Contoured Bottles and Containers Market Size, Trends, Share and Innovations

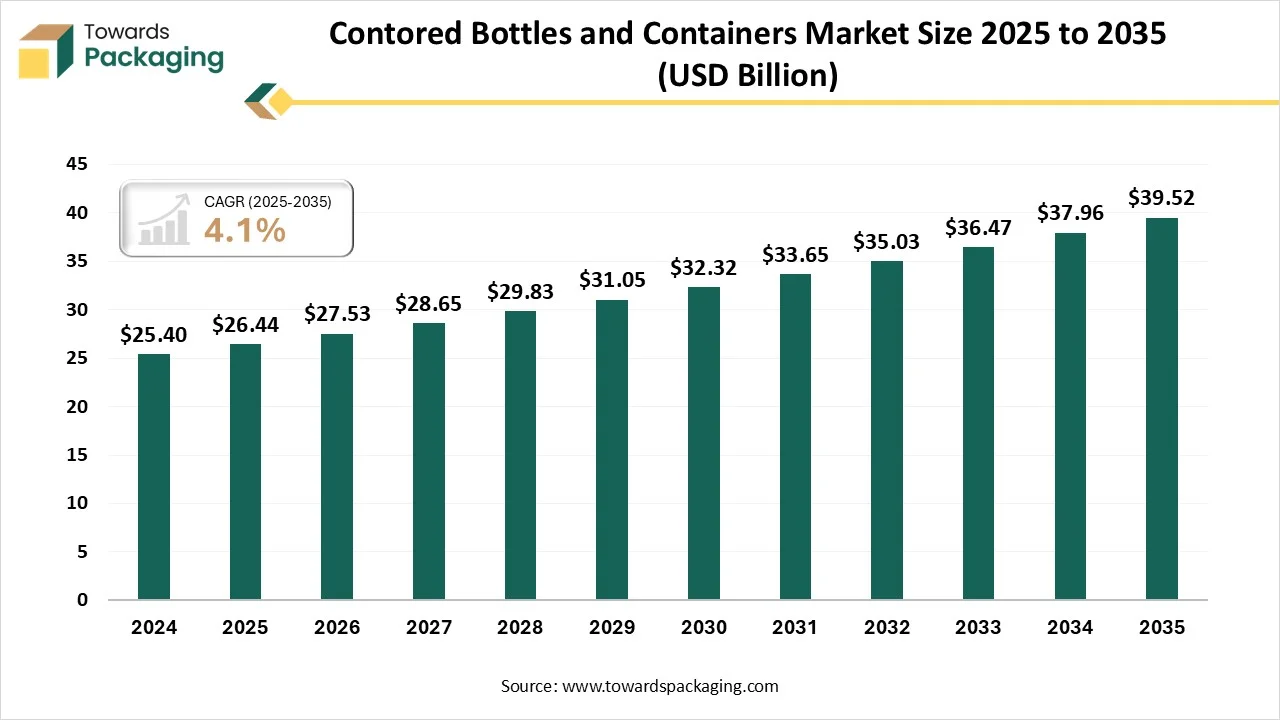

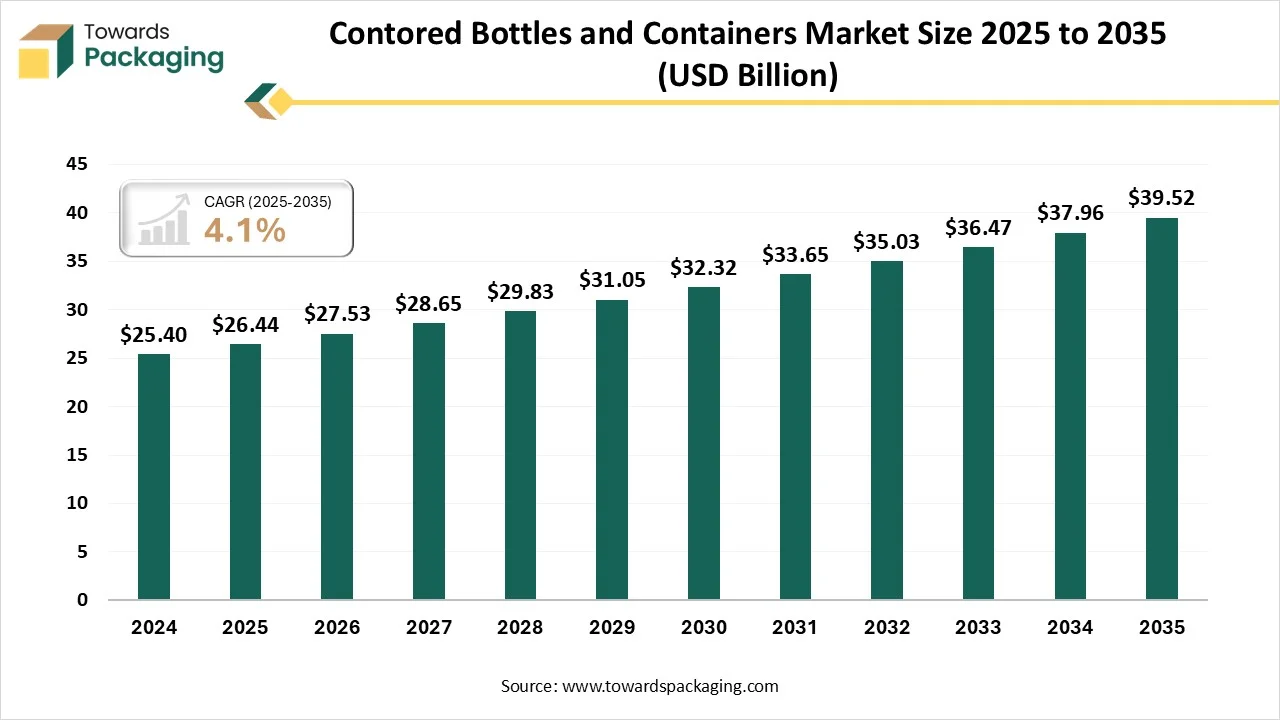

The contoured bottles and containers market is expected to increase from USD 27.53 billion in 2026 to USD 39.52 billion by 2035, growing at a CAGR of 4.1% throughout the forecast period from 2026 to 2035. This market is growing due to rising demand for visually distinctive, ergonomic, and brand-differentiating packaging across food, beverage, personal care, and pharmaceutical industries.

Key Takeaways

- By region, North America has dominated the market, having the biggest share of 42.5% in 2025.

- By region, Asia Pacific is expected to rise at the fastest CAGR between 2026 and 2035.

- By material, the PET segment contributed the largest share of 36.8% in 2025.

- By material, the bioplastics segment will grow at the fastest CAGR between 2026 and 2035.

- By product type, the beverage bottles segment has contributed to the largest market share of 42.3% in 2025.

- By product type, the personal care bottles segment will grow at the fastest CAGR between 2026 and 2035.

- By end-use industry, the food & beverage segment contributed the largest share of 40.2% in 2025.

- By end-use industry, the pharmaceuticals & healthcare segment will grow at the fastest CAGR between 2026 and 2035.

- By capacity, the 500-1,000ml segment has contributed the largest market share of 34.8% in 2025.

- By capacity, the 100-250ml segment will grow at the fastest CAGR between 2026 and 2035.

What Is Driving The Growth Of The Contoured Bottles And Containers Market?

The contoured bottles and containers market is gaining momentum as companies concentrate more on distinctive packaging designs to improve consumer recognition and shelf appeal. These containers provide better functionality, ergonomic handling, and strong brand differentiation for use in food, beverage, personal care, and pharmaceutical applications. Growing consumer demand for handling and strong brand differentiation for use in food, beverage, personal care, and pharmaceutical applications. Growing consumer demand for high-end packaging and eco-friendly design innovations is boosting market growth.

Market Trends

- Industry Growth Overview: The market is growing due to rising demand for attractive, ergonomic packaging across the food, beverage, and personal care industries, supported by advances in packaging design and molding technologies.

- Sustainability Trends: Manufacturers are adopting lightweight, recyclable, and PCR-based materials to reduce environmental impact while maintaining distinctive contoured designs.

- Startup Ecosystem: Startups drive innovation through customized designs, sustainable materials, and digital manufacturing techniques to serve premium and niche brands.

Key Technological Shifts

- Adoption of advanced blow-molding and injection-molding technologies for complex contoured shapes

- Integration of post-consumer recycled (PCR) and bio-based materials

- Use of 3D design software and rapid prototyping for faster product development

- Improved barrier and durability properties without compromising design

- Automation and smart manufacturing for consistent quality and cost efficiency

Trade Analysis

- According to Global Export data, between Jun 2024 to May 2025 (TTM), the world exported 10,688 shipments of bottles to India. These were handled by 1803 exporters and bought by 1301 India buyers, with growth rate of 34% comparing previous year.

- Most of the bottles exports from the world is destined for the United States, Vietnam, and Ukraine.

- Globally, the top three exporters are the United States, China, and Vietnam, with China leading at 473,507 shipments, followed by Vietnam with 96,592 , and the U.S. with 94,791 shipments.

Value Chain Analysis

Raw Materials Sourcing

Raw materials such as plastics, glass, and aluminum are sourced with increasing use of recycled inputs.

- Key players involved across sourcing and manufacturing include Amcor, Berry Global, ALPLA Group, Gerresheimer, and Ardagh Group, supported by strong supplier networks.

Supply to Government and Airlines

Lightweight and durable contoured packaging is supplied for government distribution programs and airline catering.

- Major players such as Amcor, Huhtamaki, Berry Global, and Nampak actively serve institutional and aviation-related packaging requirements.

Aftermarket Services and Upgrades

Aftermarket services focus on redesign, customization, and sustainability upgrades of existing packaging.

- Companies like ALPLA Group, Gerresheimer, AptarGroup, and Silgan Holdings offer value-added services to enhance functionality and brand appeal.

Material Insights

Why Did PET Segment Dominate the Contoured Bottles And Containers Market?

The PET segment dominated the contoured bottles and containers market with 36.8% share, primarily due to its affordability, great clarity, high durability, and lightweight design. PET is perfect for food, drink, and personal care products because it has strong barrier qualities against moisture and gases. Manufacturers looking for scalable and compliant packaging solutions are more likely to use it because of its extensive recyclability and well-established global supply chain.

Bioplastics emerged as the fastest-growing material segment during the forecast period, driven by growing consumer demand for environmentally friendly packaging and growing sustainability regulations. The transition to plant-based and biodegradable materials is being accelerated by growing regulatory pressure to reduce plastic waste as well as brand commitments to carbon neutrality. Wider adoption is also being supported by technological advancements in strength and shelf-life performance.

Product Type Insights

Why Did Beverage Bottles Dominate the Contoured Bottles And Containers Market?

Beverage bottles accounted for the largest share at 42.3%, encouraged by a high intake of functional beverages, juices, carbonated drinks, and bottled water. Beverage manufacturers find contoured designs very appealing because they improve grip, branding appeal, and consumer convenience. Additionally, the market gains from ongoing innovation in ergonomic and lightweight bottle designs.

Personal care bottles represent the fastest-growing product segment during the forecast period, fueled by rising demand for cosmetics, skincare, haircare, and hygiene products. Premium aesthetics, customization, and ergonomic dispensing designs are key growth drivers. Expanding e-commerce sales and increasing grooming awareness across emerging markets further boost demand.

End Use Industry Insights

What Made Food & Beverage Dominate the Contoured Bottles And Containers Market?

The food & beverages segment led the market with a 40.2% share, due to the increased demand for ready-to-drink items, packaged foods, and solutions with longer shelf lives. Contoured bottles ensure product safety while increasing handling effectiveness and brand differentiation. Strong demand in the market is still being maintained by rising urbanization and shifting eating habits.

Pharmaceuticals & healthcare is the fastest-growing end-use segment during the forecast period, driven by the need for tamper-evident packaging, rising healthcare costs, and increased pharmaceutical production. Contoured containers are becoming more popular for syrups, supplements, and medical liquids because they provide accurate dosing, simple handling, and regulatory compliance.

Capacity Insights

Why Did 500-1000ml Dominate the Contoured Bottles And Containers Market?

The 500-1000 ml capacity segment dominated with a 34.8% market share, because it is frequently utilized in drinks, home goods, and personal hygiene products. This size range serves both individual and family consumption by providing the best possible balance between volume and convenience because of its high turnover and standardized production lines. Manufacturers prefer this market.

100-250 ml segment is the fastest growing during the forecast period, supported by rising demand for premium small volume goods, trial packs, and travel size items. Adoption is accelerated by growth in personal care, pharmaceutical, and nutraceutical products, particularly in urban and mobile consumption trends.

Regional Analysis

Why Did North America Dominate the Contoured Bottles And Containers Market?

North America led the contoured bottles and containers market with a 42.5% share, driven by stringent quality standards, a high consumption of packaged and robust packaging innovation. Consistent demand is supported by the existence of significant beverage, pharmaceutical, and personal care brands. Regional dominance is further strengthened by cutting-edge recycling infrastructure and sustainability initiatives.

U.S. Contoured Bottles and Containers Market Trends

The U.S. contoured bottles and containers market remains strong, supported by the widespread use of personal care items, medications, and packaged drinks. Strict packaging safety and quality standards, as well as brand differentiation through ergonomic and high-end bottle designs, are what drive demand. The market is still expanding due to the growing use of lightweight, environmentally friendly packaged options and recyclable PET.

Asia Pacific expects the fastest growth in the market during the forecast period, because of growing food, beverage, and personal care industries, fast urbanization, and rising disposable incomes. The demand for contoured bottles and containers is rising dramatically throughout the region due to expanding manufacturing capacity, increased export activity, and a move toward contemporary retail and packaged goods.

India Contoured Bottles and Containers Market Trends

India represents a rapidly expanding market for contoured bottles and containers, driven by growing urbanization, rising disposable incomes, and expanding consumer demand for packaged foods, drinks, and personal care items. Adoption is accelerated by the move toward organized retail, the growth of pharmaceutical manufacturing, and the rising demand for handy compact packaging. Long-term market expansion is also aided by government programs that support sustainable packaging and plastic recycling.

Europe is growing steadily in contoured bottles and containers, motivated by strict sustainability laws, ambitious recycling goals, and the broad use of bio-based and recyclable packaging materials. The food and beverage, personal care, and pharmaceutical industries all contribute to the demand, with brands increasingly concentrating on premium, lightweight, and ergonomic bottle designs to satisfy consumer and regulatory demands.

Germany Contoured Bottles and Containers Market Trends

Germany is a key market in Europe, due to its advanced packaging manufacturing capabilities and strong beverage and pharmaceutical sectors. The country’s well-established recycling infrastructure and leadership in circular economy initiatives are encouraging the use of recyclable PET and innovative contoured designs. High-quality standards and technological innovation continue to support steady demand.

The Middle East & Africa are growing steadily, supported by increased demand for packaged personal care products, increased access to healthcare, and increased consumption of food and beverages. Increased adoption is a result of urbanization, tourism-driven consumption, and investments in packaging manufacturing, especially in major African markets and GCC nations.

UAE Contoured Bottles and Containers Market Trends

The UAE market is supported by a growing tourism and hospitality sector. The country’s focus on premium packaging, modern retail expansion, and sustainability initiatives is boosting the use of contoured and visually appealing bottle designs. Increasing investments in local packaging production further support market growth.

South America is an emerging market for contoured bottles and containers, driven by growing middle-class populations, better retail infrastructure, and increased consumption of packaged foods and drinks. To improve shelf appeal and functionality, brand owners are progressively implementing cost-effective and ergonomic packaging formats, which is propelling steady market expansion throughout the region.

Brazil Contoured Bottles and Containers Market Trends

Brazil leads the South America market, backed by strong demand from the pharmaceutical, personal care, and beverage sectors. Large-scale beverage consumption, rising PET packaging usage, and a growing emphasis on recyclable materials are the main drivers of growth. The market outlook is being strengthened by the growth of domestic manufacturing and the advancement of sustainable practices.

Recent Developments

- In November 2025, Sidel introduced Evo BLOW Laser technology to the Middle East at Gulfood Manufacturing 2025. The launch targets regional beverage producers seeking efficient, high-speed PET bottle production. It supports advanced bottle shaping and energy savings, which are important for large-scale bottling operations.

- In December 2025, Amcor plc launched advanced stretch blow molding technology for lightweight PET bottles with improved pressure resistance and lower material use. This new technology helps beverage producers reduce plastic use while maintaining bottle strength. It also enables more efficient production with less energy consumption.

- In March 2024, The Coca-Cola Company debuted redesigned lightweight PET bottles with new contoured shapes for its sparkling beverage portfolio in North America. Coca-Cola introduced these redesigned bottles with thinner walls and more efficient shapes to reduce plastic use while maintaining strength and brand appeal. This supports industry trends toward lightweighting and sustainability in contoured containers.

- In July 2025, Cola NEXT introduced an advanced, eco-friendly PET bottle design in Pakistan that uses 8–10% less plastic, with a new cap for better sealing and freshness. This development marks a local benchmark in sustainable contoured beverage bottles, lowering material use while improving performance. It addresses environmental concerns and supports lighter, more efficient bottle formats.

Top Companies

- Amcor plc: Global leader in sustainable, lightweight packaging solutions across diverse industries.

- Berry Global, Inc.: Specializes in innovative, engineered plastic packaging with an emphasis on the circular economy.

- Plastipak Holdings, Inc.: Provides integrated plastic packaging solutions for beverage and consumer products, a leader in PET recycling.

- ALPLA Werke Alwin Lehner GmbH & Co KG: International provider of customized plastic bottles and caps, known for environmental innovation and recycling expertise.

Other Players

- Silgan Holdings Inc

- Graham Packaging Company, L.P.

- Gerresheimer AG

- O-I Glass, Inc.

- Nampak Ltd.

Contoured Bottles and Containers Market Segments Covered in the Report

By Material

- PET

- HDPE

- PP

- LDPE

- PS

- Glass

- Metal

- Bioplastics

By Product Type

- Contoured Beverage Bottles

- Personal Care Bottles

- Pharmaceutical Containers

- Household & Industrial Containers

- Specialty & Custom-Shaped Containers

By End-Use Industry

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Household & Industrial Chemicals

- E-commerce & Logistics

By Capacity

- Below 100 ml

- 100–250 ml

- 250–500 ml

- 500–1,000 ml

- Above 1,000 ml

By Regions

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA