U.S. Clinical Trial Packaging Market Size, Trends, Share and Innovations

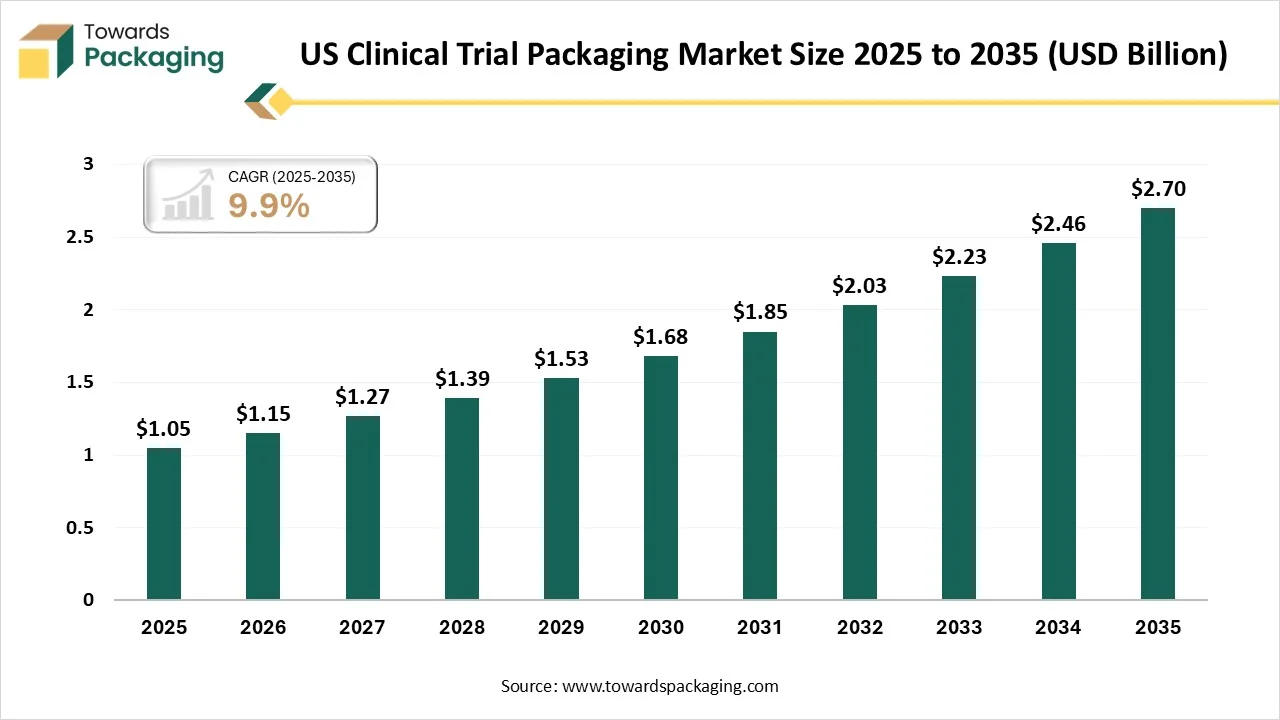

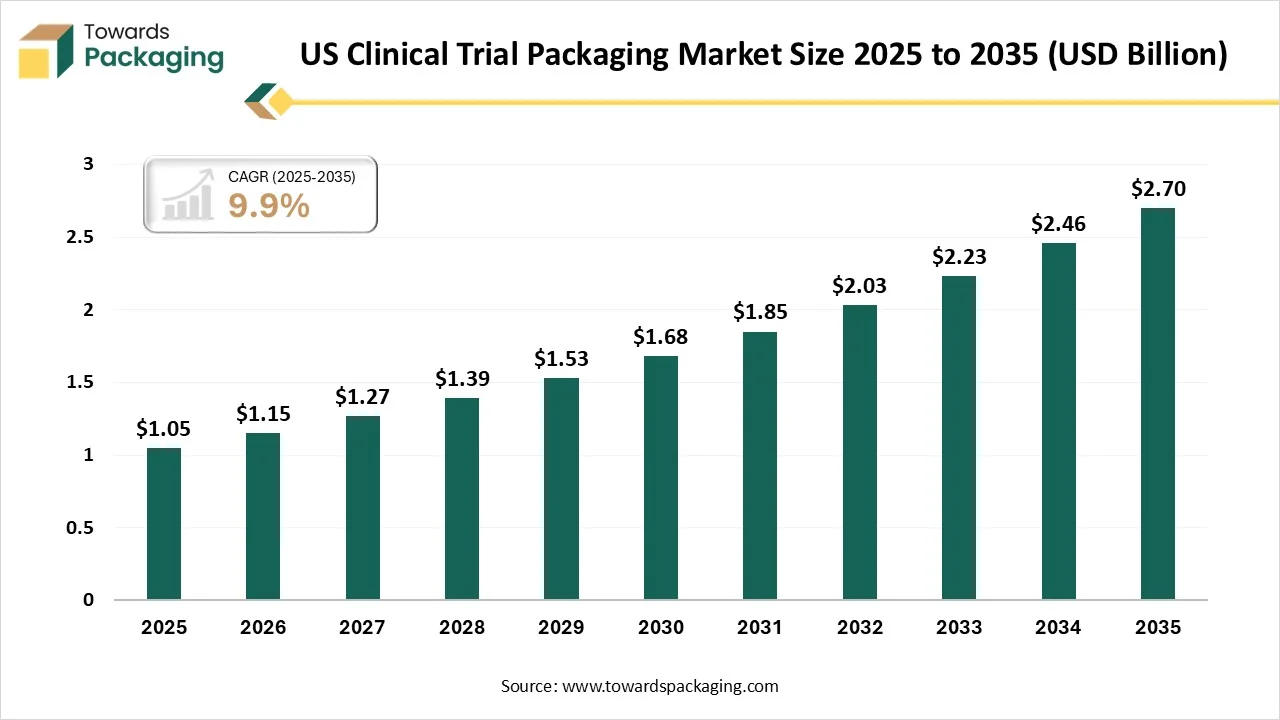

The U.S. clinical trial packaging market is forecasted to expand from USD 1.15 billion in 2026 to USD 2.7 billion by 2035, growing at a CAGR of 9.9% from 2026 to 2035. There is a developing commonness of chronic diseases like cancer, diabetes, and cardiovascular disorders, along with new infectious diseases like COVID-19, which has grown the urge for clinical trials whose goal is to develop the latest vaccines and treatments.

Major Key Insights of the U.S. Clinical Trial Packaging Market

- In terms of revenue, the market is valued at USD 1.05 billion in 2025.

- The market is projected to reach USD 2.7 billion by 2035.

- Rapid growth at a CAGR of 9.9% will be observed in the period between 2026 and 2035.

- By material type, the plastic segment dominated the market in 2025.

- By material type, the metal segment will be developing at a significant CAGR between 2026 and 2035.

- By product type, the vials and ampoules segment dominated the market in 2025.

- By product type, the syringes (prefilled) segment will be growing at a main CAGR between 2026 and 2035.

- By the trial phase, the phase III segment had dominated the market in 2025.

- By the trial phase, the phase II segment will be developing at a significant CAGR between 2026 and 2035.

- By end-user, clinical research organization (CROs) segment dominated the market in 2025.

- By end-user, drug manufacturing facilities segment is expected to experience the fastest CAGR during the forecast period.

Market Overview

The U.S. clinical trial packaging market is a critical subset of the pharmaceutical supply chain, ensuring that investigational medicinal products (IMPs) reach clinical sites and patients with their chemical integrity, stability, and blinding protocols intact. In 2026, the market is characterized by a surge in demand for temperature-sensitive biologics packaging and the rise of decentralized clinical trials (DCTs), which require specialized direct-to-patient delivery solutions.

Regulatory Standards and Quality Considerations for Vials

- Good Manufacturing Practices (GMP): They are rules set by agencies that control the checking and licensing of the producer and sale of cosmetics, food and beverages, dietary supplements, pharmaceutical products, and, lastly, medical devices too.

- ISO Certifications: Vails should also follow particular International Organization for Standardization (ISO) standards, which guide the manufacturing procedure on quality assurance and management.

- Chemical Inertness: The materials that are used, such as borosilicate glass, are chosen to ensure that they align with accurate specifications for volume and size, which develops reliability and consistency in application.

- Mechanical Stability: Vials are being tested for their potential to firmly withstand stress and pressure without leaking, which ensures they are safe to carry and can be moved without any risk of exposure.

Technological Developments in the U.S. Clinical Trial Packaging Market

Clinical packaging inventions have shifted far beyond simple translation of labels into multiple languages. Current multi-language labelling displays a standard mixing of linguistic, professional, human, engineering, and regulatory knowledge, too. Advanced systems currently have semantic tracking to make sure that converted content completely maintains not just literal precision but a regulatory and contextual meaning across cultures and languages. Multilingual clinical labelling systems should be responsible for overall regulatory needs that change mainly across jurisdictions.

Trade Analysis of the U.S. Clinical Trial Packaging Market: Import & Export Statistics:

- As per the global data, the globe has imported 3,142 shipments of Clinical Trial Packaging during the period June 2024 to May 2025.

- Such imports were being supplied by 183 exporters to 110 overall buyers.

- During this time, in May 2025 alone, the globe has imported 284 clinical trial packaging shipments.

- The globe has imported most of its clinical trial packaging from Belgium, the Czech Republic, and the United States.

- Worldwide, the leading three importers of Clinical Trial Packaging are Ukraine, India, and Colombia.

- India has topped the globe in terms of Clinical trial packaging imports, with 6,820 shipments, followed by Ukraine with 1,182 shipments, and Colombia, which has taken the third position with 216 shipments.

U.S. Clinical Trial Packaging Market - Value Chain Analysis

- Package Design and Prototyping: Clinical trials are excessively dependent on the kitting. In this example, many elements are carried together into one common package, like supplies, medication, and directions, which are then shipped to the patients involved in the trial. The self-filled package serves all of the essential elements for drug administration. Packages that are used for bundling drugs and related elements together come from plastic trays and bags to corrugated boxes and totes, too.

- Recycling and Waste Management: Sustainable packaging solutions and the transformation to reusable, biodegradable packaging, and the potential to recycle packaging into further secondary materials, mainly lower the waste levels. Additionally, it is necessary to count the logistics of recycling, collecting, or secure destruction of waste from different locations and link them with costs. Optimized recycling programs will further lower the waste.

- Logistics and Distribution: Logistics and distribution in the clinical trial supply care are developing with the acceptance of innovative technologies. Actual time tracking systems now allow overall visibility across the supply chain, which lowers the delays and ensures product integrity. Discoveries such as temperature-controlled packaging and direct-to-patient delivery designs assist in decentralized trials and improve efficiency.

Segmental Insights

Material Type Insights

How Plastic Segment Dominated the U.S. Clinical Trial Packaging Market in 2025?

Plastics segment dominated the market, changing the packaging with their reliability. High-Density Polyethylene (HDPE), Polyethene Terephthalate (PET), and Polyvinyl Chloride (PVC) are widely used. It has an unbreakable and lightweight nature and the potential to be turned into different shapes, which makes it perfect for a series of products. Such products include blister packs, bottles, and dropper bottles. Developments in terms of plastic technology also include biodegradable plastics that align with surrounding sustainability goals.

The metal (aluminium/foil) segment is expected to witness the fastest CAGR during the forecast period. Aluminium is well known for its perfect barrier characteristics, as aluminum is initially used in blister packaging. It also prevents fragile products from oxygen, moisture, and light, hence it stretches their overall shelf life too. Aluminium foils are frequently used in integration with plastic and paper to make a multi-layered package which is both user-friendly and durable too.

Product Type Insights

How Vials and Ampoules Segment Dominated the U.S. Clinical Trial Packaging Market in 2025?

The vials and ampoules segment dominated the U.S. clinical trial packaging market in 2025 as pharmaceutical vials are small containers that are used initially for storing the medications in liquid form, though they are also used for capsules and powders. Such vials make sure that medications are protected from external elements like moisture, air, and light that can lower the quality. Vials should be strong, which tracks the sterility and the quality of the ingredients until they are administered. The correct vial not only protects the quality of its contents but also ensures the safety of the patients who will suddenly use such medications.

The syringes (Prefilled) segment is predicted to experience the fastest CAGR during the forecast period. Prefillable syringes ensure accurate safety for both healthcare workers and patients. As the medicine is packed and ready to use, it lessens the chances of accidental needle injuries or contact with overall toxic drugs, but risks occur while moving from vials. The fixed dose is a prefilled syringe that also assists in protecting against measurement error, which improves diagnosis precision. They are even convenient to use as they are available with the exact dose already inside, which is ready for injection. PFS injection means it saves time, particularly in emergencies or in busy clinics.

Trial Phase Insights

How Phase III Segment Dominated the U.S. Clinical Trial Packaging Market in 2025?

Phase III trials segment dominated the market in 2025 as they are the final and most complicated stage before a drug or biologic reaches the market. It checks if a treatment is viable at scale or not, and also just under specific conditions, but in huge and real-world populations. In this scenario, investigational products should display statistically significant and clinically meaningful results. Trials often recruit 1,000 participants, with designs that are being constructed for racial, geographic, and age diversity in order to show the future that describes the population.

The phase II segment is expected to witness the fastest CAGR during the forecast period. It includes a bigger group of participants (100-300), which is generally fewer than a hundred patients who have the condition that the drug is being designed to treat. The aim here is to check the drug’s effectiveness while staying constant to check its safety. Phase 2 has frequently compared the latest drug to an inactive drug or a standard, checking and assisting in changing dosing regimens.

End-User Insights

How Clinical Research Organizations (CROs) Segment Dominated the U.S. Clinical Trial Packaging Market in 2025?

The clinical research organization (CROs) segment dominated the market in 2025 as they are a company that serves clinical trial management for the biotech, pharmaceutical, and medical device sectors. There are various types of CRO’s and different levels of specialization ( which differ from therapeutic spaces). CRO services include site selection, regulatory affairs, pharmacovigilance, medical writing, and project management, too. In a clinical trial, CROs are being rented by sponsors to complete a set of tasks that take on different administrative and technical responsibilities on the sponsor’s behalf.

The drug manufacturing facilities segment is expected to experience the fastest CAGR during the forecast period. Clinical trial packaging points are a crucial element in the pharmaceutical sector that fills the gap between drug development and market readiness. The growth of technologies such as smart solutions and cold seal packaging underlines the sector’s loyalty to efficiency, invention, and patient safety. The future of a pharmaceutical achievement depends not just on a drug discovery, but also on the capability to smoothly package and serve such inventions in a way that aligns with strong standards and solves the complicated demands of clinical trials.

Country Insights

The U.S. Clinical Trial Packaging market is seen to grow notably in California, as this state is home to a large number of clinical research organizations and a diverse population, which makes it a clinical region for patent recruitment and the same clinical supply demands. To align with the growing localized urge, servers are stretching the facilities within the state. Latest FDA regulations related to child-resistant packaging and serialization, and lastly, the Drug Supply Chain Security Act (DSCSA), are driving the California producer to accept more high-level and protected packaging technologies. Furthermore, a move towards “decentralized” trials is growing the urge for packaging that is convenient for patients to utilize at home and can be delivered quickly from a local centre.

Trend of Clinical Trial Packaging in Texas: In this state, there is a developing need for direct-to-patient packaging solutions. These count patient-friendly and tamper-evident kits that are being crafted for home delivery, which assist Texas’s big and geographically diverse participant population. The growth of cell therapies, biologics, and gene therapies in the Texas research environment has developed the urge for temperature-controlled packaging, which can track the stability across different climate zones.

Recent Developments

- In April 2025, Novartis is a top global inventive medicines company that has revealed a planned $23 billion funding for over 5 years in a US-based infrastructure, which will ensure all main Novartis medicines for US patients will be created in the United States.

- In July 2025, Radicle Science, which is a health tech innovator, revealed Radicle Discovery Gen 2, which is a further version of its Proof-as-a-Service stage, which is crafted to allow non-pharmaceutical wellness and health products that have clinically proven their claims.

- In March 2025, Avenacy, a specialty pharmaceutical organization that focuses on delivering complicated injectable medications, revealed that it has launched a set of antibiotic products for injection, which includes Ampicillin and Sulbactam for Injection, USP, and Piperacillin and Tazobactam for Injection.

Top Companies in the U.S. Clinical Trial Packaging Market

- Fisher Clinical Services (Thermo Fisher Scientific)

- Catalent, Inc.

- PCI Pharma Services

- Almac Group

- Sharp Services, LLC (Cencora)

- WestRock Company

- Amcor plc

- Schreiner MediPharm

- Bilcare Limited

- Piramal Pharma Solutions

U.S. Clinical Trial Packaging Market Segmentation

By Material

- Plastic

- Glass

- Metal

- Paper & Corrugated Fiber

By Product Type

- Vials & Ampoules

- Blisters

- Syringes

- Bags & Pouches

- Others (Bottles, Tubes, Kits)

By Clinical Trial Phase

- Phase III

- Phase II

- Phase I

- Phase IV

By End-User

- Clinical Research Organizations (CROs)

- Drug Manufacturing Facilities (Pharma/Biotech)

- Research Laboratories