Pharmacy Repackaging System Market Strategic Growth, Innovation & Investment Trends

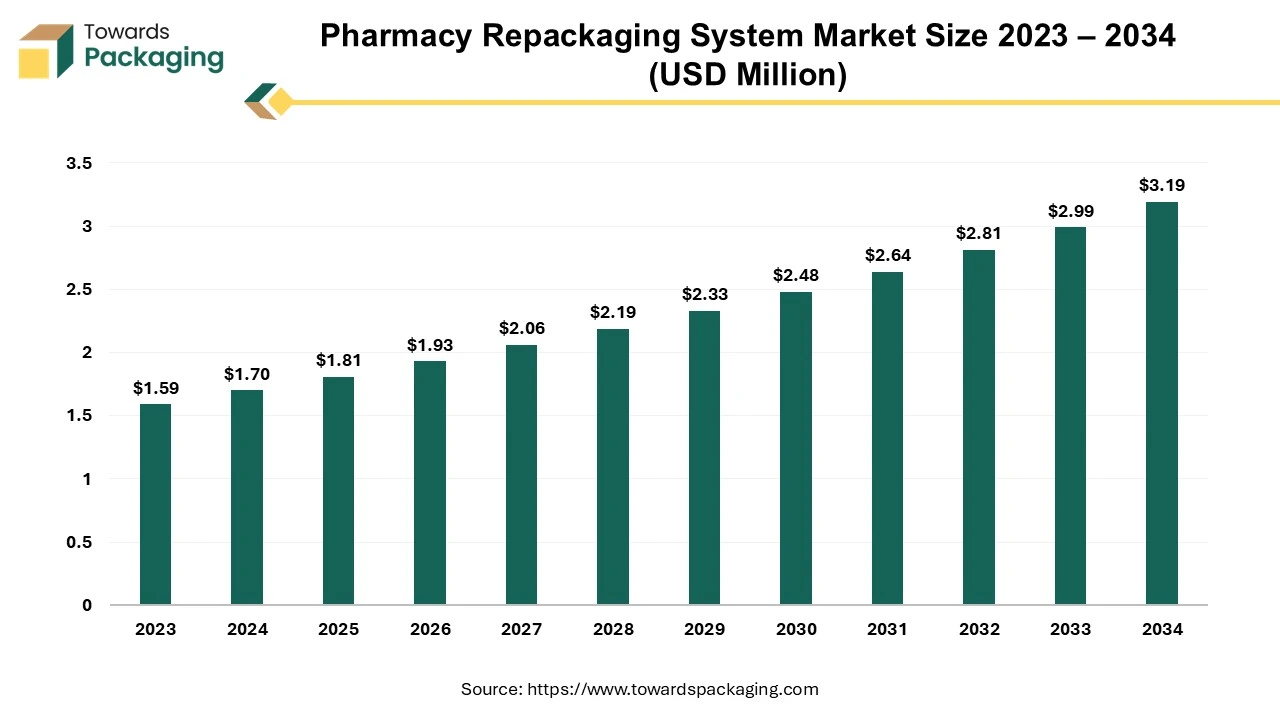

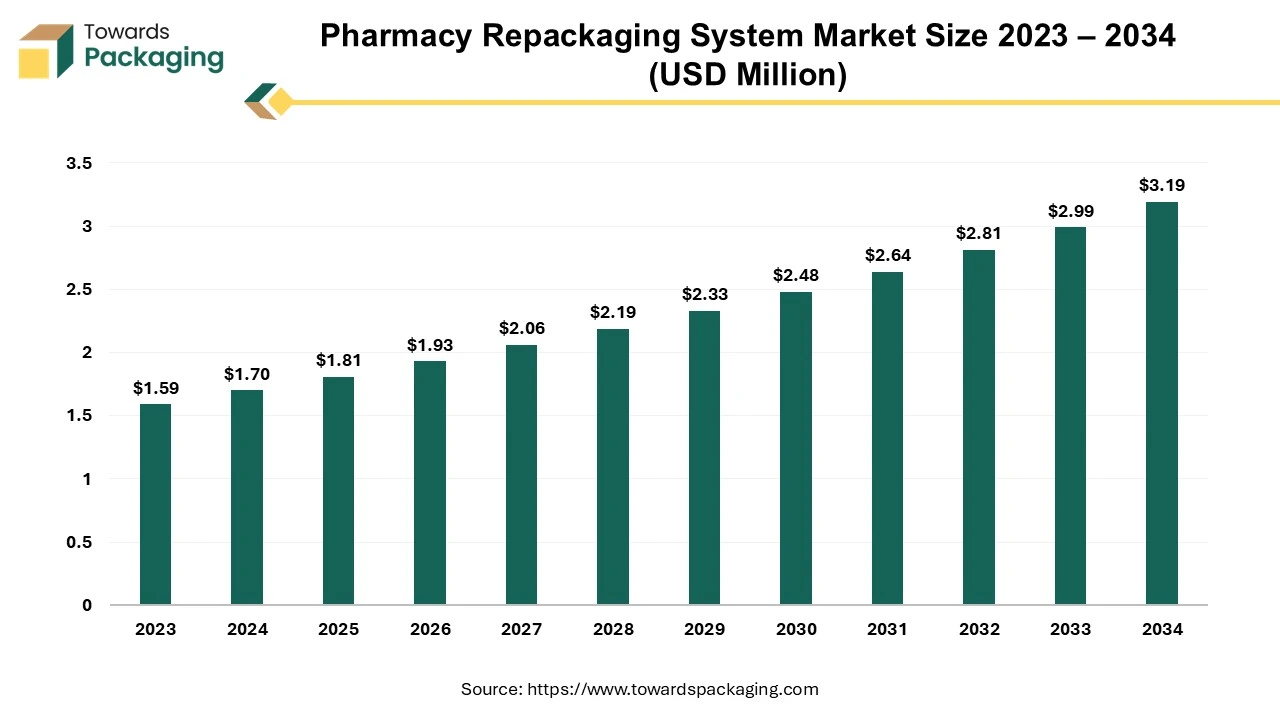

The pharmacy repackaging system market is forecasted to expand from USD 1.93 million in 2026 to USD 3.45 million by 2035, growing at a CAGR of 6.65% from 2026 to 2035.

Key Takeaways

- North America led the pharmacy repackaging system market with the highest share in 2024.

- By region, Europe is expected to witness the highest CAGR during the forecast period.

- By type, the blister card segment dominated the market share in 2024.

- By application, the hospital pharmacies segment dominated the market share in 2024.

Market Overview

The pharmacy repackaging system market is growing significantly due to the rising demand for pharmaceutical products with the growing number of diseases. These are the important components included in the pharmaceutical supply chain, strategies to confirm accuracy and efficacy in medicine distribution. These systems facilitate several semi-automated and automated machineries which are extensively used in repackaging bulk medicines into unit doses. The importance of this system is growing rapidly with the adoption of mini packages of medicines, enhancement of patient safety, and improvement of operational efficacy of pharmaceutical facilities.

Some of the major market players such as Amcor plc, SCHOTT AG, Pharma Packaging Solutions, West Pharmaceutical Services, AptarGroup, Inc., Westrock Company, and several others are continuously bringing innovations to this market which has influenced the development. With the growing number of hospitals, clinics, and other healthcare services there is a rapid growth in the demand for repackaging systems.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 1.81 Million |

| Projected Market Size in 2035 |

USD 3.45 Million |

| CAGR (2025 - 2035) |

6.65% |

| Leading Region |

North America |

| Market Segmentation |

By Type, By Application and By Region Covered |

| Top Key Players |

Amcor plc, Gerresheimer AG, SCHOTT AG, West Pharmaceutical Services, Berry Global, Pharma Packaging Solutions |

Pharmacy Repackaging Systems Market Trends

- This repackaging system is widely used to enhance the quality of the medicines which are stored for a longer period.

- The growing shift towards automation of the pharmacy packaging industry has influenced the demand for this market.

- The rising incorporation of technologically advanced equipment to improve the packaging system has boosted the development of the market.

- Continuous demand for sustainable packaging systems and growing concern for ecological issues have raised the focus of the companies towards this system.

AI Integration in the Pharmacy Repackaging Systems Market

In the pharmacy repackaging systems market, there is a huge impact AI as it is used in the enhancement of the quality of the packaging, reducing errors with the help of machine learning computer vision, and automatic processes. Artificial intelligence is considered to be extremely useful in scanning medical vials and identifying the packaging potential. It is used to reduce issues such as damaged packaging, quality control, incorrect labelling, and reduction of mismatched packaging of medication. It can verify labelling about patients’ details, and decrease any error due to incorrect medication. It plays an important role in the rationalization of this procedure and in addressing tasks related to human error, time efficacy, and charge decrease.

One of the major reasons for the incorporation of AI, it contributes primarily to automation. It decreases the reliance on manual labour, reducing human error at the time of packaging of medicines, dosage supply, and labelling. AI algorithms can analyse earlier records to identify medicines that are required in specific quantities, preventing wastage and confirming suitable supply. It can improve safety in repackaging systems by detecting inconsistencies in packing, such as mislabeled medicines or packaging imperfections. This confirms that patients accept the right medicines in the precise form lessening the possibility of adverse drug measures.

Pharmacy Repackaging System Market Future Trends:

- Automation and robotics: Adoption of robotic arms, automated pill counters, and AI-driven machines to reduce human error and improve speed.

- Modular, scalable systems: Systems that can be expanded in capacity easily as pharmacy demand develops.

- Smart data and analytics integration: Real-time tracking of inventory, expiration dates, and compliance through advanced software.

- Patient-centric packaging: Multi-dose pouches and unit-dose blister packs that assist better adherence, especially for elderly patients.

- Sustainability initiatives: Use of eco-friendly packaging materials and energy-efficient machines.

- E-pharmacy and telemedicine growth: Growing demand for repackaging solutions that support remote dispensing and home delivery.

- Global expansion: Strong rise in Asia Pacific due to investment in healthcare infrastructure and aging populations.

Market Dynamics

Emphasis over Precise Pharmaceutical Packaging Industry’s Largest Driver

The rapid growth in the awareness of the healthcare packaging sector and acceptance of the enhancement of the manufacturing process influence major market players to introduce innovation. The continuous growth in the requirement for biological products and the rising number of asthma and diabetes patients have fuelled market growth. The growing demand for automation in the pharmacy sector is influenced by the accuracy and efficacy of medication packaging.

Due to the high workload and issues in managing medication prescriptions, the importance of repackaging systems in pharmacy is growing rapidly. With the addition of such systems in this market there is a huge reduction in human error, enhance the safety of the patients, and streamlining of the workflow.

This industry is observing noteworthy investments in automation and technology to fulfil the demands of the consumers. Furthermore, supervisory bodies are progressively concentrating on the safety of patients and medicine management, which inspires pharmacies to implement unconventional repackaging systems. This trend improves operative efficacy but also expands customer demand, eventually influencing market development. As the market develops, inventions such as machine learning and artificial intelligence are being joined into these systems, additionally enhancing performance.

Rising Demand for E-commerce Sector Largest Potential for the Market

The increasing e-commerce sector in the pharmacy industry is suggestively inducing the market. Online drugstores and telemedicine facilities are becoming more widespread and these are the major reasons behind the increasing demand for effective and consistent medicine packaging resolutions. As customers choose online buying of medicines, the requirement for operative repackaging systems develops imperious to confirm product honesty and acquiescence with safety values.

This move towards online delivery services requires pharmacies to revolutionize their repackaging procedures to accommodate an extensive change of products and wrapping arrangements while preserving excellence and safety. The suitability of e-commerce stages, united with the importance of proper delivery, influences pharmacies to capitalize on progressive repackaging skills.

Patient security and medicine acquiescence are gaining huge consideration in the healthcare sector. As healthcare workers concentrate on dropping medicine errors and improving the experience of the patients, the request for pharmacy repackaging systems is growing. These systems allow pharmacies to deliver clear labelling and precise quantities, which are vital for improving patient observance of arranged treatments. The importance of agreement with supervisory standards and procedures further pushes acceptance charges in this industry. As shareholders arrange patient security, investments in operative repackaging resolutions will continue to develop.

Segmental Insights

Convenience and Cost-effectiveness Process Blister Segment Led in 2024

The blister card packaging systems dominated the market in 2024 due to their convenience and cost-effectiveness. This system of repackaging in the pharmacy industry is widely used as these are considered to be safe for medicine packaging. These systems for packaging medicines are extensively used for repackaging capsules, tablets, and several other products. The pattern of these cards is mainly made up of aluminum and plastics confirming that every dose is sealed in a distinct section which makes it convenient for patients to accomplish their medication. One of the major factors that influence the demand of the market is the safety of medication for longer storage in adverse conditions which makes it more popular.

Improved Efficiency and Safety Hospital Pharmacies Segment Led in 2024

The hospital pharmacies segment dominated the market in 2024. This segment is dominating due to improved efficiency, patient care, and safety in hospital settings. These repackaging systems are planned in such a way that they fulfil all the demands with accuracy and organize the supply of medicines in hospitals mainly. With rising pressure on hospital setups, the requirement for effective repackaging designs has increased and spread the acceptance of special packaging processes customized for pharmacies.

The market grasps several potentials that can comprise emerging custom resolutions for pharmacies. Industries are expected to contemplate cloud resolutions that offer remote admittance, permitting them to check records and repackage medicines while being more flexible. The development of telepharmacy services opens up a wide range of opportunities where pharmacies seem to improve their facilities because of varying market trends.

Rising Pharmaceutical Industries and Significant Contribution North America to Sustain as a Leader

North America held the largest share of the pharmacy repackaging system market in 2024. This is due to the rapidly growing pharmaceutical industries and its contribution towards this market. Continuous growth in the healthcare sector by countries such as the U.S. and Canada due to rising funding from government as well as private firms. There are continuous research and studies funding going on which help market players to introduce innovation in this field. The continuous rise in demand for enhanced-quality pharmacy packaging has influenced the incorporation of repackaging systems. The rising demand for automation in this market has also influenced the market to develop rapidly by introducing innovation and fulfilling the requirements of the consumers.

U.S. Pharmacy Repackaging System Market Trends

U.S. pharmacy repackaging system market is driven by the strict regulatory requirements. The U.S. has one of the largest and most sophisticated healthcare systems in the world, with thousands of hospitals, long-term care facilities, and retail pharmacies that require repackaging solutions to improve medication management and patient safety. Agencies like the USFDA and USP (United States Pharmacopeia) mandate high standards for medication labelling, traceability, and dosing accuracy. These regulations drive demand for advanced, compliant repackaging systems in hospitals and pharmacies. Repackaging systems help prevent medication errors, improve adherence (especially in elderly and chronic care patients), and reduce the risk of cross-contamination, all major priorities in U.S. healthcare. The rise of long-term care facilities, assisted living centers, and specialty pharmacies in the U.S. has increased the need for unit dose packaging and multi-dose blister packs, both of which rely heavily on repackaging systems.

The U.S. leads in automation, robotics, and software integration in pharmacy operations. This includes barcoding, RFID tracking, and cloud-based inventory management critical components of modern repackaging systems. Key companies like Swisslog Healthcare, Omnicell, McKesson, and Parata Systems are based in or operate heavily in the U.S., continuously innovating and expanding repackaging capabilities. With over 4 billion prescriptions filled annually in the U.S., there is strong demand for systems that can efficiently and accurately repackage medications for distribution.

Adoption of Updated Regulation Europe to be the Fastest-Growing Region

Europe witnessed the fastest-growing revenue share for the year 2024. There is a huge demand for pharmacy repackaging systems market due to the growing acceptance of updated regulations in the packaging industry. Countries such as Germany, the UK, Italy, South Korea, Sweden, Denmark, Norway, Spain, and France have a huge demand for prefilled syringes, ampoules, vials, and containers increasing the demand for repackaging systems. Due to the presence of a huge ageing population, there are rising number of patients which has influenced the development of this market.

Asia’s Large Consumer Base to Project Notable Growth

Asia Pacific region is seen to grow at a notable rate in the foreseeable future. Countries like China, India, Japan, and South Korea are heavily investing in healthcare infrastructure, including hospital chains, retail pharmacies, and long-term care facilities, driving demand for efficient medication handling and repackaging solutions. Aging demographics in countries such as Japan, South Korea, and China are increasing the need for chronic disease management and multi-dose medication packaging, which pharmacy repackaging systems support.

Public health initiatives and universal healthcare expansions (e.g., Ayushman Bharat in India, national health insurance in China and South Korea) are encouraging the use of advanced pharmacy practices, including automation and repackaging. Both regional and multinational companies are investing in Asia-Pacific due to its high-growth potential, increasing the availability and affordability of repackaging technologies. Countries are tightening regulations on medication safety, traceability, and labeling, pushing hospitals and pharmacies to invest in compliant repackaging systems.

Top Companies List

Latest Announcements by Market Leaders

- In December 2024, the CEO at ACG Inspection, Udit Singh expressed, "At ACG, our mission is to tailor technological innovations specifically designed to enhance the pharmaceutical industry. Whether it's efficient manufacturing, higher OEE, harnessing the power of supply chain intelligence, demand forecasting, sustainable production methods, diversion control or implementing cutting-edge anti-counterfeit technologies, we have been at the forefront of innovations utilising Machine Learning, Artificial Intelligence, and advanced analytics to elevate the quality of various critical processes and applications.”

Recent Developments

- On 6 June 2025, Honeywell disclosed that Evertis, a top producer of film for packaging, has selected Aclar film to be used by its Evercare pharmaceutical brand. Evertis' selection of Aclar Films will ensure that patients worldwide receive the life-saving medications. (Source: Honeywell)

- On 21 March 2025, with a shared loyalty to sustainability, performance, and global accessibility, Tower and CCT exhibited at Booths 91A and 68, where they will reveal their latest product crafted to set new benchmarks for reliability, efficiency, and sustainability in cold chain shipping. (Source: Pharmaceutical Manufacturer)

- On March 17-20, 2025, Tension Packaging & Automation will exhibit its extensive line of automation equipment at ProMat 2025 in Chicago. Tension will showcase its products, including the fitPACK500, HPS300, SLAM, Z-Sort, MAX-PRO 24, and TensionCONNECT workflow integration software, at the premier trade exhibition, which also features the top manufacturing and supply chain solution suppliers in the globe. These products address some of the major issues in fulfillment, like growing labor and shipping costs, while providing solutions for packing and automation optimization.

- On 27 February 2025, Systech, a part of Markem-Imaje and Dover, revealed its new AI-powered authentication solution, UNiSecure ArtAI. Crafted to ensure packaging quality, protect patients, and safeguard brands, the latest solution is a completely cloud-based SaaS. (Source: Pharmaceutical Manufacturer)

- On 3 December 2024, ACG inspection has launched its cutting-edge life sciences Cloud-an complete end-to-end analytical and traceability solution whose goal is to serve production quality, transformational supply chain efficiency, and manufacturing effectiveness that empowers our customers to make a healthier world. (Source: Business Standard)

- In December 2024, ACG Inspection announced the launch of Life Sciences Cloud and AI-powered inspection solutions, enabling pharmaceutical businesses to gain better insights.

- In September 2024, PCI Pharma Services announced the investment of more than $365 million in infrastructure supporting the clinical and commercial-scale final assembly and packaging of drug-device combination products utilizing advanced drug delivery systems, with an emphasis on injectable formats.

Pharmacy Repackaging System Market Segments

By Type

- Blister Card Packaging Systems

- Pouch Packaging Automation Systems

- Liquid Medication Packaging Systems

- Bottle Filling Automation Systems

By Application

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region Covered

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait