Primary Packaging Labels Market Size, Share, Trends and Forecast Analysis

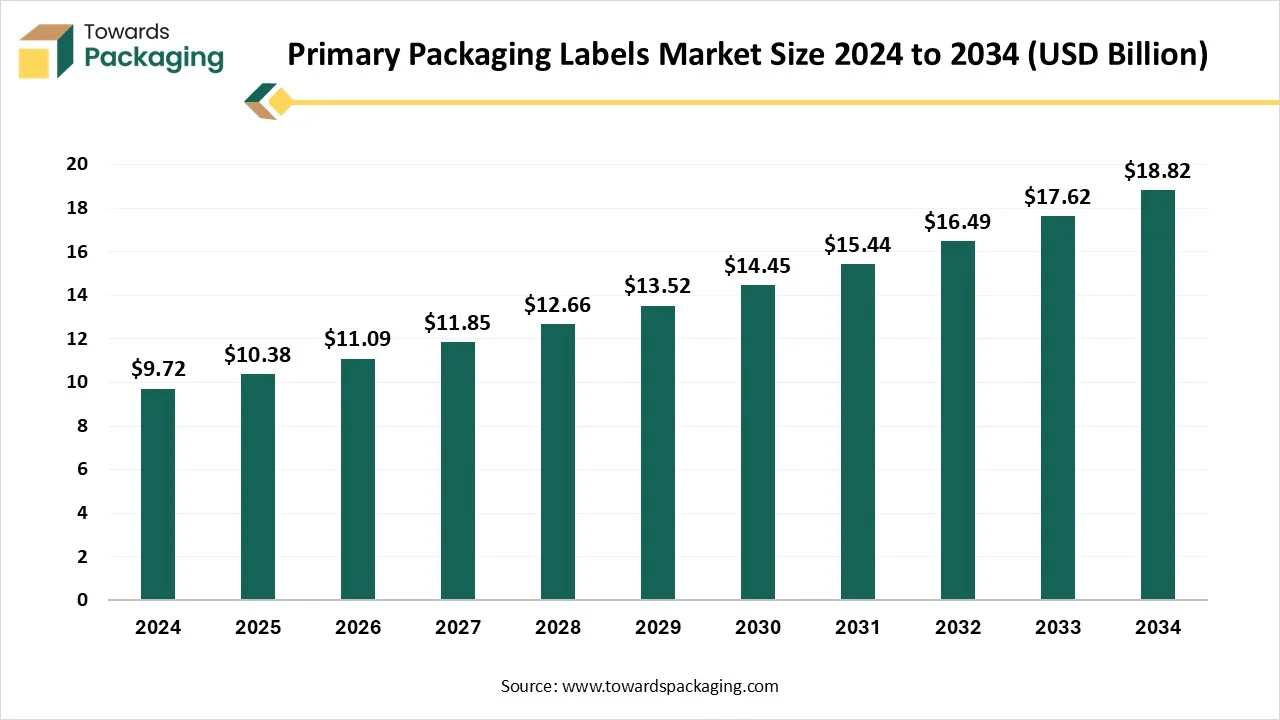

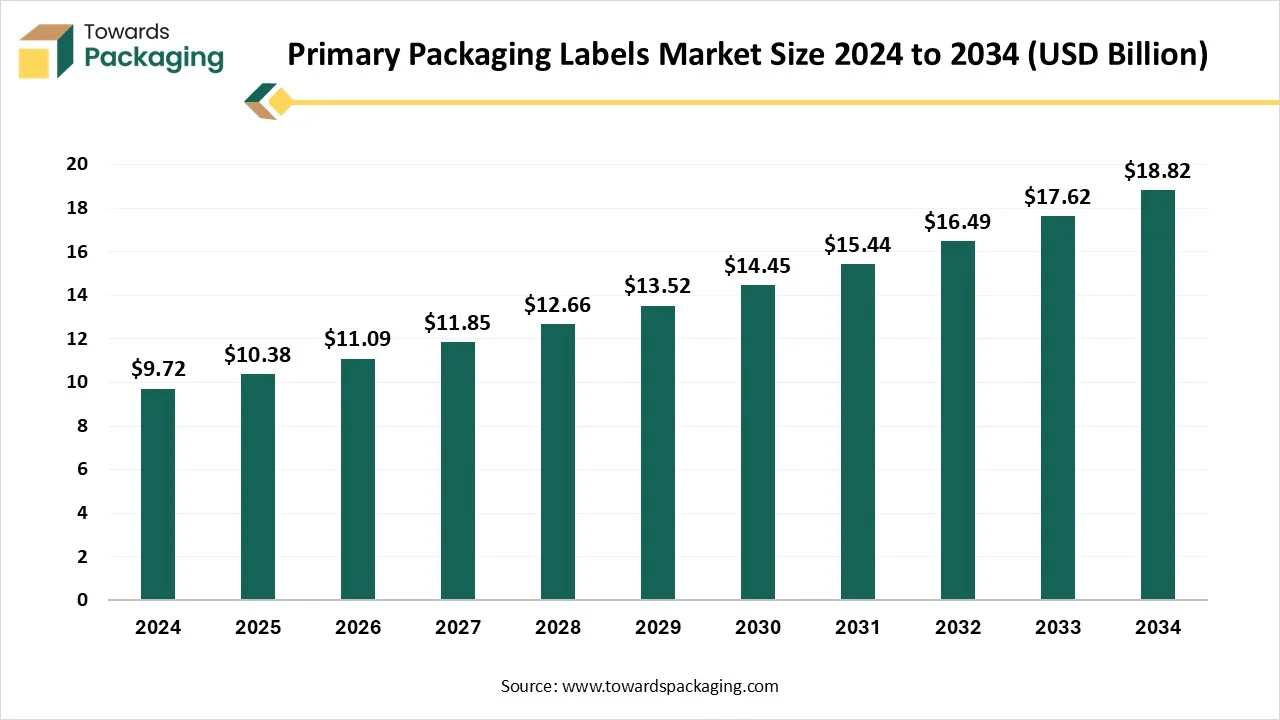

The primary packaging labels market is projected to grow from USD 11.09 billion in 2026 to USD 20.11 billion by 2035, expanding at a CAGR of 6.83%. This report covers complete market size analysis, product segments, material types, printing technologies, and application categories. It includes detailed regional coverage across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, along with insights on leading companies, competitive positioning, value chain structure, and global trade data. It also features profiles of major manufacturers and suppliers supporting the demand for high-quality, reliable, and regulatory-compliant primary packaging labels.

Key Takeaways

- In terms of revenue, the market is valued at USD 10.38 Billion in 2025.

- The market is expected to reach USD 20.11 Billion by the year 2035.

- Rapid growth at a CAGR of 6.83% will be observed in the year between 2025 and 2034.

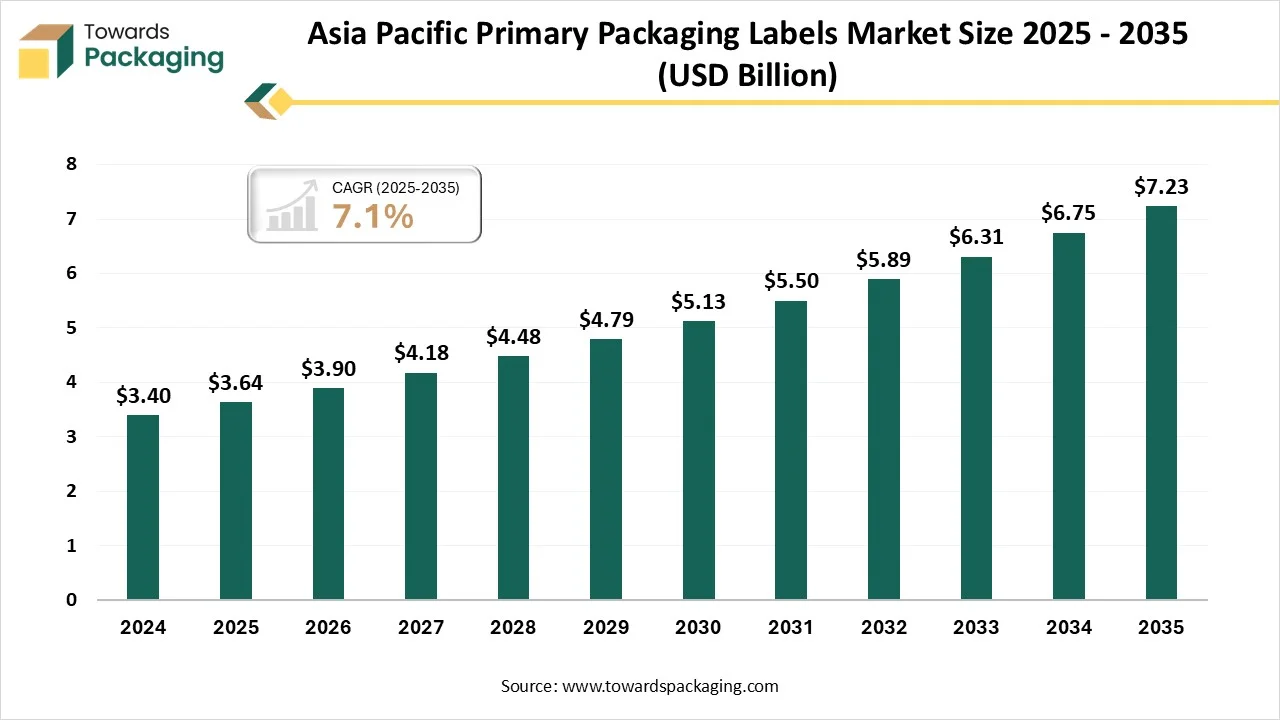

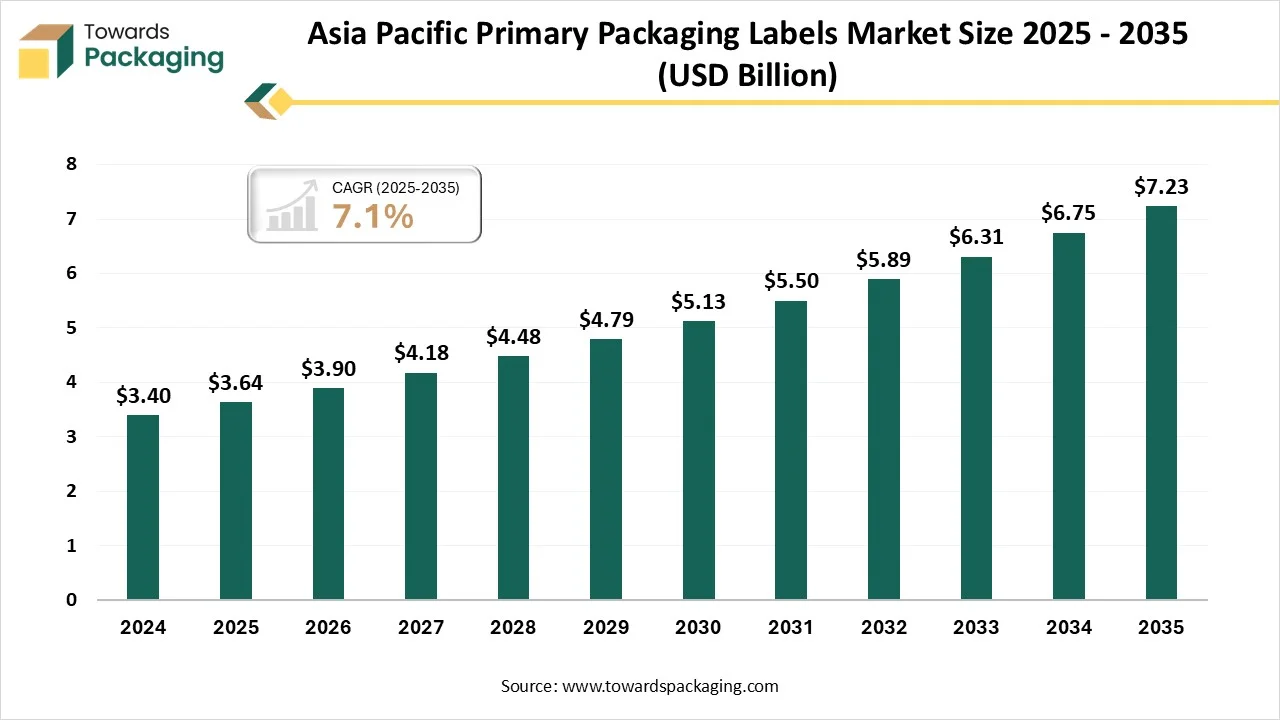

- By region, Asia Pacific has dominated the global market, having the largest share of 35% in 2024

- By region, North America is expected to grow at a notable CAGR between 2025 and 2034.

- By material type, the paper-coated paper segment contributed the largest share of 42% in 2024.

- By material type, the plastic /synthetic PET segment will expand at a significant CAGR between 2025 and 2034.

- By printing technology, the flexographic printing segment contributed the largest share of 45% in 2024.

- By printing technology, the digital printing segment will grow at a main CAGR between 2025 and 2034.

- By type of label, the self-adhesive/pressure-sensitive label segment dominated with 50% of market share in 2024.

- By type of label, the shrink sleeve label segment will expand at a significant CAGR between 2025 and 2034.

- By end-use industry, the pharmaceuticals segment held the biggest market share of 38% in 2024.

- By end-use industry, cosmetics and personal care will grow at a main CAGR between 2025 and 2034.

- By packaging type, the bottles segment contributed the biggest share of 40% in the year 2024.

- By packaging type, the blister packs segment will expand at a significant CAGR between 2025 and 2034.

Market Overview

Importance Of Primary Packaging Labels

Primary packaging labels are labels applied directly to the immediate container or packaging of a product. These labels serve multiple functions, including product identification, regulatory compliance, branding, safety instructions, and promotional messaging. They are widely used across industries such as pharmaceuticals, food & beverages, cosmetics, and consumer goods. These labels can be printed using various technologies (flexographic, digital, gravure) and may involve different materials and adhesives to meet durability, hygiene, and compliance requirements.

Primary Packaging Labels Market Trends

- Sustainable and Eco-friendly labels: In the year 2025, sustainable packaging has taken center stage as brands are seeking different ways to lower their environmental impact. This counts eco-friendly inks, recyclable materials, and biodegradable labels. Recyclable labels are an ideal solution for brands whose goal is to lessen their carbon footprint while tracking high-quality print standards. Whether it's recycled paper or plant-based materials, eco-friendly solutions are perfect.

