December 2025

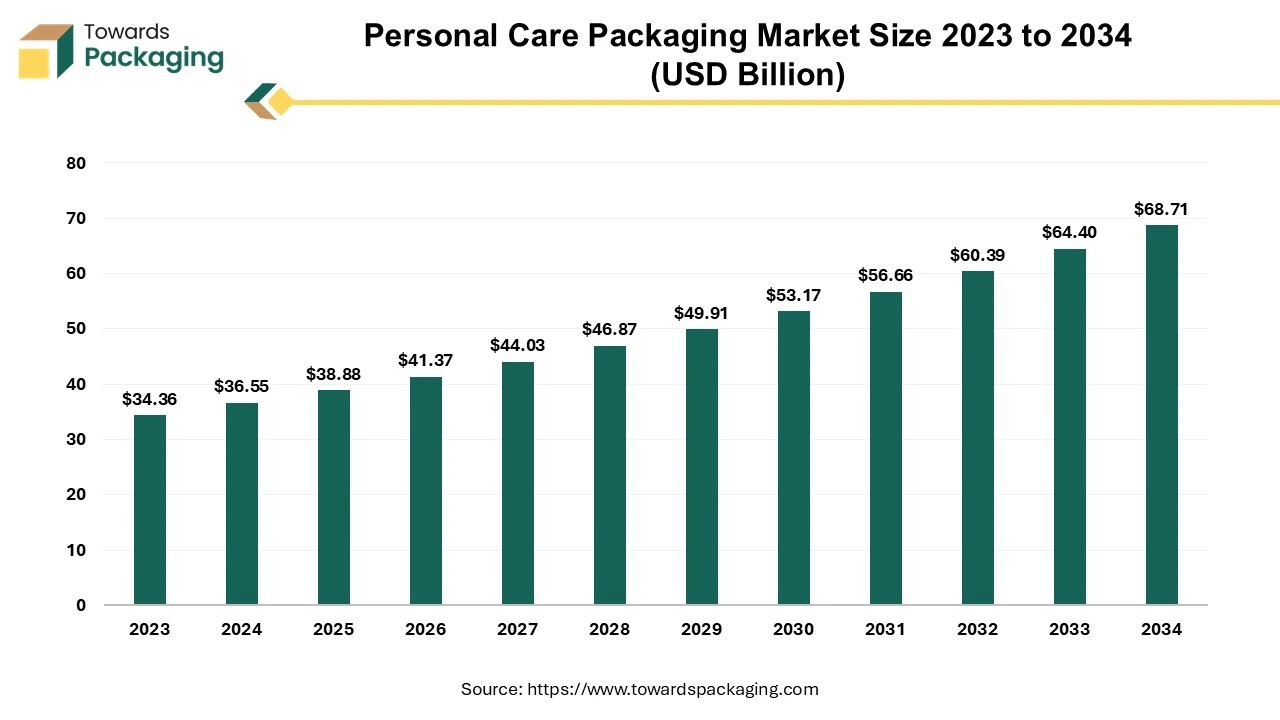

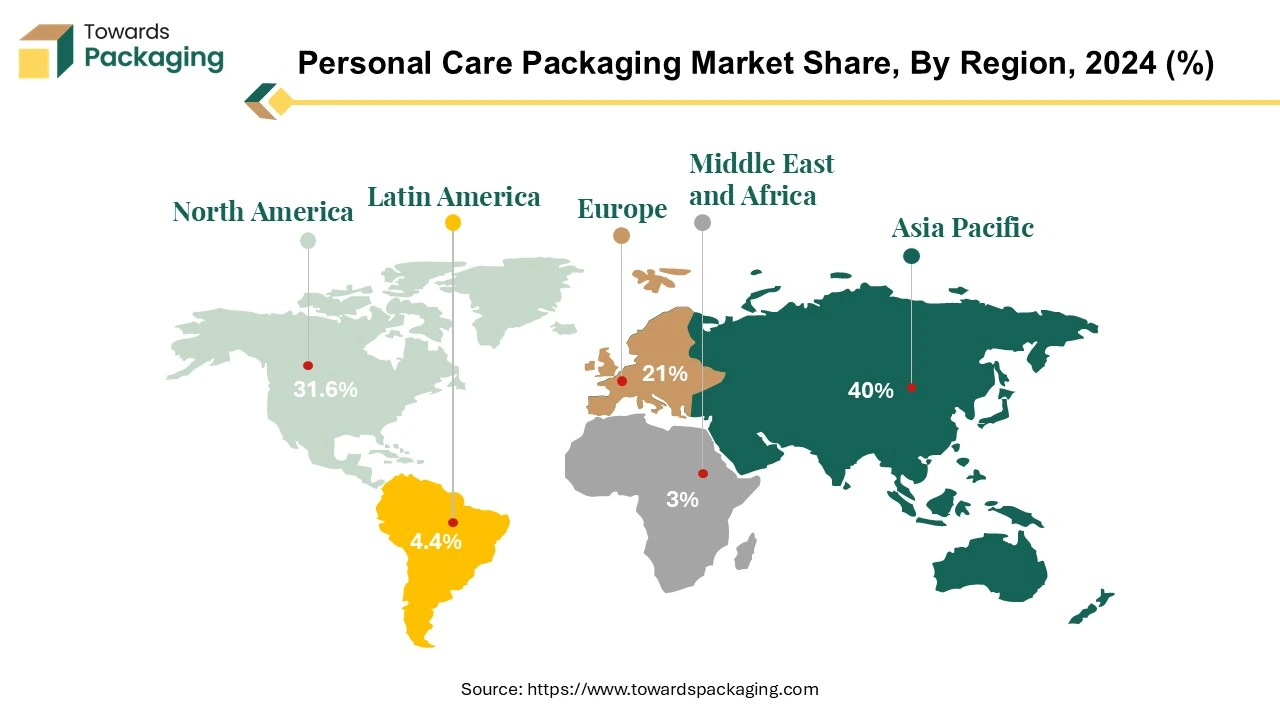

The personal care packaging market size is projected to grow from USD 38.88 billion in 2025 to USD 68.71 billion by 2034, with an expected CAGR of 6.3%. This market is segmented by material, application, and region, with plastic being the dominant material (50%–60% market share). The skincare segment holds the largest share, accounting for 40% of market value. In terms of regions, Asia Pacific leads with a 43% share, followed by North America and Europe. Major players in this space include Amcor Plc, Gerresheimer AG, Mondi Group, and Ball Corporation. The market's competitive landscape is shaped by these established manufacturers, along with new entrants leveraging digital platforms for direct-to-consumer sales.

The packaging industry that specialises in designing, manufacturing and delivering packaging solutions for a variety of personal care products is called The Personal Care Packaging market. These products include cosmetics, skincare, hair care, fragrances and toiletries, among others. Personal care packaging is designed not simply to hold and protect products, but also to improve their visual appeal, functionality and overall consumer experience. This market frequently entails the employment of novel materials and designs to satisfy the special requirements of personal care items, taking into account elements such as product preservation, simplicity of use and visual appeal in order to attract customers.

E-commerce has bolstered personal care sales, with online sales accounting for more than 27% of total revenue this year. Nonetheless, sustainability requirements change the sector, including increased demands, promises, and product lines. Companies are reconsidering their net carbon emissions while consumers aim for a zero-waste lifestyle. Reusable packaging was especially popular among consumer-packaged goods brands; 48 percent of personal care and 50 percent of home care companies chose it as the best option for environmentally friendly packaging.

