Recyclable Beverage Packaging Market Insights, Regional Analysis, and Competitive Landscape

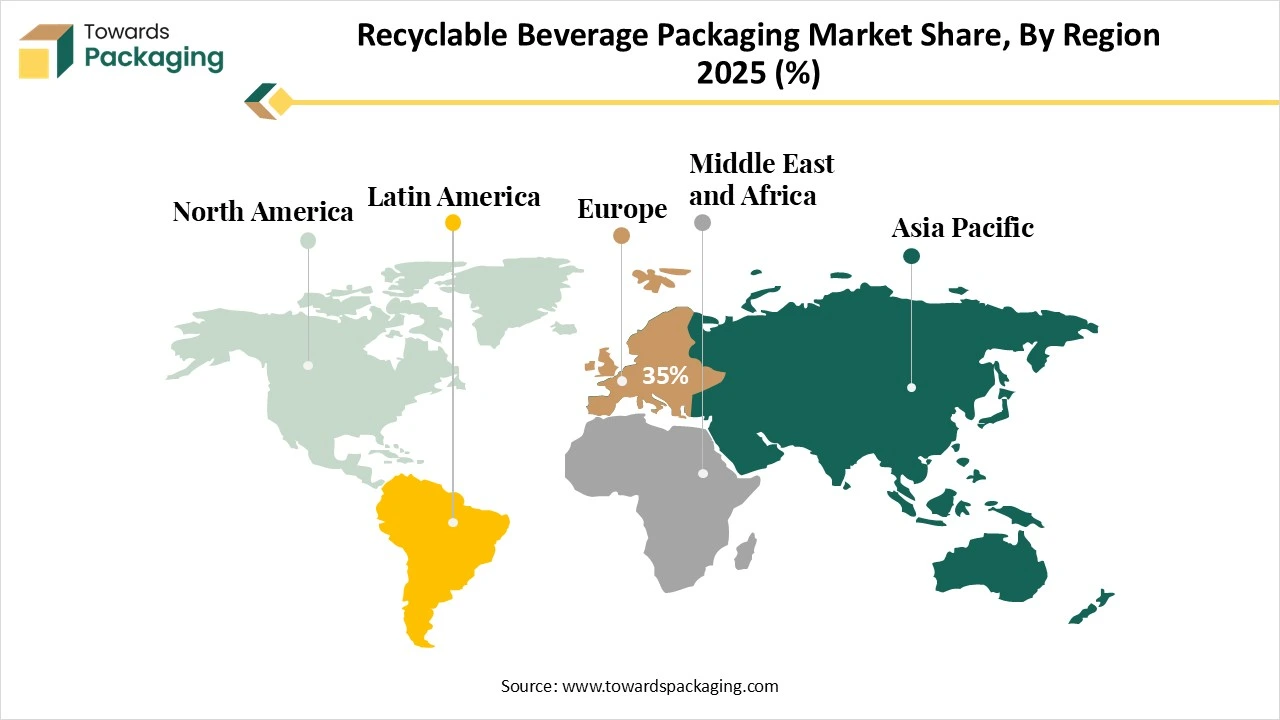

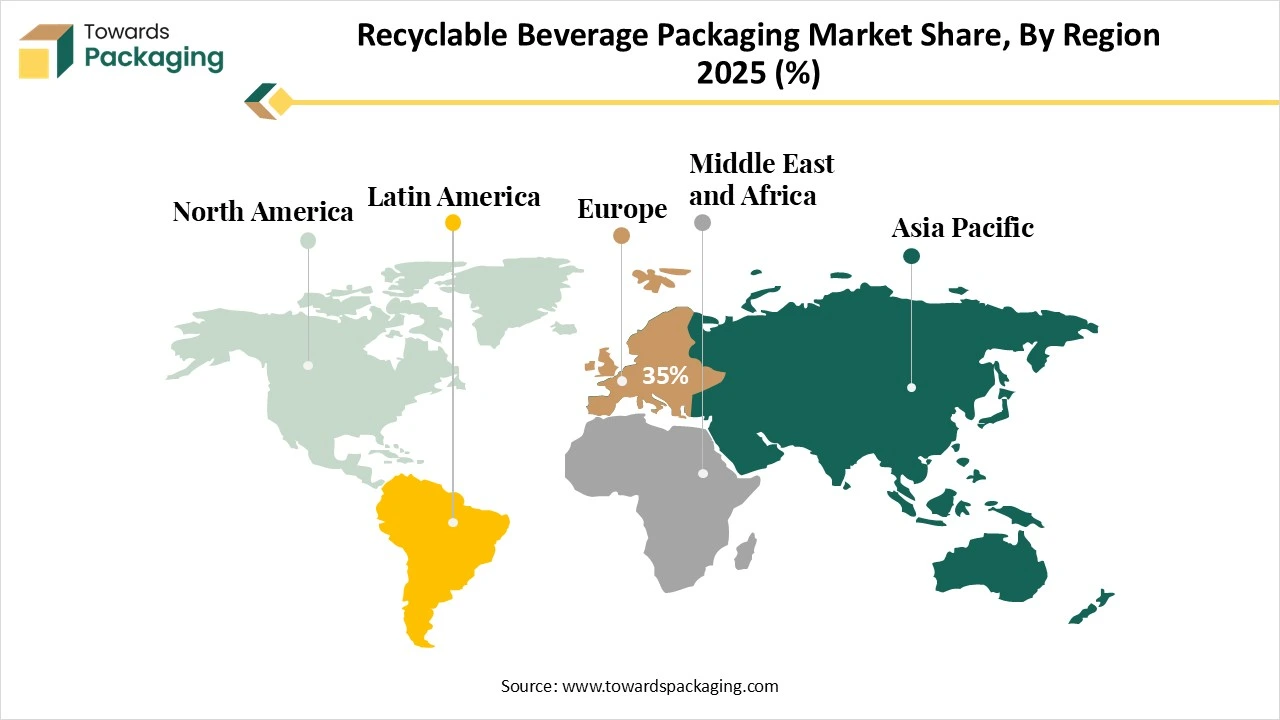

The Recyclable Beverage Packaging market overview outlines growth driven by eco-friendly packaging adoption and circular economy initiatives. The report covers market share by material, beverage type, and packaging formats, including PET, HDPE, PLA, bottles, cans, cartons, and kegs. Europe leads in policy-driven adoption, while Asia Pacific shows strong CAGR due to government regulations and rising consumer awareness.

The study also examines distribution channels, end-use trends, and the impact of government incentives, along with competitive strategies of top players such as Amcor plc, Ball Corporation, Crown Holdings, and Tetra Pak.

Key Insights

- Europe dominated the global Recyclable Beverage Packaging market in 2024.

- Asia Pacific is expected to grow at a significant CAGR in the market during the forecast period.

- The North American market is expected to grow at a notable CAGR in the foreseeable future.

- By material, the recyclable plastic (e.g., PET, HDPE) segment dominated the market with the largest share in 2024.

- By material, the biodegradable/compostable materials (e.g., PLA, bagasse) segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

- By packaging type, the bottles segment dominated the market with the largest share in 2024.

- By packaging type, the kegs and drums segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

- By beverage type, the carbonated soft drinks (CSDs) segment dominated the market with the largest share in 2024.

- By beverage type, the ready-to-drink tea and coffee segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

- By end-use, the retail / on-the-go consumption segment dominated the market in 2024.

- By end-use, the institutional/industrial (bulk use) segment is expected to grow at the fastest CAGR in the forecast period.

- By distribution channel, the supermarkets and hypermarkets segment dominated the market in 2024.

- By distribution channel, the online retail/e-commerce segment is expected to grow at the fastest CAGR in the forecast period.

Global Production in Recyclable Beverage Packaging by Country & Packaging Type (2025)