- Bold Typography and custom Fonts: Typography is not just about readability, but it's a main element of brand identity. In the current year, customers are predicted to see custom fonts and bold typography, which creates an impression in packaging. Whether it's attention-grabbing lettering, large or different font pairings, typography is playing a crucial role in making a memorable brand presence.

- Vivid colours and High-contrast Designs: While minimalism is crucial, bright colours and bold statements are predicted to be back again in 2025. High-contrast designs will help products to be unique on the shelf, catching the attention of users in a growing, crowded market. These bold designs are often paired with embellishments or metallic finishes to create a sense of exclusivity and luxury.

- Vintage and Retro Aesthetics: While sleek design and current will constantly dominate retro-inspired and vintage labels, they make a strong comeback in the year 2025. This trend enters nostalgia and applies feelings of trust and authenticity, which are the main elements in creating brand loyalty.

- Sustainability and Transparency in Printing: As the urge for transparency in the complete product develops, more organizations will seek ways to display their sustainable practices correctly on the label. Whether it's through materials, eco-friendly inks, or messaging, the year 2025 will look and grow in importance in sustainability in both production and design.

- Personalized and custom labels: In 2025, users are looking for more tailored products. Labels that have unique designs, custom messaging, or limited-edition runs will become more famous, assisting brands in connecting with their audience on a more personal level.

AI Integration in the Primary Packaging Labels Market

AI-powered design tools are considerably streamlining the label-making procedure, enabling designers to concentrate on creative aspects instead of technical implementation. These kinds of systems can systematically make label designs that comply with regulatory requirements while sticking to the brand’s rules and guidelines. For manufacturing line managers, AI-developed vision systems serve real-time quality control, checking labels at speed and precision levels which is totally impossible for human inspection.

These kinds of systems can even examine minor flows, colour variations, misalignments, or print defects that ensure constant quality across production runs. Potentially, the most insightful use of AI in labelling is in regulatory compliance. In highly regulated sectors like pharmaceuticals, having velocity with pharmaceuticals, while growing need across global markets, poses enormous challenges. For pharmaceutical manufacturing managers, these kind of tools lowers the risk of costly recalls while simplifying operations and updating label design procedures.

Market Dynamics

Market Driver

Eco-Friendly Solutions Drive The Primary Packaging Labels Industry

Environmental issues are driving the main innovations in labelling procedures and materials. As businesses experience pressure from both users and regulators to lower their environmental impact, sustainable labelling solutions have shifted to niche services to track needs and demands. Labels created from post-consumer recycled content are gaining attention, avoiding virgin material demand while tracking performance standards. Biodegradable adhesives show another crucial development, solving the regular challenge of label removal during the recycling procedure. Water-soluble labels are finding uses in sectors for resume, which are prevalent, leaving residue. At the same time, plant-based inks serve reduced environmental toxicity while serving vibrant printing results.

Market Restraint

Limitations Linked To Tools And Materials

Primary labels are frequently aimed at duplication. Lack of advanced security features (like holograms, tamper-evident seals, or smart codes) can lead to counterfeit issues, especially in FMCG and pharmaceuticals. The adhesive and label material must be compatible with the primary packaging surface (plastic, glass, aluminium, and flexible film). Poor adhesion can cause the label to bubble, wrinkle, or detach. Also, brands want visually appealing labels for shelf impact, but functionality (legibility, scannability, and compliance) can get compromised when aesthetics are given importance. Heavy-speed manufacturing lines need labels that can be applied efficiently without slowing operations. At the same time, premium features (metallic finishes, anti-counterfeit elements raise costs.

Market Opportunity

Smart Packaging Is The Solution For The Primary Packaging Label

Smart Packaging in the primary packaging label industry is quickly gaining attention as brands look to develop functionality, safety, and consumer engagement. These labels go beyond traditional identification and branding by integrating technologies such as QR codes, NFC, RFID, and temperature or freshness indicators. They allow real-time control, product authentication, and interactive communication with users through smartphones. In sectors like food and beverages, pharmaceuticals, smart labels improve transparency and ensure safety by tracking supply chain conditions and detecting tampering.

Segmental Insights

Material Type Insights

How Did The Paper-Coated Paper Segment Dominate The Material Type In The Primary Packaging Labels Market In 2024?

Paper-coated packaging segment has dominated the primary packaging labels market in 2024, Paper-coated paper in primary packaging labels is widely used due to its excellent printability, smooth surface, and cost-effectiveness. The coating, often clay or polymer-based, enhances the label’s strength, brightness, and ink absorption, ensuring graphics and vibrant colors. This makes it perfect for FMCG, food and beverage, and pharmaceutical packaging, in which visual appeal and brand recognition are important. Paper-coated labels are also compatible with various printing techniques like flexography and digital printing. Additionally, with rising demand for eco-friendly packaging, coated papers are being developed using biodegradable and recyclable coatings, making them a sustainable option for primary packaging labels.

