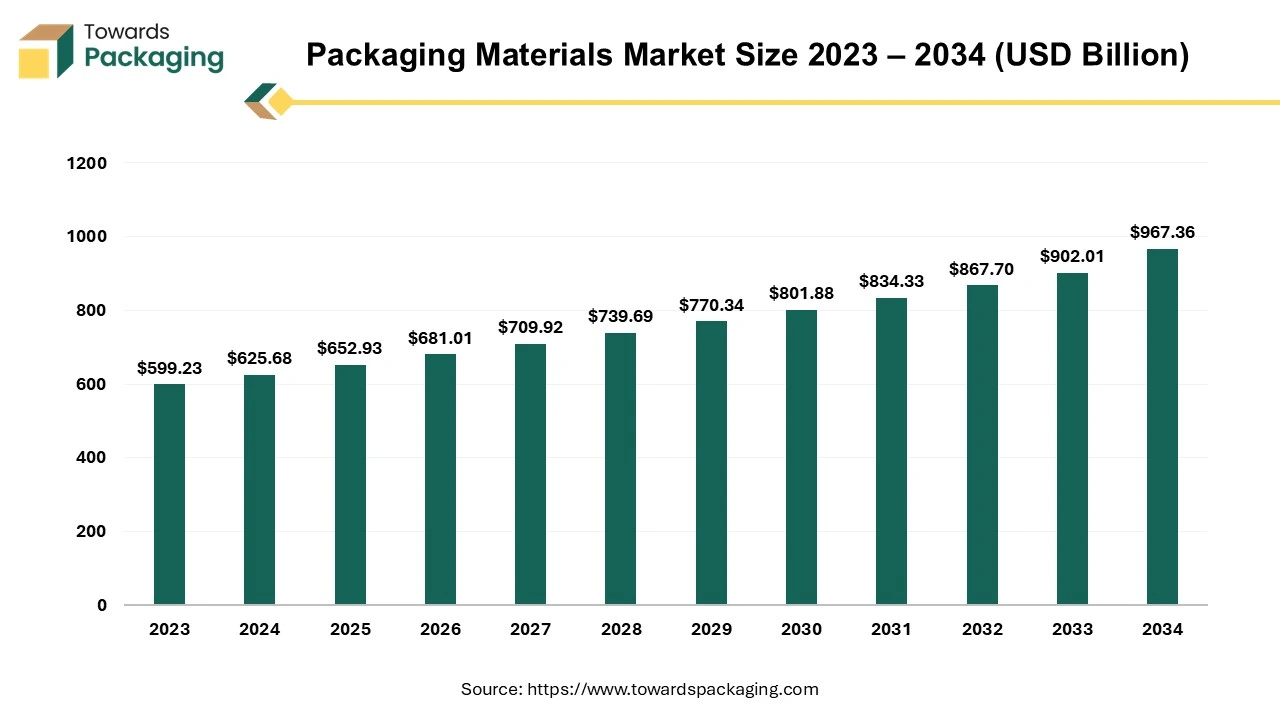

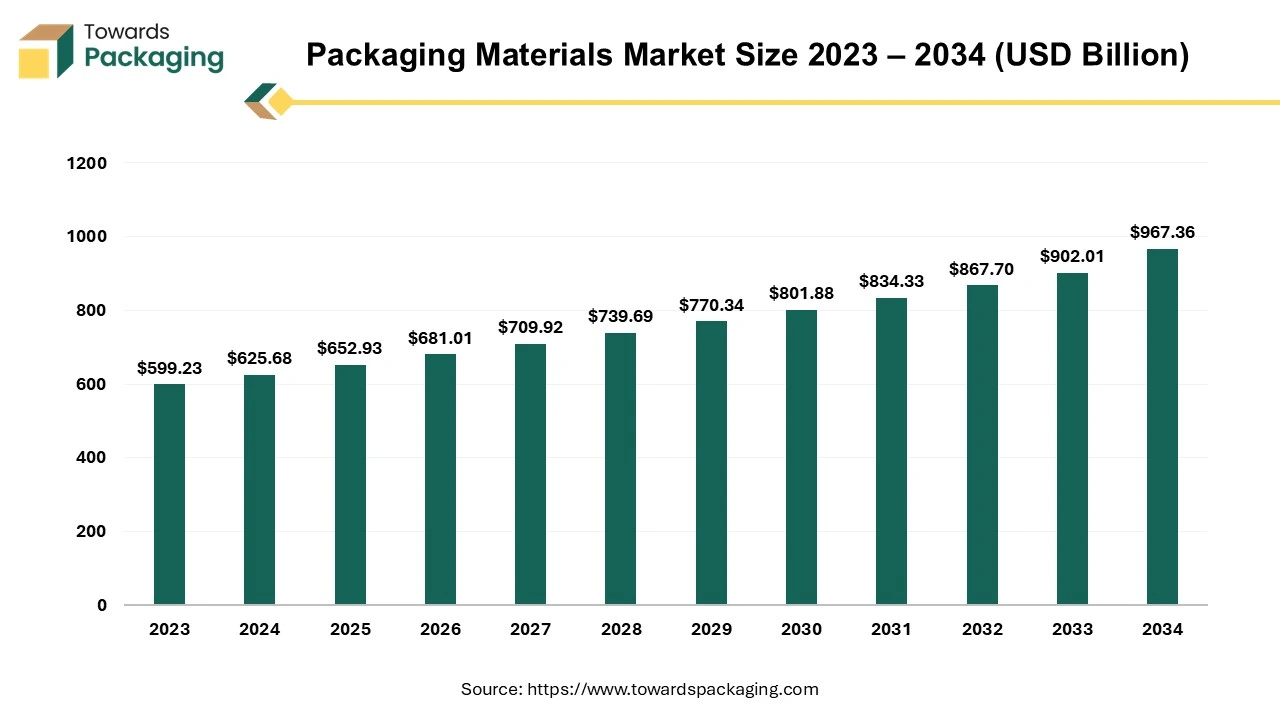

The packaging materials market is forecasted to expand from USD 682.60 billion in 2026 to USD 1,010.06 billion by 2035, growing at a CAGR of 4.45% from 2026 to 2035.

Consumers widely accept this market due to the growing e-commerce platforms, which influence people to order products online that require safe packaging for storage and transportation. The rising demand for sustainable, multi-useable, and innovative packaging among consumers also boosts the development of the packaging materials market.

The packaging materials market plays a significant role in various sectors such as e-commerce, healthcare, the food & beverages industry, and many others where the packaging of products boosts the business profoundly by enhancing the reliability of customers. Several brands try to create their unique packaging to attract a huge number of customers which allows companies to invest widely in this market. Continuous advancement in the packaging sector such as accessibility to a wide range of shapes and sizes of packages, sealable packages, personalized packaging, and many such advancements led to the development of the packaging material sector.

The rising focus on eco-friendly packaging, reusable packaging, biodegradable resources, and many such concerns has expanded the potential of this market. Growing concern for product safety while transporting to a longer distance to aesthetic packaging trends requires the market players to choose packaging materials carefully to fulfil the demand of the consumers.

