Europe Flexible Packaging Market Size, Share, Trends and Forecast Analysis

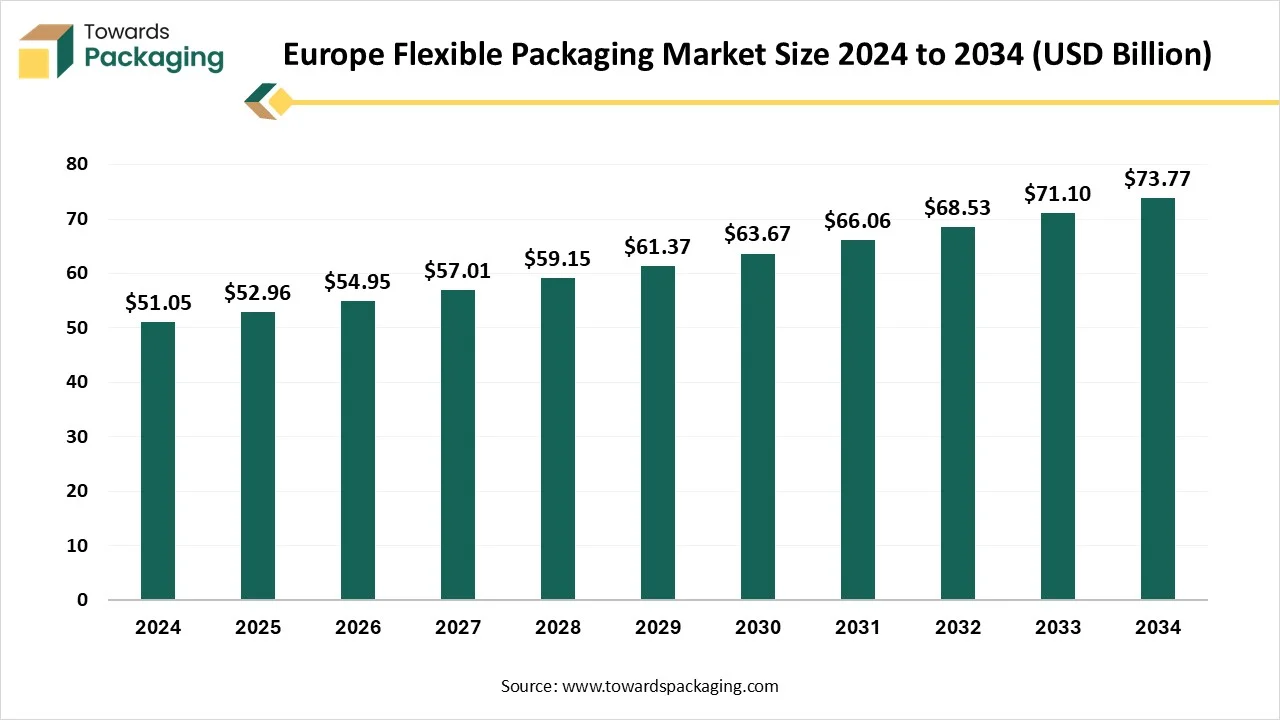

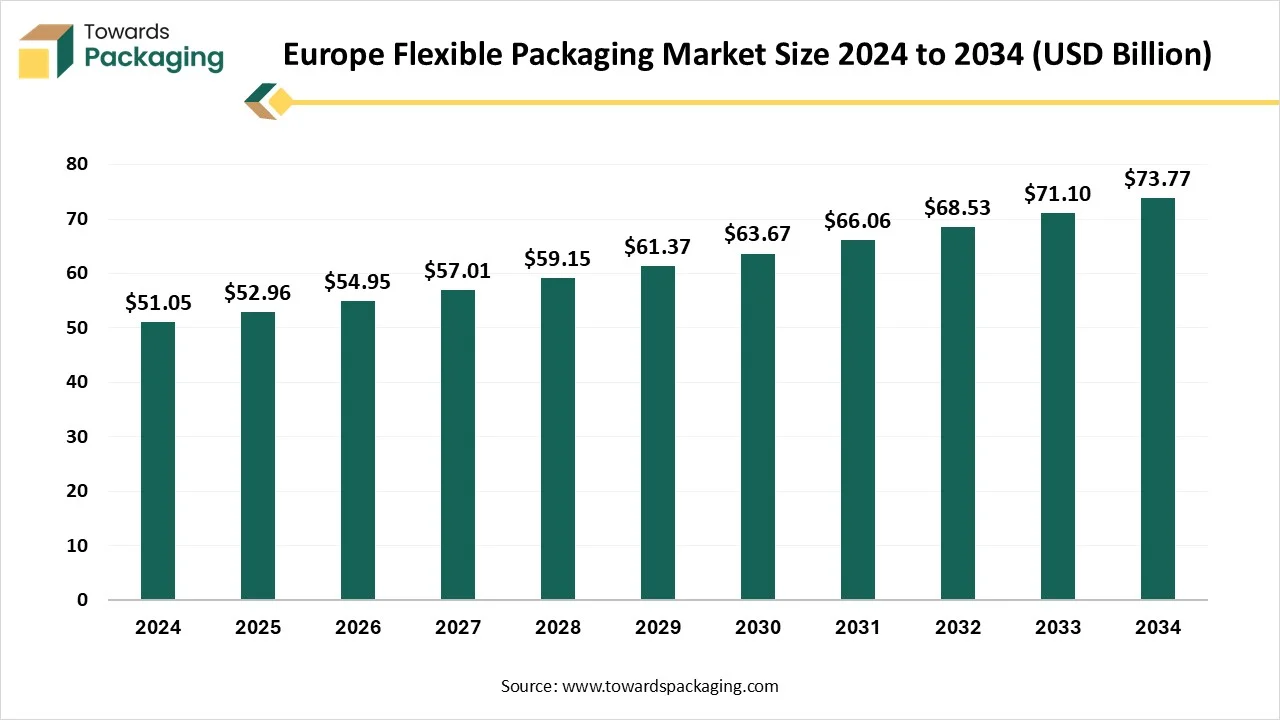

The Europe flexible packaging market is projected to reach USD 76.54 billion by 2035, growing from USD 54.95 billion in 2026, at a CAGR of 3.75% during the forecast period from 2026 to 2035. Key segments include plastics (50% market share in 2024), pouches & bags (40% share), and food & beverages (55% share). Leading companies such as Amcor plc, Mondi Group, and Huhtamaki Oyj dominate the market, with Germany, the UK, and France being the primary consumers. The market is characterized by innovations in biodegradable materials and smart packaging technologies.

Key Takeaways

- By material type, the plastics segment has contributed the biggest share of approximately 50% in 2024.

- By material type, the biodegradable/compostable materials segment will grow at a notable CAGR between 2025 and 2034.

- By packaging type, the pouches & bags segment is predicted to have the biggest share of approximately 40% in 2024.

- By packaging type, the stand-up pouches segment will grow at a notable CAGR between 2025 and 2034.

- By application, the food & beverages segment has contributed to the largest share of approximately 55% in 2024.

- By application, pharmaceuticals & healthcare will rise at a notable CAGR between 2025 and 2034.

