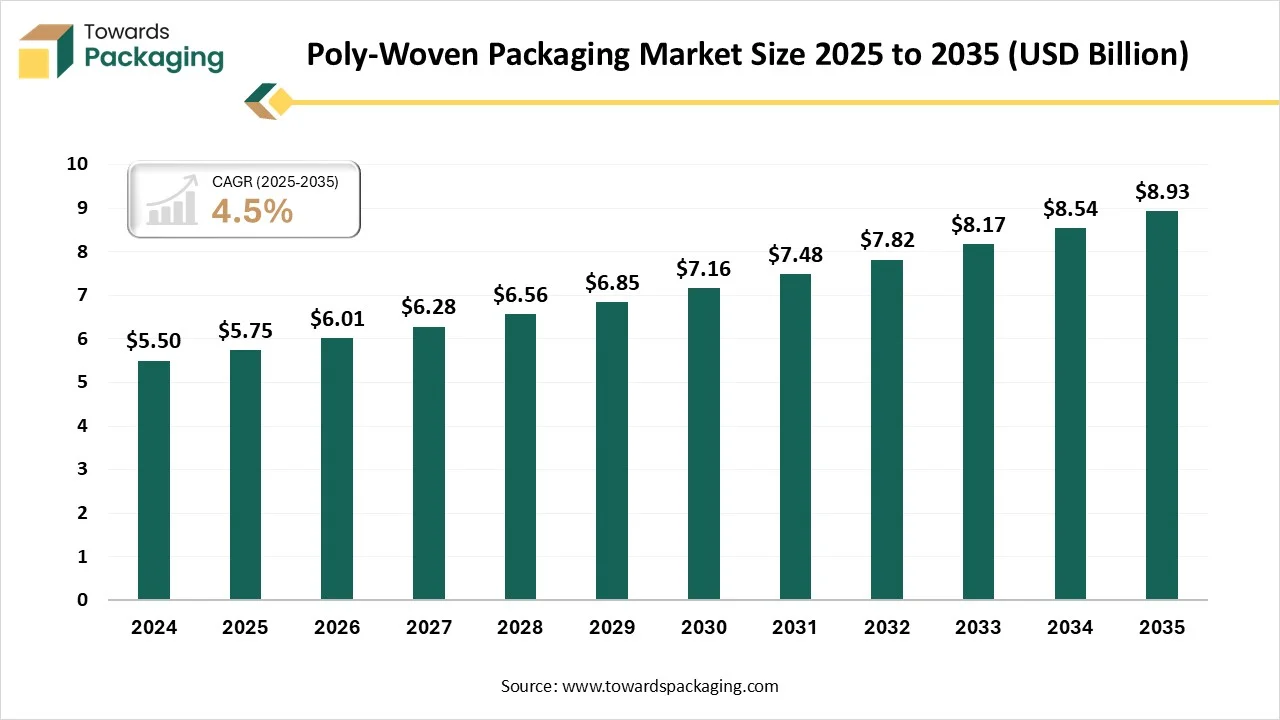

The poly-woven packaging market is forecasted to expand from USD 6.01 billion in 2026 to USD 8.93 billion by 2035, growing at a CAGR of 4.5% from 2026 to 2035. This market is growing due to rising demand for durable, lightweight, and cost-effective protective packaging solutions across apparel, textiles, and premium consumer goods.

The poly-woven packaging market focuses on protective and aesthetically pleasing packaging solutions for clothing, textiles, and high-end goods that are created from blended polymer and wool-based materials. The market is expanding steadily due to rising consumer demand for lightweight, reusable, and damage-resistant packaging. Value added and sustainable packaging. Value-added and sustainable packaging formats are becoming increasingly popular, which is helping the market grow.

Manufacturers are concentrating on better polymer-wool blends to increase durability, flexibility, and wear resistance in the market, which is seeing significant advances in material innovation. High-end clothing and textile products can benefit from the packaging's increased strength and lightweight designs thanks to the use of sophisticated fiber bonding techniques.

With the growing use of automation and precision manufacturing, production technologies are also changing. Manufacturers can increase consistency, cut down on material waste, and scale production effectively with the aid of automated cutting stiching and lamination procedures. Faster turnaround times and improved quality control across packaging formats are made possible by these upgrades.

Manufacturers buy bulk PP and HDPE granules from refineries to create durable plastic threads for weaving.

Key Players: Reliance Industries, ExxonMobil, and SABIC

Supply to Government and Airlines: Large firms secure contracts to provide heavy-duty sacks for national grain reserves and specialized cargo wraps for airline logistics.

Key Players: Klene Paks, Muscat Polymers, and Umasree Texplast

Companies add value through custom printing, UV protection, and moisture-proof BOPP lamination to extend product life and brandin

Key Players: Uflex, Emmbi Industries, and Mondi Group

The polypropylene (PP) segment dominates the poly-woven packaging market in 2025, driven by its low price, high tensile strength, resistance to chemicals, and broad industry applications. PP is compatible with printing and lamination and provides exceptional durability for heavy-duty packaging. Its recyclable nature and ease of processing encourage widespread use in international markets.

The biodegradable/recyclable blends segment is growing at the fastest CAGR during the forecast period, driven by the growing demand for sustainable packaging from consumers and regulators. Eco-friendly PP blends that lessen their impact on the environment without sacrificing strength and flexibility are being introduced by manufacturers. Adoption is speeding up due to increased awareness of plastic pollution.

The medium (10-25kg) segment dominates the poly-woven packaging market in 2025, backed by the fact that it works well with food grains, industrial raw materials, and agricultural products. This capacity is perfect for manufacturers and distributors because it strikes a balance between ease of handling and adequate storage efficiency. Additionally, it satisfies the logical needs of both export and domestic markets.

The bulk/ jumbo (>50kg) segment is growing at the fastest CAGR during the forecast period, driven by the need for large-scale grain chemicals and fertilizer packaging in the industrial sector. For large-scale operations, these sizes lower handling frequency and packaging costs. Growth is further supported by rising investments in logistics infrastructure and bulk storage.

The printed poly-woven packaging segment dominates the poly-woven packaging market in 2025, because of the demands of consumer marketing and brand visibility. Printed packaging helps with labeling, barcoding, and compliance while improving product differentiation. Its extensive use in the retail food and agricultural industries helps it maintain market leadership.

The minimal/ eco-label printing segment is growing at the fastest CAGR during the forecast period, motivated by both legal requirements and sustainability trends. To lessen their impact on the environment, brands are increasingly employing eco-friendly printing methods and limited inks. The need for recyclable and biodegradable packaging is driving adoption even more.

The agriculture segment dominates the poly-woven packaging market in 2025, driven by the high demand for feed grains, seeds, fertilizers, and bulk storage and transportation. Poly-woven sacks are affordable long lasting and moisture-resistant. This sector is supported by robust agricultural production in South America and the Asia Pacific.

The consumer goods & retail segment is growing at the fastest CAGR during the forecast period, driven by household goods, clothing, and packaged food. Convenience, printability, and brand visibility are all provided by poly-woven packaging. Growth in this market is accelerating due to urbanization and e-commerce expansion.

Asia Pacific led the poly-woven packaging market because of population growth, large-scale manufacturing, and agricultural output. Production that is economical boosts competitiveness. Demand for packaged goods is supported by high consumption. Volume usage is driven by strong export activity. Building infrastructure helps regional leadership even more.

India Poly-Woven Packaging Market Trends

The Indian poly-woven packaging market remains strong, backed by infrastructure development, FMCG expansion, and agriculture. Grain, cement, and fertilizer packaging are in high demand. Support for manufacturing by the government increases supply. Increased exports boost consumption. Consumption at home keeps rising steadily.

North America is expects the fastest growth in the market during the forecast period, motivated by retail demand, sophisticated logistics, and sustainability programs. Adoption is aided by the growing emphasis on reusable packaging. Technology innovation improves the performance of products. Growth is supported by high demand from industrial sectors. The growth of e-commerce speeds up market penetration even more.

U.S. Poly-Woven Packaging Market Trends

The U.S. represents a rapidly expanding market for poly-woven packaging, propelled by retail, agricultural, and industrial packaging applications. Robust supply networks facilitate expansion. There is an increasing demand for superior printed packaging. Initiatives for sustainability promote recyclable solutions. Adoption is further supported by the expansion of bulk transportation.

Europe is growing steadily in the poly-woven packaging market, motivated by the need for recyclable packaging and sustainability laws. Usage in industry and agriculture is still high. Innovation is supported by an emphasis on lightweight packaging. Adoption is driven by compliance with regulations. The need for packaging is still present.

Germany Poly-Woven Packaging Market Trends

Germany is a key market in Europe, due to advanced manufacturing and export-oriented industries. High demand from food chemicals and industrial sectors supports growth. Innovation in sustainable packaging is strong. Quality standards drive premium adoption. Logistics efficiency strengthens the market position.

The Middle East & Africa are growing steadily. There is a growing need for robust buk packaging. Usage is driven by the construction and agriculture sectors. Growth is supported by the expansion of contemporary retail. Hubs for logistics increase local demand.

UAE Poly-Woven Packaging Market Trends

The UAE market is supported by strong trade activity and premium packaging demand. Food and FMCG imports drive volume. Logistics and warehousing expansion support adoption. Sustainability initiatives influence packaging choices. Growth in re-exports boosts usage.

South America is an emerging market for the poly-woven packaging market, driven by the expansion of industry and agricultural exports. Grain and fertilizer packaging is becoming more in demand. Enhancing infrastructure facilitates growth. The best packaging options are those that are affordable. Growth in regional trade boosts demand.

Brazil Poly-Woven Packaging Market Trends

Brazil leads the South American market, backed by strong agricultural production and export activity. High demand for bulk packaging supports growth. MFCG expansion drives retail usage. Local manufacturing strengthens supply. Investments in logistics further accelerated market expansion.

Other Players

By Material Type

By Capacity

By Printing Type

By End-Use Industry

By Region

February 2026

February 2026

February 2026

February 2026