Smart Packaging Technologies

The integration of smart technologies improves product information and consumer engagement. These features provide instant access to product details, promotions, or brand stories. Crown Holdings' CrownConnect technology has been adopted by over 100 beverage brands globally, resulting in a 25% increase in consumer engagement. AR packaging offers interactive experiences, such as virtual tastings or brand narratives, enhancing consumer interaction.

Transparent and Minimalist Design

Nowadays consumers favour clean, straightforward packaging that reflects authenticity. Minimalist aesthetics are simple designs with neutral palettes and clear typography convey quality and modernity. The transparent packaging allows visibility of the product builds trust and emphasizes purity, especially in health-conscious markets.

Environmental and Regulatory Challenges

Governments are enforcing laws to minimize packaging waste, compelling companies to adopt sustainable practices. The European Parliament's Directive 94/62/EC focuses on limiting packaging waste and promoting recycling. There's a rising expectation for brands to disclose product origins and sustainability efforts, influencing packaging design and material choices. These trends indicate a dynamic shift in the beverage packaging industry towards sustainability, technological integration, and consumer-centric designs, shaping the future of beverage packaging.

How Can AI Improve the Beverage Packaging Industry?

The integration of artificial intelligence significantly enhances the beverage packaging industry by improving various aspects of production, design, supply chain management, and customer engagement. The artificial intelligence integration can help in product optimization and quality control. AI algorithms assist in predict when machinery will require maintenance, reducing downtime and preventing costly breakdowns. AI-powered vision systems help in inspecting packaging for defects (e.g., cracks, improper sealing) at high speed, ensuring consistent quality. The artificial intelligence integration assists in optimization of manufacturing processes, adjusting parameters in real-time to improve efficiency and reduce waste.

The integration of artificial intelligence saving energy and developing sustainable beverage packaging. The artificial intelligence integration has ability to optimize inventory levels, ensuring that raw materials and finished products are stocked efficiently. AI systems helps in monitoring and optimizing energy usage in production facilities, contributing to lower carbon footprints. AI can identify opportunities to reduce waste during production and in the design of more recyclable or biodegradable solutions.

Driver

Home Delivery & E-commerce Services

Rise of e-commerce and food delivery services increases the demand for durable and secure packaging solutions for beverages. Beverage subscription services require innovative packaging that ensures freshness and convenience, further driving the industry growth.

- In December 2024, according to data published by National Grocers Association, Online grocery shopping accounted for 77.8 million households in November 2024. In April 2020, the first full month of the COVID-19 pandemic, that record was broken.

Restraint

Competition and Market Saturation

The key players operating in the market are facing issue due to competition from alternative beverage packaging and market saturation, which has restricted the growth of the beverage packaging market in the near future. The beverage packaging market is highly competitive, with numerous players offering similar products, leading to price wars and reduced profit margins. In mature markets, high levels of market penetration limit the scope for further growth, especially for traditional packaging solutions types like plastic bottles.

The negative environmental impact of plastic packaging, particularly single-use plastics, has led to increased regulatory scrutiny and bans, restraining market growth. Stringent regulations aimed at reducing packaging waste, such as taxes on plastic packaging and mandates for recyclability, increase production costs and limit the use of certain materials. Rising consumer awareness about environmental issues leads to a preference for alternative packaging, reducing demand for traditional plastic packaging.

Opportunities

Growing Beverage Consumption & Rising Demand for Packaged Beverages

Rising consumption of carbonated drinks, alcoholic beverages, bottled water, and ready-to-drink (RTD) products fuels the demand for various types of beverage packaging. The rise in health-conscious consumers boosts the demand for packaged health drinks, juices, and functional beverages, contributing to packaging industry growth. Increasing launch of the new beverages has increased the demand for the beverage packaging packaging, which has created the opportunity for growth of the beverage packaging market in the near future.

- For instance, in February 2024, Bulleit Distilling Co., Louisville, beverage company, Bulleit American Single Malt, a new and permanent addition to its whiskey family, marks Bullet Frontier Whiskey's entry into the quickly expanding American Single Malt market. The most recent example of Bulleit American Single Malt's dedication to expanding the whiskey industry by experimenting with aging, finishing, and taste nuances is its distillation using a mash bill of 100% malted barley and its maturing in charred new American white oak barrels.

Branding and Marketing

Beverage companies utilize unique and attractive packaging to differentiate their products and enhance brand appeal, driving demand for creative and functional designs. The trend of personalized packaging, driven by consumer desire for unique experiences, promotes the growth of customizable solutions.

Plastic Segment Led the Market in 2024

The plastic segment held a dominant presence in the beverage packaging market in 2024. Plastic is extensively utilized in manufacturing beverage packaging due to several key advantages that make it a versatile and cost-effective material for this purpose. Plastic packaging are lightweight, minimizing shipping costs and making them easier to transport compared to heavier materials like glass or metal. Plastic is resistant to breakage, which minimizes product loss and ensures safer handling during transport and storage.

Plastic is generally cheaper to produce than materials like glass or aluminum, making it an economical choice for manufacturers. The production process for plastic packaging solutions is highly scalable, guaranteeing for mass production at relatively low costs.

Plastic can be easily molded into an extensive variety of shapes and sizes, catering to different consumer needs and preferences. It allows for innovative design features such as ergonomic shapes, handles, and resealable closures, enhancing user convenience. Transparent plastics like PET allow consumers to see the product inside, which can be appealing for products like water, juices, and other clear beverages.

Large Consumer Base for Metal Cans Supports Rapid Growth

The metal cans segment is expected to grow at the fastest rate in the beverage packaging market during the forecast period of 2024 to 2034. Metal cans, especially aluminum, provide an excellent barrier against light, oxygen, and moisture, which helps preserve the flavor, carbonation, and freshness of beverages, particularly for carbonated drinks and beer. Aluminum cans are one of the most recyclable beverage packaging, with a well-established recycling infrasructure. They can be recycled indefinitely without loss of quality, reducing the environmental impact.

The recycling process for aluminum requires significantly less energy compared to producing new aluminum, making it a more sustainable option. Additionally, using recycled aluminum reduces the carbon footprint of the packaging.

Metal cans are lightweight, cutting-down shipping costs and energy consumption during transportation. Their compact and stackable design also makes them convenient for storage and display. Extensive range of Beverages: Metal cans are utilized for a variety of beverages, including carbonated drinks, alcoholic beverages, juices, teas, and energy drinks, due to their versatility and protective properties.

Bottle & Jar Segment to Show Significant Share in Forecast Period

The bottle & jar segment accounted for a considerable share of the beverage packaging market in 2024. Pre-packaged beverages in bottles and jars offer convenience for on-the-go consumption, appealing to busy consumers. Many bottled and jarred beverages are marketed as healthier options, such as natural juices, smoothies, and functional drinks (like kombucha or protein shakes), aligning with consumer preferences for health-conscious products.

Bottled and jarred beverages often come in premium packaging, enhancing their appeal as higher-quality products. This can justify higher prices and attract consumers looking for luxury or artisanal products. As the bottle & jar packaging assists to preserve the aroma, taste and freshness of the beverages for a longer period.

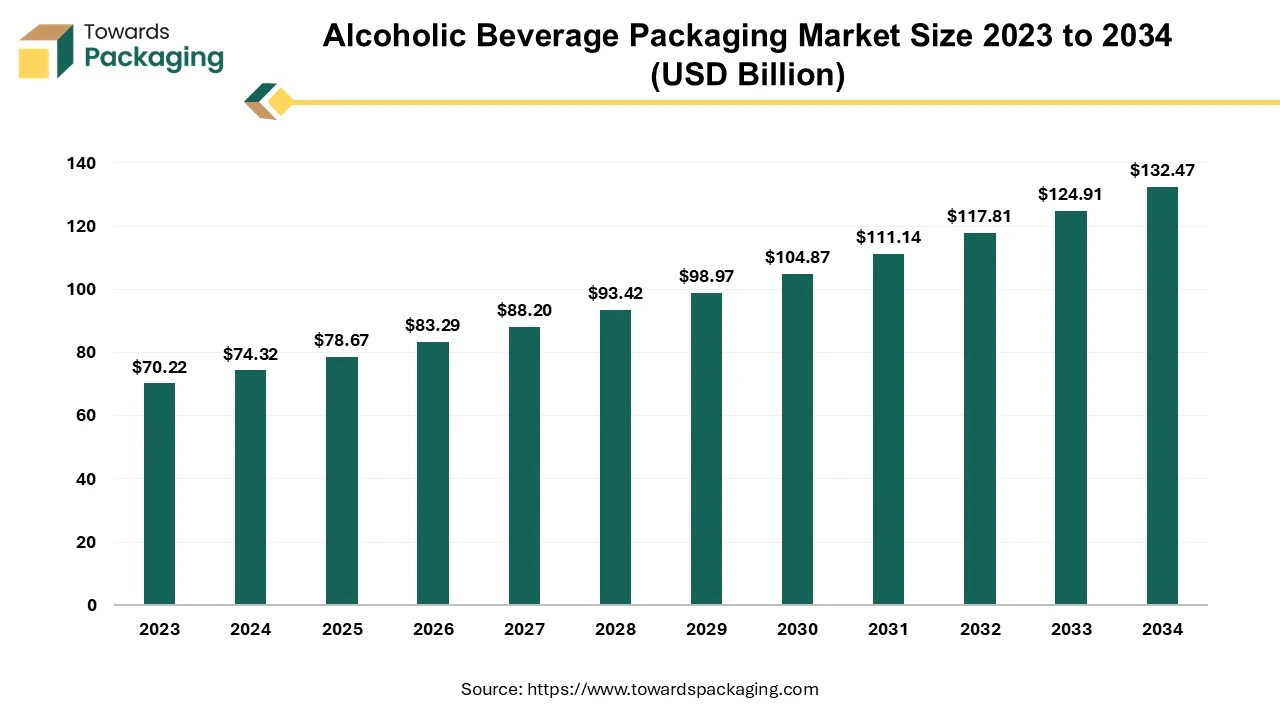

Rapidly Expanding Alcoholic Beverages Industries to Support Dominance

The alcoholic beverages segment registered its dominance over the global beverage packaging market in 2024. Alcoholic beverages, including wine, beer, and spirits, have a consistent and high level of consumer demand across various demographics, making them a significant segment in the beverage industry. The diverse range of alcoholic beverages requires various types of packaging, such as glass bottles for wine and spirits, aluminum cans for beer, and specialty beverage packaging for craft or premium products, driving the demand for an extensive array of packaging. Consumers are increasingly seeking premium and artisanal alcoholic beverages, which often come in high-quality, aesthetically pleasing packaging solutions that enhance the product's appeal and justify higher prices.

The alcoholic beverage industry is subject to strict regulations regarding packaging to ensure product quality, safety, and authenticity. This necessitates durable, tamper-evident, and high-quality packaging. The international expansion of alcoholic beverage brands increases the demand for beverage packaging as they cater to a broader market, each with its own packaging preferences and regulations.

