Europe Sustainable Packaging Market Size, Share, Trends and Forecast Analysis

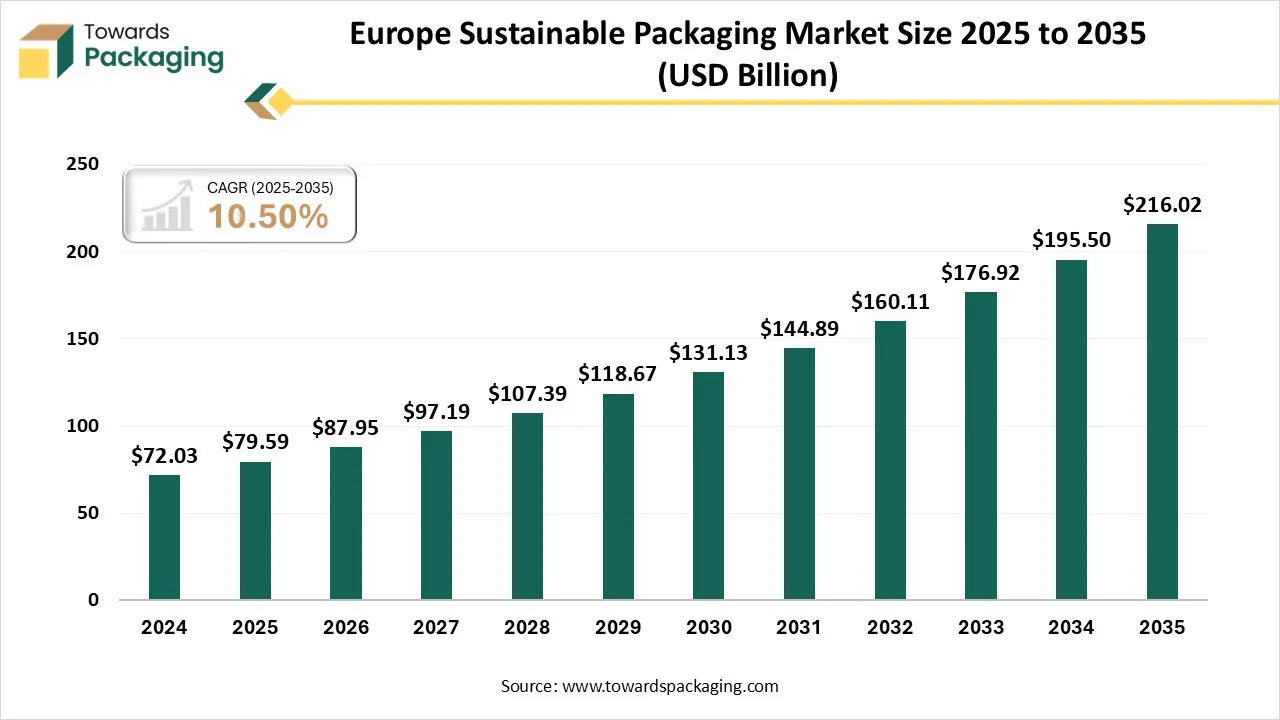

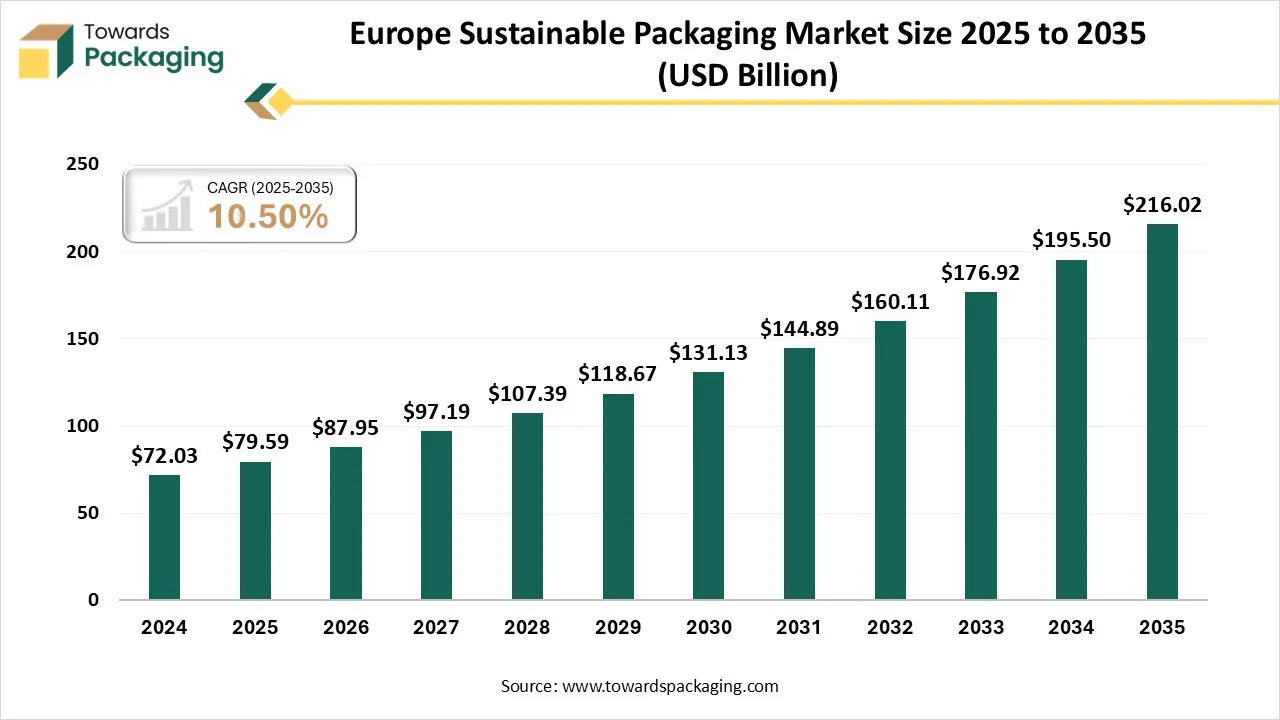

The Europe sustainable packaging market is projected to grow from USD 87.95 billion in 2026 to USD 216.02 billion by 2035, registering a CAGR of 10.50% during 2026–2035. The report provides comprehensive market size analysis, segment data by material, packaging type, and end-use industries, along with regional insights across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

It also covers major company profiles, competitive landscape, value chain analysis, trade data, and detailed information on manufacturers and suppliers operating in the sustainable packaging ecosystem.

Major Key Insights of the Europe Sustainable Packaging Market

- In terms of revenue, the market is valued at USD 87.95 billion in 2026.

- The market is projected to reach USD 216.02 billion by 2035.

- Rapid growth at a CAGR of 10.50% will be observed in the period between 2026 to 2035.

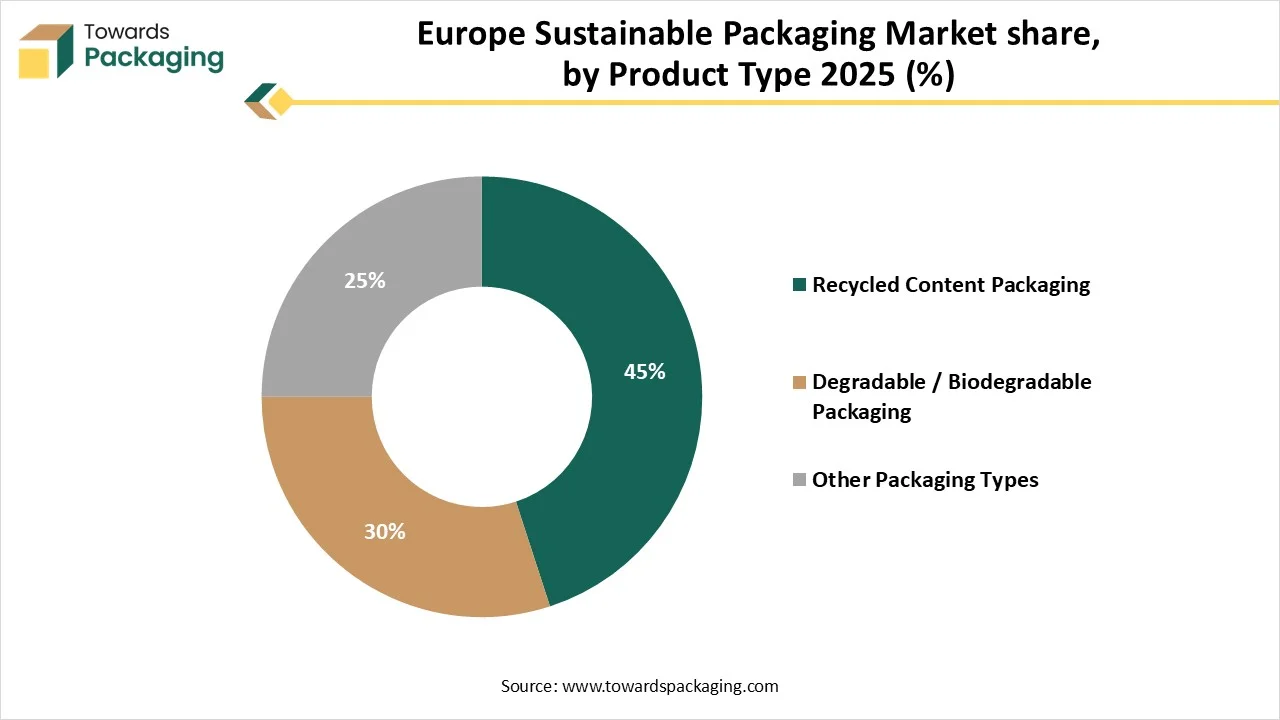

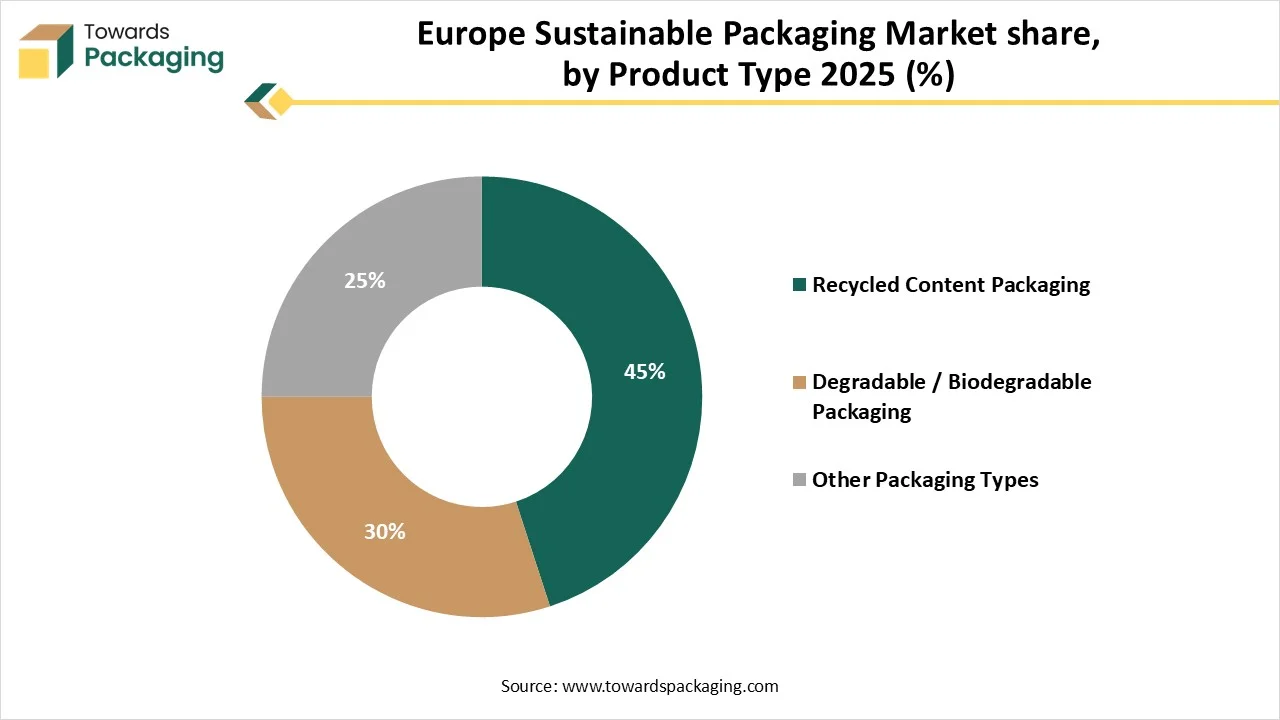

- By packaging type, the recycled content packaging segment contributed the biggest market share in 2024.

- By packaging type, the degradable / biodegradable packaging segment will be expanding at a significant CAGR in between 2026 to 2035.

- By material type, the paper & paperboard segment contributed the biggest market share in 2024.

- By material type, the bioplastics / bio-based plastics segment will be expanding at a significant CAGR in between 2026 to 2035.

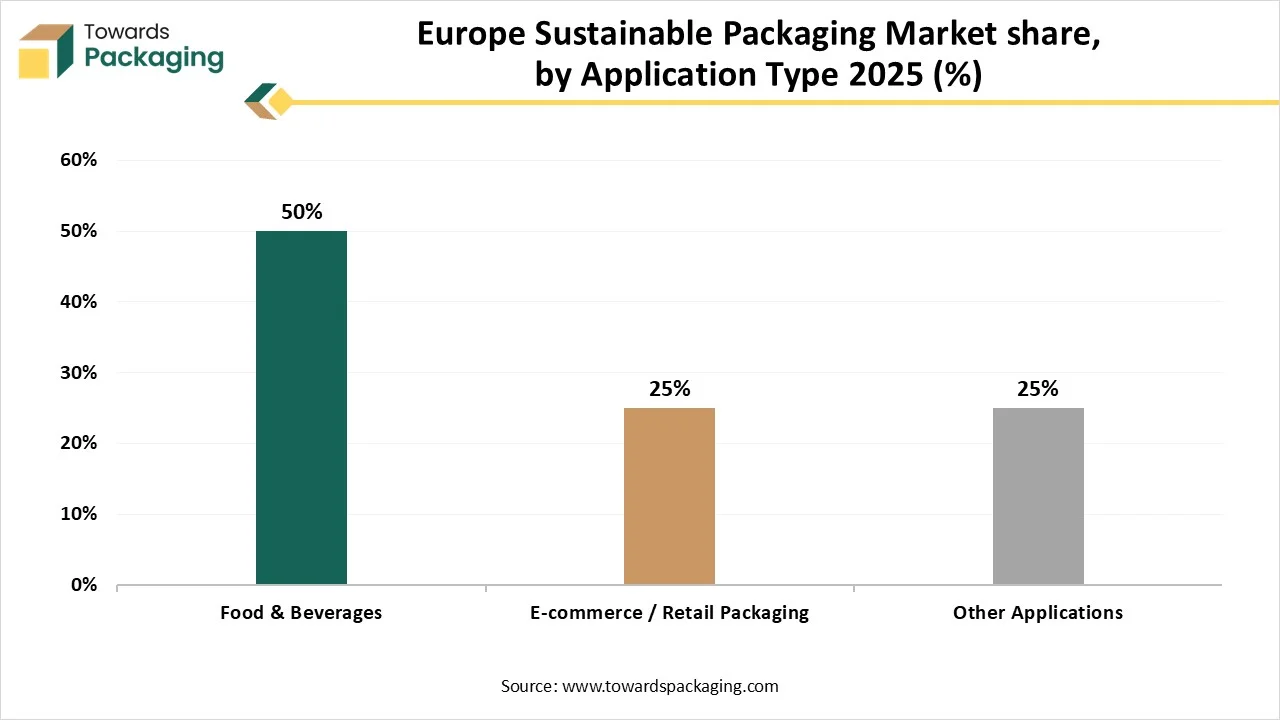

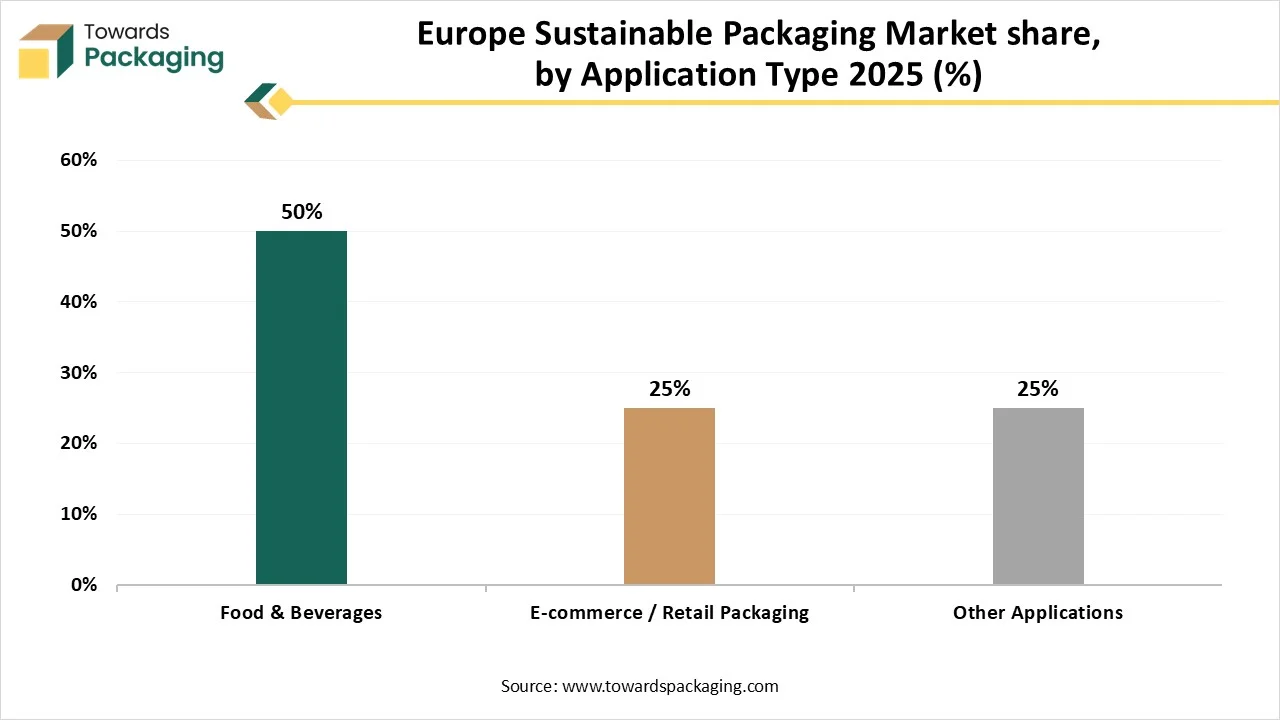

- By application, the food & beverages segment contributed the biggest market share in 2024.

- By application, the e-commerce / retail packaging segment will be expanding at a significant CAGR in between 2026 to 2035.

What is Europe Sustainable Packaging?

Europe sustainable packaging refers packaging that decreases its ecological influence through measures such as amplified recyclability, usage of recycled material, and decrease waste. The guideline focusing on to move in the direction of a circular economy by fuelling refill and reuse options, with creativities like return and deposit systems being fortified. There are officially binding goals for member states to decrease the quantity of packaging waste produced. Events also report overpackaging, with guidelines on unfilled space in e-commerce packages, and set goals for the usage of recycled content.

Europe Sustainable Packaging Market Trends

- Market Growth Overview: Europe sustainable packaging market is expanding due to growing demand for regulatory push, e-commerce growth, corporate responsibility, and rising consumer demand. The rising online shopping has enhanced the demand for sustainable packaging in this region.

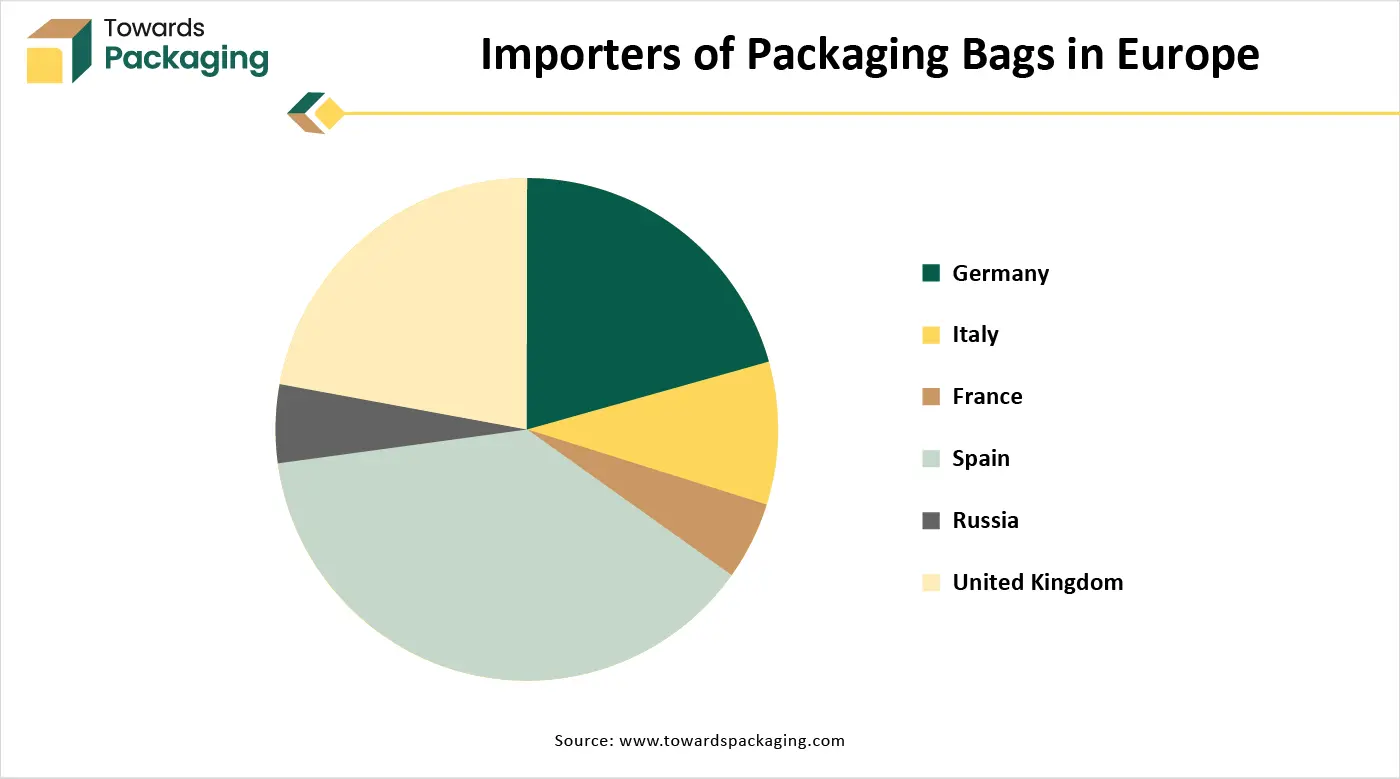

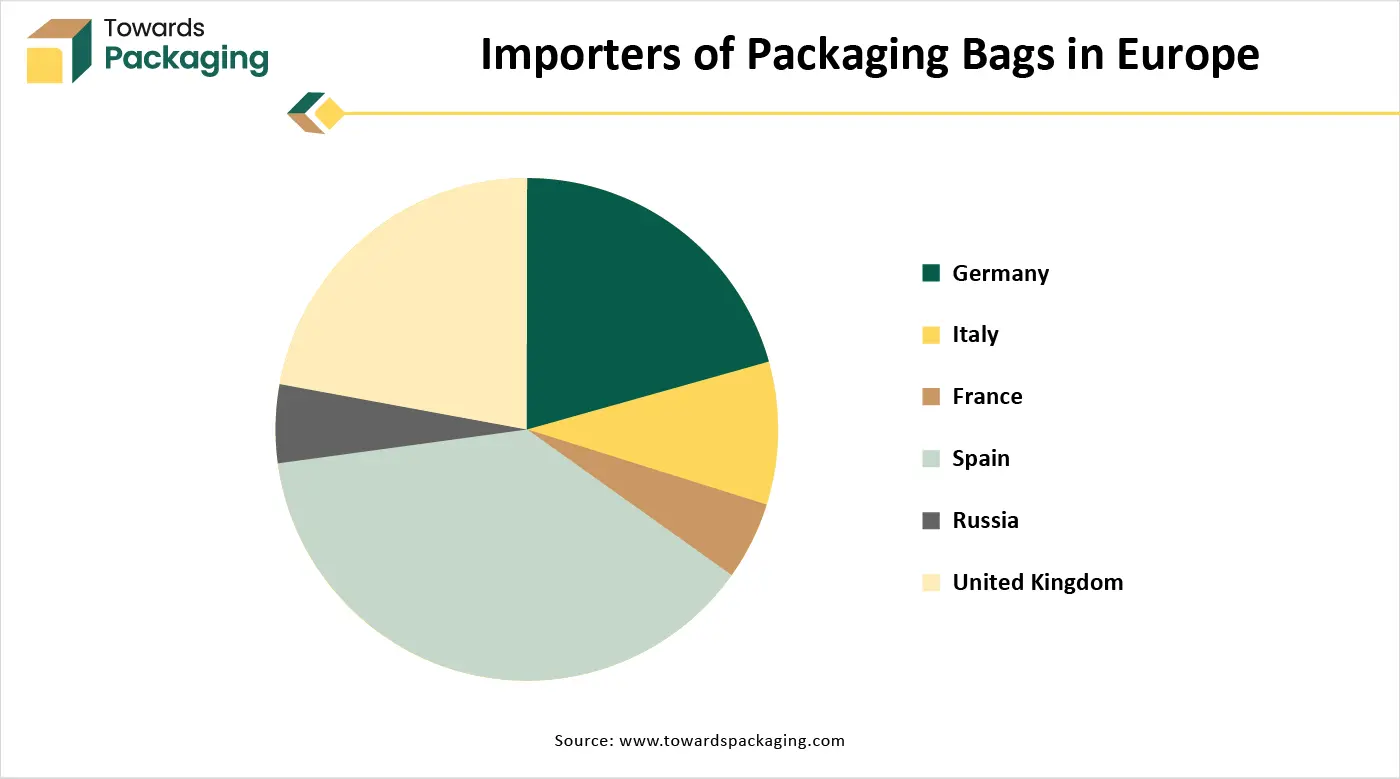

- Global Expansion: Regions such as Germany, UK, France, Russia, Italy, and Spain are witnessing the rising demand for innovation hub, corporate responsibility, eco-friendly material development, reusable process, and increasing recyclability services.

- Major Market Players: The market includes Smurfit Kappa, DS Smith Plc, Sealed Air Corporation, Amcor Plc, Sonoco Products Company, Berry Global Inc. and other.

- Startup Ecosystem: The startup industries play an important role in developing biodegradable and compostable material, enhance material usage, bioplastics, recyclability technology.

Major Transformation in Technology of the Europe Sustainable Packaging Market

Technological transformation in the market plays a significant role in its expansion. The major changes that have significantly raised this market are development of plant-based materials, reusable packaging model, watermarking, digital product passports, smart packaging, usage of AI and digital tool integration in this sector. These variations focus to decrease plastic dependence, enhance circularity, and fulfil stricter legal and customer demands. It improves traceability, increasing digital watermarking for enhanced sorting, and smart packing that utilizes on-pack sensors to observe product integrity.

Trade Analysis of Europe Sustainable Packaging Market: Import & Export Statistics

- Spain: The estimated export of packaging bags from this region is around 3,892 shipments.

- Italy: It is estimated that the export of packaging bags is approximately 3,096 shipments.

- Germany: This region is predicted to export around 2,777 shipments of packaging bags across the world.

Europe Sustainable Packaging Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are reusable and plant-based materials.

- Key Players: Stora Enso, Mondi Group

Component Manufacturing

The component manufacturing in this market comprises mono-materials and barrier layers.

- Key Players: ALPLA, DS Smith

Logistics and Distribution

This segment is growing focus on reduction of wastage, reuse, and recyclability.

- Key Players: Smurtfit Kappa, DHL Supply Chain

Product Type Insights

Why Recycled Content Packaging Segment Dominated the Europe Sustainable Packaging Market In 2024?

The recycled content packaging segment dominated the market with highest share in 2024 due to strict packaging guidelines. There is a huge demand for eco-friendly packaging which has raised the demand for this market. It is progressively favoring sustainable choices, boosting brands to accept recycled materials. The usage of plastic recycled content in packing is rising, with efforts emphasizing on enhancing utilization of post-consumer recycled (PCR) resin and recycling processes. Advancement in recycling technology has raised the demand of this segment profoundly.

The degradable/ biodegradable packaging segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to continuous advancement in material science. It has proactive approach towards sustainable packaging which pushed the adoption of this segment in various sectors. Huge investment towards research and development activities of packaging type has influenced the growth of this segment.

The recyclable packaging is the fastest-growing in the market, as it comprises well established recycling infrastructures. This segment is leading because of its biodegradability, renewability, and well-recognized, effectual recycling substructure. The increasing focus towards reducing material waste has influenced the growth of this segment. This segment comprises materials such as glass, wood, metal, paper, and various other.

Material Type Insights

| Material Type Segments | Market Share 2025 (%) |

| Paper & Paperboard | 40% |

| Bioplastics / Bio-based Plastics | 35% |

| Other Materials | 25% |

Why Paper & Paperboard Segment Dominated the Europe Sustainable Packaging Market In 2024?

The paper & paperboard segment dominated the market with highest share in 2024 due to its biodegradability and renewability. This segment is highly adopted due to its versatility and cost-effectiveness in e-commerce and food & beverage sector. The increasing awareness among consumers towards ecological impact has raised the demand for this segment. Increasing demand for convenient in food & beverage packaging is supporting this segment.

The bioplastics / bio-based plastics segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to enhanced corporate sustainability goals. Several companies are dedicated to decreasing their carbon footprint and dependence on fossils, which influences the acceptance of bioplastics. There is an increasing consumer choice for sustainable and environment-friendly packaging substitute, boosting brands to accept bioplastics.

The PLA & starch-based materials are the fastest-growing in the market, as it comprises strong ecological benefits. It is widely utilized due to its transparency and strength in applications such as food packaging. It provides good mechanical support, strength, and clarity same as traditional plastics. It is utilized in a diversity of applications, comprising flexible films, agricultural films, compostable bags, and various other disposable products.

Application Insights

Why Food & beverages Segment Dominated the Europe Sustainable Packaging Market In 2024?

The food & beverages segment dominated the market with highest share in 2024 due to continuous innovation in the packaging industry. The necessity for extension of shelf life, durable consumer preferences, and product safety has promoted the usage of sustainable packaging. The rise in online grocery sales is additionally influencing the invention in sustainable packing for protection and durability at the time of transportation, with an emphasis on recyclable and lightweight materials. It also helps food brands to establish their image by adapting such packaging solution.

The E-commerce/ retail packaging segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to continuous innovation in the packaging materials and rising e-commerce sector. The expansion of e-commerce sector raised the demand for packaging materials as well. Presence of plant-based alternatives for packaging has raised the demand for sustainable packaging. Customers are progressively attentive in sustainability and are eager to pay high for those products comes with environment-friendly packaging has promoted the consumption of these packaging.

The healthcare & pharmaceuticals expects the significant growth in the market. These companies are highly focused towards adoption of sustainable alternatives for packaging of products. Strong demand for protection of the integrity of medicines and enhance its shelf life has influenced the demand for this market. Increasing corporate social responsibility has also raised the demand for using sustainable packaging solution.

Regional Insights

How Germany is Dominating in the Europe Sustainable Packaging Market?

Germany held the largest share in the market in 2024, due to presence of strict regulatory framework. The increasing awareness among consumers towards ecological issues has influenced the demand for this market. The increasing focus towards decreasing plastic waste and growing recycling processes has boost the development of the market. Its robust industrial base offers a solid base for its packaging sector. Presence of pharmaceutical industries also raised the demand for this packaging.

Why Europe Sustainable Packaging Market is Growing Rapidly in the UK?

Strict government guidelines towards packaging industry have enhanced the demand for the market. The rising trend for online shopping has boosted the demand for sustainable packaging. Presence of major manufacturing companies has raised the innovation process in this market which has influenced the growth of this sector. The increasing adoption for compostable, reusable, and recyclable packaging has influenced the demand for this market. Presence of robust e-commerce sector, which needs a noteworthy amount of transportation and defensive packaging. This has generated an upsurge in demand for recyclable, durable, and lightweight materials such as paper-based mailers and corrugated boxes.

Which Factor is Responsible for Notable Growth of Europe Sustainable Packaging Market in France?

The major factors influencing the growth of market are extension of food & beverages industry, increasing demand for enhanced shelf life of products, increasing e-commerce industry, and rising convenient packaging demand among consumers. The requirement for cost-effective, durable, and lightweight packaging choices for shipping efficacy. The demand for portable in packaging setups, such as single-serve, lightweight, and resealable pouches. The increasing demand for sustainable packaging among consumers has raised the adoption of such packages by a wide range of industries.

Recent Developments

- In May 2025, Amazon announced the launch of custom-fit cardboard and paper bags for delivery of products. It has high sustainability benefits and reduced emission to increase deliveries.

- In January 2025, AeroFlexx announced its partnership with Chemipack to develop innovative and sustainable packaging. This partnership is to develop eco-friendly packaging with advancement of liquid packaging technology.

Top Companies in the Europe Sustainable Packaging Market

- Mondi Group: It is a global leader in packaging and paper, known for a wide range of sustainable solutions and a focus on circular economy principles.

- Amcor Plc: It is a major player in the market, with extensive offerings in sustainable packaging solutions.

- DS Smith: It is a leading provider of corrugated and plastic packaging, as well as packaging materials and support services.

- Stora Enso: It is a global leader in renewable solutions like packaging materials, pulp, and wood products.

- Sealed Air: It is a significant company in the market, with a strong focus on sustainability and a goal of making its packaging recyclable or reusable.

- Others: Tetra Pak International, Smurfit Kappa Group, Berry Global, and several others.

Europe Sustainable Packaging Market Segment Covered

By Packaging Type

- Recycled Content Packaging

- Reusable Packaging

- Degradable / Biodegradable Packaging

- Recyclable Packaging

- Minimalist / Lightweight Packaging

By Material Type

- Paper & Paperboard

- Glass

- Metal

- Bioplastics / Bio-based Plastics

- PLA & Starch-based Materials

- Recycled Plastics (rPET, rHDPE)

By Application

- Food & Beverages

- Personal Care & Cosmetics

- Healthcare & Pharmaceuticals

- Household Products

- Industrial Goods

- E-commerce / Retail Packaging

Tags

FAQ's

Select User License to Buy

Figures (4)