The plastic/Synthetic PET segment is expected to grow fastest in the market during the forecast period. They are greatly selected for their moisture resistance, durability, and premium finish. PET labels, being stronger and more flexible than paper, can withstand heat, chemicals, and rough handling, making them suitable for cosmetics, beverages, industrial products, and pharmaceuticals. They allow high-quality printing, transparency, and gloss, giving brands a sleek look. Unlike paper labels, PET labels do not tear or wrinkle easily, ensuring long-lasting shelf appeal. With growing emphasis on sustainability, many companies are now accepting recycled PET for labels to reduce plastic waste while maintaining strength and performance in primary packaging.

Printing Technology Insights

How Has Flexographic Printing Segment Dominated The Printing Technology In The Primary Packaging Labels Market In 2024?

Flexographic printing segment has dominated the market in 2024 as it is usually utilised for any product that is high in volume. As it needs printing plates, we mostly utilize this kind of printing style for products that have a huge distribution. This printing procedure saves our clients time and money. With Flexographic printing, one is enabled to print on huge sections of substrates, which makes the procedure more flexible for choosing packaging and materials. Flexographic printing also utilizes several types of inks, counting inks which are fastly UV cured. Flexographic printing can be done on cellphones, cardboards, metals, and foils, along with multilayered film composites, papers, plastics, non-woven fabrics, etc.

Digital Printing segment is predicted to grow fastest in the market during the forecast period. The packaging sector is also developing digitalisation. Management software and ERP manage just-in-time production and assist in cutting down on ineffective reusable packaging. Although analogue printing has become more adaptable in recent years, digital printing is best in terms of speed and versatility. Crucial trends such as regionalisation and personalisation have led to packaging for consumer goods that is being printed in several languages and varieties. Producers of user goods and packaging materials are already pursuing the construction of effective, smooth, and digitised workflows. Hence, printers will have to accept their product series, possibly even after complete production, to take advantage of the main changes in the packaging industry and adapt to discover themselves from the main transformations within the packaging industry.

Type of Label Insights

How Did The Pressure-Sensitive Label Segment Dominate The Primary Packaging Labels Market In 2024?

Pressure-sensitive labels segment have dominated the primary packaging labels market in 2024 as they are basically self-adhesive labels that adhere to surfaces when pressure is applied. These evergreen labels deliver various industries for product packaging, labelling, and branding. A pressure-sensitive label includes the adhesive, the face stock, and the liner, too. The face stock creates the top layer in which the product information and graphics appear. The adhesive layer makes the label stick to the surface, while the liner protects the adhesive space until the label is ready for use. They make an immediate bond whenever pressure is applied to the label surface. Just like other label types, they need no activation of the adhesive with water, heat, or solvents.

The Shrink Sleeve label segment is expected to be the fastest in the market during the forecast period. Shrink sleeve labels have changed current packaging, which serves businesses a dynamic path to develop product appearance and functionality. They are high-level packaging solutions created for heat-sensitive polymer films that tightly adhere to a container when exposed to controlled heat ( about 70 degrees Celsius). It is being applied via automated machinery, the shrink sleeve label continuously embraces each curve and outline to serve a smooth, professional outcome. The growth in convenience of shrink sleeve labels stems from their potential to integrate strong product protection, having striking, 360-degree branding opportunities, which perfectly integrate practicality and aesthetics.

End-Use Industry Insights

How Did The Pharmaceutical Industry Segment Dominate The Primary Packaging Labels Market In 2024?

The pharmaceutical industry segment dominated the market in 2024. They play an important role in ensuring safety, compliance, and clear communication. Just like regular product labels, these labels must meet strict regulatory standards set by bodies like the FDA, CDSCO, and EMA, as they serve important information such as dosage instructions, batch numbers, expiry dates, and storage guidelines. Pharmaceutical labels often use special materials like synthetic PET, polypropylene, and paper with protective coatings to withstand moisture, frequent handling, and abrasion.

Cosmetics and personal care segment are predicted to be the fastest-growing in the market during the forecast period. Cosmetic and personal care packaging has a huge importance to visual aesthetics and user experience, whether it is applied to everyday or luxury products. Beauty and skincare packaging is complicated, multi-, and highly personalized. Their packaging, products, and labelling must meet regulatory, technical, and branding demands at the same time without any issue or problem. The urge to keep on personal care packaging is heavy. It not only prevents the dishonesty of products, but also maintains important hygiene, maximizes shelf appeal, and transmits main information to users. Labelling management data models and effective networks must comply with current and accurate product data that needs label standards and regulatory marks.

Packaging Type Insights

How Did The Bottles Segment Dominate The Packaging Type In The Primary Packaging Labels Market In 2024?

Bottles segment have dominated the primary packaging labels market in 2024 as primary packaging is a kind of packaging is any packaging material that comes in direct contact with the product. For instance, a glass shampoo bottle (with its cap and label) is a kind of primary packaging, as in the plastic film, as around the sandwich or tube of the toothpaste pack. For bottles containing the liquid and its label are differentiated as primary packaging for a beverage. Every part of the bottle -the glass jar, the printed labels, and the lid-is kind of primary packaging as they touch the product and create its final barricade before the user.