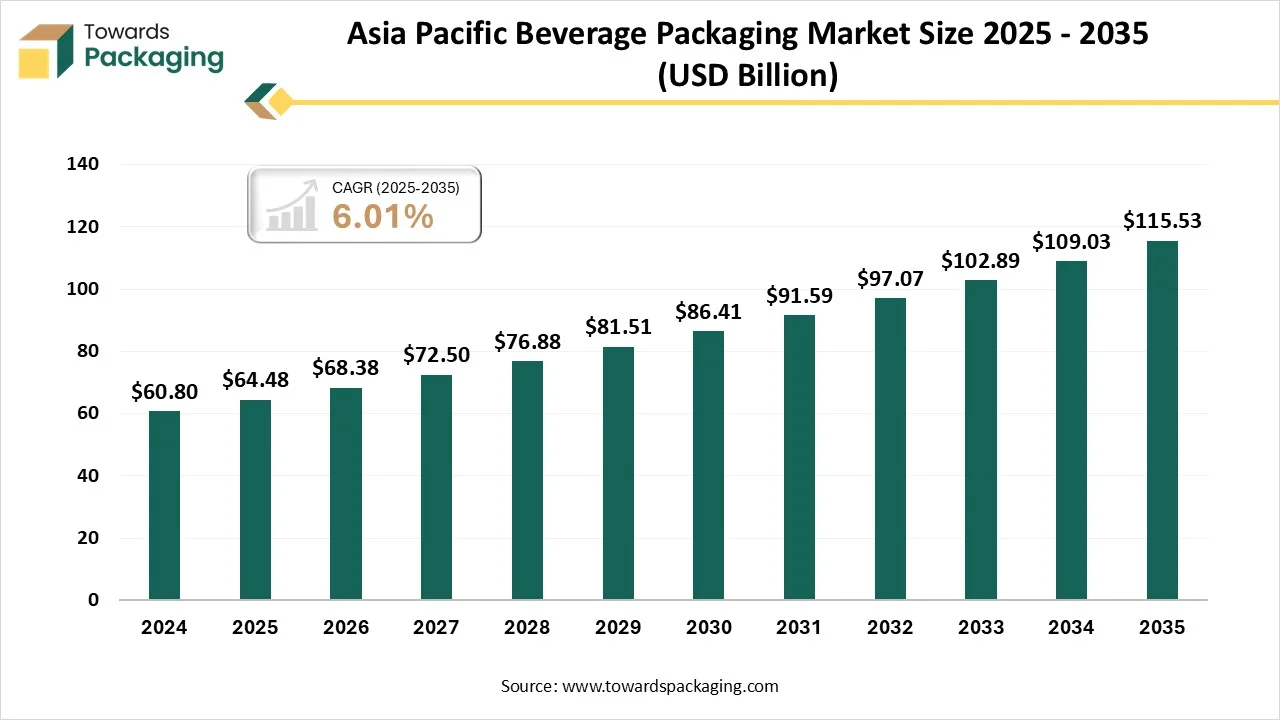

Asia’s Shift Towards Modernization to Promotes Dominance

Asia Pacific region dominated the global beverage packaging market in 2024. Asia Pacific region has a vast and rapidly growing population, particularly in countries like India and China. This large consumer base drives high demand for beverages and, consequently, beverage packaging. Economic growth in the Asia Pacific has led to increased disposable incomes, enabling consumers to spend more on packaged beverages, including premium and convenience products.

The growing middle class in many Asia Pacific countries has led to increased consumption of a variety of beverages, including soft drinks, bottled water, and alcoholic beverages, all of which require packaging. Many countries in the Asia Pacific region are major manufacturing hubs for beverage packaging, benefiting from economies of scale and export opportunities. Cultural preferences for certain types of beverages, such as tea in China and India or sake in Japan, contribute to the high demand for specific beverage packaging.

China Market Trends

China beverage packaging market is driven by advanced manufacturing and technological innovations in the country. China has significantly advanced in aseptic packaging technologies, which allow beverages to be stored without refrigeration, extending shelf-life and reducing waste. Flexible packaging solutions, such as pouches and bag-in-box systems, offer lightweight and space-efficient options, lowering transportation costs and environmental impact.

China has implemented stringent environmental regulations aimed at reducing plastic waste and promoting sustainable practices. Policies such as the ban on single-use plastics and incentives for biodegradable materials compel manufacturers to innovate and adopt eco-friendly packaging solutions. The rapid expansion of e-commerce in China has increased the demand for durable, leak-proof, and cost-effective packaging solutions that can withstand the rigors of shipping. China’s extensive logistics infrastructure supports efficient distribution, further bolstering its market position in beverage packaging.

North America’s Rising Sustainability Concerns to Support Rapid Growth

North America region is anticipated to grow at the fastest rate in the beverage packaging market during the forecast period. North America region boasts a well-established and diverse beverage industry, with a wide range of products from global and local brands. This diversity requires various types of packaging solutions, increasing the demand for packaging solutions. North America is home to advanced manufacturing facilities and technological innovations in packaging, leading to high-quality, efficient, and sustainable beverage packaging production.

The relatively stable economic environment in North America supports steady consumer spending on a wide range of beverages, ensuring consistent demand for beverage packaging. The busy lifestyles of North American consumers lead to a preference for convenient, ready-to-drink beverages, contributing to the high demand for packaged products. These factors collectively attribute to the dominance of the North American region in the global beverage packaging market.

U.S. Market Trends

U.S. beverage packaging market is driven by the adoption of the advanced manufacturing technology and surging demand for functional and on-the-Go beverages. The U.S. market is witnessing significant growth in categories like sparkling water, energy drinks, and ready-to-drink (RTD) coffee. These beverages cater to health-conscious consumers seeking functional benefits convenience. The popularity of single-serve and portable packaging formats, such as cans and PET bottles, aligns with the on-the-go lifestyles of many Americans. The U.S. beverage industry is investing in innovative packaging materials such as paperboard cartons, aluminum bottles, and molded fiber containers.

The U.S. beverage packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The rising demand for convenience, sustainable resources, and health concern has boosted the research and development of the beverage packaging industry and enhance its improvement. There is a huge demand for packaging that appeal consumers with its unique designs has raised the adoption of the market. The production of recyclable and reusable packaging with a wide variety and customizable option has extended the market significantly.