The incorporation of AI in the packaging materials industry has significantly influenced the market with its requirements for improved quality production of packaging products. AI can help to detect enhanced quality resources which can be moulded into desired shapes, sizes, and patterns of the packaging. AI is highly preferred in inventory management, quality control, predictive maintenance, and supply chain optimization.

The unique design of packaging requires high-quality material which can be easily predicted with artificial intelligence. This advanced technology integration helps in labelling automation, out-of-the-box designs, and smart packaging. To provide a personalization option in the product there is a huge role of AI in addition to techniques according to the packaging materials used.

Industry growth overview

The packaging materials market is expanding due to rising demand from the food, beverage, pharmaceutical, and e-commerce sectors. Lightweight, durable, and cost-efficient materials are driving adoption. Growth is also supported by innovations in flexible and sustainable packaging materials.

Sustainability trends

Sustainability trends include increased use of recyclable, reusable, and bio-based materials. Brands are shifting toward mono-material structures and reduced material usage. Regulatory pressure is accelerating the move toward sustainable packaging alternatives.

Startup ecosystem

Startups are developing biodegradable materials, compostable films, and recycled-content packaging solutions. Many focus on replacing traditional plastics or improving material performance. Innovation helps diversify sustainable material options.

The growing demand for advanced technology packaging products has increased the focus of the market players towards the materials used for packaging purposes. This phenomenon can be accredited to a convergence of problems that are redesigning the global corporate landscape.