Blister packs segment are predicted to be the fastest-growing in the market during the forecast period. Blister packs utilise plastic film pockets that need lidding material from plastic or aluminium foil. Blister pack packaging serves as an effective barrier against moisture and displays proof of tampering, while allowing single-dose dispensing to expand patient compliance. Various doses are included in individual packages, protecting both product quality and avoiding dosage errors. It is a kind of evergreen packaging which is perfect for a huge range of products and industries, such as nutraceuticals, pharmaceuticals, medical devices, animal health products, and consumable goods. The main aim of blister packs is to maintain the nutraceutical product safe, and since every unit is packed, blister packaging serves complete protection from pollutants.

Regional Insights

How Did The Asia Pacific Dominate The Primary Packaging Labels Market In 2024?

Asia Pacific has dominated the market in 2024 as the demand for the same kind of packaging labels in Asia Pacific has been experiencing constant growth, driven by the region’s expanding user markets, rapid urbanization, and rising regulatory focus on product safety and transparency. In the year 2024, the urge has further expanded due to strict labelling regulations in pharmaceuticals and nutraceuticals, in which clear and durable labels are mandatory for dosage, safety instructions, and traceability. The rise of smart labels with QR codes and NFC Technology in the Asia Pacific’s e-commerce and retail industry is also shaping the demand, as users increasingly expect product authenticity and transparency.

North America expected to be the fastest-growing market during the forecast period. The production, demand, and manufacturing have been growing steadily, driven by strict regulatory needs, strong growth in packaged consumer goods, and increasing adoption of smart labelling technologies. In the year 2024, the urge has further accelerated with the surge of e-commerce packaging and rising consumer preference for clean-label and transparent product information. Brands are increasingly using QR codes, RFID, and smart labels to serve authenticity checks, traceability, and sustainability credentials to align with user trust requirements. Major North American cities like Los Angeles, New York, Toronto, and Mexico City are seeking strong uptake in labels for food delivery, healthcare packaging, and premium personal care products.

Primary Packaging Labels Market Value Chain Analysis

Raw material sourcing: The raw material sourcing for primary packaging labels heavily depends on three main components, including facestick, adhesives, and inks/coatings -each with different supply dynamics. Facestock material is being sourced from both paper mills (for paper-based labels, often certified by FSC? PEFC for sustainability and petrochemical producers (for plastic film like PP, PE, and PET) with Asia Pacific, North America, and the Middle East playing main roles.

Package design and prototyping: The main goal of primary packaging design is to protect the product from its toxic nature while maintaining its quality. It also plays an important role in product identification, serving important details like expiration dates, ingredients, and usage instructions. Additionally, primary packaging serves as a rigid branding tool that assists in attracting users and marketing the product.

Recycling and waste management: Developing the recyclability of primary packaging is a part of this strategy, leading to many considerations, including the choice of raw materials utilised. For instance, it is selectable to use recyclable plastics such as PET, PE, PP, and PS instead of PVC, PC, AND PLA that are challenging to recycle. Another space for improvement is to use mono-material as far as possible. Waste management is one of the main issues in sustainability strategy accepted by pharmaceutical manufacturers.