| Country / Region |

Aluminum cans (billion cans) |

PET bottles (billion units) |

Glass bottles (kilotons) |

Aseptic/carton packs (billion units) |

| China |

140 |

110 |

11,200 |

12 |

| United States |

65 |

45 |

3,200 |

2.5 |

| India |

30 |

40 |

1,100 |

1.2 |

| Brazil |

18 |

20 |

900 |

0.9 |

| European Union |

55 |

48 |

6,500 |

9 |

| Mexico |

8.5 |

6 |

220 |

0.6 |

| Japan |

12 |

6.5 |

420 |

0.4 |

| Turkey |

6 |

5.5 |

150 |

0.3 |

Market Overview

Recyclable beverage packaging refers to packaging materials used for drinks, such as bottles, cans, and cartons, that can be collected, processed, and reused to make new products instead of ending up as waste. These materials include recycled PET, aluminium, glass, paperboard, and some specially designed plastics. The goal is to reduce environmental impact by minimizing landfill use, conserving raw materials, and promoting a circular economy. For packaging to be truly recyclable, it must be easy to separate, clean, and reprocess through existing recycling systems.

Key Metrics and Overview

| Metric |

Details |

| Key Growth Drivers |

Environmental regulations, consumer demand for sustainability, and beverage consumption rise |

| Leading Region |

Europe |

| Market Segmentation |

By Material, By Packaging Type, By Beverage Type, By End Use, By Distribution Channel and By Region |

| Top Key Players |

Amcor plc, Ball Corporation, Crown Holdings, Tetra Pak, WestRock, Mondi plc, Smurfit Kappa, Berry Global Inc. |

What are the New Trends in the Recyclable Beverage Packaging Market?

- Adoption of 100% rPET Bottles

Brands like Coca-Cola and Nestle are shifting to fully recycled PET bottles to reduce virgin plastic use.

Use of single-material designs (e.g., only plastic or paper) improves recyclability and processing efficiency.

- Smart and Connected Packaging

QR codes, sensors, and NFC tags are being used for traceability, recycling instructions, and consumer engagement.

- Plant-Based and Compostable Materials

Bio-based plastics and paper alternatives (e.g., sugarcane bottles, algae-based films) are gaining popularity.

- Circular Economy Business Models

Increased focus on reuse, refill, and closed-loop systems offers long-term opportunities for recyclable packaging providers.

- Innovation in Eco-Materials

Advancements in materials like biodegradable plastics, recycled PET, and paper-based bottles open new avenues for recyclable and compostable packaging.

How Can AI Improve the Recyclable Beverage Packaging Market?

AI integration is transforming the recyclable beverage packaging industry by enhancing efficiency, sustainability, and innovation. In recycling facilities, AI-powered vision systems enable accurate sorting of materials like PET, aluminium, and paperboard, improving recycling rates and reducing contamination. In packaging design, AI helps create lightweight, durable, and easily recyclable products by analyzing material performance and environmental impact. It also optimizes supply chains by forecasting demand and minimizing waste. Smart labels powered by AI enhance consumer engagement through traceability and recycling instructions. Additionally, AI-driven quality control ensures defect-free, recyclable packaging. While advanced data analytics support sustainability reporting, regulatory compliance, and ESG goal tracking.

Market Dynamics

Driver

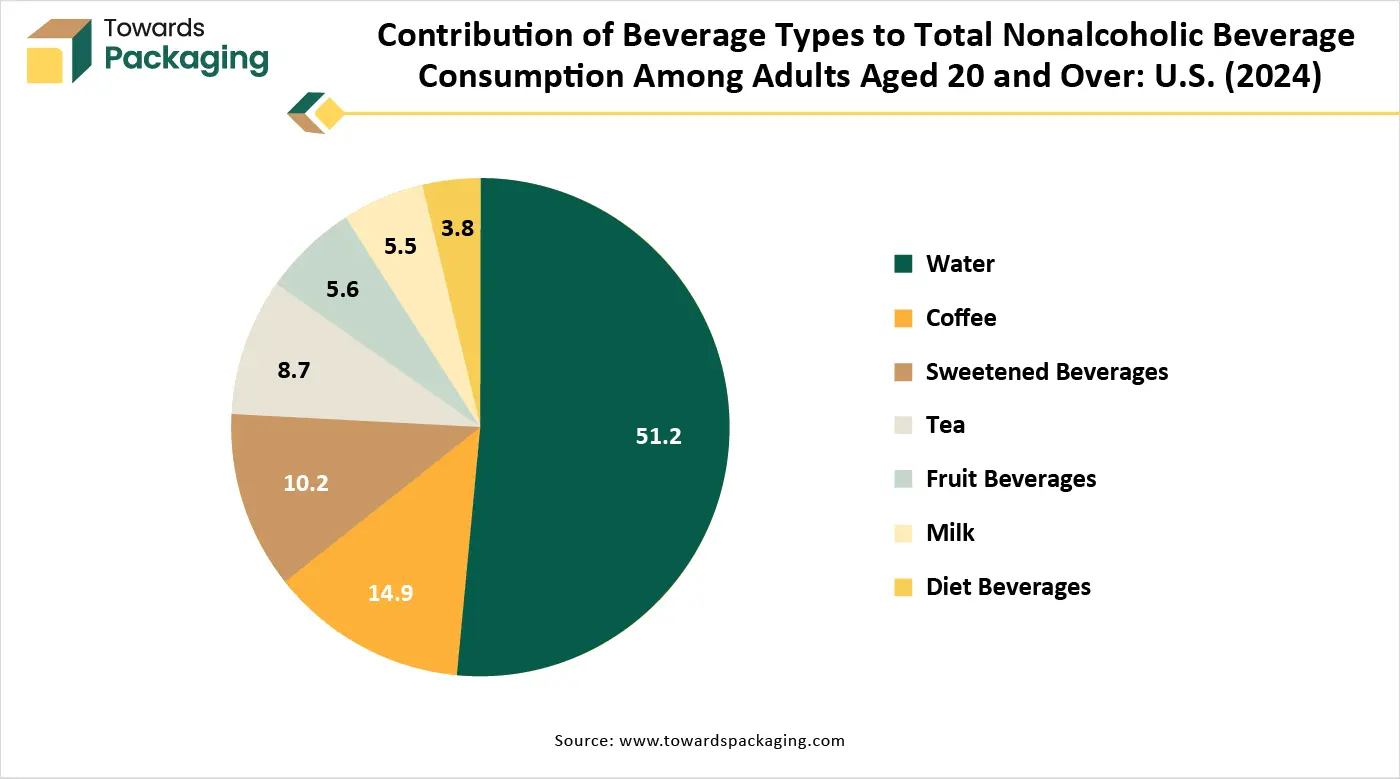

Growth in Beverage Consumption

The expanding market for bottled water, energy drinks, and ready-to-drink beverages fuels demand for sustainable packaging. For instance, in January 2025, according to the published by the International Council of Beverages Associations, with a market value of USD 4.49 trillion, spirits are among the most popular alcoholic beverages in India. Although glass bottles have long dominated the alcohol packaging market, consumers' growing environmental consciousness has led them to eventually accept spirits in cans. With a compound annual growth rate (CAGR) of over 20%, the non-carbonated soft drink industry in India is expected to reach USD 902 billion by 2027 from its 2020 valuation of USD 178 billion. Its rapid development is explained by consumers rejecting carbonated and artificially sweetened drinks more frequently, which makes room for fruit juices.

Restraint

Limited Recycling Infrastructure and Material Contamination Issues

The key players operating in the market are facing limited recycling infrastructure and material contamination issues. Many regions, especially in developing countries, lack adequate facilities for collecting, sorting, and processing recyclable packaging. Improper disposal or mixing of materials can reduce the quality and recyclability of packaging, affecting the reuse potential.

Opportunity

Government Support and Incentives

Global initiatives, subsidies, and Extended Producer Responsibility (EPR) frameworks encourage businesses to adopt recyclable solutions. Government support and incentives play a crucial role in driving the growth of the recyclable beverage packaging market by creating a favourable policy and economic environment. Regulatory frameworks such as bans on single-use plastics and mandatory use of recyclable materials push companies to adopt sustainable packaging solutions. Extended Producer Responsibility (EPR) policies require manufacturers to manage the end-of-life impact of their products, encouraging investment in recyclable designs. Additionally, governments offer financial incentives, tax benefits, subsidies, and grants to promote eco-friendly packaging innovations and recycling infrastructure. Public awareness campaigns and standardized labeling regulations further educate consumers, improving the recycling rate and demand for recyclable packaging. Collectively, these measures accelerate the transition toward a circular packaging economy.

Future Demands

- Higher demand for rPET bottles as brands increase recycled content to meet global sustainability targets and reduce plastic waste.

- Strong shift toward aluminum cans because they are fully recyclable, lightweight, and cost-efficient to recover in recycling systems.

- Growing adoption of paper-based beverage cartons as consumers prefer renewable, low-carbon packaging options.

- Rising demand for returnable and reusable glass bottles, especially in premium beverages, and growing circular-economy programs.

- Increasing need for mono-material packaging to improve recyclability and simplify waste processing.

- Growth in biodegradable and compostable beverage packaging is driven by eco-conscious consumers and retail pressure.

- Smart recyclability labeling and digital tracking help consumers identify recyclable materials and improve recovery rates.

- Lightweight packaging formats to reduce transportation emissions and align with carbon-reduction commitments.

- Expansion of refill models and dispensing systems, reducing dependency on single-use beverage packaging.

- Higher demand for food-grade recycled materials as regulations tighten and brands commit to using sustainable materials in direct-contact packaging.

Segmental Insights

Why does the Recyclable Plastic (e.g., PET, HDPE) Segment Dominate the Recyclable Beverage Packaging Market?

The recyclable plastic (e.g., PET, HDPE) segment holds a dominant presence in the market as these materials are cost-effective and durable. Recyclable plastics like PET are strong yet lightweight, reducing transportation costs and breakage risk while maintaining product integrity. Compared to glass or metal, plastic is more economical to produce and mold into various shapes and sizes. Plastics such as recycled PET can be reused multiple times, supporting circular economy goals and reducing environmental impact. Recyclable plastics provide effective barriers against moisture, oxygen, and contaminants, helping preserve beverage quality and shelf life.

The biodegradable/compostable materials (e.g., PLA, bagasse) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. These materials naturally break down into non-toxic components, helping reduce long-term waste, ocean pollution, and landfill burden. Many countries have banned or restricted single-use plastics, encouraging the shift toward compostable alternatives like PLA, bagasse, and paper. Growing environmental awareness has led consumers to favour beverages packaged in biodegradable or compostable materials. These materials align with zero-waste and circular economy initiatives by enabling composting and soil enrichment post-use.

Which Packaging Type Dominated the Recyclable Beverage Packaging Market in 2024?

The bottles segment accounted for the dominant revenue share of the recyclable beverage packaging market in 2024. Bottles are the most preferred packaging for beverages like water, soft drinks, juices, and dairy due to convenience, portability, and reclosability. Bottles, especially those made from PET and recycled PET, are widely accepted in recycling systems globally and can be recycled multiple times. Bottles offer excellent protection against moisture, oxygen, and light, preserving beverage quality and extending shelf life. Bottles can be easily molded into various shapes and sizes, allowing for branding, ergonomics, and shelf appeal. Governments and beverage companies are encouraging bottle-to-bottle recycling initiatives as part of their circular economy and sustainability goals.

The kegs and drums segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Hotels, restaurants, and cafes (HoReCa) increasingly prefer kegs and drums for serving beer, soft drinks, and other beverages in bulk, reducing packaging waste and cost. Most kegs and drums are made from stainless steel or HDPE, both of which are highly durable, reusable, and fully recyclable, supporting sustainability goals. Kegs and drums lower pre-liter packaging and transport costs, making them ideal for large-scale beverage suppliers and event organizers. Reusable kegs and drums significantly reduce the need for single-use bottles or cans, helping brands cut emissions and meet green targets.

Why does the Carbonated Soft Drinks (CSDs) Segment Dominate the Recyclable Beverage Packaging Market?

The Carbonated Soft Drinks (CSDs) segment dominates the market due to high global consumption and a strong retail network. Major soft drink brands like Coca-Cola, PepsiCo, and others are leading initiatives to use 100% recyclable or recycled materials in their packaging. Carbonated drinks are sold in various retail formats, increasing the need for durable, lightweight, and recyclable packaging options. Ready-to-drink CSDs in recyclable bottles and cans offer ease of use, portability, and storage, aligning with modern lifestyle trends. Regulatory pressure on reducing plastic waste has pushed CSD companies to adopt recyclable packaging at scale.

The Ready-to-Drink Tea and Coffee segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. On-the-go consumers, especially in urban centers, prefer ready-made beverages, boosting demand for recyclable PET bottles, cans, and cartons. Growing use of PET, aluminium, biodegradable films, and aseptic lightweighting enhances recyclability and aligns with environmental goals. Premium Ready-to-Drink coffees and sparkling teas use glass, cans, and smart packaging to appeal to Gen Z/ millennial demographics while being easy to recycle. Widespread retail, vending, and e-commerce availability fuels Ready to Drinks beverage reach, and recyclable packaging supports efficient logistics and waste reduction.

Which End Use Dominated the Recyclable Beverage Packaging Market in 2024?

The Retail / On-the-Go Consumption segment registered its dominance over the recyclable beverage packaging market in 2024. Growing urbanization and fast-paced lifestyles have increased the demand for ready-to-drink beverages in portable, single-serve, recyclable packaging. Supermarkets, convenience stores, and vending machines are primary sales channels for beverages, requiring efficient, lightweight, and recyclable packaging for quick consumption and disposal. On-the-go consumers prefer packaging that is easy to carry, resealable, and recyclable, such as PET bottles, aluminium cans, and paper cartons. Beverage companies target retail buyers with clearly labelled recyclable packaging to align with growing eco-conscious shopping behaviors. Urban and retail areas often have better recycling infrastructure, supporting a high recovery rate for bottles and cans used on the go.

The institutional/industrial (bulk use) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Hotels, restaurants, cafeterias, and corporate offices increasingly prefer bulk packaging (like recyclable kegs and drums) to reduce waste and cost per serving. Bulk recyclable packaging lowers transportation, storage, and packaging materials costs, making it economically attractive for large-scale beverage supply. Many organizations and institutions are adopting sustainable practices and prefer recyclable or reusable packaging to meet environmental and CSR targets. The expansion of institutional catering, canteens, and event services fuels demand for recyclable bulk beverage solutions.

Which Distribution Channel Dominated the Recyclable Beverage Packaging Market in 2024?

The supermarkets and hypermarkets segment accounted for the dominant revenue share of the recyclable beverage packaging market in 2024. Supermarkets and hypermarkets attract a large volume of daily shoppers, making them the primary distribution channel for packaged beverages in recyclable formats. These retail outlets offer a broad range of beverages, water, juices, soft drinks, tea, and coffee, most of which are sold in recyclable PET bottles, cans, and cartons. Shoppers at hypermarkets often purchase in bulk, increasing demand for multipacks or family-sized recyclable packaging options.

The Online Retail / E-Commerce segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The global shift toward online shopping for groceries and beverages boosts demand for durable, lightweight, and recyclable packaging suited for shipping. Busy lifestyles and mobile accessibility have led to a surge in ordering beverages online, requiring secure and sustainable packaging for doorstep delivery. Online retailers and beverage brands highlight recyclable packaging in product listings and advertising to attract environmentally aware consumers. Regulations and sustainability policies from major e-commerce platforms (like Amazon’s Frustration-Free Packaging) encourage the use of recyclable materials.

Regional Insights

Which Region Dominated in the Recyclable Beverage Packaging Market in 2024?

Europe is dominant in the recyclable beverage packaging market owing to strict environmental regulations in the region. The EU has implemented strong policies like the Single-Use Plastic Directive and Extended Producer Responsibility (EPR) schemes, mandating the use of recyclable packaging. Europe has well-established collection, sorting, and recycling systems for materials like PET, aluminium, and paperboard, supporting closed-loop packaging. European consumers are highly eco-conscious, actively choosing beverages with recyclable or sustainable packaging. The European Green Deal and initiatives like Plastics Strategy 2030 aim for all packaging to be recyclable or reusable by 2030, driving innovation and compliance.

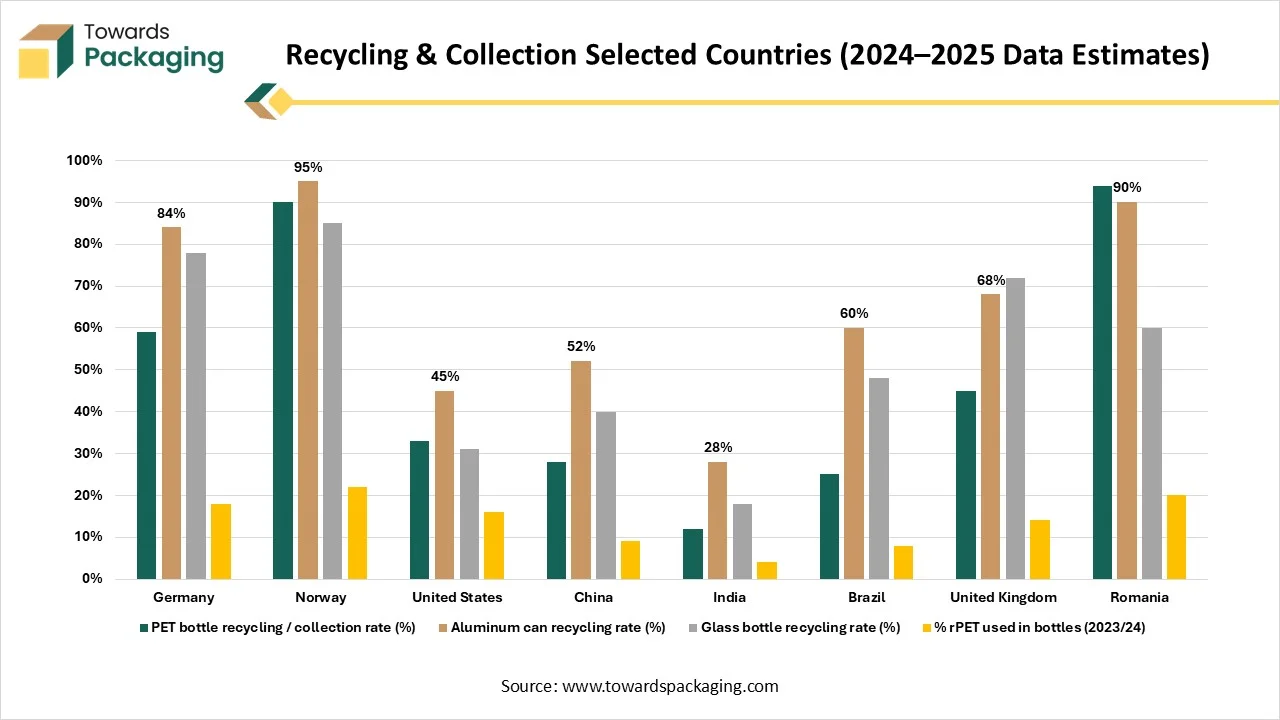

Germany Market Trends

Germany's recyclable beverage packaging market is growing owing to the most advanced recycling systems in the world, driven by its Green Dot system and strict packaging waste regulations. High consumer awareness, government-enforced deposit return schemes (DRS), and active participation in circular economy initiatives push companies to adopt recyclable packaging formats like recyclable PET bottles, aluminium cans, and paperboard cartons. Major beverage and packaging firms also invest heavily in Research and Development for sustainable alternatives.

What Promotes the Growth of the Asia Pacific Recyclable Beverage Packaging Market?

The Asia Pacific market is expanding rapidly due to the growing environmental awareness in the region. The region has a massive and growing population, particularly in urban areas, leading to higher consumption of packed food, beverages, and personal care products, driving demand for sustainable packaging. Governments are implementing strict regulations and policies to reduce plastic waste and promote recyclable materials. For example, include India’s Plastic Waste Management Rules and China’s ban on non-biodegradable plastic bags. Countries in the Asia Pacific region are heavily investing in recycling technologies and infrastructure to manage waste efficiently and support the circular economy. The Asia Pacific region benefits from low production costs and abundant raw materials, encouraging global companies to base their recyclable packaging operations here.

China Market Trends

China's recyclable beverage packaging market is driven by the industrial dominance and export-oriented market. China leads due to its massive manufacturing and packaging industry, with strong capabilities in producing recyclable plastic, paper, and metal packaging. The Chinese government has enforced strict regulations, such as bans on single-use plastics and the promotion of biodegradable and recyclable alternatives. China’s role as a major exporter of packaged goods boosts demand for compliant, eco-friendly packaging.

North America’s Large Consumption of Packed Beverages to Project Steady Growth

The North America region is expected to grow at a notable rate in the foreseeable future. Governments in the U.S. and Canada have implemented strict polices targeting single-use plastics and promoting recyclable materials. Regulatory frameworks like Extended Producer Responsibility (EPR) and bottle deposit-return systems encourage beverage companies to adopt recyclable packaging. The North America region has a highly developed and growing beverage market, especially in segments like bottled water, functional drinks, RTD tea and coffee, and alcoholic beverages, driving demand for sustainable packaging. Leading beverage companies (e.g., Coca-Cola, PepsiCo, Nestle, Keuring Dr Pepper) have committed to using 100% recyclable or reusable packaging by specific target years (e.g., 2025 or 2030), fueling market transformation.

Latin America Recyclable Beverage Packaging Market Trends

Latin America's recyclable beverage packaging market is growing as governments tighten waste regulations and companies switch to environmentally friendly materials. Paper cartons, aluminum cans, and PET with recycled content are becoming more prevalent demand for recyclable formats is further supported by rising urbanization and robust beverage consumption.

Brazil Recyclable Beverage Packaging Market Trends

The Brazilian market is expanding due to increased PET bottle collection and high recycling rates for aluminum cans. To achieve sustainability goals, beverage companies are increasing their use of returnable glass lightweight bottles, and the adoption of recyclable packaging is still being driven by the nation's high beverage consumption.

Middle East and Africa Recyclable Beverage Packaging Market Trends

MEA is seeing rising demand for recyclable beverage packaging as waste management reforms expand. Recyclable PET, aluminum cans, and glass bottles are gaining popularity for their durability and recover value. Growing consumption of drinks like water and juices supports these shifts.

UAE Recyclable Beverage Packaging Market Trends

The UAE’s market is growing quickly as the nation advances its goals for a circular economy. Beverage producers are boosting glass recycling, encouraging aluminum packaging, and using more recyclable beverage formats is being driven by the growth of tourism and consumers who are concerned about sustainability.

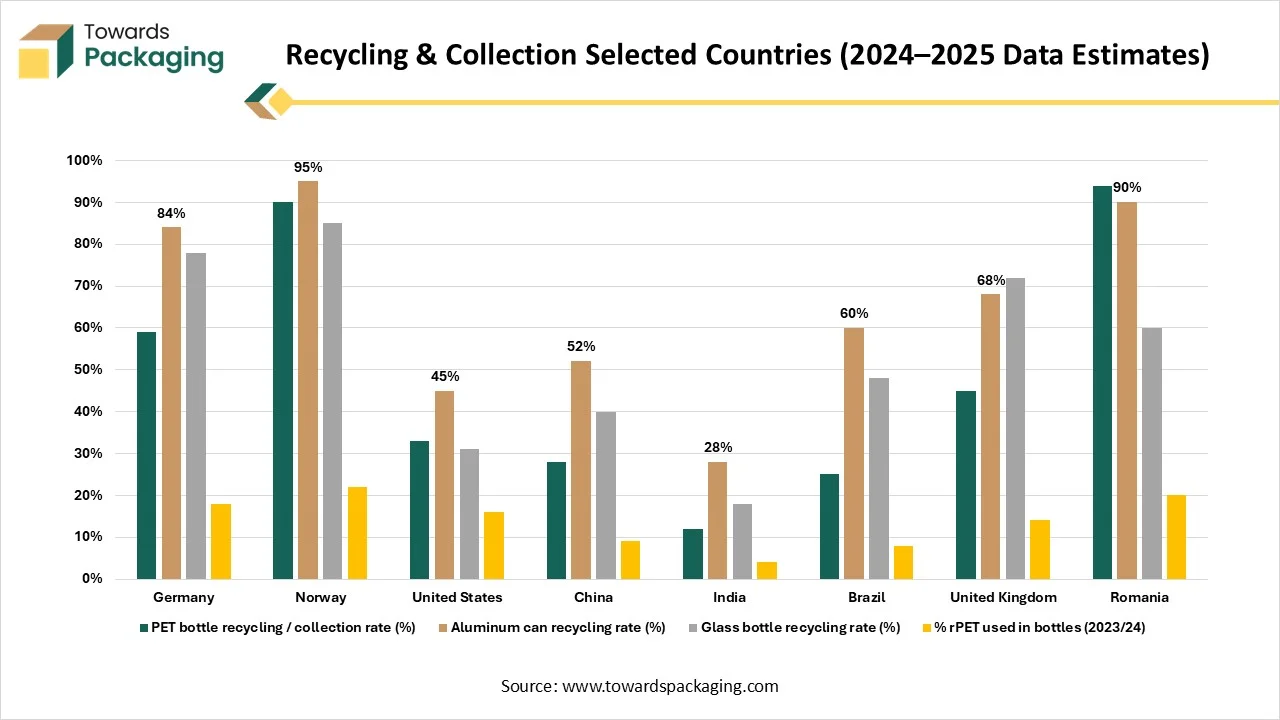

Recycling & Collection Selected Countries

| Country |

PET bottle recycling / collection rate (%) |

Aluminum can recycling rate (%) |

Glass bottle recycling rate (%) |

% rPET used in bottles (2023/24) |

| Germany |

59% |

84% |

78% |

18% |

| Norway |

90% |

95% |

85% |

22% |

| United States |

33% |

45% |

31% |

16% |

| China |

28% |

52% |

40% |

9% |

| India |

12% |

28% |

18% |

4% |

| Brazil |

25% |

60% |

48% |

8% |

| United Kingdom |

45% |

68% |

72% |

14% |

| Romania |

94% |

90% |

60% |

20% |

Consumption in Recyclable Beverage Packaging by Region Major Markets (2025)

| Region / Country |

Annual consumption aluminum cans (billion) |

PET bottles consumed (billion) |

Glass bottles consumed (kilotons) |

Aseptic/carton packs consumed (billion) |

| North America (US+CA) |

72 |

50 |

3,600 |

3 |

| Europe (EU + UK) |

60 |

52 |

6,800 |

9.5 |

| Asia-Pacific (excl. Japan & China) |

48 |

55 |

2,400 |

4 |

| China |

140 |

110 |

11,200 |

12 |

| India |

30 |

40 |

1,100 |

1.2 |

| Latin America |

24 |

18 |

1,100 |

0.8 |

| Middle East & Africa |

9.5 |

8 |

420 |

0.4 |

Recyclable Beverage Packaging Market Key Players

Major Manufacturers Packaging Producers & Capacities

| Company |

Headquarters |

Primary packaging types |

Approx. 2024 beverage-packaging revenue (USD billion) |

Production capacity (billion units/year) |

Global plants |

| Ball Corporation |

USA |

Aluminum cans |

9.8 |

210 |

70 |

| Amcor plc |

Australia/Switz. |

Flexible (PET sleeves), cartons |

10.2 |

120 |

120 |

| Tetra Pak (Tetra Laval) |

Sweden |

Aseptic cartons |

3.6 |

45 |

30 |

| SIG Combibloc |

Switzerland |

Aseptic cartons |

2 |

28 |

25 |

| Crown Holdings |

USA |

Metal ends & cans |

6 |

110 |

80 |

| Ardagh Group |

Luxembourg |

Glass & metal |

7.1 |

95 |

80 |

| Owens-Illinois (O-I) |

USA |

Glass bottles |

4.2 |

40 |

40 |

| Plastipak / ALPLA (converters) |

USA / Austria |

PET bottles & preforms |

2.8 |

65 |

45 |

| Toyo Seikan / Toyo Kohan |

Japan |

Cans, metal packaging |

1.6 |

25 |

22 |

Latest Announcements by Industry Leaders

- Ahmed ElSheikh, president and CEO at PepsiCo India, as a responsible leader in the food and beverage industry, PepsiCo India's Performance with Purpose 2025 goal is to design all packaging to be recoverable or recyclable, and supports increased recycling of plastic waste. According to him, India will be one of the first nations to test this innovative, environmentally friendly packaging option created by PepsiCo. In certain markets, rival Coca-Cola has also introduced plant-based bottles. According to a Coca-Cola India representative, this plant-based packaging material originated in India. (Source: Moving Indian Tech)

New Advancements in the Market

- In February 2025, Tetra Pak, a packaging company, the first firm in India’s food and beverage packaging sector to do so, stated that they will be providing packaging materials made of certified recycled polymers. ISCC PLUS (International Sustainability and Carbon Certification), an internationally applicable sustainability certification system, has validated its carton containers that incorporate recycled polymers. According to the Plastic Waste Management (Amendment) Rules 2022, which are enforced by the Ministry of Environment, Forests and Climate Change, the packaging material incorporates 5% certified recycled polymers. The date of this mandate’s implementation is April 1, 2025. (Source: Business Standard)

- In February 2025, Berry Global Group, Inc., a packaging solutions providing company, signed a collaboration with Mars, a leader in snacks and sweets, to switch all of the packaging for its pantry jars for the M&M’S, SKITTLES, and STARBURST brands to 100% recycled plastic, excluding the jar lids. Building on the 2022 launch of the pantry jars with 15% recycled plastic, this accomplishment furthers Berry and Mars' ongoing partnership to create packaging with recycled material. The country-wide rollout of the revised jars has begun. (Source: Mars)

- In October 2024, the Association of Plastic Recyclers (APR) officially recognized SIG for meeting the highest recyclability standards outlined in the APR Design Guide for Plastics Recyclability for their Terra RecShield D bag-in-box package for beverages like post-mix syrup. Recycling has been a popular topic for a long time, and customers are expecting more from the well-known businesses they trust. As a leading packaging for better solutions supplier, SIG is working to support those brands by designing solutions that streamline packaging waste, making recycling simpler and in line with corporate brand sustainability objectives. (Source: SIG)

- In March 2025, Amcor, the packaging company, announced the release of the Amfiber Performance Paper stand-up pouch, a paper-based refill pack for dry beverage and instant coffee products. This new innovation is a part of Amcor’s AmFiber performance paper portfolio and will initially be introduced in the Europe, Middle East, and Africa region. Amcor’s new AmFiber Performance Paper stand-up pouch is the perfect solution for soluble coffee products since it offers barrier and seal integrity. (Source: Food And Drink Technology)

Global Recyclable Beverage Packaging Market Segments

By Material

- Recyclable Plastic (e.g., PET, HDPE) – Dominated

- Aluminum

- Glass

- Paperboard/Cartons (e.g., Tetra Pak)

- Biodegradable/Compostable Materials (e.g., PLA, bagasse) – Fastest-growing

By Packaging Type

- Bottles

- Cans

- Cartons and Boxes

- Pouches and Sachets

- Kegs and Drums

By Beverage Type

- Carbonated Soft Drinks (CSDs)

- Bottled Water

- Juices and Nectars

- Dairy and Dairy Alternatives

- Alcoholic Beverages (Beer, Wine, Spirits)

- Ready-to-Drink Tea and Coffee

- Functional and Nutritional Drinks

By End Use

- Retail / On-the-Go Consumption

- Foodservice and Hospitality

- Institutional / Industrial (bulk use)

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail / E-Commerce

- Specialty Beverage Shops

- Foodservice Outlets and Vending Machines

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait