Packaging Market Size, Growth Forecast, and Industry Trends

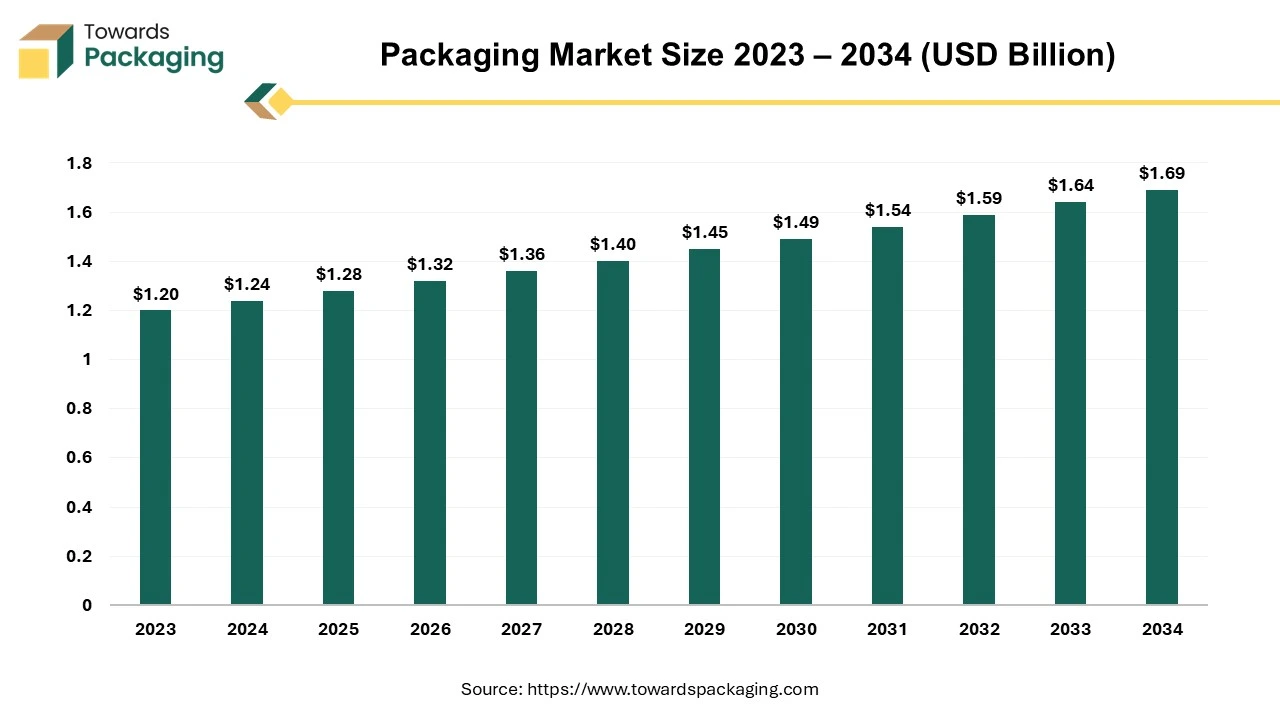

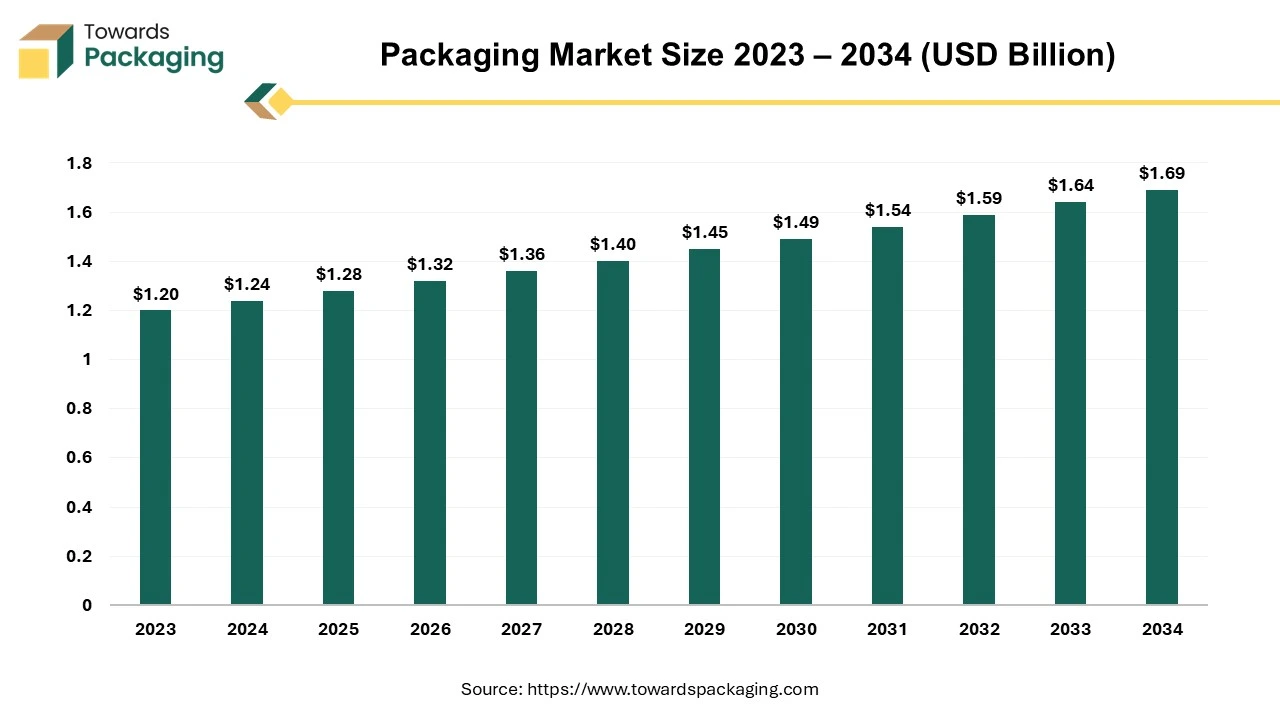

The global packaging market size reached a size of USD 1.24 trillion in 2024 and is projected to grow to USD 1.69 trillion by 2034, expanding at a CAGR of 3.16%. The Asia-Pacific region leads the market, with North America expected to grow significantly during the forecast period.

The paper & paperboard segment dominated the market, while rigid packaging holds the largest share in terms of packaging type. The flexography printing technology is leading the industry, and the food & beverages sector remains the primary end-user. Major companies such as Smurfit Kappa, Mondi PLC, and WestRock Company are actively contributing to market advancements.

Major Key Insights of Packaging Market

- Asia Pacific dominated the packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By material, the paper and paperboard segment led the packaging market in 2024.

- By packaging type, the rigid packaging segment held the largest share in 2024.

- By printing technology, the flexography segment dominated the market in 2024.

- By end user, the food & beverages segment dominated the packaging market in 2024.

Packaging Market: Storage & Transportation of Goods

Packaging is known as the process of designing, evaluating, and producing containers or wrappers for products. It plays a crucial role in protecting goods during storage, distribution, and sale. Packaging not only ensures the product reaches the consumer in good condition but also serves as a marketing tool, communicating brand identity and product information.

Packaging safeguards products from contamination, damage, and tampering during transportation, storage, and handling. It helps in preserving the quality and extending the shelf life of perishable items. Packaging facilitates ease of handling, storage, and usage of the product. It serves as a medium for conveying information such as usage instructions, nutritional information, and branding.

The packaging industry encompasses all businesses and activities involved in the design, production, and distribution of packaging materials and solutions. It is a vital sector in the global economy, supporting various industries like consumer goods, pharmaceuticals, food and beverage, cosmetics, and electronics. There is a significant push towards eco-friendly packaging solutions, including biodegradable materials, recyclable packaging, and minimalistic designs.

Packaging Industry has Transformed Over Three Key Eras

Era 1: Substrate Shift Changes (2000-2009)

Era 2: Changing Face of the Consumer (2010-2020)

- China becomes the largest packaging market.

- Rise in online shopping and awareness of packaging waste.

- Innovations in convenient, high-functionality, and sustainable packaging.

- Corporate consolidation and strong private equity activity.

Era 3: Sustainability and Digital Transformation (2020 and Beyond)

- Consumers push for genuine sustainability.

- Growth of e-commerce, especially in groceries.

- Focus on sustainable packaging, new technologies, and digital printing.

- Companies divest noncore businesses and accelerate digital transformation.

Packaging Market Trends

- The packaging business has transformed due to digital printing technologies, which allow firms to produce bespoke and customized packaging designs with vivid colours, sharp graphics, and changeable data printing capabilities.

- Growing emphasis on eco-friendliness, recyclable containers, and sustainable packaging techniques is reflected in the packaging sector's increasing sustainability trend. Increased use of plant-based plastics, paper, and other biodegradable materials that break down naturally. Rising demand for packaging that can be easily recycled or reused, reducing waste and environmental impact.

- Growing trends towards connected and smart packaging. Integration of sensors, RFID tags, and QR codes that provide real-time data on product condition, location, and authenticity. Rising trend of interactive packaging by the use of augmented reality (AR) and QR codes to offer interactive experiences, such as product information, tutorials, and promotions. Temperature-controlled packaging is especially important for pharmaceuticals and food, these packages monitor and maintain optimal temperature conditions.

- A variety of its advantages in terms of convenience, portability, and weight, flexible packaging types, such as bags, pouches, sachets, and wraps, are a growing trend.

- The Paper & Paperboard Market is witnessing a tremendous shift, fuelled by innovative trends that address the needs of a changing world.

- The packaging, with its incorporated safety precautions (holographic labels, tamper-evident seals, track-and-trace technology), plays a vital part in reducing tampering, counterfeiting, and theft of items.

- Due to cultural and regional influences the customization of packaging designs and materials to cater to regional preferences and cultural nuances. Regions with higher environmental awareness are driving demand for sustainable packaging solutions.

How Can AI Improve the Packaging Industry?

AI integration is revolutionizing the packaging market by enhancing efficiency, sustainability, and customer experience. AI can analyze vast amounts of data to develop optimized packaging designs that reduce material usage while maintaining structural integrity. Machine learning algorithms can quickly generate and test multiple design iterations, speeding up the prototyping process.

AI-powered sensors and analytics can predict equipment failures and maintenance needs, minimizing downtime and increasing productivity. Machine learning models can inspect packaging for defects or inconsistencies at high speeds, ensuring consistent quality. AI can recommend alternative, sustainable materials that reduce environmental impact without compromising quality. AI systems can monitor and optimize the use of resources, reducing waste during production and helping achieve sustainability goals. AI systems can monitor and optimize the use of resources, reducing waste during production and helping achieve sustainability goals.

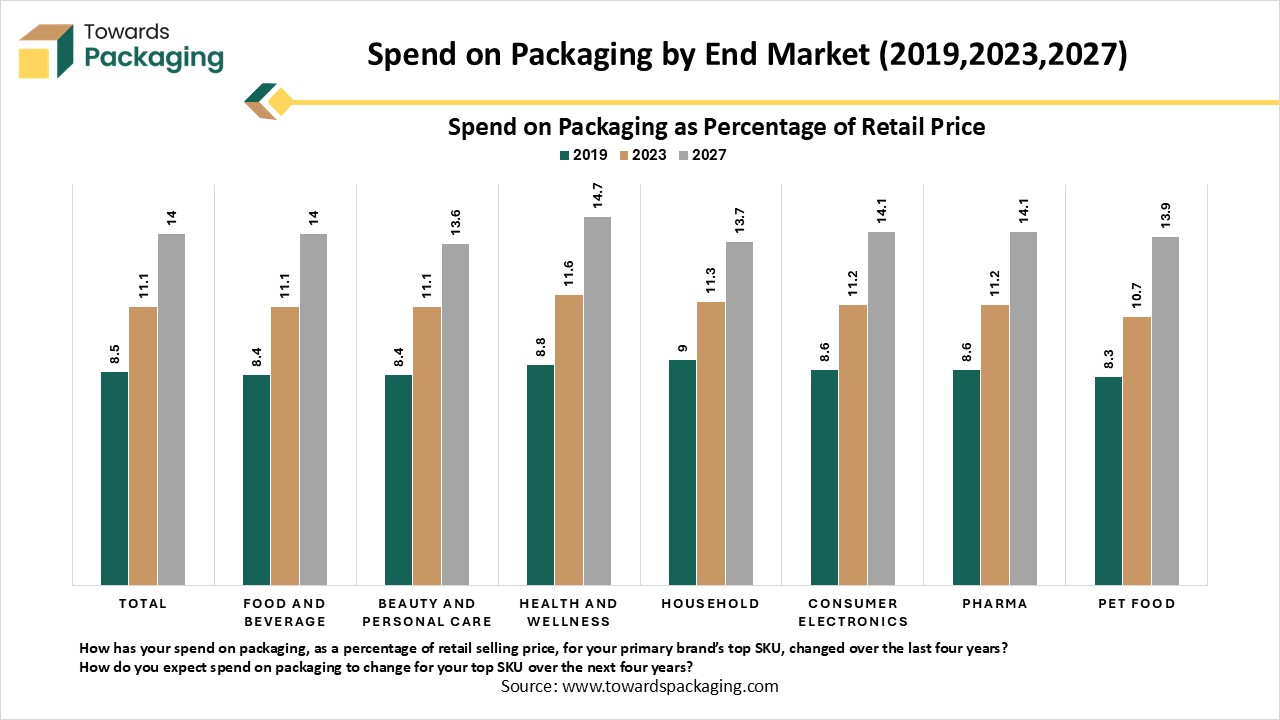

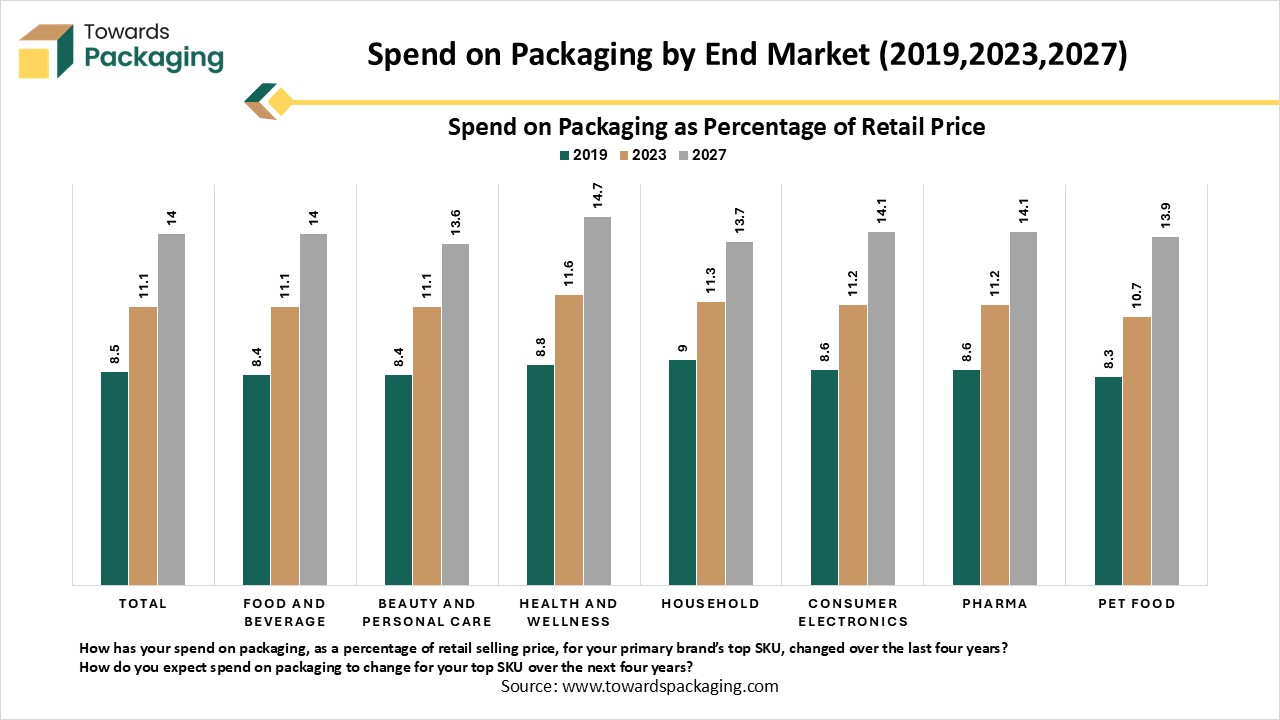

Spend on Packaging by End Market (2019, 2023, 2027)

The chart shows how much companies in different industries spend on packaging as a percentage of the retail price of a product. It compares three years: 2019, 2023, and projected values for 2027. The eight end-market categories analyzed are:

- Total average spend across all sectors

- Food & Beverage

- Beauty & Personal Care

- Health & Wellness

- Household products

- Consumer Electronics

- Pharmaceuticals

- Pet Food

Across every category, spending on packaging has been increasing from 2019 to 2023 and is expected to increase further by 2027. This means packaging has become a more important and more expensive part of delivering a product to the consumer likely due to sustainability requirements, rising material costs, improved packaging formats, and premiumization.

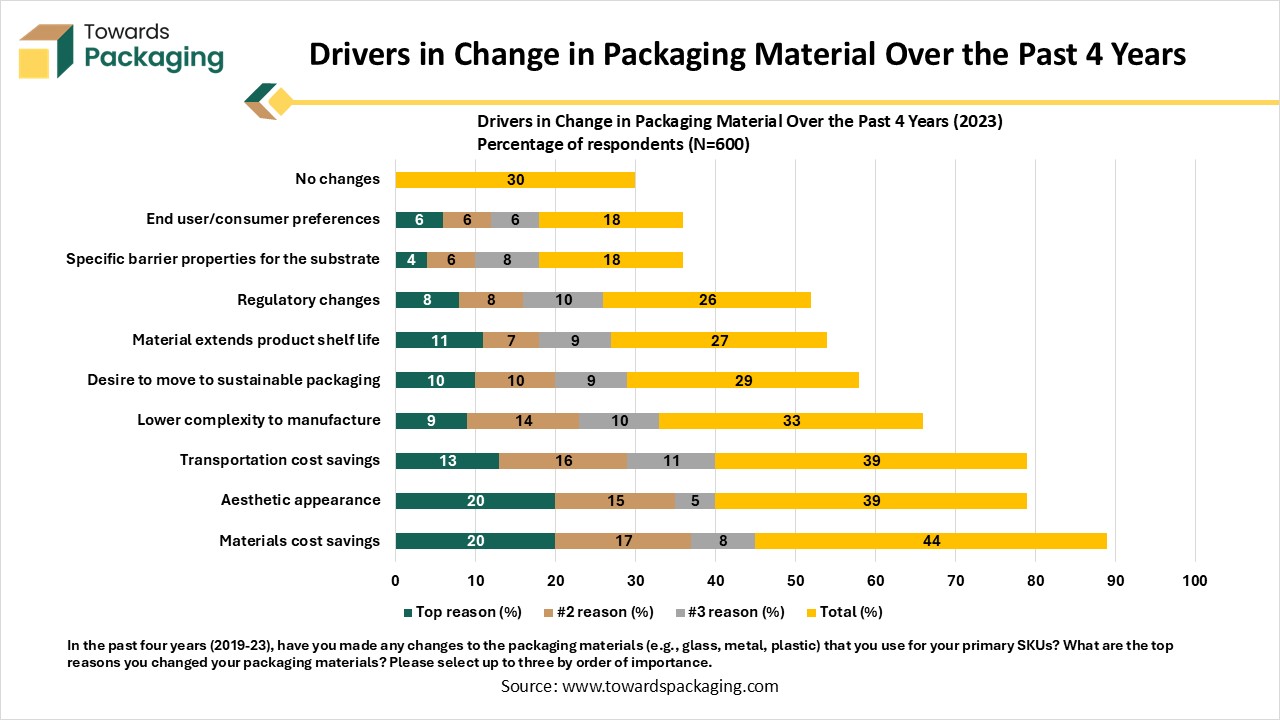

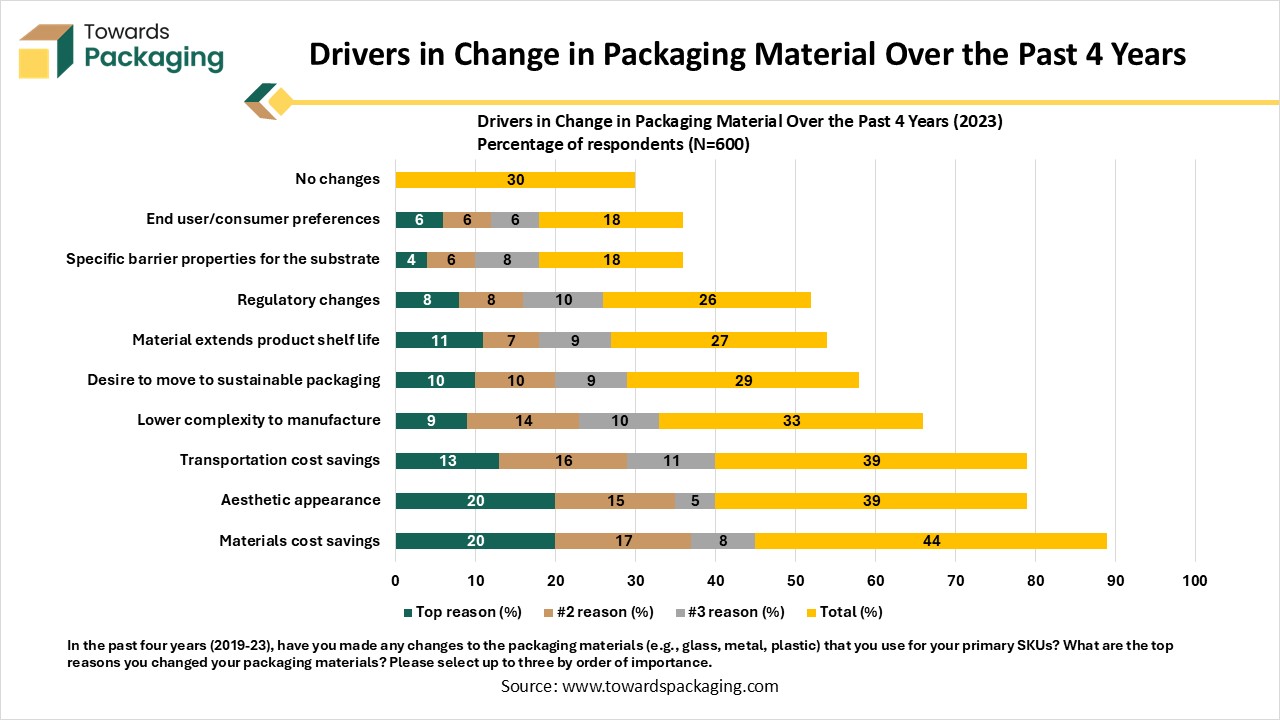

Drivers in Change in Packaging Material Over the Past 4 Years (2019-2023)

This chart shows the main reasons why companies changed their packaging materials over the last four years. The data is based on responses from 600 participants. Respondents were asked to select their top three reasons for making these changes.

The most common motivations for switching packaging materials are related to cost savings, sustainability, and appearance. These factors strongly influence packaging decisions across industries.

The last four years have seen a significant shift in packaging strategies. Companies are optimizing packaging to:

- Reduce costs

- Improve product appearance and branding

- Meet sustainability and regulatory expectations

- Increase efficiency and product protection

This shows that packaging decisions are increasingly strategic rather than purely operational.

Driver

Growth of E-commerce Platform

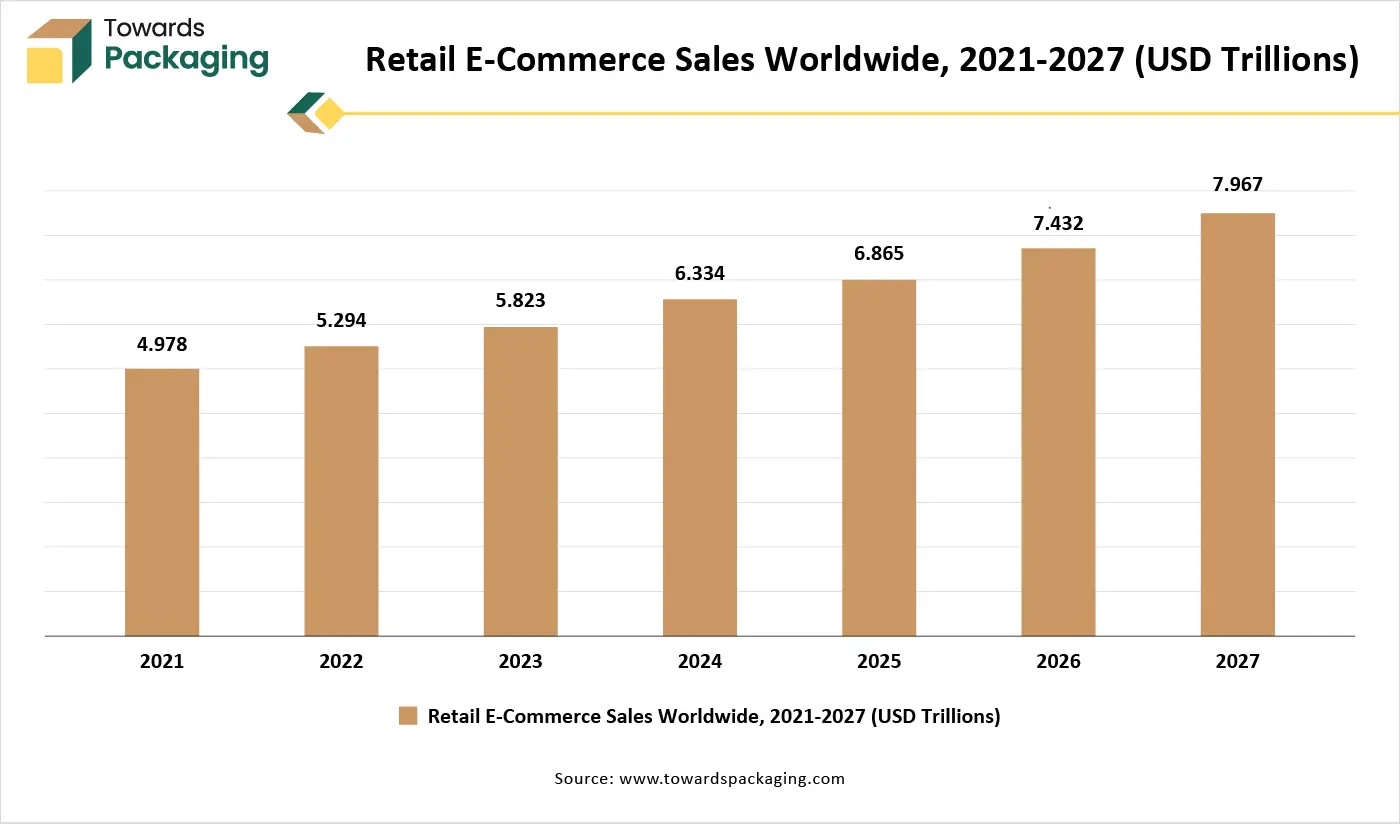

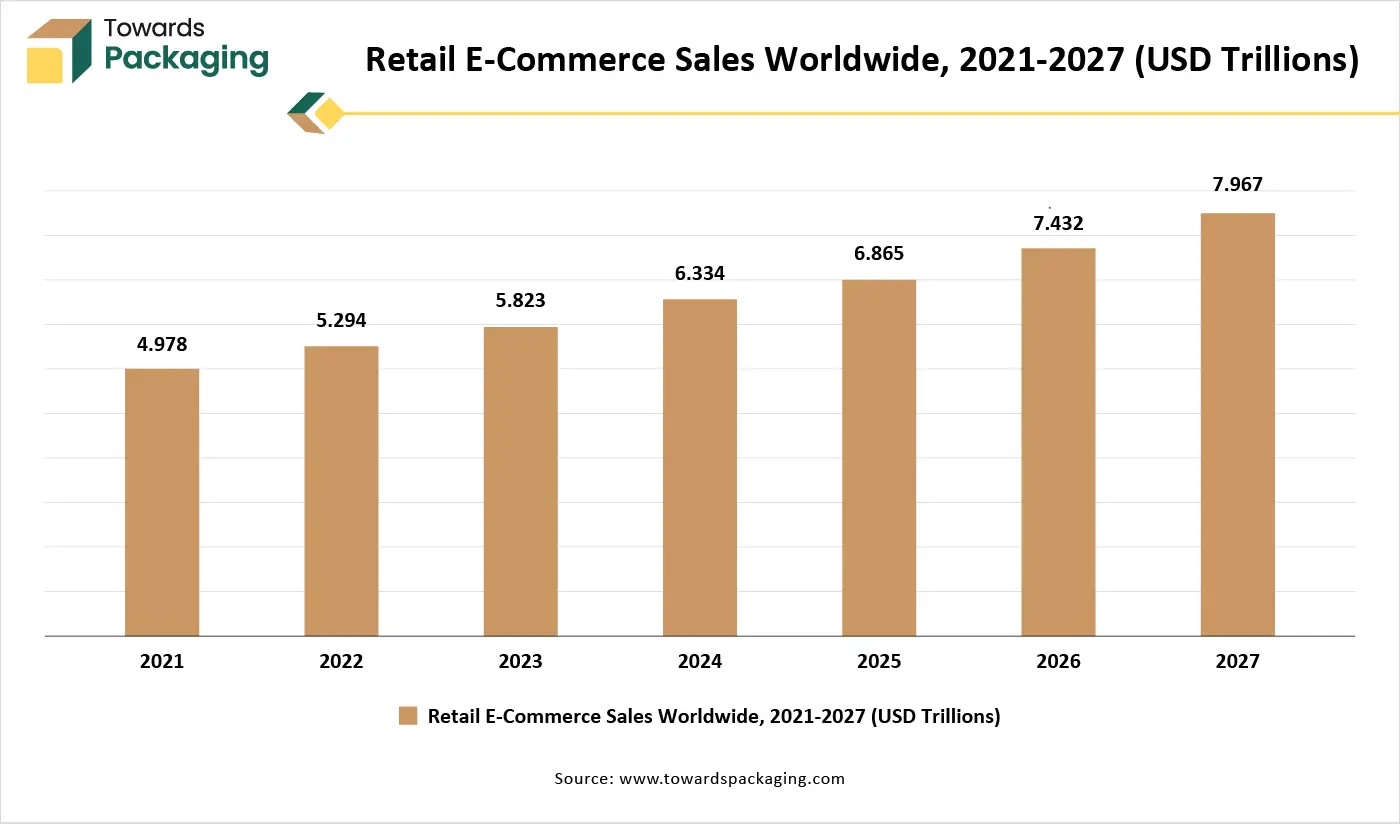

The surge in online shopping has significantly increased the need for robust, protective, and lightweight packaging that can withstand shipping and handling. Consumers seek convenient, easy-to-use packaging solutions, such as resealable pouches, single-serve packages, and ready-to-eat formats. Urbanization and the fast-paced lifestyle of consumers are driving demand for on-the-go and convenience packaging solutions. Rising demand of the packaging due to the growth in the Ecommerce platform has driven the growth of the packaging market over the forecast period.

In January 2025, according to the data published by the National E-commerce Associations, it was estimated that the COVID-19 epidemic has increased the scale of the e-commerce industry and, more than anticipated, its share of overall retail sales. As a result, the pandemic boosted e-commerce's weight in overall retail by 10.61 percent and caused an excess of US$227.820 billion in e-sales, hastening its structural shift. Before 2026, these changes would not have been seen if the pandemic had not occurred.

By 2025, there will be 2.77 billion internet shoppers worldwide. This indicates that 33% of people worldwide shop online. This is a 2.2% rise over the prior year. By 2026, there will be 2.86 billion online shoppers, a statistic that reflects the growth in eCommerce brought on by greater internet accessibility and convenience.

Opportunities

Advancements in Technology

Rising innovation of smart packaging has created lucrative opportunity for the growth of the packaging market. Innovations like RFID tags, IoT-enabled packaging, and augmented reality are improving product tracking, authenticity, and customer engagement. Advanced manufacturing technologies, including AI and robotics, are improving production efficiency, reducing costs, and enabling customization.

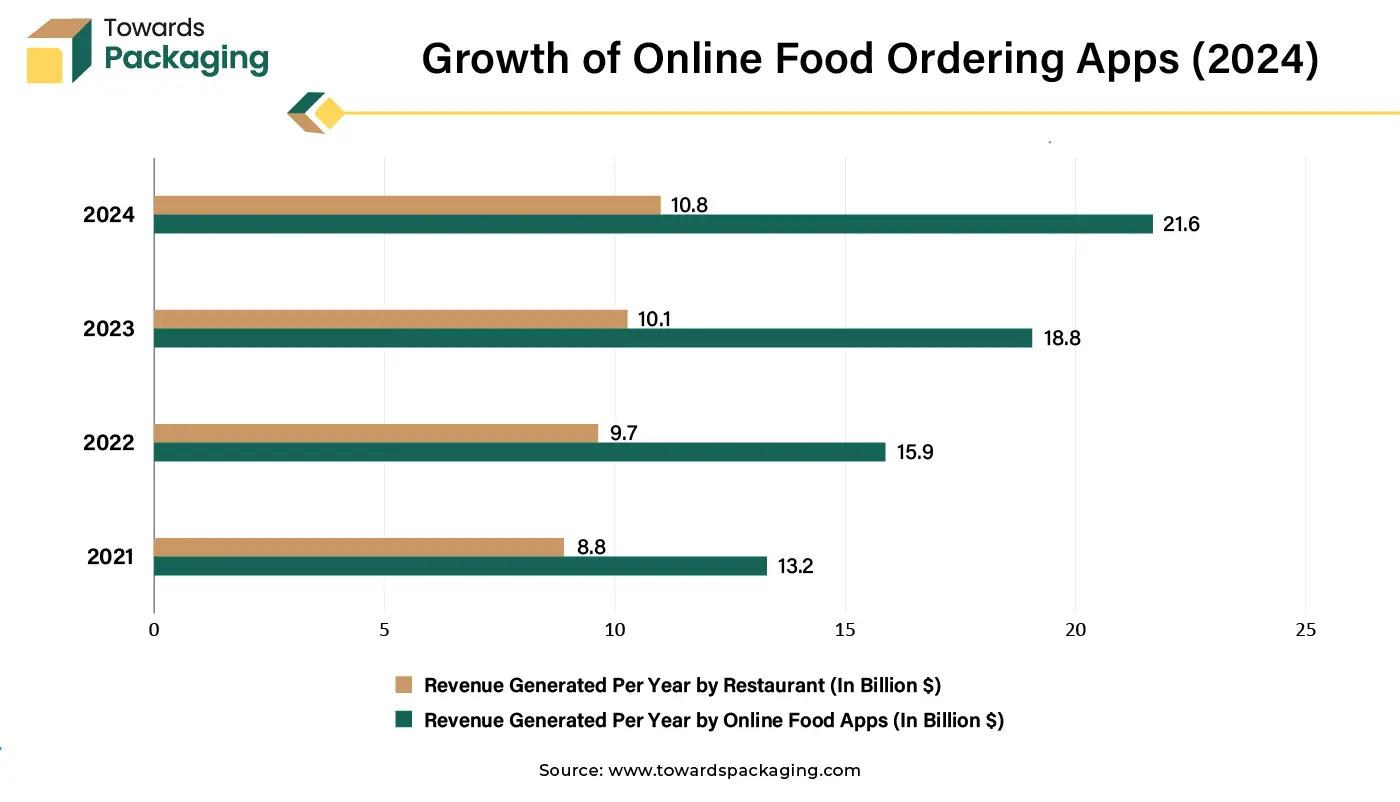

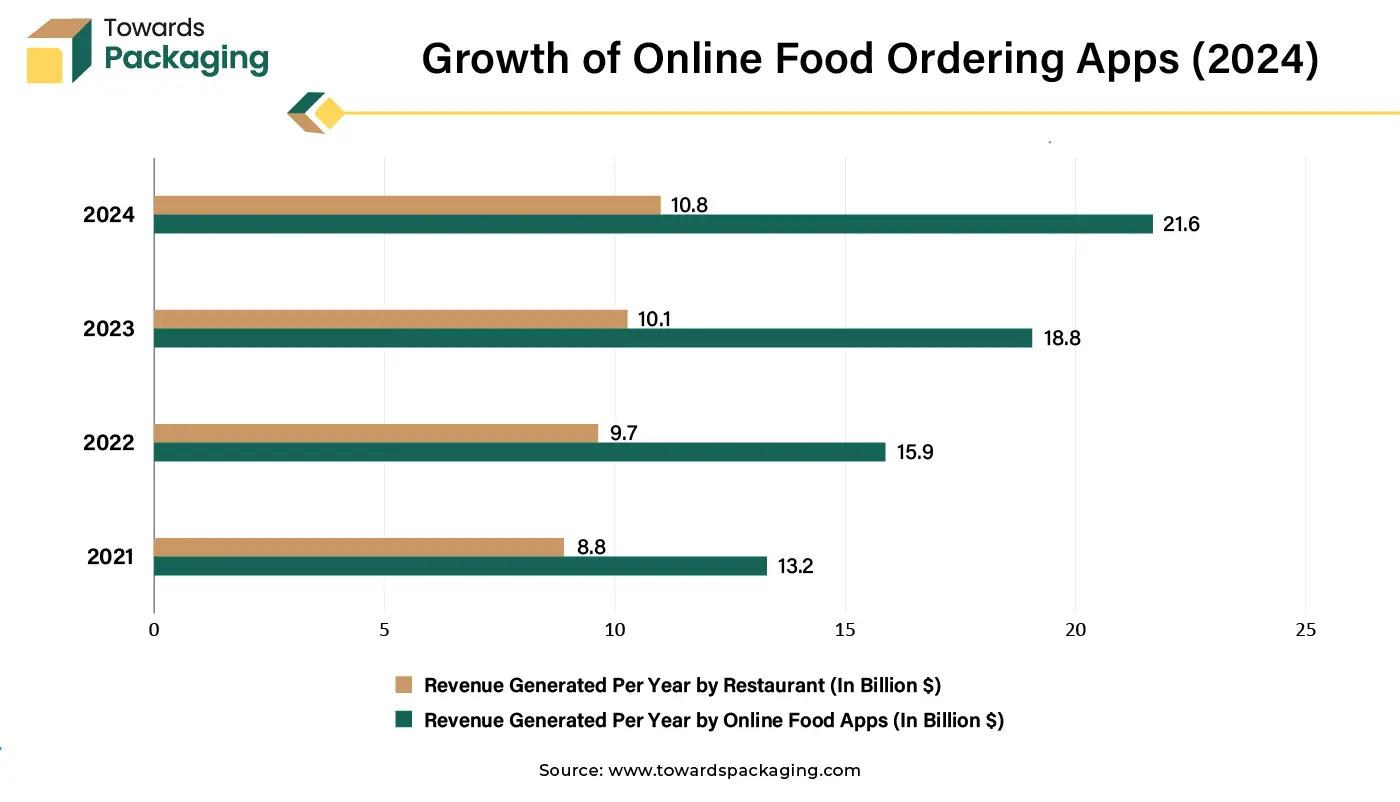

Growth in Key Industries

The food and beverage sector is a major contributor to the packaging market, driven by demand for safe, hygienic, and attractive packaging. The pharmaceutical industry's growth, especially with the rising need for healthcare products, has led to increased demand for specialized, tamper-proof packaging. Growth in online food ordering has raised the demand for the secured packaging and created lucrative opportunity for the growth of the packaging market in the near future.

In October 2024, according to the data published by the Food Industry Association, it was estimated that Bain & Company and Swiggy, the percentage of Indians who order food online increased from 8% to 12% between 2021 and 2024, which is 3.2 times the growth of online food delivery when compared to total food services. It goes on to say that India's penetration rates are doubled in markets like the US and China.

Segmental Insights

Sustainability Trends: Paper & Paperboard Material Led in 2024

In 2024, the paper & paperboard market led the packaging market in 2024. Paper and paperboard are highly recyclable, which makes them more environmentally friendly compared to other materials like plastic. As sustainability becomes a growing concern, many companies and consumers are opting for paper-based packaging to reduce their environmental footprint. Paper and paperboard materials are generally less expensive to produce than alternatives like metals, glass, or plastics, which makes them an attractive choice for manufacturers.

As e-commerce continues to expand, the demand for corrugated boxes (a type of paperboard packaging) has surged. These boxes are essential for shipping and ensuring that products arrive safely at their destination. Governments and regulatory bodies worldwide are increasingly implementing policies to reduce plastic waste, which has spurred the shift to paper-based solutions. Many regions are now enforcing bans or restrictions on single-use plastics, and this has further fueled the growth of paper and paperboard packaging.

Superior Packaging and Consumer Demand: Rigid Packaging to Sustain the Dominance

In 2024, the rigid packaging segment led the market with the largest share. Rigid packaging is highly durable and provides excellent protection for the contents, which is essential for a wide range of products, from food and beverages to pharmaceuticals and electronics. Its sturdiness helps prevent damage during transportation, handling, and storage. Rigid packaging also allows for complex designs, embossing, and color schemes that enhance brand visibility and appeal on retail shelves.

Global Adoption of Technology, Flexography Led the Market in 2024

By printing technology, the flexography segment dominated the market. Flexography has become the preferred printing technology for industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods, all of which rely heavily on high-quality printed packaging. As flexible packaging continues to grow, due to its advantages in terms of lightweight, portability, and convenience, flexography remains the dominant printing method for these materials. Flexible packaging is popular in sectors like food and beverage (e.g., snack bags, beverage pouches), consumer goods (e.g., personal care packaging), and pharmaceuticals.

Ever Changning Consumer Approach: Food & Beverages Segment Dominated in 2024

By end user, the food & beverages segment dominated the packaging market. With a rapidly growing global population and changing consumer lifestyles, there’s an ever-increasing demand for packaged food and drinks. Convenience, portion control, and longer shelf life are key trends that shape packaging needs. Glass bottles, plastic containers, metal cans, and jars are commonly used for beverages, sauces, dairy, and other food products. These materials are essential for preserving the quality and safety of the products.

Regional Dominance Growing Demand for Packaging Market

Asia currently accounts for the majority of global packaging sales, owing to the rapid expansion of wealthier middle-class populations in developing countries such as China and India. This population change is followed by increased spending as revenues rise. The expansion of single-member households, an attraction for ready-to-eat meals and smaller container sizes, urbanization, and the increase in online shopping all help drive the growth of the packaging market in Asia. Global patterns in consumption are impacting the packaging business, with the Asia-Pacific area expected to develop at the most rapid pace.

The leaders of this expansion are China and India. The primary consumer of sustainable packaging is the food and beverage industry, promptly followed by the personal care and cosmetics sector. Growing demand for eco-friendly products, increasing customer knowledge of environmental issues, and government programs supporting environmentally friendly packaging practices are all projected to contribute to the resilient development in sustainable packaging that the region of Asia-Pacific is expected to experience.

For Instance,

- In December 2022, A majority interest in Parekhplast India Limited was purchased by Shriji Polymers (India) Limited, a producer of stiff plastic packaging solutions for the medicines sector.

North America represents the globe's second-largest packaging market. The integrated markets of North America, consisting of the United States, Canada, and Mexico, account for a sizable percentage of the global packaging market. With an estimated revenue of 2,818 million euros in the United States alone by 2025. Though flexible packaging has reached commercial maturity in North America's industrialized nations, the outlook for future development is more muted. The United States appears as one of the fastest-growing packaging markets in the region. This expansion is being accelerated by the presence of major packaging businesses, such Amcor Ltd. and Mondi PLC, among others, which are supporting investments in R&D and innovation.

These companies play an important role in developing unique solutions to the market's different packaging difficulties. Their drive to push the boundaries of packaging technology ensures that the industry evolves indefinitely, fulfilling the ever-changing demands of consumers and businesses. The packaging industry in North America has an opportunity for continued expansion and adjustment owing to the strong foundation these industry leaders have laid. Innovation and appropriate investments will help the industry navigate the constantly shifting terrain of consumer preferences, legal requirements, and technology breakthroughs.

Europe Packaging Market Trends

The European packaging market is rapidly expanding, with sustainability and environmental concerns taking primacy in all European countries. 74% of Europeans say that the problem of packaging waste has had a major impact on their purchasing decisions. Among European customers, more over half (52%) actively search out products packaged with eco-friendly materials; this percentage is significantly higher among French shoppers (55%) and Turkish shoppers (56%). Cardboard emerges as the preferred choice for eco-friendly packaging, with 52% of Europeans considering it is the most environmentally friendly material. This perspective is especially prominent in the UK, where 63% of consumers choose this material. Similarly, 45% of Europeans believe cardboard is the most recyclable material, followed by glass (32%). Tins/cans have the lowest perceived recyclability, behind only plastic marginally. The demand for protecting the environment has grown increasingly recognized across Europe.

"Easy to recycle" is ranked as the second preferred packaging feature, with 63% placing it in the top three. This is closely followed by the preference, which is highest among German consumers, for packaging composed of natural or renewable materials. As the European packaging market evolves, sustainable practices and environmentally friendly solutions are anticipated to remain important drivers of consumer preferences and industry developments.

Europe packaging market is driven by stringent sustainability laws, ambitious recycling goals, and rising consumer demand for environmentally friendly packaging designs. Owners of brands in the food, beverage, pharmaceutical, and personal care sectors are quickly moving towards packaging options that are lightweight recycllable and made of a single material. Flexible and intelligent packaging is still in high demand throughout the region thanks to technological advancements and established retail and e-commerce infrastructure.

Germany represents one of the most advanced packaging markets in Europe, backed by stringent waste management laws and a robust manufacturing foundation. The nation is a leader in the use of high-quality packaging designs, refill systems, and recyclable materials, especially in the food, automotive, and industrial packaging industries. Strong infrastructure for recycling and high consumer awareness both support market expansion.

Middle East and Africa Packaging Market Trends

The MEA packaging market is witnessing gradual expansion due to population expansion, urbanization, and rising packaged food and drink consumption. To cut down on plastic waste, governments in the area are implementing sustainability frameworks and promoting the use of recyclable and lightweight packaging. Packaging demand is also for retail and logistics infrastructure.

The UAE packaging market is growing steadily, fueled by robust demand from the pharmaceutical, food and beverage, and e-commerce industries. The use of recyclable and sustainable packaging materials is increasing as a result of government initiatives aimed at waste reduction and sustainability. The demand for superior long-lasting packaging solutions is further supported by the nation's position as a regional hub for trade and logistics.

Latin America Packaging Market Trends

The Latin America packaging market is supported by an increase in organized retail, middle-class consumption, and urban population growth. Due to their affordability and sustainability for food and personal care items, flexible packaging formats are becoming increasingly popular. Even though sustainability laws are still developing, growing environmental consciousness is promoting the slow adoption of recyclable packaging options.

Brazil dominates the Latin American packaging market due to its sizable consumer base and robust food, beverage, and agricultural sectors. Growing packaged food consumption and export activity are driving up demand for both rigid and flexible packaging. Further packaging innovations in the nation are anticipated to be shaped by a greater emphasis on recycling programs and circular economy practices.

Top Companies in Packaging Market

Latest Announcements by Packaging Industry Leaders

- In September 2024, The CEO of Veritiv, Sal Abbate, stated that the Veritiv company are positioned to offer a broad range of goods and value-added solutions that satisfy even the most intricate packaging and supply chain requirements since Veritiv company brought together two prosperous companies that share a dedication to innovation, sustainability, and providing outstanding client experiences. The Veritiv company value provide to clients will be greatly increased by the merger of Veritiv and Orora Packaging Solutions.

New Advancements in Packaging Industry

- In November 2024, Indorama Ventures, Suntory, Neste, ENEOS, Mitsubishi Corporation, and Iwatani created the "world's first" bio-PET container, which is made from used cooking oil and is thought to lower CO2 emissions. The Suntory Group will start distributing bio-PET bottles for a few chosen beverages in Japan this month; the initial launch will include about 45 million bottles. In the future, more products are expected to use these bottles.

- In October 2024, Accredo Packaging, packaging company, revealed the introduction of the first 100% biobased resin pouch with a zipper closure, in partnership with Fresh-Lock closures, a division of Reynolds Consumer Products. Compared to traditional packaging, this product is a significant step forward in more environmentally friendly packaging, meeting the growing demand for more ecologically friendly alternatives. The pouch's entirely renewable content, which is made from sugarcane-derived resin, helps firms achieve their sustainability objectives by reducing their environmental effect.

- In June 2024, Mondelèz, a major maker of fast-moving consumer goods, and Saica Group, one of the top providers of packaging solutions, have partnered to introduce a new paper-based product aimed at multipacking items for the chocolate, biscuit, and confectionery industries. The novel paper-based packaging can be either coated or uncoated, depending on the final appearance that is wanted, and is made to be recyclable in the paper waste stream. It is also appropriate for the heat sealable packing process.

- In October 2024, Paboco, manufacturing company and Blue Ocean Closures, packaging company revealed the launch of the first paper bottle and fiber-based cap that are ready for the market. With consumer goods incorporating the new packaging anticipated to debut in early 2025, this invention is currently accessible. The entire box, including the HDPE barrier, weighs less than 16 grams. The entire box can be recycled as paper due to its low material usage. A fiber-based cap that fits a variety of bottle types was provided by Blue Ocean Closures in an effort to lessen dependency on plastic.

Packaging Market Segmentation

By Material

- Plastic

- Paper and Paperboard

- Glass

- Metal

By Packaging Type

- Flexible Packaging

- Rigid Packaging

By Printing Technology

- Offset

- Flexography

- Screen

- Gravure

- Digital

By End User

- Food & Beverages

- Pharmaceutical

- Beauty and Personal Care

- Industrial

- Others

By Region Covered

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait