Liquid Packaging Market Analysis Size, Key Companies, Market Share, and Growth Opportunities

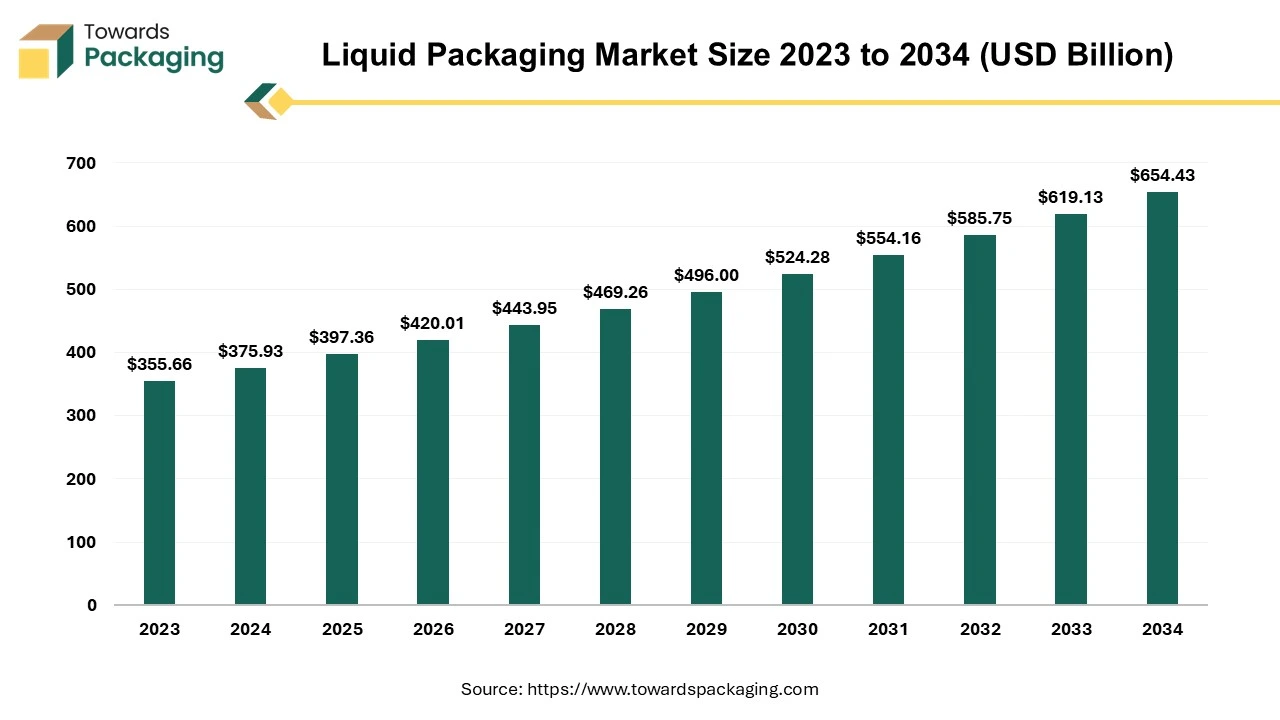

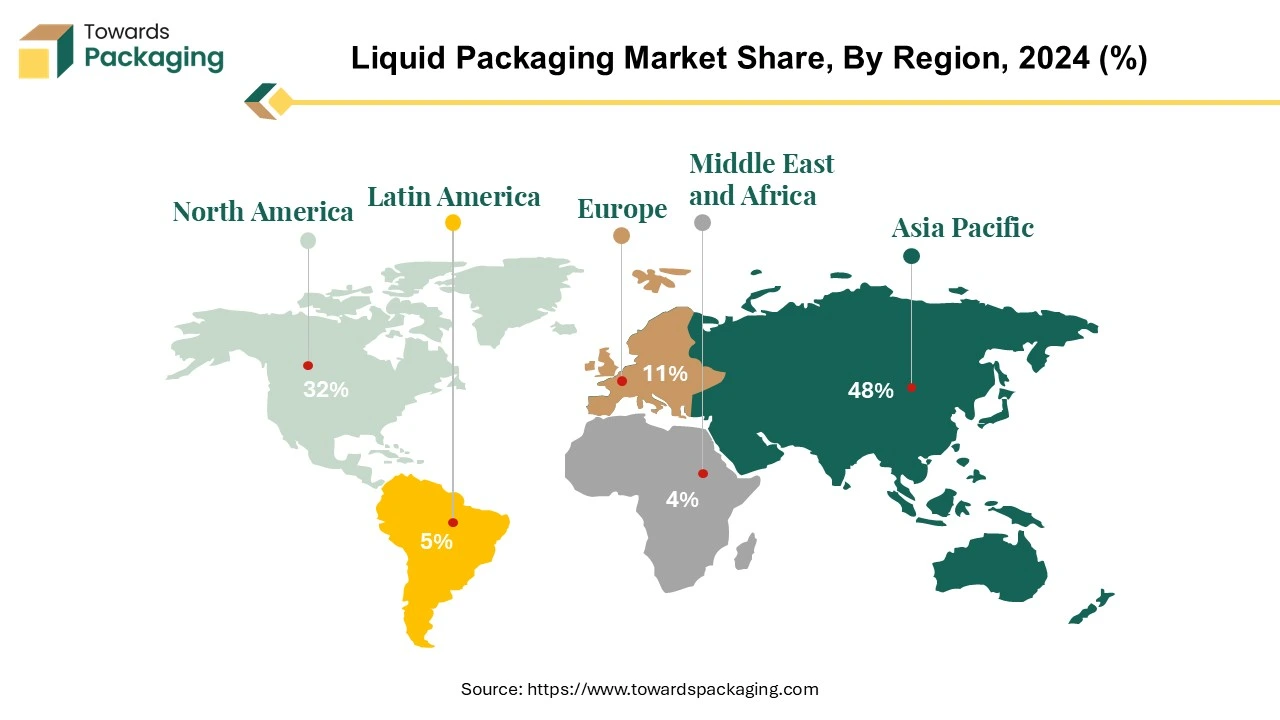

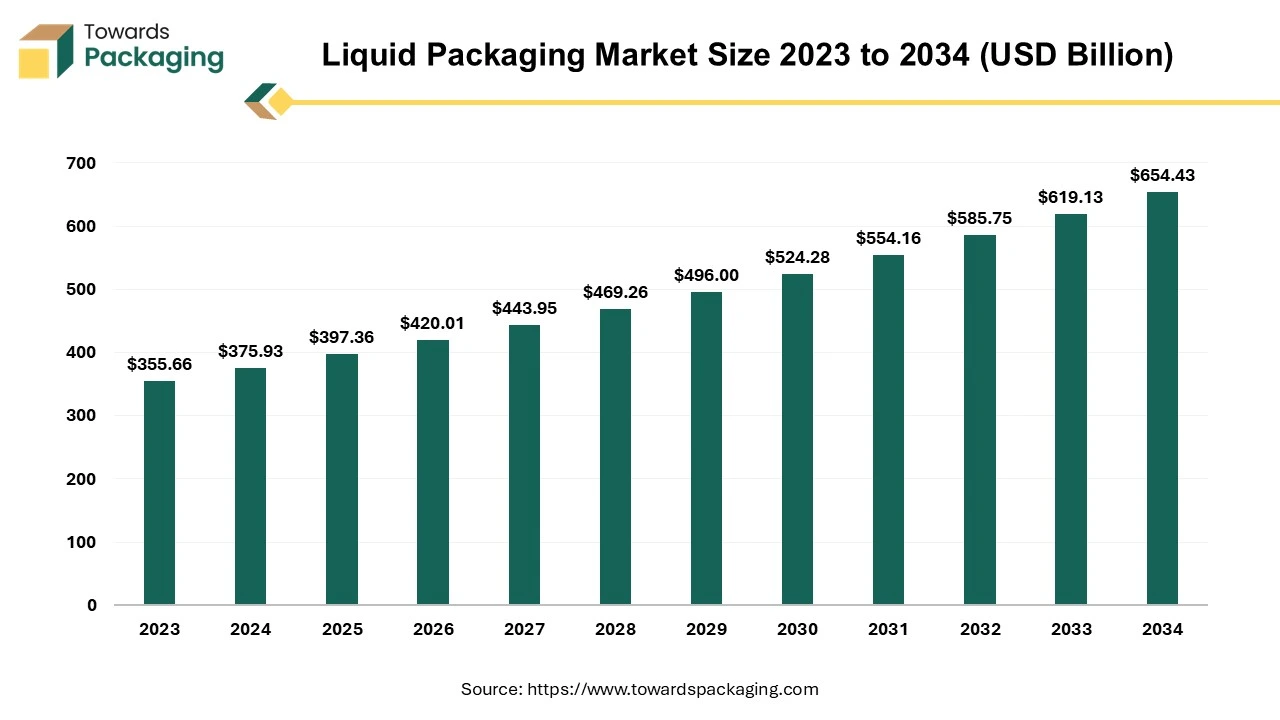

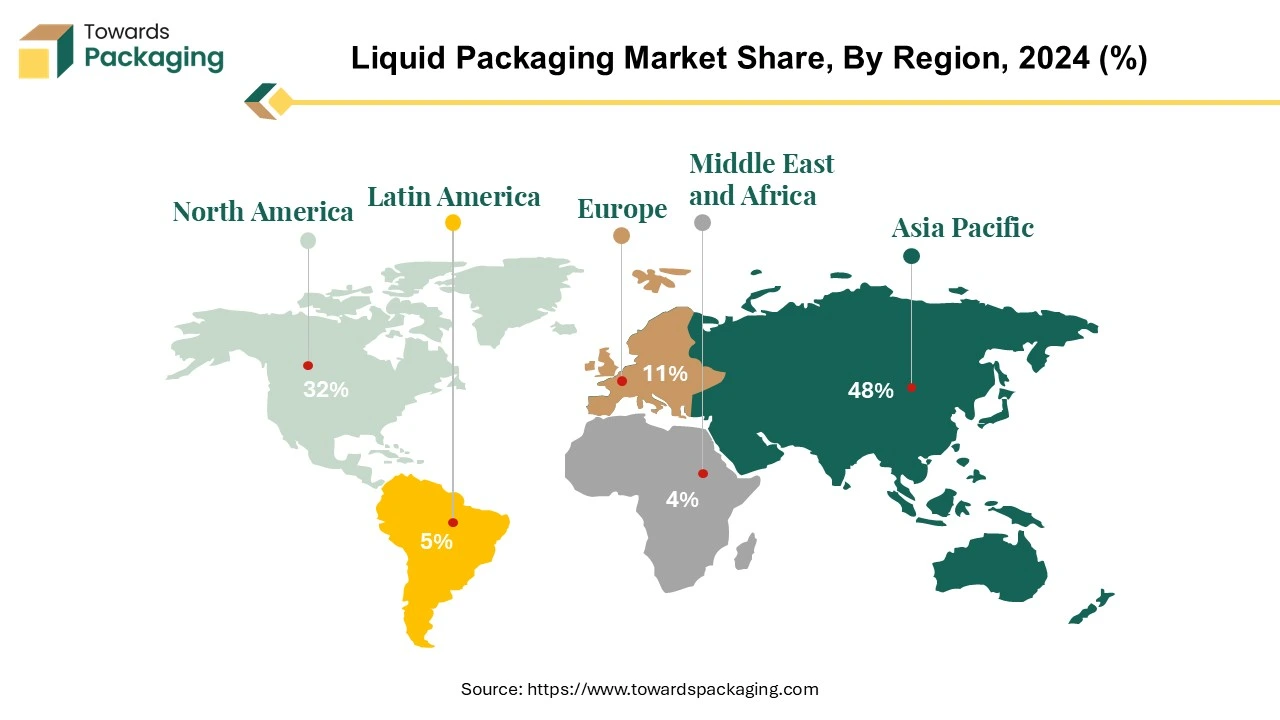

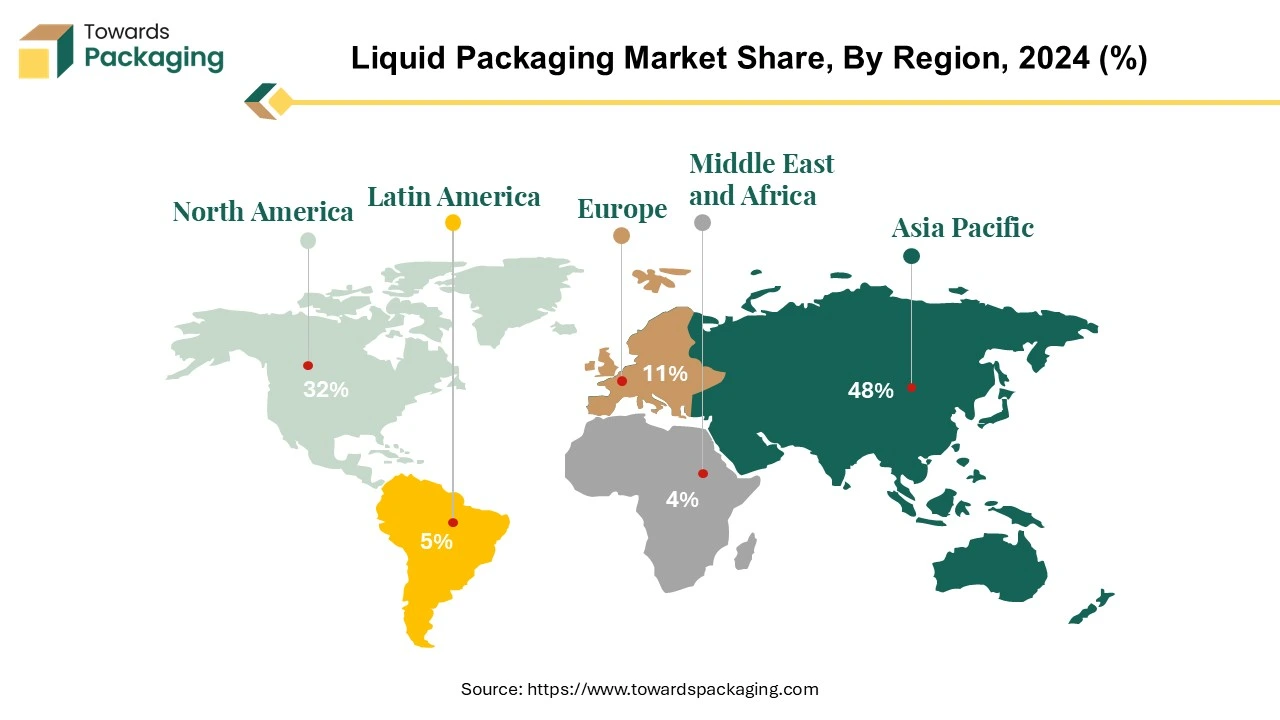

The liquid packaging market is forecasted to expand from USD 420.01 billion in 2026 to USD 691.73 billion by 2035, growing at a CAGR of 5.7% from 2026 to 2035. The market is categorized into flexible and rigid packaging types, with key materials including plastic, paper, glass, and metal. The market spans multiple end-use industries such as food & beverage, pharmaceuticals, personal care, and chemicals. Geographically, Asia-Pacific is witnessing rapid growth, particularly driven by China and India, while North America and Europe also contribute significantly due to increasing demand for sustainable packaging solutions.

Report Highlights Key Insights, Trends, and Critical Revelations in the Market

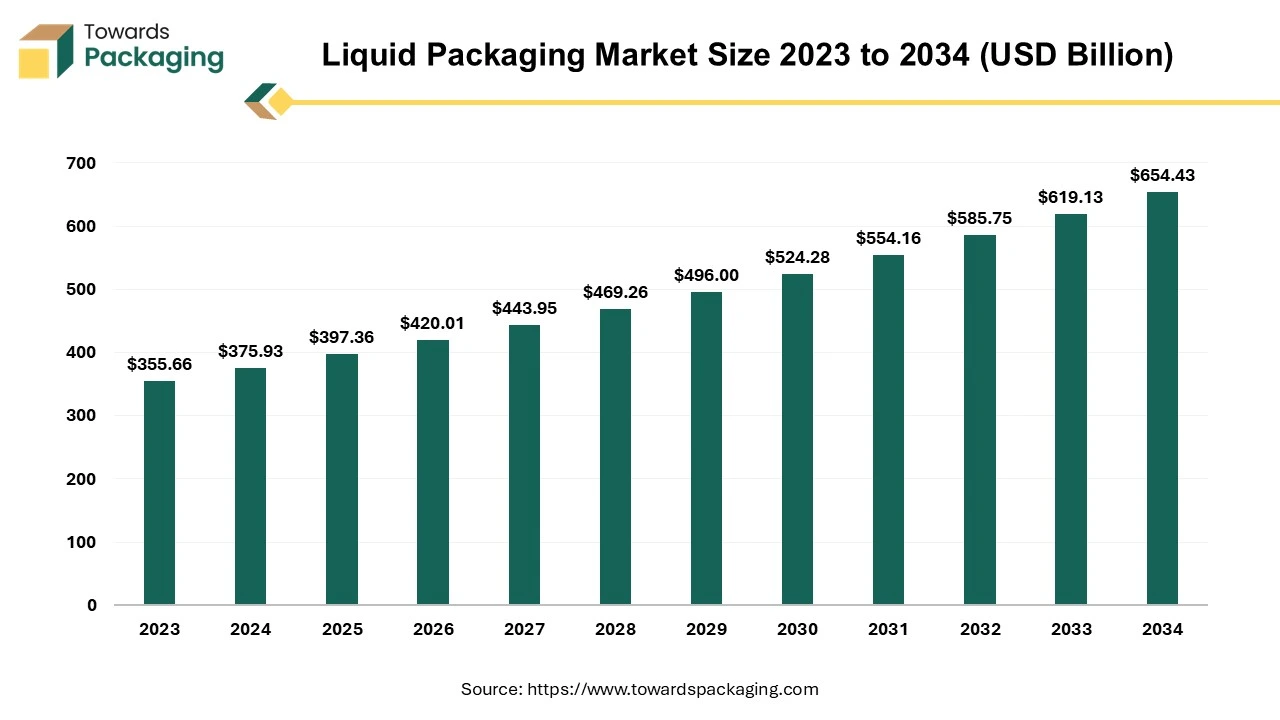

- The liquid packaging market is projected to grow from USD 397.36 billion in 2025 to USD 645.43 billion by 2034, with a CAGR of 5.7%.

- Smaller pack sizes are rising in demand due to convenience preferences and ready-to-drink products.

- The Asia-Pacific region is experiencing rapid growth, driven by increased demand from millennials in markets like China and India.

- North America is also expanding, fueled by sustainability trends and innovation in liquid packaging solutions.

- Rigid plastic packaging is dominating due to its cost-effectiveness, lightweight design, and recyclability, but faces pressure for sustainability.

- Aseptic packaging ensures sterility and shelf stability, driving growth, especially in the Indian and global markets.

- The competitive landscape includes major players like Elopak, SIG, and Tetra Laval, focusing on product innovation and sustainability.

Navigating Liquid Packaging Challenges Optimizing Containment, Preservation, and Consumer Engagement Strategies

Liquid packaging is the sector that creates packaging solutions expressly crafted for liquid products. This industry addresses a diverse range of liquid substances, encompassing beverages, pharmaceuticals, personal care items, household chemicals, and more.

Liquid packaging, whether juices, gels, lotions, soaps, condiments, or creams, poses a multifaceted challenge. Each liquid, with its unique viscosity and properties, presents its challenges in the packaging process. Effectively addressing these challenges requires a nuanced understanding of how each liquid interacts with and fills the package. Beyond the characteristics of the liquid itself, considerations extend to various aspects, including package format, tear-open features, speciality fitment access, and the critical issue of minimizing spillage.

One of the critical challenges in liquid packaging is comprehending the behaviour of the liquid within the package. Different liquids have distinct flow characteristics, and packaging experts must carefully analyze how each liquid moves, settles and reacts to various environmental conditions. This understanding is crucial for designing packaging that contains the liquid securely and facilitates easy dispensing or pouring for the end user.

The choice of package format is another critical aspect of liquid packaging. Factors such as the material used, the design of the container, and the type of closure must align with the specific requirements of the liquid product. For Instance, certain liquids may necessitate a pour spout for controlled dispensing, while others may require a pump or spray nozzle. Packaging specialists must consider these factors to ensure the functionality and user-friendliness of the packaging.

Moreover, spillage is a significant concern in liquid packaging, as it not only leads to product wastage but can also compromise the safety and cleanliness of the surrounding environment. The costs associated with spillage, in terms of product loss and potential damage to the packaging, underscore the importance of developing packaging solutions that minimize the risk of spills during transportation, handling, and usage.

Recognizing the intricate nature of liquid packaging, it becomes evident why entrusting this task to experts is imperative. Packaging professionals bring specialized knowledge and experience, allowing them to navigate the complexities of different liquid products. These experts focus on the technical aspects of containment and preservation and leverage their skills in designing visually appealing and functional packaging.

Liquid packaging involves a multifaceted process that demands a deep understanding of the unique challenges of different liquid products. From fluid dynamics within the package to considerations of package format, tear-open features, and spillage prevention, every aspect requires meticulous attention. Entrusting this task to packaging experts ensures the effective containment and preservation of liquids and the creation of visually appealing and functional packaging that resonates with consumers.

Artificial intelligence is transforming the liquid packaging market by increasing the operational effectiveness of automation and precision throughout packaging lines. Real-time monitoring, predictive maintenance, and automated quality inspection are all made possible by AI-powered systems, which minimize product loss and downtime. Machine learning algorithms ensure uniformity and adherence to safety regulations by optimizing filling levels, packaging speeds, and material usage. Furthermore, as industry adoption increases, AI helps smart supply chain management by predicting demand and optimizing inventory, making liquid packaging operations more adaptable, durable, and economical.

What Role Will Liquid Packaging Play in Sustainable Market Growth?

Liquid packaging is driving sustainable market growth through encouraging lightweight designs, recyclable materials, and lower production and distribution carbon emissions. To satisfy consumer demand and regulatory requirements, brands are increasingly using PET eco-friendly cartons and multi-layer recyclable fills. While increasing supply chain efficiency, innovations in smart and reusable packaging also support circular economy initiatives. Liquid packaging helps businesses strike a balance between environmental responsibility and operational cost savings as sustainability becomes a competitive advantage, increasing market adoption worldwide.

