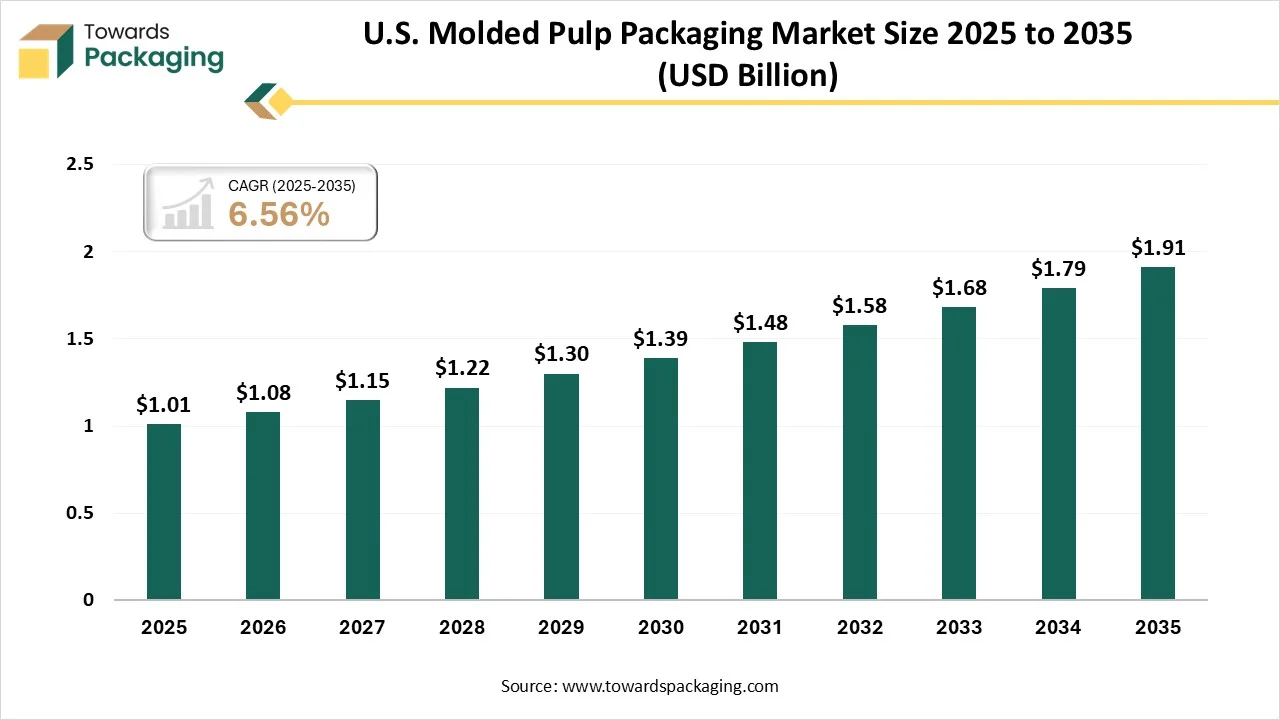

The U.S. molded pulp packaging market is forecasted to expand from USD 1.08 billion in 2026 to USD 1.91 billion by 2035, growing at a CAGR of 6.56% from 2026 to 2035. The push towards recyclable packaging and the expansion of takeout services drive market growth.

The U.S. molded pulp packaging market growth is driven by environmental bans on EPS, a rise in e-commerce, a growing retail industry, regulatory pressure on plastic use, consumer shift towards recyclable packaging, expansion of food delivery platforms, increasing use of protective packaging, robust growth in electronic products, advancement in PFAS materials, and increasing use of food packaging materials.

The U.S. molded pulp packaging market is undergoing a key technological shift driven by demand for lowering energy usage, increased production speed, and enhancing sustainability. The technological shifts like 3D design, smart manufacturing, smart packaging integration, dry-pressing, and automation develops biodegradable products and support advanced manufacturing. The AI integration is a major shift in the industry, driven by demand for lower material usage, enhancing production efficiency, and rapid prototyping.

AI detects microscopic defects in the packaging and reduces material waste. AI optimizes manufacturing parameters and offers better protection for products. AI lowers excess inventory and offers predictive maintenance for machinery. AI easily analyzes improper molding and enhances the machine performance. AI enhances the sustainability of the production process and manages complexities in supply chains. Overall, AI is the automated process that transforms the molded pulp packaging industry by managing diverse variables.

The stage sources raw materials like agricultural waste, flame-retardant agents, recycled paper, plant fibers, virgin wood pulp, and cardboard.

The material processing involves steps like raw material selection, hydropulping, refining, removing impurities, additive incorporation, and slurry adjustment. The conversion includes steps like forming, transfer molding, drying methods, and finishing.

The stage focuses on steps like collecting molded pulp, sorting, repulping, cleaning pulp, processing pulp, and composting.

The wood pulp segment dominated the U.S. molded pulp packaging market in 2025. The increased production of food containers and the stringent regulations for single-use plastics increase demand for wood pulp. The increased use of egg trays and the shift towards eco-friendly packaging require wood pulp. The superior performance, sustainability, cost-effectiveness, and manufacturing versatility of wood pulp drive the market growth.

The non-wood pulp segment is the fastest-growing in the market during the forecast period. The stricter regulations for ES foam use and the strong focus on reducing carbon footprint increase demand for non-wood pulp. The increased utilization of durable packaging and the push for sustainable packaging increases adoption of non-wood pulp. The high availability of agricultural waste and the lower water consumption increases use of non-wood pulp, supporting the overall market growth.

The transfer segment held the largest revenue share in the market in 2025. The increasing need for protecting agricultural products and the prevention of fragile items increases demand for transfer molded pulp packaging. The high production of packaging items and the robust growth in the food service sector require transfer molded pulp packaging. The cost-efficient production, hygroscopic properties, high availability, superior performance, and sustainability of transfer molded pulp packaging drive the market growth.

The thermoformed segment is experiencing the fastest growth in the market during the forecast period. The strong focus on plastic replacement and the increasing use of protective packaging increase demand for thermoformed molded pulp packaging. The surging utilization of food-safe clamshells and the high production of medical devices increase demand for thermoformed molded pulp packaging. The high durability, superior aesthetics, excellent performance, and high precision of thermoformed molded pulp packaging support the overall market growth.

The trays segment dominated the U.S. molded pulp packaging market in 2025. The rapidly expanding food service sector and the focus on maintaining structural integrity in food applications increase demand for trays. The expanding healthcare industry and the increased production of fragile items require trays. The growing packaging of meat & eggs and the increasing use of electronic products increase demand for trays. The high functional utility, cost-efficiency, and sustainability of trays drive market growth.

The clamshells segment is the fastest-growing in the market during the forecast period. The increased consumer awareness about the consumption of fresh prepared foods and focus on protecting fragile items increases demand for clamshells. The robust growth in e-commerce and the increased development of pharmaceutical product increases demand for clamshells. The customization, excellent protective performance, convenience, and superior functionality of clamshells support the market growth.

The food packaging segment held the largest revenue share in the market in 2025. The strong presence of the food processing industry and the increasing demand for meal kits require molded pulp packaging. The popularity of takeout culture and the increasing use of drink carriers increases demand for molded pulp packaging. The strong presence of companies like Sweetgreen, Starbucks, Swiggy, Zomato, and McDonald’s drives the market growth.

The electronics segment is experiencing the fastest growth in the market during the forecast period. The increasing use of consumer electronics devices and the growth in packaging electronics increases demand for molded pulp packaging. The development of complex electronic products and the strong focus on lowering carbon emissions of the electronics industry require molded pulp packaging. The development of sensitive electronic components and the increasing use of mobile phones require molded pulp packaging, supporting the overall market growth.

California is a major contributor to the market. The environmental regulations on EPS and the heavy presence of quick-service restaurants increase demand for molded pulp packaging. The shift towards compostable materials and the well-established agricultural base requires molded pulp packaging. The corporate companies focus on sustainability, and the increasing use of advanced manufacturing technology increases demand for molded pulp packaging, driving the overall market growth.

Washington is rapidly growing in the market. The expanding use of consumer goods and the increasing use of plastic pollution increases demand for molded pulp packaging. The growing number of restaurants and the rise in online shopping require molded pulp packaging. The strong presence of Seattle and the increased transportation of agricultural items require molded pulp packaging, supporting the market growth.

Other Companies

By Source

By Molded Type

By Product

By End-Use

February 2026

February 2026

February 2026

February 2026