- By end user, the food processing & beverages segment is predicted to have the biggest share of approximately 60% in 2024.

- By end user, the cosmetics & personal care segment will grow at a notable CAGR between 2025 and 2034.

- By distribution channel, the distributors & dealers segment has contributed to the largest share of approximately 50% in 2024.

- By distribution channel, online platforms will rise at a notable CAGR between 2025 and 2034.

Market Overview

Europe flexible packaging market is experiencing steady growth, motivated by the growing need for lightweight and environmentally friendly packaging options. Flexible packaging is becoming increasingly popular due to rising consumption in the food, beverage, and pharmaceutical industries. Innovations in eco-friendly substitutes and materials are also facilitating market growth throughout the region.

Market Outlook

Industry Growth Overview

- The Europe flexible packaging market is growing steadily due to the need, particularly in the food, beverage, and pharmaceutical industries, for convenient, lightweight, and sustainable solutions. Growth is being propelled by innovations such as biodegradable materials and high-barrier films.

Global Expansion

- To increase their global presence, European manufacturers are collaborating with foreign companies and increasing their exports to emerging markets. By utilizing cutting-edge technologies, the region is also meeting global sustainability trends and improving its reputation overseas.

Startup Ecosystem

- With funding, mentorship, and access to research facilities for quicker commercialization, Europe's startup ecosystem focuses on smart and sustainable packaging solutions. To scale innovations and meet the needs of niche markets, startups are increasingly collaborating with well-established packaging companies.

“Europe's Packaging Future: Sustainability Rules Rewrite the Flexible Packaging Playbook”

Europe’s flexible packaging market is being shaped by stringent sustainability regulations that force businesses to use materials that are recyclable, reusable, or compostable. Traditional multilayer formats are becoming less viable due to regulations like mandatory recycled content, EPR fees, and prohibitions on plastics that are hard to recycle. Brands are consequently moving toward low-carbon designs mono mono-material structures, and packaging that can amply demonstrate recyclability and environmental performance.

At the same time, there is a growing data approach to compliance requirements. Businesses are required to offer carbon reporting, traceability, and verified sustainability claims, which promotes the use of eco certifications, digital labeling, and open supply chain procedures. In general, packaging manufacturers are being forced to innovate swiftly while controlling costs as sustainability in Europe shifts from voluntary pledges to mandated standards.

Key Metrics and Overview

| Metric | Details |

| Market Size in 2025 | USD 52.96 Billion |

| Projected Market Size in 2035 | USD 76.54 Billion |

| CAGR (2026 - 2035) | 3.75% |

| Market Segmentation | By Material Type, By Packaging Type, By Application, By End-User Industry, By Distribution Channel and By Region |

| Top Key Players | Amcor plc, Mondi Group, Constantia Flexibles, Huhtamaki Oyj, DS Smith Plc |

Key Technological Shifts in the Europe Flexible Packaging Market

- Sustainable and Eco-friendly Materials: To satisfy strict EU regulations and rising consumer demand for sustainable packaging, the industry is growing, moving toward biodegradable, compostable and recyclable compostable and recyclable films. Businesses are making films. Businesses are making investments in multi-layer recyclable solutions and plant-based polymers.

- Smart and Active Packaging: Smart packaging features like NFC enable tracking, QR codes, and freshness indicators are becoming increasingly popular. Consumer engagement, supply chain transparency, and product safety are all improved by these innovations.

- Recycling and Waste Reduction Technologies: New recycling technologies are being created to manage intricate, flexible packaging with multiple layers. Companies are concentrating on minimizing their overall environmental impact and designing for recyclability.

Future Demands

- Higher Demand for Recyclable and Mono Material Packaging: Businesses will increasingly switch to flexible packs that are simple to recycle and composed of a single material as Europe moves toward stricter sustainability regulations. Demand for recyclable films, pouches, and laminates that still provide strong branding and protection will rise as a result.

- More pressure from sustainability costs and policies: The cost of using non-recyclable packaging will increase if producers are held accountable for waste management. Brands will therefore favor flexible packaging that satisfies circular economy goals and has less of an impact on the environment, spurring innovation in environmentally friendly formats.

- Growing need for Functional Packaging in Food & Beverage: Flexible packaging that keeps goods fresh portable and easy to use will continue to be demanded by food companies. This indicates increased demand for lightweight packs, resealable pouches, and sustainable barrier materials that prolong shelf life.

Emerging Technologies

- Mono Material High Barrier Films: To achieve oxygen and moisture barrier performance comparable to multilayers, new films composed of a single polymer are being developed. Why it matters: It is simple to recycle and satisfies EU circularity goals without sacrificing product safety.

- Digital & Smart Printing Technologies: Low-volume customization, interactive packaging, and traceability are made possible by advanced digital printing, QR codes, and variable data printing. Why it matters: promotes regulatory compliance, brand engagement, and short-term waste reduction.

- Biodegradable and Compostable Polymers: Materials from plant sources, bio-based PLA, PHA, and starch blends are being tested and commercialized for pouches and films. Why it matters: Reduces dependence on fossil plastics and helps brands meet eco-label and sustainability claims.

Major Drivers that Shape the Europe Flexible Packaging Market

Rising Focus on Sustainability and Recyclability

To reduce packaging waste and increase recycling rates Europe governments are enforcing stricter regulations, which are forcing companies to rethink their packaging designs. Additionally, consumers are actively selecting products with eco-friendly packaging, hastening the transition to adaptable recyclable solutions.

Shift toward convenient and lightweight packaging formats

Easy-to-handle single-serve and resealable packaging is becoming increasingly popular due to urban lifestyles and smaller households. Additionally, flexible packs help brands draw customers in cutthroat retail settings by improving shelf visibility and product differentiation.

Rapid growth of e-commerce and organized retail

By decreasing shipping weight and material consumption, flexible packaging promotes effective logistics because of its adaptability and durability. It can be used to protect goods during last-mile delivery and long-distance shipping.

Cost efficiency compared to rigid packaging

Manufacturers can keep operating costs under control by using fewer materials and having less storage space. In addition to lowering fuel consumption and carbon emissions, reducing transportation weight also enhances supply chain efficiency.

Advancements in packaging materials and printing technologies

The creation of high-performance films and nonmaterial structures increases recyclability without sacrificing protection. More customization, shorter production runs, and improved branding are all made possible by advanced printing techniques.

Government Initiatives

- In January 2025, the European Union Commission approved a new regulation to replace the older directive on packaging and packaging waste. This regulation establishes requirements for packaging design, recyclability, recycled content, and harmful substance limits, aiming to reduce waste and promote sustainability across all packaging types, including flexible packaging.

Trends in Europe Flexible Packaging

- Smart Packaging: Radio-frequency Identification (RFID ) tags and NFC(Near-Field Communication) have been accepted in transportation and retail logistics for some period already, as they are not costly and serve users with reliability through the supply chain. Smart packaging also allows users to use detailed information on the product, such as the sourcing of raw materials and the environmental impact.