Liquid Packaging Market Trends Innovations, Consumer Preferences, and Future Growth Drivers

| Trends |

| Sustainable Barrier Coatings |

- In the dynamic landscape of liquid packaging, a noteworthy trend is the adoption of sustainable barrier coatings, particularly in liquid paperboard applications.

- This strategic shift aims to minimize environmental impact, reducing reliance on traditional materials.

- These innovative materials promise superior performance and align with sustainability objectives.

- With properties like exceptionally high strength and composition derived entirely from renewable raw materials, these barrier coatings are poised to outperform plastics and other fossil-based materials in diverse liquid packaging applications.

|

| Competing Materials |

- The industry is grappling with the influence of competitive materials, particularly glass packaging and the price volatility of aluminium. This impact is felt across both liquid packaging boards and multi-substrate flexible pouches.

- Liquid packaging board encounters stiff competition, with the latest contender being the clear reportable plastic can. While its influence on the liquid paperboard market is expected to be limited, it poses a notable threat to the retort carton. This packaging format has demonstrated significant opportunities in the market.

|

| Smaller Pack Sizes |

- The evolving social landscape is reshaping packaging preferences in unexpected ways, driven by an escalating need for convenience and a rising demand for ready-to-drink and on-the-go food and beverage options.

- Consequently, there is a noticeable uptick in the demand for smaller pack sizes across various sectors within the food and beverage industry.

- Despite packing the same quantity of product, smaller packs contribute to increased consumption of liquid paperboard as raw material.

- This trend, while responding to evolving consumer needs, also presents opportunities for converters to add value through increased demand for associated consumables.

|

Asia-Pacific's Rapid Growth in the Liquid Packaging Market: Trends, Opportunities, and Market Dynamics

In recent times, significant players in the beverage industry have strategically expanded their presence into the markets of China and India, catalyzing substantial sales growth within the Asia-Pacific liquid packaging sector. This heightened demand is notably underpinned by the escalating inclination of millennials towards packaged beverages, encompassing a spectrum from dairy products to soft drinks and juices.

Over the past two decades, China has witnessed a pronounced surge in liquid packaging, driven by sustainability considerations, technological advancements, and favourable economic conditions. Evolving consumer perspectives on packaging have prompted industry stakeholders to prioritize sustainability, ushering in an era where eco-friendly paperboard carton packaging creatively supersedes traditional rigid alternatives. This paradigm shift positions liquid packaging as a pragmatic and cost-effective alternative, aligning with the market's escalating preference for consumer-centric packaging solutions and augmented product preservation.

The trend towards employing natural materials for the production of liquid packing cartons has gained significant traction, contributing substantively to the expansion of this product segment. Liquid packing cartons are increasingly finding applications in industrial and institutional settings, resonating with manufacturers and consumers and further propelling the growth trajectory of this segment.

Governmental initiatives to reduce carbon footprints and foster sustainable packaging practices are pivotal in amplifying the demand for liquid carton packaging in the Asia-Pacific region. India emerges as a substantial market player, being the fourth-largest market for fast-moving consumer goods, as endorsed by the Indian Brand Equity Foundation. The convergence of market dynamics, heightened sustainability consciousness, and progressive technological advancements firmly establishes Asia-Pacific as a dynamic and rapidly expanding epicentre for liquid carton packaging.

North America closely trails Asia Pacific in the growth trajectory of the liquid packaging market. The region, characterized by an intensifying focus on sustainability, technological progress, and evolving consumer preferences, experiences a pronounced surge in demand for innovative liquid packaging solutions. This trend significantly contributes to the noteworthy expansion of the market in the region.

- In March 2023, the UK-based grocery retailer Sainsbury's unveiled environmentally friendly packaging for its proprietary liquid laundry detergent. These new cartons, weighing 35% less than their predecessors, have been designed to exhibit a 50% lower carbon footprint.

- In November 2023, Ariake, a leading Japanese company specializing in producing natural flavours derived from animals and operating across two continents, introduced premium liquid broths in SIG carton packaging. This strategic move exemplifies a commitment to packaging innovation within the global liquid food industry.

Strategic Dominance of Rigid Plastic and the Shift Towards Sustainable Solutions in the Packaging Industry

The rigid plastic packaging industry has witnessed a significant shift away from traditional formats such as glass bottles, jars, liquid cartons, and metal cans, marking its dominance in the market. This transition is driven by the inherent advantages of rigid plastic, including its lighter weight, cost-effectiveness, design flexibility, and recyclability. However, increasing public pressure on brand owners and retailers to address the environmental impact of plastic packaging is compelling the industry to adopt more sustainable practices.

In response to environmental concerns, stakeholders in the packaging sector are implementing measures such as weight reduction and the use of biodegradable or sustainably sourced materials. The growth of the rigid plastic packaging market is shaped by a combination of technological, economic, social, and demographic factors. Advances such as enhanced barrier solutions, improved resin formulations, and more efficient processing machinery increase consumption, including hot-filling and aseptic-filling solutions.

While ongoing opportunities exist to expand rigid plastic packaging, especially at the expense of traditional formats, specific segments, such as carbonated soft drinks and mineral water, have reached market saturation in developed regions. Simultaneously, initiatives like lightweight and the increased use of recycled plastics are expected to limit the consumption of virgin polymers.

Moreover, the rigid plastic packaging market faces heightened competition from the flexible plastic packaging industry, with a notable surge in the popularity of flexible stand-up pouch packaging across various food and beverage applications. As the industry navigates these complexities, adopting a strategic approach that balances innovation, sustainability, and market dynamics becomes crucial for ensuring sustained growth and relevance in the ever-evolving liquid packaging landscape.

- In May 2023, Allpack launched sustainable packaging PaintGuard, In-transit liquid product solution, since the impact on the environment is becoming a more pressing concern

Exploring the Versatility and Growth Potential of the Flexible Liquid Packaging Market

Flexible liquid packaging is not just limited to single-serve fruit drinks or household product refills like laundry detergent; it also proves highly effective for storing bulk quantities of various items, including health and beauty products, salad dressings, chemicals, and paint, all while ensuring freshness. Their remarkable versatility is the defining characteristic that sets flexible materials apart from rigid packaging.

When opting for flexible Packaging, one can typically achieve the same storage capacity with smaller containers compared to rigid alternatives. This holds even for bag-in-box styles, where the containers are smaller when empty and more compact when filled. This inherent space efficiency translates to more effective utilization of storage spaces, providing more excellent mileage for your storage facilities.

Beyond the advantages in storage, the space-saving nature of flexible Packaging extends its benefits to transportation costs and environmental impact. Smaller and lighter containers reduce transportation requirements, leading to fewer vehicles, fewer trips, and ultimately fewer carbon emissions. This environmentally conscious approach aligns with sustainability goals, making flexible packaging a compelling choice.

Despite its lightweight nature, flexible Packaging does not compromise on durability. In the case of bag-in-box containers, there is a significant reduction in plastic usage compared to rigid or semi-rigid alternatives. This reduction contributes to a lighter environmental footprint and reflects a commitment to resource efficiency.

In essence, flexible liquid packaging emerges as a versatile solution with broad applications, efficiently accommodating various products while offering storage, transportation, and sustainability advantages. These packages' lightweight yet durable nature, particularly evident in bag-in-box containers, emphasize a commitment to minimizing environmental impact while maximizing efficiency.

- In November 2023, Sealed Air (SEE) launched a new automated liquid packaging technology as a vertical form-fill-seal system.

Strategic Role of Aseptic Packaging in Ensuring Sterility and Extending Shelf Life

Aseptic packaging a meticulous process characterized by filling a commercially sterile product into a container under impeccably uncontaminated conditions, has emerged as a linchpin ensuring product sterility. The essence of aseptic packaging lies in hermetically sealing containers, eliminating the possibility of any reinfection and resulting in shelf-stable products at ambient conditions.

In essence, aseptic packaging is a robust mechanism to maintain the sterility and freedom from harmful microorganisms in food products for an extended period, precisely eight months at room temperature. A distinctive characteristic of this packaging is its ability to prevent the need for refrigeration, making it a compelling choice for various products. Packaging items such as flavoured milk, dairy products, and liquor using aseptic packaging materials is poised to be a catalyst in driving the growth of aseptic packaging globally.

As of 2021, the Indian aseptic liquid packaging market is experiencing a remarkable growth rate of 17-18% annually. Projections indicate that the market will witness a twofold increase over the next five years, reaching an estimated 20 billion packs annually. Drawing parallels with the Chinese market, which has already achieved a staggering figure of approximately 80 billion packs, India, with a similar population, presents an immense growth potential.

The trajectory of aseptic packaging in India underscores a compelling growth story fueled by factors such as changing consumer preferences, technological advancements, and an increasing awareness of the importance of product sterility. The adaptability of aseptic packaging, particularly in accommodating a variety of products without the requirement for refrigeration, positions it as a strategic solution for a broad spectrum of industries.

The growth potential in the market is underscored by the surging demand for aseptically packaged products, particularly in the domains of flavoured milk, dairy, alcoholic beverages and several cosmetic brands. The versatility of aseptic packaging in preserving the integrity of these products while offering convenience to consumers aligns with evolving market dynamics.

Aseptic packaging is a pivotal player in ensuring the sterility and longevity of products, emerging as a critical driver of growth in the Indian market. As the demand for aseptically packaged products continues to rise, propelled by consumer preferences and market dynamics, the industry is poised for substantial expansion in the coming years. The Indian aseptic liquid packaging Market is experiencing significant growth and is indicative of the global trajectory, where aseptic packaging is becoming increasingly indispensable in various sectors.

- In March 2022, Elopak and GLS declared a joint venture, with Elopak as the managing partner. Roll-fed aseptic cartons in multiple sizes are available under the "ALPAK" name.

Competitive Landscape Analysis Key Players, Market Dynamics, and Strategic Insights

The liquid packaging Market is characterized by intense competition because there are several key players, such as Elopak AS and SIG Global Ptv. Ltd, Evergreen Packaging LLC, Tetra Laval International SA, Greatview Aseptic Packaging Co. Ltd, Mondi PLC, Nippon Paper Industries Co. Ltd, IPI SRL, Refresco Group NV. This market has a medium level of market concentration, and several major players are present, using tactics such as product innovation, acquisitions, and mergers to obtain a competitive edge.

The market players are significantly impacting environmental development by adopting sustainable packaging and creating awareness among consumers through innovative packaging materials. Elopak AS and Mondi PLC are lead players who have a global impact by reducing carbon through innovative packaging materials adopted by leading companies that started sustainable packaging by introducing liquid packaging for personal care, food and beverage and several pharmaceuticals industries in their packaging and other materials.

Value Chain Analysis

Raw Materials Sourcing

Liquid packaging relies on materials such as plastics (PE, PET, PP), paperboard, and barrier coatings to ensure safety and shelf life. The growing demand for lightweight and sustainable materials is influencing sourcing strategies. Key players include Dow, ExxonMobil, LyondellBasell, Mondi, and Borealis.

Logistics and Distribution

Efficient logistics are essential to deliver liquid packaging materials and finished packs safely and on time. Companies use global supply chains and third-party logistics providers to support food, beverage, and pharmaceutical customers. Key players include DHL Supply Chain, FedEx, DB Schenker, and Kuehne + Nagel.

Retail Sales and Financing

Liquid packaging products are distributed through retail, e-commerce, and direct supply to brand owners. Investments, partnerships, and financing support innovation and capacity expansion across the value chain. Key players include A mcor, Berry Global, Sonoco, Smurfit Kappa, and DS Smith.

Major Key Player in the Liquid Packaging Market

Recent Developments in the Liquid Packaging Market Innovations, Trends, and Key Player Advancements

- In December 2025, Tetra Pak launched the world’s first juice carton with a paper-based barrier, made with up to 92% renewable content and reducing carbon footprint compared with traditional aseptic packaging. This innovation supports improved recyclability and downstream paper recovery.

- In July 2025, SIG launched the world’s first 1-liter aseptic carton pack offering full barrier protection without an aluminum layer, reducing carbon emissions and maintaining up to 12-month shelf life, now available with German retailer ALDI.

- In July 2025, Greatview Aseptic Packaging opened a new aseptic carton packaging facility in Perugia, Italy, aimed at meeting growing demand for sustainably manufactured liquid packaging products and enhancing local production capabilities.

Market Segmentation Analysis of the Liquid Packaging Industry

By Type

- Flexible Packaging

- Pouches

- Sachets

- Bag-in-box

- Flexible liners

- Rigid Packaging

- Bottles

- Cartons

- Cans

- Jars

By Material

- Plastic

- PET

- HDPE

- LDPE

- PP

- Multilayer plastic laminates

- Paper

- Liquid cartons

- Coated paperboard

- Paper-based composites

- Glass

- Metal

By Technique

- Aseptic Packaging

- Aseptic cartons

- Aseptic bags & pouches

- Aseptic bottles

- Intelligent Packaging

- QR-enabled smart labels

- Time–temperature indicators

- Freshness & tamper indicators

- Modified Atmosphere Packaging (MAP)

- Gas-flushed packaging

- Controlled atmosphere packs

- Vacuum Packaging

- Vacuum-sealed pouches

- Vacuum bottles & containers

By End-Use

- Personal Care

- Shampoos & conditioners

- Liquid soaps

- Lotions & creams

- Food & Beverage

- Dairy products

- Beverages (juices, soft drinks, alcohol)

- Sauces & liquid foods

- Pharmaceuticals

- Liquid medicines

- Syrups

- Nutraceutical liquids

- Chemical

- Industrial liquids

- Agrochemicals

- Household chemicals

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

-

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA