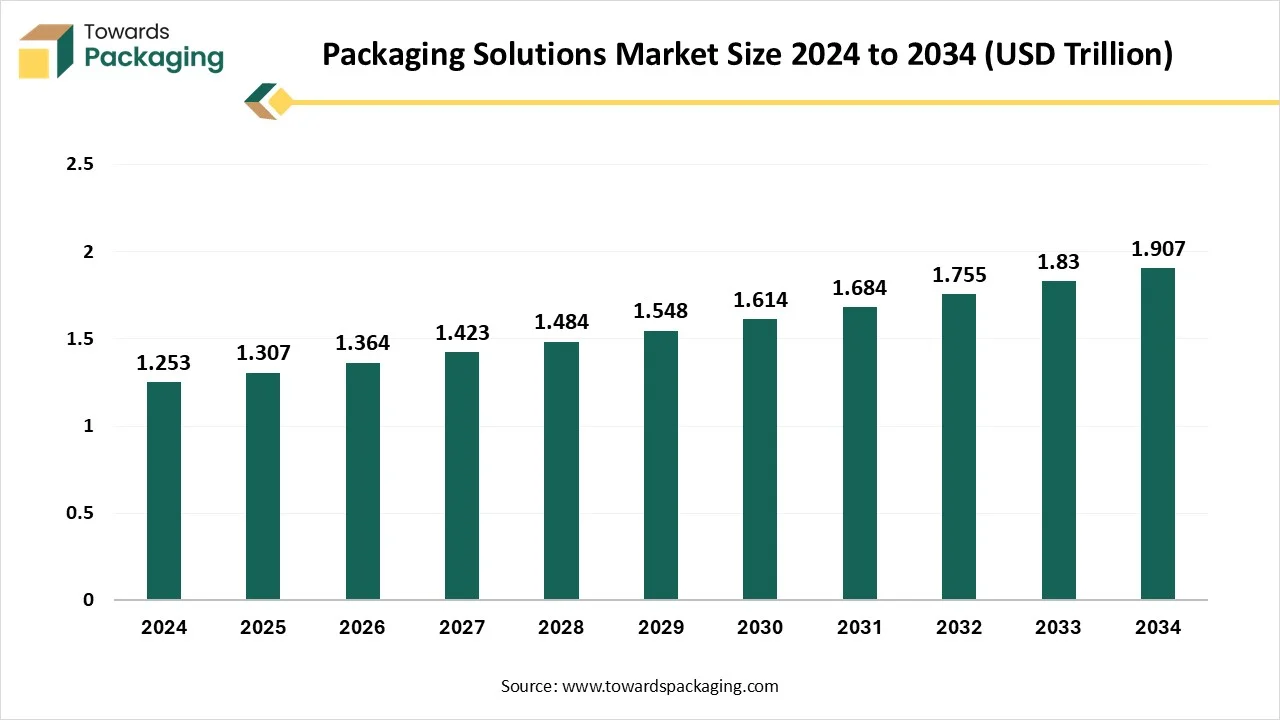

The packaging solutions market is forecasted to expand from USD 1.36 trillion in 2026 to USD 2.00 trillion by 2035, growing at a CAGR of 4.33% from 2026 to 2035. This comprehensive report covers market trends, segment data across material, packaging type, and end-use industries, and detailed regional insights spanning North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

It also includes competitive share statistics of key companies such as Amcor PLC, Sealed Air Corporation, Ball Corporation, International Paper, and WestRock, along with value chain analysis, trade data, manufacturing ecosystem, supplier mapping, growth rate metrics, and all market share figures including plastic at 40 percent, paper and paperboard at 25 percent, recycled packaging at 60 percent, and food and beverages at 45 percent.

In the packaging industry, packaging solutions include various types of packaging materials that are designed to protect the product during handling, storage, and transportation. They also provide crucial information about the contents and other necessary details. The recycled segment continues to dominate owing to the rising environmental concerns and evolving customer preferences. In recent years, sustainability has become a key focus in the packaging industry, which has compelled the key players to heavily focus on adopting sustainable packaging materials.

| Metric | Details |

| Market Size in 2025 | USD 1.31 Trillion |

| Projected Market Size in 2035 | USD 2.00 Trillion |

| CAGR (2025 - 2035) | 4.33% |

| Leading Region | Europe |

| Market Segmentation | By Material, By Packaging Type, By End-User Industry and By Region |

| Top Key Players | Amcor PLC, Sealed Air Corporation, Ball Corporation, International Paper Company, WestRock Company |

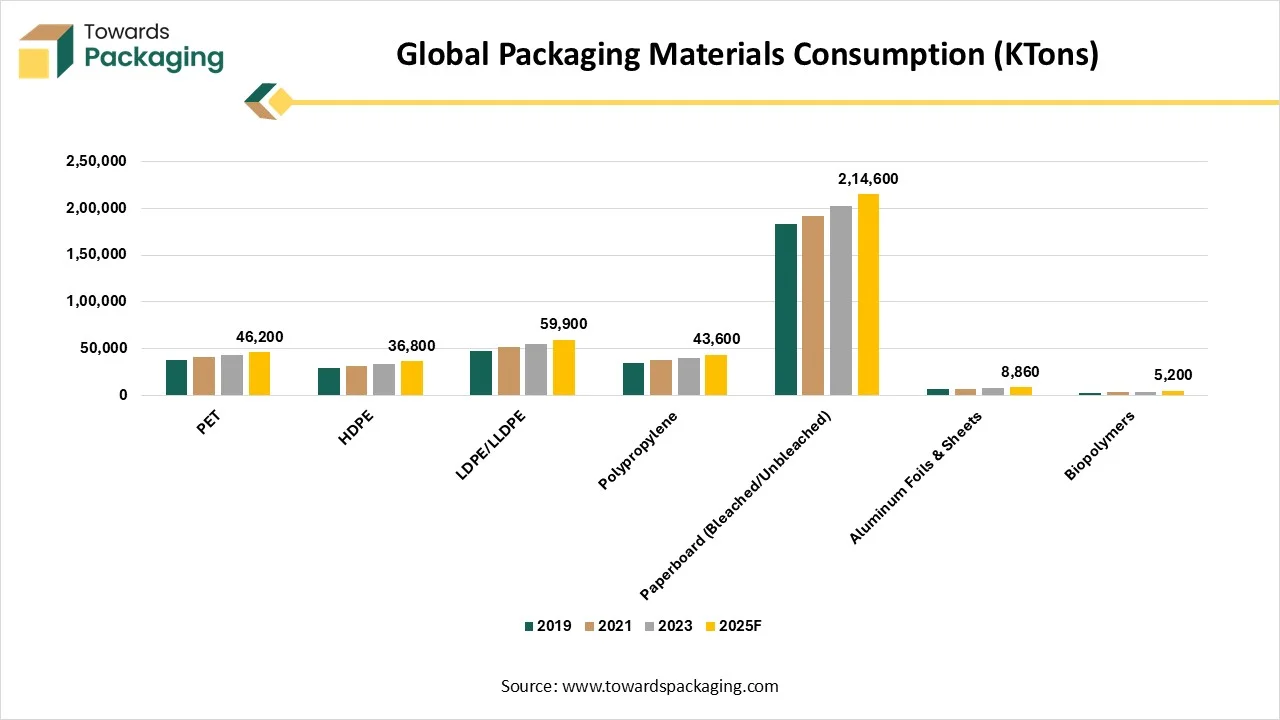

| Material Type | 2019 | 2021 | 2023 | 2025 |

| PET | 38,500 | 40,900 | 43,300 | 46,200 |

| HDPE | 29,700 | 31,400 | 33,900 | 36,800 |

| LDPE/LLDPE | 48,100 | 51,700 | 55,600 | 59,900 |

| Polypropylene | 34,900 | 37,800 | 40,200 | 43,600 |

| Paperboard (Bleached/Unbleached) | 1,83,500 | 1,91,700 | 2,01,900 | 2,14,600 |

| Aluminum Foils & Sheets | 7,200 | 7,680 | 8,230 | 8,860 |

| Biopolymers | 2,900 | 3,600 | 4,300 | 5,200 |

As AI technology continues to evolve, Artificial intelligence integration holds great potential to reshape the landscape of the packaging solutions market by improving sustainability, optimizing packaging dimensions, and reducing material waste. Artificial intelligence (AI) integration can effectively streamline design processes to optimising supply chains in the market. By harnessing the power of automation and machine learning (ML), companies can create more cost-effective, versatile, durable, sustainable, and consumer-friendly packaging solutions. AI-driven software is rapidly reshaping the design phase by allowing businesses to develop efficient and innovative packaging solutions. ML algorithms can effectively analyse large datasets to predict design trends, significantly assisting brands to stay ahead in the long run.

Rapid Expansion of the Ecommerce and Retail Sector

The rapid expansion of the e-commerce industry is expected to boost the market’s expansion during the forecast period. In the retail and e-commerce industry, packaging solutions play a crucial role and are widely used to protect the product during handling, storage, and transportation. Packaging solutions also provide important information about the contents of the product and other required information to educate the customers. Packaging solutions allow for shipping lightweight goods with durability and strength. In the form of various types of packaging, such as paper and paperboard, plastic, metal, glass, and others, packaging solutions improve handling efficiencies, reduce product damage, enhance the shelf life, and also offer an economical option for the retail and e-commerce industries.

Fluctuating Raw Material Costs

The price volatility is expected to hinder the market's growth. The fluctuation in the price of raw materials has led to an increasing production cost of packaging solutions, which can adversely impact the profitability of manufacturers. In addition, insufficient infrastructure for recycling packaging materials, particularly in middle- and lower-income countries, may limit the expansion of the global packaging solutions market.

Growing Consumer Demand for Sustainable Packaging Solutions

The rising consumer demand for sustainable packaging materials is projected to offer lucrative growth opportunities to the packaging solutions market in the coming years. The rising environmental concerns and increasing awareness of circular economy models influence sustainable packaging practices and are reshaping the packaging landscape. Recyclable, reusable, and biodegradable packaging is gaining immense popularity as it is offering an eco-friendly packaging solution and a sustainable alternative to traditional plastic packaging. Several manufacturers have significantly increased their product offerings to include a more extensive range of sustainable packaging solutions for a wide range of industries. Therefore, eco-friendly packaging solutions align with the principles of the circular economy and are expected to accelerate the market’s revenue in the coming years.

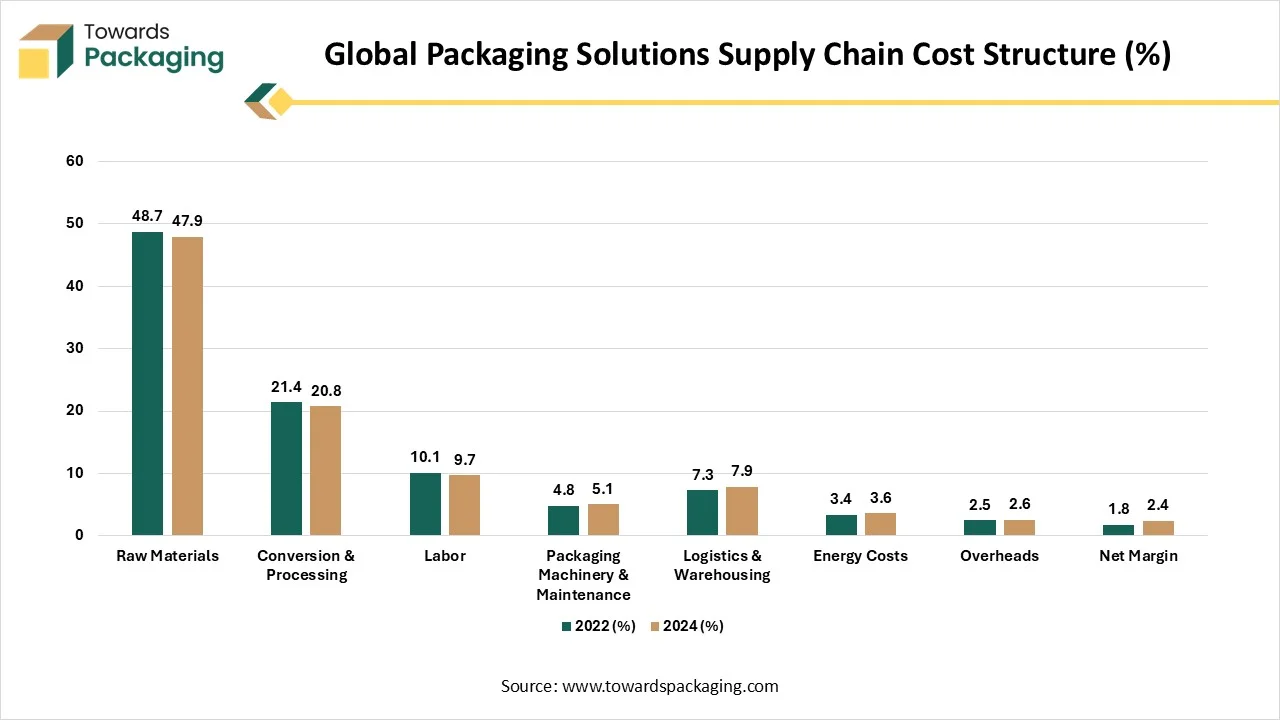

| Cost Component | 2022 (%) | 2024 (%) |

| Raw Materials | 48.7 | 47.9 |

| Conversion & Processing | 21.4 | 20.8 |

| Labor | 10.1 | 9.7 |

| Packaging Machinery & Maintenance | 4.8 | 5.1 |

| Logistics & Warehousing | 7.3 | 7.9 |

| Energy Costs | 3.4 | 3.6 |

| Overheads | 2.5 | 2.6 |

| Net Margin | 1.8 | 2.4 |

The recycled segment dominated the market with the largest share in 2024, owing to the supportive government framework for recycled materials to minimize waste and promote the circular economy. Recycled includes the packaging that is manufactured from recycled materials such as cardboard, glass, metal, aluminium, paper, paperboard, and others. Recycled packaging solutions aim to reduce waste and conserve natural resources. Moreover, manufacturing increasingly prefers recycled materials as it requires less energy than creating new ones, leading to lower greenhouse gas emissions. On the other hand, the new segment is growing at a notable rate. This type of packaging is generally made from newly manufactured materials, often sourced from virgin resources. New packaging has the optimal performance capability and certain crucial properties to protect the product from damage during storage and transportation. Thus, driving the segment’s growth during the forecast period.

The plastic segment held a dominant presence in 2024, owing to its maximum strength, cost-effectiveness, versatility, and durability. Several manufacturers prefer plastic material to lower their production costs while offering protection to the product against contamination, ensuring product freshness, and maintaining integrity. In recent years, bio-based plastics have rapidly gained momentum in the market as a sustainable choice among eco-conscious individuals, as they are made from renewable sources. Bio-based plastics are assisting in promoting a circular economy. On the other hand, the paper and paperboard segment is expected to grow at the fastest CAGR. The growth of the segment is attributed to the growing need for eco-friendly materials. These packaging solutions are made out of recycled materials and paperboard, offering both durable and eco-friendly options to reduce carbon emissions and boost sustainability.

The food and beverages industry segment accounted for the majority share of the packaging solutions market in 2024. The growth of the segment is majorly driven by the rapid urbanization and increasing demand for packaging solutions for food packaging in fresh produce, ready-to-eat meals, and frozen foods. Packaging solutions play a crucial role in the food and beverages industry by offering durability, protection, cost-effectiveness, versatility, and availability in a wide range of sizes and innovative designs. Moreover, the increasing expansion of the ecommerce sectors has increases the online shopping of groceries, consumer goods, consumer care, and cosmetics, and others are expected to fuel the segment’s expansion during the forecast period.

On the other hand, the healthcare segment is expected to witness remarkable growth during the forecast period, owing to the rising expansion of the healthcare sector in the developed and developing economies. Packaging solutions cover and protect the pharmaceutical product and offer extra external security. The common types of healthcare packaging include bottles, vials, blister packs, sachets, syringes, and others. Such factors are bolstering the market’s growth.

| Material | 2020 | 2021 | 2022 | 2023 | 2024 |

| Rigid Plastics | 100 | 104 | 112 | 115 | 119 |

| Flexible Films | 100 | 107 | 118 | 122 | 126 |

| Corrugated Paper | 100 | 109 | 127 | 131 | 134 |

| Metal Cans/Aluminum | 100 | 103 | 116 | 120 | 125 |

| Glass Containers | 100 | 102 | 108 | 113 | 117 |

Europe’s government-led sustainability initiatives and stricter environmental regulations compel companies to adopt eco-friendly alternatives, boosting the market’ expansion. European countries such as the Netherlands, Spain, France, Germany, and the UK are leading with robust recycling measures and EPRs. Policies like the European Union’s Circular Economy Action Plan encourage companies to invest more in sustainable packaging solutions. The incorporation of smart technologies into corrugated packaging, such as QR codes, NFC tags, and RFID tags, allows for real-time tracking, authentication, and improved consumer engagement. Moreover, the rising consumer and business inclination towards sustainable packaging solutions is expected to drive the market’s revenue in the region.

Germany

Germany’s packaging solutions market is motivated by its robust FMCG industry, sophisticated manufacturing base, and stringent sustainability laws. To achieve the objectives of the circular economy, businesses are quickly implementing lightweight, recyclable, and reusable packaging materials. As industries prioritize efficiency, accuracy, and less environmental impact, automation and smart packaging technologies are also gaining traction.

On the other hand, Asia Pacific is expected to grow at a significant rate in the market during the forecast period, owing to the rising consumer inclination for sustainable packaging solutions, surge in online shopping, and increasing demand for lightweight and cost-effective packaging solutions from various industries. The Asia Pacific region has a robust presence of food and beverages, pharmaceuticals, retail and ecommerce, personal care and cosmetics, and the apparel industry, which are all major users of packaging solutions. Several manufacturers are heavily investing in developing innovative packaging designs and printing on packaging to better connect with customers and stand out from the competition.

India

In India, the packaging solutions market is expanding quickly because of the rapid industrial growth, growing demand for consumer goods, and flourishing e-commerce. Companies are implementing flexible long long-lasting, and economical packaging formats to enhance product safety and logistics. Paper-based, bio-based, and recycled plastics are examples of sustainable materials that are becoming more popular as companies adapt to changing environmental laws.

Latin America’s packaging solutions market is growing as the food and beverage retail and agricultural industries grow. Packaging that extends shelf life, lowers shipping costs, and can withstand long-distance transportation is becoming more popular among businesses. With the help of growing consumer awareness and better recycling infrastructure, the area is gradually switching to greener packaging materials.

Brazil

Brazil’s market is driven by thriving food processing, chemical, and agricultural sectors that demand high-performance packaging solutions. Packaging that supports export operations and is economical eco eco-friendly, and protective is becoming more and more popular. Businesses are increasingly utilizing lightweight designs and recyclable materials to meet transportation efficiency requirements as well as environmental goals.

The MEA in the packaging solutions market is expanding because of rising urbanization, industrial activity, and packaged goods consumption. Packaging formats that are adaptable, robust, and climate-resistant are highly sought after. Adoption of sustainability is gradually increasing as businesses work to cut down on plastic waste and governments launch recycling programs.

UAE

The UAE market benefits from strong retail e-commerce and food service industries that rely heavily on modern, high-quality packaging solutions. Demand is rising for smart, attractive, and sustainable packaging as the country pushes toward circular economy goals. Logistics and export-driven sectors are also adopting advanced lightweight and recyclable materials to improve transport efficiency.

North America’s packaging solutions market is driven by the high demand for packaging that is automation-compatible eco eco-friendly, and ready for e-commerce to cut waste and carbon emissions. Businesses are increasingly utilizing lightweight structures high performance films, and recyclable nanomaterials. Digital printing and small packaging technologies are quickly changing the packaging scene in the area.

U.S.

The U.S. demand for fueled by growth in e-commerce, food and beverage, pharmaceutical, and consumer goods. Packaging that improves product safety, sustainability, and durability is becoming a top priority for businesses. As brands react to stringent state-level regulations and growing consumer expectations, the trend toward recycled content, reusable models, and smart labels is quickening.

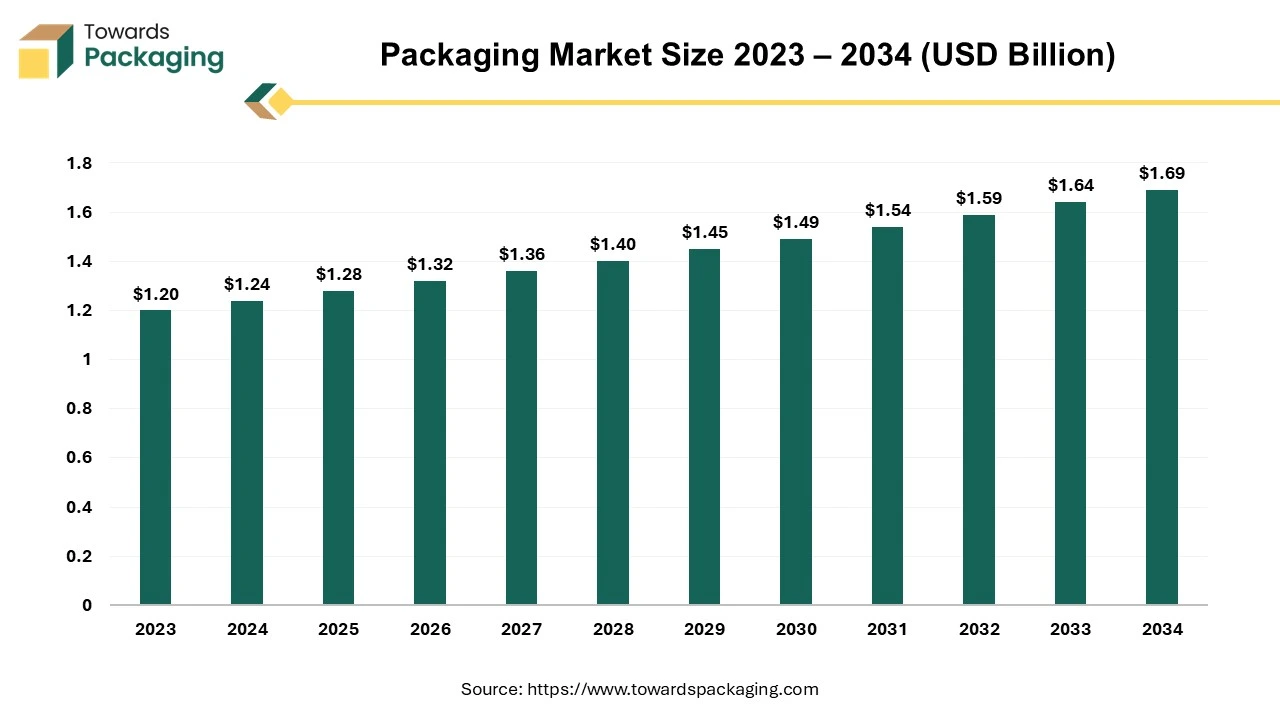

The global packaging market size reached US$ 1.24 trillion in 2024 and is projected to hit around US$ 1.69 trillion by 2034, expanding at a CAGR of 3.16% during the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing plant fiber-based packaging which is estimated to drive the global packaging market over the forecast period.

Packaging is known as the process of designing, evaluating, and producing containers or wrappers for products. It plays a crucial role in protecting goods during storage, distribution, and sale. Packaging not only ensures the product reaches the consumer in good condition but also serves as a marketing tool, communicating brand identity and product information.

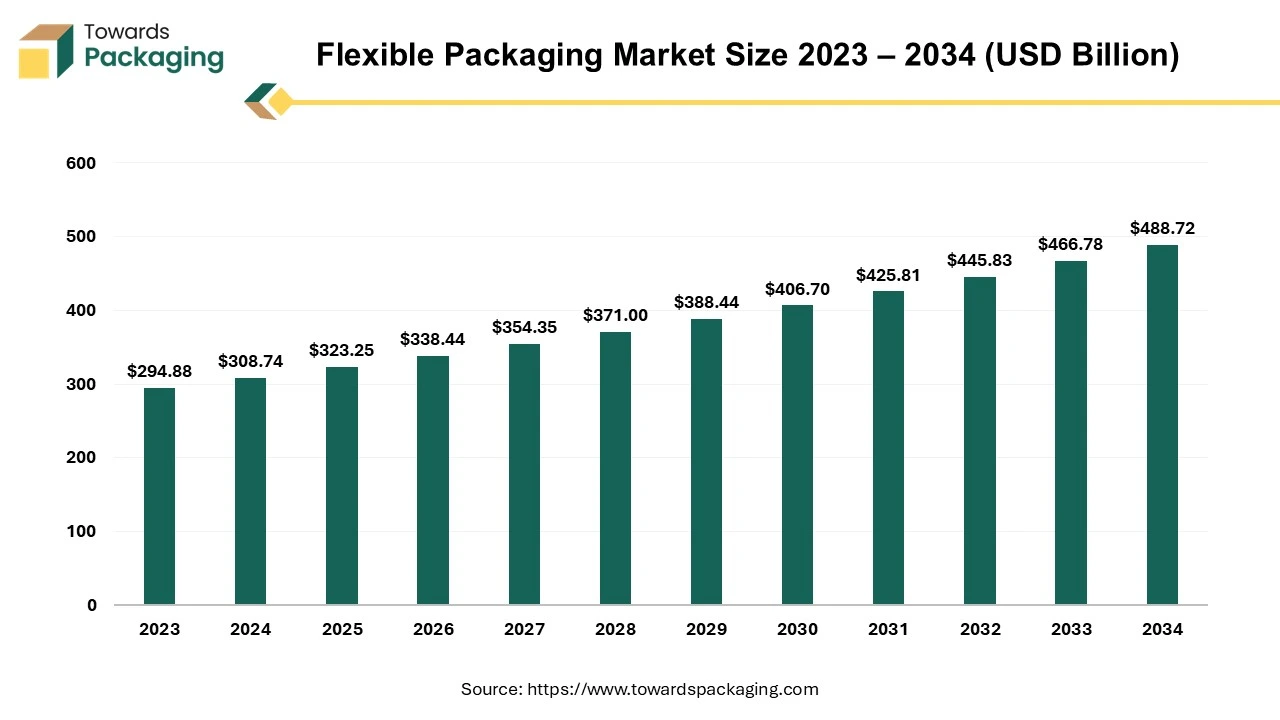

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

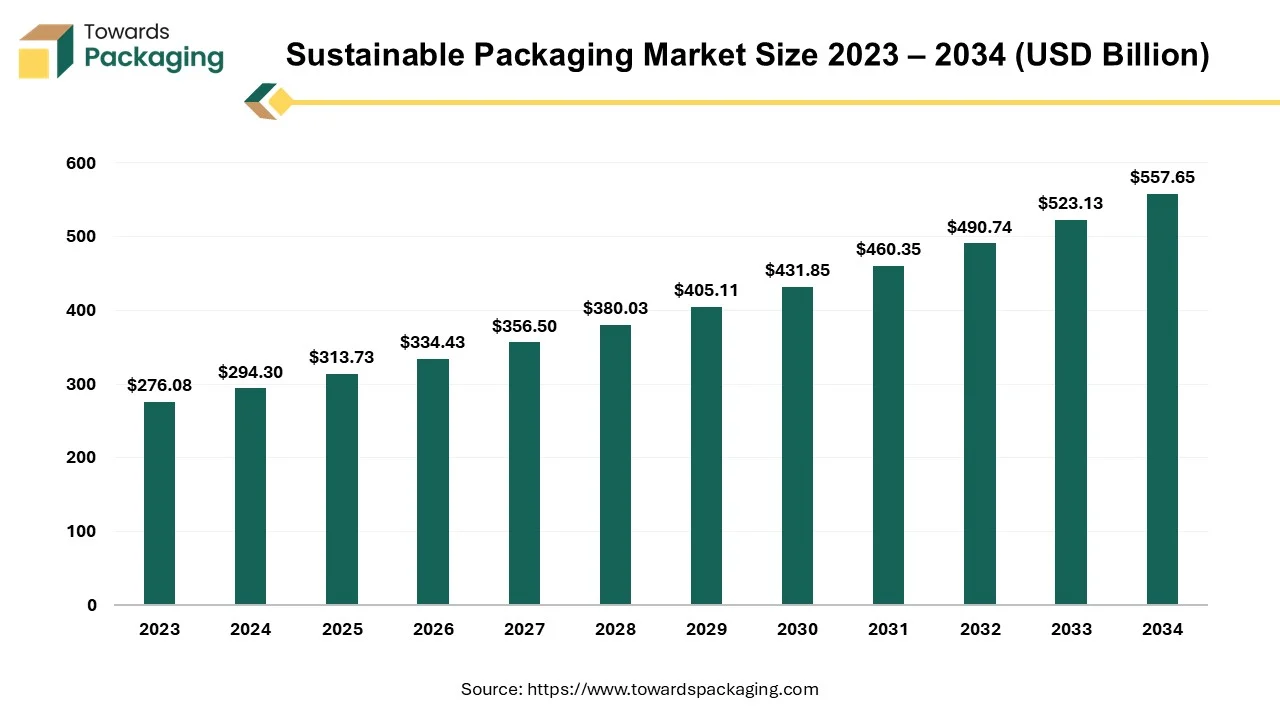

The sustainable packaging market is predicted to expand from USD 313.73 billion in 2025 to USD 557.65 billion by 2034, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034.

Sustainable packaging is the use of environmentally friendly materials to package, store, distribute, or display products. Sustainable packaging incorporates materials with a low environmental impact throughout their existence. This strategy entails employing environmentally friendly and renewable materials, reducing waste, and lowering carbon emissions connected with packaging manufacturing, transportation, and disposal.

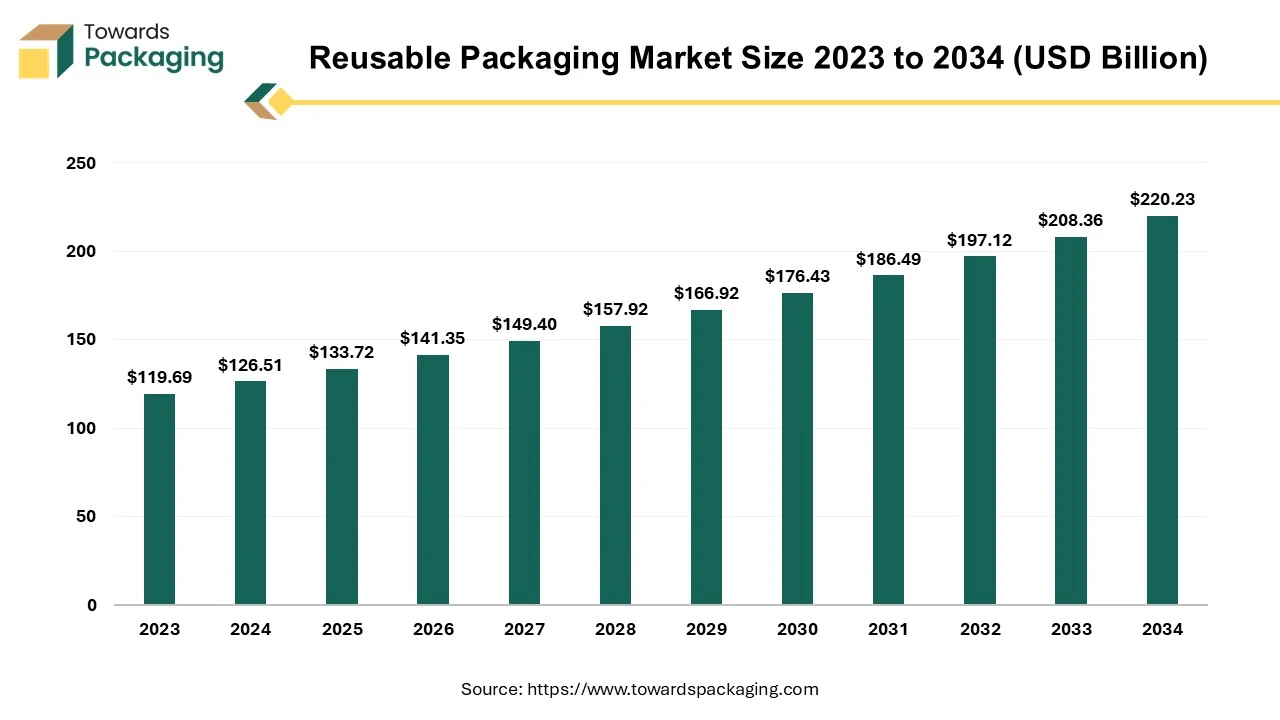

The reusable packaging market is expected to grow from USD 133.72 billion in 2025 to USD 220.23 billion by 2034, with a CAGR of 5.7% throughout the forecast period from 2025 to 2034. The expansion of e-commerce and urban delivery services has increased the need for durable and cost-effective transport solutions. The growing focus on sustainability and stricter environmental regulations is encouraging businesses to move away from single-use options.

In order to move goods through supply chains effectively and safely, reusable transport packaging typically consists of pallets, bins, tanks, intermediate bulk containers, reusable plastic containers, and other hand-held containers, as well as totes, trays, and dunnage. In order to assure their efficient recovery and return for ongoing usage, these packaging products are made to last. Transporting commodities, raw materials, ingredients, or parts to facilities for manufacturing or processing goods is a common usage. Next, completed goods are shipped to warehouses or distribution centers en route to commercial markets like wholesale or retail outlets. The majority of reusable transport packaging items are made for business-to-business use, but the rise of home delivery and e-commerce is creating new chances for reusable packing to be used effectively.

By Material

By Packaging Type

By End-User Industry

By Region

February 2026

February 2026

February 2026

February 2026