- Sustainability: Current advances have created bio-resins and biodegradable materials available to brands. The main restriction of the bio-resonance is its cost. Hence, once it is accepted, it becomes widely spread and develops an increase, and the price will decrease. The circular economy is further driving inventions that develop the complete sustainability of the products that are sold within the flexible packages, but this can be complex for flexible packaging producers to show direction.

- E-commerce: It is expected that E-commerce will have sold out 23 % of overall retail sales by 2027, which is already affecting the packaging that protects these products that are sold online. This develops the decrease in flexible packaging as it must be lightweight to restrict carbon emissions during transportation, and serve with tamper-evident seals and packaging, which becomes inseparable from the complete brand and user experience.

- Regulatory Compliance: Many factors are driving the developing scenario of the regulatory needs for the flexible packaging manufacturer, which includes product labelling, food safety, and environmental supervision. As such, funding is being created in technologies and procedures to ensure compliance with sector and government regulations to mitigate risks and ensure compliance too.

Financial Snapshot of Publicly Traded European Flexible Packaging Companies (2025)

| Company | Ticker / Exchange | Country | Market Cap | P/E Ratio | Price-to-Sales (P/S) | EV / EBITDA | Dividend Yield | Revenue (Last FY) | EBITDA (Last FY) | Employees |

| Huhtamäki Oyj | OMXHEX: HUH1V | Finland | €3.0 B | 14.2× | 0.76× | 8.18× | 3.65% | €4.8 B | €587 M | 17,790 |

| Mondi plc | LSE: MNDI | United Kingdom | £3.6 B | 12.8× | 0.80× | 7.80× | 5.00 % (2024) | £6.14 B | £880.94 M | 22,000 |

| Amcor plc | NYSE: AMCR / ASX: AMC | Switzerland / Australia | USD 19 B | 21.3× | 1.07× | 10.5× | 4.60% | USD 14.7 B | USD 1.40 B | 44,000 |

| Ergis S.A. | GPW: ERG | Poland | PLN 160 M (≈ €33 M) | 11.5× | 0.41× | 13.20× | 1.20% | PLN 320 M | PLN 24 M | 128 |

| UPM-Kymmene Oyj | OMXHEX: UPM | Finland | €11.5 B | 16.7× | 0.73× | 8.40× | 4.30% | €10.48 B | €1.25 B | 16,500 |

| Smurfit Kappa Group plc | Euronext Dublin: SKG / LSE: SKG | Ireland | €11.8 B | 14.9× | 0.85× | 6.9× | 3.10% | €12.85 B | €1.86 B | 47,000 |

| DS Smith plc | LSE: SMDS | United Kingdom | £7.2 B | 13.1× | 0.70× | 7.25× | 4.90% | £8.22 B | £1.08 B | 30,000 |

Key Takeaways

- Highest Dividend Yield: Mondi plc (5 %) and DS Smith (4.9 %)

- Lowest Valuation Multiples: Ergis S.A. (P/S = 0.41 ×, P/E = 11.5 ×)

- Largest Market Cap: Amcor plc (~USD 19 B)

- Strongest EBITDA Margin: Huhtamäki and UPM (> 11 %)

- Most Focused on Flexible Packaging: Huhtamäki Oyj, Amcor plc, Ergis S.A., Mondi plc

Government Support in Europe for the Flexible Packaging Market:

The PPWR is officially applicable to all packaging that is kept in the EU industry; instead, they are supplied, produced, and sold from outside the EU, and the packaging waste is generated in the EU. The regime, which has imposed restrictions on producers, importers, suppliers, and distributors, has checked representatives and completeness service providers.

Every packaging, regardless of the number of exemptions, has to be crafted for recyclability and align with defined recyclability performance criteria. We can implement acts that are needed to be accepted by 1 January 2028.

Market Opportunity

Growing Demand for Biodegradable and Recyclable Packaging

Businesses are adopting eco-friendly packaging because of stricter EU regulations on single-use plastics and growing consumer preference for sustainable products. Manufacturers now have the chance to experiment with plant-based substitutes, recycled materials, and compostable films.

Market Restraint

Recycling and Waste Management Challenges

Although there is a growing need for environmentally friendly packaging, multi-layer flexible packaging is still challenging to recycle effectively. Eco-friendly packaging solutions are not widely adopted due to a lack of infrastructure and high sorting costs. Furthermore, regional variations in consumer awareness and recycling program participation continue to undermine overall efficacy.

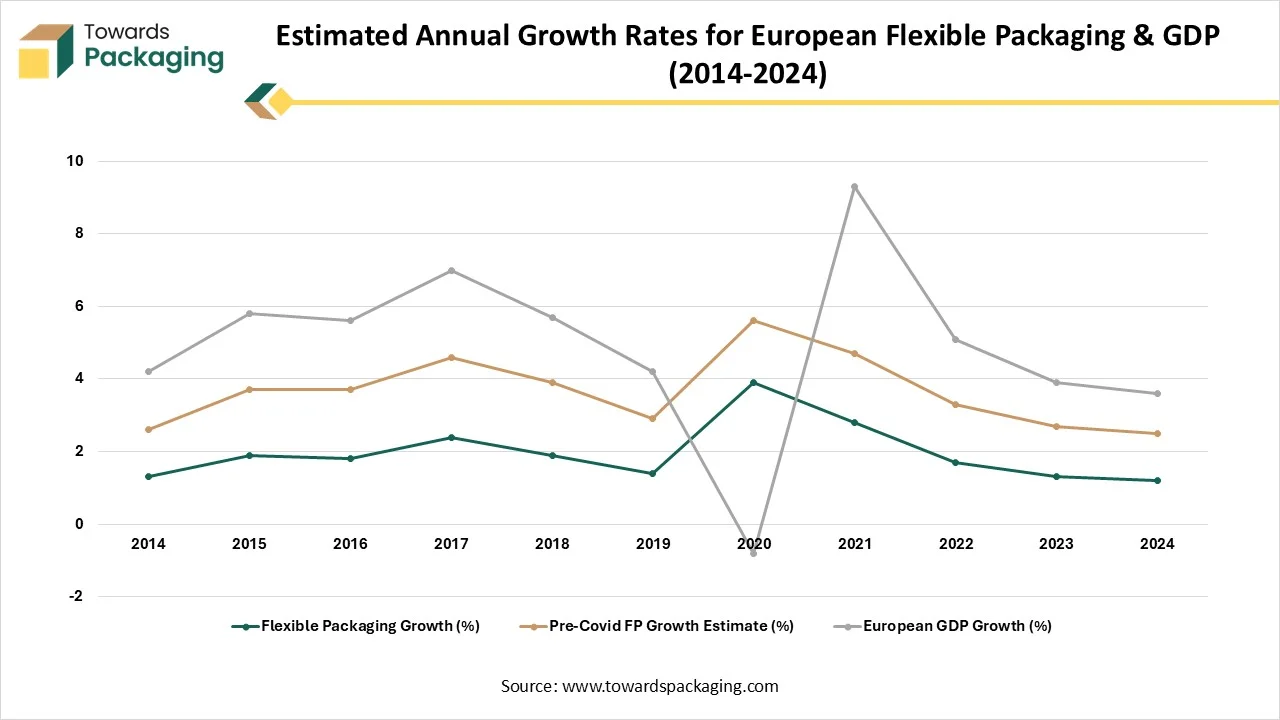

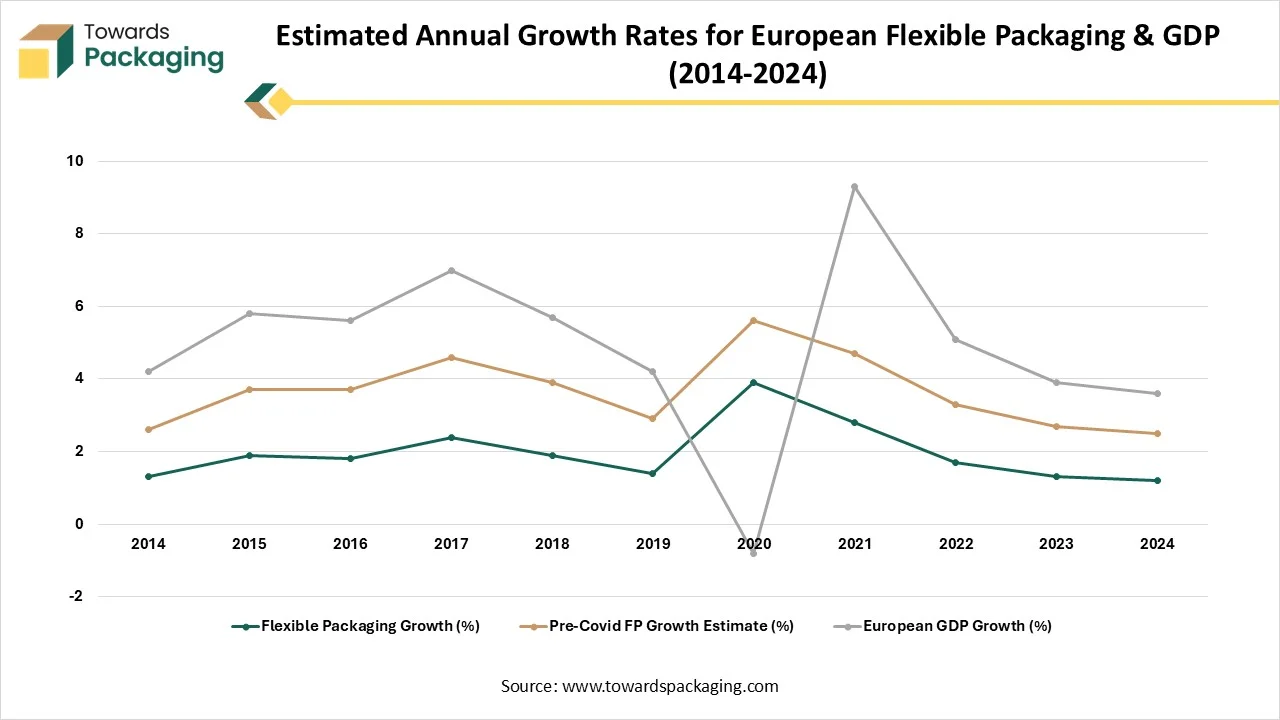

Estimated Annual Growth Rates for European Flexible Packaging & GDP (2014-2024)

| Year | Flexible Packaging Growth (%) | Pre-Covid FP Growth Estimate (%) | European GDP Growth (%) |

| 2014 | 1.3 | 1.3 | 1.6 |

| 2015 | 1.9 | 1.8 | 2.1 |

| 2016 | 1.8 | 1.9 | 1.9 |

| 2017 | 2.4 | 2.2 | 2.4 |

| 2018 | 1.9 | 2 | 1.8 |

| 2019 | 1.4 | 1.5 | 1.3 |

| 2020 | 3.9 | 1.7 | -6.4 |

| 2021 | 2.8 | 1.9 | 4.6 |

| 2022 | 1.7 | 1.6 | 1.8 |

| 2023 | 1.3 | 1.4 | 1.2 |

| 2024 | 1.2 | 1.3 | 1.1 |

The data compares the annual growth of Europe’s flexible packaging sector with overall GDP performance from 2014 to 2024. Flexible packaging growth remained stable between 1-2.5% before Covid-19, while GDP followed a similar but slightly more volatile trend. In 2020, the pandemic caused a steep drop in GDP, contrasted by a sharp rise in flexible packaging demand driven by increased food, medical, and e-commerce consumption. Growth levels normalize after 2021, returning to steady, moderate rates through 2024.

Segments Insights

Why did the Plastics Segment Dominate the Europe Flexible Packaging Market?

The plastics segment dominated the Europe flexible packaging market with a 50% share in 2024 because it is affordable, long-lasting, and adaptable. Plastics are the most popular material for packaging in the food, beverage, and pharmaceutical industries because of their strong barrier qualities, lightweight nature, and compatibility with a variety of products.

The biodegradable/compostable materials are expected to be the fastest-growing in the market during the forecast period, driven by tighter EU sustainability regulations and growing consumer awareness. The region's drive for eco-friendly substitutes and circular economy objectives is reflected in the growing use of bio-based polymers and compostable films.

What made the Pouches & Bags Segment Dominate the Market in 2024?

The pouches & bags segment dominated the Europe flexible packaging market with approximately 40% share in 2024, because they are widely used in food and household products and are convenient and affordable. They appeal greatly to both manufacturers and consumers due to their resealable, lightweight, and portable qualities.

The stand-up pouches segment is predicted to be the fastest growing in the market during the forecast period. They blend robust functionality with shelf appeal because they use less material than rigid packaging alternatives. These pouches promote longer shelf life, take up less room, and support sustainability goals.

What made the Food & Beverages Segment Dominate the Market?

The food & beverages segment has dominated the market with approximately 55% share in 2024, for perishable goods, since flexible packaging guarantees longer freshness, portability, and cost effectiveness. Its widespread adoption has been further fueled by the growing demand for packages and ready-to-eat foods.

The pharmaceuticals & healthcare is predicted to be the fastest growing in the market during the forecast period because of an increasing demand for packaging that is safe tamper tamper-evident, and protective encourages adoption. The region's safe distribution and storage are supported by the growing use of medical pouches, sachets, and blister packs.

What made the Food Processing & Beverages Dominate the Market?

The food processing & beverages segment has dominated the market with approximately 60% share in 2024, bolstered by the strong demand for flexible packaging in the dairy, pastry snack, and beverage industries because of its low cost, long shelf life, and ability to accommodate a range of product-sized manufacturers favor flexible packaging.

The cosmetics & personal care segment is predicted to be the fastest growing segment in the market during the forecast period because, to meet sustainability goals, brands are using flexible packaging formats such as refill packs, sachets, and pouches. This trend is being driven by the consumer's growing desire for packaging that is convenient, environmentally friendly, and portable.

What made the Distributors & Dealers Segment Dominate the Europe Flexible Packaging Market in 2024?

The distributors & dealers segment dominated the market with approximately 50% in 2024 because they serve as the main conduit between producers and consumers, guaranteeing supply across the retail and industrial sectors. Their well-established networks facilitate quicker distribution throughout several areas.

The online platforms segment is predicted to be the fastest in the market during the forecast period because of the growth of direct-to-consumer and e-commerce brands. Flexible packaging is perfect for online delivery due to its durability and light weight, which is further reinforced by consumers increasing desire for easy doorstep shopping.

Country Level Analysis

Trend of France Flexible Packaging

The French flexible packaging sector is witnessing constant growth in 2050, which is being assisted by strong government policies, growing consumer demand, and the development of technology acceptance. Regional trends have featured in developed funding across main urban hubs such as Lyon, Paris, and Marsvield during the period of market expansion and innovation. With a developing center on sustainability, compliance with EU regulatory requirements, the sector is maintained for long-term relevance. Industry size continues to stretch, which is being driven by both domestic usage and export capability. Foretell suggests constant growth possibilities, which makes France a strategic center for organisations finding invention, sustainable development, and competitiveness in the Flexible Packaging industry.

Trend of Italy Flexible Packaging: Italy’s packaging industry is witnessing a major move towards sustainability that is being driven by both regulatory pressure and consumer expectations. Environmental issues are at the top of mind for 79% of the Italian users while buying food products, which predicts 73% sustainable packaging for the healthy foods. The Italian government and the EU have used rigid controls on the packaging materials that encourage greater recyclability and lower plastic usage.

The Europe flexible packaging market is witnessing robust growth, encouraged by growing industry demand for lightweight, sustainable solutions. Businesses are being pushed to use recyclable, biodegradable, and compostable materials by the region's stringent environmental laws and strong emphasis on circular economy principles. The demand for creative and long-lasting flexible formats is rising due to the expansion of e-commerce.

Germany dominates the European flexible packaging market, enjoying the benefits of a robust industrial base and high packaged food and beverage consumption. Due to strict national recycling regulations and consumer demand for sustainable goods, the nation has taken the initiative to implement eco-friendly packaging solutions. A major exporter of flexible packaging materials to other European countries.

The UK flexible packaging market continues to expand, largely bolstered by expansion in the food processing sector, retail, and internet shopping. The market is changing due to growing consumer demand for easy-to-use and recyclable packaging options, and businesses are being pushed by regulations to reduce plastic waste to use recyclable and biodegradable alternatives.

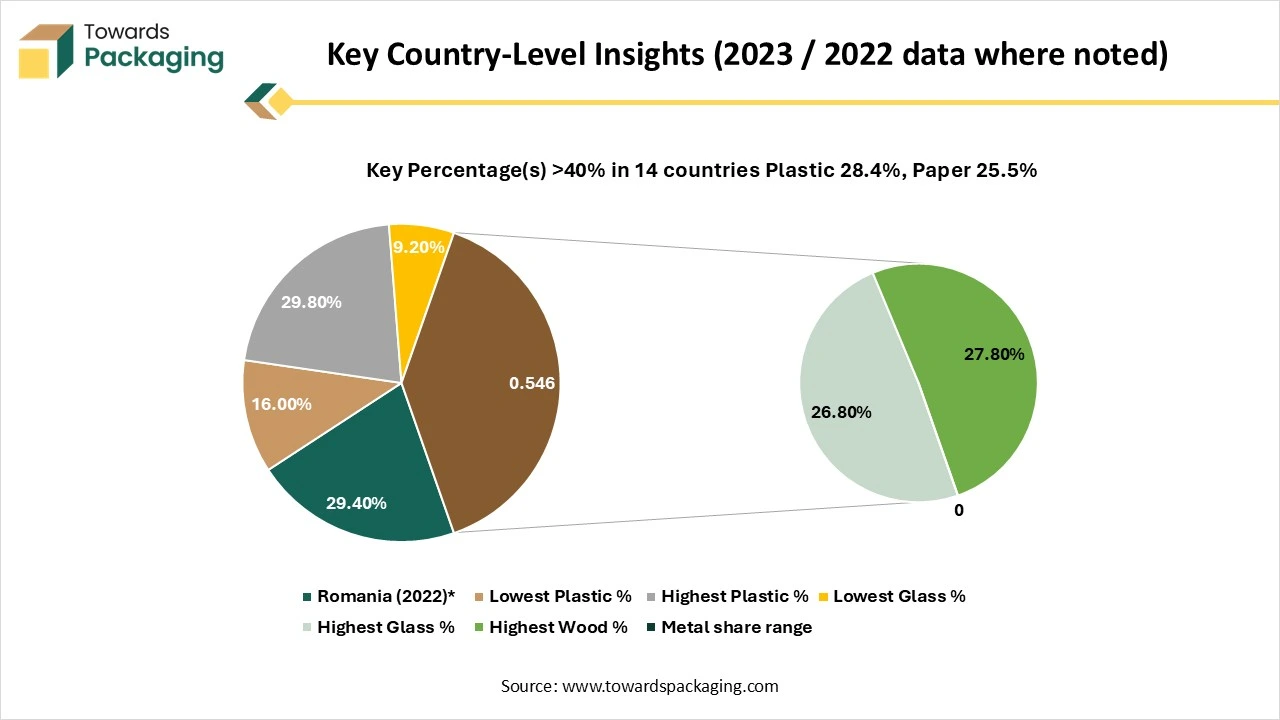

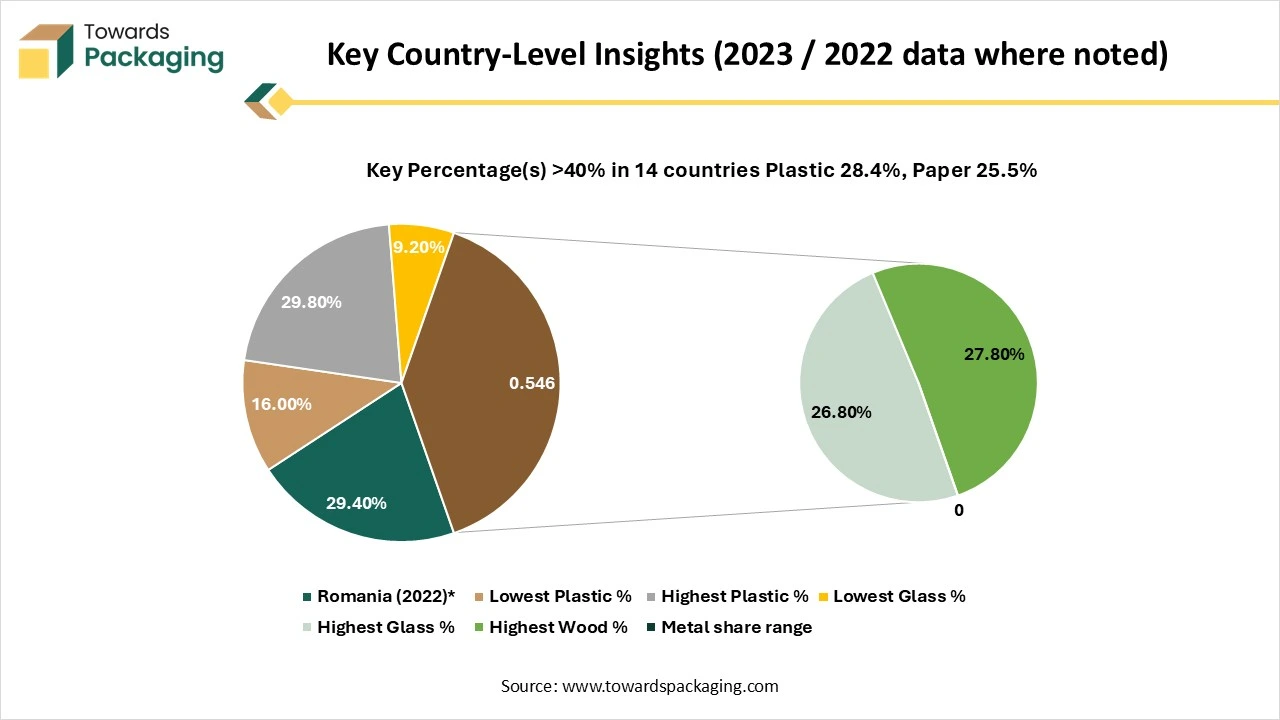

EU Packaging Waste by Material - 2023

In 2023, the European Union generated 79.7 million tonnes of packaging waste. The majority came from paper and cardboard, which accounted for over 40% of the total. Plastics and glass also contributed significantly, making up 19.8% and 18.8%, respectively. Wood represented about 15.8%, while metals and other materials formed only a small portion.

Across most EU countries, the distribution by material was similar to the EU average. Paper and cardboard were the largest source of packaging waste in 26 out of 27 countries, with Bulgaria being an exception, where plastic waste was slightly higher. Plastic waste contributed as little as 16% in Luxembourg and nearly 30% in Ireland. Glass packaging waste varied widely—from 9.2% in Finland to 26.8% in Croatia. Metal waste was generally low everywhere, remaining below 10% in all nations.

PE Flexible Films Market Statistical Table (Europe / EU28)

PE Flexible Films by Main Application (Share % of Total Market Volume - 8.5-9 Mt)

| Product/Application Segment | Share of PE Flexible Films (%) | Approx. Volume (Mt) |

| Non-Food Packaging Films | 41% | 3.48 – 3.69 |

| Food Packaging | 23% | 1.96 – 2.07 |

| Bags & Sacks | 22% | 1.87 – 1.98 |

| Agricultural Films | 7% | 0.60 – 0.63 |

| Building & Construction Films | 2% | 0.17 – 0.18 |

| Other | 5% | 0.42 – 0.45 |

| Total | 100% | 8.50 – 9.00 Mt |

Breakdown of Non-Food Packaging Films (41%)

| Sub-Category | Share % | Approx. Volume (Mt) |

| Stretch Film | 18% | 1.53 – 1.62 |

| Shrink Film | 14% | 1.19 – 1.26 |

| Film on Reel | 9% | 0.77 – 0.81 |

Import & Export Summary – EU28 (Primary LDPE/LLDPE & Films)

| Product Category | EU28 Trade Status | Quantity | Value Impact |

| LLDPE (Primary form) | Net Importer | +720 Kt imports | Negative trade balance |

| LDPE (Primary form) | Net Exporter | +330 Kt exports | Positive impact |

| Combined LDPE/LLDPE | Net Importer | - | –€200M |

| Film & Sheet | Net Exporter | - | +€950M |

| Sacks & Bags | Net Importer | - | –€700M |

| Major sources/destinations | Imports: Saudi Arabia | Exports: China, Turkey | - |

Flexible Packaging Market Intelligence, Benchmarking, Consumer Insights & Growth Strategies

The flexible packaging market is set to grow from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, driven by convenience-seeking consumers and regulatory demands for eco-friendly solutions. This report explores key market drivers, including innovations in technology, AI integration, and the growing adoption of sustainable materials across industries like food & beverages, pharmaceuticals, and personal care. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

Major Key Insights of the Flexible Packaging Market:

- Asia Pacific dominated the flexible packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By raw material, the plastics segment dominated the market with the largest share in 2024.

- By packaging type, the pouches segment registered its dominance over the global flexible packaging market in 2024.

- By printing technology, flexography segment is expected to grow at significant rate during the forecast period.

- By application, the food & beverages segment dominated the flexible packaging market in 2024.

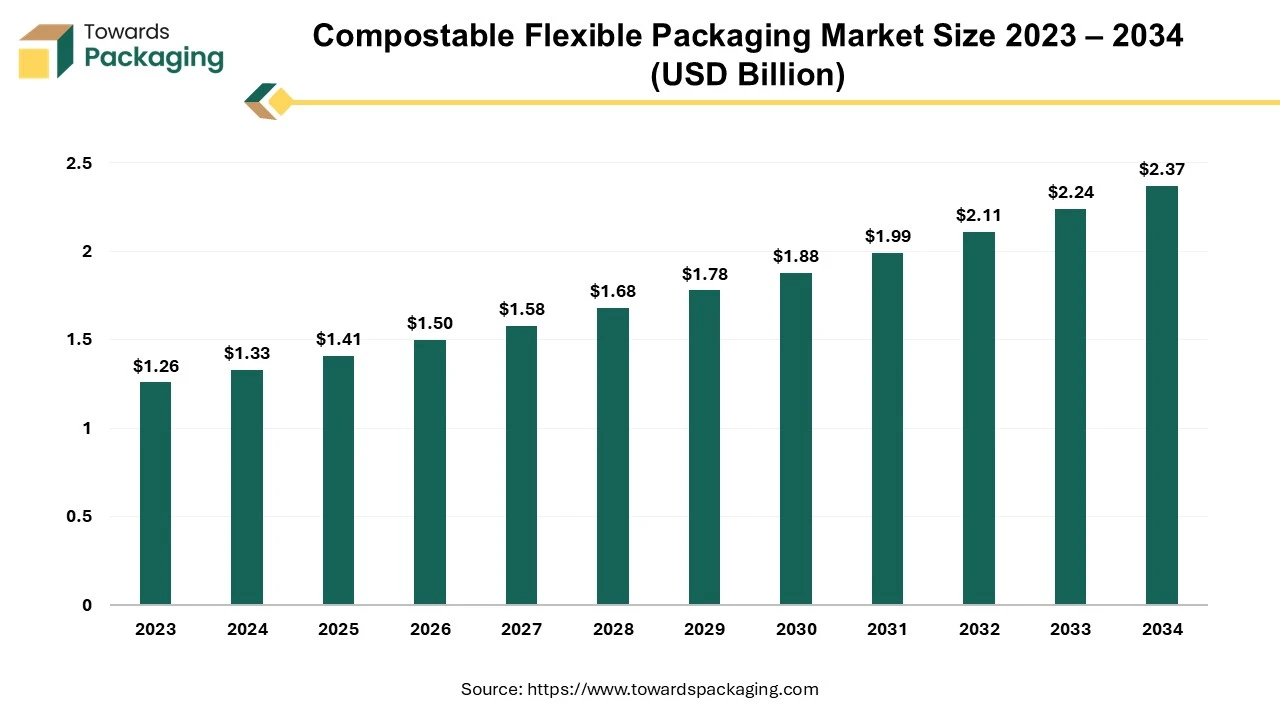

Compostable Flexible Packaging Market Intelligence Report, Key Trends, Innovations & Market Dynamics

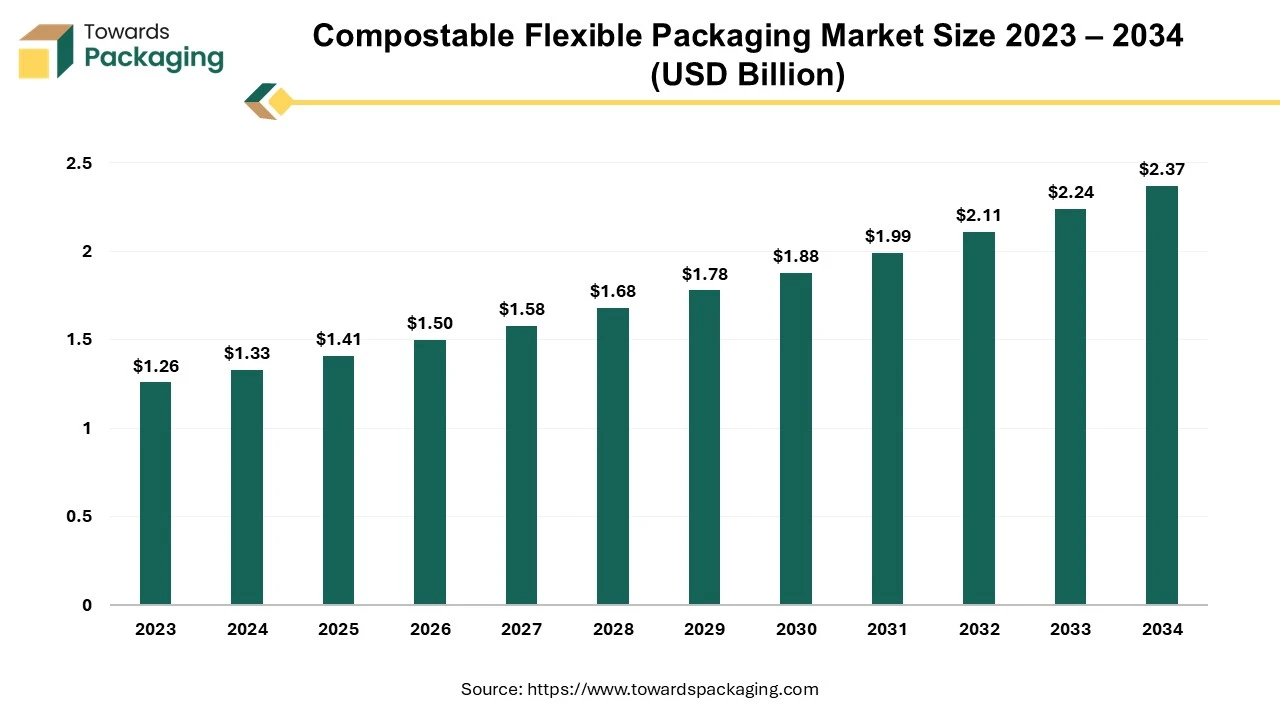

The compostable flexible packaging market is projected to grow from USD 1.41 billion in 2025 to USD 2.37 billion by 2034, at a CAGR of 5.9%. This market includes various biodegradable materials such as PLA, PBAT, and PHA, with North America, Europe, and Asia Pacific leading the charge. The report provides detailed data on market segments, including bioplastics, end-use sectors like food & beverage, pharmaceuticals, and industrial applications. In-depth regional performance analysis is also covered, along with key trends driving the market forward.

Report Highlights: Important Revelations

- Global compostable flexible packaging sector is poised for growth, starting at a value of USD 1.2 billion in 2022.

- The market is expected to surge, reaching an estimated value of USD 2.11 billion by 2032.

- This expansion is registered at a consistent CAGR of 5.9% over the period from 2025 to 2034.

- North America's pioneering initiatives in compostable flexible packaging.

- Europe's dedication to a circular economy via compostable flexible packaging.

- Bioplastics transforming the terrain of compostable flexible packaging.

- Exploring the expanding influence of compostable flexible packaging in food and beverage.

- Business-to-business dynamics in compostable flexible packaging and reusable systems.

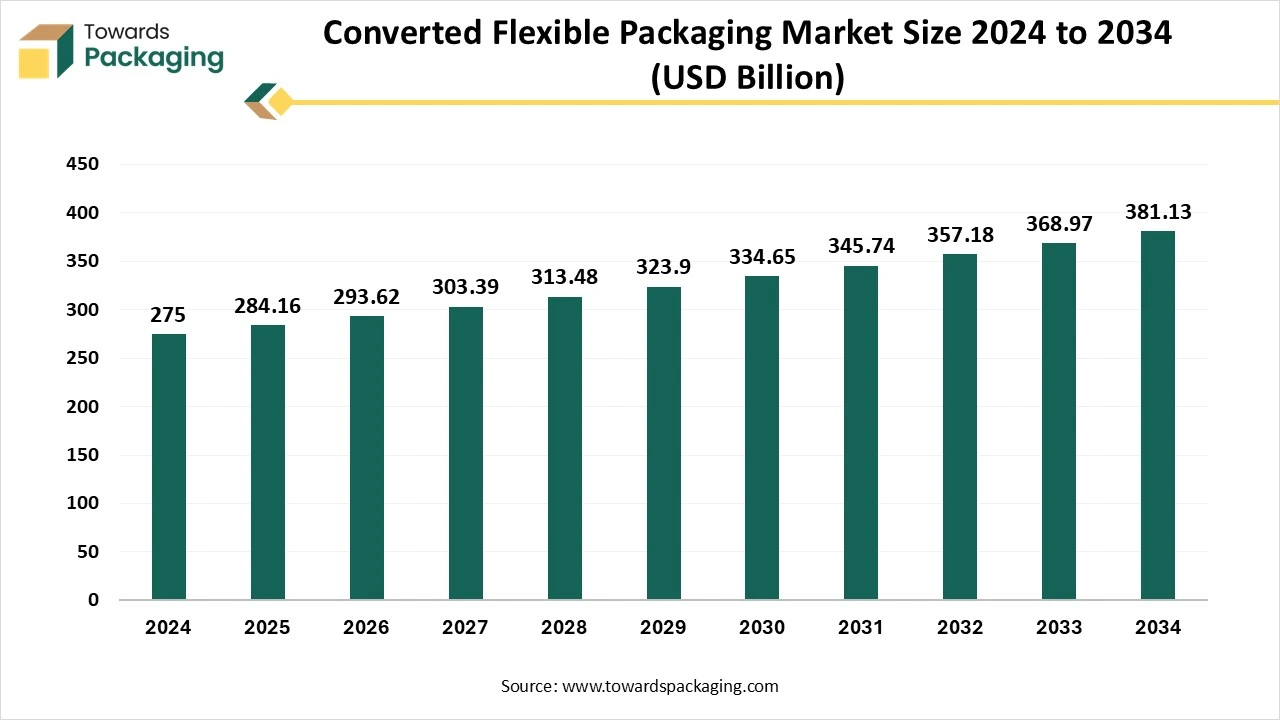

Converted Flexible Packaging Market Size, Trends, Share and Innovations

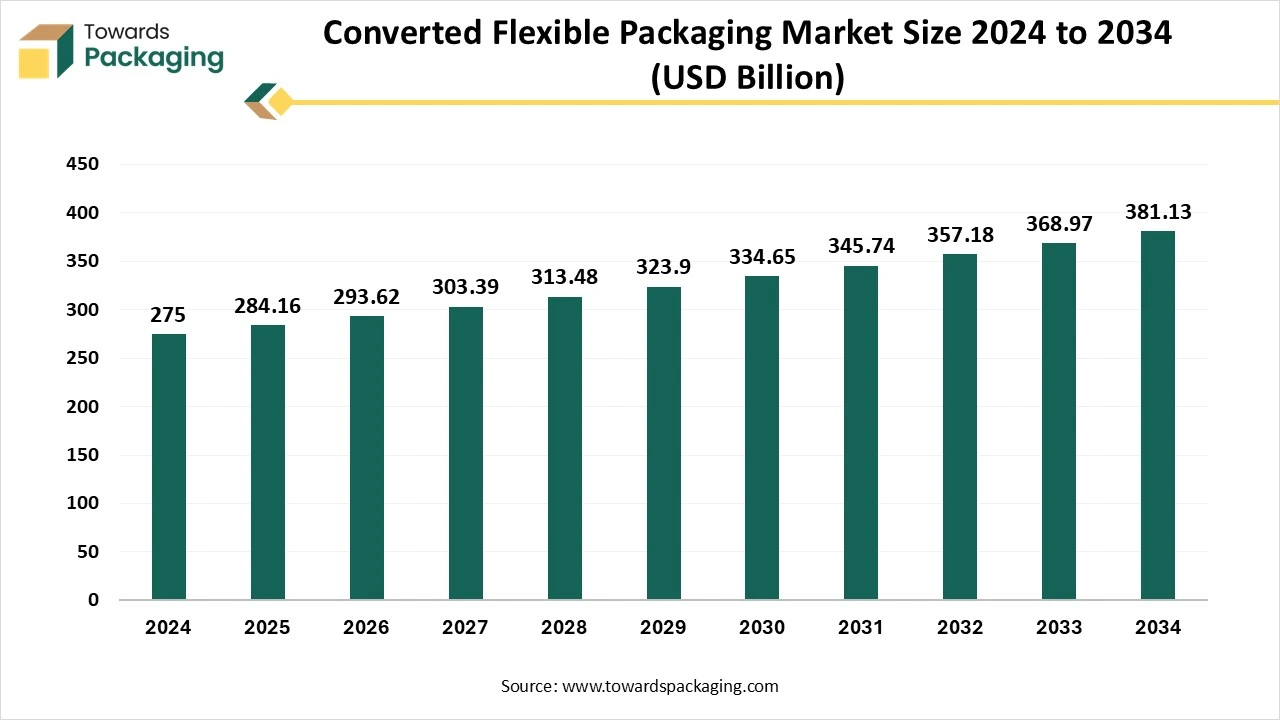

The global converted flexible packaging market is expected to increase from USD 284.16 billion in 2025 to USD 381.13 billion by 2034, growing at a CAGR of 3.33% throughout the forecast period from 2025 to 2034. The increasing focus on sustainability and the rising consumer preference for convenient and portable packaging options.

Key Takeaways

- In terms of revenue, the market is valued at USD 284.16 billion in 2025.

- The market is projected to reach USD 381.13 billion by 2034.

- Rapid growth at a CAGR of 3.33% will be observed in the period between 2025 and 2034.

- Asia Pacific dominated the converted flexible packaging market in 2024.

- North America is expected to grow at a significant CAGR during the forecast period.

- By material, the plastic segment dominated the market with the largest revenue share.

- By material, the paper segment is expected to grow at a significant CAGR in the coming years.

- By application, the food and beverages segment dominated the market in 2024.

- By application, the pharmaceuticals segment is expected to grow at a notable CAGR during the projection period.

Recent Developments

- In April 2024, Parkside launched Recoflex, a recyclable paper-based flexible packaging range. This eco-friendly solution aligns with consumer and regulatory demand for sustainable packaging and is fully recyclable in kerbside collection schemes.

- In 2024, Constantia Flexibles unveiled EcoPeelCover, a sustainable packaging solution that reduces material use and carbon footprint. It features solvent-free UV Flexo printing and Carbon Aluminum with ASI-certified quality.

Top Vendors in the Europe Pharmaceutical Flexible Market

- Amcor plc: A global leader in consumer and healthcare packaging solutions, recently completing its acquisition of Berry Global.

- Mondi Group: An international paper and packaging company focused on sustainable solutions.

- Constantia Flexibles: A major manufacturer of flexible packaging for the consumer and pharmaceutical industries, acquired by One Rock Capital Partners in 2024.

- Huhtamaki Oyj: A global food packaging company from Finland emphasizing sustainable solutions.

- DS Smith Plc: Formerly a UK-based provider of sustainable fiber-based packaging, the company was acquired by International Paper in 2025.

Value Chain Analysis

Material Processing and Conversion

- Raw materials like plastics, paper, and biopolymers are processed into films and laminates using extrusion and coating. The focus is shifting toward recyclable and compostable materials. This stage is critical for ensuring barrier properties and product protection.

Package Design and Prototyping

- Designs emphasize lightweight, resealable, and branded formats such as pouches and bags. Digital printing and smart features support shelf appeal and consumer engagement. Prototyping also helps brands test sustainability and cost-effectiveness before scaling.

Logistics and Distribution

- Flexible packaging is supplied via distributors and online channels to the food, pharma, and personal care industries. Efficient, low-carbon logistics are key amid growing e-commerce. Strong networks ensure wider regional and global market reach.

Top Players in the Europe Pharmaceutical Flexible Market

Tier 1

- Berry Global, Inc.

- Sealed Air Corporation

- Smurfit Kappa Group

- Coveris Holdings S.A.

- BillerudKorsnäs AB

- Sonoco Products Company

Tier 2

- Uflex Ltd.

- Innovia Films Ltd.

- Winpak Ltd.

Segmentation of the Europe Pharmaceutical Flexible Market

By Material Type

- Plastics (Polyethylene, Polypropylene, PET, PVC)

- Paper & Paperboard

- Aluminum Foil

- Laminates / Multi-Layer Materials

- Biodegradable / Compostable Materials

By Packaging Type

- Pouches & Bags

- Shrink & Stretch Films

- Stand-Up Pouches

- Rollstock Films

- Sachets & Sachet Packs

- Blister Packaging

- Others (Tubing, Lidding Films)

By Application

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Industrial & Chemical Products

- Others (Pet Food, Household Products)

By End-User Industry

- Food Processing & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Chemicals & Industrial Products

- Retail & E-commerce

By Distribution Channel

- Direct Sales

- Distributors & Dealers

- Online Platforms

By Region

- Germany

- France

- United Kingdom

- Italy

- Spain

- Rest of Europe

Tags

FAQ's

Select User License to Buy

Figures (7)