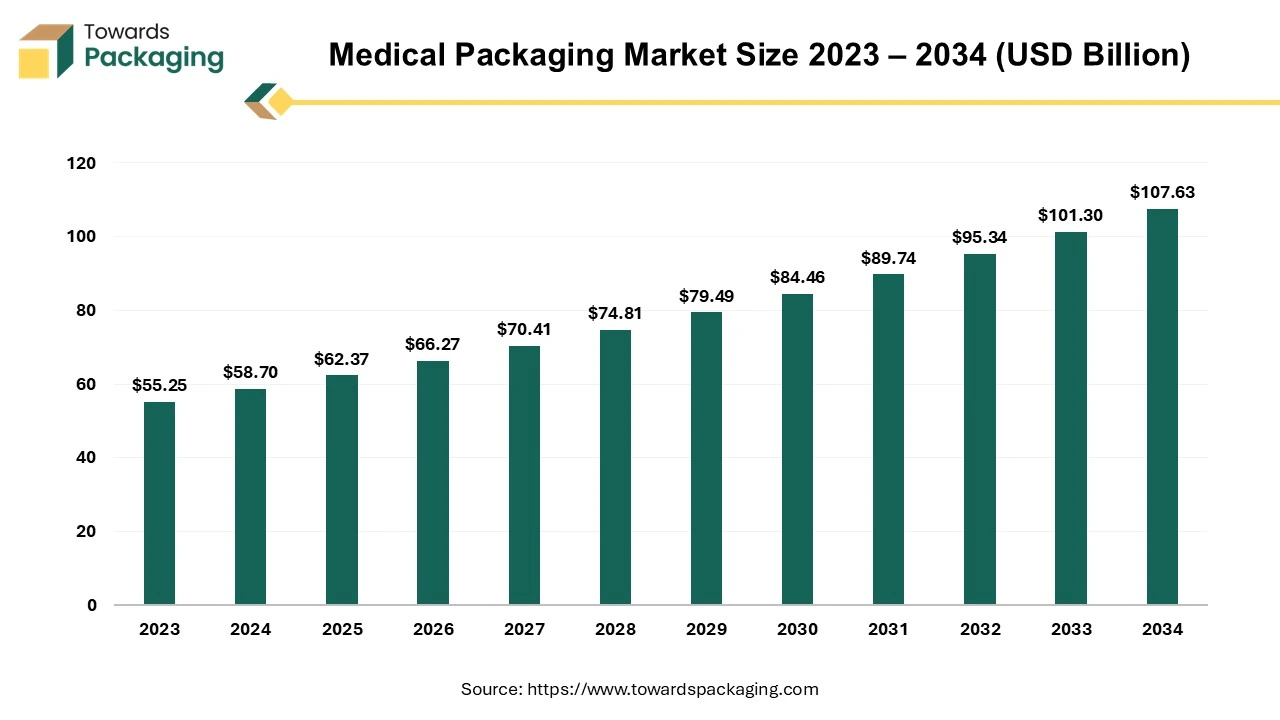

The medical packaging market is forecasted to expand from USD 66.27 billion in 2026 to USD 114.36 billion by 2035, growing at a CAGR of 6.25% from 2026 to 2035. This expansion is driven by increasing demand for sterile, sustainable, and smart packaging solutions in the healthcare sector. Innovations in biodegradable materials, tamper-evident designs, and intelligent tracking systems are shaping the industry landscape.

This market is proliferating significantly due to rising awareness towards healthcare, growing earnings among people, and increasing cases of chronic diseases such as diabetes, high blood pressure, coronary diseases, respiratory diseases, and many others. The growing concern among people about health issues and medical treatment also contributes to the growth of the medical packaging market.

The medical packaging market has a significant impact on the healthcare sector and pharmaceutical companies. This market is majorly focusing on biologics, medical devices and pharmaceutical requirements for packaging. It has a major role in storing for a long time safely, maintaining sterility, preventing damage while transporting, and keeping unaffected in adverse conditions. This market has experienced rapid growth in recent years due to continuous advancement in the healthcare sector and products related to the medical field.

The key factors comprise rapid growth in the ageing population, continuous research on medical devices and pharmaceutical sectors, and the growing prevalence of chronic diseases. The growth in personalized medicine demand and biopharmaceuticals necessitates special medical packaging choices. Additionally, innovations in the field of packaging resources such as advancements in barrier films, sustainable packaging materials, and various such factors fuel the market development.

| Metric | Details |

| Market Size in 2025 | USD 62.37 Billion |

| Projected Market Size in 2035 | USD 114.36 Billion |

| CAGR (2025 - 2035) | 6.25% |

| Leading Region | Asia Pacific |

| Market Segmentation | Amcor plc, West Pharmaceutical Services Inc., SCHOTT AG, Gerresheimer AG, SGD Pharma, S K Packaging, AptarGroup, Inc. |

| Top Key Players | By Material Outlook, By Application, By Packaging Type, By Packing Type and By Region Covered |

Industry Growth Overview: Growth is driven by increasing pharmaceutical production, specialty drugs, and the expansion of hospital and retail pharmacy networks. The rise of e-pharmacies and home care treatments is further accelerating packaging columns. Regulatory mandates for serialization and tamper evidence continue to shape market expansion.

Sustainability Trends: Companies are shifting to recyclable, lightweight, and mono-material packaging to meet environmental and regulatory goals. Reduction of plastic usage and adoption of paper-based alternatives are key priorities. Lifecycle assessments and sustainable sourcing are increasingly influencing supplier selection.

Startup Ecosystem: Startups are innovating in smart, eco-friendly, and adherence-focused packaging, often partnering with pharma companies. Many are developing connected packaging with tracking and reminder features. Venture funding is growing where solutions show clear improvements in patient outcomes or efficiency.

The incorporation of AI in the medical packaging market has brought a huge change in the healthcare sector as it provides top-quality packaging while fulfilling all the essential requirements of the market. It helps in the personalized packaging of medicines due to the rising trend for personalisation in the medical sector has enhanced this type of packaging. By analysing data to understand the demand of the people in an area and with the help of machine learning it is convenient for the packaging industry to produce such packaging which is effective in several ways and as a result, increases the demand of the market.

AI can help to analyse the improvements required in the packaging of the products. It can help to produce defect-free packaging which enhances the reliability of the market players and ultimately enhances the demand for the medical packaging market. With the incorporation of AI, there is a huge transformation can be witnessed in this market.

It gathers real-time data and helps to predict any issues or drawbacks that are associated with the packaging as a result improvements can easily be introduced to maintain the demand of the market. It is increasing the demand of the market by enhancing the standard of packaging quality, reducing the cost, and supervisory compliance.

| Resin Code | Plastic Type | Abbreviation | Common Healthcare Uses |

| 1 | Polyethylene Terephthalate (Polyester) | PET, PETE | Water/drink bottles, textile fabrics |

| 2 | High-Density Polyethylene | HDPE | Milk/yogurt drink bottles, waste bags, IV fluid containers, syringe barrels |

| 3 | Polyvinyl Chloride | PVC | Blood bags, IV bags, tubing, catheters, respiratory masks, disposable gloves |

| 4 | Low-Density Polyethylene | LDPE | Plastic bags, films, flexible packaging |

| 5 | Polypropylene | PP | Syringes, sterilisation “blue” wrap, irrigation bottles, basins, cups, masks, gowns, caps, shoe covers, drapes |

| 6 | Polystyrene | PS | Cutlery, yogurt cups, trays, clear packaging, test tubes |

| — | Expanded Polystyrene (Styrofoam) | EPS | Food packaging, packing peanuts, insulation |

| 7 | OTHER Plastics (not fitting into codes 1–6) | — | — |

| — | Polycarbonate | PC | Medical tubing, catheters, incubators, syringes, blood oxygenators, baby bottles |

| — | Polyurethane | PUR | Sponges |

| — | Polyamide | PA | Tea bags |

| — | Nitrile Rubbers | — | Disposable gloves, catheters |

| — | Polylactide | PLA | Coffee cup lids, yogurt pots |

The medical packaging market is driven by several factors such as patient safety, extended shelf life of medicines, product protection, and dose management. Medical products, such as medicines, medical devices and diagnostic devices can be damaged by factors such as temperature, humidity and sunlight.

The correct packaging protects such products from damage and ensures that they can be stored effectively up to when they are used by patients. Gradually healthcare sectors are evolving which influences them to ensure safety, enhance the longevity of the device, and extend pharmaceutical sector demand for better-quality packaging materials.

These packaging include blister packs, pouches, and strips which can protect from exposure to oxygen, moisture, and light. These can extend the shelf life of medicinal products is growing important, mainly for medical devices and pharmaceutical products. Packaging resources implanted with measured-statement skills such as pouches which absorb moisture or are sensitive to temperature. The extension of the shelf-life of the medicines reduces the wastage of the medicines and lowers the charges for the products. Both of the factor, product safety and extended shelf-life enhance the demand of the medical packaging market.

A generic medicine is a pharmaceutical medicine with the same chemical composition, planned use, quantity, route of administration and side effects as every other medicine. Several market players are capitalizing on industrial generic medicines to provide medication treatments at lower charges. Medical packaging plays a vital role in the production process of generic medicines as they are desired to pack and protect medicines throughout storage and transportation. Hence, the growing demand for generic medicines will push product utilization.

Additionally, the pharmaceutical industry’s rising importance on sustainability and ecological accountability fuelled the requirement for environment-friendly packaging choices. A rising market for biodegradable and recyclable packaging resources is generating a demand for advanced packaging technology that can manage these resources. The increasing usage of track and trace machinery also influences the industry for medical packaging devices. Progressive tracking and tracing machinery can be utilized to improve the safety and security of pharmaceutical medicines.

Due to the fluctuation in the charges of raw materials which are used in the production of medical packaging. This can hinder the growth of the market as medium to small companies face difficulties in investing in such raw materials.

| Source / Audit | Total Waste Generated | Plastic Waste (kg or %) | Hard Plastics (%) | Soft Plastics (%) | Other Plastic Details |

| US Healthcare (Estimate) | – | ~26% of total waste | – | – | General medical plastics |

| NHS (UK, Pre-COVID) | 11,300 tonnes/day | ~23% of total waste | – | – | Plastic fraction likely increased post-COVID |

| Operating Theatres (General) | – | Majority of waste is plastic | – | – | Includes gowns, drapes, blue wrap, packaging |

| Blue Wrap Share in OR Waste | – | ~18% of OR waste | – | – | Mostly polypropylene |

| Hysterectomy Surgery (US) | ~9.2 kg per surgery | 22–34% plastic items | ~5% gloves | 36–45% mixed plastics | Includes gowns, wraps, trays |

| Emergency Department (US, 300 patients) | 676 kg / 24 hrs | 63.8% plastic | 19.30% | 44.50% | 2% unused items |

| Neonatal Ward Audit (Europe, 48 hrs) | 1,330 kg | 631 kg (47.5%) | – | – | Mix of recyclable and general plastics |

Bio-layering and bio-packaging are becoming increasingly important for both human health and environmental sustainability. Unlike conventional plastics, which can release harmful chemicals into food, these materials significantly reduce chemical exposure. By using biodegradable and natural substances, they also help combat plastic pollution, one of the most pressing environmental challenges of our time.

For consumers, bio-layering enhances food safety by acting as a protective barrier against bacteria, pathogens, and contaminants. In the healthcare sector, bio-layered materials are used in medical packaging to safeguard sensitive instruments and pharmaceuticals while minimizing environmental impact.

The polymer segment led the market in 2024. This material is extensively used due to its versatile, durable properties and it can withstand strict supervisory requirements. These polymers' medical packaging generates protective barriers which can preserve the integrity of the products. It offers advanced-level resistance and protects medical products from light, air, and moisture. These are light in weight which reduces their transportation charges with enhanced safety of the products. Polymer packaging is highly customizable which makes them most preferable by several companies as it can be designed with a variety of shapes and sizes.

Devices segment dominated the medical packaging market in 2024 due to the rising demand for medical devices and their safety in transportation. Several medical devices starting from diagnostic tools to surgical instruments required top-quality packaging which can safeguard them from damage while transporting. Packaging of such devices need to be sterilized, it should provide long term storage, and extend shelf-life of the products. It also protects from any adverse external effect that can cause damage to the devices. Aluminum foils, polymers, and specialized films are used for medical packaging as these create a protective barrier between devices and external environment.

Bags and pouches segment led the market in 2024 due to the rising demand for cost-effective and versatile packaging of medical products. These are most preferable for the sterilisation of medicines and medical devices. Several pouches are made in a sterilised way such as autoclaving, gamma radiation, or ethylene oxide. Its ability to manufacture customized sizes has influenced the market progress.

Primary packing segment held the dominating share of the medical packaging market in 2024. It is due to high concern for the safety of the medicines and devices. As primary packing comes in direct contact with the material it plays a crucial role in choosing its material for manufacturing. For medicines or other pharmaceutical products aluminum, glass, and plastic have played a significant role. These packing support maintaining the potency and stability of the medical products.

The paper and paperboard segment is growing rapidly, driven by the growing need for recyclable and sustainable packaging materials. To use less plastic, manufacturers of medical devices and healthcare providers are switching to paper-based secondary and tertiary packaging. The growth of this market is further aided by regulatory support for environmentally friendly materials and advancements in barrier coatings.

The IVD segment is expanding quickly, driven by the growing need for early disease detection, preventive healthcare, and diagnostic testing. The need for dependable, sterile, and protective packaging is rising due to the expansion of point-of-care testing, home diagnostics, and molecular testing. The demand for packaging in this market is further accelerated by ongoing advancements in diagnostic kits and rising healthcare spending.

The trays segment is expanding in the market due to widespread use in surgical instruments, medical devices, and procedure kits. Trays provide strong protection, easy sterilization, compatibility, and efficient organization of components. Their suitability for automated filling and handling makes them a preferred choice among manufacturers and healthcare facilities.

The secondary segment is growing rapidly in the market, motivated by growing regulatory demands for product information, traceability and labeling. The demand for carton boxes and wraps is rising as tamper-evident branding and transportation safety become more important. The growth of secondary medical packaging is further supported by the expansion of hospital distribution channels and e-commerce.

Asia Pacific held the largest share of the medical packaging market in 2024. Many Asia Pacific countries are expanding their healthcare infrastructure. Rising healthcare expenditures and government investments in medical services are increasing the demand for pharmaceuticals and medical devices and their packaging. Asia-Pacific is home to over 60% of the global population, with a growing elderly demographic in countries like Japan, South Korea, and China. These drives increased demand for medications, chronic disease treatments, and sophisticated packaging for elderly-friendly and home-use medical products.

Asia Pacific, especially India and China, is are global hub for generic drug manufacturing and medical device production. These countries require large volumes of medical packaging, often produced locally at competitive costs. Countries like China, India, and South Korea are major exporters of pharmaceuticals and medical supplies. Growing adoption of automation, smart packaging, and sustainable materials in countries like Singapore, Japan, and South Korea. Multinational companies are investing in local manufacturing facilities, Research and Development centers, and partnerships in the region.

North America is expected to grow at the fastest CAGR over the forecast period. It is due to the growing companies in the pharmaceutical sector, which enhance the demand in the medical packaging market. The rising demand for medical packaging products, growing disease occurrence, and increasing healthcare expenditure have boosted market development in this region. Additionally, the medical packaging market in the U.S. and Canada is growing rapidly due to high investment in the healthcare sector by various market players.

North America dominated the medical packaging market in 2024, due to the growing demand for pharmaceutical and medical device packaging, strict regulatory requirements, and the growth in sustainable packaging solutions. As consumers are becoming more health-conscious, they are selecting better-for products, which is making shifts in product choices (eg, fresh produce over prepackaged food). Similarly, packaging should protect product integrity, especially for supplements, food, cosmetics, and medical products. This requirement grows demand for the best barrier characteristics and less demand for packaging materials that are observed as potentially polluting, for instance, microplastics.

U.S. Market Trends

The U.S. medical packaging market is driven by the advanced healthcare infrastructure in the country. The U.S. has one of the most developed and sophisticated healthcare systems in the world. High demand for pharmaceuticals, medical devices, and diagnostics supports the need for high-quality, compliant packaging solutions. The U.S. is home to many of the world's largest pharmaceutical and medical device companies. These companies invest heavily in research and development and require specialized packaging for protection, compliance, and branding. Agencies like the FDA enforce strict regulations for medical packaging, especially regarding sterility, tamper-evidence, and labeling.

Compliance with such regulations drives innovation and high standards that other countries often emulate. U.S. companies lead in the development of smart packaging, antimicrobial materials, and biodegradable or sustainable packaging. The U.S. spends more on healthcare per capita than any other country, creating a large and profitable domestic market for medical packaging. U.S.-based packaging companies often set international benchmarks for quality and safety. American medical packaging products are widely exported and used in global markets

Europe is expected to experience steady growth during the forecast period. This is majorly due to the rising government support in the pharmaceutical sector, growing healthcare expenditure, and increasing occurrence of diseases. Moreover, the German medical packaging market has the highest market share among other countries such as Italy, France, Sweden, Denmark, and Norway, whereas the UK medical packaging market is observed as the fastest-growing market in this region.

Germany Medical Packaging Market Trends

Germany is a heavily developed market for the medical packaging market, driven by stringent pharmaceutical regulations and high patient safety standards. Environmental responsibility and sustainability regulations are driving the use of recyclable and low-impact packaging materials. The nation's robust pharmaceutical manufacturing sector sustains steady demand for superior legal solutions. Additionally, packaging innovation and investment are strengthened by the widespread use of digital traceability systems and serialization.

Medical packaging is an emerging sector in Latin America, as it has advantages in lightweight, contamination-free, safe, convenient, and barrier-resistant packaging, too. Plastic is considered the main medical packaging material, which is used in the pharmaceutical sector. The urge for plastic packaging in the healthcare industry is developing as it protects medical packaging from biological contamination, damage, and external influences.

Brazil has the largest medical packaging industry in Latin America, with around 9.5% of GDP expenditure on medical packaging. As per the International Trade Administration, there are around 7,191 hospitals in the region. The area’s growing medical packaging demand, the growing availability of over-the-counter medicines, and the main investments made by the local organizations contribute to development in the medical packaging market.

The Middle East and Africa market is rapidly growing into a powerhouse of the medical packaging industry, driven by growing investment, rising demand for innovative medical solutions, and regulatory advancements. With governments giving importance to medical expansion and pharmaceutical production, trade shows have become an important part for industry leaders to partner with, display new technologies, and discover emerging market trends.

R&D : R&D focuses on barrier materials, drug–pack compatibility, and smart packaging for safety and monitoring. Innovation is also centered on child-resistant yet senior-friendly designs. Collaboration between material scientists and pharma companies is accelerating product development.

Distribution to Hospitals, Pharmacies : Hospitals prefer unit-dose and traceable packaging, while pharmacies demand tamper-evident and delivery-friendly formats. Automation-ready packaging is increasingly important for hospital dispensing systems. Reliable supply and short lead times are key distributor requirements.

Patient Support and Services : Packaging now supports adherence through easy-open designs, clear labeling, and smart reminder features. Customized blister packs help reduce dosing errors. These services improve treatment outcomes and patient satisfaction.

By Material Outlook

By Application

By Packaging Type

By Packing Type

By Region Covered

February 2026

February 2026

February 2026

February 2026