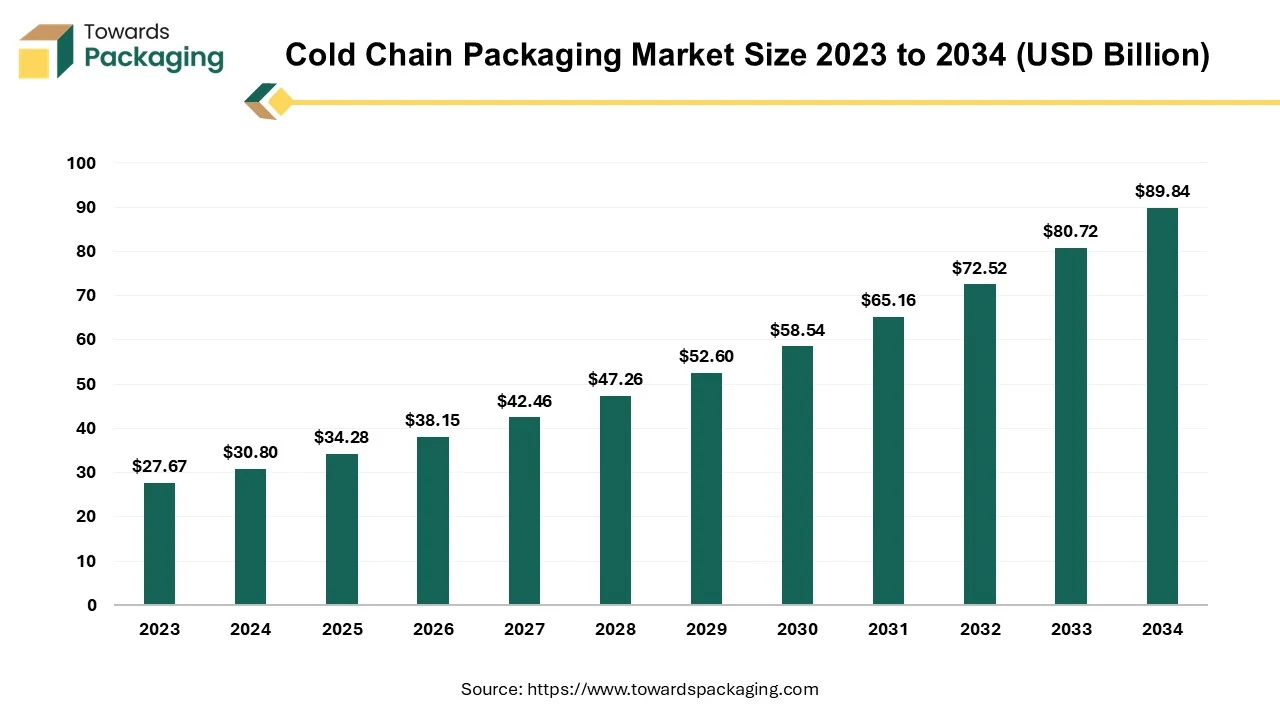

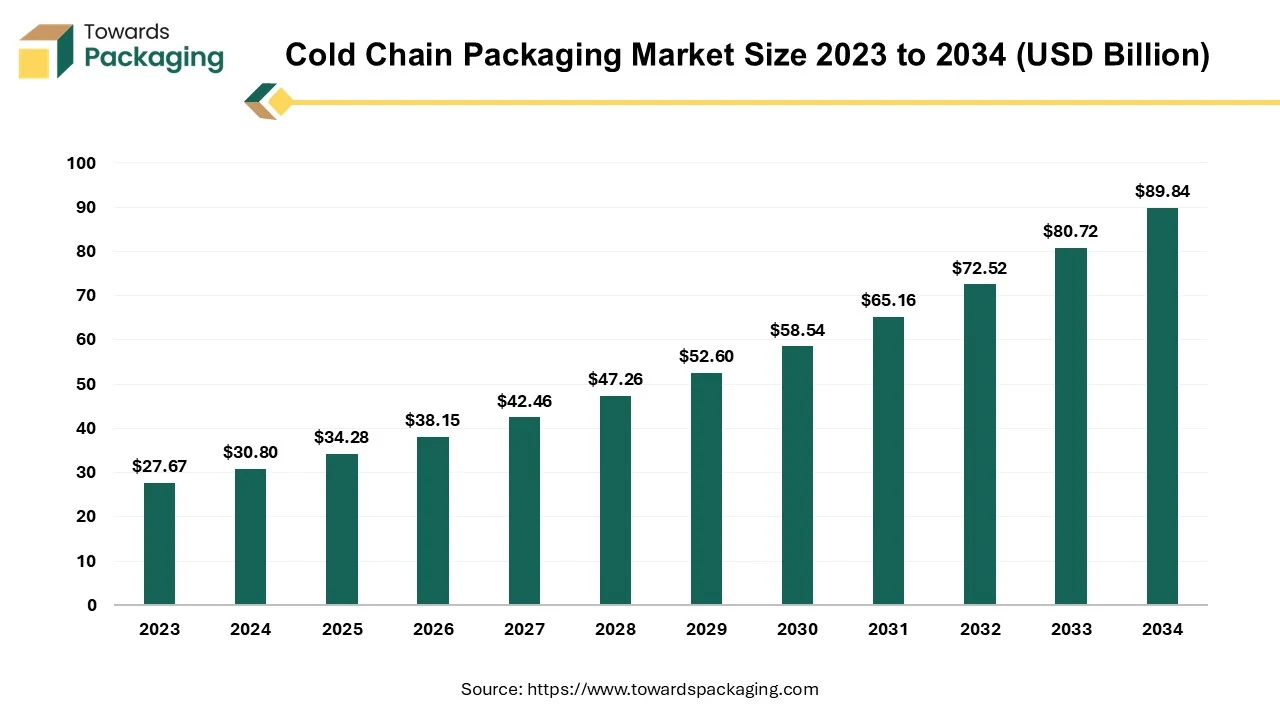

The cold chain packaging market is forecasted to expand from USD 38.15 billion in 2026 to USD 100.00 billion by 2035, growing at a CAGR of 11.3% from 2026 to 2035. This report provides an in-depth analysis of the market's size, growth trends, and segmented data, focusing on key regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa (MEA). The material segment analysis covers Expanded Polystyrene (EPS), Polyurethane Rigid Foam (PUR), and Vacuum Insulated Panels (VIP), while the product analysis includes Insulated Containers, Gel Packs, and Foam Bricks. The market’s competitive landscape is enriched with detailed company profiles and strategic moves from industry giants like CSafe, Sealed Air Corporation, and Cold Chain Technologies.

Major Key Insights of the Cold Chain Packaging Market

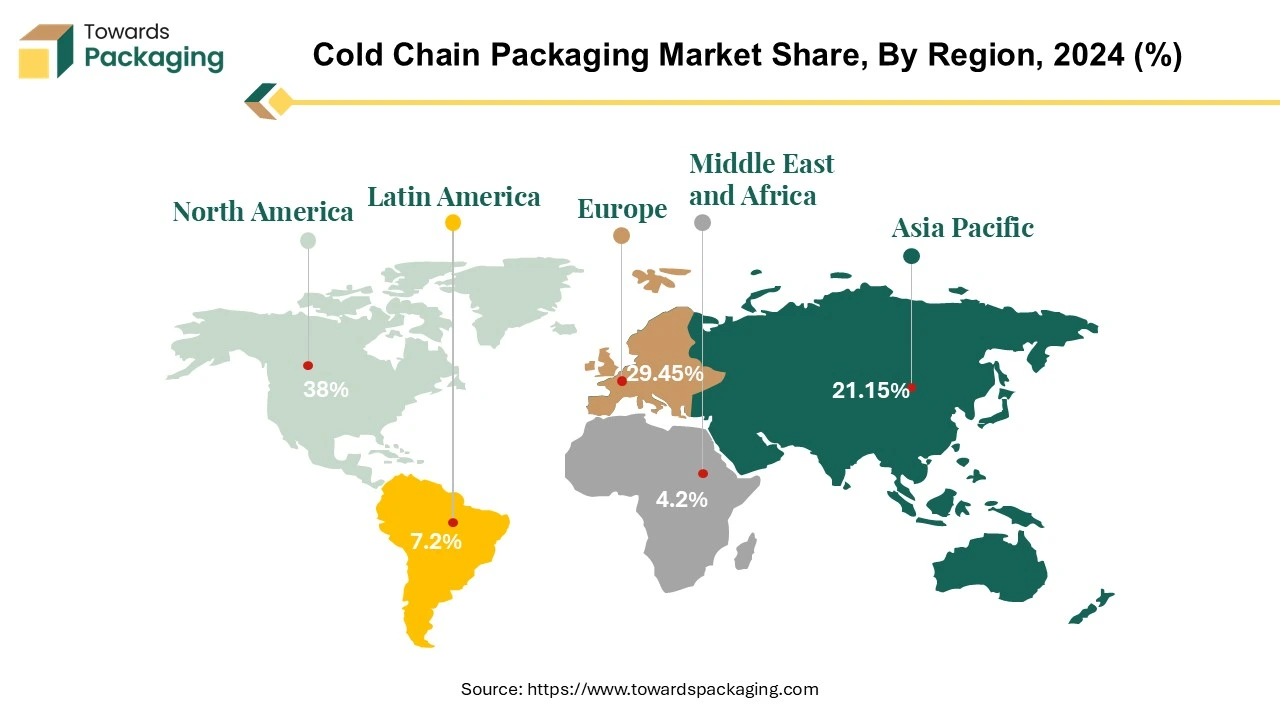

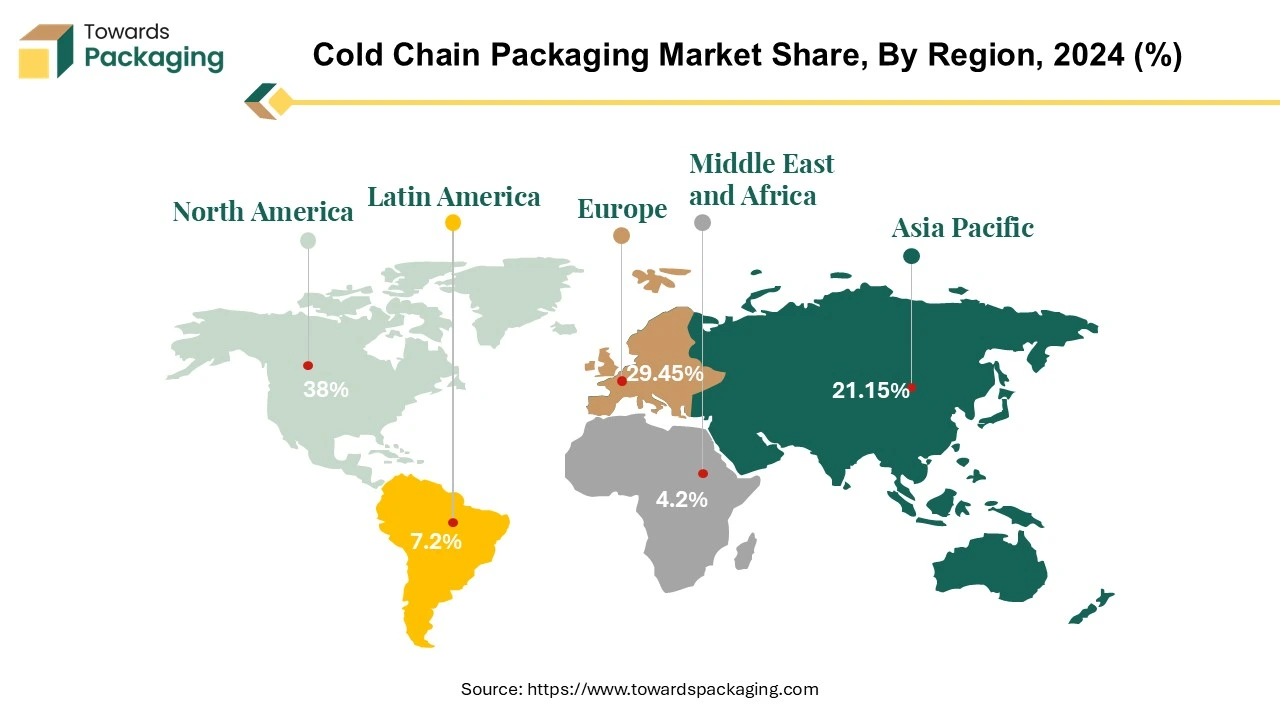

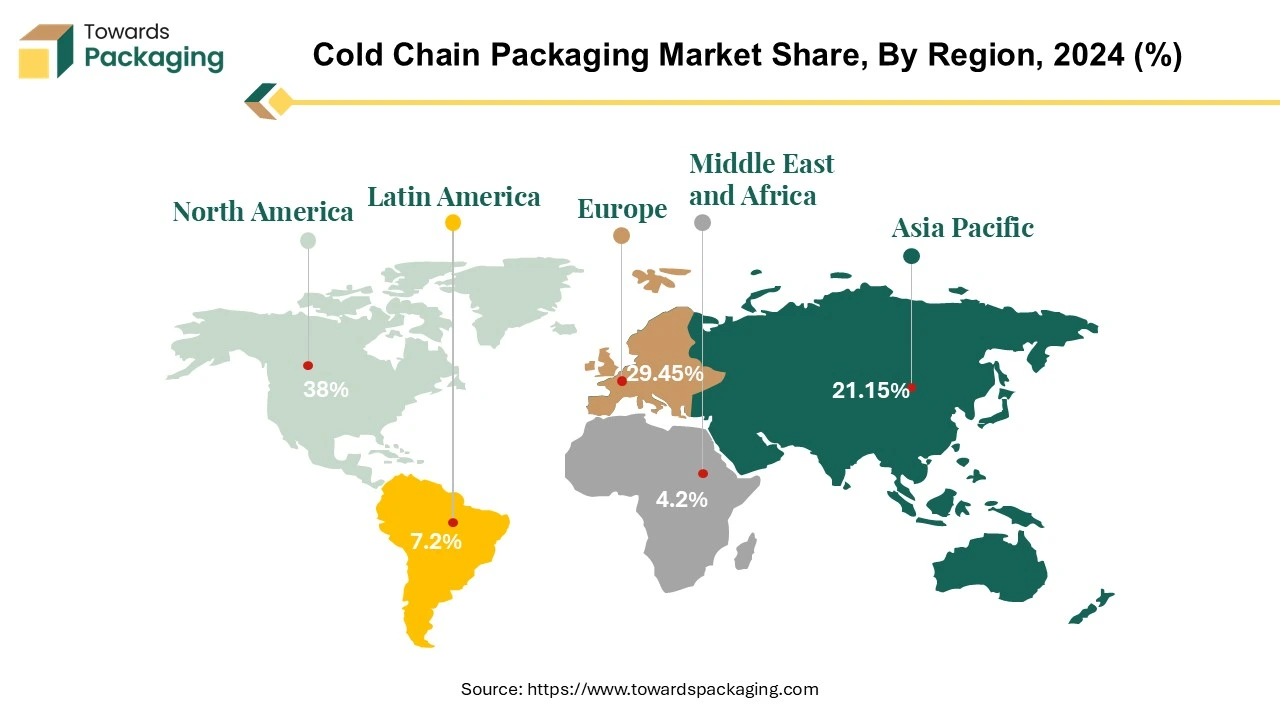

- North America dominated the cold chain packaging market in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By material, the expanded polystyrene (EPS) segment dominated the market with the largest share in 2024.

- By product, the insulated containers segment registered its dominance over the global cold chain packaging market in 2024.

- By end use, the Fish, Meat & Seafood segment dominated the cold chain packaging market in 2024.

Cold Chain Packaging Market

Cold chain packaging is known as specialized temperature-controlled packaging designed to maintain the safety, freshness, and stability of perishable goods during transportation and storage. It is an important part of the cold supply chain, ensuring that products such as food, vaccines, pharmaceuticals, and biologics remain within specific temperature ranges to prevent spoilage or degradation.

The cold chain packaging maintains temperatures from frozen (-20°C to -80°C), refrigerated (2°C to 8°C), or controlled room temperature (15°C to 25°C). The cold chain packaging uses materials like polystyrene, polyurethane foam, vacuum-insulated panels, and seaweed-based bioplastics to prevent heat transfer. The cold chain packaging has special gels or liquids that absorb and release heat to stabilize temperature inside the packaging.