Firstly, the growing middle-class people in developing markets are progressively driving consumption. With the rise of disposable incomes, the demand for well-packaged products extended from personal care products to food and beverages and electronics. This rise in demand imposes effectual and operative packaging choices to preserve goods' quality, confirm safety, and improve shelf appeal.

Moreover, the speedy urbanization and automation of all the developing areas contribute to the growth of the packaging industry. Urbanization contributes to better availability of modern retail stores, which results in a boost in the requirement for packaged goods. Additionally, the increase of online platforms, simplified by refining digital organization and connectivity, needs safe and attractive packaging choices to safeguard goods during transportation, improving the consumers' experience.

With the developing business site, sustainability has appeared as a supreme apprehension for both customers and enterprises. The packaging sector, an important constituent of the worldwide supply chain, is facing a noteworthy alteration as a consequence of this everchanging pattern. There is a growing demand for supportable and environment-friendly packaging choices, determined by heightened ecological consciousness and the authority to decrease natural footprint.

Customers, above all, are making mindful choices, and they are requesting that the goods they buy are not only of enhanced quality but also packed in a way that reduces damage to the atmosphere. Concurrently, industries are understanding the status of aligning with sustainable utility to meet regulatory needs and improve their brand image.

With such refined quality of packaging products, there is a huge rise in the pricing of the packaging which ultimately increases the charges of the product, this hinders the growth of the packaging materials market. Several market players are searching for ways that can help to use materials which are eco-friendly as well as low in price.

The global packaging materials market is expected to grow steadily in the coming years, driven by rising demand from sectors such as consumer goods, e-commerce, healthcare, and food and beverages. Companies are being forced to use recyclable, reusable, and biodegradable packaging due to government regulations, corporate sustainability initiatives and growing environmental consciousness. Innovations in smart packaging, like sensors traceable label and QR codes, are also driving up demand globally. Efficiency and sustainability are increasingly important factors influencing the market's future.

With lightweight multipurpose and biodegradable solutions becoming more popular, the market is expected to witness rapid innovation in materials and design in the future. Businesses are spending money on intelligent packaging that increases customer engagement, improves product safety, and offers real-time tracking. Efficiency and waste reduction opportunities are being created by the emergence of circular economy practices and digitization in packaging processes. Businesses that combine sustainability and innovation are likely to take the biggest chunk of future growth as consumers demand more convenient and eco-friendly packaging.

Automation and technological developments are also anticipated to change the packaging industry. Automated production lines, robotics, and AI-powered sorting are cutting waste and increasing consistency and speed. Edible and bio-based material innovations are also attracting attention because they provide eco friendly substitutes that appeal to consumers who care about the environment. The market's future will be determined not only by volume growth but also by how quickly businesses can use technology to develop more intelligen environmentally friendly packaging solutions, improve user experience, and adjust to sustainability trends.

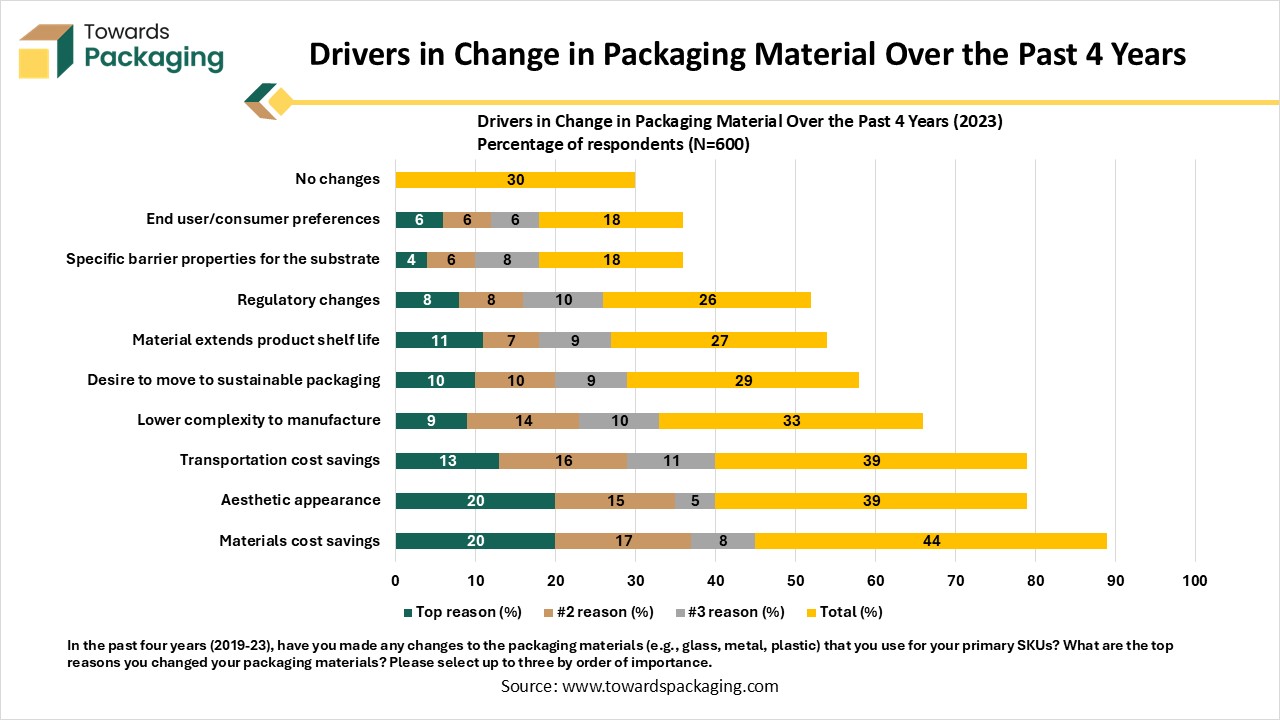

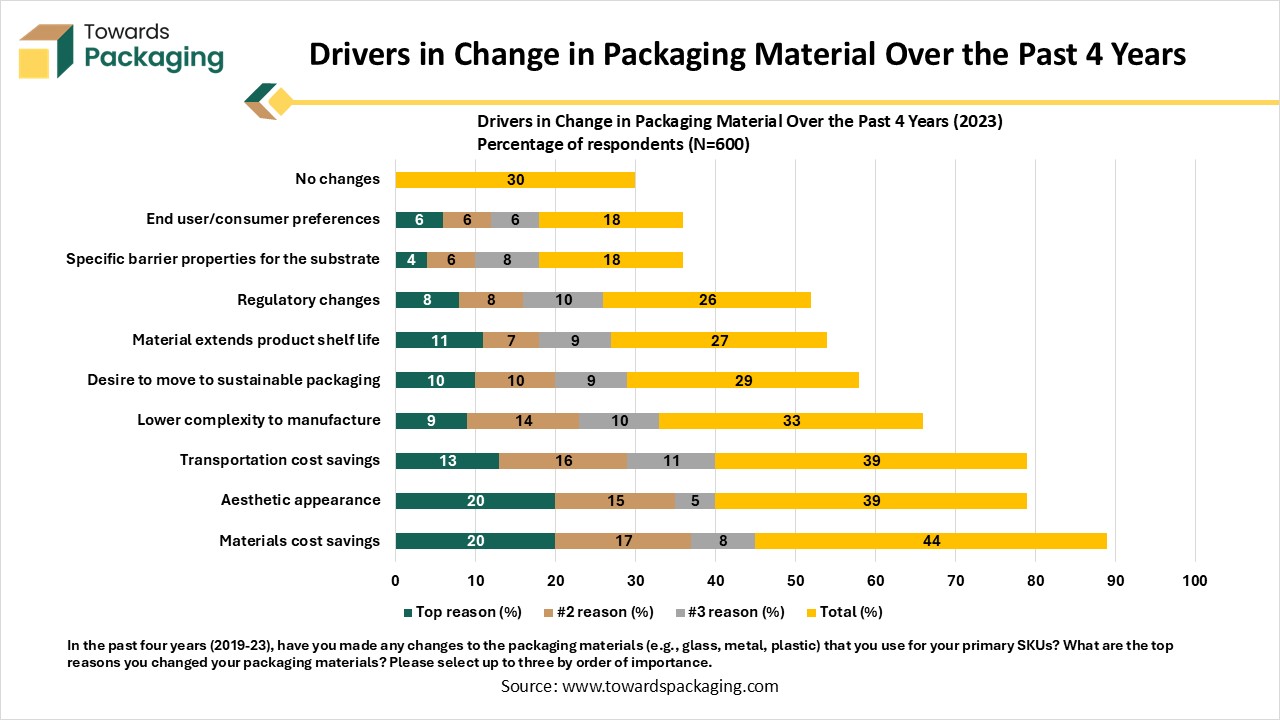

This chart shows the main reasons why companies changed their packaging materials over the last four years. The data is based on responses from 600 participants. Respondents were asked to select their top three reasons for making these changes.