Europe’s Growing Sustainability Initiatives to Project Steady Growth

Europe region is seen to grow at a notable rate in the foreseeable future. European Union (EU) policies have been instrumental in shaping the beverage packaging landscape. Regulations such as the single-use plastics directive and the packaging and packaging waste regulation mandate reductions in plastic usage and promote recycling and reuse. These directives compel manufacturers to adopt eco-friendly materials and sustainable practices.

Latin America

The future point of view of technology serves as positive, as the worldwide beverage sector is developing. The sector is witnessing a two-speed development model. Mature markets are banking on the luxury level with the help of promising functional inventions and blurred spaces. In growing consumer markets, volume growth is being driven by huge affordability and accessibility, which takes into account both local taste and local economic conditions.

Additionally, carbonated soft drinks are a crucial driver in the Latin American market. The region is home to three of the six biggest markets in the world for the retail sale of carbonated soft drinks (Mexico, Brazil, and Argentina) and the three countries with the highest per capita consumption. One trend in the soft drinks industry in Argentina is the growing popularity of energy drinks, specifically among young adults and athletes. Their consumption is predicted to grow by almost 47% to 135 million litres by 2028.

Middle East and Africa

Sustainability is a rising topic among users in the UAE, and packaging plays a crucial role in designing a different point of view for a brand’s environmental loyalty. Organizations must accept eco-friendly packaging solutions to appeal to environmentally conscious users and align with regulatory standards. The Middle East is a culturally different nation with a huge population, including local and refugee populations. Beverage design elements that display the UAE’s culture, such as regular patterns, references, and Arabic script, can create a sense of appreciation and connection among local consumers.

