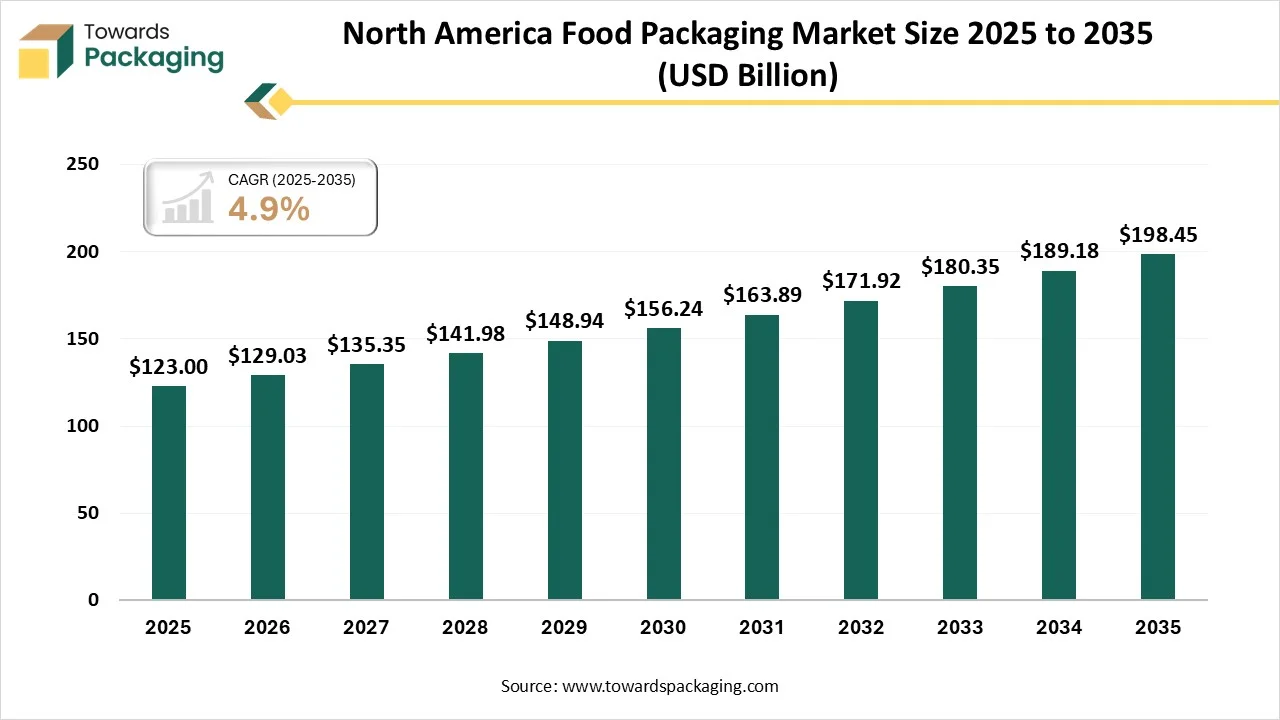

The North America food packaging market is forecasted to expand from USD 129.03 billion in 2026 to USD 198.45 billion by 2035, growing at a CAGR of 4.9% from 2026 to 2035. The urge for food packaging is due to busy and easy -focused lifestyles that drive ready-to-eat (RTE) meal consumption and big demand for food security.

The North America food packaging market encompasses the production, distribution, and application of packaging materials and solutions designed specifically for food products across the United States, Canada, and Mexico. This market includes a wide range of packaging types such as rigid plastics, flexible films, paper and paperboard, glass, metal, and innovative sustainable solutions used to protect, preserve, transport, and display food items from manufacturers to end consumers.

Active packaging counts on materials that communicate with the food or its surroundings to maintain freshness. Moisture absorbers, oxygen scavengers, and antimicrobial films assist in preventing bacterial development and daily spoilage. Such antimicrobial packaging solutions lower food waste and lower the demand for artificial preservatives. Nanotechnology is coming as an updated strategy for food protection. Nano-coatings on packaging materials make antimicrobial barriers that protect against bacterial growth and oxidation. Additionally, nano-encapsulation procedures also enable the controlled release of antimicrobials and antioxidants to store food for a longer time.

The plastics segment dominated the North America food packaging market with approximately 40.8% share in 2025, as polyethylene terephthalate (PET) is prevalently used for food packaging material. They are usually lightweight, transparent, and rigid, which makes it possible to watch them in grocery stores for the packaging of fruits such as cherry tomatoes. As it is recyclable packaging, this material is used for food packaging for online fascinating cuisines like salads, cakes, and bread as well. It efficiently stores carbon dioxide in carbonated beverages through avoidance.

The compostable materials segment is projected to witness the fastest CAGR during the forecast period. PLA has shown that it's a perfect material option for a thermoforming and sheet extrusion die due to its power and performance outcomes. It is manufactured from annually renewable resources. PLA comes to brands and users who select to utilize a third-party certified compostable and safe packaging, which is 100% biobased and low-carbon packaging materials, allowing the changing of both packaging and food scraps, which are far from landfills, into a stretching industrial composting design.

The rigid packaging segment dominated the market with approximately 58.1% share in 2025, as it is filled with a variety of rigid and non-bendable materials. They are the backbone of rigid packaging that needs minute care during production. Its overall meaning is to protect the ingredients from an external mechanical pollutant, to protect the product’s structural design, and to develop the appearance and aesthetics of the product on the shelves. Organizations serve a wide range of commercial and industrial uses for good-quality rigid packaging.

The flexible packaging segment is projected to witness the fastest CAGR during the forecast period. This packaging points to any packaging created from pliable or flexible materials. It classifies rigid packaging, such as plastic containers and glass bottles, that cannot be conveniently folded. The initial defining feature of flexible packaging is reliability. Additives such as aluminum foil, polyvinyl chloride (PVC) and ethylene vinyl alcohol can be used as flexible packaging materials. Flexible packaging is meant to serve convenient usage, extended shelf life, and perfect preservation for the product, along with easier availability for the user.

The traditional packaging segment dominated the market with a share of approximately 62% in 2025, as this packaging is a material and procedure that is greatly used for a long period of time, particularly for those who depend on non-renewable resources. Such packaging types are initially crafted to protect the shelf's life, lower the spoilage, and easily promote mass manufacturing and transport. This packaging is frequently inexpensive. Furthermore, it tends to be made from petroleum-based resources and non-renewable sources.

The smart and active packaging segment is projected to witness the fastest CAGR during the forecast period. Active packaging systems operate by including materials that actively communicate with the ingredients of the package. Such systems can release or absorb various materials present in the packaging environment, which leads to the development of sensitive products. Oxygen scavengers play a crucial role in the active packaging systems, which are crafted to stretch shelf life. They are the real materials that consume oxygen present in the package to make a low-oxygen environment.

The bakery and confectionery segment dominated the market with approximately 38.8% share in 2025 because brown paper is a grounded material which is a classic selection for its cost-effectiveness, simple appearance, and surprising reliability as a reliable option in the real insight of the bakery packaging industry. Hence, while brown paper is reliable in some aspects, it can be less susceptible to moisture, oil, and heavy handling, which can affect the product’s freshness and quality. Vacuum-packed bags are another option as they take protection step further by avoiding air from the packaging, which mainly prevents the development of mold and aerobic bacteria.

The ready-to-eat meals segment is projected to witness the fastest CAGR during the forecast period. Advanced sealing procedures are important. Inventions in hermetic seals and the modified atmosphere packaging (MAP) make sure that oxygen is minimized, hence extension of shelf life, and managing nutrition and flavor is crucial. Such procedures protect the entry of environmental contaminants and microbes that assist in retaining safety and freshness. Such developments are important in making sure that users receive high-quality meals each day.

The United States dominated the North America food packaging market with approximately 84.5% share in 2025, as it is a vital industry within the huge food sector, which is classified by constant invention and growing user choice. It includes a huge range of materials and technologies whose goal is to protect food quality, ensure safety, and develop the shelf life of the product. As the user's urge for sustainability, convenient nature, and health-conscious products develops, the market is experiencing main growth which is driven by regulatory changes, technological advancements, and the moving sector dynamics. Organizations are funding environmental packaging materials, such as recyclable and biodegradable solutions, which can match the eco-friendly conscious users and comply with regulatory requirements.

Trend of Food Packaging Market in Mexico

The Mexican food packaging industry is initially being driven by growing urbanization and updated user lifestyles, which demand portability and convenience in the food products. The growing disposable incomes allow users to spend more on packaged foods, which boosts the demand. Furthermore, the growth of the retail industry, which includes convenience stores and supermarkets, increases the packaging needs. The expanding food processing sector, which is linked with a developing choice for branded and packaged foods, further completes market development.

By Material Type

By Type

By Technology

By Application

February 2026

February 2026

February 2026

February 2026