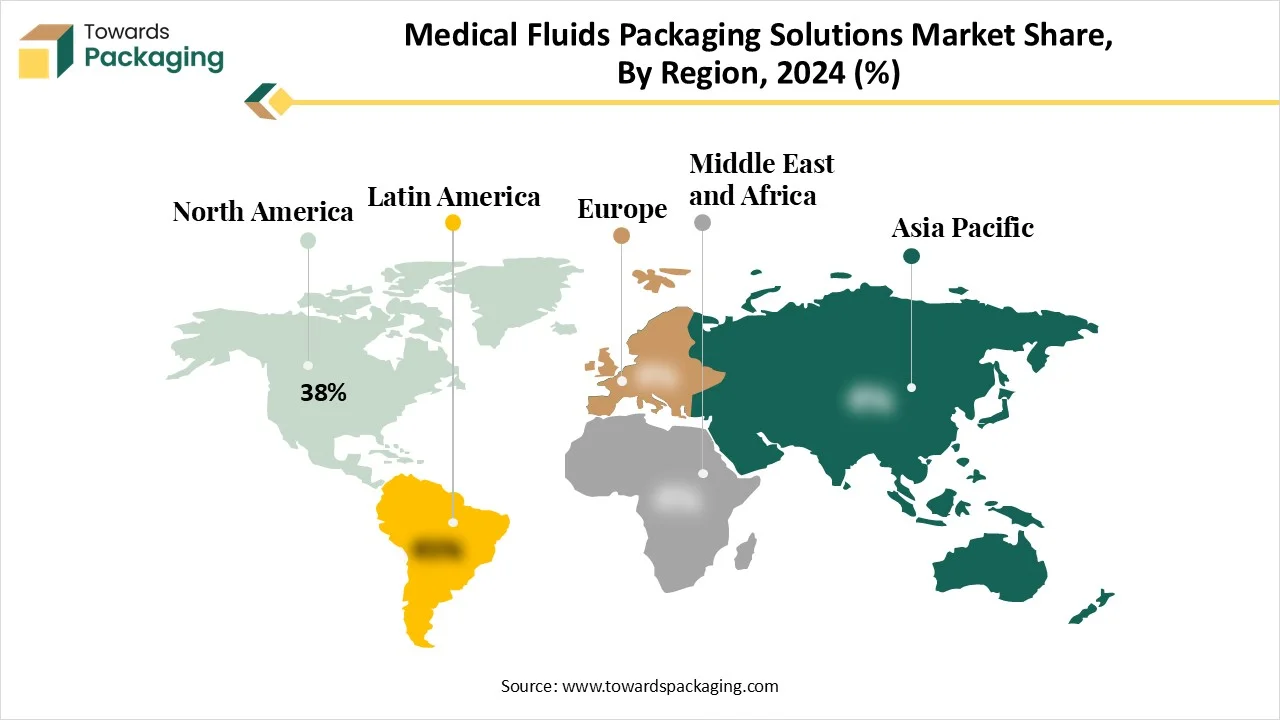

The medical fluids packaging solutions market covers a detailed examination of global market size, growth trajectory, and key trends shaping the industry between 2025 and 2034. The report includes statistical insights such as North America’s 38% share in 2024, APAC’s fast CAGR, single-chamber IV bags leading with 40% share, and plastics-PP dominating with 45%. It provides an in-depth segmentation analysis across packaging type, materials, applications, and end-users, along with regional assessments spanning North America, Europe, Asia Pacific, Latin America, and MEA. The study also features competitive analysis of top companies like Amcor, BD, Baxter, and DuPont, trade flow data, value chain mapping, and manufacturer and supplier benchmarks.

The medical fluids packaging solutions market covers packaging systems designed to safely store, transport, and administer medical fluids such as intravenous (IV) solutions, dialysis fluids, parenteral nutrition, irrigation fluids, and blood products. These solutions ensure sterility, chemical compatibility, ease of use, and regulatory compliance. Packaging formats include bags, bottles, ampoules, and specialized containers, using materials like plastics, glass, and multilayer films. They serve hospitals, clinics, home healthcare, and pharmaceutical manufacturing.

The integration of AI in the market plays an imperative role in several ways such as in designing customized packaging, optimize efficiency, smart packaging, and many others. AI is also used in the logistics and supply chain process for enhancing route planning, and delivery strategy. By leveraging artificial intelligence, producers can create revolutionary packaging solution. It has helped in the production of error-free packaging which enhance the reliability of the market in the pharmaceutical industry.

Rapid Advancement in Medical Technology Boost the Medical Fluids Packaging Solutions Market Development

The rapid advancement in the medical technology and rising prevalence to diseases has driven the market to grow significantly. With the increasing number of aging and unhealthy population the demand for pharmaceutical products also rises and its requirement for long-term storage influence the high-quality packaging. Rising investment towards development of high-quality drugs has enhanced focus towards medical fluid packaging solutions. There is a rapid enhancement in injectable medicines which require superior packaging for transportation as well as storage.

High Charges in Advancement of Technology Hindered the Market Growth

The high rising advancement of the packaging technology demand for medical fluids packaging hindered the development of the market. The existing supply chain vulnerabilities has restricted the expansion of this market.

Rising Demand for Sterile Packaging Enhanced the Opportunities of the Medical Fluids Packaging Solutions Market

The increasing demand for sterile packaging enhanced the opportunities of the market. The increasing concern towards maintaining hygiene and storage of medicines for longer period has raised the rising research for packaging solutions. Such huge investment and innovation have enhanced the opportunities in this market. The huge demand for contamination-free storage has influence the demand for suitable combination for medical fluid packaging solutions.

Why Single-Chamber IV Bags Segment Dominated the Medical Fluids Packaging Solutions Market In 2024?

The single-chamber IV bags segment dominated the market in 2024 due to its extensive usage in basic intravenous therapies. These are considered as cost-effective solution available for packaging of fluid drugs. These are majorly used for storage of electrolyte replacements, hydration liquid, and medication administration. These bags are convenient to use while administrating medicines which raise the demand for this segment.

The multi-chamber & specialty bags segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing growth in the medical fluid packaging sector due to its versatility. The rising demand for compatibility, safety, and flexibility in the medical sector has influenced the growth of this market.

Why Plastics Polypropylene (PP) Segment Dominated the Medical Fluids Packaging Solutions Market In 2024?

The plastics polypropylene (PP) segment held the largest share of the market in 2024 due to rising demand for safe and reliable packaging solutions. It has high resistance to chemicals and moisture which make it suitable material for packaging. The rapid development of biopharmaceutical industries has raised the utilization of such materials for manufacturing of medical bags, pouches, and various other packaging. Its unique properties ensure high protection and efficacy to the medical fluids and enhance the demand for this segment.

The multilayer laminates & barrier films segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing significantly due to increasing demand for durable and sustainable packaging for the storage of medical fluids. In the segment of multi layers laminates 7 layers barrier films are highly utilized because of specialized functionality.

Why Intravenous (IV) Fluids Segment Dominated the Medical Fluids Packaging Solutions Market In 2024?

The intravenous (IV) fluids held the largest share of the market in 2024 due to rising cases of chronic diseases. The increasing cases of chronic diseases like cardiovascular diseases, diabetes, and several others has boosted the demand for this segment in clinics and hospitals. The rising focus towards patient safety has enhanced the demand for high production of such fluid and suitable packaging for its storage and transportation. Technological advancement has supported its enhancements in the healthcare sector.

The parenteral nutrition solutions segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing rapid growth due to rising number of elderly populations, increasing rate of premature birth, and rising demand for neonatal care. It contains several nutritive elements such as lipid emulsions, vitamins, minerals, carbohydrates, and several others.

Why Hospitals & Clinics Segment Dominated the Medical Fluids Packaging Solutions Market in 2024?

The hospitals & clinics segment dominated the market in 2024 due to rising demand for efficient, safe, and sterile packaging. The increasing number of healthcare infrastructures for infection control and patient safety raise this segment. Robust guidelines for medical packaging and safety push the demand for high-quality packaging. Blood banks need special packaging for the safe storage of blood and blood components. These medical fluid packages contain dialysis fluid, and various other fluid which has different packaging demand for safety.

The home healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing increasing demand due to growing number of patients, increasing rate of chronic diseases, technological advancement, and cost-efficacy. This segment is influencing extensively by advancement in the delivery system of healthcare products, and demographic shifts.

North America held the largest share of the medical fluids packaging solutions market in 2024, due to the presence of strong pharmaceutical industries. Huge production of medical fluids enhances the requirement for packaging that can be used for both transportation as well as storage. The heavy investment by the major pharmacy brands enhances the demand for innovation in this market. High volume drugs approval, and production of vaccines influence this market to introduce enhanced packages. With the rising concern towards controlling infection there is a bulk demand to produce sterile packages.

The presence of well-established healthcare infrastructure increases the investment towards its packaging sector which has resulted the rapid innovation in the market. There is a huge demand for reliable and efficient packaging solutions for fluids boost the market to grow significantly. Advancement in the packaging technology focuses on enhancing the flexibility of the packages, sustainable packaging, and sterile packaging.

Asia Pacific expects the significant growth in the medical fluids packaging solutions market during the forecast period. This region has huge population which has enhanced the demand for healthcare services. With the support of government policies and initiatives this market is growing rapidly. In countries such as India, China, Japan, South Korea, and several other has a huge capacity to develop in the healthcare sector which progressively boosting the growth of this sector.

The presence of large and progressively expanding healthcare sector has influenced the demand for market in China. There is a rapid increase in the demand for single-use products which enhance the usage of pouches in this region. Several innovations such as development of smart packaging and antimicrobial packaging have raised the demand for this market.

By Packaging Type

By Material

By Application

By End-User

By Region

February 2026

February 2026

February 2026

February 2026