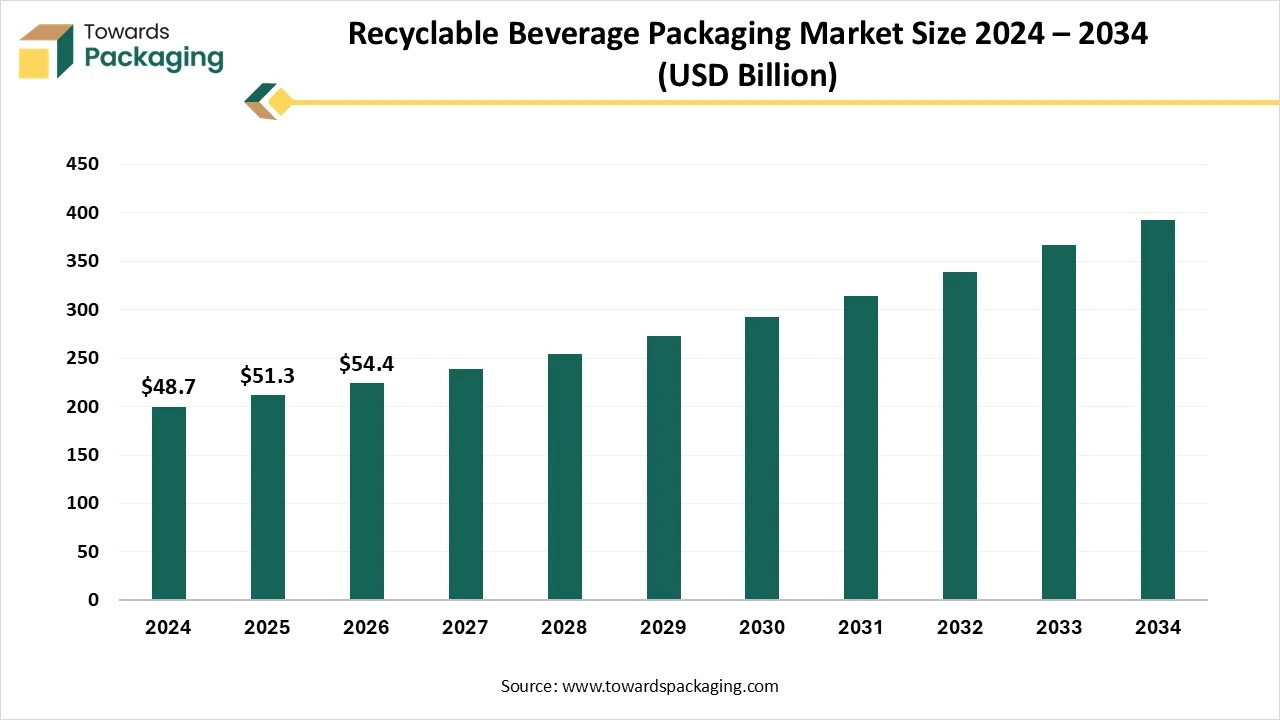

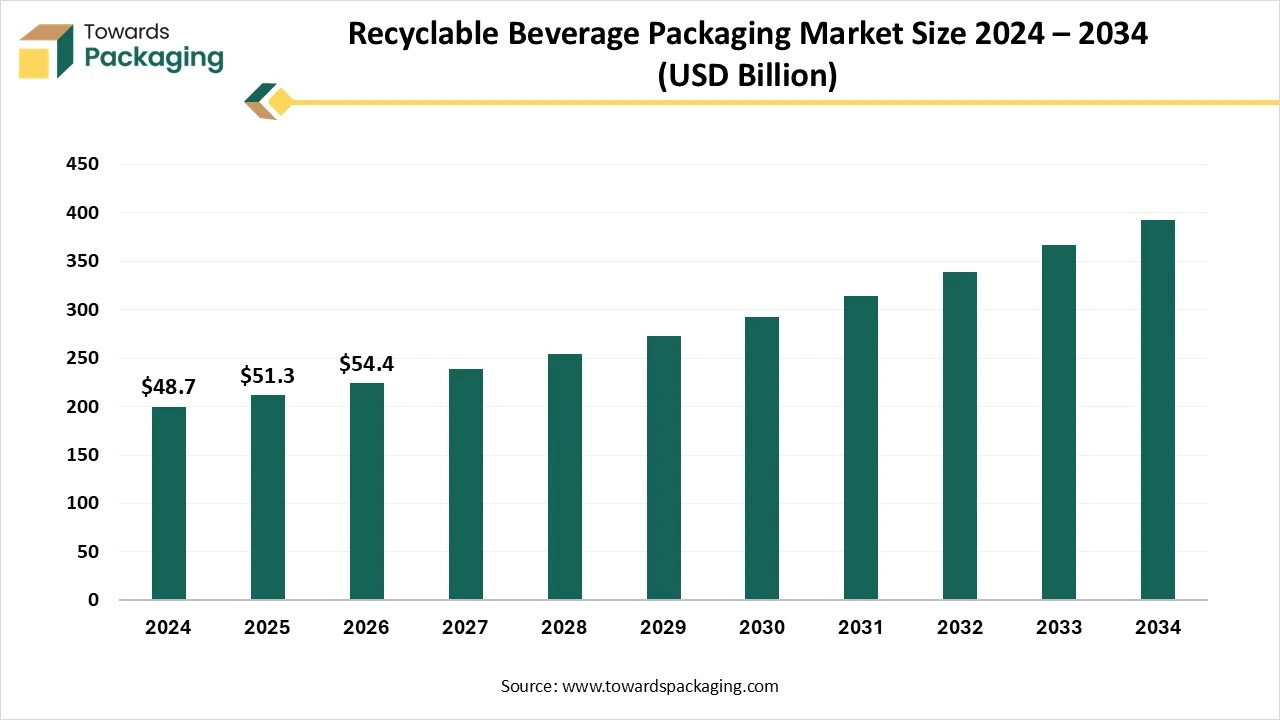

Future of Recyclable Beverage Packaging Market

The recyclable beverage packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing recyclable beverage packaging. The recyclable beverage packaging market is evolving rapidly due to rising environmental concerns, strict regulations, and growing consumer demand for sustainable solutions.

Materials like PET, paperboard, and plant-based plastics are widely adopted, while innovations in smart packaging and monomaterial designs enhance recyclability. Europe leads in policy-driven adoption, North America in technological advances, and Asia Pacific in growth momentum.

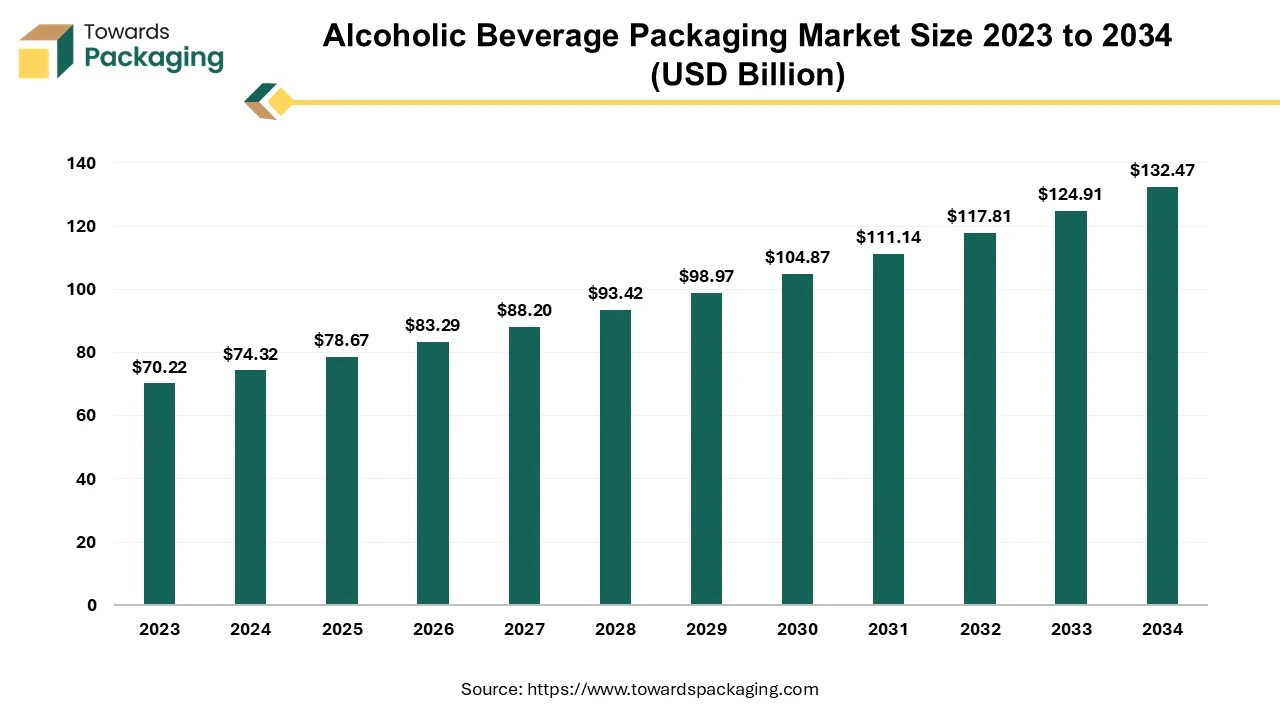

Future of Alcoholic Beverage Packaging Market

The alcoholic beverage packaging market is projected to reach USD 132.47 billion by 2034, growing from USD 78.67 billion in 2025, at a CAGR of 5.8% during the forecast period from 2025 to 2034.

Alcohol, a fascinating molecule with a long history of ancient civilizations, has seen extraordinary transformations over the centuries. Alcoholic beverage transportation and storage vessels have changed substantially, from rudimentary hollowed-out gourds and clay flasks to more sophisticated glass bottles. Cans, bag-in-boxes and pouches have recently been added to the list of containers, reflecting advances in packaging technology and different consumer preferences.

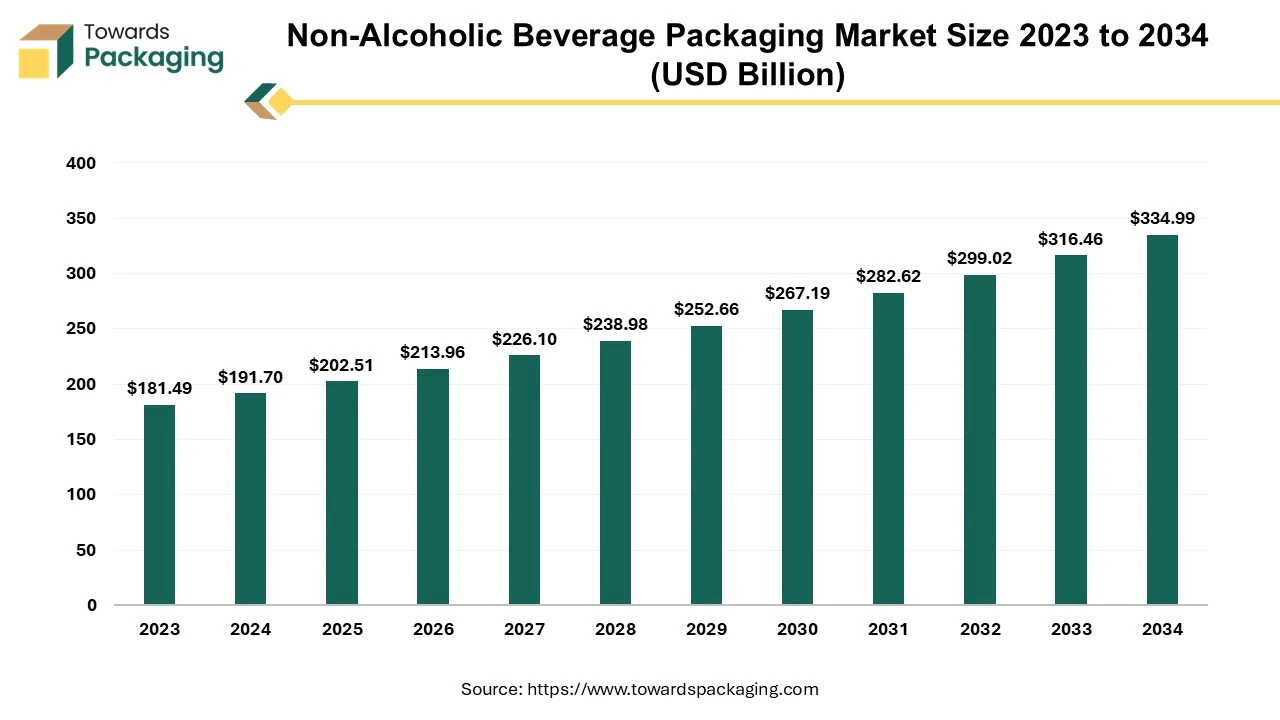

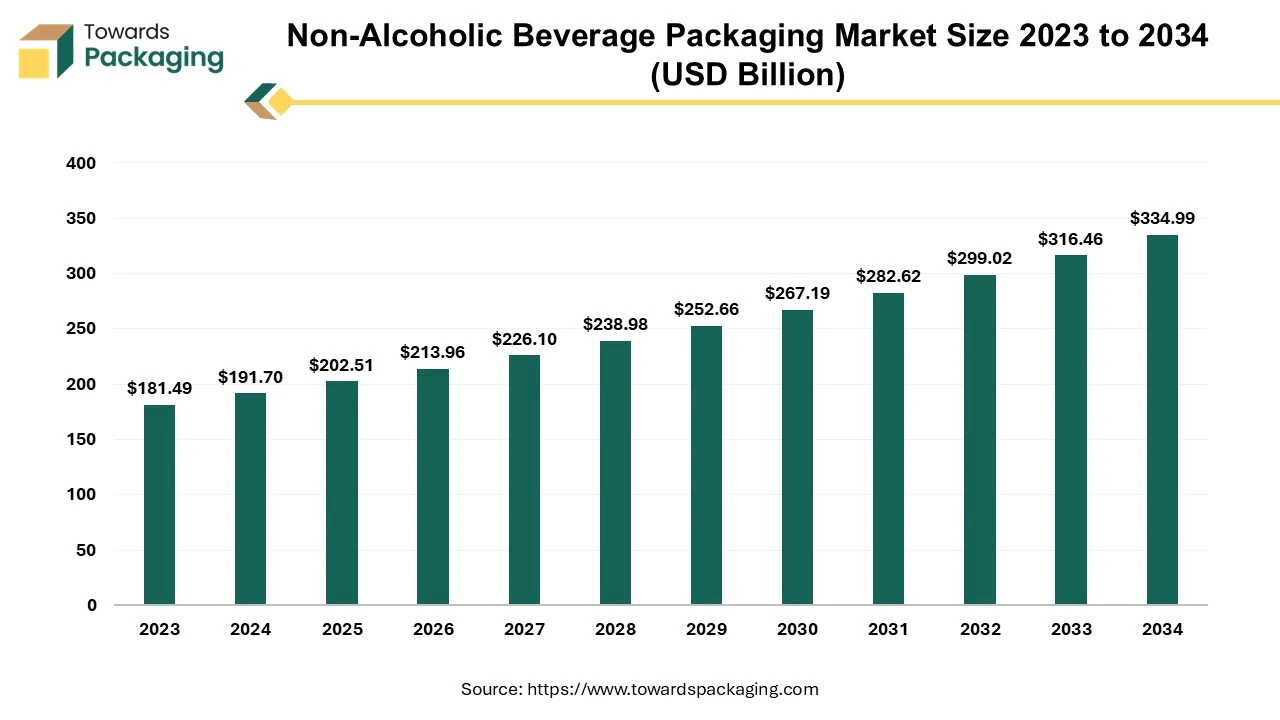

Future of Non-Alcoholic Beverage Packaging Market

The non-alcoholic beverage packaging market size is set to grow from USD 202.51 billion in 2025 to USD 334.99 billion by 2034, with an expected CAGR of 5.9% over the forecast period from 2025 to 2034.

Drinks classified as non-alcoholic include a wide range of liquids such as fruit juices, nectars, vegetable juices, carbonated and non-carbonated flavored drinks, and water-based brewed or steeped drinks such as tea and coffee. Aptly called non-alcoholic beverage packaging, this specialty area of the packaging business handles the packaging of these drinks.

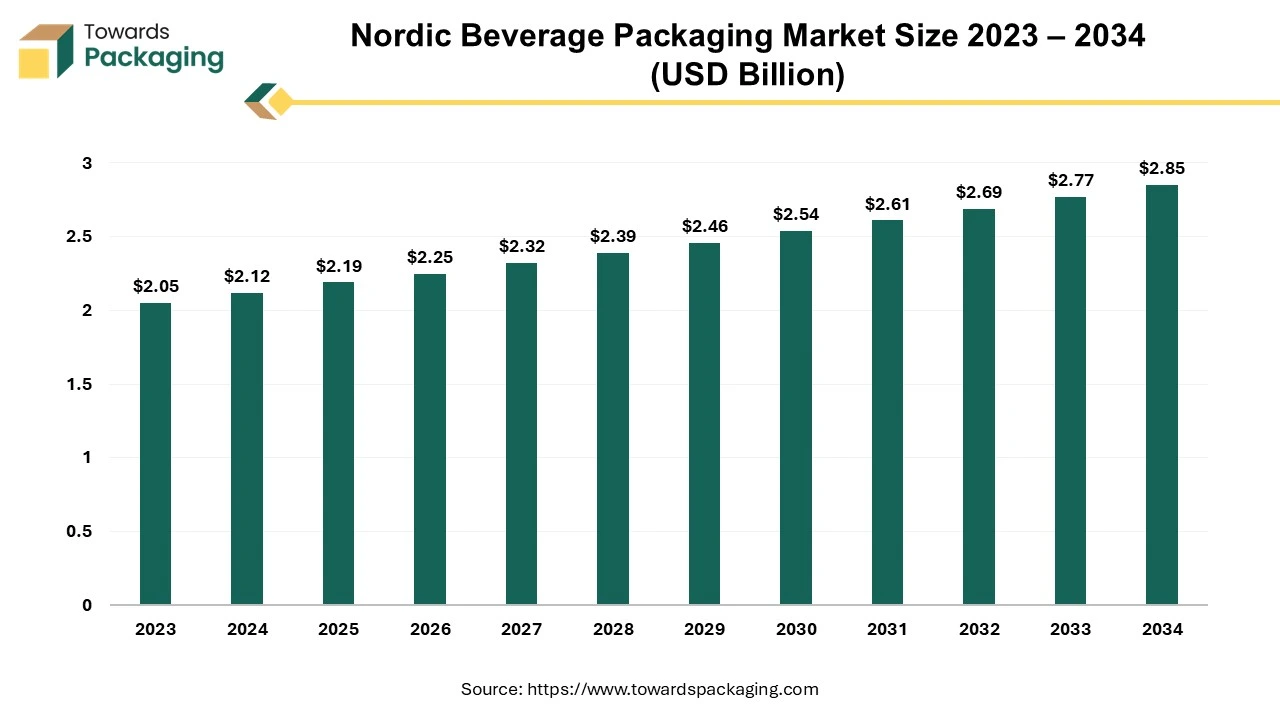

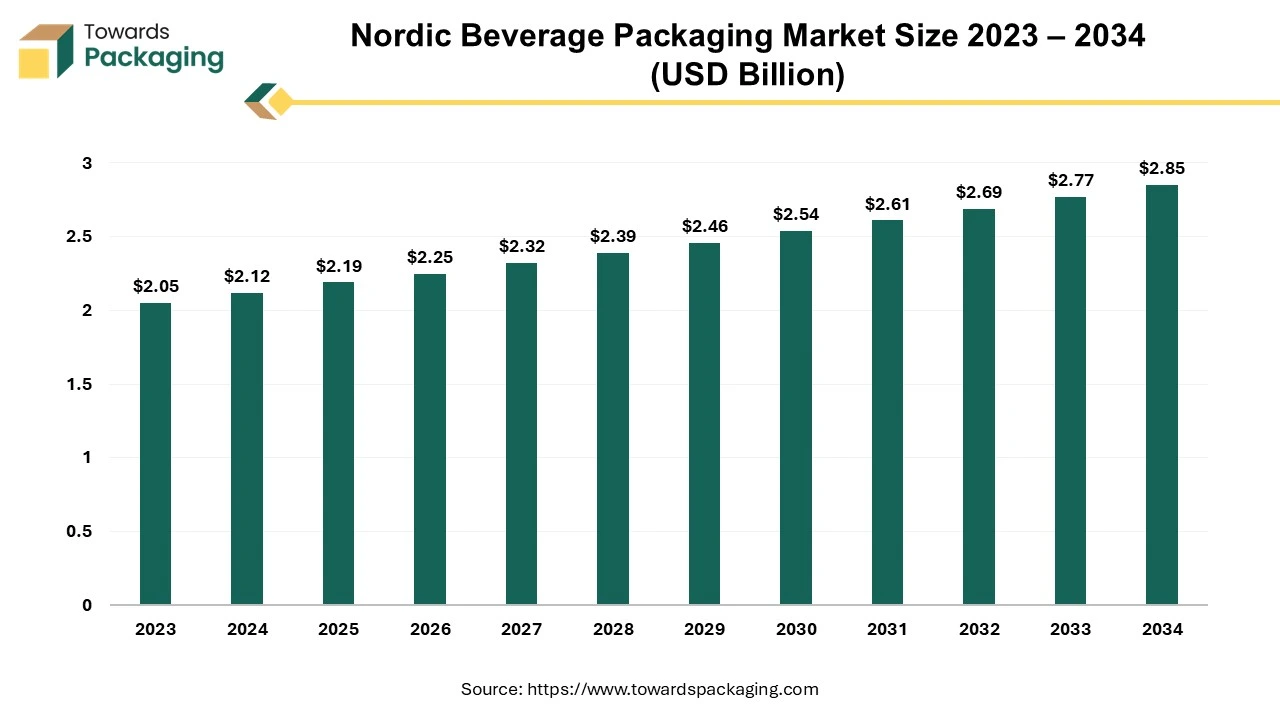

Future of Nordic Beverage Packaging Market

The Nordic beverage packaging market is projected to reach USD 2.85 billion by 2034, growing from USD 2.19 billion in 2025, at a CAGR of 3.05% during the forecast period from 2025 to 2034.

The rising demand for carbonated fruits and vegetable juices and their packaging will influence the market to grow significantly during the predicted period. These beverage packaging are highly preferred due to their ability to prevent chemical deterioration, alter the products' flavour, and avoid leakage. The growing e-commerce industry and innovation in the packaging industry have boosted market demand.

Beverage Packaging Market Top Players

- Bemis Company, Inc.

- Sonoco Products Company

- Scholle IPN

- Mondi

- Amcor plc

- Reynolds Group Ltd.

- Crown

- Stora Enso

- Tetra Laval International S.A.

- Ball Corporation

- WestRock Company

- Graham Packaging

- SIG

- Berry Global Inc.

- Amber Packaging

Latest Announcements by Beverage Packaging Industry Leaders

- In January 2025, Regarding the collaboration, Bacardi CEO Mahesh Madhavan stated that the Bacardi company is thrilled to combine two famous brands so that customers can savor one of the most well-known drinks in the world, which was initially created generations ago with Bacardi rum and Coca-Cola, in a premium, practical version. The Bacardi firm will increase accessibility to eco-friendly packaging and reach through this partnership, allowing even more people of sustainable packaging to reduce environmental effects.

- According to Sanjeev Agarwal, Chairman of Moon Beverages Limited (a division of the MMG Group), PET plastic bottles are valuable after their initial use. He praised the introduction of rPET. New PET bottles from companies are recyclable and can be recycled again, giving them a second chance at life. A significant step towards embracing plastic circularity in India is the use of recycled PET.

New Advancements in Beverage Packaging Industry

- In August 2025, Domino Printing Sciences, which is a trusted high-level provider of variable data printing solutions that will exhibit at Drinktec in 2025, is leading the fair food trade for the liquid and beverage food industry. At the event, Domino experts will be on hand to help beverage producers rethink coding and packaging solutions.

- In February 2025, Berry Global revealed its current packaging solution, developing recyclability, durability, and the use of the company‘s patented evergreen technology. It's crafted to have cold and hot beverages; the containers have the confidence to withstand different conditions, making sure that beverages remain at their desired temperature.

- In February 2025, Tetra Pak asserts that it is the first company in India's food and beverage packaging sector to use ISCC PLUS certified recycled polymers in its packaging materials, in compliance with new national laws pertaining to the management of plastic waste. According to reports, the components include 5% ISCC PLUS certified recycled polymers that were procured and distributed using the ISCC mass balance attribution method. The polymers, in turn, are produced using a combination of chemically recycled and virgin ingredients; the recycled material is said to be of the same quality as its fossil-based counterpart and to comply with the same international food contact standards.

- In February 2025, Mineragua, a brand manufacturing sparkling water revealed the introduction of the latest edition of 12-pack bottle packaging. The new design gives customers a practical and environmentally friendly way to enjoy Mineragua's famous sparkling water, whether they're stocking up at home, having family get-togethers, or hydrating while on the go. The new 12-pack from Mineragua comes with 12 glass bottles, each containing 12.5 fluid ounces, in response to the increasing demand for multipack beverage options.

- In January 2025, TÖST Beverages, beverage company, revealed that the company has launched new packaging of 250-ml cans.

- In January 2025, Amor, as a leader in the development and manufacturing of responsible packaging solutions worldwide, remains recognized for its dedication to environmental, social, and governance sustainability performance by being included in the Dow Jones Sustainability Indices (DISI): Australia Index (D]SI Australia). Amor's leadership position in the packaging and beverage packagings industry was reaffirmed when it placed in the top 12% of the market. Amor works to strengthen its leadership in innovation and sustainability through alliances and calculated investments throughout the value chain in an attempt to create a circular society where recycling and sustainable consumption are the standard.

- In September 2024, the first PET (PolyEthylene Terephthalate) bottle-to-bottle recycling facility in the Western Cape is expected to be operational, adding an additional 15,000 tons of food-grade recycled PET output capacity annually. The statement was made during the International Solid Waste Association's (ISWA) inaugural day in Cape Town. Deputy Minister of Forestry, Fisheries, and the Environment Bernice Swarts was given a site tour of the R300 million (approximately US$17 million) PET processing facility that is currently under construction by producer responsibility organization Petco and recycling partner Extrupet. The facility "represents a first-of-its-kind technology for Africa.

- In October 2023, Coca-Cola India has announced the launch of Coca-Cola in PET in pack sizes of 250 ml and 750 ml, marking another significant step towards establishing a circular economy. This comes after the company was the first in India to introduce a one-liter bottle made entirely of recycled PET (¡PET) for its packaged drinking water brand Kinley. Coca-Cola bottling partners Moon Beverages Ltd. and SLMG Beverages Ltd. are producing these PET bottles.

Beverage Packaging Market Segments

By Material

- Plastic

- Glass

- Metal

- Other Materials

By Product

- Bottle & Jar

- Can

- Pouch

- Carton

- Other Products

By Application

- Alcoholic Beverages

- Non-alcoholic Beverages

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (8)