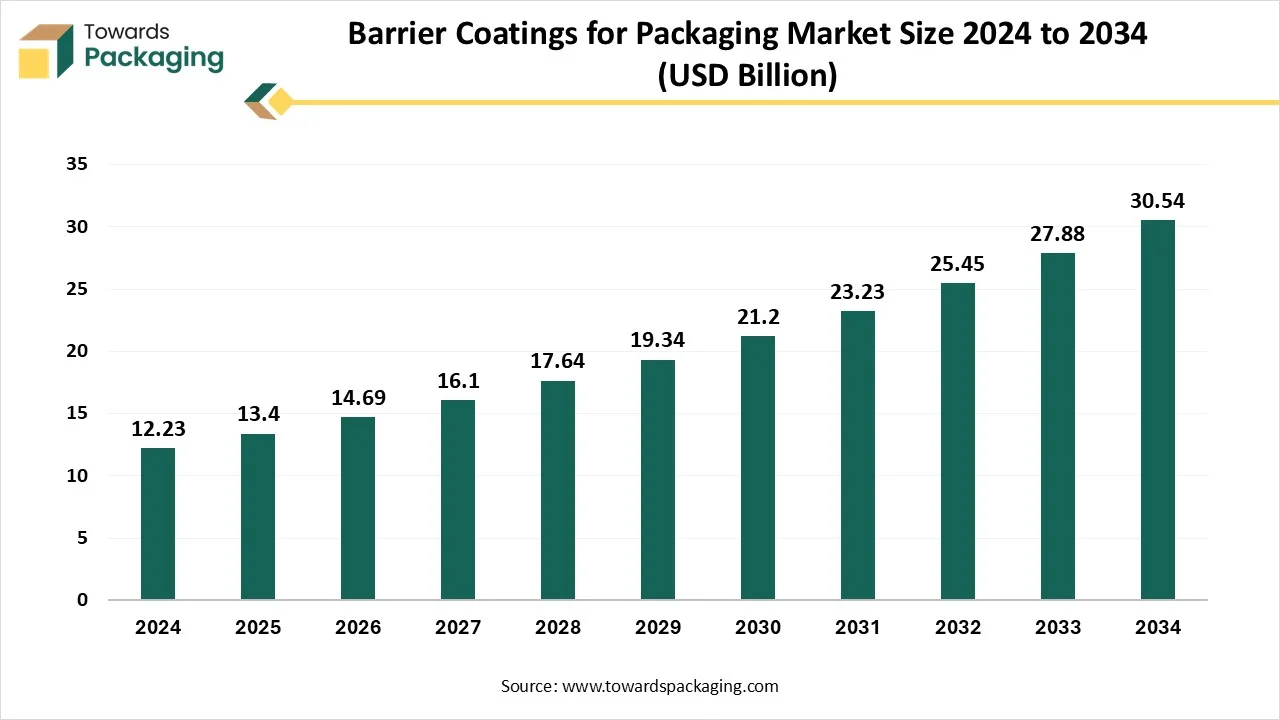

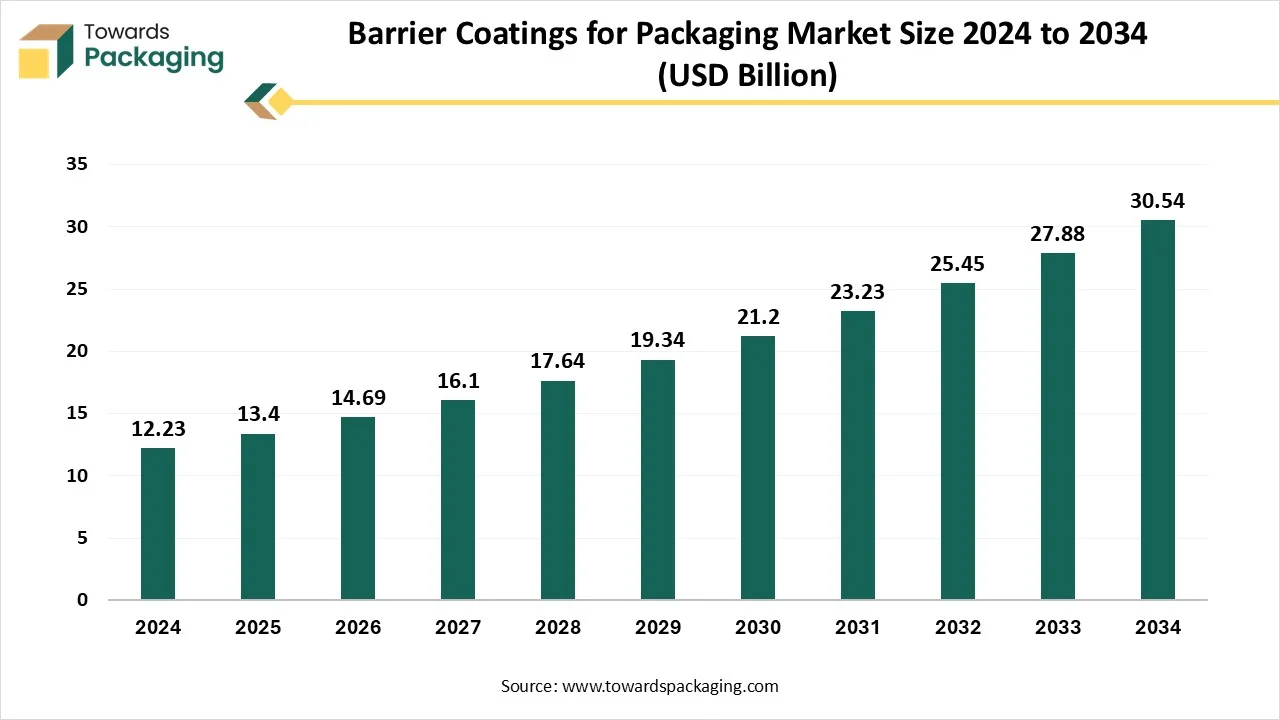

The barrier coatings for packaging market is forecasted to expand from USD 14.69 billion in 2026 to USD 33.52 billion by 2035, growing at a CAGR of 9.6% from 2026 to 2035. This coverage includes leading company profiles, competitive analysis, value chain evaluation, trade data, manufacturer–supplier mapping, and all supporting quantitative datasets for strategic decision-making.

The future of barrier coating in the food sector is poised for rising growth. Technological advancements are expected to rise and to lead to even more sustainable and effective solutions, with a concentration on focusing and reducing environmental impact and enhancing recyclability. Consumer demand for eco-friendly packaging is driving invention, with companies like KCl is on top in developing high level materials and technologies. Furthermore, regulatory change’s goal is to reduce plastic waste and are likely to increase the move towards recyclable and biodegradable barrier coatings that shape the packaging industry.

The barrier coatings for packaging market is growing significantly due to the rising concern about ecological issues. Growing customer consciousness for sustainable packaging processes is anticipated to grow uninterruptedly, and customer shifting demand changes from paper to plastic is one of the significant trends. Barrier coatings for packaging of materials are utilized in several sectors, comprising food, pharmaceuticals, and many others. Oxygen barriers assist the limited contact to oxygen and reduce oxidation which can lead to colour change, spoilage, and rancidity of product. A huge variety of barrier coatings are utilized for certain requirement such as grease-protection barrier coatings are extensively utilized in food packaging facility to protect oil from spilling through the packaging at the time of transportation.

Chemical resistance barrier coatings are utilized in the packing of fertilizers, chemicals, and other commercial products to defend the packaging resources from deprivation. Major companies are concentrating on emerging and transporting advanced corrosion regulator technologies, such as MCI and VpCI, across several industries comprising construction, packaging, oil and gas, metalworking, and electronics. Industries are presenting commitment to reduce ecological impact around the complete product lifecycle with a goal to cause the companies in providing operative, ecologically accountable choices for worldwide markets.

| Metric | Details |

| Market Size in 2025 | USD 13.40 Billion |

| Projected Market Size in 2035 | USD 33.52 Billion |

| CAGR (2026 - 2035) | 9.6% |

| Leading Region | North America |

| Market Segmentation | By Coating Type, By End Use Industry, By Distribution Channel and By Region Covered |

| Top Key Players | Sierra Coating Technologies, Avery Dennison, Cork Industries, Sonoco Products, Stora Enso, H.B. Fuller, Dow Chemical, Chemline Global. |

In the barrier coatings for packaging market, there is a huge impact of AI in improving the quality of the packaging. The packaging industry is evolving rapidly to enhance the protection quality to avoid any damage to the products. It is widely used in selecting the material of the packaging to ensure the high-quality barrier from leakage. The integration of advanced technology has raised if any defects occur in the packaging which help to fix the issues before supplying and enhance the reliability of the barrier coatings for packaging industry.

These barrier coatings enhance the packaging quality and reduce the risk of leakage of beverages or other liquid products and addition of advanced technology to this market help to understand the details of the packaging. By using artificial intelligence powered technologies, a multi-disciplinary process of researchers’ strategies to utilize thermal imaging to notice imperfections in the barrier coatings in the real time and instantly improve them.

There are several factors driving the barrier coatings for packaging market such as growing focus towards convenience of the packaging, quality and safety of the packaging, and advancement in the technology of coating. A significant aspect that has provided for the development of barrier coatings for packaging industry is the amplified usage of the convenience of packaging for products. Busy customers are progressively attracted towards packaged foods and beverages because of their easy-to-handle and enhanced shelf-life properties.

To fulfil the demand for convenience packaging, these barrier coatings support in preserving the freshness of the products, quality and taste, which make them essential in this field. The importance of food quality and safety is highly in demand by the customers, which resulted in the growing demand for barrier coatings for packaging options that protect food products from possible spoilage and pollution. Barrier coatings provide high protection against oxygen, moisture, and other ecological materials to the beverage and help to store for a longer period. Another factor that influences the demand for this market is the appearance of modern and cutting-edge coating systems. These expansions have resulted in barrier coatings with enhanced properties, sustainability as well as durability.

The growing healthcare and pharmaceutical industries are increasing the demand for advancement in the barrier coatings for packaging market. The pharmaceutical and healthcare market demands enhanced-quality barrier coatings to defend medical devices, vaccines, and medicines from light, moisture, and oxygen exposure. As worldwide healthcare guidelines are becoming stricter, packaging producers are capitalizing in oxygen-scavenging and antimicrobial coatings to improve product safety. The increase in biodegradable healthcare and pharmaceutical packaging options has boosted the acceptance of solvent-free and water-based coatings, decreasing chemical pollution risks. Technological developments have resulted in the growth of advanced barrier coatings that improve the shelf life of packaged products. These barrier coatings deliver high moisture and oxygen resistance, and grease repellency properties, protecting from spoilage and maintain the freshness of the products.

Nanotechnology and hybrid barrier coating designs are gaining popularity, contributing ultra-thin, enhanced-barrier coatings without hampering recyclability potential. Brands looking for enhanced shelf life and preserve the integrity of the product and hence the adoption is increasing for these advanced coatings, particularly in the food and beverage market. Market players are capitalizing for research and development to revolutionize and improve the functioning of the barrier coatings to fulfil the specific requirements with an intention of emerging bio-based coatings which are made up of bio-based resources. Constant research on the improvement of barrier coatings comprises the incorporation of nanomaterials such as nano-cellulose and nano clays are considered effectual against oils, gases, and moisture.

Economic instability and fluctuation of raw materials charges carries an important threat to the market and these can result in increasing production charges and influence the profit margins as well as pricing policies. Developing ecological guidelines and new ideals may upsurge the operational intricacies and hinder the ability of the producers to present groundbreaking products to market rapidly.

Addressing growing customer and supervisory expectations about ecological sustainability and decreasing carbon footprint through the supply chain carries a noteworthy challenge. This comprises managing material consumption and generation of wastage. Also, supporting technological revolution needs substantial investment in research & development to grow new barrier coatings.

The PE segment dominated the market in 2024 due to its moisture resistant, cost-effectiveness, and flexibility properties. These coatings are majorly used in flexible or paperboard substrates, which make a protective layer that provide resistance against contamination, moisture, and grease. This quality makes these polyethylene segment most demanding and important in the food and beverages packaging industry. Enhanced adaptability and durability properties of the PE has raised the demand for this segment efficiently. The ease in manufacturing barrier coatings with these materials are the factors behind the increasing demand for this segment. The advancement in the recyclability and bio-based polyethylene variant has expanded this segment of the market.

The food segment dominated the market in 2024 due to the rising demand for preserving the integrity of the food products. The enhanced demand for sustainable barrier coatings forced the major market players to develop coatings with eco-friendly resources. This dominance is majorly because of the increasing requirement for the protection of food products from external factors such as moisture, contamination, and light. The growing consumption of packaged food products has also raised the demand for extra protection in the packaging that can enhance the shelf life of the food products.

The distribution channel segment dominated the market in 2024 due to the rising production and application process. The dominance over quality checking and customization of the barrier coatings has influenced the distribution channels to contribute significantly. Producers are progressively concentrating towards the development of advanced quality coatings. The active involvement allows them to answer quickly to market trends and consumer needs, offering a competitive control over additional distribution channels. Moreover, producers sometimes establish partnership with companies for smooth distribution of the packaging and fulfilling the demand of the consumers.

In Asia Pacific, the urge for barrier coating packaging is experiencing strong growth, fueled by rapid urbanization, changing lifestyles, and the expanding food and beverage industry. Countries such as China, India, Japan, and South Korea are leading consumers, with increasing demand for packaged foods, ready-to-eat meals, and online grocery deliveries driving the need for high-performance barrier solutions that extend shelf life and preserve product quality. Rising awareness about food safety and hygiene, coupled with regulatory emphasis on reducing food waste, is further boosting adoption. The packaging industry in the region is also shifting toward sustainable materials, prompting the usage of recyclable or compostable substrates with advanced barrier coatings to replace traditional plastic laminates.

North America held the largest share in 2024. This is due to the strict laws of the government and rising concern towards eco-friendly packaging. Such regulations push this market to develop coatings with eco-friendly resources for the enhancement of the demand of the market in this region. In countries such as the U.S. and Canada has high demand for packaged food and beverages due to the presence of huge number of working individuals. This high demand upsurges the development of better-quality barrier coating for packaging market.

Europe is expected to grow at the fastest rate during the forecast period. This is due to the rising demand for compostable and recyclable barrier coating for packaging of products. The strict regulation for the reduction of plastic waste has influenced this market to grow extensively. In countries such as the UK, France, Germany, and several others there is a huge production of fibre-based packaging and enhance the requirement of barrier coating to provide proper protection to the packaged products.

In the Middle East and Africa, the demand for barrier coating packaging is steadily increasing, driven by the growth of the food and beverage, pharmaceutical, and personal care sectors. Rising disposable incomes, urban population growth, and a move towards packaged and convenience foods are the main factors fueling this demand. Countries like the UAE, Saudi Arabia, and South Africa are leading adopters, with a growing retail and e-commerce ecosystem that needs packaging solutions offering extended shelf life, moisture resistance, and protection against oxygen and contaminants. In addition, the hot and humid climate in many parts of the region increases the need for high-performance barrier coatings to track product freshness and prevent spoilage.

Although the market is still emerging compared to other regions, increasing industrial investments, global brand presence, and expanding local manufacturing capabilities are expected to boost the acceptance of barrier coating packaging in the Middle East and Africa in the coming years.

By Coating Type

By End Use Industry

By Distribution Channel

By Region Covered

February 2026

February 2026

February 2026

February 2026