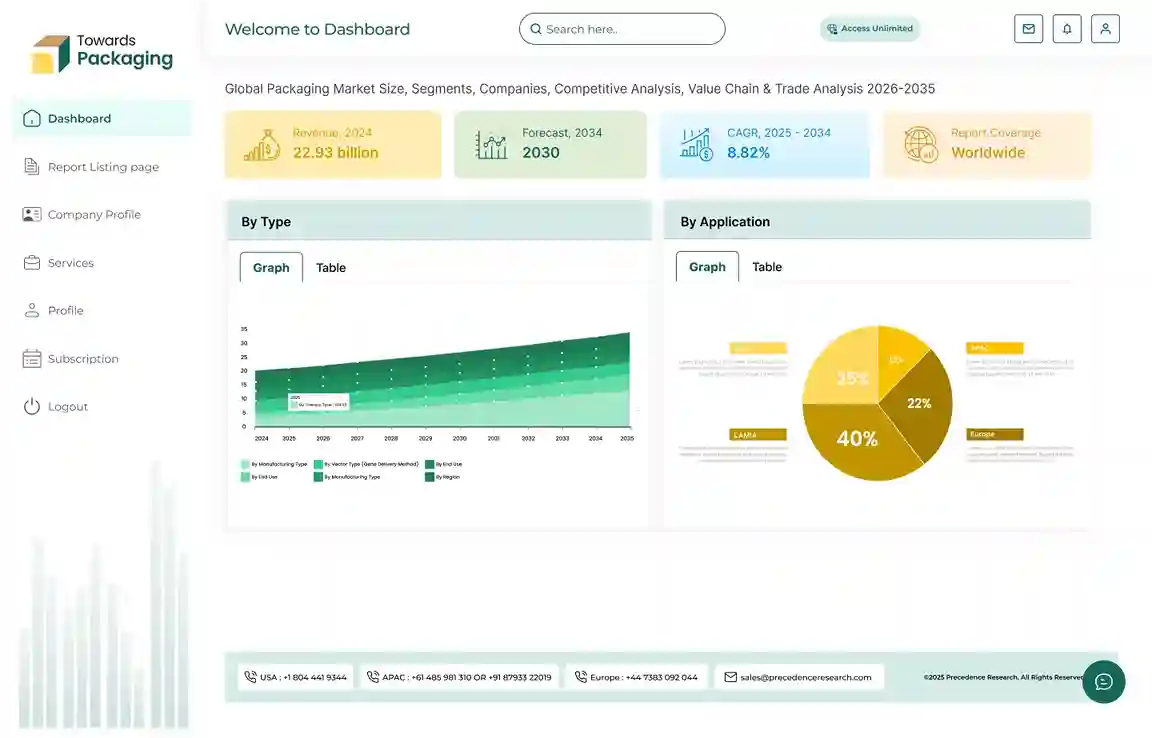

Healthcare Packaging Market Global Size, Segmentation Trends, Regional Breakdown, and Key Manufacturers Data