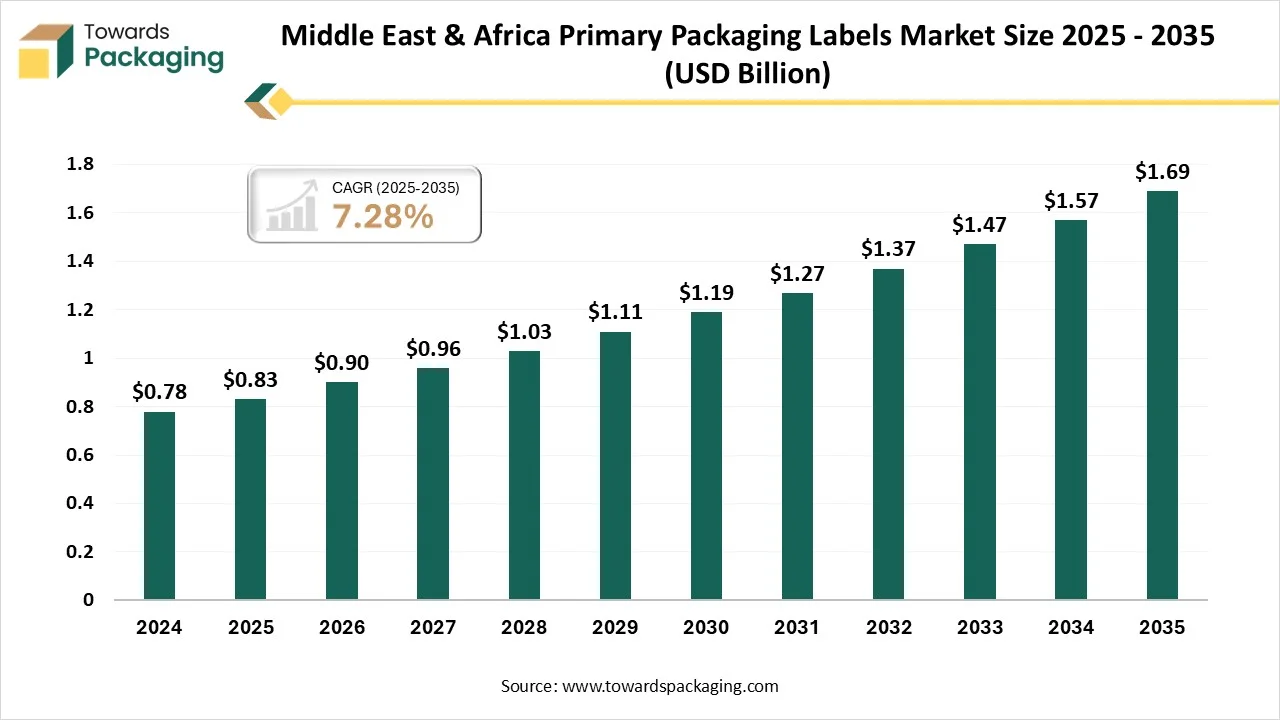

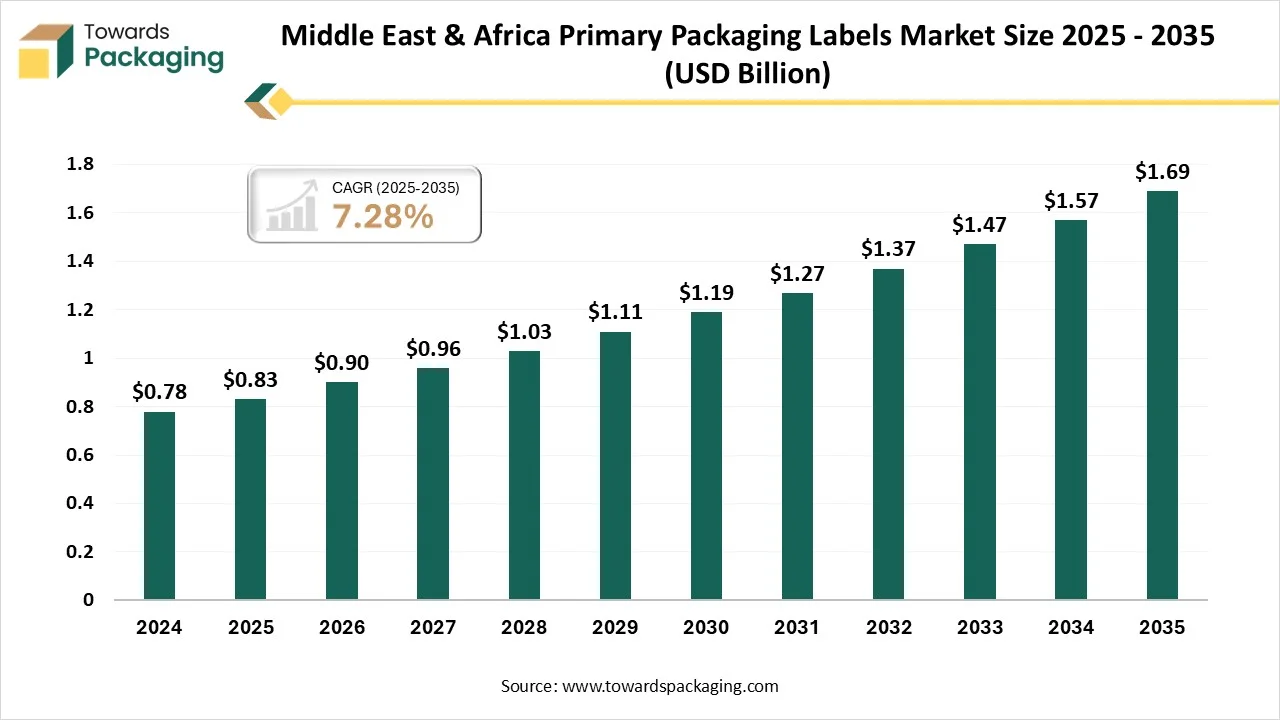

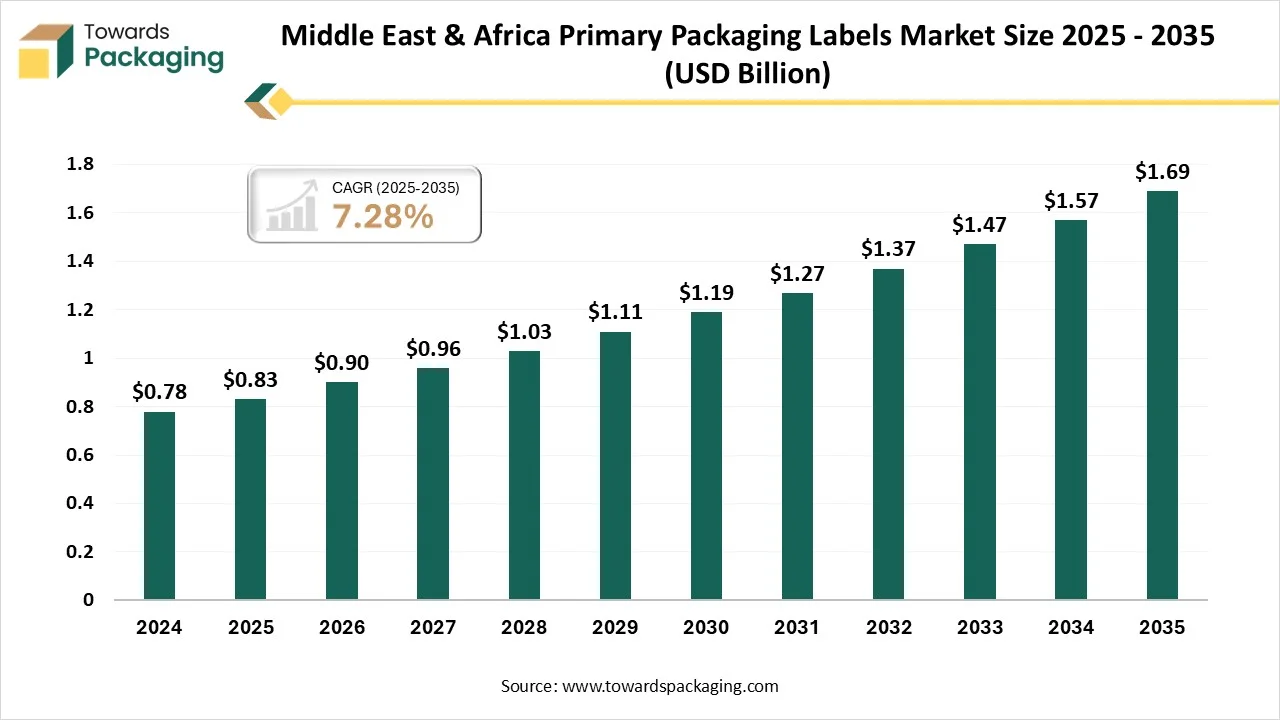

Middle East & Africa Primary Packaging Labels Market Size 2025 - 2035 (USD Billion)

Leading Primary Packaging Labels Market Company List

Latest Industry Leader Announcements

- In August 2025, Mr.Donald G. Lang, an Executive Chairman of CCL industries, which is a top company in specialty labels packaging solutions, and delivery security for global corporations, governments, small businesses, institutions, and users, had revealed the confirmation of Mr. Manddep Chawla and Mr. Michael Larsen to the Board of Directors.

Recent Developments

- In March 2025, Coveris, a top producer, revealed the SleeveFlexR stretch, the latest circular stretch sleeve developed using up to 75% recycled content. The product develops sustainability in the stretch sleeve market and is compliant with the Packaging and Packaging Waste Regulation (PPWR). The growth is made possible through Coveris' recycling business, Recover.

- In October 2024, Bayer disclosed its first-of-its-kind in the healthcare industry, polyethylene terephthalate blister packaging on its top brand, Aleve. In partnerships with pharmaceutical packaging specialist Liveo Research, this type of innovative carbon footprint for packaging by 38% and marks a strong presence in environmental stewardship by avoiding the use of polyvinyl chloride (PVC).

- In January 2025, Schreiner MediPharma revealed the Cap-Lock, which is a novel functional Label that integrates the Schott Topic that has infused a COC Syringe and a cutting-edge capacity that completely substitutes previous blister packaging.

Detailed Segmentation of Primary Packaging Labels Market Segments

By Material Type

- Paper

- Coated Paper

- Uncoated Paper

- Thermal Paper

- Others (e.g., recycled paper, specialty paper)

- Plastic / Synthetic

- Polypropylene (PP)

- Polyethylene (PE)

- Polyester (PET)

- PVC

- Others (e.g., polycarbonate, polylactic acid)

- Foil / Metallic

- Aluminum Foil

- Metalized PET

- Others

By Printing Technology

- Flexographic Printing

- Digital Printing

- Gravure Printing

- Screen Printing

- Offset Printing

- Others

By Type of Label

- Self-Adhesive / Pressure-Sensitive Labels

- Wet-Glue Labels

- Shrink Sleeve Labels

- In-Mold Labels (IML)

- Blister Labels

- Others

By Application / End-Use Industry

- Pharmaceuticals

- Food & Beverages

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Packaged Foods

- Dairy Products

- Others

- Cosmetics & Personal Care

- Consumer Goods / Household Products

- Chemical / Industrial Products

- Others

By Packaging Type

- Bottles

- Jars / Tubs

- Blister Packs

- Boxes / Cartons

- Cans / Tins

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia