Middle East Seafood Packaging Market Growth, Demand and Production Forecast

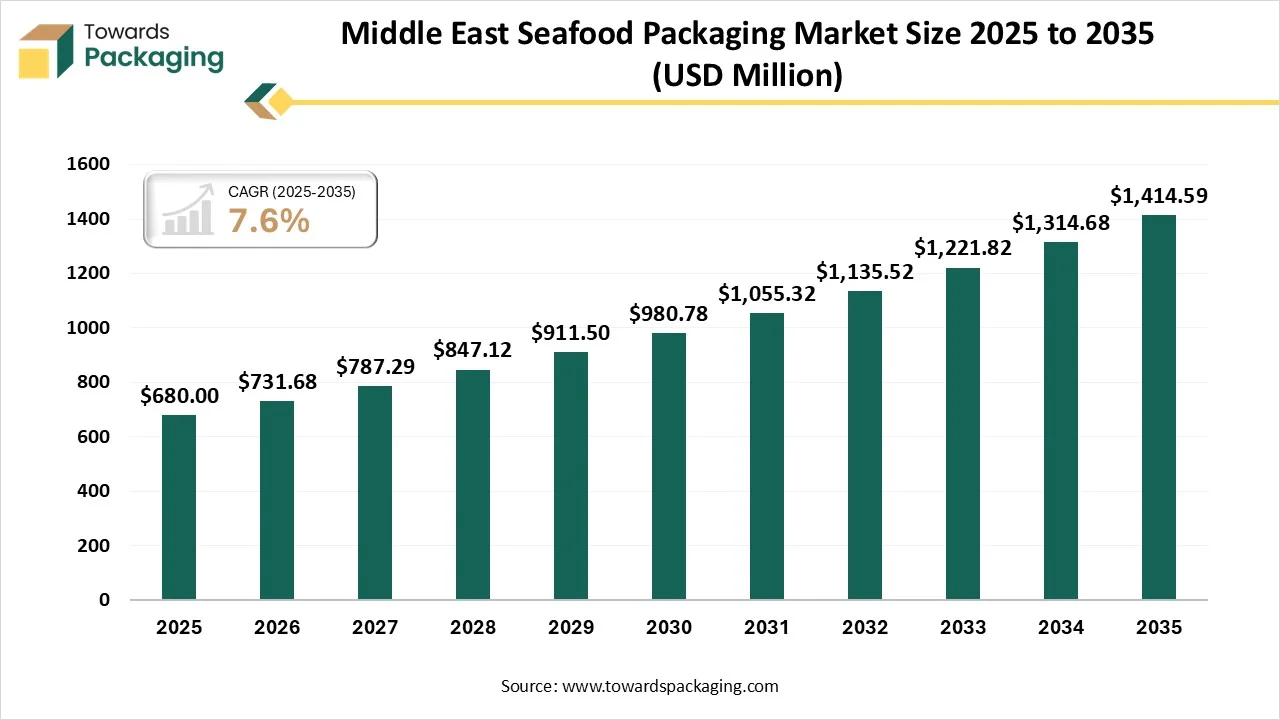

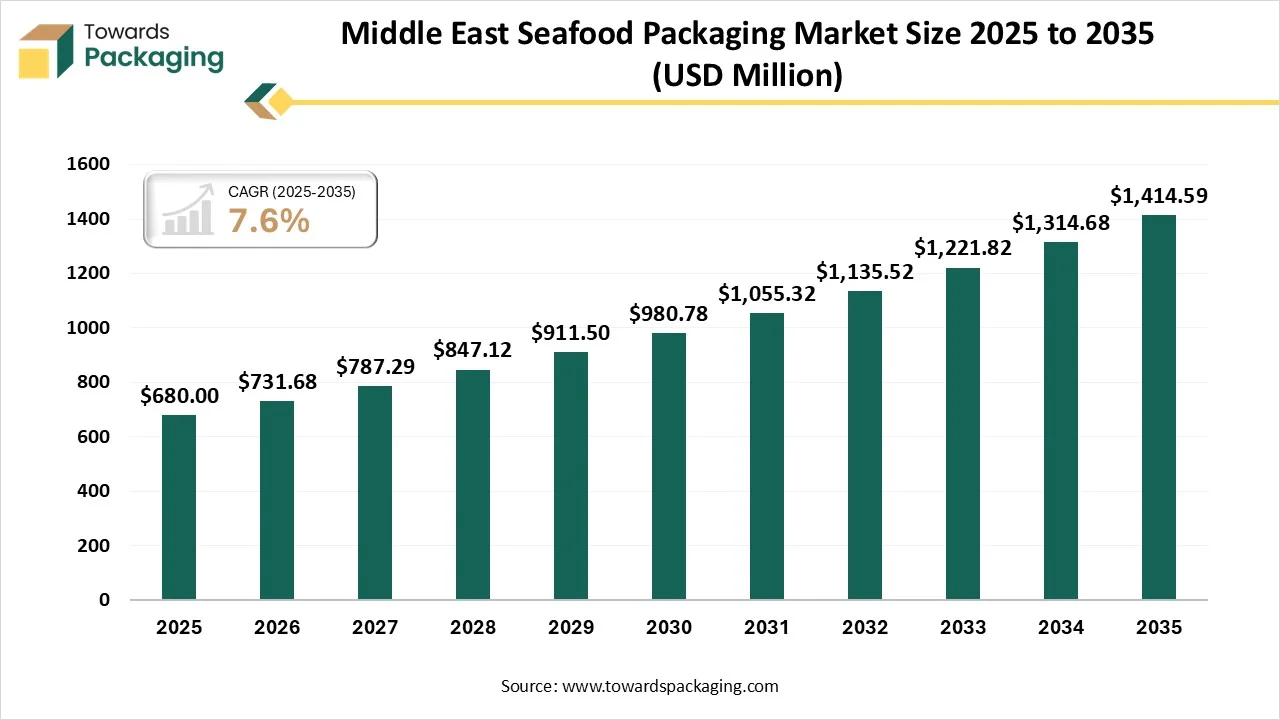

The middle east seafood packaging market is forecasted to expand from USD 731.68 million in 2026 to USD 1414.59 million by 2035, growing at a CAGR of 7.6% from 2026 to 2035. The growth is increasingly driven by the GCC’s high per capita seafood consumption and a strategic shift toward localized aquaculture and food security.

Major Key Insights of the Middle East Seafood Packaging Market

- In terms of revenue, the market is valued at USD 680 million in 2025.

- The market is projected to reach USD 1414.59 million by 2035.

- Rapid growth at a CAGR of 7.6% will be observed in the period between 2026 and 2035.

- By material type, the plastic segment has dominated the market with approximately 51% share in 2025.

- By material type, the paper and paperboard segment will be developing at a significant CAGR between 2026 and 2035.

- By packaging technology, the modified atmosphere packaging segment has dominated the market with approximately 45% share in 2025.

- By packaging technology, the retort packaging segment will be growing at a significant CAGR between 2026 and 2035.

- By end-user, the fresh and chilled seafood segment has dominated the market with approximately 40% share in 2025.

- By end-user, the processed and ready-to-eat segment will be developing at a fastest CAGR between 2026 and 2035.

- By seafood type, the fish segment has dominated the market with approximately 54% share in 2025.

- By seafood type, crustaceans will be growing at a significant CAGR between 2026 and 2035.

What is the Middle East Seafood Packaging Market?

The Middle East Seafood Packaging Market refers to the regional industry focused on the packaging of seafood products such as fresh fish, frozen seafood, shellfish, and processed seafood for distribution, retail sale, foodservice, and export across Middle Eastern countries. This market encompasses a range of materials (like plastic, paperboard, metal), packaging technologies (e.g., vacuum packaging, modified atmosphere packaging), and formats (trays, pouches, bulk containers) designed to protect seafood quality, extend shelf life, ensure food safety, and meet regulatory and consumer expectations for hygiene and sustainability.

Trends in Seafood Packaging

- Sustainability: Sustainability remains one of the most complicated seafood trends. Certifications such as ASC and MSC are excessively necessary in both complete mergers and user-experience shelves. Suppliers and retailers are predicted to accept environmental responsibility.

- Premiumization Develops Value across the Chain: Consumers are finding advanced-level seafood with crystal-clear proof, nutritional assurance, and artisanal making. Sashimi-grade cuts and thick dry-aged fish are the main choices. Private-label seafood is also witnessing a demand, as retailers seek to increase margins and construct brand commitment with luxury and exclusive servings.

- Alternative and Plant-based Seafood: This is another trend as the growth of plant-based and lab-cultivated seafood increases. Such alterations are crafted to align with sustainability goals while meeting the needs of vegan, flexitarian, and allergy-fragile markets. Suppliers are funding innovation; on the other hand, retailers are stretching the shelf space for such developing products.

- End-to-End Traceability: Compliance progress, such as FSMA 204 compliance and developing Seafood HACPP standards, is encouraging suppliers to accept the digital systems that ensure both food safety readiness and traceability. Vendors are using QR codes, blockchain, and mixed ERP systems, while retailers have an advantage from loyal sourcing stories and clean labelling.

- Health-Focussed Products overcome user Interest: Seafood stays constant in health -focussed diets, particularly those concentrated on heart health and high protein. Items that are rich in omega-3s are lower in mercury, and are responsibly linked to a high urge. Health -based marketing and clear nutritional labelling are necessary to stand out in a crowded industry driven by wellness-driven seafood trends.

Technological Developments in the Middle East Seafood Packaging Market

One of the most revolutionary inventions in seafood packaging is the use of Artificial Intelligence (AI). High-level AI systems can now check the quality of fish and freshness too, with perfect precision. Such innovative solutions make sure that only luxury-grade fish reach the industry, therefore expanding user trust and satisfaction. Maintaining the cold chain from the grab to the user is complicated. Technological inventions in smart logistics and cold storage are enabling seafood suppliers to manage humidity, temperature, and transform time in real-time. IoT-allowed sensors can make ware vendors aware of any disturbances in the cold chain.

Middle East Seafood Packaging Market - Value Chain Analysis

- Package Design and Prototyping: Skin packs are a compilation of carded packaging materials that are prevalently used to package seafood, such as fish fillets. With a skin pack, a slim film of transparent plastic covers the seafood product and a paperboard backer, which is then used. Furthermore, skin packs have the same kind of texture and aesthetic as blister packs.

- Recycling and Waste Management: Recycled expanded polystyrene (EPS) boxes are gaining attention as a sustainable option that tracks the thermal efficiency needed for frozen fish logistics and transportation. Also, cardboard packaging and moisture-resistant coated cardboard boxes are being accepted in particular markets. Such materials develop waste management and are conveniently recyclable.

- Logistics and Distribution: In current seafood logistics, visibility is non-adjustable. While regular temperature data loggers serve retrospective insights, constant and real-time tracking has become relevant for high-value shipments. Multi-point seniors manage multiple pallet positions and atmosphere cabin temperatures, which check localized problems before they can affect the cargo.

Middle East Seafood Packaging Market Segmental Insights

Material Insights

How Plastic Segment Dominated the Middle East Seafood Packaging Market in 2025?

The plastic segment dominated the Middle East seafood packaging market with approximately 51% share in 2025 as particular packaging material are needed for various seafood products such as PET (Polyethylene terephthalate), which is a plastic that has perfect clarity and can be recycled, PP (polypropylene) is opposing to heat and assist in microwaveable products and PE (polyethylene) is an insightful for its sealing features and is used in skin packaging. Hence, high -barrier plastic films store moisture and oxygen from transferring to seafood for a longer shelf life.

The paper and paperboard segment is expected to witness the fastest CAGR during the forecast period. Frozen food packaging uses technical paperboard, which is crafted to firmly withstand different issues of freezing and storage. Crucial characteristics include unavoidable moisture-resistance, less temperature tolerance capacity, and edge wicking opposition, which lowers the liquid absorption at the corner to track packaging accountability. They are most commonly used for seafood packaging, like shrimp.

Packaging Technology Insights

How Modified Atmosphere Packaging Segment Dominated the Middle East Seafood Packaging Market in 2025?

The modified atmosphere packaging segment has dominated the Middle East seafood packaging market with approximately 45% share in 2025, as MAP points to replace the air in a package of fish with various combinations of gases, specifically some combination of nitrogen, oxygen, and carbon dioxide. The ratio of every element gas is permanent when the mixture is released, but no future control is applied during storage, and the combination of the mixture may slowly update. The storage lifecycle of chilled products, particularly white fish, can be stretched by packing in a modified atmosphere.

The retort packaging segment is projected to experience the fastest CAGR during the forecast period. Retort pouch packaging shows a standard food protection technology that uses flexible and multilayered pouches that are designed to withstand high-temperature thermal processing. From salmon to tuna to shellfish and the fish curries, retort pouches have become the go-to choice for producers seeking to make easy and shelf-stable seafood products that users can store in their kitchens and make quickly whenever needed.

Application Insights:

How Fresh and Chilled Seafood Segment Dominated the Middle East Seafood Packaging Market in 2025?

The fresh and chilled seafood segment dominated the market with approximately 40% share in 2025 because fresh seafood, such as salmon, cod, and tuna, is packaged in modified atmosphere packaging, shrink wrapping, and skin packaging to manage the freshness and color. Prawns, shellfish like shrimps, and carbs are packaged by using an atmosphere packaging and the tray packing procedures. This commands odor and protects the food. Vacuum packaging or thermoforming has high-volume manufacturing, which develops smoothness and cost-effectiveness.

The processed & Ready-to-Eat segment is expected to witness the fastest CAGR during the forecast period. Ready-to-eat packaging means to pack food solutions that are crafted to store pre-cooked or minimally made meals safely, fresh, and easy for consumption. Such solutions are necessary in assisting the current lifestyle that values portability, convenience, and less preparation time. As more users urge for on-the -go meals and reliability, producers need to make sure that packaging solutions match that dynamic lifestyle while protecting freshness, lowering the food waste, and protecting against external pollutants.

Seafood Type Insights

How Fish Segment Dominated the Middle East Seafood Packaging Market in 2025?

The fish segment dominated the Middle East seafood packaging market with approximately 54% share in 2025 as proper packaging procedures are involved, which lowers the tunnel inside the package, as lowering the air exposures is important to restrict chemical updates, which can affect the taste and texture of the seafood. Furthermore, labelling packages that have a date of storage, and the kind of seafood can be an assistance to accurate inventory management and timely usage. Accepting such strict packaging manages the product’s quality and ensures that the seafood stays safe for usage, which protects its nutritional and sensory elements for an extended period.

The crustaceans segment is predicted to experience the fastest CAGR during the forecast period. Seafood has always been a crucial feature in the food traditions of the Gulf. Fish has been chosen as a staple meal and a crucial part of the meal served in Gulf cuisine. Spiced rice with simmered fish, machboos, and grilled hammour (grouper) is selected for the chosen dish. The huge coastline of the Gulf and the accessibility of fresh seafood are necessary for everyday and festive occasions too, which is an accurate reflection of the traditions and bonds that the region shares with the ocean.

Country Insights

How Saudi Arabia has Dominated the Middle East Seafood Packaging Market?

Saudi Arabia has dominated the Middle East seafood packaging market as the fish packaging and processing plant serves drying, freezing, and packaging services for different types of fish such as prawns, pasta fish, catfish, squid, shrimp, and coho salmon. From the Vision 2030 point of view, with the Public Investment Fund (PIF) pouring billions into the tourism sector, the number of resorts and hotels is expanding quickly, which creates sustained demand for luxury food and beverage products.

Furthermore, a young and perfectly-travelled population is driving the urge for a huge variety of international cuisines, plant-based options, healthy alterations, and luxury and authentic contents too. Also, analysing the safety and quality of sensitive goods, from fresh produce and dairy to luxury meats and seafood, needs a world-class transportation network.

The seafood packaging market is growing in the UAE because it’s becoming a central point in the UAE’s food security methods. With imports that are dominating the seafood industry, the government is pouring resources into the aquaculture projects. Entrepreneurs who wish to penetrate into a seafood supply chain, whether with the assistance of freezing, processing, cold-chain distribution, and packaging, will seek a high-development category that matches accurately with the UAE’s sustainability goals.

- In July 2025, the UAE’s fisheries and aquaculture had experienced major growth, which is supported by a national method that balances sustainability, economic classification, and food security.

Trend of Seafood Packaging in Egypt: Cold storage availability in Egypt is important for managing the quality and expanding the shelf life of sensitive products such as vegetables, fruits, seafood, and dairy. In another scenario, the government has created waves in developing its cold storage link, specifically around major ports such as Damietta, Alexandria, and Port Said. Growing and updating cold storage potential, particularly by having effective and technologically advanced machines, is complicated in order to help Egypt’s aim of growing agricultural exports, aligning with international quality standards, and decreasing the food waste throughout the supply chain.

Recent Developments

- In October 2025, a Finnish aquaculture company named Finnforel revealed its luxury rainbow trout company called LoHi in the UAE, which is a part of its worldwide growth strategy. By performing this, they have entered into the country's fishing rule, and the urge for clean-label easy nutrition grows.

- In January 2025, AL Islami Foods, who is an UAE-based wholesome food products company and a topper in terms of poultry and meat products was delighted in order to disclose the launch of its Extra-big Shrimp series that contains three products.

- In December 2025, Oman disclosed a latest investment initiative whose goal is to change its fisheries industry from an initially resource-based activity into a mixed and value-added production sector located in Duqm.

- In December 2025, Oman's floating factory mission officially began with the revelation of a high-tech vessel which is designed to catch, process, and freeze the fish directly at sea, marking a move in how the Sultanate makes its fisheries industry under Oman Vision by the year 2040.

Top Companies in the Middle East Seafood Packaging Market

- Amcor plc

- Sealed Air Corporation

- Mondi Group

- Berry Global Inc.

- DS Smith Plc

- Swiss Pac UAE

- Amber Packaging Industries

- ENPI Group

- Huhtamaki Oyj

- ULMA Packaging

- Coveris Holdings S.A.

Middle East Seafood Packaging Market Segmentation

By Material

- Plastic (PE, PP, PET, etc.)

- Paper & Paperboard

- Metal (Cans/Tins)

- Others (Glass, Wood, Bio-materials)

By Packaging Technology

- Modified Atmosphere Packaging (MAP)

- Vacuum Packaging

- Retort Packaging

- Others (Active & Smart Packaging)

By Application

- Fresh & Chilled Seafood

- Frozen Seafood

- Processed & Ready-to-Eat

- Dried/Canned

By Seafood Type

- Fish (Salmon, Tuna, Whitefish)

- Crustaceans (Shrimp, Prawns, Lobster)

- Mollusks & Others