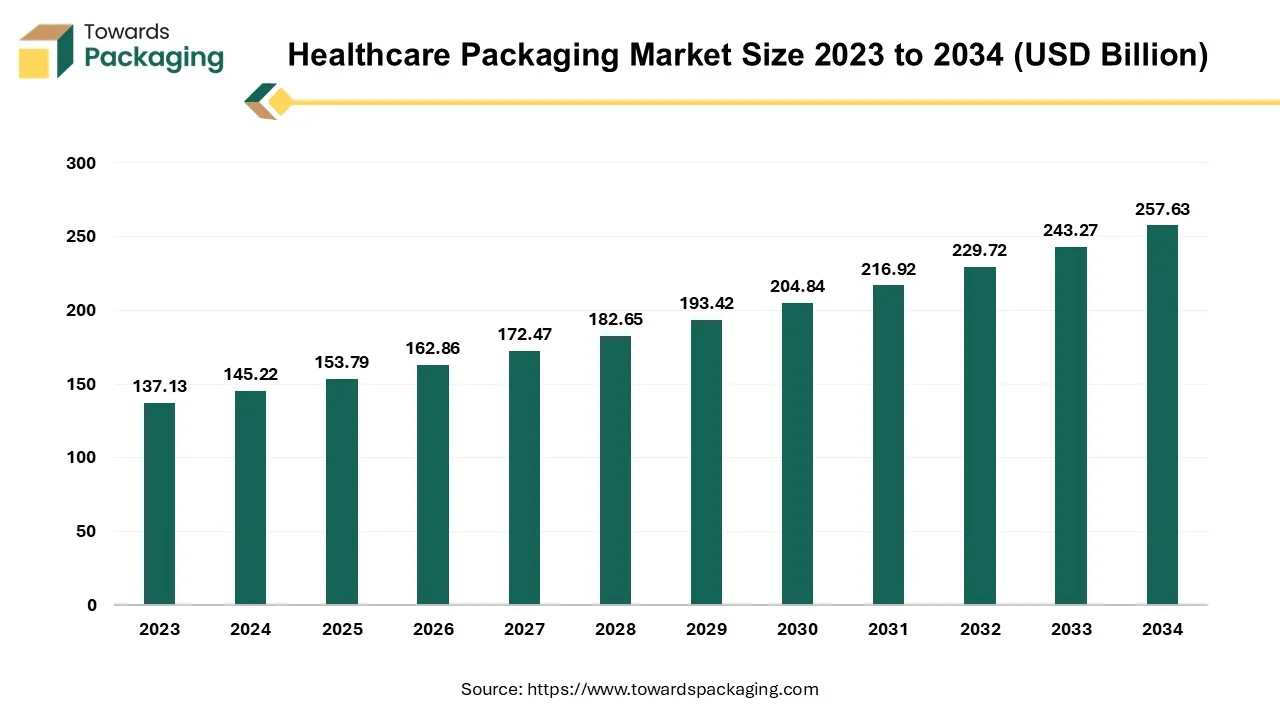

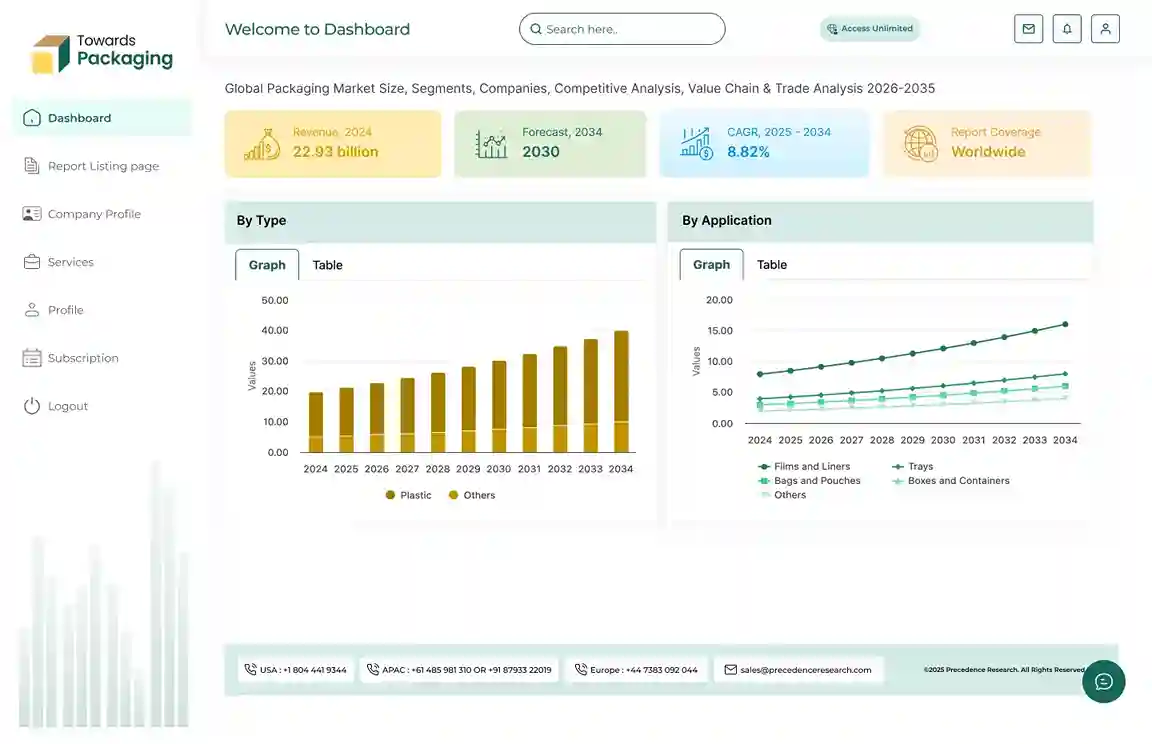

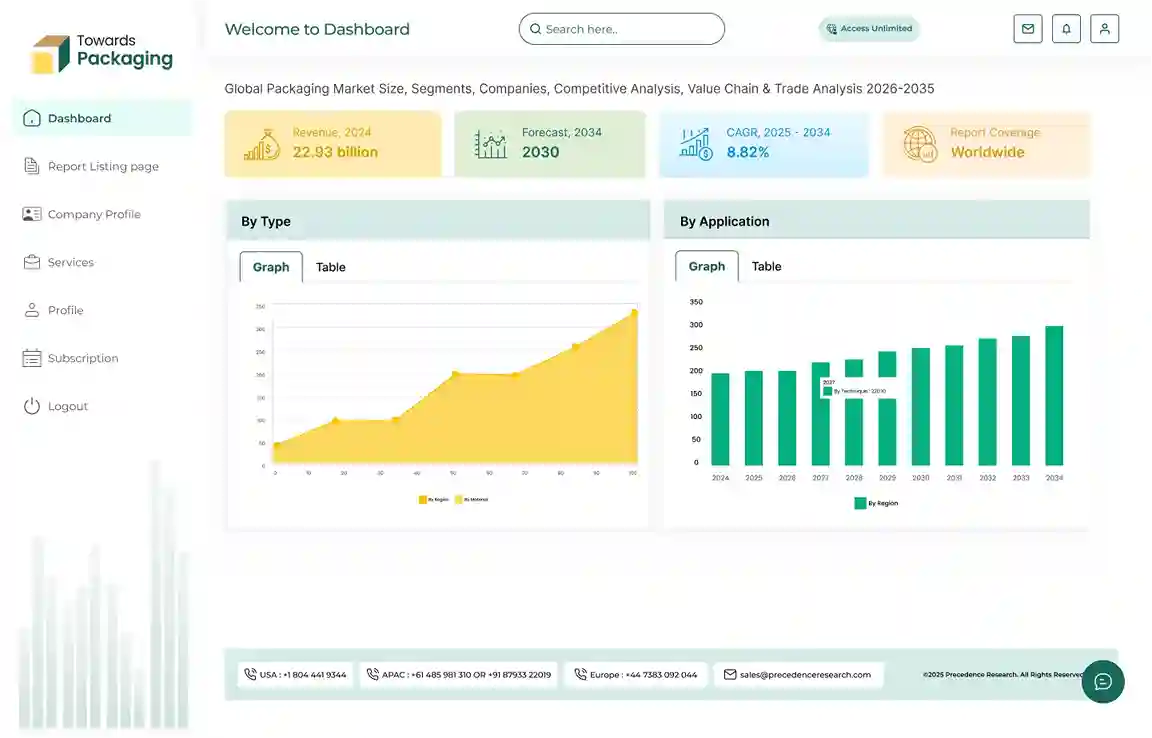

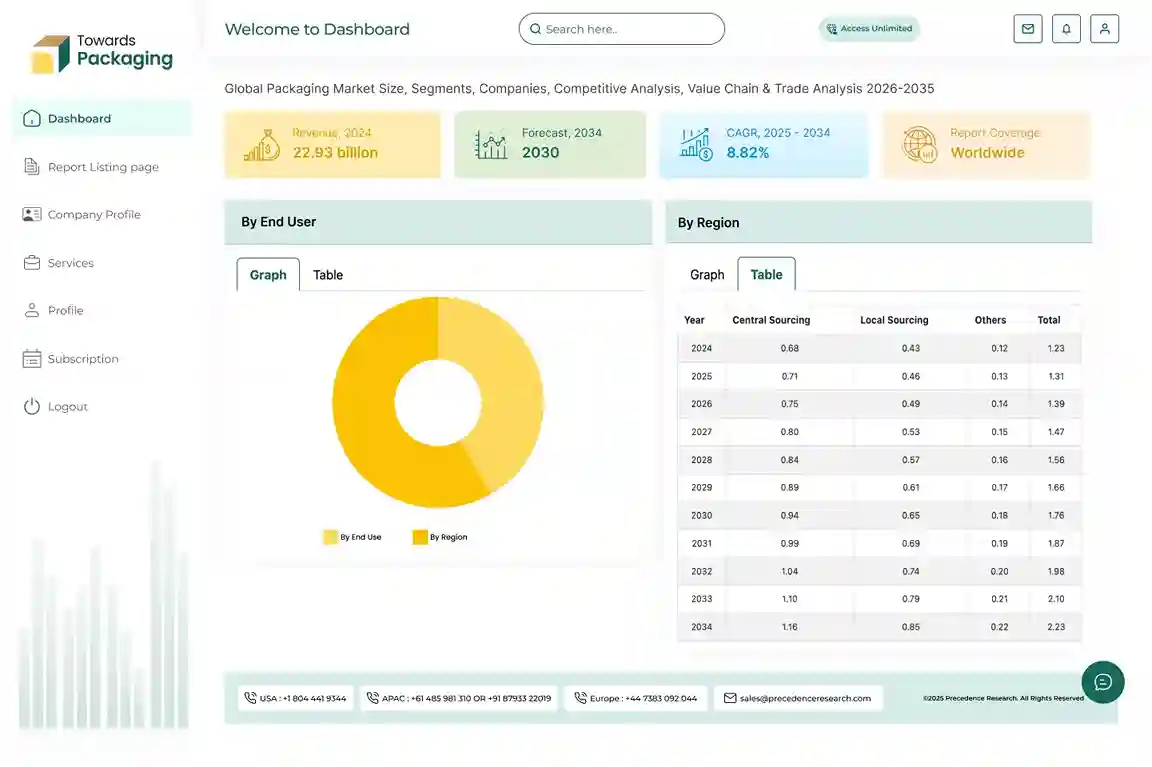

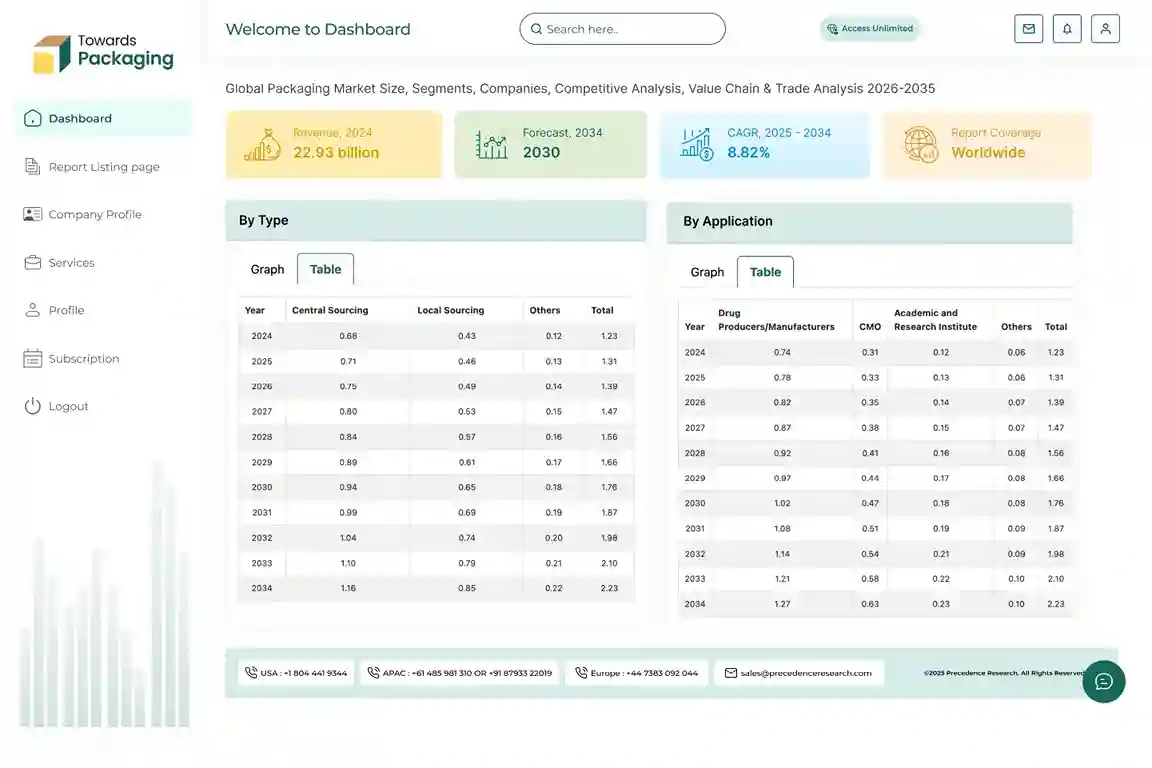

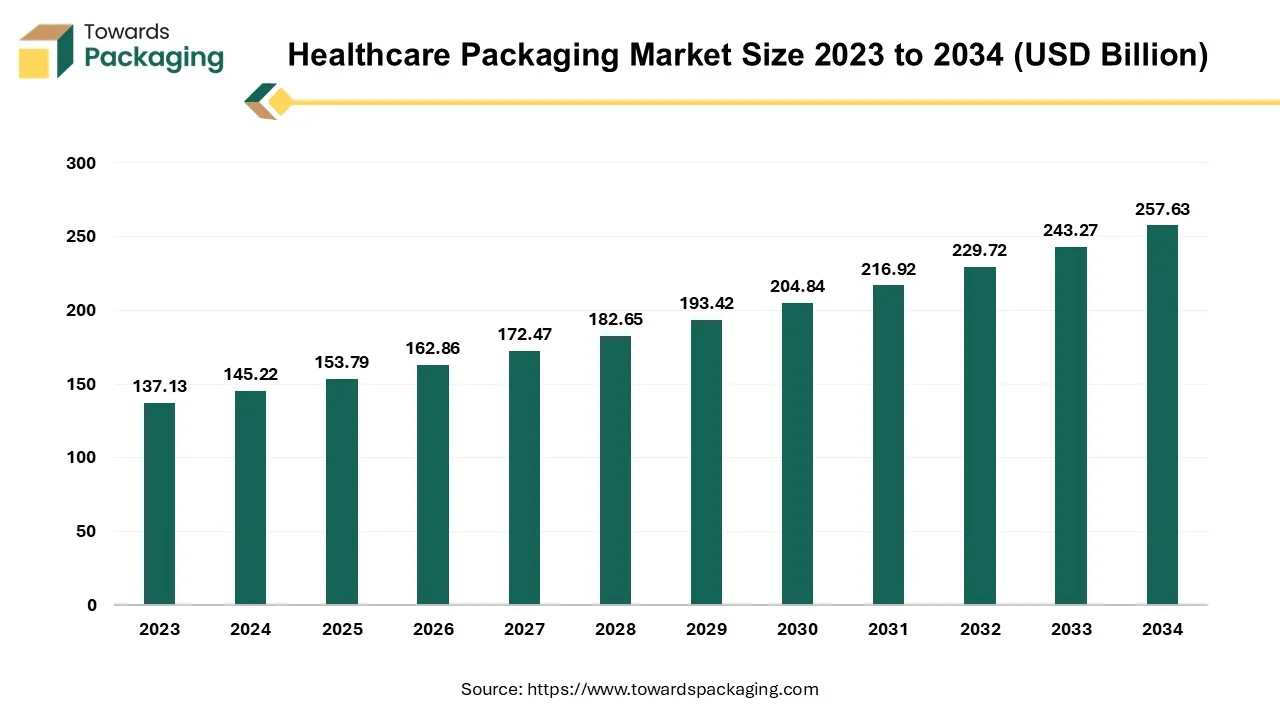

The healthcare packaging market is forecasted to expand from USD 162.86 billion in 2026 to