The personal care packaging market refers to the industry segment specializing in designing, manufacturing and distributing packaging solutions specifically tailored for personal care products. These products encompass a wide range of items related to personal hygiene, skincare, cosmetics, hair care and toiletries. The primary purpose of personal care packaging is to provide protective enclosures for these products, ensuring their integrity, quality and safety throughout the supply chain, from manufacturing to retail shelves and ultimately into the hands of consumers. The significance of personal care packaging extends beyond functional protection. It also plays a crucial role in branding and marketing, contributing to the overall visual appeal of products on store shelves and influencing consumer purchasing decisions. Innovations in this industry frequently focus on increasing user experience, product dispensing techniques, and incorporating interactive and informational technologies. Smart package solutions, such as QR codes, NFC (near-field communication), and other digital features, are becoming more common, giving consumers additional information or engaging experiences about the personal care goods they buy.

| Manufacturer | Estimated Market Share (%) |

| Amcor Plc | 18.0% |

| Berry Global | 16.0% |

| Gerresheimer AG | 12.0% |

| Albea S.A. | 10.0% |

| Ball Corporation | 9.0% |

| Mondi Group | 8.0% |

| AptarGroup | 7.0% |

| Cosmopak | 6.0% |

| Silgan Holdings | 5.0% |

| Crown Holdings | 4.0% |

| WestRock Company | 3% |

| Smurfit Kappa | 2% |

| Others | 4% |

| Supplier | Estimated EBITDA Margin (%) |

| Amcor Plc | 18.0% |

| Berry Global | 16.0% |

| Gerresheimer AG | 15.0% |

| Albea S.A. | 14.0% |

| Ball Corporation | 13.0% |

| Mondi Group | 12.0% |

| AptarGroup | 11.0% |

| Cosmopak | 10.0% |

| Silgan Holdings | 9.0% |

| Crown Holdings | 8.0% |

| WestRock Company | 7% |

| Smurfit Kappa | 6% |

| Others | 5% |

| Metric | Details |

| Market Size in 2024 | USD 36.55 Billion |

| Projected Market Size in 2034 | USD 68.71 Billion |

| CAGR (2025 - 2034) | 6.3% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Application and By Region |

| Top Key Players | Amcor Plc, Gerresheimer Ag, Mondi Group, Ball Corporation, Albea SA |

The personal care industry is undergoing a significant transformation as brands adapt to the increasing demand for sustainable and eco-friendly solutions. A notable area of change is the adoption of innovative replacement packaging that reflects a commitment to environmental responsibility. Here are some of the latest trends in replacement packaging for personal care products:

These trends highlight the industry’s dedication to a greener future, showcasing a commitment to reducing environmental impact while meeting consumer demands for sustainability.

The Asia Pacific region emerges as the major player in the personal care packaging market, accounting for 43% of total global sales. Within this vast industry, China, Japan and Korea stand out as the principal customers, accounting for an astounding 70% of total market value. This regional domination establishes Asia Pacific as a major player in the personal care packaging sector. Despite its importance, some difficulties loom over the market's near-term prospects in key markets such as China and Korea. The ongoing fight against the pandemic has created a dynamic and ever-changing set of government restrictions in reaction to the shifting scenario. This volatility makes the short-term picture less appealing to investors and business participants.

The personal care packaging market in the Asia Pacific region has enormous long-term growth potential. The growing middle class, Western cultural influences, and rising earnings all help to fuel the market's upward trend. These socioeconomic variables increase the demand for personal care goods and feed the need for creative and appealing packaging solutions. The market's heterogeneity presents a hurdle to profitability, as businesses must traverse numerous submarkets with varying consumer preferences. Striking a balance between serving some clients' price-sensitive demands and achieving others' quality expectations is critical for long-term success in this diverse market.

The popularity of online shopping in countries such as Korea and China have considerably impacted the expansion of personal care packaging in the Asia-Pacific area. Due to their propensity towards the digital realm and inherent digital knowledge, these populations have made it easier for foreign firms to enter the market through social media channels. This digital integration promotes the smooth adoption of Western methods by making spreading trends and behaviours easier. It helps the personal care packaging industry flourish in the area. The dynamic nature of the current pandemic presents short-term hurdles. Still, the Asia Pacific area continues to lead the way in personal care packaging, offering significant long-term growth potential driven by changing demographics, cultural influences and the region's proficiency in technology population.

Asia Pacific dominated the global personal care packaging market by contributing the largest revenue share in 2024. The dominance of the region is attributed to the larger population base in countries like China and India. The popularity of retail and online stores is rapidly increasing in the developing regions, which is attracting a significant revenue share.

China stands as a major contributor in the Asian region due to its manufacturing base in the beauty and wellness industry. The Chinese government is highly backing the local brands, which are providing significant business opportunities in the region. The product expansion is also playing a crucial role in enhancing the packaging, like glass bottles, airless pumps, sustainable plastics and many more.

For Instance,

North America is the second largest region in the personal care packaging market, with the United States accounting for more than 80% of the overall value. This market is shared with Canada and Mexico, and in recent years, growth has been robust in the makeup goods area, outpacing other categories. The North American market is expected to be the most steady and consistent of the three major regions. The North American personal care packaging industry is renowned for its uniformity in buyer preferences, allowing marketers to develop a cohesive action plan to reach most customers. The region's high degree of customer taste homogeneity, particularly between the two biggest economies (the United States and Canada), opens up new markets and fosters a climate conducive to foreign corporations asserting dominance.

The COVID-19 epidemic showed the region's excessive reliance on specialized supply strategies. To reduce operational risks, firms are increasingly embracing manufacturing-oriented strategies. This change improves operational resilience and corresponds with broader industry trends and consumer expectations. Unlike other markets with a diversified client base, the North American market is far more uniform, allowing for more significant consolidation. The existence of large firms that profit from economies of scale tends to erode the market position of smaller companies. Promoting sustainability and carbon neutrality also impacts the North American personal care packaging business. Businesses are changing their strategies, moving away from traditional and manufacturing-oriented sourcing models to capitalize on market gaps. This strategic shift is consistent with the increased emphasis on sustainability in consumer preferences and legislative frameworks, impacting the industry's trajectory in the region.

North America is anticipated to emerge as the fastest-growing region due to the higher consumer demand for grooming and personal hygiene products. The e-commerce industry is one of the dominant ones in countries like the United States and Canada, which is attracting several business opportunities for companies in the region.

The United States stands as a prominent player in the North American market due to the presence of global leading companies like Procter & Gamble (P&G), Johnson & Johnson and other brands. These companies are expanding rapidly through many sustainable initiatives, which are helping them gain more popularity in the recent competitive environment. The higher R&D investment capacities are also anticipated to bring many innovations in compostable sachets and sugarcane-derived plastics. For instance, P&G introduced aluminium bottles, which aim to reduce the use of plastic in packaging.

Europe is expected to grow at a notable rate in the foreseeable future. Europe's steady growth in the personal care packaging market can be attributed to a combination of regulatory, consumer, technological, and environmental factors. High consumer awareness of health, wellness, and sustainability drives demand for high-quality, eco-friendly packaging. European consumers are willing to pay more for products with sustainable packaging and clear ingredient labeling.

The EU’s Green Deal, Circular Economy Action Plan, and Single-Use Plastics Directive push companies toward sustainable and recyclable packaging solutions. These policies encourage innovation in biodegradable, refillable, and recyclable packaging formats. Europe has one of the world’s most efficient recycling systems, which supports the circular economy model and sustainable packaging use. This infrastructure reduces the environmental impact of personal care packaging.

Leading European companies invest heavily in the research and development of innovative packaging materials. It hosts many packaging technology hubs and advanced manufacturing capabilities. Europe is home to global giants in personal care, which drives the regional packaging demand. These brands lead in adopting sustainable packaging and setting global trends. European markets emphasize design sophistication, minimalism, and functionality in packaging, pushing companies to continually enhance packaging quality and appeal.

Plastic is a dominant material in the personal care packaging industry, accounting for most industrial output. It accounts for a significant share, ranging from 50% to 60% of all available market products. Plastic's appeal is due to its shatterproof nature, lightweight properties and durability, making it a suitable alternative to glass, typically used in scent packaging. Furthermore, corporations are strategically minimizing the number of raw plastic materials required in production, increasing cost efficiency. Despite plastic's dominance in the personal care packaging industry, there is increasing awareness and pressure on companies to incorporate sustainable solutions and features into their offers. This has encouraged businesses to look for alternatives to traditional low-cost materials, resulting in biodegradable plastics and packaging made from cork and wood.

The personal care packaging market provides various sizes and formats, with tubes dominating the scene. While bottles and jars remain popular, businesses have taken advantage of the simplicity and portability provided by small tubes. This trend is consistent with consumer preferences for on-the-go items and supports the push for more practical and readily transportable packaging solutions. Plastic is popular in personal care packaging due to its practical properties. However, the industry is moving towards sustainability. Companies are looking at alternative materials to address environmental concerns, and the market is also responding to changing consumer desires for easy and portable packaging designs, particularly tubes.

Skincare is the dominant segment in the personal care packaging industry, accounting for two-fifths of the overall market value. According to L'Oréal, skincare products have accounted for roughly 60% of global market growth. Despite the problems provided by the epidemic, the skincare industry expanded significantly due to increased awareness of self-care. The increase in interest can be related to the widespread adoption of skincare routines, emphasizing having perfect skin, which is essential in social interactions. This trend has notably resonated with younger consumers, attracting them to the cosmetics industry—the pandemic-induced focus on general well-being and greater health awareness aided in developing skincare regimes. Notably, an upsurge in skincare can be ascribed to overusing high-alcohol products, indicating shifting consumer tastes and habits.

Digital innovations are altering brand-customer relationships in the skincare industry. Digital services play an increasingly important part in client advice, helping firms to learn more about their consumers' preferences, wants and expectations. In a significant advance, market leader Shiseido announced Optune, an IoT-based service that provides personalized skincare advice based on a skin condition study. This convergence of technology and skincare exemplifies the industry's dedication to innovation and satisfying particular client needs. The skincare industry has been a significant driver in personal care packaging, growing significantly despite the pandemic's obstacles. The focus on skincare practices, the desire for perfect skin and the incorporation of digital services highlight how the cosmetics industry is changing and how companies are adjusting to satisfy the needs and tastes of a customer base, becoming more aware of health issues.

The five primary business segments of the global personal care market are skincare, haircare, color (make-up), fragrances and toiletries. These markets complement one another well, and because of their diversity, they can meet the demands and expectations of every customer when it comes to cosmetics. Beauty goods can also be separated into luxury and mass-production categories dependisng on the brand prestige, cost, and distribution methods.

The competitive landscape of the personal care packaging market is characterized by established industry leaders such as Amcor Plc, Gerresheimer Ag, Mondi Group, Ball Corporation, Albea SA, Cosmopak Ltd, Sonoco Products Company, Crown Holdings Inc., RPC Group Plc and HCT Packaging Inc. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences. Additionally, the sector sees dynamic collaborations, acquisitions and strategic partnerships as companies strive to capture market share in this highly competitive and evolving industry.

By Material

By Application

By Region

December 2025

December 2025

December 2025

December 2025