The most common motivations for switching packaging materials are related to cost savings, sustainability, and appearance. These factors strongly influence packaging decisions across industries.

The last four years have seen a significant shift in packaging strategies. Companies are optimizing packaging to:

This shows that packaging decisions are increasingly strategic rather than purely operational.

The rigid plastic packaging materials market is important in the raw material segment of this market during the predicted period. These types of packaging are extensively used in pharmaceutical sectors for packaging a variety of products that require long-term storage. Its high-strength bottles and other packaging are convenient to use for the customers. Such packaging is reusable and hence attracts a wide range of consumers and hence companies are majorly focusing on such packaging materials that can last longer and also be refilled and used multiple times. These rigid plastics can be easily recycled which makes them most preferable for both consumers and companies.

Boxes and carton segment led the market in 2024 and is observed to sustain the position during the forecast period due to the rising demand for safe transportation of products. Boxes and cartons are versatile and fundamental packaging goods that play an important role in the packaging sector. These goods help as defensive methods of packaging for a variety of products, confirming safe storing, presentation, and transportation.

Boxes and cartons are manufactured in several materials, shapes, and sizes, making them flexible to a variety of packaging requirements. Boxes are generally made up of corrugated cardboard and are famous for their stackability and durability. They are usually used for storage, shipping, and show purposes. These packaging goods offer numerous benefits.

The primary packaging segment led the market in 2024 and is observed to sustain the position during the predicted period. Primary packaging is in huge demand in the packaging sector, representing the preliminary layer of defence and control for a product. It includes the instant, direct packing of a product, frequently in direct interaction with its contents. Primary packaging is considered to protect the product's honesty, preserve its freshness, and safeguard its harmless usage. Common methods of primary packaging comprise pouches, jars, closures, bags, and many more. These resources are designated based on the precise necessities of the good, comprising factors such as their shelf life, nature, and intended usage.

The food & beverages segment held the largest share of the packaging materials market in 2024. The role of packaging materials in this industry ranges beyond inhibition, surrounding preservation, guard, marking, and sustainability deliberations. Packing materials for food & beverages must meet strong quality and safety ideals to guarantee that products continue uncontaminated and fresh. These materials comprise several forms of flexible packaging, specialized films, and rigid containers, often personalized to precise product necessities. They play an important role in spreading the shelf life of unpreserved items, avoiding degeneration, and defending against outside aspects such as light and moisture.

Asia Pacific witnessed the largest share in the packaging materials market in 2024. With its huge and varied customer base, increasing online industry, and thriving manufacturing sectors, this region has developed as a focal point for invention, demand, and struggle within the market. This region is noticeable by its important economic development, led by countries such as China, India, South Korea, Thailand, and Japan which boost the manufacturing competencies and a growing middle-class population. Therefore, the demand for packaging choices like paperboard, flexible plastics, and corrugated materials has rushed, pushing the growth of the market.

China Market Trends

China packaging materials market is driven by the strong manufacturing infrastructure in the country. China has large-scale, integrated manufacturing hubs that reduce production costs. A well-developed ecosystem for raw materials (plastics, paper, aluminium, etc.) supports efficient packaging production. High demand for packaged goods in food, electronics, e-commerce, and healthcare fuels the need for packaging. China's leadership in online retail (e.g., Alibaba, JD.com) has driven rapid growth in packaging needs.

China country support for domestic industries through favourable policies, including tax breaks and infrastructure investments. China investment in Industry 4.0 has enabled more efficient, high-quality packaging production. Although labor costs have risen, China still offers competitive labor compared to Western nations, especially in mid-range manufacturing. China is a global supplier of packaging materials, exporting to Southeast Asia, Europe, Africa, and North America. Many companies control multiple stages of the packaging process from raw material processing to finished products enhancing efficiency and profitability.

North America is seen to grow at a notable rate in the foreseeable future. North America region has high demand for packaged goods in food, beverage, healthcare, personal care, and electronics. E-commerce giants like Amazon create continuous demand for protective and sustainable packaging. North America region has well-established distribution networks enable rapid and efficient movement of packaged goods. North America’s cold chain logistics support demand for temperature-sensitive and specialized packaging (especially for pharmaceuticals and fresh food). Multinational packaging firms headquartered in the U.S. and Canada (like International Paper, Ball Corporation, and WestRock) lead global innovation and market influence. Corporate ESG goals (Environmental, Social, and Governance) are pushing brands to adopt low-carbon and reusable packaging solutions.

The U.S. Packaging Materials Market Trends

The U.S. plays a significant role in the global packaging materials market. This is stemming from its substantial market share and a projected growth rate, as it is considered a major producer and consumer of packaging materials, including paper and paperboard, spurring the market, particularly for e-commerce. Also, the presence of International Paper and WestRock is among the top packaging companies in the U.S. and globally, fostering the market growth. The U.S. market is also influenced by factors like sustainability trends and advancements in packaging materials.

Europe is estimated to grow at a rapid rate in the packaging materials market during the forecast period. With a sturdy importance on ecological awareness, countries are foremost responsible towards environmentally friendly and recyclable packaging choices, pouring a noteworthy change in the direction of biodegradable resources, and decreasing the business's carbon footprint.

The packaging materials market in this region is pushed by a strong manufacturing industry, mainly in the UK, Germany, Sweden, France, Denmark, Norway, and Italy, which are predictable for their unconventional technologies and high-quality manufacturing processes. Moreover, the growing e-commerce sector has enlarged the demand for sturdy and defensive packaging materials to safeguard the harmless transportation of products, fostering the acceptance of strong yet sustainable packaging choices.

Germany Packaging Materials Market Trends

Germany plays a significant role in the packaging materials market due to its strong manufacturing base together with major players in packaging technology like Bosch Packaging Technology and Krones AG., and regulatory framework. As Germany is a leader in promoting circular economy principles along with recycling and waste reduction programs, it is more focused on sustainable solutions. The Packaging Act and its quotas have led to increased responsibility for manufacturers and distributors in managing packaging waste by creating a favorable environment for sustainable packaging development.

Packaging remains the most rigid market for ink production in Latin America. Packaging remains the most constant and resilient segment of the printing and ink segment in Latin America. Even during the time of economic uncertainty, packaging specifically linked to food consumption and exports has officially been stable to perform rigidly. The space has been the main driver of the market development in recent years..Packaging materials like flexible packaging, paper and board, sheetfed offset folding cartons are all witnessing favourable development across the region. Ink industry directors are also witnessing development in digital printing. Magiitman points out that digital printing is generally gaining attention in Latin America, with some transformers investing in digital potential. Hybrid machines and digital presses that integrate regular and digital technologies are being accepted, reflecting rising interest in the flexibility digital printing serves, specifically for short runs, quick turnaround times, and customization.

Kraft paper is hugely used in the packaging sector because of its versatility, cost, effectiveness, and recyclability. It is also famous due to its biodegradable characteristics that make it recyclable. Middle East and African industry are been growing between year 2020 and 2029 due to lot of reasons like the food and beverage industry is one of the biggest user of paper packaging in the Middle East and Africa region due to several factors. Online shopping for food integrated with food delivery services is predicted to grow the demand for sacks, folding cartons, kraft papers, and liquid cartons. Hardwood pulps are utilised in the outer layer due to their effect on surface characteristics, whereas softwood pulp is demanded to provide enough power to the paperboard product.

Raw materials sourcing

Raw materials include plastics, paper, metals, glass, and bio-based inputs. Volatility in raw material prices is influencing sourcing strategies. Increased use of recycled materials reduces reliance on virgin inputs.

Supply to the government and airlines

Governments procure packaging materials for public distribution, healthcare, and food programs. Airlines require lightweight, durable, and sustainable packaging for catering and onboard services.

Aftermarket services and upgrades

Aftermarket services include material redesign, performance enhancement, and sustainability upgrades. Packaging suppliers offer technical support to improve shelf life, recyclability, and cost efficiency. Continuous material innovation supports long-term market growth

By Material Outlook

By Product Outlook

By Packaging Format

By End Use

By Region Covered

March 2026

March 2026

February 2026

February 2026