U.S. Beer Packaging Market Growth and Segment Analysis

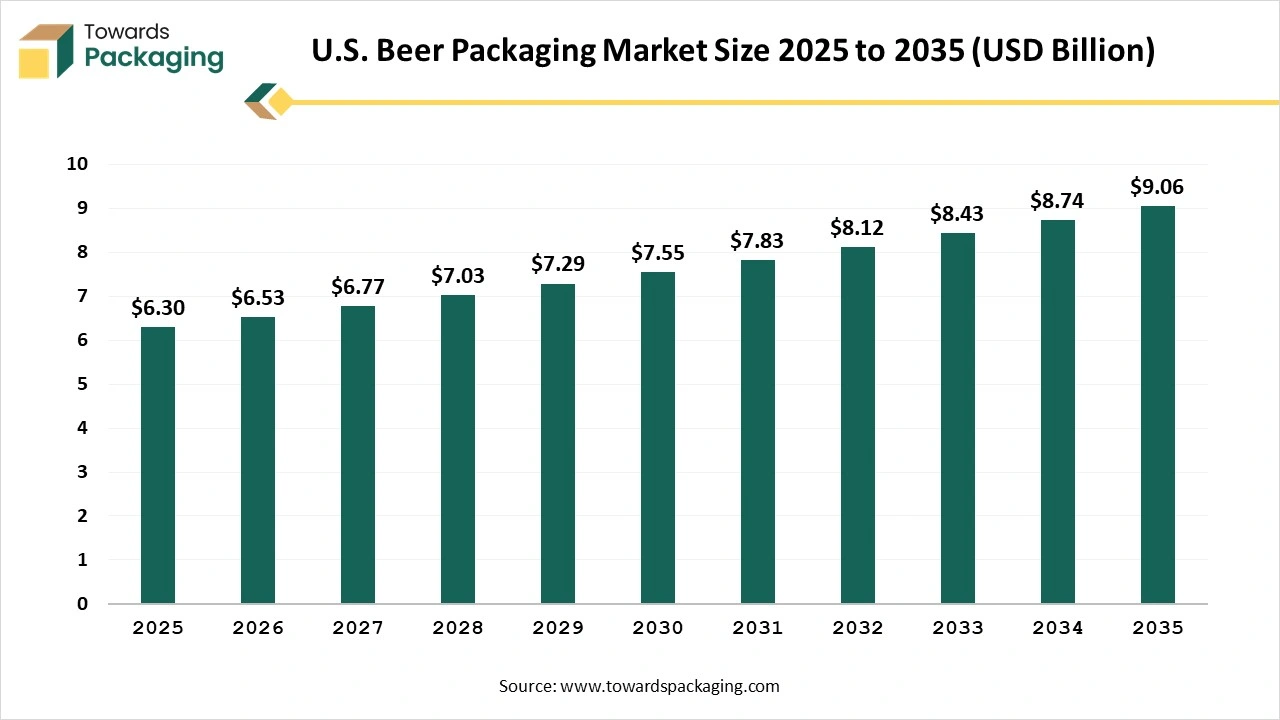

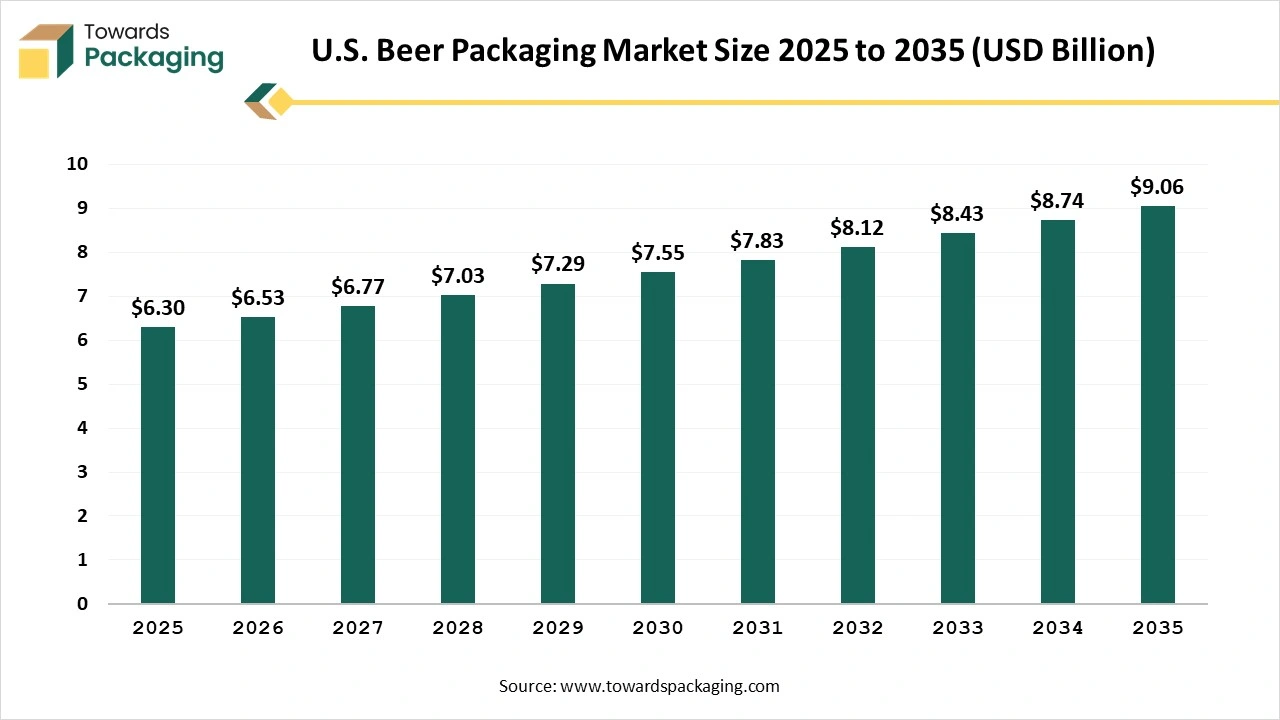

The U.S. beer packaging market reached USD 6.30 billion in 2025 and is set to grow steadily over the forecast period. The market is expected to increase from USD 6.53 billion in 2026 to nearly USD 9.06 billion by 2035, registering a CAGR of 3.7% from 2026 to 2035. Craft brewery expansion continues to drive demand, as brewers adopt innovative packaging solutions to strengthen brand identity and respond to rising consumer preference for premium and sustainable packaging.

Major Key Insights of the U.S. Beer Packaging Market

- In terms of revenue, the market is valued at USD 6.30 billion in 2025.

- The market is projected to reach USD 9.06 billion by 2035.

- Rapid growth at a CAGR of3.7 % will be observed in the period between 2026 and 2035.

- By material, the glass segment dominated the market in 2025.

- By material, the metal segment will be developing at a significant CAGR between 2026 and 2035.

- By product, the bottles segment dominated the market in 2025.

- By product, the cans segment will be growing at the main CAGR between 2026 and 2035.

- By end-use, the breweries segment dominated the market in 2025.

- By end-use, the restaurants and bars segment will be developing at a significant CAGR between 2026 and 2035.

What is the Beer Packaging?

Beer packaging is an important procedure in the manufacturing and sale of such beverages. It includes not only kegging, canning, or bottling beer but also the strategy and aesthetic request of cans, bottles, and kegs, as well as the secondary packaging, which includes paper wraps and cardboard boxes. Every category of packaging has its own opportunities and drawbacks, which affect the user s point of view and product shelf life.

Trends in U.S. Beer Packaging Market

Low-Alcohol and Non-Alcoholic Beers

The tag, named the sober curious movement, has continued to change drinking habits, which has more users finding flavorful alternatives to regular alcoholic beverages. Craft brewers are taking the lead with a variety that serves complicated and hop-forward selections.

Local and Hyper-Local Ingredients: Brewers are shifting to local ingredients to make different flavors and assist the regional agriculture. They have set hops which are developed in nearby farms to heirloom grains and locally made foraged fruits.

Sustainability in Brewing

Breweries are accepting green practices like carbon -neutral brewing procedure, the usage of renewable energy, and water protection. Some are even discovering circular economy designs that are shifting grains into edible products such as animal feed or granola bars.

Beer Tourism and Experiences

Beer tourism is developing in the current year 2025 with a fervor that moves to dissolve brewery trails, participate in huge experiences like brew-your-own beer workshops, and even attend beer festivals. Breweries are finding taproom upgrades that make welcoming spaces that double as community centers.

Technological Developments in the U.S. Beer Packaging Market

The technological growth in the beer packaging industry is experiencing a drastic change as the efforts to make a truly closed-loop recycling system for aluminum cans are receiving attention globally. Organizations are funding smoother collection, classification, and reusing the technologies to make sure that used cans are constantly reused with less wastage. Lowering energy usage in can manufacturing is overall a significant focus for producers. Additionally, inventions such as low-temperature can make, advanced water-saving procedures, and solar-powered canning facilities will help make the canning sector more eco-friendly.

Trade Analysis of the U.S. Beer Packaging Market: Import & Export Statistics

- U.S. Beer packaging import data between June 2024 to May 2025, as the buyers globally imported 193 shipments of U.S. beer packaging.

- Such shipments were expedited by a total number of 193 exporters and bought by 151 official worldwide buyers.

- Colombia, Vietnam, and Russia have come up as the top three U.S. beer packaging importing countries.

- Vietnam, Germany, and Russia are the leading 3 exporting countries.

- Vietnam has exported 410 shipments, followed by Germany with 270 shipments, and Russia has exported 255 shipments, respectively.

U.S. Beer Packaging Market - Value Chain Analysis

- Package Design and Prototyping: Current beer package design has maintained a balance between brand storytelling, functional sustainability, and shelf visibility. There is a rigid move towards eco-friendly materials, like recycled paperboards, plastic-free round cans, and even experimenting with paperboard bottles.

- Recycling and Waste Management: Recycling beer bottles has saved crucial energy as compared to manufacturing new glass from raw materials. It lowers greenhouse gas emissions, stores valuable materials in circulation patterns, and protects natural resources like limestone and stands. Several recycling initiatives have adopted colored glass bottles and processed them separately in order to protect the quality.

- Logistics and Distribution: Several beverages are being transported within temperature ranges. Refrigerated trucks are necessary for protecting quality and freshness. For instance, craft beers or wines can be compromised if exposed to too much heat or sunlight, which makes temperature control a leading priority in beverage logistics.

Segmental Insights

Material Insights

How Glass Segment Dominated the U.S. Beer Packaging Market in 2025?

- The glass segment dominated the U.S. beer packaging market in 2025 as the initial reason for the perfection of taste and its potential as a beer bottle. Glass is an inert material, which means it does not react with beer, ensuring that it tastes accurately as they brew deliberately, without any pollutants from the packaging. Furthermore, dark glass beer bottles, like green beer bottles and brown beer bottles, protect against ultraviolet light. UV exposure can lead to beer making a sneak taste, which is a common problem with clear packaging.

- The metal segment is projected to witness the fastest CAGR during the forecast period. This packaging, regardless of template or aluminum, serves unmatched benefits in sustainability, durability, cost-effectiveness, and user preference. As the beverage companies are progressively giving importance to environmental responsibility and consumer satisfaction, metal packaging has continued to develop not only as another choice, but as the latest sector standard. Recycling aluminium can save up to 955 of the energy consumption needed to generate current aluminum from raw materials. Such major energy effectiveness converts into lower manufacturing costs and lower environmental impact.

Product Insights

How Bottles Segment Dominated the U.S. Beer Packaging Market in 2025?

- The bottles segment has dominated the U.S. beer packaging market in 2025 because it utilizes glass containers, which allows beer producers to expand the shelf life for their product, enabling them to perfectly track their catalog, quality, and brand reputation. Glass as an inside element means it preserves the ingredients inside to avoid the pollutants from external factors. Like plastics that record essence, it releases the toxic elements, but glass does not modify the contents aroma or flavor.

- The cans segment is expected to experience the fastest CAGR during the forecast period. Cans present a packaging solution for every drink. It is a perfect design for carbonated and non-carbonated beverages like energy drinks, soft drinks, beer, juices, wines, and flavored alcoholic beverages through dairy and water products too. These cans are easy, as they chill quicker than any other packaging type, and the sound of opening a beverage can is an unusual feature of product freshness. Another advantage of beer cans is that they are accessible in different types and sizes, which enables us to select the perfect one. Size lists are as follows: 8.4 oz, 12 oz, 12 oz slim, 12-ounce, 16 oz, 19.2 oz, and lastly 32 oz crowler.

End-Use Insights

How the Breweries Segment Dominated the U.S. Beer Packaging Market in 2025?

- The breweries segment dominated the market in 2025 as the craft beer sector has witnessed a move towards pressure-sensitive labels, particularly for cans. Like regular glue-used labels, pressure-sensitive designs can comply precisely, cover smoothly around the curved surfaces, and enable a huge range of results. Such labels can manage perfectly in cold storage and prevent peeling in humid surroundings, which is an important element for a solid display in a chilled showcase. Apart from these, craft beer users care about sustainability as beer can be shipped in molded pulp containers made from recycled materials, which are completely recyclable.

- The restaurants and bars are projected to witness the fastest CAGR during the forecast period. The hospitality beverage industry carries huge importance, which mainly contributes to a proper financial victory. For several resorts and hotels that track food and beverages running in-house, a quarter of their total amount is made from such services. Such an important share features how guests are being valued on the dining experience during their stays. Different bottle shapes, high-quality digital printing, and embossed glass cans can assist luxury products on crowded back bars easily.

State Level Insights

The U.S. Beer Packaging market is seen to grow notably in California, as it has topped the nation in terms of both the number of craft breweries and the largest manufacturing in terms of number. The state has topped in the production of barrels of craft beers in a year. As the breweries find classification, several of them are searching for some development in the hospitality industry and with stretched offerings beyond a regular beer. The BA and CCBA stay loyal to ensure that every brewer has industry-free availability and align with user demand and update the market trends. On the other hand, value and standard beer segments are witnessing double-digit losses, while the super-luxury segment is premium. Users are excessively selecting their higher quality, and more luxury selections as reliable alterations are the spirits.

Trend of U.S. Beer Packaging Market in Texas

In the center of Texas, a transformation is brewing as it has changed how locals appreciate beer. The craft beer scene has been discovered over the past decade, with local breweries coming up like wildflowers after a good season. As per the Texas Craft Brewers Guild (TCBG), approximately 300 little independent breweries are now operating across the entire state. Such a place not only invests mainly in local economies but also demands, like with Texans who ensure quality skills in their beverages.

Recent Developments in the U.S. Beer Packaging Market

- In February 2025, Atmos Zero was on a mission to update steam and become the first to produce industrial steam heat pumps in the United States. Hence, it has manufactured its primary commercial-range Boiler 2.0 product at the AtmosZeto factory.

- In June 2025, LIDL has disclosed a US food and drink range in terms of stores, which includes beer, encouraged by the Simpsons, as the supermarkets latest range has been classified by shoppers this week and counted Frappe drinks as the latest crisp flavors.

DS Smith and Martins Brewery have legally partnered to make a sustainable fiber-based 6-packhandle packaging solution that has made a memorable experience, which encourages the purchasing and unboxing experience of the brewerys users.

Top Companies in the U.S. Beer Packaging Market

- Amcor plc

- ALPLA

- Ardagh Group S.A

- Smurfit Westrock

- Crown

- Gamer Packaging

- O-IPS

- Berlin Packaging

- CCL Industries

- CANPACK

U.S. Beer Packaging Market Segmentation

By Material

- Glass

- Plastic

- Metal

- Other

By Product

By End-Use

- Breweries

- Restaurants & Bars

- Convenient Stores

- Liquor Stores

- Others