USD 272.82 billion by 2035, growing at a CAGR of 5.9% from 2026 to 2035. The report provides an in-depth analysis of market segmentation by material (plastics, glass, paper & paperboard, and metal), packaging type (primary, secondary, tertiary), and end use (pharmaceuticals, medical devices, medical supplies).

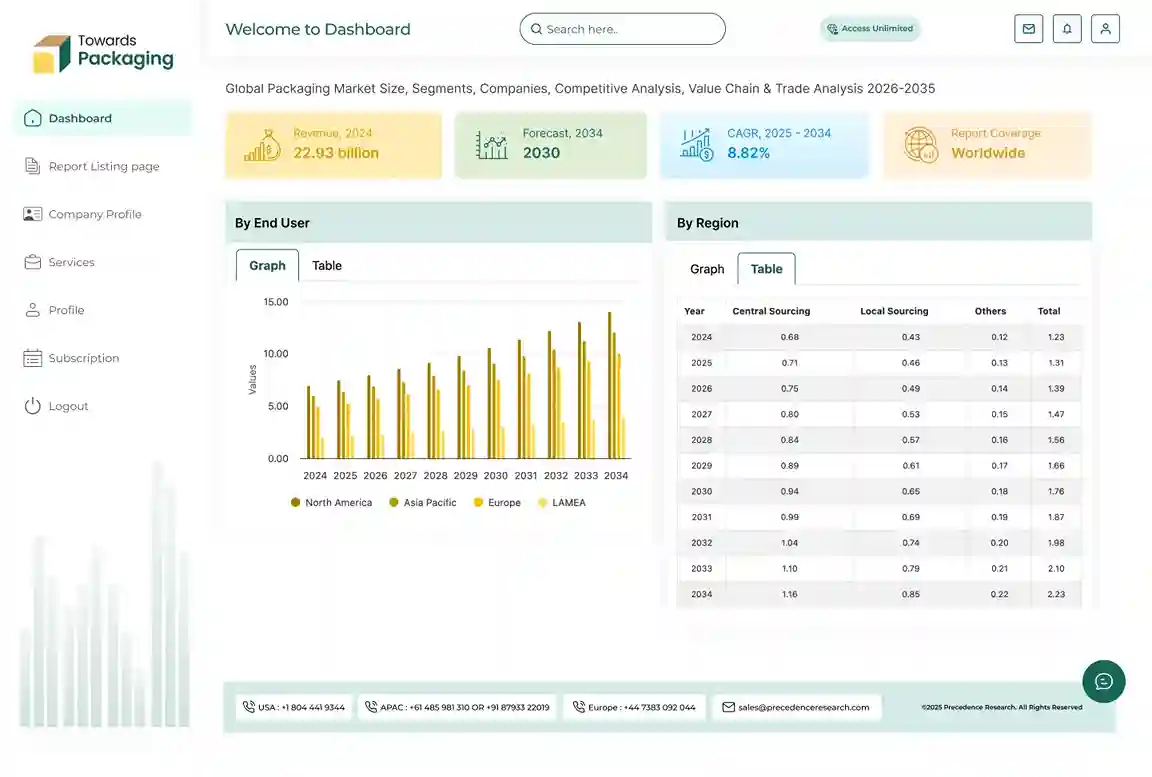

Regional insights cover North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, highlighting North America and Asia-Pacific as leading contributors. The study includes company profiles, competitive benchmarking, trade data, and value chain analysis featuring industry leaders such as Amcor, Gerresheimer, WestRock, and Schott AG.

Report Highlights: Important Revelations

- This expansion is at a consistent CAGR of 5.9% over the period from 2025 to 2034.

- Healthcare packaging drives growth in the Asia-Pacific region.

- Packaging industry in North America's healthcare sector shows promising growth prospects.

- Plastics play a fundamental role in healthcare packaging.

- Significance of primary packaging in healthcare is recognized.

- Packaging holds strategic importance in the pharmaceutical sector.

Healthcare Packaging Market Overview: Ensuring Product Safety and Advancing Innovation with Smart and Sustainable Solutions

The healthcare packaging is a packaging designed to protect and preserve the products and ensure it is safe to the consumer or patient. The healthcare packaging is made up of various materials such as plastic, glass, metal, paper and paperboard. Which is used to make packaging products such as primary packaging, secondary packaging and tertiary packaging. These packaging products are primarily used in pharmaceutical industry, medical devices and medical supplies.

The healthcare packaging industry plays a vital role in the healthcare sector by providing safe and secure packaging solutions for healthcare products. This industry encompasses a wide range of companies specialized in the manufacturing and supply of packaging components and delivery systems. These companies offer innovative packaging solutions that ensure the integrity of pharmaceutical products, maintaining their quality and efficacy. The industry is driven by the growing demand for healthcare global and the increasing focus on patient safety. The evolving regulations and advancements in technology, the industry is heading towards more sophisticated packaging solutions, including smart packaging and patient-specific packaging. Companies in this industry are also investing in sustainable packaging practices to reduce environmental impact and meet sustainability goals. Healthcare packaging industries are inclined to using active, intelligent, and antimicrobial packaging systems to increase the durability and future consumption.

- In March 2023, UK-based pharmaceutical packaging supplier Colorcon has completed its previously announced acquisition of Airnov Healthcare Packaging.

Healthcare Packaging Market Trends

- Interactive Packaging: Interactive packaging includes features like lights, sounds and vibrations, which are aimed to remind the patients that they should not skip taking their medication.

- Smart Labels: It can be contained by the marking which may have printed sensors that can show variations of temperature, humidity, etc. that could impact the effective use of drugs. Another type of label is something that contains not only serial-number related data but also tamper-evident features.

- RFID Tags: Radio frequency identification (RFID) tags is a new technology, which is very small and without wires. It can be embedded into packaging and used for tracking and monitoring of medication and medical devices in order to monitor their condition within the supply chain in real-time.

- Temperature Monitoring: The drugs and vaccines which are temperature specific cannot be kept properly during transport and storage thus they tend to lose their goodness and become ineffective. The smart packaging solutions can be designed that would help in activation of the sensors which, ones the temperature deviates from the normal value will send an alert automatically.

Asia-Pacific Healthcare Packaging Market Driving Growth Through Personalized Healthcare, Economic Expansion, and Strategic Investments

Asia-Pacific healthcare packaging market is the largest healthcare packaging market. The Asia-Pacific region, representing a wide spectrum of diverse populations, recognizes personalized healthcare as an essential tool for ensuring timely and accurate interventions when an individual is diagnosed with a disease or, more importantly, for disease prevention.

The Chinese government has done a lot to develop infrastructure in local healthcare. A health Industry Summit report published last October exposed that the Chinese government has got a 2030 master plan called “Healthy China 2030” which will be used to get a healthy China in the next 15 years. The healthcare market by 2030 will have reached a size of $2.3 trillion.

India is economically growing and medicine shift from communicable diseases to lifestyle diseases. India will soon be the epicentre of the diabetes pandemic. Various types of drugs and pharmaceuticals are exported from India. India’s healthcare sector is cheaper than other countries healthcare sector. These factors have provoked a hive of activities and an influx of investment in the Indian healthcare industry.

Such factors have been observed to be the driving forces that are leading to the expansion of healthcare packaging in the Asia Pacific region.

For Instance,

- In February 2024, Amcor, a global leader in the design and manufacture of responsible packaging systems, has signed an agreement acquired private Shanghai-based MDK. Amcor is a company that has a sales revenue of about $50 million per annum and is a major supplier of medical device packaging, a key growth field in which Amcor is focused.

North America's Healthcare Packaging Market: Driving Innovation and Growth Through High Expenditures, Industry Initiatives, and Strategic Investments

North America represents a fastest growing market with increased awareness about hygiene and growing healthcare sector. Comparing the health care spending per person between wealthy countries, such as the U.S., and lower-income countries, the former likely spend more than the latter. Even among the wealthier countries, the U.S expenditure more per individual, compared with other countries.

| Top Healthcare Companies by Revenue, U.S., 2022 (US$ Billion) | |

| Company | Annual Revenue |

| CVS Health Corp. | $315.3 Billion |

| UnitedHealth Group Inc. | $313.2 Billion |

| McKesson Corp. | $273 Billion |

| AmerisourceBergen Corp. | $238.7 Billion |

| Cardinal Health Inc. | $188 Billion |

| Cigna Corp. | $181 Billion |

| Elevance Health | $153.3 Billion |

| Centene Corp. | $141.7 Billion |

| Walgreens Boots Alliance | $132.8 Billion |

| Pfizer | $99.9 Billion |

The leading healthcare companies in U.S. are innovating advance packaging for healthcare sectors which are improving the products protection and preservation. High-income nation average health expenditures per person in the U.S. reached a record $12,555 in 2022, that was approximately $4,000 more than in competing nations. The amount of $6651 per capita spent on health in other like countries is around 50% higher than the U.S. per capita. This expenditure impacts packaging of the medicines in the healthcare family.

In North America, there is no mandatory federal legislation that mandates the use of recycled content in medical devices and their packaging. Some industry associations have come up with a wider pledge namely the American Chemistry Council which commits to reuse or recover every plastic packaging by 2040 and the Canadian Plastics Industry which targets at having all plastic packaging to be reused, recycled or recovered by 2040.

The packaging industry will witness the promising growth in the market with the North Americans making efforts to have a better packaging.

- In February 2024, Resource Label Group (RLG), a provider of full-service labels and packaging which has made RLG Healthcare, a specialty division in pharmaceutical and healthcare packaging.

Healthcare Packaging Market, DRO

Demand:

- The daily increase in the global healthcare sector there arises a demand for the packing solutions to save and ensure safe keeping of the medical devices, pharmaceuticals, and other healthcare products.

Restraint:

- The healthcare sector faces an environmental threat through single-use plastics which, in order to reduce the problem, necessitate the green packaging development. The switch to the sustainable ways of disposing waste may lie in perils in regard to cost and the readiness of the technology.

Opportunity:

- The shift towards recyclable packaging companies now have a chance to create a full spectrum of eco-solutions based on biodegradable, recyclable and compostable materials.

Plastics as the Backbone of Healthcare Packaging

Plastics are one of the most important and undeniable components of primary packaging of healthcare packaging. These are the main functions of packaging materials, and they are responsible for the protection and shelf life of the content, by acting as a barrier to microbes, moisture, oxygen and light. That the product is in perfect condition after two years, or the packages open without damage or contamination are the highest requirements compared with most of the consumer goods packaging.

The provision of the right labelling, child-resistance and the possible of counterfeit among the regulatory environment of healthcare packaging is extremely risk-averse and restrictive, making the process of updating the packaging expensive and time-consuming.

The most used plastic in healthcare packaging are PE, PVC, PET and PP, as these provide a great combination of protection and the low interaction with sensitive content. Nevertheless, in flexible packaging, the main plastic materials are often combined with other polymers or with aluminium to improve the barrier properties which creates multi-material laminates that are almost impossible to recycle. The acceptance and wide availability of plastic growing the demand in healthcare packaging market.

- In January 2024, Plastic blow moulder Container Services Inc (CSI) has bought US-based Apex Plastics at an unspecified price. Apex is an expert in custom single-stage polyethylene terephthalate and extruded high-density polyethylene packaging.

Primary Packaging in Healthcare Ensuring Protection, Compliance, and Safety for Sensitive Products

The primary packaging is the one that has the direct contact with the product, and it is often called retail packaging or POS (Point-of-Sale) Packaging. The primary packaging is used both for preserving the product and for informing the consumer. In this healthcare packaging, primary packaging is the material that directly touches your medical device or drug. During the process of choosing the primary packaging solution, there are many factors that should be considered product consistency, weight, sharp or rough edges, barrier requirement, and sterilization methods. To determine the most suitable packaging solution for the selected product, the following components have to be considered which are bags and pouches, blisters, clamshell, bottles, tubes, ampoules and vials.

The plastic bags that are used for packaging or the waste that is to be disposed must follow the regulations as far as the concerned state standards on plastic disposal and recycling are concerned. The bags can be recycled. There are a number of medical plastic bags or pharmacy bags used in these two sectors for various applications, such as dressing disposal waste bags, specimen bags, and adhesive closure bags, and bedside and respiratory setup bags. There are many different types of plastic bags that are used in the healthcare sector for packing and disposal and many other things. The healthcare sector is a highly demanding consumer of bags and pouches of different varieties which are used as a packaging material.

- In June 2023, CCL Industries Inc, a global leader in specialty label, security and packaging solutions for multinational corporations, government bodies, small businesses and consumers, has signed a deal to take over Pouch Partners, Italy, from Pouch Partners AG, Switzerland, a company owned by the Swiss-headquartered Capri-Sun Group.

Strategic Importance of Packaging in the Pharmaceutical Sector

The main purpose of healthcare packaging is to preserve the drugs and to ensure that they are stored properly. it is also a crucial information tool such as labelling, leaflet in order to boost patient compliance and fight for medication errors. Packaging industry of healthcare sector led by pharmaceutical, medical devices and medical supplies. The choice of primary and secondary packaging is a key strategic tool for pharmaceutical business. The packaging alteration involves the bags, closures, labels, and related things. there is a clear movement towards contract packagers as a source of growth in the industry which is a major factor in its rapid development.

In the pharmaceutical sector, the drugs have been taken orally in the form of tablets or capsules, which made up 51% of whole. Packaging in blister packs, which is a common technique in Europe and Asia, or in plastic pharmaceutical bottles, which are popular in the United States, are the most common ways to deliver these medicines. In addition, oral drug intake encompasses tablets, powders, pastels, and liquids. The consumption of medicines and drugs are protected by the innovative packaging where preservation of products is an important factor.

Composite materials, 24% of the market, provide unique combination of plastic strength as well as a desirable characteristics like transparency and barrier protection. This shift in packaging materials broadens out the field of possibilities for pharmaceutical businesses and thus motivates innovation in response to the changing needs of customers who prefer sustainability and product integrity. The diversity of packaging materials, in turn, calls for the business to be able to handle changing demands.

- In March 2023, Colorcon, Inc., a top pharmaceutical film coatings and specialty excipients company, acquired by Arsenal Capital Partners, announced that the deal is closed.

Key Players and Competitive Dynamics in the Healthcare Packaging Market

The competitive landscape of the healthcare packaging market is dominated by established industry giants such as Amcor, WestRock, Gerresheimer, Schott AG, BD, Berry Global, West Pharmaceutical Services, Avery Dennison, Ball Corp, Crown Holdings, DuPont, International Paper Co, Oliver Healthcare Packaging, Smurfit Kappa, DS Smith, Mondi, Sonoco, Abbott, AptarGroup, CCL Industries, Constantia Flexibles, Nelipak Healthcare, Origin Pharma Packaging. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Amcor applies innovation and sustainability to the healthcare industry, giving a wide variety of packaging solutions to each of the industry’s specific needs. Highlights the importance of advanced materials and technology development in the context of product protection, safety, and environmental sustainability.

- In November 2023, Amcor, a packaging developer and provider, has announced the launch of its Medical Laminates solution. Amcor’s latest innovation has been proven to produce the entire packaging from all-film that is recyclable in PE stream.

WestRock, as our supplier, will prioritize customers' needs and supply chain optimization with the aim of producing comprehensive packaging solutions that are tailor-made for the healthcare sector. Provides a broad spectrum of packaging options which contain paperboard, corrugated packaging, and rigid containers, to meet the vast needs of pharmaceutical and medical device companies.

- In July 2022, WestRock Company reported on having signed a deal to buy the rest of Grupo Gondi shares, paying about $970 million, plus assuming debt, which is an implied value of enterprise at $1. 763 billion.

Gerresheimer is in the business of providing specialty glass and plastic packaging solutions for pharmaceutical, biotech, and medical device companies. Emphasizes innovation, quality and regulatory compliance, providing a wide variety of packaging that involves product safety, integrity and usability.

- In January 2024, Gerresheimer, a supplier for the pharmaceutical and life sciences industry, will spend more than $88 million in its manufacturing expansion in Peachtree City.

Schott AG, widely recognized for its high-end glass packaging for the pharmaceutical and healthcare market. Emphasizes on precision engineering, quality control, and customer relationship to design packages that are accurate, secure and consistent in performance.

- In March 2023, SCHOTT poured $75 million over the last 3 years in order to increase its pharma glass production in India to meet the growing demand in Asia.

Healthcare Packaging Market Companies

- Amcor

- WestRock

- Gerresheimer

- Schott AG

- BD

- Berry Global

- West Pharmaceutical Services

- Avery Dennison

- Ball Corp

- Crown Holdings

- DuPont

- International Paper Co

- Oliver Healthcare Packaging

- Smurfit Kappa

- DS Smith

- Mondi

- Sonoco

- Abbott

- AptarGroup

- CCL Industries

- Constantia Flexibles

- Nelipak Healthcare

- Origin Pharma Packaging

Healthcare Packaging Market Segments

By Material

- Plastic

- Polyethylene

- LDPE

- HDPE

- LLDPE

- PET

- Polypropylene

- Polyvinyl Chloride

- Polystyrene

- Polyurethanes

- Polyethylene

- Glass

- Paper & Paperboard

- Metal

- Aluminium

- Tin

By Packaging

- Primary Packaging

- Bags & Pouches

- Blister

- Clamshell

- Bottles

- Tubes

- Ampoules & Vials

- Secondary Packaging

- Jars

- Boxes

- Trays

- Sachets

- Tertiary Packaging

- Folding Cartons

- Containers

- Shrink Films

- Stretch Film

By End Use

- Pharmaceutical

- Medical Device

- Medical Supplies

By Material Type and By End Use Type

- Pharmaceutical

- Plastic

- Glass

- Metal

- Paper & Paperboard

- Medical Devices

- Plastic

- Glass

- Paper & Paperboard

- Aluminium

- Metal

- Medical Supplies

- Plastic

- Glass

- Paper & Paperboard

- Aluminium

- Metal

By Region

- Asia Pacific

- North America

- Europe

- MEA

- Latin America

- MEA

Tags

FAQ's

Select User License to Buy

Figures (1)