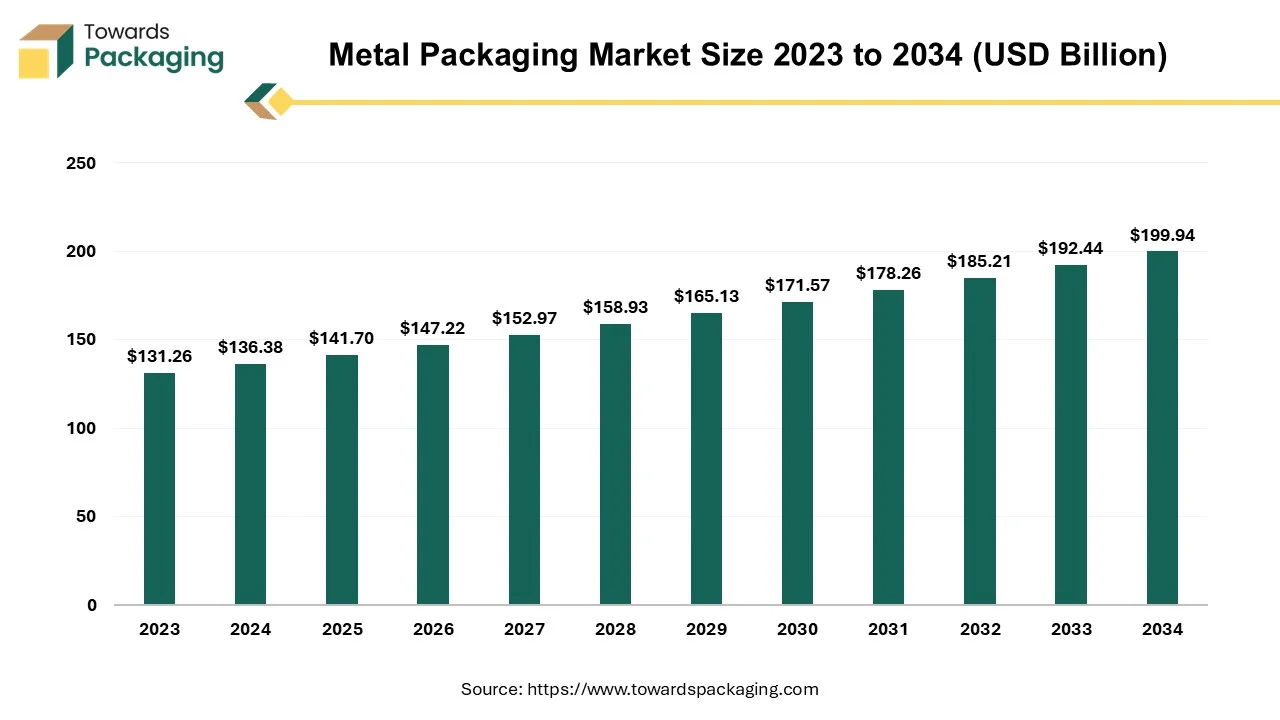

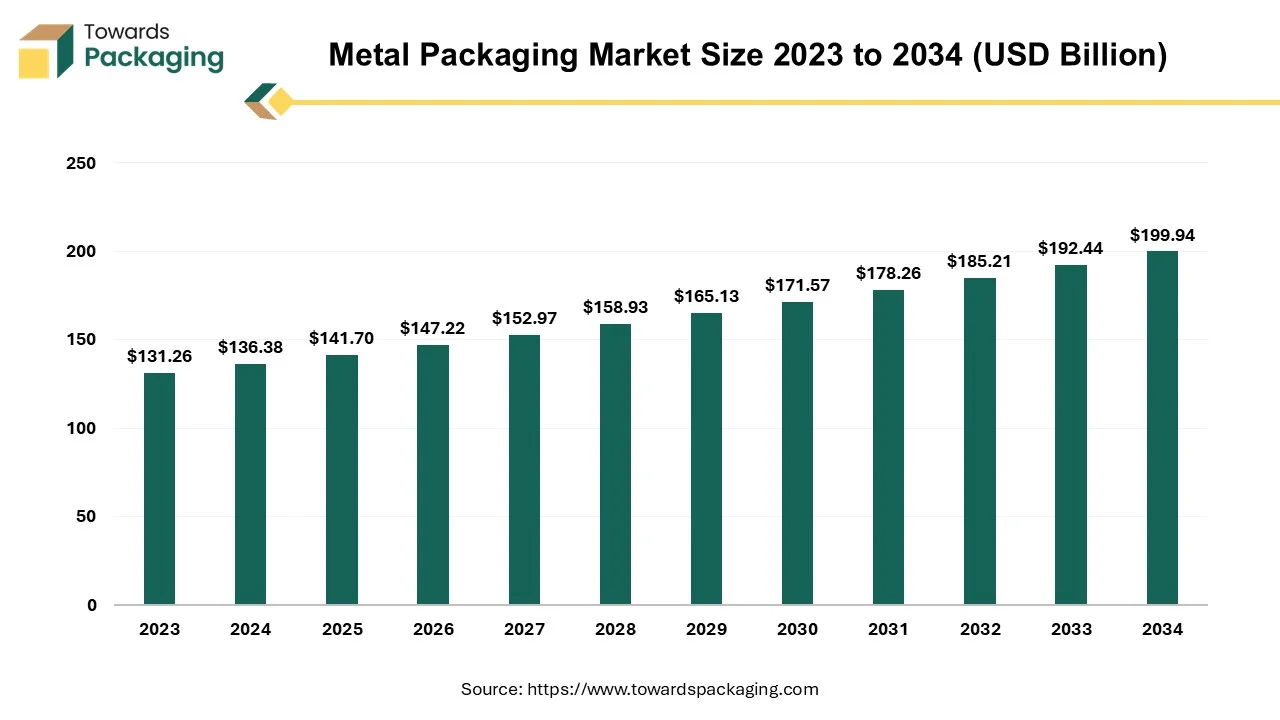

The metal packaging market is forecasted to expand from USD 147.23 billion in 2026 to USD 207.74 billion by 2035, growing at a CAGR of 3.9% from 2026 to 2035. The market is segmented by material (aluminum and steel), product type (cans, caps & closures, barrels & drums, others), and end-use (food & beverages, paints & varnishes, personal care, pharmaceuticals, and others). Key regions covered include North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In-depth competitive analysis and a value chain breakdown highlight major players such as Ball Corporation, Crown Holdings, Amcor, and Ardagh Group SA. Detailed trade data and manufacturers' information further enhance market insights.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing metal packaging which is estimated to drive the global metal packaging market over the forecast period.

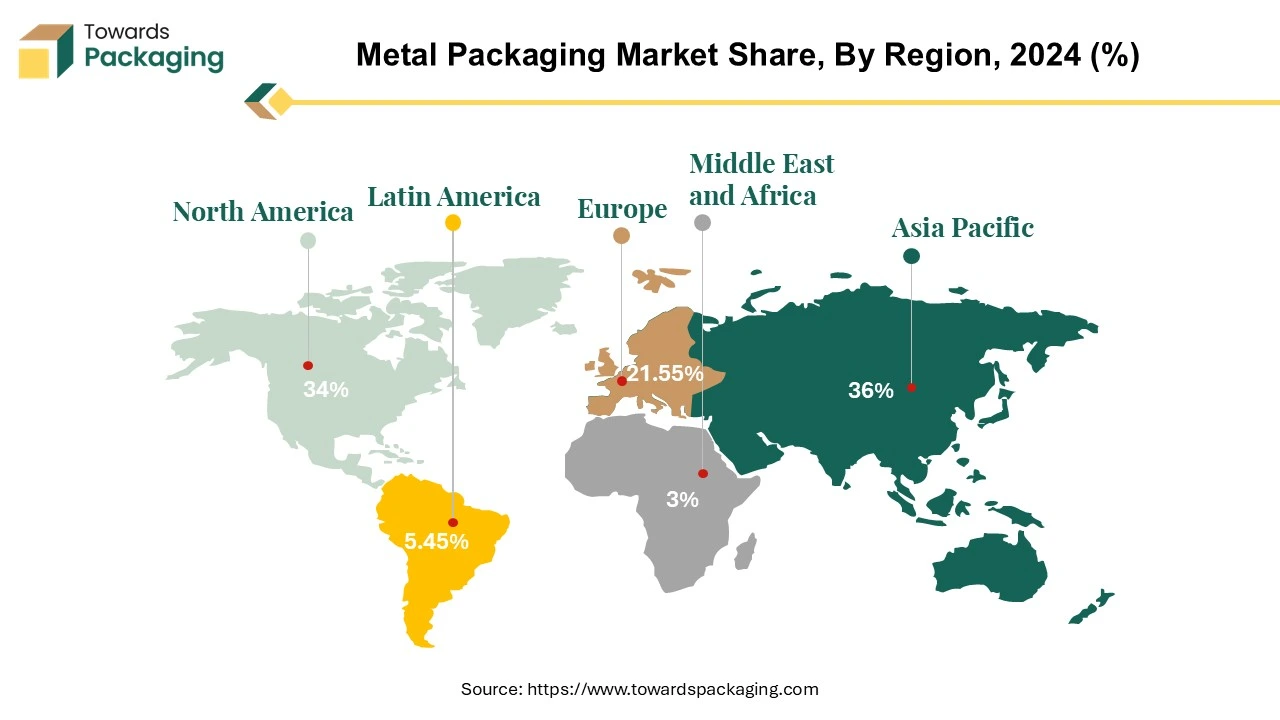

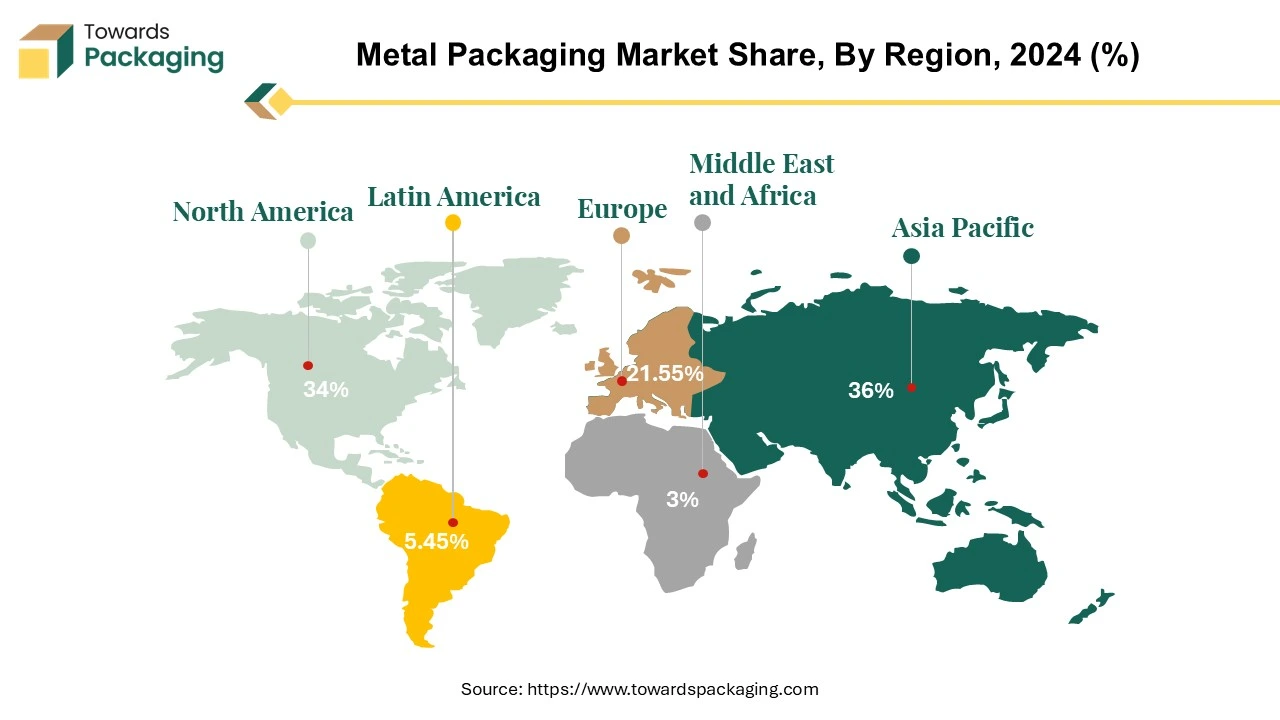

- Asia Pacific dominated the metal packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By material, the aluminum segment dominated the market with the largest share in 2024.

- By product type, the cans segment registered its dominance over the global metal packaging market in 2024.

- By end use, the food & beverages segment dominated the metal packaging market in 2024.

Metal packaging refers to containers and enclosures made from metals like aluminum, steel, and tinplate to store and protect various products. It is widely used in industries such as food & beverages, pharmaceuticals, cosmetics, chemicals, and personal care due to its durability, recyclability, and excellent barrier properties. Metal packaging is strong, heat-resistant, and impact-resistant.

Advancements in metal packaging, such as nitrogen-infused widgets in aluminum cans, are enhancing product quality and consumer experience. These innovations are particularly popular in the ready-to-drink beverage segment, offering durability and improved shelf stability.

Market Trends

- Sustainability and Consumer Preferences: There is a growing consumer preference for eco-friendly packaging solutions, leading companies to adopt recyclable materials like aluminum. For example, Budweiser Brewing Company APAC Limited launched a "Can-to-Can" recycling initiative in China in October 2023 to boost aluminum can recycling rates and reduce carbon emissions. The industry is placing a strong emphasis on sustainability, with steel being one of the most recycled materials globally.

- Impact of Tariffs and Trade Policies: Recent trade policies, including the reinstatement of 25% tariffs on aluminum imports by the U.S. starting March 12, 2025, have led to increased costs for aluminum products. This has caused companies like Coca-Cola to consider shifting from aluminum cans to plastic bottles to manage expenses. Additionally, U.S. physical market premiums for aluminum have reached record highs, further impacting the cost structure for manufacturers relying on metal packaging.

- Active Packaging Technologies: Innovations in active packaging, such as metal-chelating active compounds, are enhancing the shelf life and quality of food products. These technologies help in scavenging transition metals from products, thereby enhancing oxidative stability and reducing the need for synthetic preservatives.

- Financial Performance Amid Market Changes: Companies like Ball Corp have reported better-than-expected profits in recent quarters, driven by increased prices of beverage containers and cost-saving measures in logistics and supply chain management. This reflects the industry's resilience and adaptability to market changes.

AI-powered computer vision can detect micro-defects (e.g., cracks, dents, or coating inconsistencies) in cans and other metal packaging at high speeds. Machine learning models can classify defects and suggest corrective actions in real time, reducing waste and rework. AI-driven predictive analytics can monitor machinery (presses, cutters, coaters) and predict failures before they happen, minimizing downtime and extending equipment life. Sensors and IoT devices collect real-time data, which AI analyzes to optimize maintenance schedules.

AI can fine-tune production parameters (e.g., temperature, pressure, speed) to optimize metal forming, cutting, and coating processes, reducing material waste and energy consumption. Smart algorithms can automate workflow scheduling to balance demand, reduce bottlenecks, and enhance productivity. AI can predict demand fluctuations based on market trends and historical data, helping to avoid overproduction or shortages.

Driver

Expansion of Food and Beverages Industry

The rise in urbanization and busy lifestyles has increased demand for ready-to-eat meals, canned foods, and beverages. Growth of the beverage industry, especially carbonated soft drinks, alcoholic beverages, and energy drinks, boosts the demand for aluminum cans. Metal packaging is highly durable, making it ideal for e-commerce shipping, where products face handling, stacking, and long transit times. It protects contents from damage, contamination, and external factors like moisture and light, especially for food, beverages, and pharmaceuticals.

Online grocery shopping is increasing demand for canned foods, beverages, and preserved products that require long shelf life and secure packaging. Meal kits and subscription food services rely on metal packaging to keep products fresh. Consumers prefer recyclable and eco-friendly materials, and aluminum and steel packaging align with sustainability goals. Many e-commerce brands are replacing plastic with metal alternatives to appeal to environmentally conscious buyers.

Growth of Food and Beverage Metal Cans Market

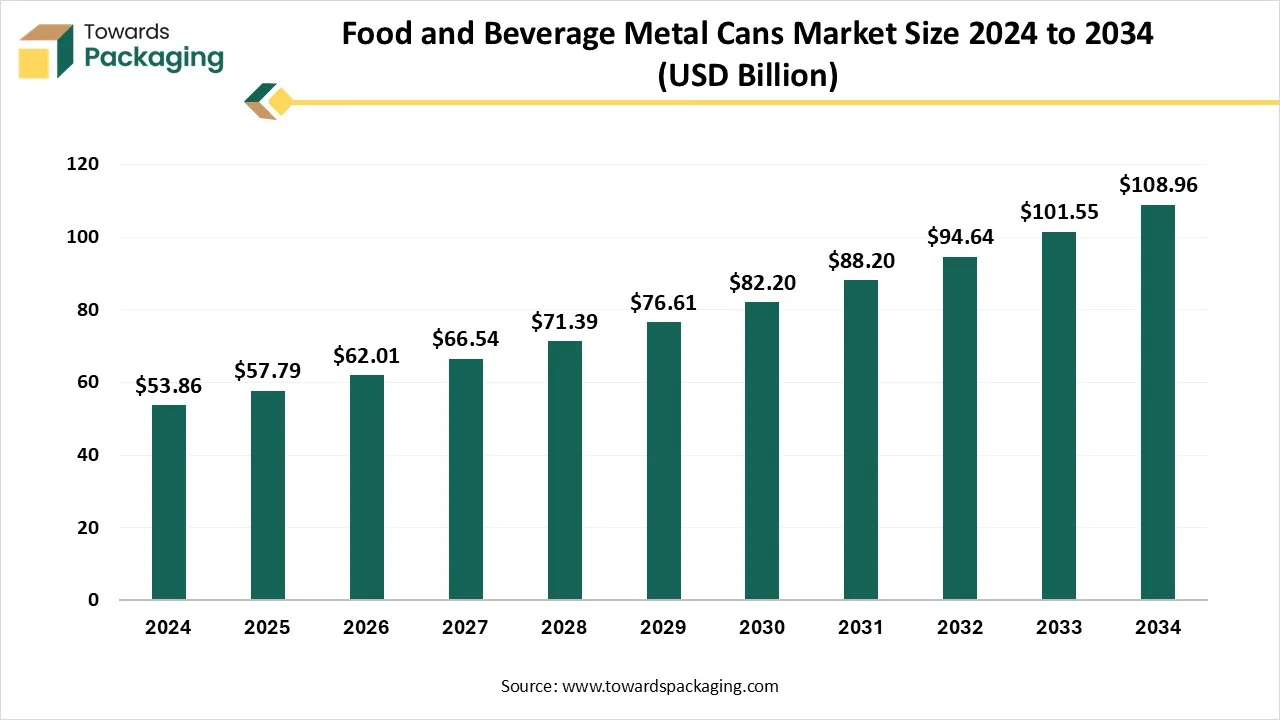

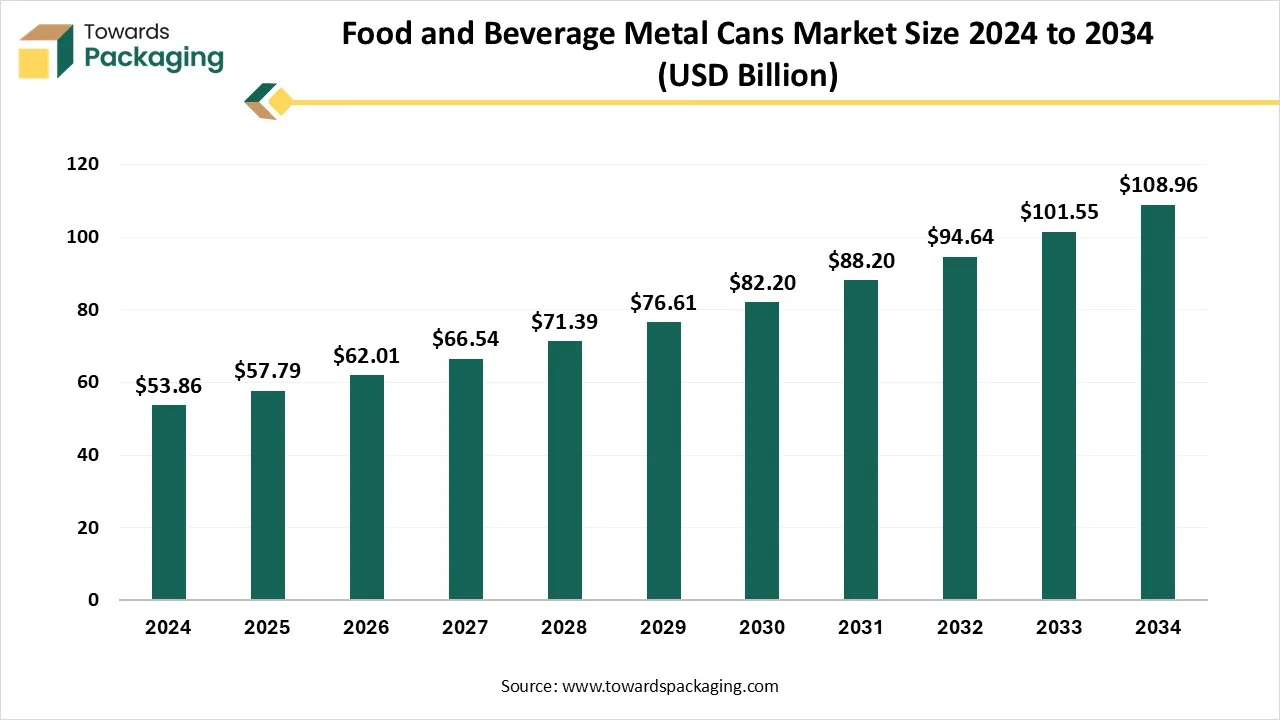

The food and beverage metal cans market is expected to increase from USD 57.79 billion in 2025 to USD 108.96 billion by 2034, growing at a CAGR of 7.3% throughout the forecast period from 2025 to 2034. The demand for food and beverage metal cans is stretching due to the growth in digital printing technology, which has created materials that have become lighter and developed coatings that lower expenses while providing sustainability advantages.

The region, North America, holds the greatest share in 2024, and Asia Pacific is the fastest-growing region. The food and beverage metal cans market is expanding quickly. The most common material type was aluminium cans. Beverage cans were dominated by product type. The medium can account for the largest can size, while the small can is set to grow quickly. By functionality, easy-open cans have dominated the food and beverage metal cans market. By distribution channel, the retail sales are the dominating one, while online sales are the fastest-growing segment.

Restraint

High Initial Investment & Production Costs

The key players operating in the market are facing issue due to high initial investment and production costs which has estimated to drive the growth of the metal packaging market. Stringent recycling and carbon footprint regulations make compliance costly. BPA concerns in metal can linings have led to stricter rules and reformulations. Growing demand for lightweight and resealable packaging favors plastic and composite materials. Eco-conscious consumers are pushing brands toward recyclable and biodegradable options. Dependence on global metal supply chains makes the industry vulnerable to disruptions (e.g., trade restrictions, logistics bottlenecks). Geopolitical tensions can affect raw material availability.

Opportunity

Sustainability & Recycling Initiatives

Aluminum and steel packaging are 100% recyclable, with high global recycling rates, making them environmentally preferred over plastic. Government regulations and consumer preferences are pushing companies toward eco-friendly packaging solutions. For instance, in October 2023, Eviosys, a pioneer in the metal packaging sector with sustainability and innovation at its heart, makes its debut as a brand-new, independent business. With hundreds of customers for food and consumer goods both locally and internationally, the company is the biggest producer of steel and aluminum food packaging in Europe.

Segmental Analysis

Aluminium Material: Expected to Carry the Dominance

The aluminium material segment to dominated the global metal packaging market in 2024. Aluminum is significantly lighter than steel, reducing transportation costs and making handling easier. Naturally forms an oxide layer that protects it from corrosion, making it ideal for moisture-sensitive products like beverages and canned foods. The aluminium metal offers 100% protection against light, oxygen, and moisture, preserving product freshness and extending shelf life.

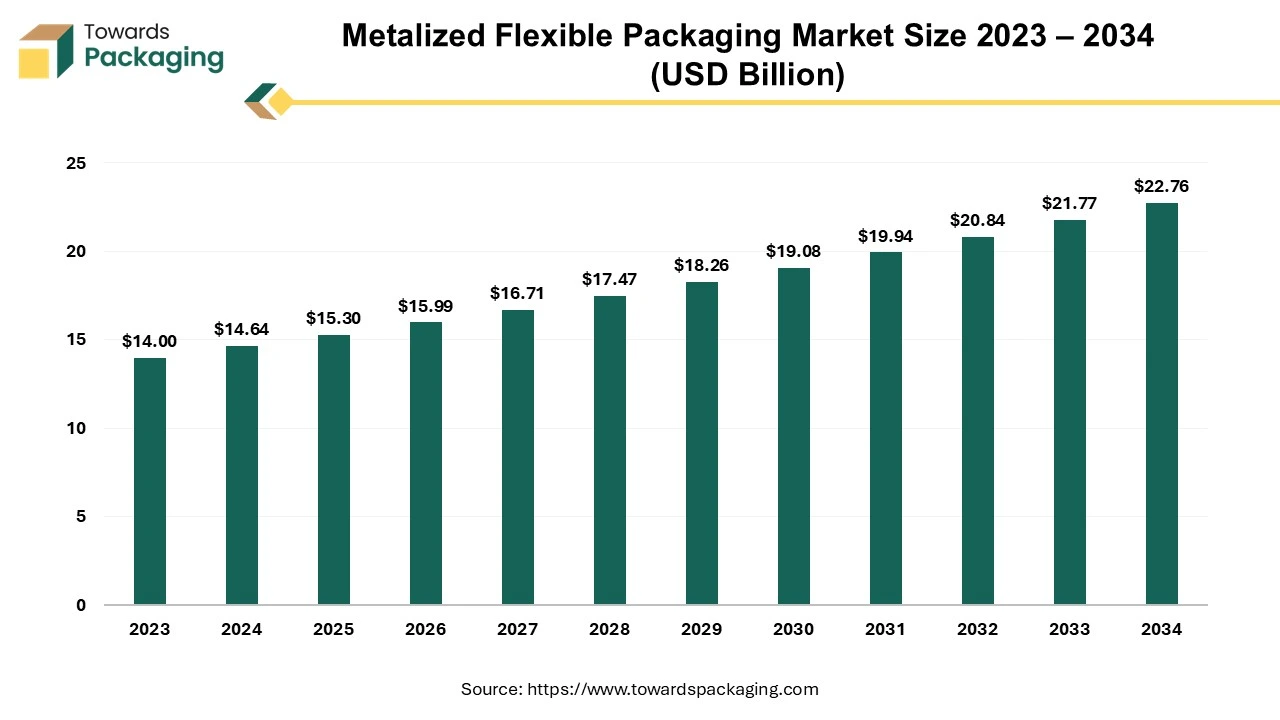

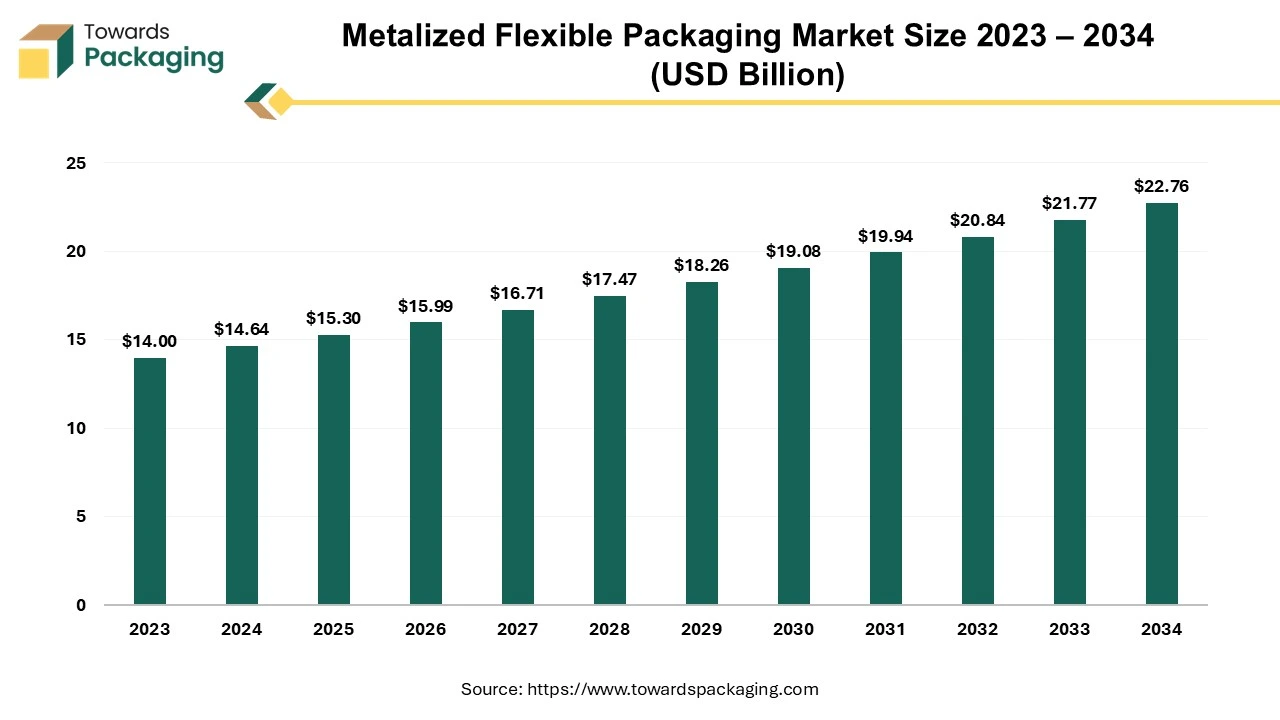

Growth in the Metalized Flexible Packaging Market

The global metalized flexible packaging market size reached USD 15.30 billion in 2025 and is projected to hit around USD 22.76 billion by 2034, expanding at a CAGR of 4.55% during the forecast period from 2025 to 2034.

Metalized flexible packaging typically comprises a metal-coated polymer film, with aluminium being the most commonly used metal. However, chromium and nickel are also employed in this process. These films are generally produced by heating metals in a vacuum, leading to the condensation of metal droplets on polymer films and the formation of metalized films. Like aluminium foils, metalized flexible films exhibit a shiny metallic surface and are highly combustible. However, they are lighter and more cost-effective due to their significantly thinner profile than aluminium foils. The industry's widespread adoption of flexible packaging and films is attributed to various technological advancements.

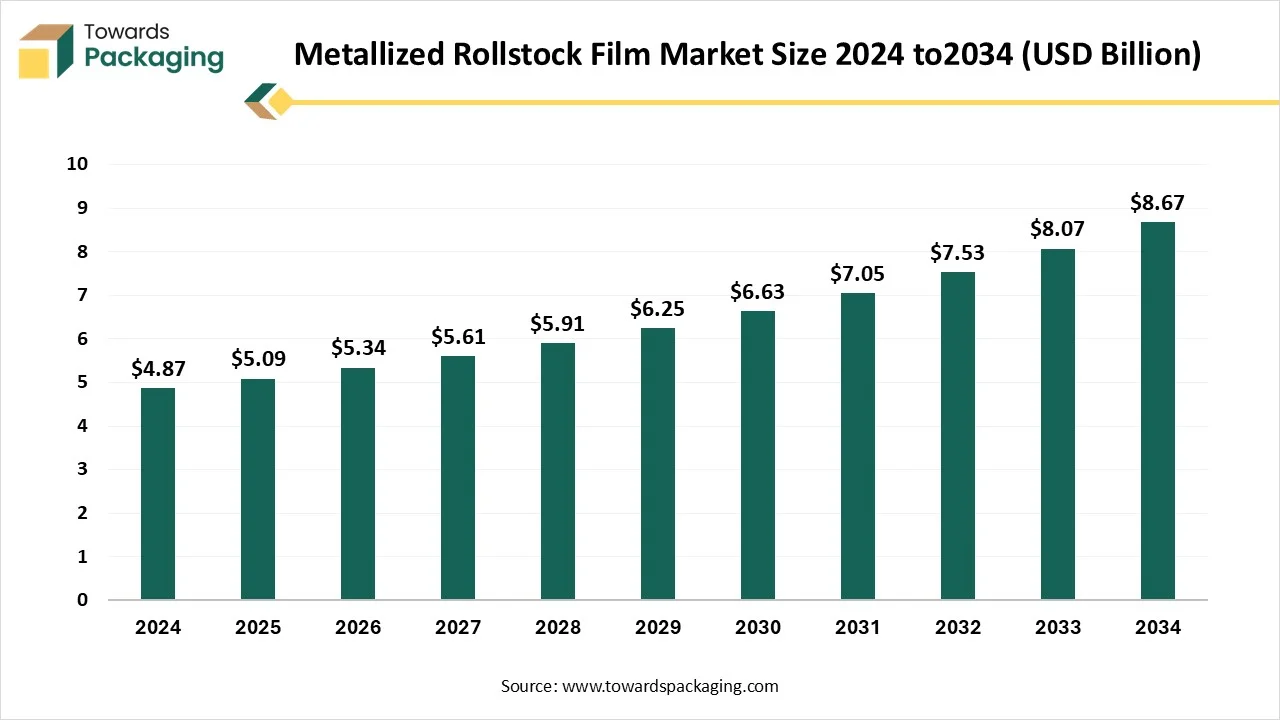

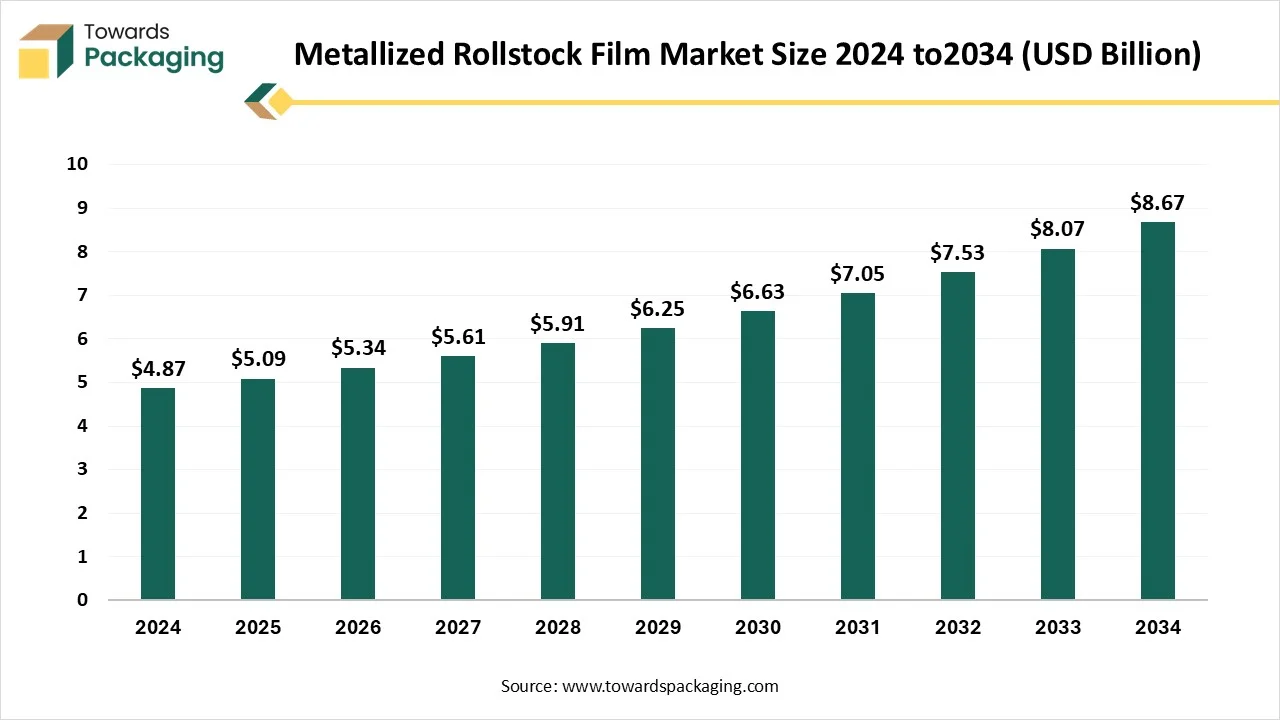

Growth of Metallized Rollstock Film Market

The global metallized rollstock film market is expected to increase from USD 5.09 billion in 2025 to USD 8.67 billion by 2034, growing at a CAGR of 6.09% throughout the forecast period from 2025 to 2034.

The metallized rollstock film market continues to grow at a steady rate within the estimated timeframe. Rollstock films are metalized with a light layer of aluminum to provide different degrees of protection or application based on the product and its specifications. It has an average price point and a high barrier capacity. A zip-lock plastic bag, for instance, doesn't need a high barrier, but food product packaging frequently does. The film's barrier qualities are improved by the metallization and this improves its resistance to light, oxygen and moisture. These films are commonly utilized in food, pharmaceuticals, cosmetic & personal care and other industries. Some manufacturers also provide sustainable metallized films to reduce the environmental impact.

The increasing demand for high-barrier packaging in the industries such as food, beverage and pharmaceutical is expected to augment the growth of the metallized rollstock film market during the forecast period. Furthermore, the rise of e-commerce and flexible packaging along with the adoption of sustainability trends and regulatory pressures are also anticipated to augment the growth of the market. Additionally, the technological advancements in the vacuum metallization and nano-coatings as well as the growth of the personal care and cosmetics industry coupled with the increasing consumer demand for sustainable and recyclable packaging is also projected to contribute to the growth of the market in the near future.

The metalized biaxially oriented polypropylene films market is set to grow from USD 7.74 billion in 2025 to USD 13.1 billion by 2034, with an expected CAGR of 6.05% over the forecast period from 2025 to 2034. It serves as the perfect moisture barrier for every regulatory-used plastic film, and its metalized versions serve as the best oxygen barrier to the goods.

BOPP is called the " packaging queen" in terms of the packaging film industry. It plays an important role in the flexible packaging industry. This kind of material is perfectly notable for transparency, exceptional power, and adaptability which makes it a perfect choice for improving product presentation and protection.

Polypropylene films that are expanded in cross directions and machine are termed Biaxially oriented polypropylene films. It has received huge appreciation as a heavy-growth film as it is a perfect barrier for water vapor, acts as a barricade to oil and greases, can be recycled, and is not affected by surrounding changes. The biodegradability and non-toxic characteristics of BOPP films make it one of the most eco-friendly films on the market. With the rising awareness about environmental and pollution problems, it is more crucial than ever to include such issues. They are available in various types such as:

- Metalized BOPP Films: They are covered with a thin layer of aluminum to transmit a metallic appearance and grow barrier elements.

- BOPP Holographic film: It is created from thermoplastic and is a visually attractive film which is both opaque and transparent.

- Printable BOPP Film: Printable BOPP Film contains a glossy nature and is highly transparent. Hence this solution is the best solution when it comes to marketing and decorating a product.

- BOPP Matte Film: It has exceptional machinability and is perfect for lamination. By the assistance and nature of eco-friendly film properties, it is also specifically water and pollution-resistant.

Cans Segment Led in 2024

The cans segment accounted for a significant share of the metal packaging market in 2024. One of the most prominent types of metal packaging is the can, which is usually used for chemicals, food, and beverages. Growth in this market is also being driven by the increased demand for canned drinks, including soda, energy drinks, and alcoholic beverages. Designed to seal and safeguard the contents of containers like bottles, jars, and cans, caps and closures are crucial parts of metal packaging. They are employed in the food and beverage, pharmaceutical, cosmetic, and chemical sectors and come in a variety of forms, such as screw caps, flip-top caps, and crown caps. Metal closures, which are frequently composed of steel or aluminum, guarantee product freshness, safety, and tamper proof.

Growth of Can Coatings Market

The can coatings market is playing a significant role in the packaging industry majorly in the food & beverage industry due to safety as well as convenience. These are widely used for the preservation of food products. Can coatings are majorly used in the packaging of food products in schools, supermarkets, hospitals, and kitchens. The rising trend for canned food in the ready-to-eat food products section is driving the market to grow rapidly. Growing demand for the consumption of healthy food products in changing lifestyles has compelled market players to bring innovation to the can coatings market.

These can coatings are the organic layers which protect from any chemical reaction between cans and food. These cans preserve the nutritional value of food, provide longer storage, and protect from contamination due to external factors which increases the demand for this market. Some of the major factors such as National Paints Factories Co. Ltd., VPL Coatings GmbH & Co KG, Axalta Coating Systems, RPM International, Axalta Coating Systems, and several others are continuously introducing innovations which boost the market growth.

Aerosol Cans Market Growth Insights

The aerosol cans market is projected to reach USD 20.71 billion by 2034, expanding from USD 12.56 billion in 2025, at an annual growth rate of 5.75% during the forecast period from 2025 to 2034. Expansion of the e-commerce sector, expansion of automotive and industrial applications, and increasing use in automotive and industrial applications contributing to the growth of the aerosol cans market.

Aerosol cans prove to be cost effective for both producers and consumers, while being incredibly convenient for transportation, storage, and packaging. Steel aerosol containers stand out for their ease of use and efficiency. It needs just a quick finger press for most applications. Sustainable packaging benefits include conserves natural resources, helps business with applicable regulations, can reduce long term costs, satisfies consumer demands, reduces carbon emissions, minimizes harm to wildlife and natural environments, and helps to reduce pollution. Modern aerosols can avoid ozone harming CFCs but can emit VOCs, impact air quality and contributing to smog and harm the environment.

Laminated Can Packaging Market Outlook Scenario

The global laminated can packaging market size reached US$ 2.50 billion in 2024 and is projected to hit around US$ 3.71 billion by 2034, expanding at a CAGR of 4.05% during the forecast period from 2024 to 2034.

The container manufactured by bonding layers of materials together to create a strong, durable package is known as laminated can packaging. This process typically combines metal, plastic, and sometimes paper to enhance barrier properties, protect contents from light and moisture, and improve overall strength. Laminated cans are often used for beverages and food products, offering benefits like extended shelf life and improved freshness. Laminated can packaging is an innovative approach in the food and beverage industry, designed to enhance the preservation and presentation of products. This method involves the combination of multiple materials to create a can that offers superior protection and functionality.

Growth of Recycled Aluminum Cans Market

The recycled aluminum cans market is anticipated to grow from USD 3.90 billion in 2025 to USD 5.90 billion by 2034, with a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2034.

The recycled aluminum cans market plays a significant role in the packaging industry and it is driven due to its sustainable packaging solution. Aluminum is an important metal that is used in various industries such as food, transport, power transmission, construction, and electronics. It is well-known for recycling as it requires less energy for the recycling process and is highly valuable as scrap. When aluminum metal is recycled, it stays the same quality as its basic construction remains the same even after melting several times. This property makes it both environment-friendly and cost-effective. Only 5% of the energy is required for recycling aluminum than to make new aluminum cans, but all the properties of the metal stay still the same as the original one.

Food and Beverages Led the Market in 2024

The food and beverages segment registered its dominance over the global metal packaging market in 2024. The global consumption of canned foods and beverages continues to rise, especially in urban areas. Consumers prefer convenient, long-shelf-life products, making metal packaging ideal for items like soft drinks, beer, canned vegetables, and ready-to-eat meals. Metal packaging provides excellent barrier properties, protecting food and drinks from oxygen, light, and moisture. Canning extends the shelf life of food without preservatives, making it ideal for long-term storage. Aluminum and steel cans are 100% recyclable, with high global recycling rates, making them a preferred choice for brands aiming for sustainability.

Consumers and regulations are pushing brands toward eco-friendly packaging, reinforcing metal’s dominance. The rising demand for carbonated soft drinks, energy drinks, and alcoholic beverages drives significant use of aluminum cans. Lightweight aluminum cans are cost-effective to transport and easy to cool, making them popular in on-the-go consumption. Stringent food safety regulations favour metal packaging due to its non-reactive and protective nature. Unlike plastic, metal packaging does not contain harmful chemicals like BPA in its raw form, making it safer for food storage. Advanced printing technologies allow brands to use eye-catching designs on cans, boosting marketing appeal. Lightweight and resealable cans (e.g., aluminum bottles) enhance user convenience, driving further adoption.

Growth of Food and Beverage Metal Cans Market

The food and beverage metal cans market is expected to increase from USD 57.79 billion in 2025 to USD 108.96 billion by 2034, growing at a CAGR of 7.3% throughout the forecast period from 2025 to 2034. The demand for food and beverage metal cans is stretching due to the growth in digital printing technology, which has created materials that have become lighter and developed coatings that lower expenses while providing sustainability advantages.

Growth of Food Cans Market

According to market projections, the food cans industry is expected to grow from USD 3.90 billion in 2024 to USD 7.49 billion by 2034, reflecting a CAGR of 6.75%. This report analyzes the key trends driving demand, including eco-friendly materials, smart manufacturing, and AI integration. Regional insights reveal North America leading in market share while Asia Pacific emerges as the fastest-growing region.

Growth of Beer Cans Market

The global beer cans market is expected to increase from USD 13.85 billion in 2025 to USD 19.93 billion by 2034, growing at a CAGR of 4.13% throughout the forecast period from 2025 to 2034.

Rising beer consumption is projected to drive the growth of the global beer cans market over the forecast period. Cans are estimated to be the preferred and favoured choice of beer manufacturers when releasing limited-edition beer cans and other promotional events.

Growth of Aluminium Cans Market

The aluminium cans market is projected to reach USD 94.9 billion by 2034, growing from USD 62.23 billion in 2025, at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Aluminium cans for beverage are even more preferable because of their light, yet sturdy structure, which will considerably help to lower the bills for shipping and to improve product preservation. They provide 70% cost benefits over conventional glass bottles and are aligned with major stringent environmental standards. The market growth of North America is a slightly increasing trend which users want different beverages. The European zone also decides to manufacture more aluminium cans as a result of green tendency. Distributing channels are the essential functions in the aluminium cans industry, which is led by the renowned companies that do their best to maintain their competitive advantage through innovation and sustainability.

Asia Pacific region dominated the global metal packaging market in 2024. The metal packaging market is dominated by the Asia Pacific area because of a number of interrelated variables. In nations like China, India, Vietnam, and Indonesia in particular, the middle class is expanding and has more disposable money as a result of rapid urbanization and industrialization. The desire for premium packaged goods that are portable, easy to use, and handy is increasing due to this demographic transition, and metal packaging can meet this need. Additionally, the region's enormous growth in the food and beverage sector in response to shifting consumer preferences has opened up a lot of potential for metal packaging solutions, particularly for beverages, canned goods, and prepared foods.

China Metal Packaging Market Trends

China has a huge production base and a sizable and expanding consumer base, which together have generated an unprecedented demand for metal packaging solutions across a variety of industries, driving the China metal packaging market. Also, well-known Chinese companies like Wahaha and Master Kong have started using metal containers for their teas and soft beverages, which is encouraging the country's market to grow even more. Metal packaging communicates quality and safety to consumers who are concerned about their status, which has increased the trend of premium packaged goods among China's expanding middle class.

North America’s Growing Food and Beverage Industry to Support Growth

North America region is anticipated to grow at the fastest rate in the market during the forecast period. The need for metal packaging is mostly driven by North America's thriving food and beverage sector. While canned food businesses like Campbell's and Del Monte continue to sustain a consistent need for steel packaging, major beverage corporations like Coca-Cola and Anheuser-Busch InBev are responsible for large volumes of aluminum can use. With more than 2,000 craft breweries in the United States alone moving from glass bottles to cans for benefits in shipping, storage, and brand uniqueness through creative designs, the craft beer boom has further increased the use of aluminum cans.

U.S. Metall Packaging Market Trends

The growing food and beverage industry and the growing emphasis on sustainability are the main factors propelling the metal packaging market in the United States. The U.S. regulatory climate has also been conducive to the expansion of metal packaging. Market potential have been generated by the FDA's approval of many metal packaging methods as well as tightening regulations on some plastics. Significant investment has also been made in metal packaging innovation in the United States, leading to advancements in coating systems, smart packaging technologies, and lightweight materials.

Europe’s Sustainable Packaging Resolution to Project Notable Growth

Europe is seen to grow at a notable rate in the foreseeable future. The Circular Economy Action Plan and the European Green Deal have encouraged businesses to use more environmentally friendly packaging options. Metal packaging is particularly recyclable, with recycling rates for steel and aluminum exceeding 80%. Strict waste management laws in nations like Germany, France, and the Netherlands encourage metal packaging since it can be recycled endlessly without losing quality.

Germany Metal Packaging Market Trends

With more than 1,500 breweries and an annual per capita beer consumption of about 100 liters, Germany has a well-established beer sector that mostly depends on metal cans for distribution and packaging. Metal packaging, which preserves product freshness and carbonation integrity, naturally fits with the German fondness for carbonated beverages, both alcoholic and non-alcoholic. Furthermore, aluminum cans are becoming more and more popular in the nation's expanding craft beer market because of their exceptional resistance to light and air, which helps maintain the unique aromas and qualities of specialty brews.

- On February 06, 2025, Adrian Davies, Tata Steel UK's Marketing Manager for Packaging, clarified one crucial step in the direction of a brighter future is the switch to EAF technology. It maintains the premium, food-safe steel that consumers and brands rely on while significantly lowering carbon emissions. This development is essential for retailers and fast-moving consumer goods (FMCG) companies to satisfy their sustainability goals and meet the increasing demand for environmentally friendly packaging options.

- In September 2024, A new initiative has been started by a local government in U.K. to promote the recycling of more metal products. Cherwell District Council's MetalMatters initiative will promote the advantages of recycling metal home packaging through online, postal, and in-person channels. It claimed that it would have a major positive impact on the environment by lowering greenhouse gas emissions and energy consumption. The Aluminum Packaging Recycling Organization (Alupro) is collaborating with the effort.

- In April 2024, AkzoNobel company developed a next-generation line of metal packaging coatings that is free of polyvinyl chloride and bisphenols (BPXni*) is now available to food can producers. The Securshield* 500 line of simple open-end coatings is intended to assist can manufacturers and their clients. With a more sustainable offering and noticeably better performance than the organosol-based alternatives of today, the Securshield satisfies both present and future regulatory standards.

By Material

By Product Type

- Cans

- Caps & Closures

- Barrels & Drums

- Others

By End-Use

- Food & Beverages

- Paints & Varnishes

- Personal Care & Cosmetics

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait