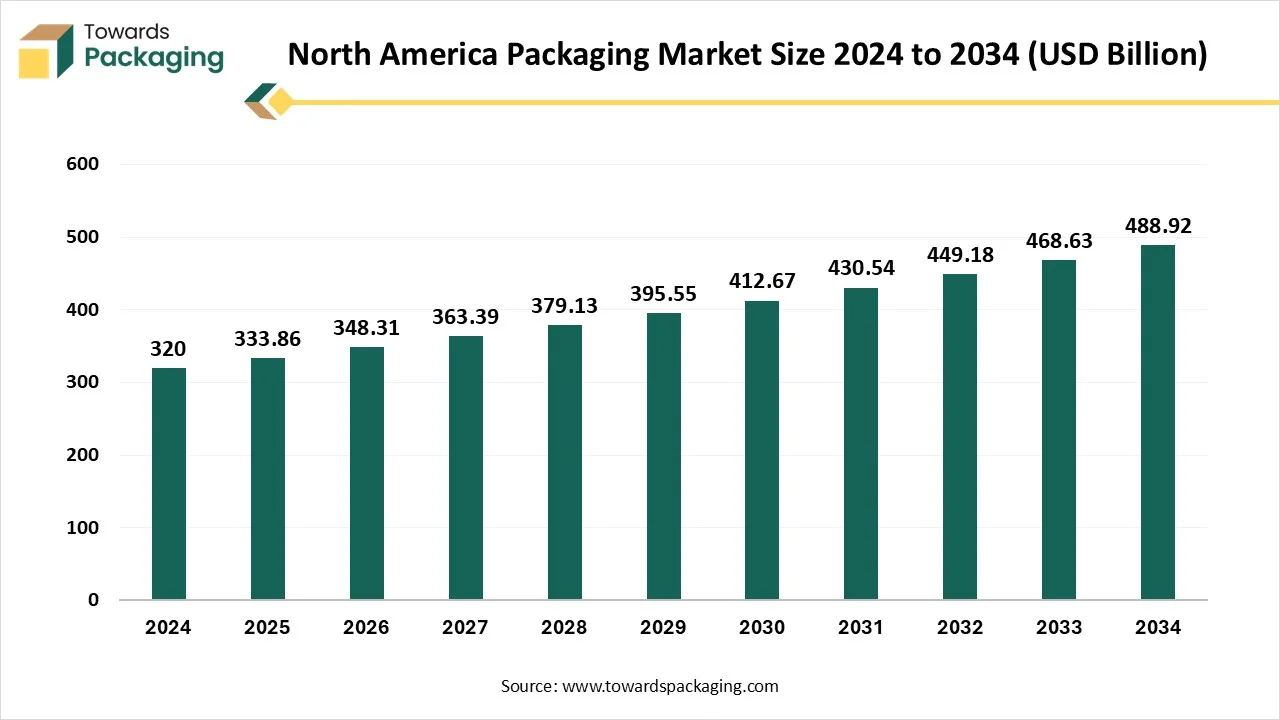

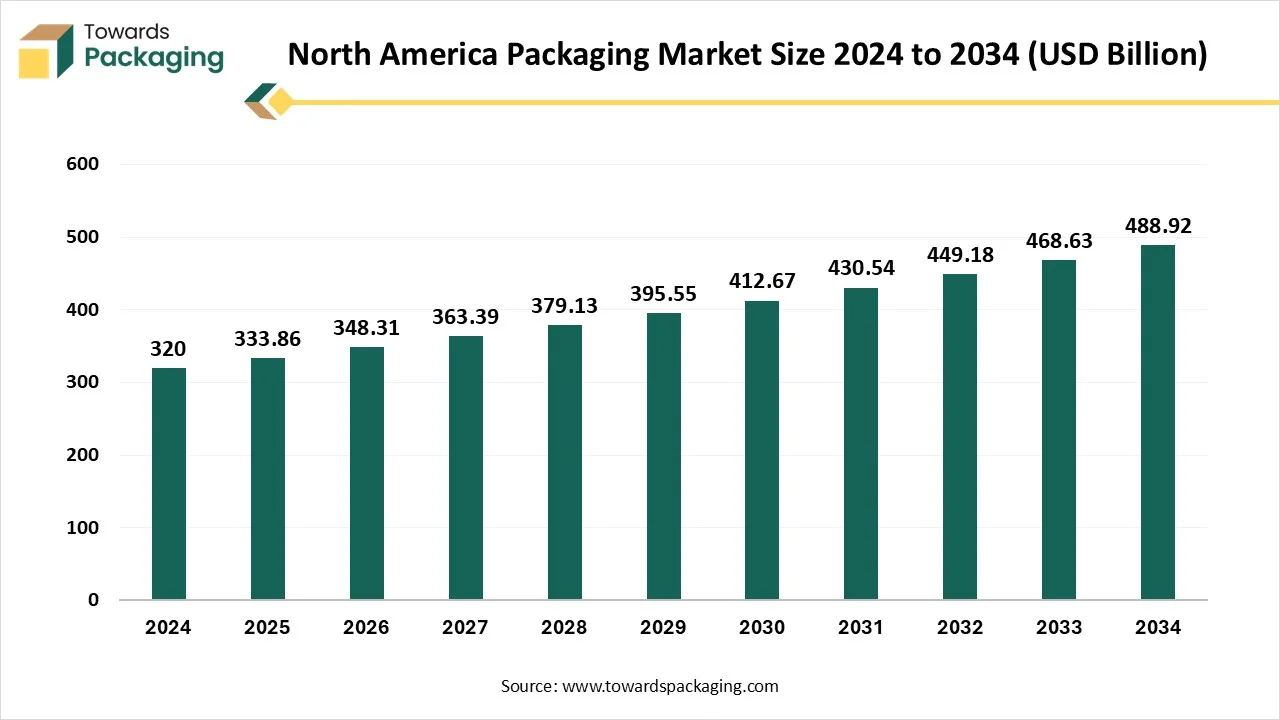

The North America packaging market is forecasted to expand from USD 348.31 billion in 2026 to USD 510.10 billion by 2035, growing at a CAGR of 4.33% from 2026 to 2035. It includes primary, secondary, and tertiary packaging solutions spanning rigid, flexible, and semi-rigid forms, across various end-use industries such as food, beverage, healthcare, personal care, industrial goods, e-commerce, and more.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing sustainable packaging.

Packaging refers to the materials and processes used to protect, contain, transport, and present products from production to consumption. It plays a crucial role in ensuring product safety, extending shelf life, enabling branding, complying with regulations, and enhancing consumer convenience. In North America, the packaging industry is evolving rapidly due to rising sustainability concerns, technological advancements, and the surge in e-commerce. Rigid plastics remain a dominant material, while paper and paperboard are experiencing the fastest growth due to eco-friendly demand.

North America is a global leader in next-generation packaging, driven by innovations in automation, smart packaging, and digital printing. Regulatory developments, such as extended producer responsibility (EPR) laws in states like California, are pushing manufacturers to adopt more sustainable practices. North American companies are also investing heavily in research and development to improve packaging efficiency, recyclability, and consumer engagement, particularly in sectors like food, beverages, personal care, and pharmaceuticals.

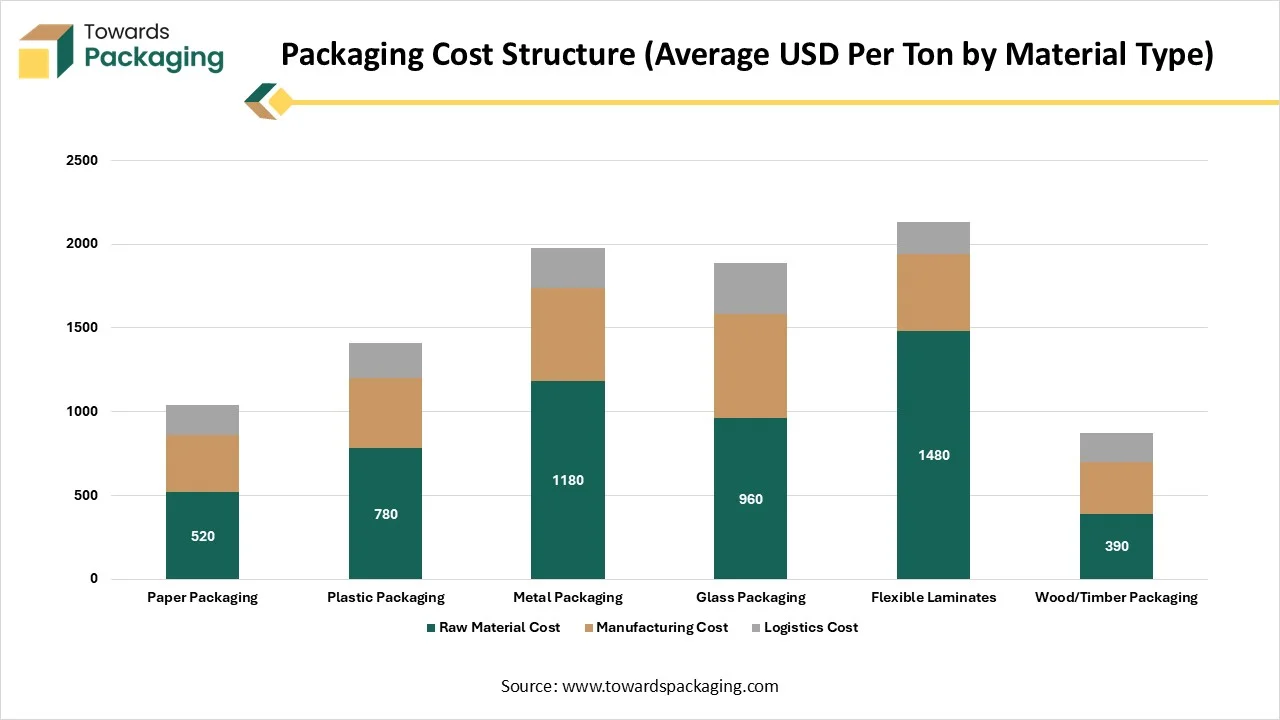

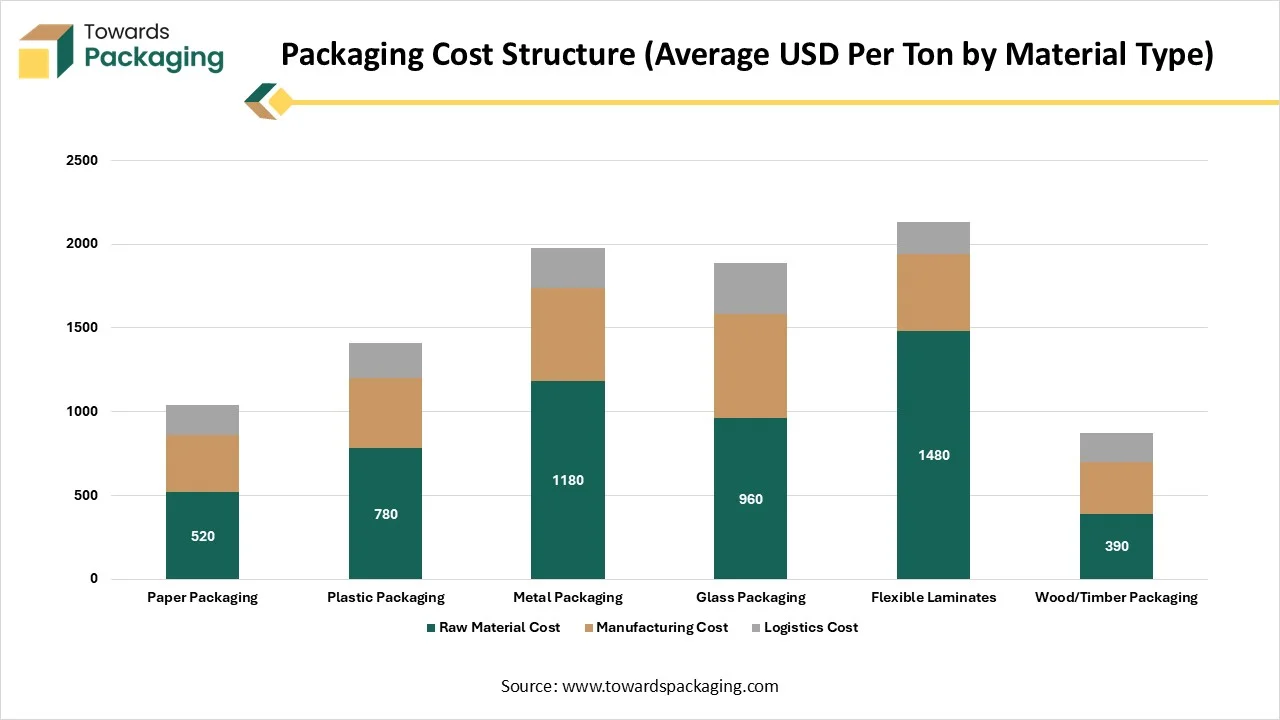

| Material Type | Raw Material Cost | Manufacturing Cost | Logistics Cost |

| Paper Packaging | 520 | 340 | 180 |

| Plastic Packaging | 780 | 420 | 210 |

| Metal Packaging | 1180 | 560 | 240 |

| Glass Packaging | 960 | 620 | 310 |

| Flexible Laminates | 1480 | 460 | 190 |

| Wood/Timber Packaging | 390 | 310 | 170 |

| Metric | Details |

| Market Size in 2025 | USD 333.86 Billion |

| Projected Market Size in 2035 | USD 510.10 Billion |

| CAGR (2026 - 2035) | 4.33% |

| Leading Region | North America |

| Market Segmentation | By Material Type, By Packaging Type, By Packaging Function, By Technology and By End-Use Industry |

| Top Key Players | Amcor plc, WestRock Company, International Paper Company, Berry Global Inc., Mondi Group, Sealed Air Corporation, Sonoco Products Company |

| Year | Polymer Price Index (Base 100) | Pulp & Paper Index | Aluminum Sheet Index | Glass Melt Index | Composite Films Index | Weighted Packaging Cost Index |

| 2020 | 100 | 100 | 100 | 100 | 100 | 100 |

| 2021 | 108 | 103 | 111 | 104 | 106 | 107 |

| 2022 | 114 | 109 | 117 | 108 | 113 | 113 |

| 2023 | 121 | 112 | 123 | 111 | 118 | 118 |

| 2024 | 126 | 115 | 129 | 113 | 121 | 122 |

| 2025 | 130 | 119 | 133 | 115 | 124 | 125 |

AI integration is revolutionizing the packaging industry by improving efficiency, sustainability, and accuracy across all stages from design to delivery. One of the key applications is in optimized package design and right-sizing, where AI tools analyze product dimensions and shipping data to reduce excess material use. For example, Amazon’s Package Decision Engine (PDE) uses AI to choose the most efficient box or bag for millions of items, saving around 60,000 tons of cardboard annually in North America. AI also enhances quality control through computer vision systems that detect defects and labeling errors with near-perfect accuracy, significantly reducing waste and product returns. Additionally, predictive maintenance powered by AI improves machinery uptime and production flow.

Smart packaging technologies such as QR codes, RFID, and IoT sensors, integrated with AI, enable real-time monitoring of freshness, anti-counterfeiting, and consumer interaction. Key players leading this shift include global tech and packaging giants like IBM, Microsoft, Tetra Pak, and Sealed Air, along with innovative startups like EcoPackAI. In North America, companies such as Amazon, WestRock, Sealed Air, and Ranpak are at the forefront. WestRock uses AI and machine learning for QR-coded packaging and intelligent recycling systems, while Ranpak deploys AI-enabled automation in its paper-based cushioning systems. These advancements are collectively transforming packaging into a smarter, more sustainable, and data-driven industry.

Sustainability and Circular Economy Initiatives

Consumer preference for eco-friendly packaging and regulatory pressure (e.g., plastic bans and EPR laws) are encouraging companies to invest in recyclable, compostable, and reusable packaging formats. For instance, in January 2025, according to the U.S. Plastics Pact, the initiative was put forth that by the end of 2025, all plastic packaging must be recyclable, compostable, or reused. The CIRCLE Alliance was established by Unilever, SAID, and EY with the goal of promoting packaging circularity and empowering entrepreneurs and small enterprises along the plastics value chain, especially in the Global South's informal waste sector.

Stringent Environmental Regulations & Supply Chain Disruptions

The key players operating in the market are facing issues due to stringent environmental regulations & supply chain disruptions, which may restrict the growth of the North America packaging market in the near future. Increasing regulations around plastic usage, recyclability, and waste reduction, such as California’s Extended Producer Responsibility (EPR) laws, require companies to invest in costly transitions to sustainable materials and processes, slowing down growth for traditional packaging. Fluctuations in the prices of raw materials like paper, aluminum, and plastics, along with rising energy costs, increase production expenses, putting pressure on profit margins and limiting expansion.

Ongoing logistics challenges, including labor shortages, port congestion, and geopolitical instability, disrupt the consistent supply of packaging materials and finished products. The lack of uniform recycling standards across the U.S. and Canadian states/provinces complicates compliance and limits the effectiveness of circular packaging systems. While awareness of sustainable packaging is growing, many consumers are still unwilling to pay higher prices for eco-friendly packaging, which can discourage companies from adopting greener but costlier alternatives. Cheaper packaging imports from Asia and other regions make it difficult for domestic manufacturers to stay competitive on price, especially in mass-market segments.

| Year | Recycled Content (%) | Recycling Rate (%) | Landfill Share (%) | CO₂ Emissions (Million Tons) | Energy Intensity (kWh per Ton) | Recycled Plastic Output (Million Tons) |

| 2020 | 14.2 | 37.9 | 46.1 | 93.4 | 623 | 4.1 |

| 2021 | 15.6 | 39.4 | 44.8 | 91.7 | 611 | 4.4 |

| 2022 | 17.1 | 41.2 | 43.1 | 89.2 | 598 | 4.9 |

| 2023 | 19.4 | 44.6 | 40.3 | 86.1 | 582 | 5.7 |

| 2024 | 21.2 | 46.8 | 38.7 | 83.4 | 571 | 6.1 |

| 2025 | 23.5 | 49.1 | 36.9 | 80.6 | 559 | 6.6 |

The dominance of the plastic material type segment in the North American packaging market can be attributed to its versatility, cost-effectiveness, and excellent barrier properties. Plastic offers lightweight and durable packaging solutions that are ideal for protecting a wide range of products, including food, beverages, pharmaceuticals, and consumer goods. The material’s ability to be molded into various shapes and sizes makes it highly adaptable to both traditional and innovative packaging designs. Furthermore, ongoing advancements in biodegradable and recyclable plastics have alleviated some environmental concerns, encouraging continued use.

The bioplastic material type segment is expanding fastest in North America’s packaging market due to a perfect convergence of environmental, regulatory, technological, and consumer trends. Rising eco‑awareness and concerns about plastic pollution, especially single‑use plastics, have driven demand for biodegradable, bio‑based alternatives. Governments offer incentives, impose bans, and support R&D to accelerate adoption through grants, tax credits, and legislation. Advancements in materials like PLA, PHA, PBS, and starch blends have improved barrier performance and cost parity with conventional plastics. Meanwhile, consumers and brands increasingly favour sustainable packaging as part of corporate responsibility and green purchasing trends.

U.S. Government Support for Packaging Market

The U.S. government is supporting the North American packaging market through a range of policies and initiatives aimed at strengthening sustainability, innovation, and recycling infrastructure. One major driver is the adoption of Extended Producer Responsibility (EPR) laws in several states, which require companies to take financial and operational responsibility for collecting, recycling, and managing the end-of-life stage of their packaging.

These laws reduce the burden on municipalities while channeling new funding into recycling systems, improved materials recovery, and public education. In addition, federal programs promote sustainable packaging materials, including initiatives that encourage the use of paper-based and recyclable packaging formats. The government also backs research and development efforts through national science and technology programs that help accelerate innovations in smart, lightweight, and advanced packaging materials.

The dominance of bottles and jars in North America’s packaging market stems from their exceptional functionality and consumer appeal. Bottles, especially glass ones, are adaptable for beverages, pharmaceuticals, and personal care, offering strong protection, recyclability, and preservative benefits that maintain product integrity and premium perception. Their portability, brand customization options, and cost-effective storage and transport further reinforce their market position. Meanwhile, jars widely used for food, condiments, and cosmetics offer vacuum-seal safety and reusability, appealing to sustainability-conscious consumers.

The pouch segment is the fastest-growing packaging format in North America due to its lightweight, space‑saving design that significantly reduces shipping and storage costs. Its multi-layer barrier films provide excellent protection for food, beverages, and pharmaceuticals, extending shelf life. Consumer demand for resealable zippers, spouts, and easy-tear features supports convenience and on-the-go lifestyles. Pouches also offer expansive branding surfaces and align with sustainability goals through recyclable and mono‑material options. Finally, the rise of e‑commerce and DTC models drives adoption for durable, transit-ready packaging.

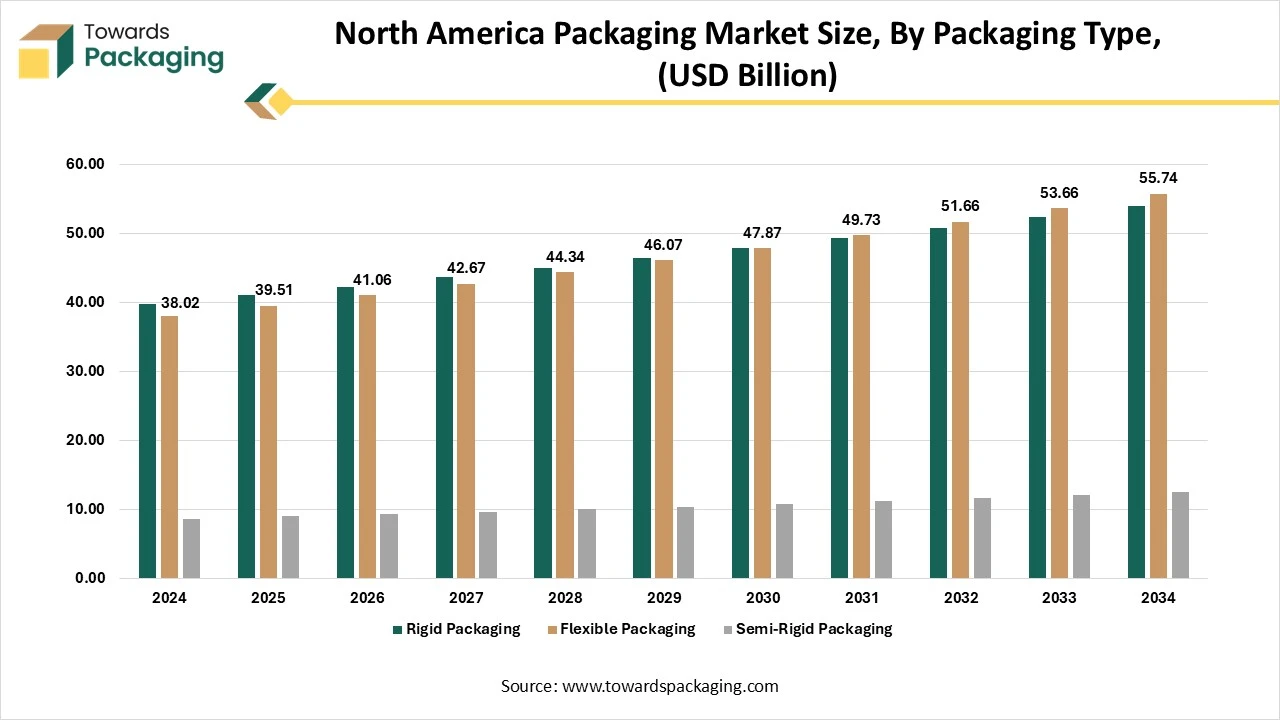

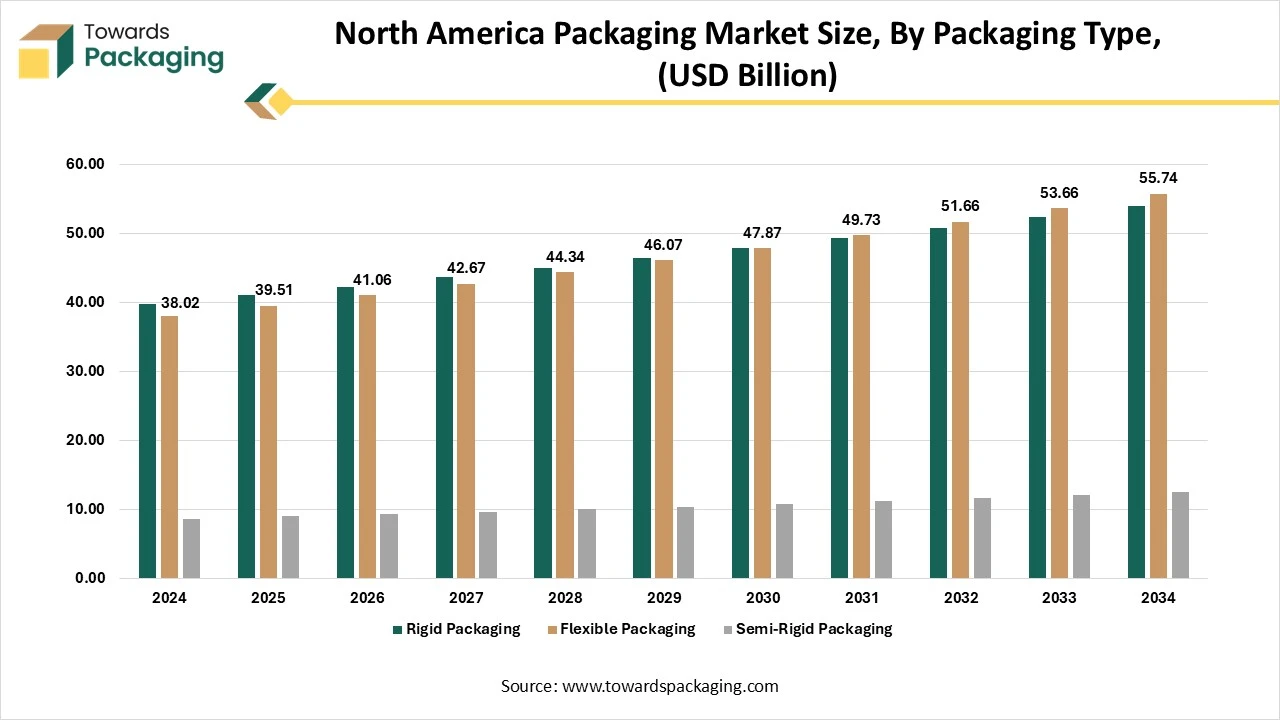

The rigid packaging type segment holds dominance in the North America packaging market due to its superior strength, durability, and protective qualities. Rigid packaging, such as bottles, containers, cans, and boxes, provides excellent structural integrity, making it ideal for safeguarding products during transportation and storage. Its widespread use in industries like food and beverages, pharmaceuticals, personal care, and household goods strengthens its market position. Moreover, rigid packaging supports branding and shelf appeal through customizable shapes and designs.

The key factors driving flexible packaging to be the fastest-growing segment in North America. Flexible packaging’s lightweight, compact nature reduces material use, shipping costs, and carbon footprint, appealing to cost-conscious brands and e-commerce platforms. It offers convenience features like resealable zippers, spouts, and easy-tear strips, meeting consumer demands for on‑the‑go and user-friendly formats. Technological innovations such as multi-layer films, enhanced barrier coatings, high-quality digital printing, and smart packaging boost shelf life, brand differentiation, and regulatory compliance. Additionally, rising eco‑awareness and regulations push the adoption of recyclable, compostable, and mono-material structures, aligning flexible packaging with sustainability goals.

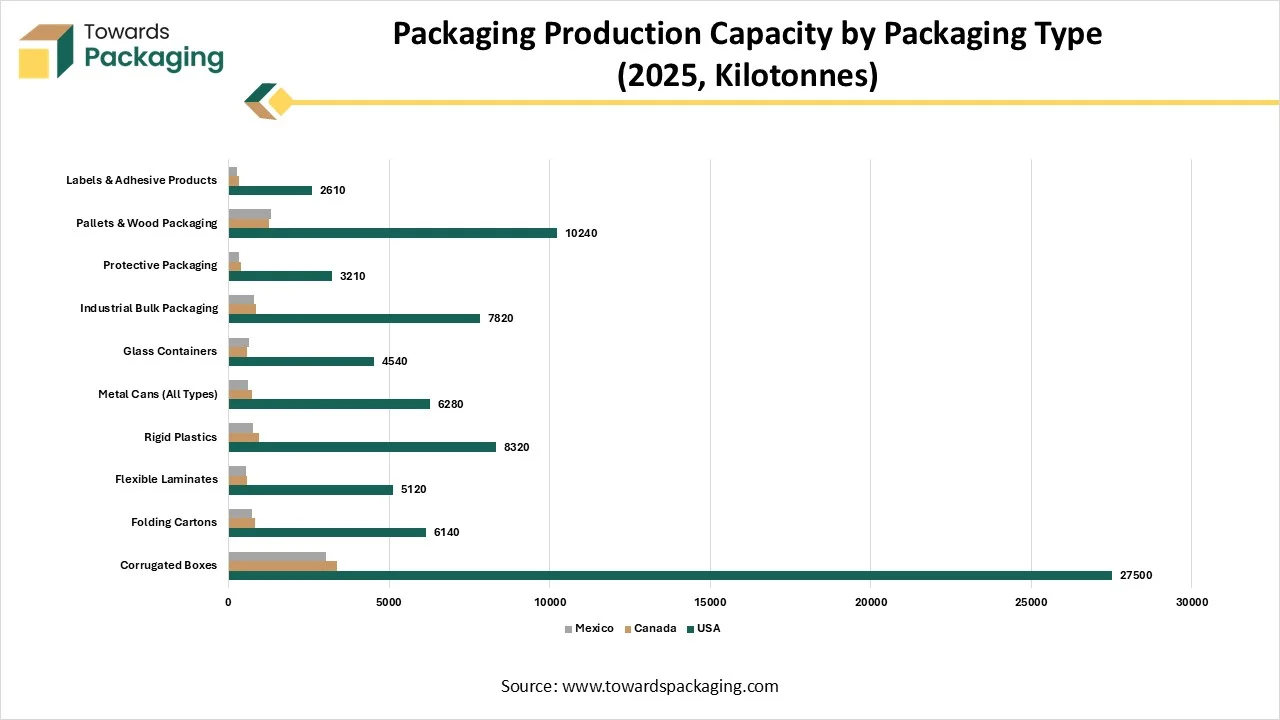

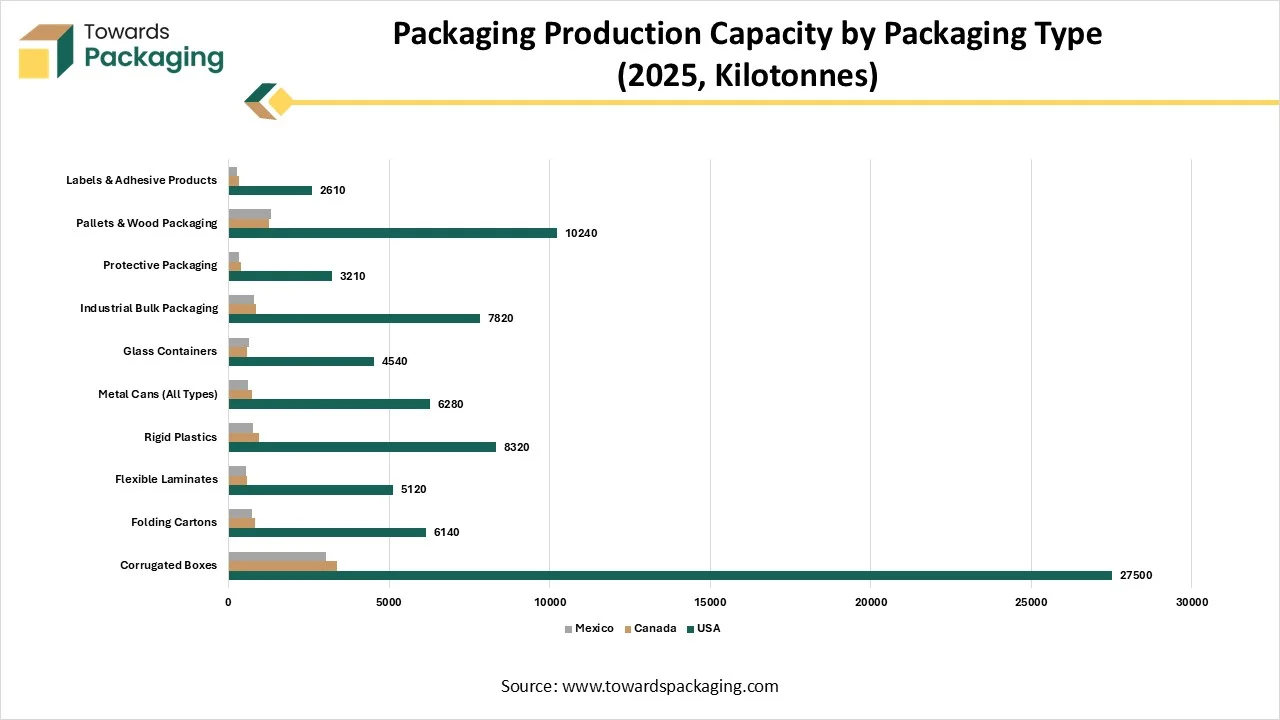

Different parameters focuses on production volume by format, not revenue)

| Packaging Type | USA | Canada | Mexico |

| Corrugated Boxes | 27500 | 3380 | 3020 |

| Folding Cartons | 6140 | 820 | 740 |

| Flexible Laminates | 5120 | 580 | 540 |

| Rigid Plastics | 8320 | 940 | 770 |

| Metal Cans (All Types) | 6280 | 720 | 610 |

| Glass Containers | 4540 | 580 | 620 |

| Industrial Bulk Packaging | 7820 | 840 | 780 |

| Protective Packaging | 3210 | 370 | 330 |

| Pallets & Wood Packaging | 10240 | 1260 | 1320 |

| Labels & Adhesive Products | 2610 | 310 | 270 |

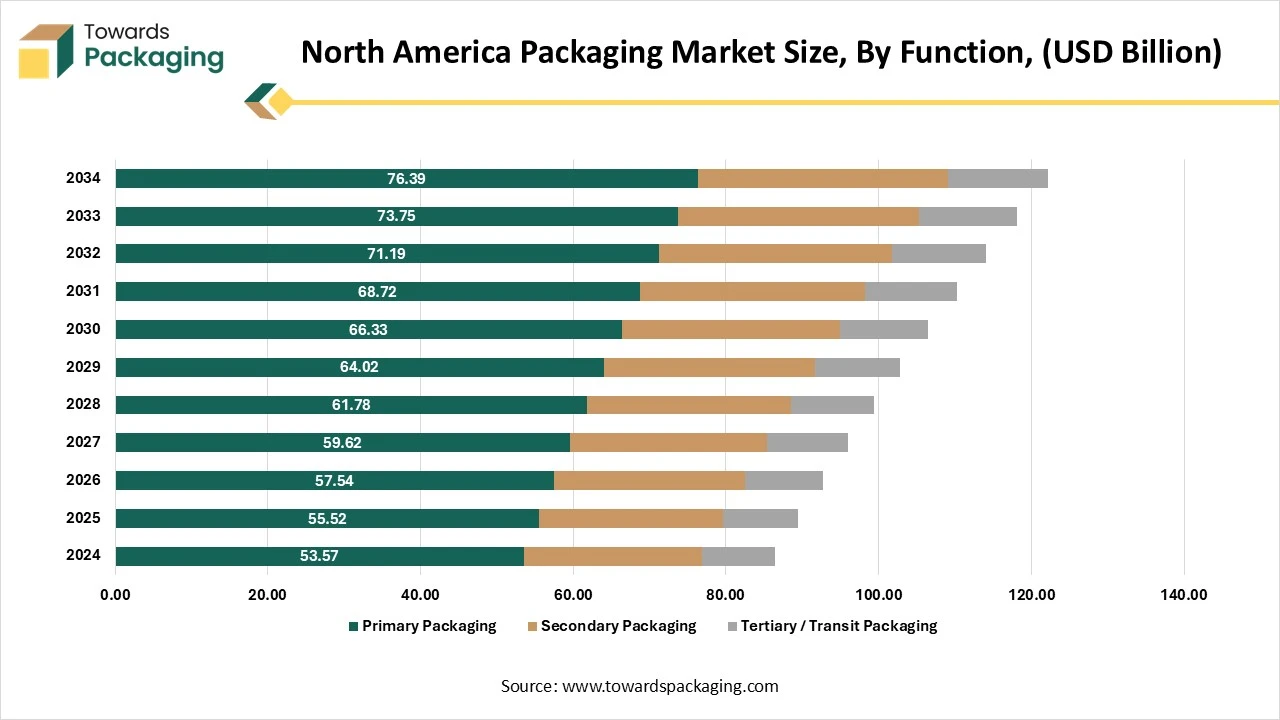

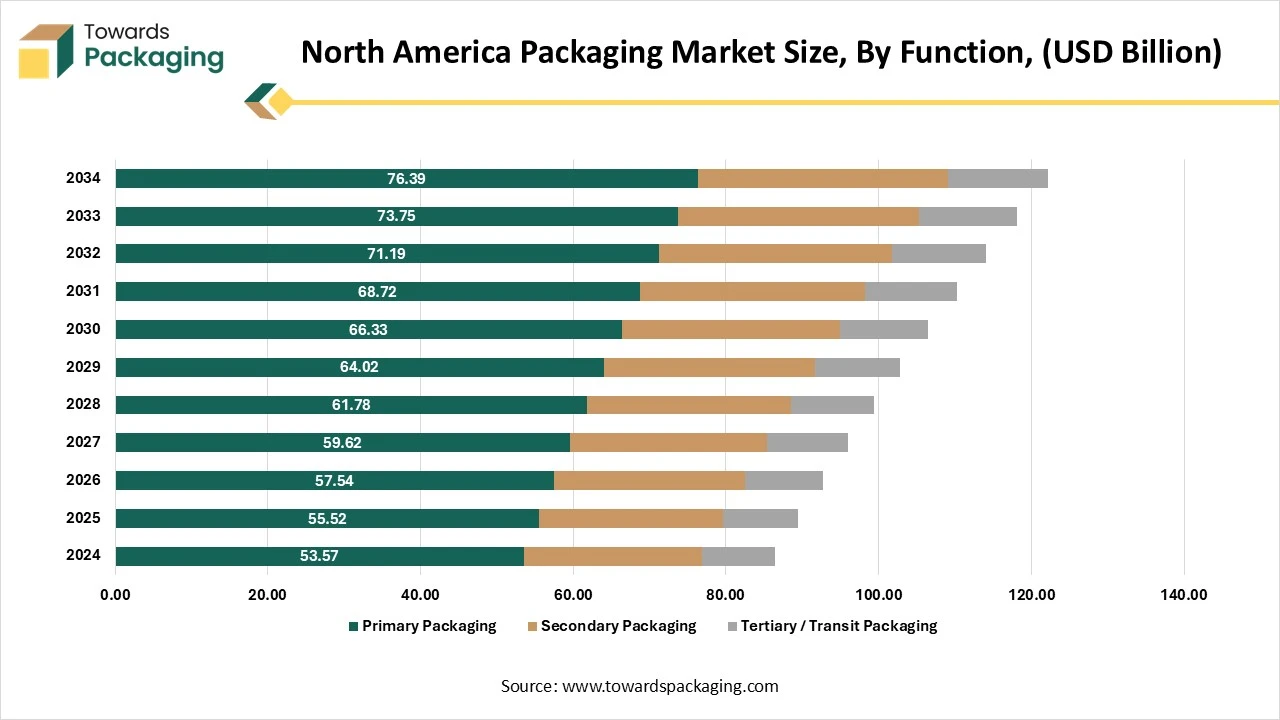

Primary packaging is the dominant packaging function segment in the North America packaging market due to its direct role in protecting, preserving, and presenting products to consumers. It serves as the first layer of containment, making it essential for maintaining product integrity, hygiene, and shelf life, especially in food, beverages, pharmaceuticals, and personal care sectors. Rising consumer demand for convenience, safety, and sustainability has led to increased adoption of advanced materials and innovative designs in primary packaging. Furthermore, branding and product visibility rely heavily on primary packaging, which plays a crucial role in consumer purchasing decisions, reinforcing its market dominance.

Tertiary packaging is the fastest-growing packaging function segment in the North America packaging market due to the rapid expansion of e-commerce, logistics, and global trade. This type of packaging, which includes pallets, stretch wraps, and bulk containers, is essential for the safe and efficient transportation and storage of goods in large quantities. The increasing need for streamlined supply chain operations, warehouse automation, and damage prevention during transit has boosted demand for robust tertiary packaging solutions. Additionally, the rise of online retail and direct-to-consumer shipping has led to greater reliance on tertiary packaging to handle higher shipment volumes, further accelerating its growth.

Aseptic packaging is the dominant technology segment in the North America packaging market due to its ability to extend the shelf life of perishable products without refrigeration or preservatives. This technology is widely used in the food and beverage industry for packaging dairy products, juices, and liquid foods, meeting growing consumer demand for safe, fresh-tasting, and convenient products. Aseptic packaging also supports lightweight, eco-friendly materials, reducing transportation costs and environmental impact. With increasing health awareness, demand for sterile and contaminant-free packaging solutions continues to rise, making aseptic packaging a preferred choice for manufacturers across the region.

Smart packaging is the fastest-growing segment in the North America packaging market due to rapid advancements in technology, increasing consumer expectations, and the booming e-commerce sector. Integration of IoT, RFID, NFC, and sensor-based technologies enables real-time tracking, condition monitoring, and anti-counterfeiting, which are essential for industries like food, pharmaceuticals, and retail. Consumers are demanding safer, more convenient, and engaging packaging, with features such as freshness indicators, tamper evidence, and interactive elements like QR codes or augmented reality. The growth of online retail has further fuelled the need for packaging that ensures product integrity during transit and provides traceability. Additionally, strict regulatory requirements and sustainability goals have pushed companies to adopt smart packaging for improved compliance, reduced waste, and resource efficiency. North America’s advanced infrastructure, strong R&D capabilities, and innovation-driven companies like Amazon and Coca-Cola are accelerating this trend, making smart packaging the leading growth segment in the region.

The dominance of the food packaging segment in North America stems from a combination of robust infrastructure, regulatory requirements, and evolving consumer behaviors. Stringent safety and labelling regulations enforced by the U.S. FDA and Canadian CFIA drive adoption of advanced, hygienic packaging systems. The region’s extensive cold‑chain network for frozen, chilled, and fresh foods demands insulated, moisture‑resistant packaging. Meanwhile, busy lifestyles and growth in meal kits, e‑commerce, and single‑serve options fuel demand for convenient, tamper‑evident formats. Together, these factors cement food packaging’s leadership in the North American market.

The e-commerce and logistics-induced industry is the fastest-growing segment in the North America packaging market due to a surge in online shopping, accelerated by changing consumer preferences and digital transformation. The need for durable, lightweight, and sustainable packaging solutions has increased to meet the demands of efficient shipping, product protection, and returns. Rapid growth in direct-to-consumer (DTC) models and last-mile delivery services has pushed brands to invest in customized, secure, and smart packaging. Additionally, increased focus on minimizing environmental impact and optimizing supply chains has driven innovations in flexible, recyclable, and tamper-evident packaging formats, further fueling market expansion.

The B2B distribution channel segment is dominant in the North America packaging market due to strong demand from large-scale manufacturers, wholesalers, and industrial buyers across sectors like food, pharmaceuticals, and consumer goods. These businesses prefer bulk procurement, long-term contracts, and customized packaging solutions, which B2B channels efficiently provide. Additionally, established supply chain networks, better pricing structures, and value-added services such as logistics support and technical consultation make B2B distribution the preferred and most reliable choice for commercial packaging buyers in the region.

The e‑commerce supply chain segment is surging as the fastest-growing distribution channel in North America due to rapid online shopping growth, digital infrastructure, and consumer demand for convenience. The rising volume of DTC brands and e-commerce platforms like Amazon, Walmart, and Shopify requires agile, scalable fulfillment networks offering same‑day delivery, real‑time tracking, and branded packaging. Advanced logistics, including micro‑fulfillment centers, automation, and local distribution hubs, support faster delivery and reduce transit damage, making this channel dominant.

North America dominates the global packaging market due to its advanced infrastructure and strong consumer and industry demand. The region’s highly developed e-commerce ecosystem, led by giants like Amazon and Walmart, continuously drives the need for efficient, durable, and innovative packaging solutions. Its robust supply chain and logistics systems support smooth distribution, reverse logistics, and packaging reuse across vast geographies. Companies in North America invest heavily in research and development, adopting cutting-edge technologies such as AI, automation, and smart packaging. Additionally, government policies like Extended Producer Responsibility (EPR) and plastic reduction laws further encourage sustainable packaging innovations.

On the demand side, North American consumers are highly eco-conscious, pushing brands toward recyclable and biodegradable packaging. Key industries such as food, pharmaceuticals, and retail rely on safe, compliant packaging, further stimulating growth. Trends like customization, premiumization, and the integration of smart, connected packaging also play a major role, making North America a global leader in the packaging sector.

U.S. Market Trends

The U.S. is the largest and most influential player in the North American packaging market. Its dominance stems from a combination of advanced manufacturing capabilities, strong technological innovation, and the presence of global packaging giants like WestRock, Sealed Air, and International Paper. The country’s booming e-commerce sector, led by Amazon, Walmart, and Shopify, drives massive demand for efficient, sustainable, and protective packaging solutions across all industries.

The U.S. leads in smart packaging adoption, with companies integrating AI, IoT, and digital printing to improve traceability and user engagement. Regulatory momentum, such as California’s Extended Producer Responsibility (EPR) law, is pushing for more sustainable materials and waste reduction practices. The pharmaceutical, food and beverage, and personal care industries in the U.S. further contribute to strong packaging demand by requiring compliant, safe, and customized solutions.

Mexico Market Trends

Mexico is emerging as a significant contributor to the North American packaging market, primarily due to its strong manufacturing base and strategic trade relationships under the USMCA (United States-Mexico-Canada Agreement). The country offers cost-effective production and labor advantages, making it a hub for packaging exports and contract manufacturing for U.S. and Canadian companies. Mexico’s growing e-commerce sector and expanding middle class are fueling domestic demand for consumer goods packaging, particularly in food, beverages, and personal care.

While sustainability initiatives are still developing, there is increasing interest in bio-based and recyclable packaging materials, driven by multinational corporations operating in the region. Government efforts to modernize waste management and reduce plastic pollution are expected to further accelerate growth in sustainable packaging over the coming years.

Canada Market Trends

Canada is a steadily growing player in the packaging market, driven by increasing environmental awareness and regulatory action. The Canadian government has introduced stringent policies to reduce single-use plastics, supporting the growth of recyclable, reusable, and compostable packaging. Provinces like British Columbia and Ontario are leading in implementing EPR regulations, making producers more responsible for post-consumer waste management.

Canada also has a robust food processing and grocery retail sector, which creates sustained demand for flexible, barrier-protected, and smart packaging formats. Additionally, Canadian companies are innovating in sustainable packaging technologies and collaborating with logistics and retail firms to introduce closed-loop systems. The rising popularity of eco-conscious brands and subscription-based models further strengthens the packaging market growth in the country.

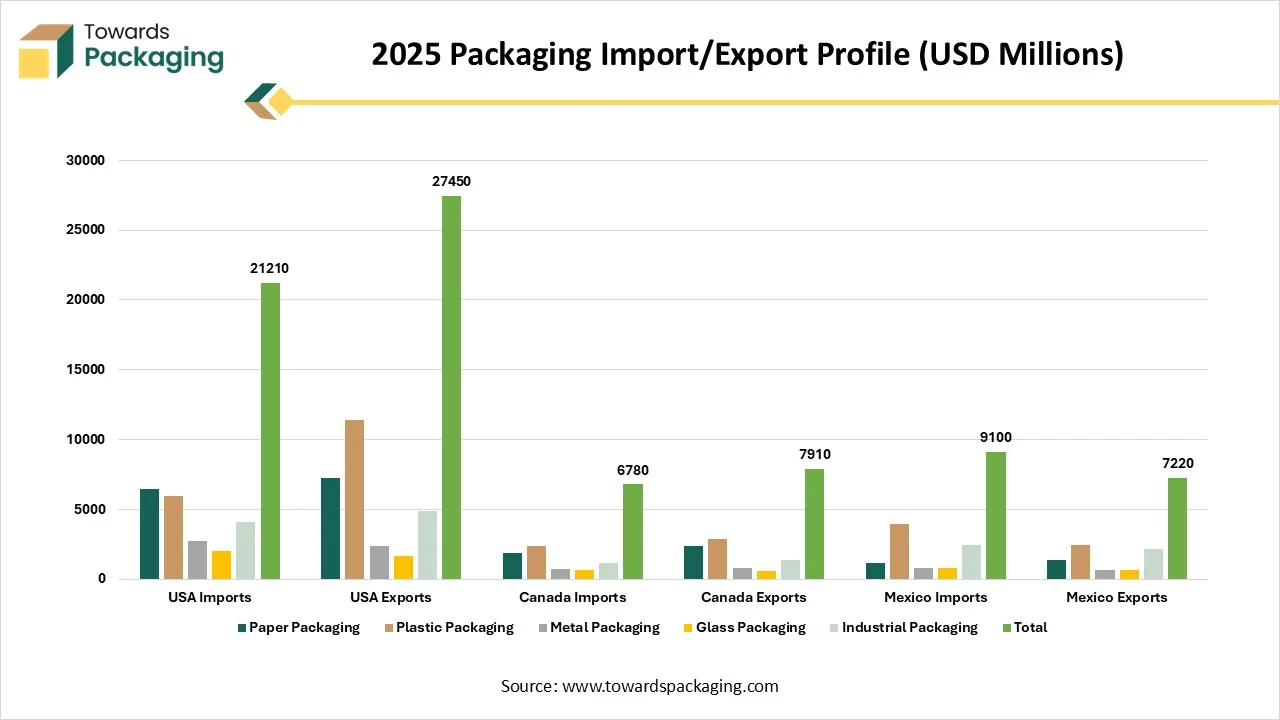

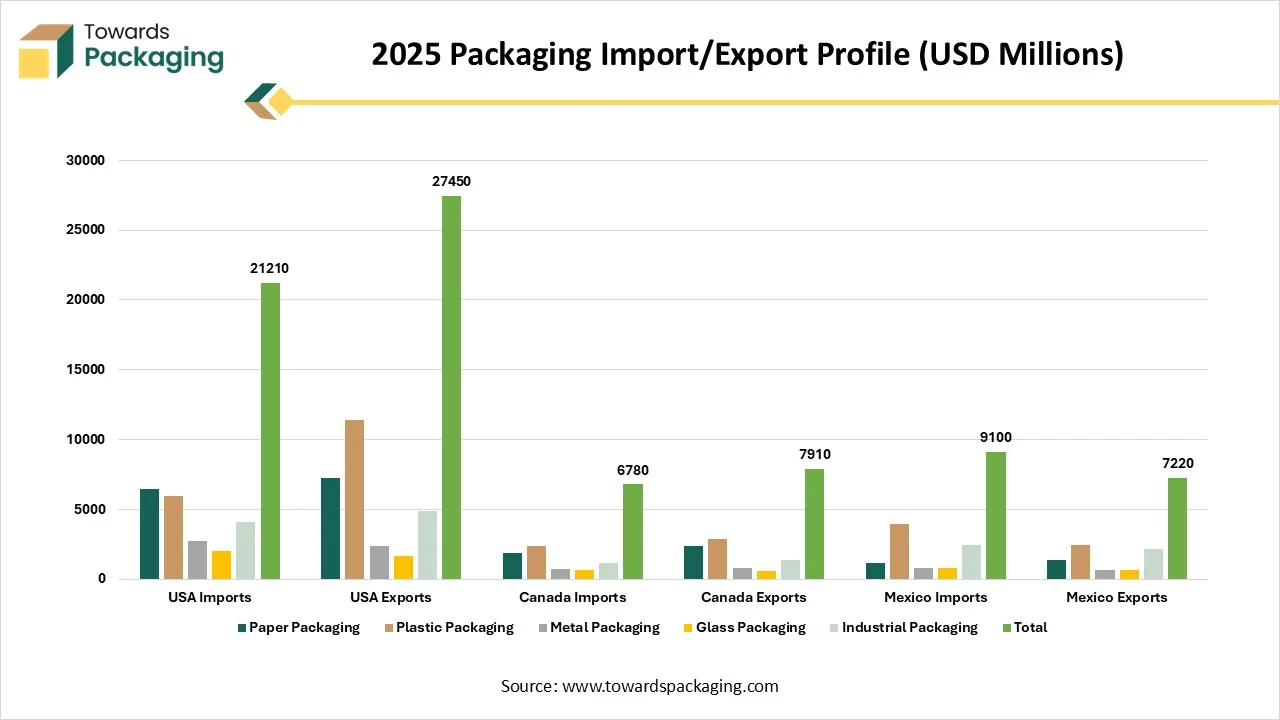

| Category | USA Imports | USA Exports | Canada Imports | Canada Exports | Mexico Imports | Mexico Exports |

| Paper Packaging | 6420 | 7220 | 1840 | 2360 | 1120 | 1340 |

| Plastic Packaging | 5980 | 11380 | 2400 | 2860 | 3960 | 2440 |

| Metal Packaging | 2710 | 2380 | 740 | 780 | 820 | 660 |

| Glass Packaging | 1980 | 1620 | 620 | 570 | 780 | 620 |

| Industrial Packaging | 4120 | 4850 | 1180 | 1340 | 2420 | 2160 |

| Total | 21210 | 27450 | 6780 | 7910 | 9100 | 7220 |

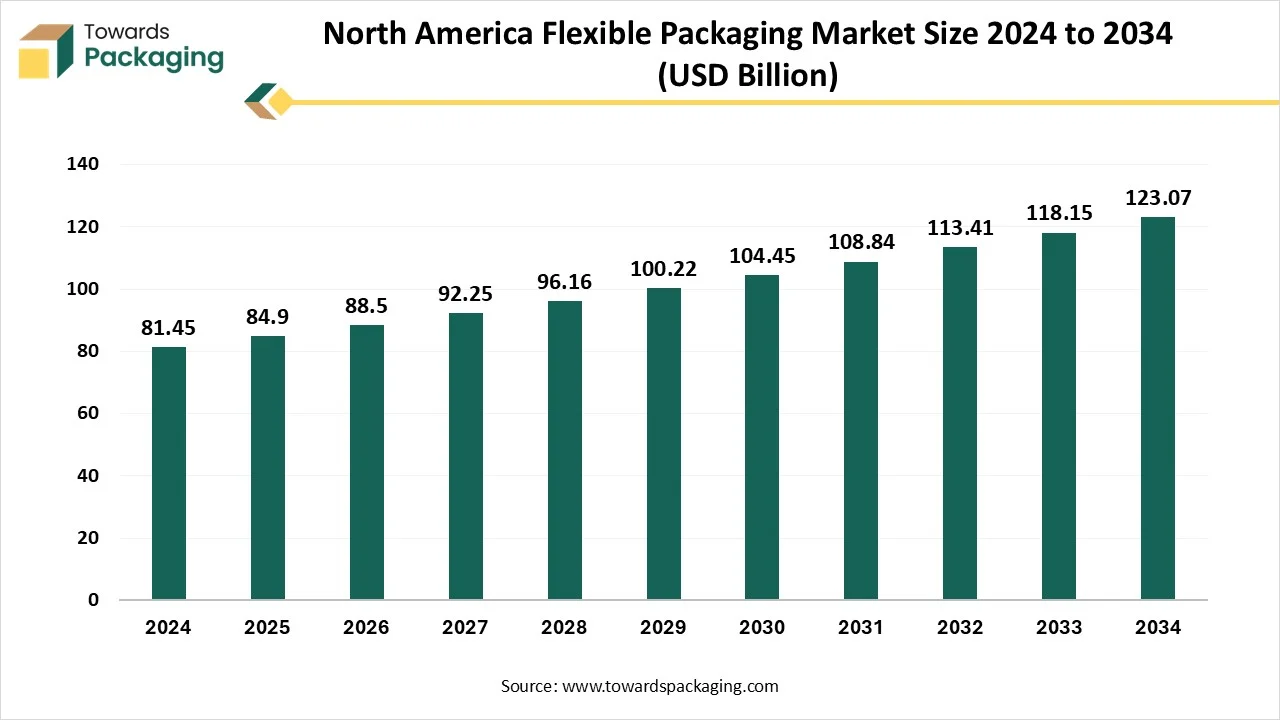

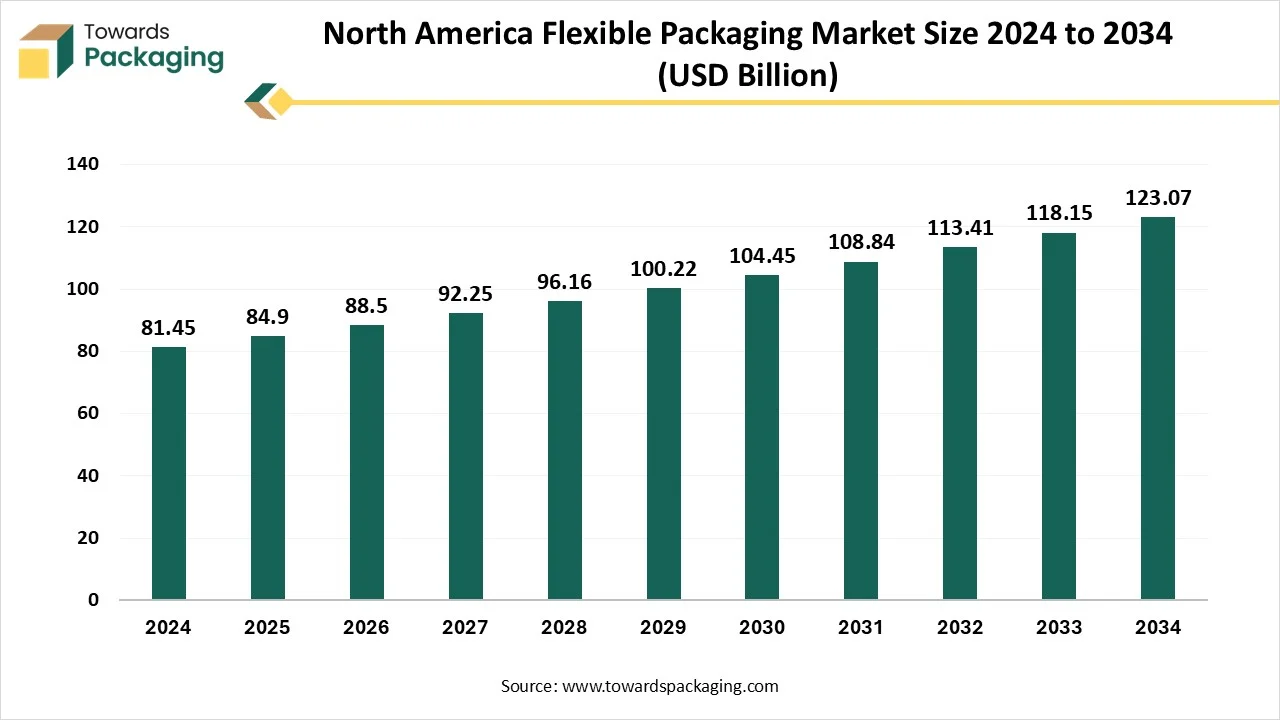

The North America flexible packaging market is expected to increase from USD 84.9 billion in 2025 to USD 123.07 billion by 2034, growing at a CAGR of 4.23% throughout the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing flexible packaging which is estimated to drive the North America flexible packaging market over the forecast period. The North America flexible packaging market is experiencing steady growth, driven by rising consumer demand for convenience, sustainability, and innovation in packaging solutions.

A type of packaging made from easily shaped materials such as plastic, foil, paper, or a combination of these, which can be molded into various shapes and forms is known as flexible packaging.

The North America corrugated packaging market is projected to reach USD 54.41 billion by 2034, expanding from USD 42.77 billion in 2025, at an annual growth rate of 2.72% during the forecast period from 2025 to 2034. Processed foods will dominate North America’s corrugated packaging market in the year 2024 due to their widespread consumption and rigid FDA labelling rules and regulations. Corrugated boxes are important for processing fresh produce during transport, especially in the U.S and Canada, where sustainability trade policies and sector assistance further drive market development.

Corrugated packaging is a kind of cardboard material that is made up of three layers: an inside liner, an outside liner, and a fluting corrugated medium sandwiched between the liner sheets. The fluting corrugated medium is generally made of kraft paper, which is rigid and more durable than regular paper. Corrugated containers remain stable even when exposed to moisture, shocks, and sudden temperature fluctuations. While no container is discreet to extreme force or prolonged or rigid conditions, corrugated serves a great level of assurance that our products will shift from our warehouse to their final point in great shape.

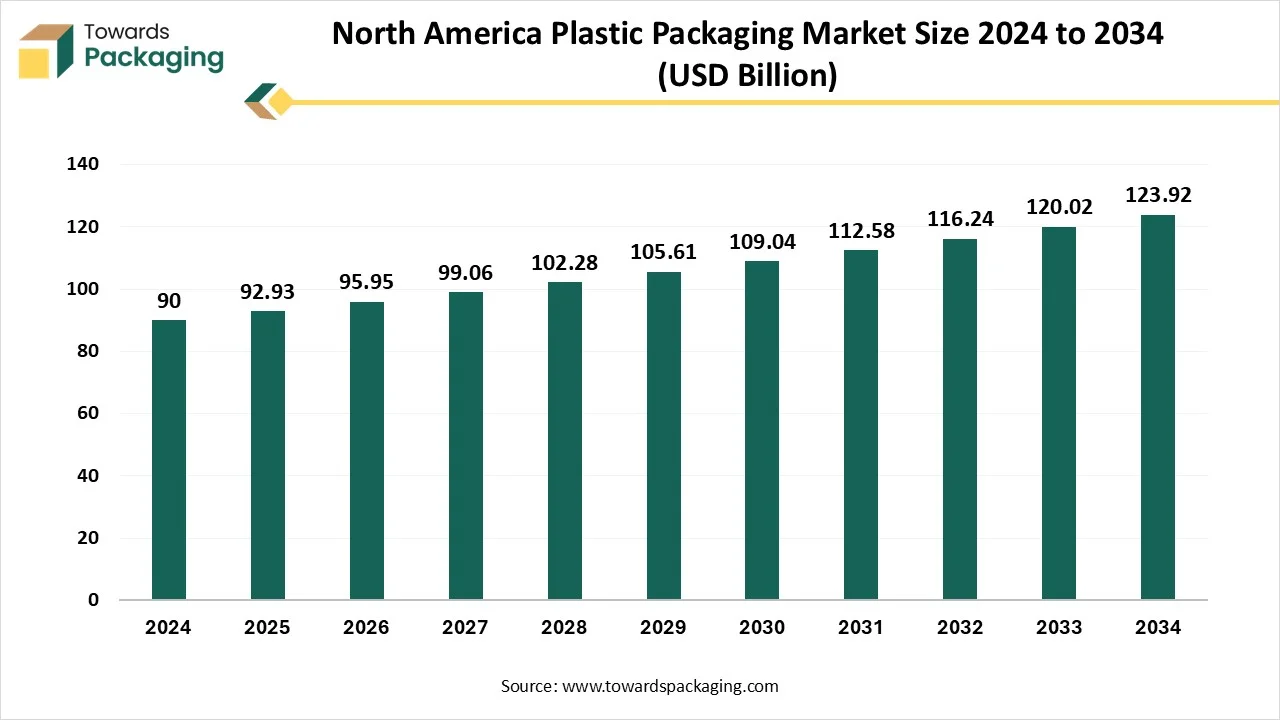

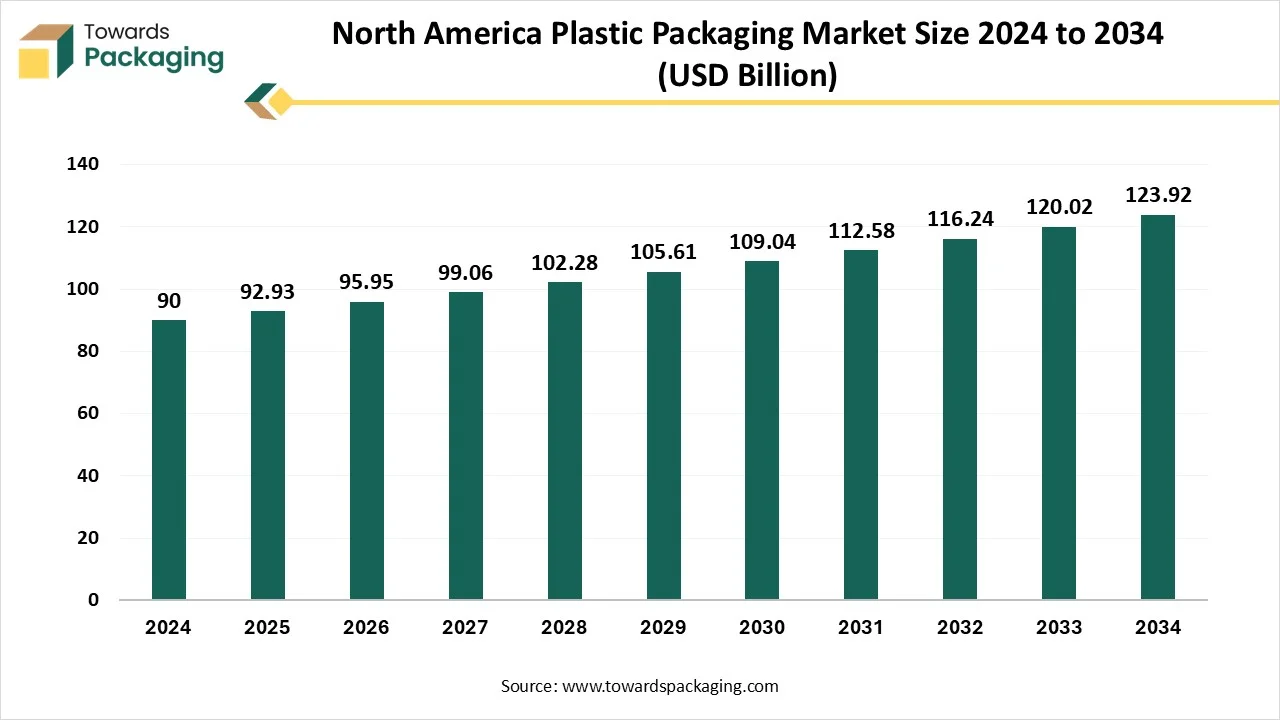

The North America plastic packaging market is predicted to expand from USD 92.93 billion in 2025 to USD 123.92 billion by 2034, growing at a CAGR of 3.25% during the forecast period from 2025 to 2034. The increasing demand for suitable packaging in that region has fuelled the innovation technology in the North America plastic packaging market. The altering existence influences the packing industry in North America, fulfilling customer demands for suitability and the increasing number of single-person families. The United States, because of the growing demand for suitable packing, is seeing individuals demand easy-to-transport packaging solutions.

The North America plastic packaging market includes the production, transformation, and application of plastic-based materials used for packaging goods across various sectors. Plastic packaging provides a lightweight, durable, and versatile solution for preserving product integrity, enhancing shelf life, and reducing transportation costs. It is widely adopted in industries such as food and beverage, pharmaceuticals, personal care, and e-commerce. Plastic packaging formats include both rigid (e.g., bottles, containers) and flexible (e.g., films, pouches) options, with innovations focused on sustainability and recyclability.

By Material Type

By Packaging Type

By Packaging Function

By Technology

By End-Use Industry

February 2026

February 2026

February 2026

February 2026