Flow Wrap Packaging Market Trends, Growth and Market Size Analysis

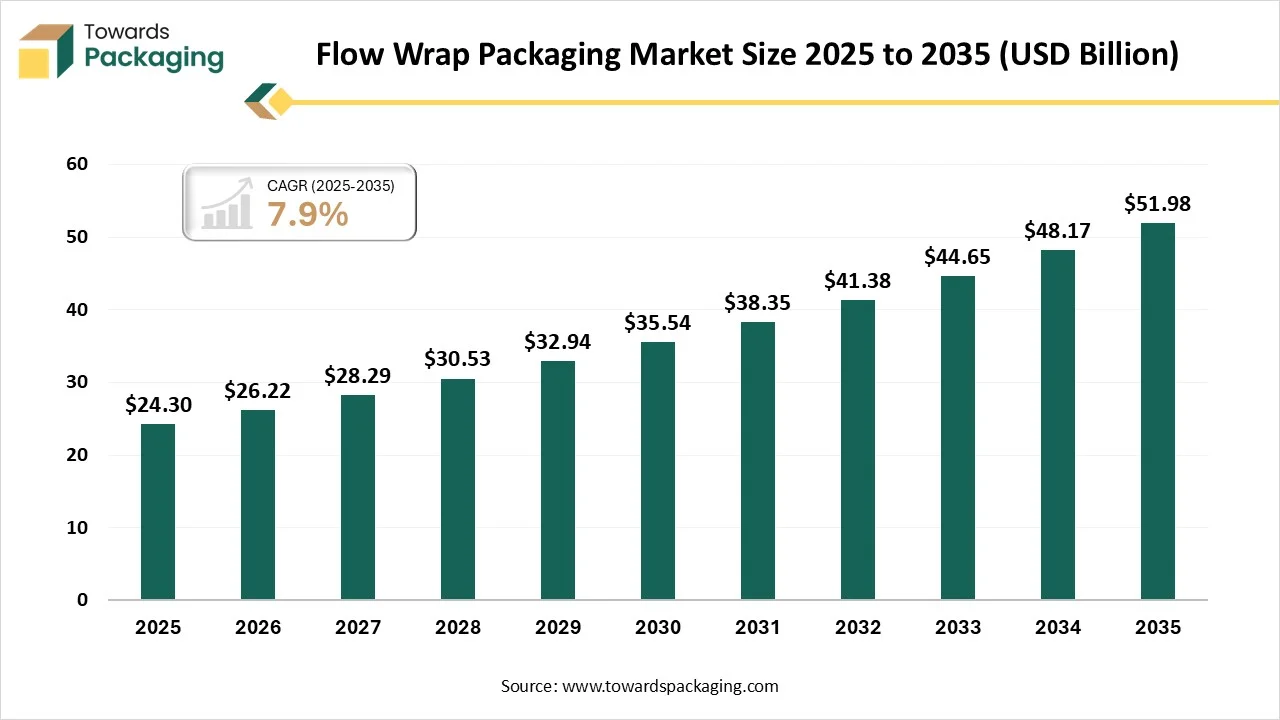

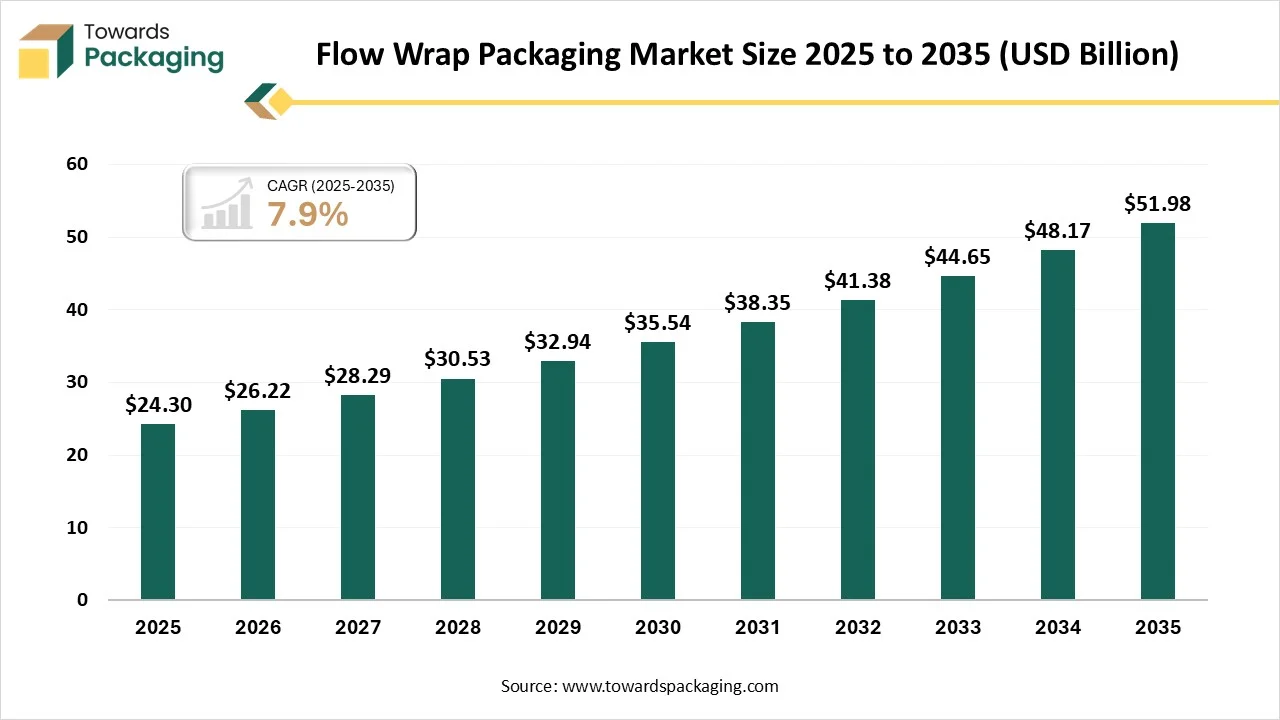

The flow wrap packaging market is forecasted to expand from USD 26.22 billion in 2026 to USD 51.98 billion by 2035, growing at a CAGR of 7.9% from 2026 to 2035. The flow wrap technology develops automation by growing the packaging automation, speed, and tracking the constant sealing quality by lowering the material waste and developing a tamper-evident and protective seal.

Major Key Insights of the Flow Wrap Packaging Market

- In terms of revenue, the market is valued at USD 24.3 billion in 2025.

- The market is projected to reach USD 51.98 billion by 2035.

- Rapid growth at a CAGR of 7.9% will be observed in the period between 2026 and 2035.

- By region, Asia Pacific dominated the global market by holding the highest market share in 2025.

- By region, North America is expected to grow at the fastest CAGR from 2026 to 2035.

- By material, the plastic segment dominated the market in 2025.

- By material, the paper-based segment will be developing at a significant CAGR between 2026 and 2035.

- By application, the packaged snacks segment dominated the market in 2025.

- By application, the chocolate & confectionery segment will be growing at a main CAGR between 2026 and 2035.

- By end-use, the food & beverages segment dominated the market in 2025.

- By end-use, the medical and pharma segment will be developing at a significant CAGR between 2026 and 2035.

What is Flow Wrap Packaging?

Flow wrapping is a packaging procedure in which a product is kept on a polypropylene or polyethylene sheet that is shifted horizontally and packed at both ends. The most prevalent type is a horizontal flow wrapper. This procedure is also called horizontal bagging, crimp seal wrapping, fin seal wrapping, and pillow pouch packaging.

It is an airtight form of packaging. The escape of oxygen prevents the product from linking with moisture and any airborne pollutant, like dust. This also assists in protecting the shelf's life and perfect freshness.

Trends in Flow Wrap Packaging Market

- High-Contrast Graphics: High-contrast graphics are ideal for attention-grabbing statements with any packaging. Flow wrap packaging is being packed with contrast graphics with bright and complementary colors, which makes a bold and visual effect.

- Bold Colors and Shapes: Bright colors, saturated, and geometric shapes are a trendy selection this year, particularly for retro-checked designs, as they have a bold strategy, which can be a perfect way to catch a user's eye. To decode a shape, we must know how to measure a box to select the correct shape and style depending on the dimensions of the product.

- Complementary Illustrations: Hand-painted factors have been one of the biggest design trends for the last few years, and huge brands and organizations are using designs in their product packaging. It counts everything with respect to flow wrap packaging, such as 3d Design, line art, and geometric patterns.

- Strategic texture is set to become the main product packaging trend. It is the opposite of the famous belief and texture and is the latest in branding and earthy, natural products.

Technological Developments in the Flow Wrap Packaging Market

Plastic flow wrap creates an airtight barrier that extends the shelf life and lowers food waste. Flow wrap technology makes protective and rigid seals that protect against leaks and tears, which serve the main advantages from a perfect hygiene point of view. While the expanded life and lower pack weight were the significant advantages of shifting the complete product to flow wrap.

On the other hand, secure seals also point to a perfect user experience for luxury products like cakes and biscuits, while removing the oxygen, which makes life longer and the products that remain longer or fresher.

Trade Analysis of Flow Wrap Packaging Market: Import & Export Statistics

- Between the period May 2024 to April 2025 buyers have officially imported 32 shipments of flow wrap packaging.

- Such shipments were being assisted by 32 exporters and purchased by 31 global buyers, which shows 3% development compared to the last twelve months.

- India, Nepal, and Russia are the top three flow wrap packaging importing countries and China, India, and Pakistan are the major 3 exporting countries.

- Globally, the top three importers of the wrap packaging are Vietnam, Ukraine, and the United States, and on the other side, Vietnam, China, and the United States were the three exporting countries in the list.

- Between the period July 2024 to June 2025, buyers globally imported 4,837 shipments of wrap packaging.

- Such shipments were being facilitated by 4,837 exporters and have been bought by 5,496 global buyers that have shown 2% development as compared to the last twelve months.

Flow Wrap Packaging Market - Value Chain Analysis

- Package Design and Prototyping: Flow wrappers are an important part of current packaging automation, which is designed to wrap products in a tamper-evident and protective, appealing film. Such machines play an important role in sectors that need presentable and secure packaging, like pharmaceuticals, food, consumer goods, and stationery, too.

- Recycling and Waste Management: LDPE recycling serves both operational and financial advantages. By classifying LDPE film from usual trash, such facilities lower their waste by reducing their volume and totally avoid the landfill tipping fees too. The accurately wrapped LDPE can also make revenue through recycling markets that serve a measurable return on the materials, which can otherwise go to waste.

- Logistics and Distribution: The stackable and flat design of the packages created by flow pack machines uses the space on shelves and the transport trucks too, which develops the distribution and storage of products. The perfect logistics efficiency is important to save on operating costs.

Segmental Insights

Material Insights

Why Plastic Segment Dominated the Flow Wrap Packaging Market in 2025?

The plastic segment dominated the flow wrap packaging market in 2025, as polyethylene is a widely used plastic in terms of flow wrap technology because of its durability and flexibility. It delivers excellent resistance and mixture, which makes them perfect for food products. PE films are also recyclable, which matches the rising surrounding sustainability efforts. Additionally. PVC is an evergreen plastic that is used in flow wrap packaging for its strength and clarity. It serves as perfect protection against the prevention against pollutants and is frequently used for packaging medical machines, particularly food products, and toys.

The paper-based segment is expected to experience the fastest CAGR during the forecast period. As sustainability becomes important, paper flow wrap packaging solutions are developing. In the current year, organizations are concentrating on biodegradable materials. Such a move means using recycled fibers instead of plastics. The creativity of paper flow wraps is another main advantage. They can smoothly package a huge series of products. From food products to user goods, they serve as a relevant solution. Several producers feature that such wraps can track product freshness while ensuring a requested presentation.

Application Insights

Why the Packaged Snacks Segment Dominated the Flow Wrap Packaging Market in 2025?

The packaged snacks segment dominated the market in 2025 as flow wrap packaging has become necessary in the food packaging sector, which is specifically for frozen foods, cheese packaging, sauces, snacks, and bakery items. Its potential is to create airtight seals that avoid pollutants and expand the shelf life of sensitive goods. For instance, in cheese packaging, polyethylene-based flow wraps make sure that cheese stays fresh while serving a clear and visually appealing appearance for users.

The chocolate and confectionery segment is projected to experience the fastest CAGR during the forecast period. The horizontal flow-wrap machines generate pillow-pack wraps for confectionery and bars. Molten chocolate pieces are being filled into constant film tubes that are being cut and sealed. The high-speed flow wrappers can package thousands of bars per minute. They can carry different chocolate shapes and utilise films as foil and plastic laminates. Flow wrapping machines, which are frequently known for folder-gluers, cover singular chocolates in foil, paper, and bioplastic bands. A specific fold wrapper can cover bars or block-shaped chocolates by folding tight envelopes around them.

End-Use Insights

How the Food and Beverages Segment Dominated the Flow Wrap Packaging Market in 2025?

The food and beverages segment has dominated the market in 2025, as flow wrap machines are specifically useful for the packaging of refrigerated and frozen foods, as they deliver a quick and smooth way to wrap products in preventive films that prevent exposure to moisture, air, and contaminants. Furthermore, for frozen foods, the potential to quickly and protectively monitor products is necessary to track their temperature and protect them from freezer burn. Flow wrap machines can conveniently package products like meats, frozen vegetables, and ready-to-eat meals, which ensures that the packaging stays intact through transport and storage.

The medical and pharma segment is expected to witness the fastest CAGR during the forecast period. Flow-pack packaging serves high protection for the pharmaceutical sector by utilizing a heat-sealing system. Hermetic packages make sure that the fragile products are overall prevented from external contaminants like light, dust, and bacteria, too. Therefore, the quality and productivity of the product are protected throughout its entire lifetime. Moreover, flow pack machines can be used with various film types with particular elements, such as gas resistance and moisture, that are necessary for products that can degrade or oxidize. Films with protective barriers can expand the lifetime limit of products by tracking the smoothness of fragile active ingredients.

Regional Insights

How Asia Pacific Dominated the Flow Wrap Packaging Market?

Asia Pacific dominated the flow wrap packaging market in 2025, as this kind of packaging solution is utilized to wrap products, specifically in the food and beverage sector, which serves protection, expanded shelf life, and ease. Main trends count the move towards sustainable materials, which is the acceptance of digital printing for developed branding, and growing automation in the packaging process. The drivers of development count the growing urge for ready-to-eat products, packaged, and the demand for reliable and smooth packaging for e-commerce, and advances in packaging technology, which improve product appeal and protection.

How is the Flow Wrap Packaging Market Growing in India?

There is a fast entry of online retail and grocery delivery, which has made a surge in demand for lightweight, reliable, and protective packaging that can firmly withstand handling and shipping too. There is a rigid move towards high-speed automation and the AI-driven packaging systems to update manufacturing lines and lower labor costs. So, the flow wrapping is excessively used for blister packs, medical devices, and hygiene products such as sanitizing wipes, which serve as tamper-evident seals and the management of surrounding factors. There is growing environmental alertness and government regulations that are used for single-use plastics, which are encouraging producers towards bio-based, paper-based, and recyclable films, too.

Why is the Flow Wrap Packaging Market Growing Rapidly in North America?

North America expects the fastest growth in the flow wrap packaging market in 2025. It has emerged as an important region in the huge packaging sector, which is driven by the region’s fast-growing user goods sector, which develops the demand for easy foods, and technological developments in the packaging solutions. The flow wrap packaging is classified by its potential to effectively use the products in a constant, smooth film, which serves several benefits such as expanded shelf life, developed product visibility, and lastly enhanced operational smoothness.

Why is the United States using the Flow Wrap Packaging Market Importantly?

The United States flow wrap packaging market is witnessing main development by the growth in packaging technology, the growing urge for flexible packaging solutions across different sectors, and a growing focus on sustainability. As users select the move towards longer shelf life and convenience for packaged goods, producers are investing in inventive machines that develop smoothness, lower waste, and ensure product integrity. The market is also differentiated by a demand for digital integration and automation, which allows for product integrity. The market is also classified by demand in the food and beverage industry, which remains constant as the market is meant for constant development, which is being assisted by regulatory standards and user trends that favour cost-effective and eco-friendly packaging solutions.

Recent Developments

- In December 2025, Barry-Wehmiller's packaging machinery business launch its Hayssen X850, which is a multi-jaw flow wrapper crafted for cheese and other products that need high seal integrity at high speeds.

- In February 2025, A top delivery of connected and smart packaging solutions, named Harpak-ULMA, has revealed the ARTIC SS Chevron, which is a developed horizontal flow wrap machine crafted particularly for pharmaceutical and medical packaging uses.

- In April 2024, Cox & Co revealed that users are currently revealing brands that take sustainability seriously, and the products that are convenient to recycle serve a complete 12-month shelf life, so this enables the brand to stand out from plastics and give users an inside look at recyclable wrapping.

Top Companies in the Flow Wrap Packaging Market

- Constantia Flexibles Group

- Amcor plc

- Huhtamaki Oyj

- MONDI PLC

- Billerud AB

- Sonoco Products Company

- Winpak Ltd

- Polystack Flexible Packaging Ltd

- Asteria Group

- ePac Holdings, LLC

Flow Wrap Packaging Market Segments Covered

By Material

- Paper

- Plastic

- Aluminum Foil

By Application

- Chocolate & Confectionary

- Packaged Snacks

- Bakery Products

- Personal Hygiene Products

- Medical Devices

By End-Use

- Food and Beverages

- Medical & Pharma

- Industrial Goods

- Cosmetics & Personal Care

- Pet Food & Supplies

- Tobacco Products

- Household Products

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA