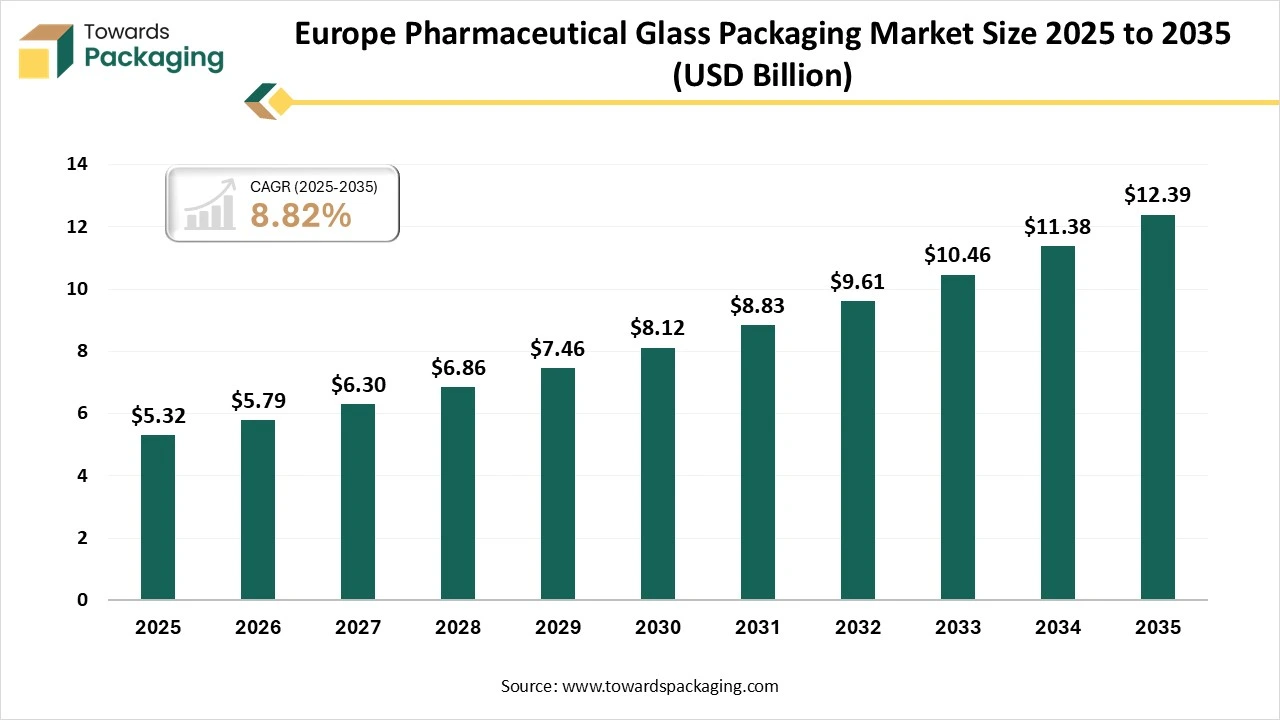

The Europe pharmaceutical glass packaging market is forecasted to expand from USD 5.79 billion in 2026 to USD 12.39 billion by 2035, growing at a CAGR of 8.82% from 2026 to 2035. The demand is due to the growth of biologic therapies and cold chain pharmaceuticals. Europe finds a rigid demand for good-quality borosilicate glass packaging, which ensures drug contamination control, stability, and long-term storage safety.

The Europe pharmaceutical glass packaging market involves the manufacture of primary containment solutions, such as vials, ampoules, and pre-fillable syringes composed of high-purity glass (Types I, II, or III). It is valued for its superior chemical inertness, recyclability, and ability to preserve the stability of sensitive medications and biologics.

Pharmaceutical glass containers serve as a strong barrier against the external factors, such as moisture and oxygen, that can affect drug smoothness. They also enable sterilisation through radiation or heat without adjusting the container's design. Furthermore, glass provides perfect visibility, which allows patients and healthcare staff to check the ingredients conveniently.

Pharmaceutical glass packaging should be relevant, which ensures product protection, patient safety, and tamper evidence too. Inventions such as blow-fill-seal (BFS) vials, child-resistant designs, and anti-counterfeit technologies are developing the latest trends in the sector. Packaging plays a crucial role in serving life-saving medications worldwide in different forms, right from syringes to pills. Additionally, pharmaceutical packaging design is experiencing some serious updates, such as the glass vial. Some of the latest biological drugs have been searched for and delaminate glass, which results in unwanted glass flaking in certain types of solutions. Materials such as silicone oil, which are used for the lubrication of syringe plungers and tungsten, for the making of glass syringe tips, have been connected to causing such feedback.

Regulatory compliance in the pharmaceutical sector is of top importance. The producer of glass containers for the pharmaceutical items should be durable, safe, reliable, and free from leaks and pollutants. The list of important standards to apply while manufacturing and testing pharmaceutical glass products is:

Package Design and Prototyping: The initial job of any pharmaceutical packaging is to prevent its ingredients, and not only just in the link of storing the tablets dry or protecting the glass vials from breaking. It should definitely guard against the light, moisture, and contamination- possibly most crucially, tampering too. A perfectly-crafted package, hence, will have a tamper-evident characteristic that displays if anyone has tampered with the product.

Recycling and Waste Management: Glass waste, whether it is broken or hard, should be cleaned before every disposal into an accurate glass waste container. Glass waste containers are generally labeled broken glass boxes, which are easily accessible from laboratory vendors, but a hard and labeled cardboard box that has a plastic liner and a sealable lid, which is accurate.

Logistics and Distribution: The European Medicines Agency (EMA) delivers in-depth information about the packaging and transportation of pharmaceutical products. It is crucial that transportation organizations match the EMA’s Good Distribution Practice (GDP), which includes different aspects such as temperature transport, humidity control, and traceability. Vaccines and medicines that are fragile to temperature should be transported in managed conditions.

The bottles segment has dominated the Europe pharmaceutical glass packaging market with approximately 38% share in 2025, as glass bottles are prevalently used for the packaging of medicines, which range from oral liquids and pills to injectable solutions. Because of its protective and inert nature, glass packaging material is the selected choice of several pharmaceutical organizations, which ensures that the medicine inside is being protected from oxidation, contamination, and degradation. Glass packaging serves as a perfect barricade against environmental factors such as oxygen, moisture, and light. This is particularly cruel for strong and fragile medicines such as biologics, vaccines, and antibiotics, which are exposed to degradation due to air exposure.

The ampoules segment is predicted to experience the fastest CAGR share during the forecast period. Ampoule glass has developed as a consistent option that lowers drug-container communication risk and protects the therapeutic smoothness of medications. Ampoule glass is being crafted to meet strong standards, which include EP, USP, YBB, ISO, and JP. Such regulations make sure that the glass aligns with strict safety and quality needs for pharmaceuticals. By using an ampoule glass that sticks to such standards, producers can mainly lower the risk of chemical leaching and pollutants. Such compliance not only develops trust among the end-users but also develops the complete safety profile of the medications.

The type I (borosilicate) segment has dominated the Europe pharmaceutical glass packaging market with approximately 55% share in 2025, as they are greatly used in the pharmaceuticals because of their high resistance to thermal chemicals and shock. Accurate sterilization ensures product compliance and safety, which is in line with global standards. They are ideal because of their addition of boron oxide, which lowers the rate of thermal growth, as well as develops resistance to water attack and fast temperature updates. For injectable aim, even a microdose of leachables can spell failure. Borosilicate glass ensures zero adjustment. This is the reason why vaccine producers from Serum Institute and Pfizer use Type 1 glass bottles for complicated dose pollutants.

The type II segment is predicted to experience the fastest CAGR share during the forecast period. They are made of soda-lime glass, which is generally made by sulphurization to dealkalize the glass surface. Such transformations develop the hydrolytic opposition of the glass, and it can be utilized in aqueous solution as well as in some acidic or neutral injectable solutions. Type III glass is an economical adjustment for producers that operate with less fragile formulations, which have constant parenteral delivery.

The branded drugs segment dominated the Europe pharmaceutical glass packaging market with approximately 45% share in 2025, as ampoules and prefilled syringes, like ready-to-use and sterile forms, are crucial in clinics and hospitals where accuracy and safety are important. The growth of any pharmaceutical package should stick to strong standards. Regulatory bodies like EMA in Europe, and other worldwide health officials, apply pharmaceutical packaging rules that cover everything from labelling the materials to traceability and tamper prevention.

The generic drugs segment is predicted to experience the fastest CAGR share during the forecast period. They do not have any brand name and are generally classified by their current active ingredient name, and such packaging may not convey any brand-specific elements. Various regulations and demands may be applied to the packaging of branded and generic drugs. They are aligned to particular demands linked to labelling, bioequivalence, and the packaging consistency with the reference branded product. Various producers may have their own packaging choice for generic drugs. This can be encouraged by elements such as manufacturing procedure, cost, and the supply chain selections.

Germany has dominated the Europe pharmaceutical glass packaging market in 2025 as it is initially driven by the growing demand for vaccines, injectable drugs, and highly confidential biologic formulations that need perfect barrier elements and chemical inertness. Glass packaging, particularly, has Type I borosilicate glass, which has remained the gold standard for tracking the drug stability and the purity. The driving factors that require strict regulatory checks on drug safety have developed for the global vaccination program.

The Europe pharmaceutical glass packaging market is growing in the United Kingdom because it is initially being driven by the growing demand for effective and safe medication delivery systems. There is a growing commonness of chronic diseases and an aging population, which leads to greater medication usage and creates the need for reliable packaging solutions. Additionally, the move towards eco-friendly and sustainable packaging selections pushes the producers to accept glass over plastics, which gives it recyclability. Technological developments in production procedures also improve the product quality and lower the costs, which makes glass bottles more attractive.

By Product Type

By Glass Type

By Drug Type

February 2026

February 2026

February 2026

February 2026