The food and beverage metal cans market is expected to increase from USD 62.01 billion in 2026 to USD 116.91 billion by 2035, growing at a CAGR of 7.3% throughout the forecast period from 2026 to 2035. The demand for food and beverage metal cans is stretching due to the growth in digital printing technology, which has created materials that have become lighter and developed coatings that lower expenses while providing sustainability advantages.

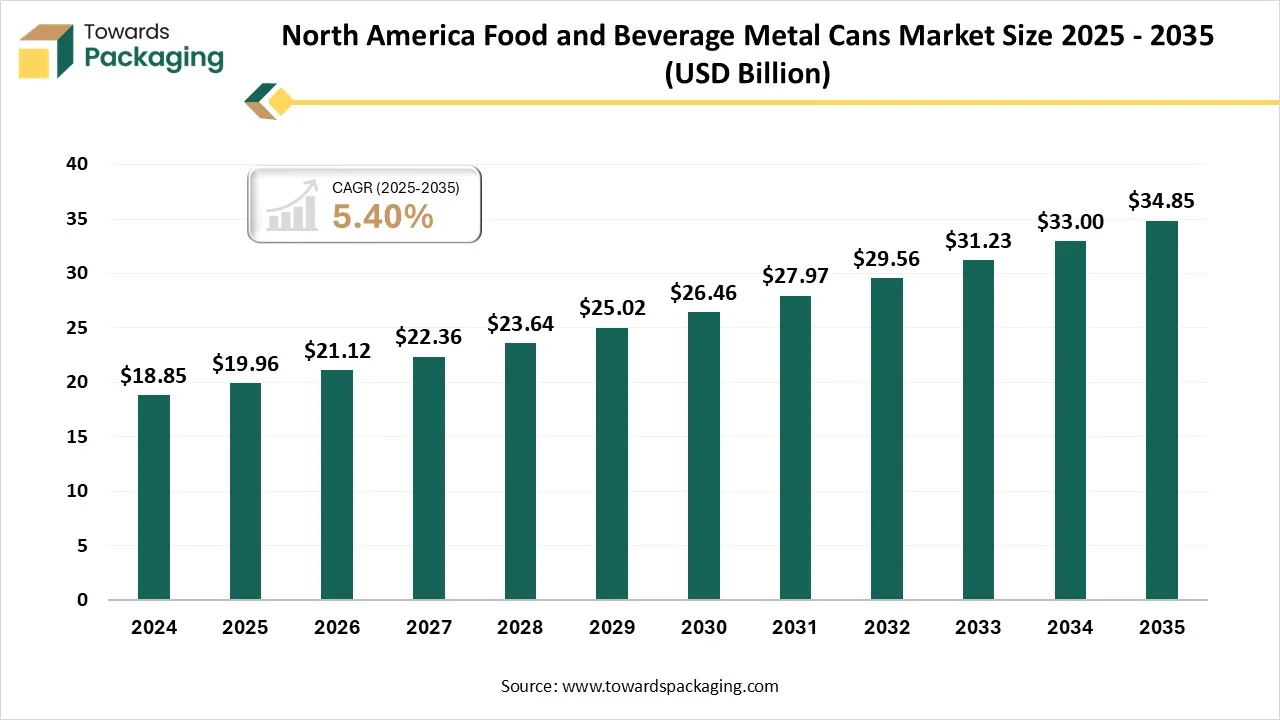

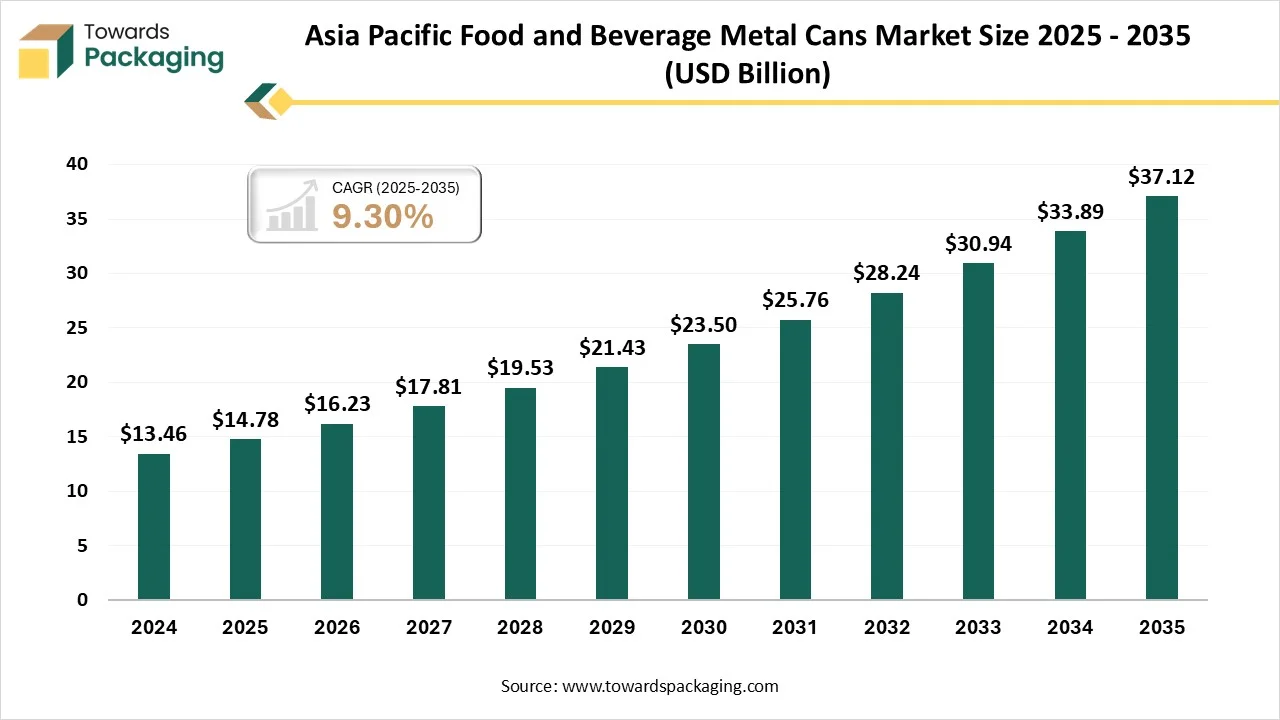

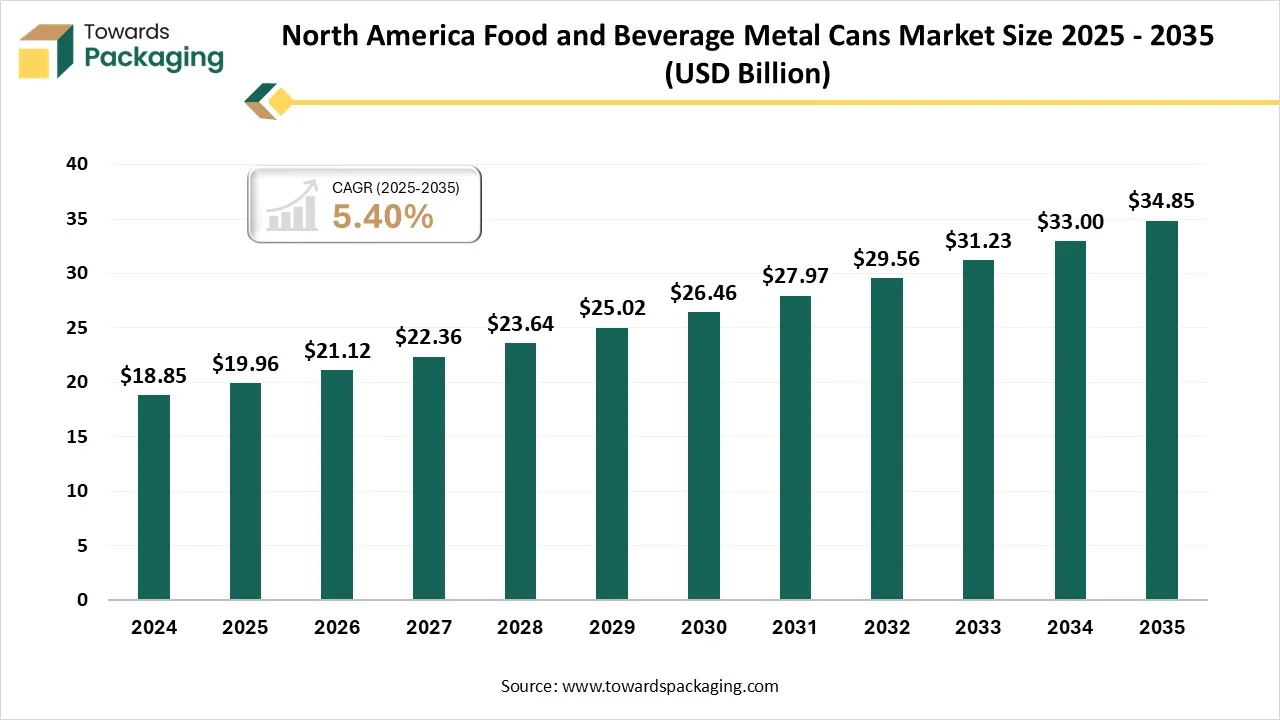