Market Trends

Rising Demand for Temperature-Sensitive Products

The demand for effective cold chain packaging solutions is escalating due to the global consumption of perishable goods, including fresh produce, dairy products, meat, and seafood. The transportation of temperature-sensitive pharmaceuticals, such as vaccines and biologics, necessitates reliable cold chain packaging to maintain product efficacy.

Technological Advancements in Packaging

The integration of smart indicators, such as time-temperature indicators and RFID technology, is on the rise, enhancing real-time monitoring and ensuring product integrity throughout the supply chain. Developments in biodegradable and edible packaging materials, including those derived from seaweed, are gaining traction, offering sustainable alternatives to traditional packaging.

Strategic Acquisitions and Expansions

Major logistics companies are expanding their cold chain capabilities through strategic acquisitions. For instance, UPS announced plans to acquire Germany-based healthcare logistics firm Frigo-Trans to bolster its cold-chain facilities in Europe.

Emphasis on Sustainability

Eco-Friendly Solutions: There is a growing focus on sustainable packaging solutions, with companies investing in materials and technologies that reduce environmental impact while maintaining temperature control.

How Can AI Improve the Cold Chain Packaging Industry?

Artificial Intelligence (AI) is transforming the cold chain packaging industry by enhancing efficiency, cutting-down waste, ensuring regulatory compliance, and optimizing temperature-sensitive logistics. AI-powered IoT sensors continuously track temperature, humidity, and packaging integrity in real-time. Predictive analytics help detect potential temperature fluctuations before they occur, preventing spoilage. For instance, AI-driven platforms can predict when a cold storage unit may fail, allowing for proactive maintenance. AI enables smart packaging with RFID tags, QR codes, and blockchain integration for real-time tracking. Smart labels provide instant temperature history, ensuring compliance with FDA and WHO guidelines. For Example: AI-driven packaging that changes color if temperature conditions are breached.

AI analyzes weather conditions, traffic, and storage facility availability to optimize delivery routes. Reduces fuel consumption and transit time, keeping products within safe temperature ranges. AI-powered logistics platforms like Flexport and Shipwell optimize shipping for perishable goods. AI-powered computer vision systems inspect cold chain packaging for leaks, damage, or contamination. The AI integration enhances product safety and quality assurance, reducing human error. Example: AI-driven drones inspect warehouse inventory and cold storage conditions.

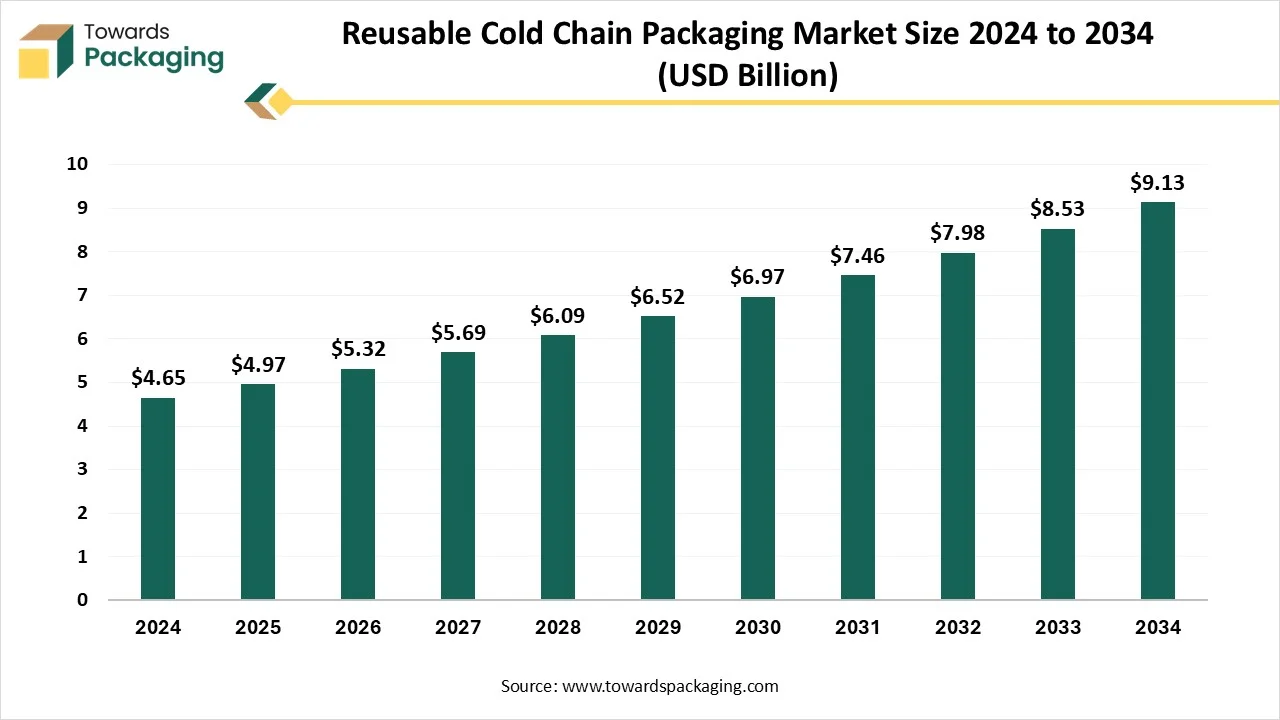

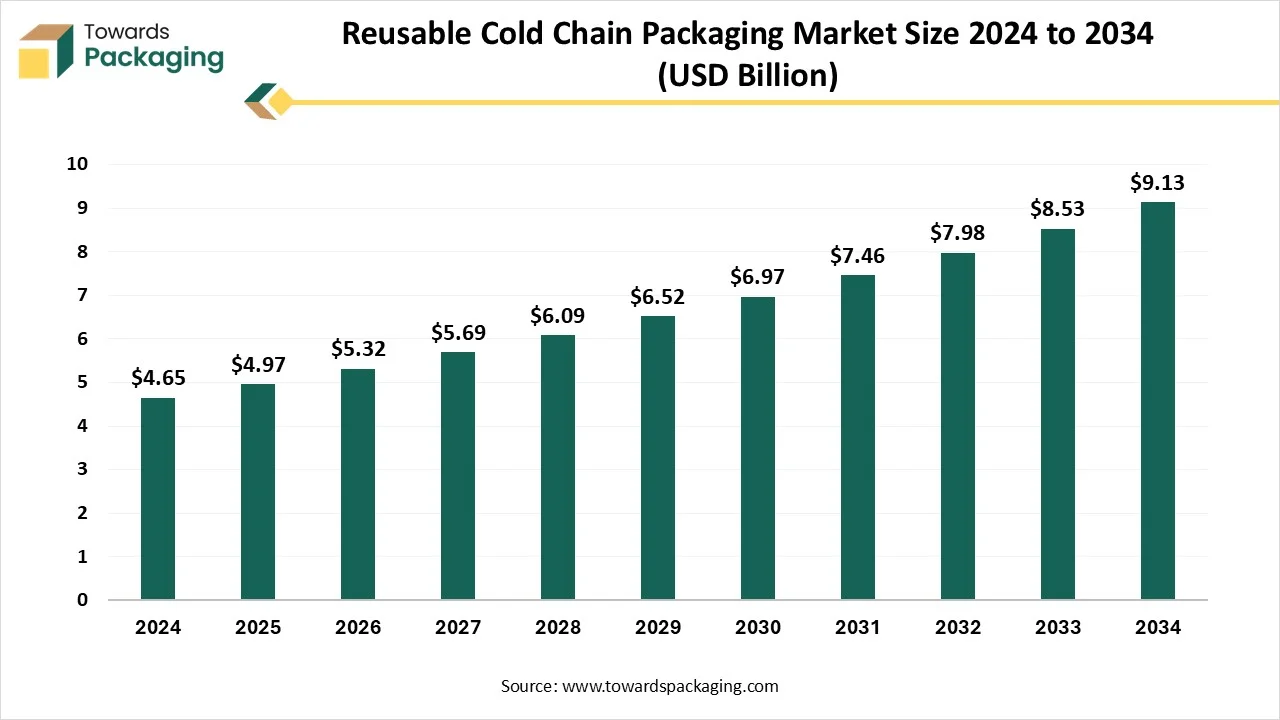

Growth of Reusable Cold Chain Packaging Market

The global reusable cold chain packaging market is expected to grow from USD 4.97 billion in 2025 to USD 9.13 billion by 2034, with a CAGR of 6.98% throughout the forecast period from 2025 to 2034. The global reusable cold chain packaging market is driven by increasing sustainability demands, rising pharmaceutical and biologics shipments, and the growing need for reliable temperature-controlled logistics in food and beverage e-commerce.

Companies are adopting reusable solutions to reduce waste, cut long-term costs, and meet regulatory requirements, especially in healthcare. Technological advancements, such as IoT-enabled tracking, vacuum-insulated panels, and phase change materials, enhance performance and visibility. North America and Europe lead in adoption due to mature infrastructure, while Asia-Pacific is rapidly emerging. Despite challenges like high upfront costs and complex reverse logistics, the market offers strong growth potential through innovation and circular economy initiatives.

Reusable cold chain packaging refers to temperature-controlled packaging solutions that are specifically designed to be used multiple times for the safe transportation and storage of perishable or temperature-sensitive products such as pharmaceuticals, biologics, fresh food, dairy, and seafood. These packaging systems maintain a consistent internal temperature over a defined period by utilizing advanced insulation materials, such as phase change materials (PCMs), vacuum-insulated panels (VIPs), and gel packs.

Unlike single-use packaging, reusable systems are built with durable, hygienic, and easy-to-clean materials to withstand repeated use across logistics cycles. They often include features like real-time temperature tracking, tamper resistance, and modular designs for efficient storage and transport. Reusable cold chain packaging contributes to environmental sustainability by reducing packaging waste and lowering carbon emissions. It also offers cost benefits in the long run by minimizing the need for constant repurchasing and reducing spoilage losses.

Driver

Advancements in Cold Chain Packaging Technologies

Smart packaging solutions with IoT sensors, RFID tracking, and real-time temperature monitoring are revolutionizing the industry. Development of eco-friendly and biodegradable cold chain packaging materials (e.g., seaweed-based packaging, biodegradable foam, and compostable insulation) is gaining traction. Use of phase change materials (PCMs) to maintain stable temperatures without excessive refrigeration costs. Hence, increasing innovative advancement in cold chain packaging has estimated to drive the growth of the cold chain packaging market in the near future.

For instance, in June 2024, Overhaul, a world leader in intelligence and active supply chain risk management, announces the release of its state-of-the-art Cold Chain Quality Solution. This cutting-edge software solution ensures ideal conditions across the supply chain for the pharmaceutical, healthcare, and high-value food and beverage industries by providing unmatched risk and quality control for time and temperature-sensitive goods.

The Cold Chain Quality Packaging Solution from Overhaul uses proactive risk management, real-time global visibility, and sophisticated quality control to meet the urgent demand for dependable cold chain logistics. Given that supply chain interruptions cause an estimated 20% of temperature-sensitive products to be damaged in transit, technology reduces substantial financial losses while ensuring patient safety in healthcare supply chains. With its device-agnostic capabilities and extensive monitoring functions, it smoothly integrates with current systems.

Restraint

Lack of Infrastructure in Developing Regions & Strict Regulatory Compliance

The key players operating in the market are facing issue due to lack of infrastructure in developing regions & strict regulatory compliance which has estimated to restrict the growth of the cold chain packaging market in the near future. Limited cold storage facilities, poor road connectivity, and unreliable power supply make cold chain logistics inefficient in many countries. In regions with hot climates, maintaining temperature-sensitive goods becomes even more challenging. For instance, developing markets in Africa, Latin America, and parts of Asia lack proper cold storage and refrigerated transport networks.

Cold chain packaging must comply with WHO, FDA, and Good Distribution Practice (GDP) guidelines for food and pharmaceutical products. Meeting these stringent temperature control regulations increases costs and complexity for companies. The U.S. Food Safety Modernization Act (FSMA) and Europe Union GDP regulations impose strict requirements on tracking and monitoring temperature-sensitive goods. Global supply chain disruptions, fuel price fluctuations, and labor shortages impact cold chain packaging operations.

Market Opportunity

Rising Demand for Perishable Food & Beverages

Increasing consumption of fresh produce, dairy, meat, seafood, and frozen foods is driving the need for effective cold chain packaging. Growth in online grocery shopping and food delivery services is further boosting demand for insulated and temperature-controlled packaging. Companies like HelloFresh, Blue Apron, and Walmart Grocery require reliable cold packaging solutions for perishable deliveries.

The pharmaceutical sector relies on cold chain packaging for vaccines, biologics, insulin, blood samples, and specialty drugs that require strict temperature control. The COVID-19 pandemic accelerated demand for ultra-cold packaging solutions, such as those needed for Pfizer and Moderna vaccines. The expansion of biotechnology and personalized medicine is further increasing the need for secure cold chain logistics.

According to the data published by the National Grocers Association, in February 2025, While overall grocery expenditure climbed by just 2.5% over the previous year, monthly food sales increased by 16.6% year over year in January 2025. Consequently, groceries accounted for 15% of total food sales in January 2025, a rise of 180 basis points from 2024.

Expanded Polystyrene (EPS) Led the Market in 2024

The expanded polystyrene (EPS) segment held a dominant presence in the cold chain packaging market in 2024. Expanded Polystyrene (EPS) is extensively utilized in cold chain packaging because of its excellent thermal insulation, lightweight nature, and cost-effectiveness. Expanded polystyrene (EPS) has low thermal conductivity, meaning it effectively slows down heat transfer, keeping products at stable temperatures during transit.

It is extremely light, reducing shipping costs while still providing structural strength. Expanded Polystyrene (EPS) can be molded into various shapes and sizes to fit different packaging needs, ensuring secure and efficient storage of perishable goods like vaccines, pharmaceuticals, and food products. While disposal has been a concern, Expanded Polystyrene (EPS) can be recycled and repurposed, making it more environmentally viable than before.

Insulated Containers Segment to Show Significant Share in the Upcoming Period

The insulated containers segment accounted for a significant share of the cold chain packaging market in 2024. Insulated containers provide stable thermal protection, ensuring temperature-sensitive products (like pharmaceuticals, biologics, and perishable foods) remain within required temperature ranges during transit. These containers are used across multiple industries, including food, pharmaceuticals, and chemicals, making them essential for maintaining product integrity.

Many insulated containers are designed for multiple uses, making them more cost-effective and environmentally friendly compared to single-use packaging. Innovations in phase change materials (PCM), vacuum insulation panels (VIPs), and high-performance EPS/EPP foams have enhanced the efficiency and reliability of insulated containers. The rise of online grocery delivery, meal kit services, and international pharmaceutical shipments has fueled the demand for reliable cold chain packaging solutions. Insulated containers reduce product loss due to temperature excursions, leading to long-term savings for companies.

Fish, Meat & Seafood Segment Led the Market in 2024

The fish, meat & seafood segment registered its dominance over the global cold chain packaging market in 2024. Fish, meat, and seafood are highly perishable and prone to bacterial contamination if not stored at the correct temperature. Cold chain packaging maintains low temperatures, slowing microbial growth and preserving freshness. Proper temperature control ensures that these products remain safe for consumption longer, reducing waste and improving supply chain efficiency. Specialized cold chain packaging, such as vacuum-sealed and insulated containers, helps prevent dehydration and oxidation, which can affect the taste and appearance of seafood and meat.

North America region dominated the global cold chain packaging market in 2024. The U.S. and Canada have a robust pharmaceutical sector that requires strict temperature-controlled packaging for vaccines, biologics, and other temperature-sensitive drugs. - The presence of major pharmaceutical companies like Pfizer, Moderna, and Johnson & Johnson boosts demand. Growth of plant-based and alternative protein markets in North America has estimated to drive the growth of the cold chain packaging market in the region. The demand for plant-based meat, dairy alternatives, and functional beverages is rising, requiring temperature-controlled storage and packaging. Companies like Beyond Meat and Oatly depend on cold chain logistics to maintain product integrity.

U.S. Cold Chain Packaging Market Trends

The U.S. cold chain packaging market account the large share. Major agricultural hubs and seafood industries in the West Coast (California, Washington, Oregon) drive demand for efficient cold storage and packaging. Strong meat, dairy, and frozen food industries in the Midwest (Illinois, Ohio, Minnesota, Wisconsin) fuel the growth of the cold chain packaging market. Northeast states -Massachusetts, New Jersey, Pennsylvania, New York are house for major pharmaceutical and biotech companies that require advanced cold chain solutions for vaccines, biologics, and specialty drugs. Florida, Georgia, Texas, North Carolina states are experiencing a boom in online grocery shopping, meal kit deliveries, and direct-to-consumer frozen food shipments.

Asia Pacific region is anticipated to grow at the fastest rate in the cold chain packaging market during the forecast period. Asia-Pacific is responsible for the highest amount of global R&D expenditures, as well as a significant portion of vaccine research and development patents and publications, according to the United Nations ESCAP. Due to incentives offered by Asia Pacific nations for investments in vaccine research and development, multinational pharmaceutical companies are moving some of their R&D operations to the region in addition to offshoreing a portion of their production. Higher incomes in China, India, and Southeast Asia are driving demand for fresh produce, dairy, meat, and seafood. Companies like Alibaba’s Freshippo, JD.com, and GrabFood are expanding cold storage and packaging needs.

China Cold Chain Packaging Market Trends

China cold chain packaging market is estimated to grow at fastest rate over the forecast period. The Chinese government enforces GB/T 28842 (cold chain logistics standards) to improve food safety. Initiatives like the Five-Year Plan in China promote modern cold chain warehousing and distribution. More demand for cold chain packaging for imported fruits, seafood, and dairy (e.g., from the U.S., Australia, and Europe). China is a leading producer of vaccines (e.g., Sinovac, Sinopharm), requiring advanced cold storage and packaging. CIMC Cold Chain specializes in passive temperature control packaging solutions for the pharmaceutical, life sciences, and cold chain logistics sectors. The company offers a range of products, including medical insulation containers and phase change materials (PCMs), and has provided cold chain services for over 600 million vials of COVID-19 vaccines.

Europe Region’s Stringent Regulations to Project Notable Growth

Europe region is seen to grow at a notable rate in the foreseeable future. The European cold chain business is confronted with issues like appropriate handling (63%), product packaging (31%), and sufficient storage (31%), according to A.P. Moller-Maersk. These persistent problems have drawn investments aimed at building out Europe's cold chain infrastructure, which may have a favorable impact on market expansion.

For instance, Cold Chain Federation Magnavale, one of the top cold storage companies in the UK, stated in May 2023 that it would invest USD 161.3 million (GBP 130 million) to build a cold store that could hold 101,000 pallets. Europe has a large market for vaccines, biologics, and specialty drugs that require strict cold chain packaging.

Countries like Germany, Switzerland, France, and the UK house leading pharmaceutical companies (e.g., Roche, Novartis, GSK, Sanofi, Bayer). The Good Distribution Practice (GDP) regulations ensure strict temperature control, boosting high-quality packaging demand. The European Union enforces regulations to reduce carbon emissions, leading to innovation in biodegradable and recyclable cold chain packaging. Countries like Germany, the Netherlands, and France are investing in energy-efficient refrigerated warehouses.

New Advancements in Cold Chain Packaging Industry

- In April 2024, In order to serve the biopharmaceutical industry with active and passive temperature-controlled shipping solutions, CSafe is expanded its portfolio of products by introducing three new cold chain packaging technologies that incorporate real-time data tracking for optimal visibility during the shipping process. The most urgent issues facing pharmaceutical firms in the cold chain sector today are intended to be addressed by Cafe's new solutions. The first in the CGT Cryo Series, Cafe's Multi-Use Dewars are made to cater to the expanding market for gene and cell therapy.

- In December 2024, Tower Cold Chain, a Cold Chain Technologies firm that supplies passive temperature-controlled containers, has increased its global presence after being recently acquired by Cold Chain Technologies (CCT). This strategic partnership expands the capacities of both businesses by providing a wide range of temperature-controlled solutions to satisfy the rising demand for pharmaceutical and life sciences shipments worldwide. Customers now enjoy the benefits of a greatly expanded hub network with three Centers of Excellence and 54 regional hubs spread across 26 countries due to the combined resources of Tower and CCT, which allows for greater geographic coverage and improved customer support.

- In January 2025, D Smith, provider of international fiber-based packaging solutions provider announced the release of Tailor Temp, the most recent ground-breaking development in temperature-controlled packaging for the pharmaceutical sector. Between January 22 and 23, 2025, the packaging company will make its debut presentation of the product at PharmaPack Europe 2025 (Paris). To help pharmaceutical and biotech companies reach their sustainability goals, DS Smith created the Tailor Temp packaging solution, which satisfies their requirement to store and ship sensitive pharmaceuticals across several regions in temperature-controlled conditions.

Global Cold Chain Packaging Market Players

- Cascades Inc.

- Cold Chain Technologies

- Creopack

- Cryopak

- Intelsius

- Pelican

- Sofrigam

- Sonoco ThermoSafe

- va-Q-tec

- Softbox Systems Ltd

- Pelican Products, Inc.

- CSafe

- TOWER Cold Chain Solutions

- Sealed Air Corporation

- CoolPac

- Nordic Cold Chain Solutions

- Global Cooling Inc.

- Inmark LLC

- Envirotainer AB

- DGP Intelsius LLC

- Vericool, Inc.

- Emballages Cre-O-Pack Intl

- TemperPack Technologies, Inc.

Latest Announcements by Cold Chain Packaging Industry Leaders:

- In October 2024, Nordic Cold Chain Solutions CEO Andy Bolton stated with the expansion in Reno, the purchase of Minus Works, and the new facility in Pottstown, Nordic is making tremendous strides toward goal of providing high-performance, sustainable cold chain solutions. This action enhances capacity to lessen influence on the environment while providing clients with top-notch goods and services. According to Ben Shore, CEO of Minus Works, the company can quickly scale ideas and satisfy the expanding market demand due partnership with Nordic cold chain solutions company.

Global Cold Chain Packaging Market Segments

By Material

- Expanded Polystyrene (EPS)

- Polyurethane Rigid Foam (PUR)

- Vacuum Insulated Panel (VIP)

- Metal

- Cryogenic Tanks

- Paper & Paperboard

- Others

By Product

- Insulated Containers

- Insulated Pallet Shippers

- Vacuum Insulated Panels

- Gel Packs

- Crates

- Temperature Controlled Pallet Shippers

- Foam Bricks

- Others

By End Use

- Fruits & Vegetables

- Fruit & Pulp Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice Cream

- Fish, Meat & Seafood

- Processed Food

- Pharmaceuticals

- Bakery & Confectionaries

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait