Caps for Returnable Glass Bottles Market Size, Share, Trends and Forecast Analysis

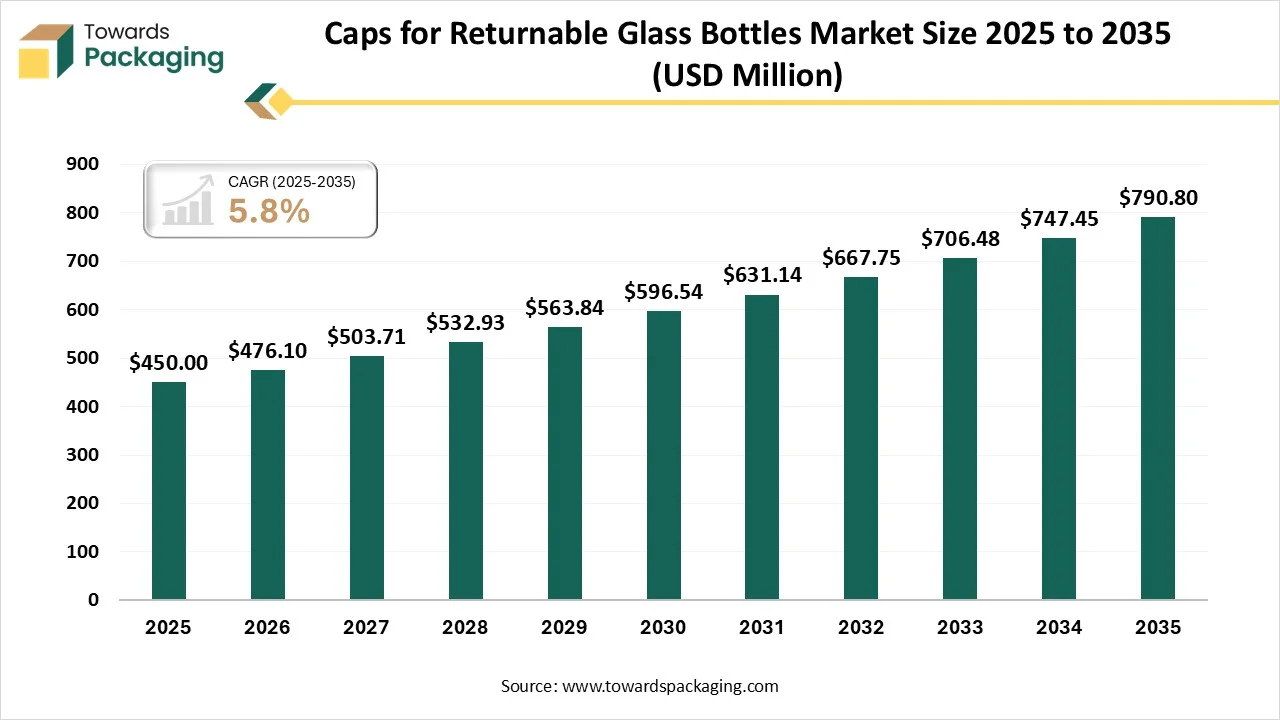

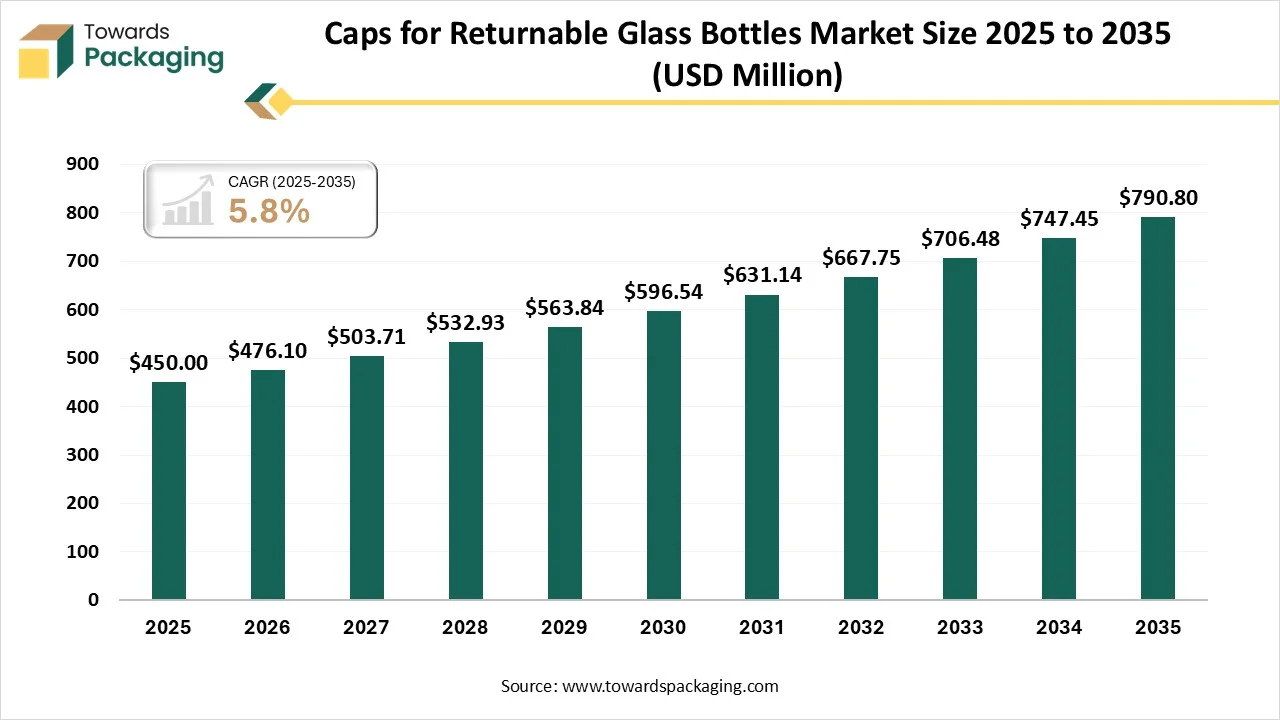

The caps for returnable glass bottles market is forecasted to expand from USD 476.1 million in 2026 to USD 790.8 million by 2035, growing at a CAGR of 5.8% from 2026 to 2035. The developing worldwide focus on sustainability, usage of strict regulations related to single-use plastics, and the acceptance of circular economy practices are crucial factors that drive the returnable glass bottle industry growth.

Major Key Insights of the Caps for Returnable Glass Bottles Market

- In terms of revenue, the market is valued at USD 450 million in 2025.

- The market is projected to reach USD 790.8 million by 2035.

- Rapid growth at a CAGR of 5.8% will be observed in the period between 2026 and 2035.

- By region, Asia Pacific has dominated the global market by holding the highest market share in 2025.

- By region, North America is expected to grow at the fastest CAGR from 2026 to 2035.

- By product type, the screw caps segment dominated the market in 2025.

- By product type, the flip-flop segment will be developing at a significant CAGR between 2026 and 2035.

- By material, the plastic segment dominated the market in 2025.

- By material, the bio-based material segment will be growing at a main CAGR between 2026 and 2035.

- By application, the alcoholic beverages segment dominated the market in 2025.

- By application, the non-alcoholic beverages segment will be developing at a significant CAGR between 2026 and 2035.

- By distribution channel, the direct sales (OEM contracts) have dominated the market in 2025.

- By distribution channel, the distributors and wholesalers segment will be growing at a main CAGR between 2026 and 2035.

What is Caps for Returnable Glass Bottles Market?

The caps for returnable glass bottles market is defined as the tailored industry of the packaging sector that concentrates on the closures crafted for glass containers for several use-cycles through professional washing, collection, and refilling too. This industry includes the production, design, and distribution of closures that deliver a tamper-evident and airtight seal for reusable glass packaging.

Trends in Caps for Returnable Glass Bottles Market

- Eco-friendly and Sustainable Design: Sustainability is the current term in packaging trends. Organizations are accepting sustainable practices, which range from lightweight glass bottles that reduce carbon footprint to developing reuse. Such innovative designs are not only eco-friendly for conscious users but also enable organizations to stay in line with international environmental standards.

- Smart Packaging Technology: The use of the latest technology in sunglass packaging is developing. NFC tags, QR codes, and augmented reality characteristics are being mixed into cosmetic container designs to serve consumers with usage information, product details, and even online brand experiences.

- Rising Demand for Luxury Packaging: Premium brands now give importance to high-tech glass bottles as they talk about exclusivity and quality. There are Asian glass bottle producers that are implementing accurate engineering and innovative technology to serve perfect packaging solutions for high-end product lines.

Technological Developments in the Caps for Returnable Glass Bottles Market

Digital transformation is linked to the mixing of digital technologies into every aspect of production. In the glass bottle sector, this points to developing tools such as data analytics, automation, and IoT ( Internet of Things) in order to update glass bottle manufacturing. Robotics and AI-driven machines are simplifying the procedure, like cooling, molding, and quality checking, too. IoT-allowed devices check machine failures before they occur, which lowers changes. Apart from this, sensors and software provide real-time insights into manufacturing smoothness and lower the downtime and waste.

Trade Analysis of Caps for Returnable Glass Bottles Market: Import & Export Statistics

- According to the global data, the world has imported 32,657 shipments of glass bottles from India from June 2024 to May 2025.

- The imports were supplied by 882 Indian exporters to 2,296 overall buyers, that has marked a development rate of 5% as compared to the previous twelve months.

- Within this period, in May 2025 alone, the globe has officially imported 2,741 glass bottle shipments from India.

- The globe has imported most of its glass bottles from India, China, and Ukraine.

- Worldwide, the leading three importers of glass bottles are Vietnam, the United States, and Mexico.

- The United States has topped the globe in terms of glass bottles imported, with a number of 183,486 shipments, followed by Vietnam with 40,518 shipments, and lastly Mexico which has taken the third position with 21,899 shipments.

Caps for Returnable Glass Bottles Market - Value Chain Analysis

Package Design and Prototyping: Returnable glass bottle packaging should be washable, strong, and crafted for several use cycles. It must firmly stand with logistics and industrial washing. These are used, for instance, to glass bottles, flasks, jars, or transport containers.

Recycling and Waste Management: Returnable packaging (RVAC) is a system that markets the return of empty bottles to producers for the aim of reuse. This machine is mainly for making sure a circular economy and lowering the environmental impact of glass bottles. With the help of VAR, all empty bottles are being gathered from users and returned to producers, who clean them, sterilize, and even reuse them to bottle current mineral water.

Logistics and Distribution: A localized supply chain is the unwanted hero of a successful resume machine. By giving importance to regional manufacturing, processing, and collection, producers can receive many advantages, such as localized supply chains that avoid emissions linked with the transportation of bottles over a long distance. Every kilometer saved in transportation translates to a significant reduction in terms of greenhouse gas emissions.

Segmental Insights

Product Type Insights

How Screw Caps Segment Dominated the Caps for Returnable Glass Bottles Market in 2025?

The screw caps segment has dominated the market in 2025, as they are one of the differentiated elements of screw closures because of their simplicity. They are convenient to open and seal, which makes them perfect for beverages that are consumed over a period of time. Scientists showcase that resealable closures, such as screw designs, develop user satisfaction by 40% as compared to non-resealable alterations.

The flip-flop segment is predicted to witness the fastest CAGR during the forecast period. They are also known as swing top glass bottles, which have a metal wire bail closure and a rubber or silicone gasket, making them highly accessible as a reusable and returnable option for keeping different beverages. Such caps deliver an airtight and leakproof seal, which makes them a perfect choice for storing the ingredients fresh.

Material Insights

How Plastic Segment Dominated the Caps for Returnable Glass Bottles Market in 2025?

The plastic segment has dominated the market in 2025, as manufacturing glass is an energy-intensive procedure and uses a large amount of energy. The raw materials are being substituted in a furnace in which they are heated to 2600-280 degrees Fahrenheit for melting. The temperature is then lowered as the molten glass is cut, blown, and molded into its final bottle shape. The glass creation process needs energy, which is equal to 3.0 grams of C02 per 1.0 gram of glass.

The bio-based material segment is predicted to witness the fastest CAGR during the forecast period. A bio-based product is completely made from plant-based and renewable raw materials. This kind of material is BPA-free, strong, and odorless, which makes it perfectly accessible for reuse applications. This material hence points not only to replacing plastic with a sustainable material, but also makes them aware of residual streams that can go to waste. These water bottles are usually biobased and made from renewable resources such as sugarcane.

Application Insights

How the Alcoholic Beverages Segment Dominated the Caps for Returnable Glass Bottles Market in 2025?

The alcoholic beverages segment has dominated the market in 2025 because luxury alcohol brands have been focusing on sustainable glass packaging, which gives importance to glass bottles. It has a lower carbon footprint and recyclability, too, particularly when generated by using renewable energy sources. The application of wind or solar power in glass manufacturing mainly avoids depending on fossil fuels, hence, lowering the greenhouse gas emissions linked with the manufacturing procedure.

The non-alcoholic beverages segment is expected to witness the fastest CAGR during the forecast period. Glass packaging is utilized to keep different types of beverages. Such bottles are most frequently used by producers of juices, alcohol, and carbonated and non-carbonated minerals and spring water, too. Beverage storage is meant to meet various quality needs, like transparency, glass thickness, and complete hygiene standards, just to name a few.

Distribution Channel Insights

How did the Direct Sales (OEM Contracts) Segment Dominate the Caps for Returnable Glass Bottles Market in 2025?

The direct sales segment has dominated the market in 2025 as brands serve particular designs, and the OEM producer generates bottles to those exact specifications. Contracts usually include “ tooling” fees for making tailored molds. Such bottles should align with strong and durable standards to remain consistent with various wash and refill cycles. Hence, the current contracts frequently mention lightweight but hard glass technologies to lower the carbon footprint and breakage.

The distributors and wholesalers segment is expected to witness the fastest CAGR during the forecast period. A deposit return scheme, or a DRS, involves the use of investments to return plastic or glass to retail stores, in the way they are recycled and collected. An additional fee is being added to the retail sale of the bottled drinks, and the user can update which fee when the empty bottle is returned to a collection point. By using the returnable glass bottles, bottle care not only develops the bottle's look, but it also directly develops an eco-friendly track record. A returnable option is necessary to develop sustainability.

Regional Insights

How Has Asia Pacific Dominated the Caps for Returnable Glass Bottles Market?

Asia Pacific has dominated the market in 2025, as this market includes overall brands and the latest innovators. Several of the main players are stretching their product lines and changing their partnerships to attract other companies to stay competitive. Several of them are using automation, sustainability, and digital tools to practise in order to align with changing user demands. Overall, competition is changing as both well-established organizations and latest market entries focus on a fast-growing industry.

India is utilizing the Caps for Returnable Glass Bottles Market Crucially, as glass is largely utilized in several parts of the globe, which have enough procedures set up for glass recycling. It is also widely available in the form of raw materials which are silica sand, limestone and soda ash too which makes its eco-friendly impact lesser than plastic. Its manufacturing needs a large amount of energy, but utilising a cullet (glass can be recycled) lowers the melting point, which decreases carbon dioxide emissions.

North America expects the fastest growth in the market during the forecast period, it has emerged as an important segment in the huge packaging sector, which is being driven by the growing user demand for sustainable and eco-friendly packaging solutions. At the current state, North America stands as a main centre for caps for returnable glass bottles, with the United States leading the charge due to its excess beverage sector and strong recycling design. The industry is experiencing innovations in material durability, bottle designs, and logistics that develop the attractiveness and feasibility of returnable machines.

The Caps for Returnable Glass Bottles Market is growing in Canada to make a simple transformation, policymakers need the two entities that track the DRS to create the latest PRO. The central design for tracking EPR programs through a PRO is more prevalent in Canada, where most of the provinces have current EPR for the packaging programs and the DRSs. In Quebec, the current PRO and the Quebec Beverage Container Recycling Association have been mandated by the regulatory body, Recyc-Quebec, to manage usage of the recycling program, such as funding for the latest return location.

Recent Developments

- In September 2025, Poland introduced the beverage container DRS to increase national circularity. The system designed for expansion of recycling, with target collection of 77% in October and 90% by 2029.

- In February 2025, to complete the aim of reducing plastic waste, Tokyo-based Fuji Mineral Water has revealed the latest mineral water product which is packaged in an aluminum bottle.

Top Companies in the Caps for Returnable Glass Bottles Market

- Amcor Plc

- Crown Holdings Inc.

- Silgan Holdings Inc.

- Berry Global Group

- AptarGroup Inc.

- Guala Closures Group

- BERICAP GmbH & Co. KG

- ALPLA Group

- Closure Systems International

- Herti JSC

Caps for Returnable Glass Bottles Market Segments Covered

By Product / Cap Type

- Screw Caps

- Flip-Top / Snap Caps

- Crown Caps

- Tamper-Evident Caps

- Dispensing Caps

By Material

- Plastic

- Metal

- Rubber / Elastomers

- Bio-based / Sustainable Materials

By Application

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Growing

- Pharmaceuticals

- Personal Care & Cosmetic

- Food

By Distribution Channel

- Direct Sales (OEM Contracts)

- Distributors & Wholesalers

- Aftermarket / Replacement Caps

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Tags

FAQ's

Select User License to Buy

Figures (1)