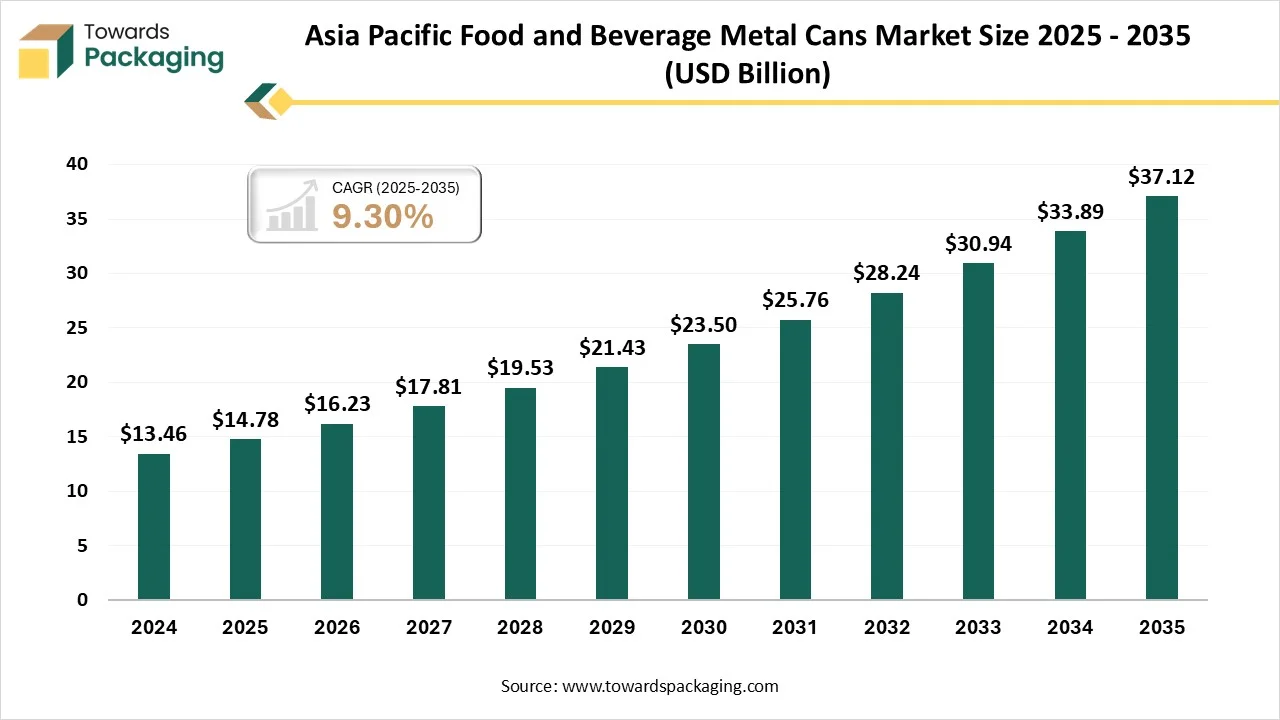

The region, North America, holds the greatest share in 2024, and Asia Pacific is the fastest-growing region. The food and beverage metal cans market is expanding quickly. The most common material type was aluminium cans. Beverage cans were dominated by product type. The medium can account for the largest can size, while the small can is set to grow quickly. By functionality, easy-open cans have dominated the food and beverage metal cans market. By distribution channel, the retail sales are the dominating one, while online sales are the fastest-growing segment.

Key Takeaways

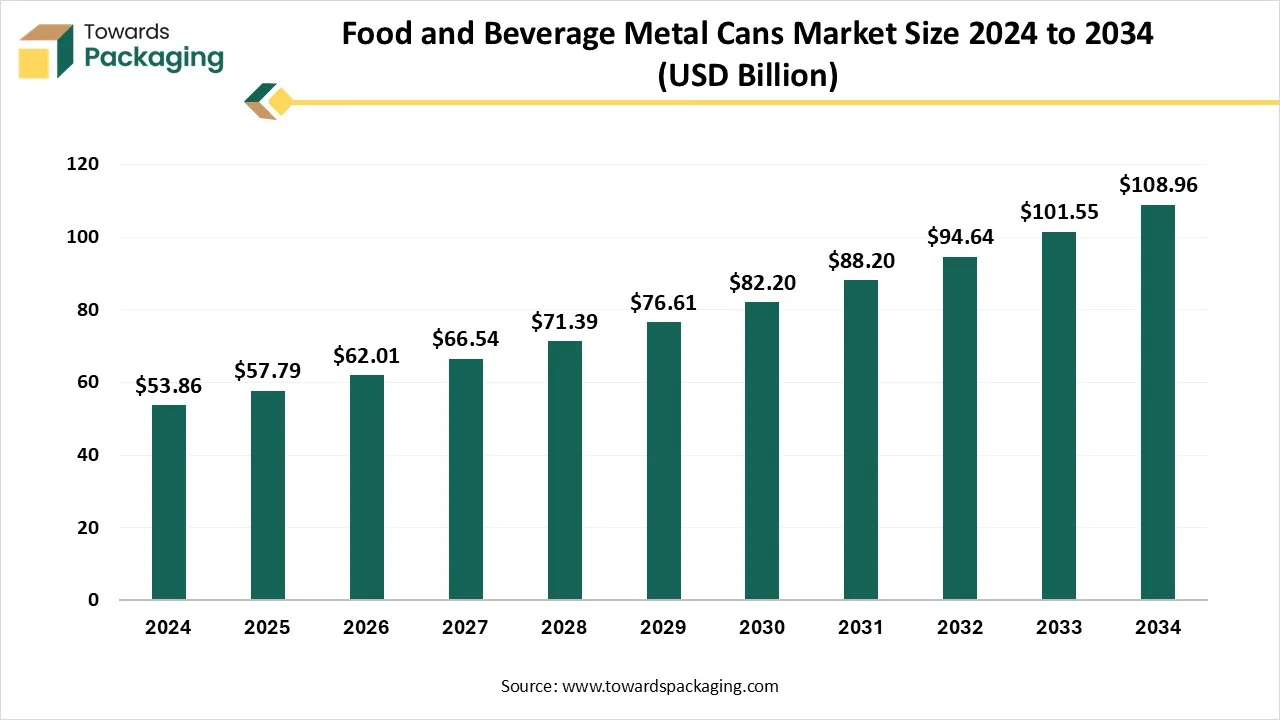

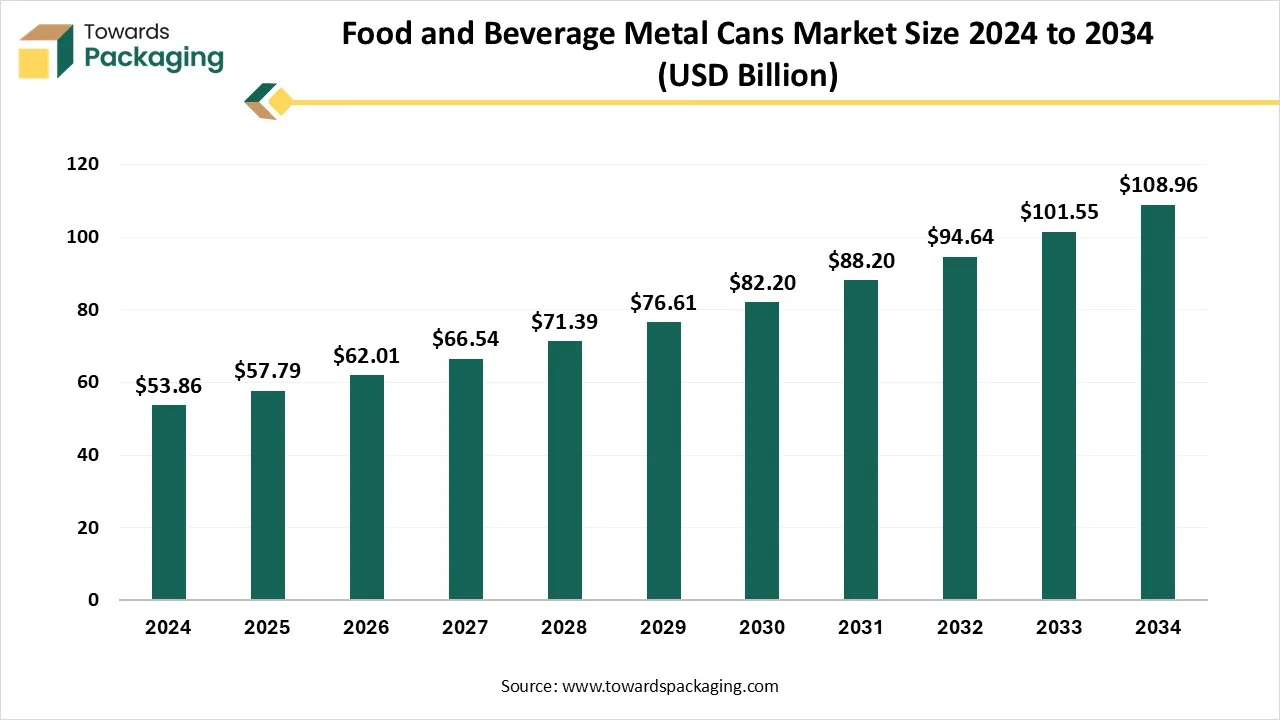

- In terms of revenue, the market is valued at USD 57.79 billion in 2025.

- The market is projected to reach USD 108.96 billion by 2034.

- Rapid growth at a CAGR of 7.3% will be observed in the period between 2025 and 2034.

- North America dominated the global market with the largest revenue share in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By material type, the aluminium cans segment contributed the biggest revenue share of 70% in 2024.

- By product type, the beverage cans segment contributed 50% revenue share in 2024.

- By can size, the medium can segment dominated the market in 2024 with a 40% share.

- By can size, the small can segment is expected to grow significantly over the studied period.

- By functionality, the easy-open cans segment dominated the market in 2024, with a share of 65%.

- By distribution channel, the retail sales segment had dominated the market by share 65% in the year 2024.

- By distribution channel, online sales are the fastest-growing segment over the upcoming years.

The food and beverage metal cans market refers to the manufacturing and distribution of metal containers, primarily made of aluminum or steel, used for packaging various food and beverage products. These cans provide a long shelf life, protection from contamination, and maintain the quality and taste of the contents. They are widely used for beverages such as soft drinks, beer, and energy drinks, and foods like vegetables, fruits, and ready-to-eat meals.

Food in cans is convenient to store without using energy. Cans are manufactured in different sizes and shapes to align with the various demands of users. For instance, up to 10,000 80 g cans can fit into one cubic metre. Metal packaging is hence specifically effective in production, storage, and transport, and lowers the risk of spoilage and spillage. To deliver additional stability, cans are often served with grooves, the "so-called" corrugations. These grooves have a functional aim. They allow the can to stretch and compact with temperature changes during the sterilisation procedure without distorting.

- In the year 2023, South America led the coffee consumption with 89.3 kilograms of 60-kilogram bags, followed by Asia and Oceania with 49.9 billion bags, and Africa had 20.1 million bags. By the year 2025, the average volume of coffee consumed per person at home is anticipated to be 0.79 kilograms.

- Sustainability: The new trend in packaging. Sustainability has become a main focus for both users and businesses. Like plastic, metal packaging -specifically steel and aluminium -serves infinite recyclability without loss of quality. In the United States, Ball Corporation has led the charge with its small Infinity Aluminum Bottle.

- Premiumization and Innovation: The trend of premiumization is changing metal packaging into a marketing tool. Craft beer and wine brands have implemented metal cans as a canvas for visually striking designs and innovation. One difference is that BrewDog, a craft beer company, has utilized glossy aluminum cans and high-resolution, full-body printing to convey its brand story.

- Smart packaging for engagement and security: As digital transformation transforms industries, metal packaging is changing to serve communicative and smart features. Near-field communication and QR Code tags included in the packaging provide users with instant access to brand stories, brand details, and promotions. Many companies have launched smart beer cans with embedded NFC Technology, which enable users to unlock exclusive content and marketing through their smartphones.

- Barrier properties and food preservation: The food sector's dependence on metal packaging stems heavily from its superior barrier properties. Metal cans provide rigid protection against moisture, light, and air, ensuring extended shelf life for food products. For instance, Del Monte utilises hermetically sealed metal cans to protect its fruits and vegetables without preservatives, entering into growing consumer demand for 'clean-label' products.

- Lightweight and cost optimization: The growing cost of raw materials has caused producers to discover lightweighting -lowering the amount of metal used without adjusting performance. Crown Holdings has been at the top in this area, generating ultra-light aluminum beverage cans, which are 10% lighter than standard cans. This invention not only lowers material costs but also decreases transportation emissions, which makes it a win for both producers and the surrounding environment.

The metal can industry hasn't remained motionless. Current inventions have led to the growth of Drawn and Wall iron (DWI) Cans, which show the main advancements in packaging technology. These cans are produced utilising a procedure that draws the metal into shape and then ironing the walls to receive the required thickness and power. DWI cans can serve required material savings as compared to regular can manufacturing procedures. By utilising drawing and ironing procedures, producers can create cans with thinner walls while tracking structural integrity.

This decrease in material usage translates to cost savings and environmental advantages, as less raw material is needed for each can generated. The environmental impact expands beyond material savings. Lighter cans need less energy transport, lowering the carbon footprint linked with distribution. Additionally, the aluminum used in several DWI Cans is highly recyclable, with recycled aluminum needing only 5% of the energy needed to generate new aluminum from raw materials.

Market Dynamics

Driver

Metal packaging for food has developed mainly over the years. Inventions such as easy-open lids, lightweight aluminum cans, and BPA-free linings have improved both sustainability and convenience. Brands continue to invest in research and development to develop food protection while lowering the environmental impact of packaging waste. Aluminium cans totally dominate the beverage industry, specifically in energy drinks, soft drinks, and beer packaging too. These cans are easy to stack, lightweight, and resistant to breakage, making them the preferred choice for producers. Furthermore, aluminum cans can chill beverages faster than other materials, enhancing the consumer experience.

Restraint

Metal cans are relatively expensive compared to plastic. First of all, the price of metal materials is relatively high. Secondly, the metal plating process needs assistance, which increases production costs. This may affect the competitiveness of metal cans in particular applications. As compared to lightweight packaging materials, such as metal cans, they are heavier. This may generate inconvenience during travelling and handling, because of energy consumption. For products that need lightweight packaging, metal cans may not be the best choice. Although metal cans have a particular degree of power and stiffness, they may still be damaged or deformed when affected by large external forces. Especially in high-intensity transportation and storage environments, the impact resistance of metal cans may be ineffective, affecting the safety of the content.

Opportunity

Metal packaging protects the world from exterior points, a specifically crucial job for the transportation of toxic substances and food and beverage ingredients. Metal packaging serves as an impenetrable barrier against pollutants from gases, chemicals, and bacteria. But packaging will be as secure as the weakest ink, and for several products, this is the closure. Cans are one of the most protected types of packaging because goods are securely packed at the canned factory, and it's a one-use open; once a can has opened, it can't be reclosed. Food and beverages demand a lot from their packaging format. The metal food packaging can resist the highest heating temperatures, which means the canning procedure can be utilised to protect meat, vegetables, and fish, which would otherwise spoil quickly. Sensitive foods can be steam-exhausted and packed hot to make sure all bacteria are killed, to keep the contents safe and fit to eat months later.

Segmental Insights

How did the Aluminium Cans Material Dominate the Food and Beverage Metal Cans Market?

Aluminium cans are dominating and the fastest growing due to several reasons, such as they are perfect for preserving food and beverages over extended periods. Like glass and plastic, aluminum is dense to oxygen and light, these two elements, which often lessen flavour and food quality. This feature is especially important for beverages and sensitive products, as it assists in maintaining freshness, taste, and nutritional value. For brands, this expanded shelf life translates into fewer returns because of spoilage and a developed customer experience. Buyers enjoy products that retain freshness for a longer time, whether on a retail shelf or in their pantry at home.

How did the Beverage Can Dominate the Product Type in the Food and Beverage Metal Cans Market?

The beverage material type has dominated the food and beverage market, as with the growth in the health and wellness industry, users are seeking beverages with functional advantages. From drinks that boost immunity to gut-health marketing drinks, the urge for health-oriented beverages is growing. Such chemical ingredients utilised in making these functional beverages are vitamins, prebiotics, and minerals. Producers are heavily using these ingredients to reassure concerned users about their health, who expect more advantages through beverage consumption. But a few products, namely collagen, antioxidants, and adaptogens, that were found to serve particular health benefits, have been included in beverages and are on the increase among buyers.

How did the Medium Cans Dominate the Can Size in the Food and Beverage Metal Cans Market?

Medium metal cans have dominated the industry as they initially deliver the protection to food products from physical damage, oxygen, and light while also serving a longer shelf life to the inside products of food and beverage containers, and also give easy transportation and storage. The integration of physical protection and barrier properties against expands the shelf life of food products, allowing them to be stored for longer periods without significant quality degradation. The stackable durability and nature of metal can make them perfect for effective transportation and storage, both for users and manufacturers.

Small Cans are the Fastest-growing Can Size in the Food and Beverage Metal Cans Market.

Small cans are initially made from tinplate (tin-coated plate), that are used in food packaging for many reasons: durability, preservation, and recyclability. They serve as an airtight seal to protect food from oxygen, moisture, and contaminants, expanding shelf life and preventing spoilage. Their rigidness ensures storage and transport, while their recyclability assists sustainability. The strength and rigidity of small cans prevent the food from exterior damage during transportation, handling, and storage, too. This lowers the risk of breakage and leakage, making sure the product reaches the users in perfect condition.

How did the Easy-open Cans Dominate the Functionality in the Food and Beverage Metal Cans Market?

Easy open cans are dominating and fastest growing in terms of functionality, caused by demand in FMCG and food and beverage, serve ultimate integrity and durability, and track freshness and flavor. With the cutting-edge technology, the metal sealing comes in lightweight and is safe for carrying. With the development in living standards, folks want their consumer goods in updated packaged solutions. From tea, coffee, dry powdered food, canned food, and jam to consumer goods, the peel ends have become the latest trend in the packaging industry. The base lids of Pell off ends are created from tinplate or aluminum with a multi-layered plastic membrane, sterilization at extremely high temperature (121 degrees Celsius) and high pressure, thus, the quality of the inside food remains undamaged. Users quickly get attracted to easily open cans because of their attractive colour appearance and easy opening performance.

How did the Retail Sales Dominate the Food and Beverages Metal Cans Market Distribution Channel?

Direct sales have dominated the market, which plays an important role in examining how products and services reach end-users. These channel series are from direct sales and online platforms to other integrators and distributors. Each channel has its own benefits, with real sales allowing companies to gain greater control over customer relationships and pricing; on the other hand, the third-party distributors can serve a huge market reach and faster scaling. The food segment, specifically in the canned fruit, vegetable, and meat, has experienced the greatest growth in metal cans. Rapid urbanisation, busy lifestyles, and rising preference for single-use packaging have also been growing in the food and beverage industry.

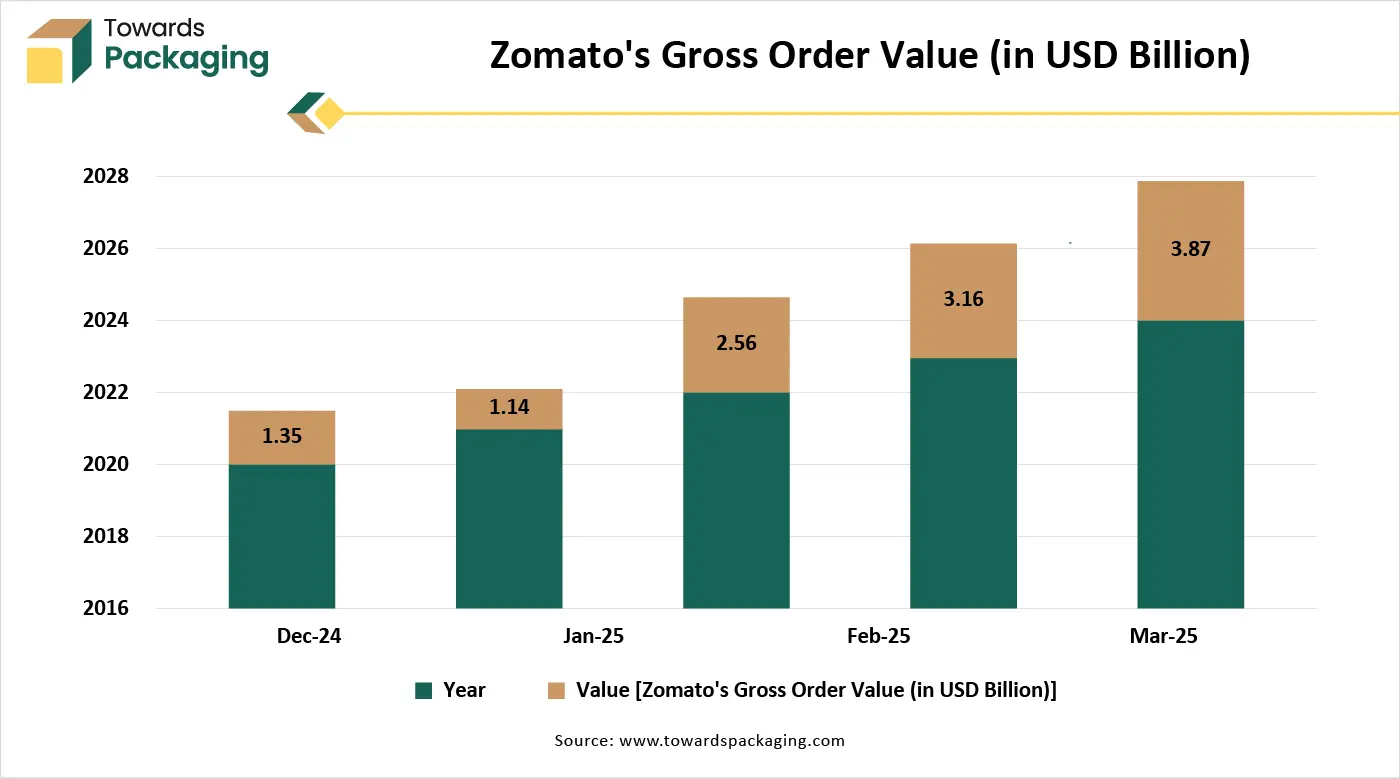

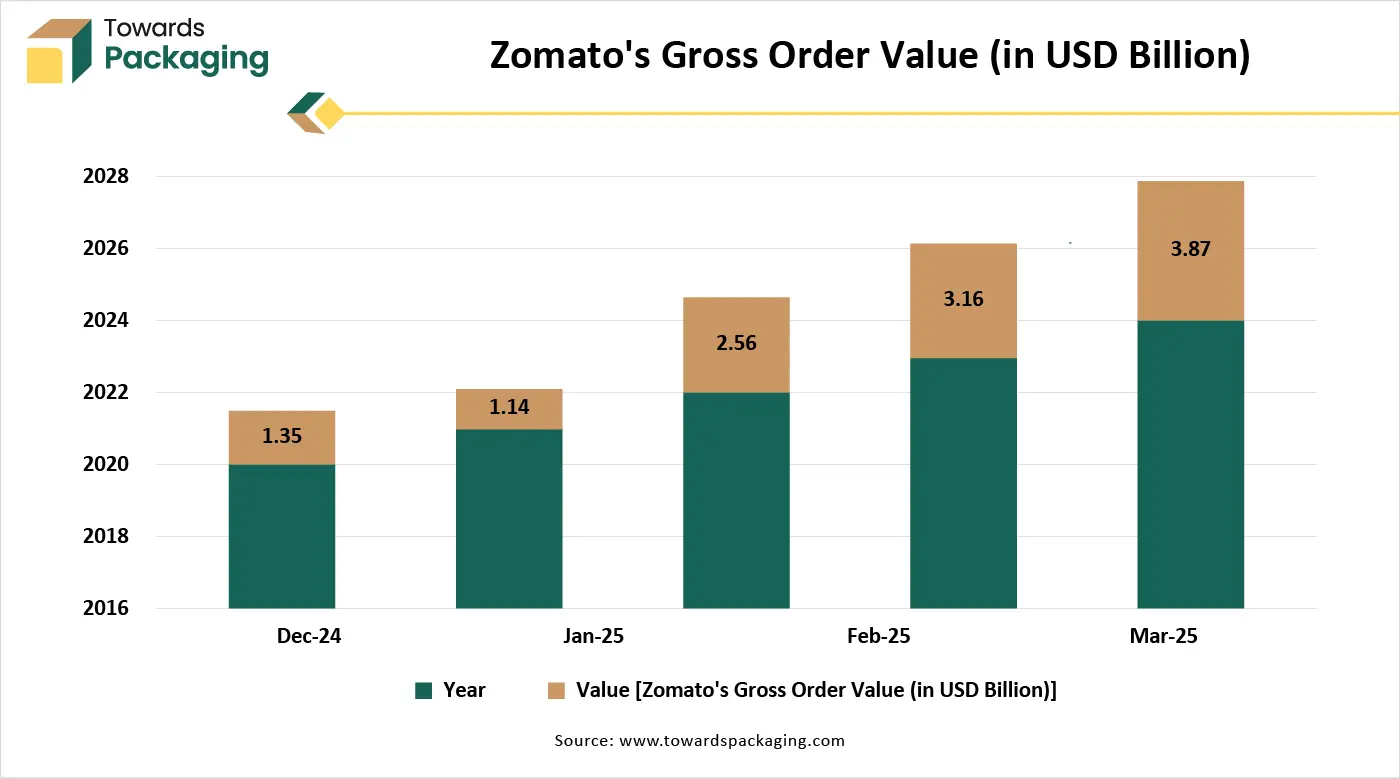

Online Sales are the Fastest-growing Food and Beverage Metal Cans Market.

The growth of online retail has significantly influenced the food and beverage metal cans industry. With the growing selection of convenience, users are shifting to e-commerce platforms for purchasing canned food and beverages. This transformation is due to busy lifestyles, and the expansion of online grocery shopping among youth, especially Gen Z and millennials, as they want every product at their doorstep ready, and they are perfect for well-suited online sales handling during shipping from one place to another. The growth in online subscriptions, on-the-go consumption, and ready-to-eat meals has led to the development of online sales in the food and beverage market.

By Region

How did North America Dominate the Food and Beverage Metal Cans Market?

North America has dominated the market because of the growth in metal can packaging of wine, cocktails, and both hard and soft drinks, heavily driven by rising demand for portability. The beverage sector's dependency on metal cans can be classified into two main categories: alcoholic and non-alcoholic. Also, beer has been the main food packaging, notably wine, other liquors, and glass bottles, too, are now making the transformation to metal cans. Organizations are investing in AI-based production automation, developing embossing technology, and corrosion-proof coatings. The importance is also on encouraging the extended producer responsibility (EPR)schemes, and the growing population of circular economy measures is stressing firms to move towards completely recyclable and renewable materials, such as metal can packaging.

U.S.

The U.S. food and beverage metal cans market benefits from strong demand for canned beverages, carbonated drinks, and ready-to-eat foods. The use of aluminum cans is supported by high recycling rates and reliable collection systems. To achieve sustainability goals, manufacturers are concentrating on lighter cans with more recycled materials. Innovation in can coatings and designs further boosts growth.

Asia Pacific is the fastest-growing region in the food and beverage metal cans market

The food and beverage metal cans markets in Asian countries like India, China, Japan, and South Korea are witnessing a transformative change, driven by urbanization, transforming consumer lifestyles, and growing demand for convenience. Inventions in sustainable packaging, moves in buyer decisions, and technological advancements are creating opportunities, shaping the industry's future prospects. Elements like the expansion of organized retail, uptick in exports, and growing middle-class income group are supporting the industry. Nanofabrication technologies are growing as cutting-edge solutions to make active materials for use in the design of coatings, packages, and packaging technologies. These solutions assist in maintaining and improving sensory and nutritional characteristics, developing shelf life, and increasing food safety.

India

India’s market is growing due to growing urbanization and the consumption of packaged foods and drinks. Adoption of metal cans is increasing due to increased awareness of food safety and longer shelf life. Stable demand is supported by the growth of organized retail and food processing industries. The use of recyclable metal packaging is being progressively promoted by sustainability initiatives.

MEA

The MEA market is supported by the demand for robust, long-lasting food packaging and the increase in beverage consumption. Due to their powerful barrier qualities, metal cans are more in demand in hot climates. Local manufacturing and food security investments are increasing market penetration but the regions infrastructure for recycling is still uneven.

UAE

The UAE market benefits from a strong hospitality, tourism, and food service sector. Steady growth is supported by the high demand for imported food items and canned beverages. Recyclable packaging options are encouraged by government sustainability initiatives. Demand for high-end products and sophisticated retail infrastructure supports the use of metal cans.

Value Chain Analysis

Raw Materials Sourcing

Metal cans are primarily made from aluminum and steel, sourced from mining and recycled scrap. Rising focus on lightweighting and recycled metal content supports sustainability goals.

Key players: Novelis, ArcelorMittal, UACJ, Norsk Hydro.

Logistics and Distribution

Efficient logistics are critical due to high production volumes and global beverage demand, with manufacturers relying on regional plants and just-in-time supply models.

Key players: Ball Corporation, Crown Holdings, Ardagh Group.

Recycling and Waste Management

Metal cans offer high recycling rates and strong circularity, though collection efficiency varies by region.

Key players: Novelis, Ball Corporation, Norsk Hydro.

- Ball Corporation

- Crown Holdings, Inc.

- Ardagh Group

- Can-Pack S.A.

- Tata Steel Limited

- BWAY Corporation

- Alcoa Corporation

- Silgan Containers

- Sonoco Products Company

- Amcor Limited

- General Steel Industries, Inc.

- Toyobo Co., Ltd.

- Rexam

- WestRock Company

- Mueller Industries, Inc.

- SAB Miller

- Constellium N.V.

- Tinplate Company of India Ltd.

- Zhejiang Materials Industry Group Corp.

- China National Petroleum Corporation

Industry Leader Announcement

- On 1 May 2025, MPE Partners disclosed that it had invested in and the simultaneous merger of Central Coated Products and Sun America to establish a new platform dedicated to serving inventive, custom, and high-performance food packaging solutions.

- On 24 June 2024, Sonoco Products Company, a top company in high-value sustainable packaging, revealed that it has entered into an agreement to acquire Evisosys, Europe's leading food cans, ends, and closures manufacturer, from KPS Capital Partners for approximately USD 3.9 billion.

Recent Developments

- On 25 February 2025, Axiom Foods disclosed the launch of Oryzatein 2.0, a rice protein which, as per the independent testing, has no detectable levels of heavy metals. The product that comes in both organic and isolate versions is made for use in food and beverages

- On 19 September 2024, Marigold Heath Foods partnered with Sonoco to reveal its fully recyclable packaging for a variety of plant-based food products that include sauces, stock cubes, and meat and fish alternatives.

By Material Type

By Can Type

- Tinplate Cans

- Aluminum Cans

By Product Type

- Beverage Cans

- Soft Drink Cans

- Beer Cans

- Energy Drink Cans

- Fruit Juice Cans

- Food Cans

- Vegetable Cans

- Fruit Cans

- Meat Cans

- Ready-to-Eat Meal Cans

By Can Size

- Small Cans (Under 250 ml)

- Medium Cans (250-500 ml)

- Large Cans (Above 500 ml)

By Coating Type

- Lacquer Coated Cans

- Non-Lacquer Coated Cans

By Functionality

- Easy-Open Cans

- Standard Cans

By Distribution Channel

- Online Sales

- Retail Sales

- Direct Sales

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa