Rigid Plastic Packaging Market Growth, Innovations and Market Size Forecast

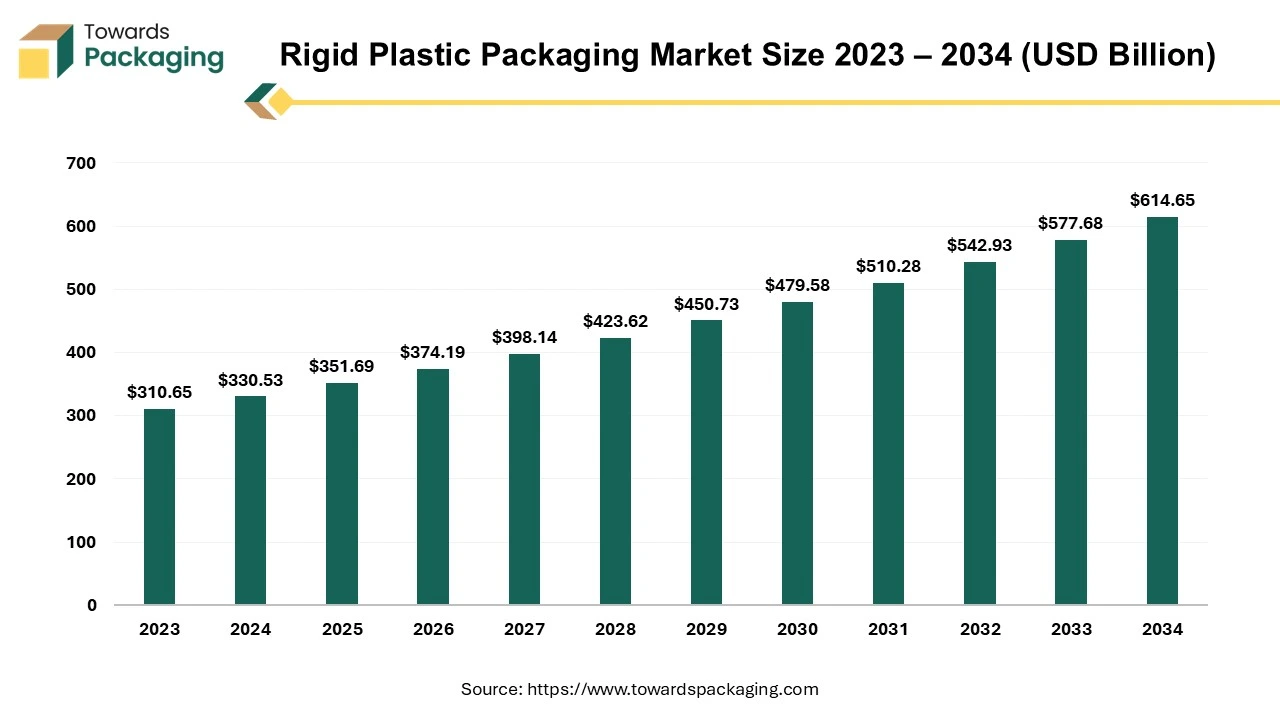

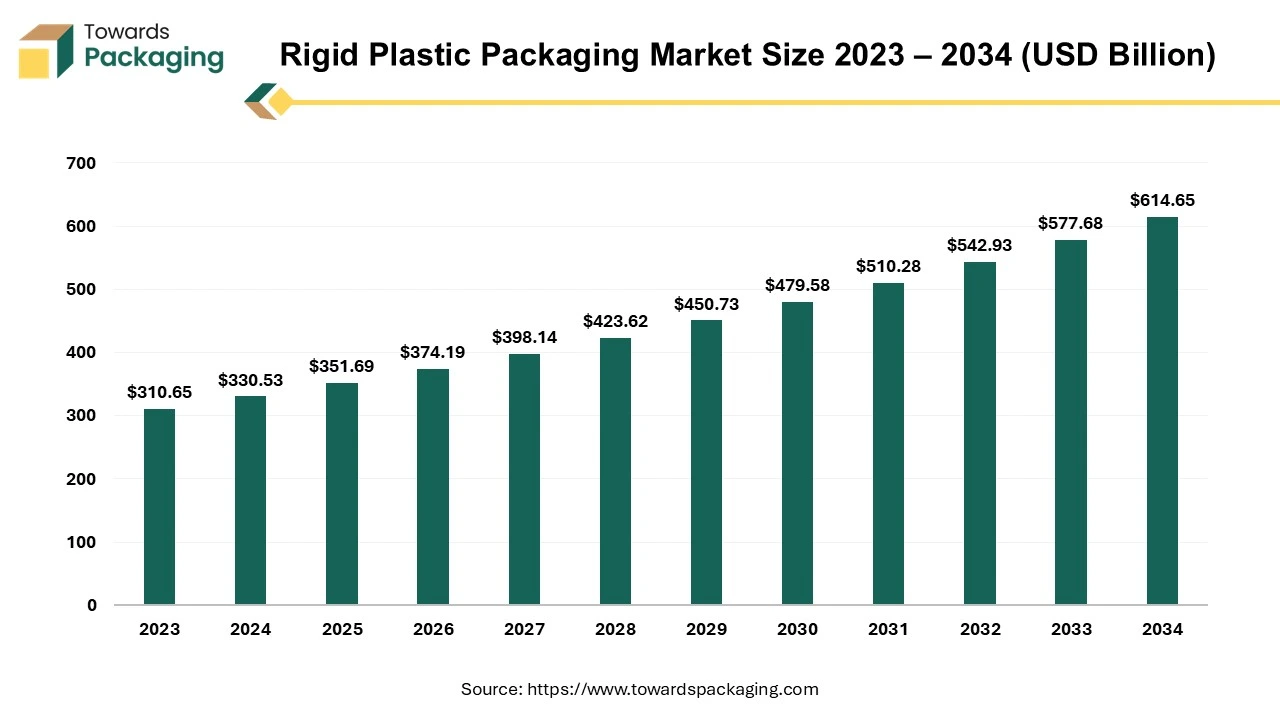

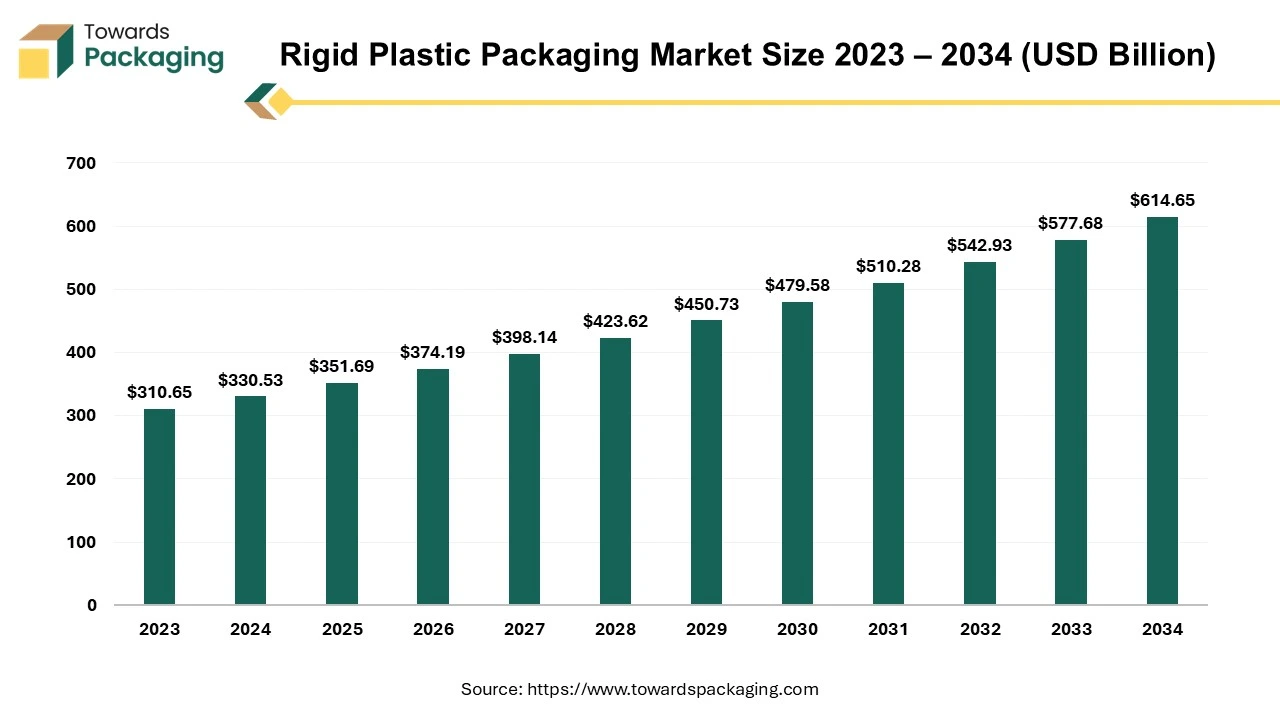

The rigid plastic packaging market is projected to reach USD 653.99 billion by 2035, growing from USD 374.19 billion in 2026, at a CAGR of 6.4% during the forecast period from 2026 to 2035. We quantify every major segment (product bottles & jars, trays, tubs/cups/pots, bulk; production injection, blow, thermoforming, extrusion; materials PET, PE, PP, PS, PVC, EPS, bioplastics; end users food, beverages, healthcare, cosmetics & toiletries, industrial), with country-level splits across NA, EU, APAC, LA, and MEA.

The study benchmarks companies by market share and EBITDA (e.g., Amcor, Berry, Silgan, Sealed Air, Huhtamäki, Sonoco, ALPLA, Pactiv Evergreen, Graham, Aptar), maps manufacturers and suppliers, tracks prices and capacity, and adds value-chain, trade (import/export), policy, and technology trend analysis delivering all statistical tables and charts for 2026-2035.

Major Key Insights of the Rigid Plastic Packaging Market:

- Asia Pacific dominated the rigid plastic packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By product type, the bottles & jars segment dominated the market with the largest share in 2024.

- By production process, the injection molding segment registered its dominance over the global rigid plastic packaging market in 2024.

- By material, the polyethylene terephthalate (PET) segment dominated the rigid plastic packaging market in 2024.

- By end user, the food segment registered its dominance over the global rigid plastic packaging market in 2024.

Rigid Plastic Packaging Market: Sturdy & Protective Packaging

Rigid plastic packaging means packaging products that are made from hard, inflexible plastic. These packages keep their shape even when you press or handle them. They are strong, protective, and used to store and transport a wide range of goods safely. The example of rigid packaging has been mentioned here as follows: plastic bottles (for water, milk, shampoo), jars (for creams, sauces), trays (for fruits, electronics) and food containers (like yogurt cups, takeaway boxes).

Rigid plastic packaging helps in keeping products safe from damage, contamination, and moisture. Hard plastics act like a shield. It holds its shape, so it doesn’t collapse or crush the product inside. Clear rigid plastics (like PET) let customers see the product, which helps in marketing. It's strong enough for stacking, shipping, and handling without breaking easily. Many rigid packages (like jars and tubs) can be resealed, keeping products fresh longer. It’s much lighter than materials like glass or metal, which saves shipping costs. It can be molded into different shapes, sizes, and designs to match branding.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 351.68 Billion |

| Projected Market Size in 2035 |

USD 653.99 Billion |

| CAGR (2026 - 2035) |

6.4% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Product Type, By Production Process, By Material, By End User and By Region |

| Top Key Players |

Berry Global Inc., Amcor plc, Pactiv Evergreen Inc., Sonoco Products Company, ALPLA, WINPAK LTD, Nuplas Industries |

Market Trends

Emphasis on Sustainable Packaging

The key players operating in the market are increasingly utilizing recycled plastics like rPET and bio-based alternatives derived from cornstarch or sugarcane to minimize environmental impact. Companies are adopting closed-loop recycling systems, designing packaging for recyclability, and minimizing waste through lightweighting and source reduction.

Compliance of Regulatory Norms

Regions like the European Union are enforcing regulations to ensure all new packaging is recyclable by 2030, pushing companies toward sustainable practices.

Increase in Trend of Functional and Smart Packaging

Integration of QR codes and RFID tags allows consumers to access product information, improving transparency and engagement. Innovations like battery-free smart packaging can monitor food freshness and release preservatives as needed, extending shelf life and minimizing waste.

Demand for Portability and Convenience

The key players are focused on providing user-friendly designs. Features such as easy-open mechanisms, resealable closures, and portion control options cater to on-the-go lifestyles and enhance product usability.

Ready-to-Eat Packaging

The popularity of ready-to-eat meals has increased the demand for rigid plastic packaging that can withstand various temperature conditions and handling requirements.

Advanced Printing Technologies

Brands are leveraging digital printing to develop customized packaging designs that resonate with target audiences, enhancing brand engagement and loyalty.

Eco-Friendly and Minimalist Aesthetics

There’s a trend toward clean, minimalist packaging designs that incorporate eco-friendly materials, aligning with consumer preferences for sustainability.

How Can AI Improve the Rigid Plastic Packaging Industry?

AI-driven design tools can create new packaging shapes and structures that use less material while keeping strength. AI can simulate how a package will behave (drop tests, temperature changes) without needing physical prototypes, saving time and money. AI can analyse material properties and suggest the best combinations (e.g., recycled vs virgin plastic) to maximize durability and sustainability. It can help predict the performance of new eco-friendly plastics before mass production.

AI can monitor production lines in real time, spotting defects or irregularities instantly (using computer vision). It optimizes machine settings (like temperature, pressure) to reduce energy use, waste, and downtime. Sensors and AI can predict when machines (injection molders, extruders) need maintenance, preventing breakdowns and costly production halts.

AI forecasts demand more accurately, helping manufacturers produce the right amount of packaging at the right time. It can optimize logistics, reducing shipping costs and carbon footprint by better packing and routing. AI-powered inspection systems (using cameras + machine learning) can spot tiny defects in packaging (like cracks, deformities) that humans might miss. This ensures consistent, high-quality packaging products.

Driver

Growing E-commerce Platform and Retail Expansion

Online shopping demands strong packaging to protect goods during shipping. Rigid plastics offer impact resistance, minimizing product damage in transit. As cities grow, people want convenient, portable, and durable packaging. Busy lifestyles drive the demand for easy-to-carry and resealable plastic containers. Hence, rising e-commerce platform and retail expansion has driven the growth of the rigid plastic packaging market. Products bought online must survive longer shipping routes and rough handling. Rigid plastic packaging is durable, impact-resistant, and protects products better than flexible or paper alternatives. It prevents breakage, leakage or spoilage during delivery.

E-commerce sells everything from electronics to cosmetics to groceries. Each product often needs custom-fitted, tamper-proof, or display-friendly rigid plastic packaging to attract buyers and ensure safety. Categories like frozen foods, meal kits, health supplements, and personal care products are booming online all of which rely heavily on rigid plastic containers for hygiene, protection, and brand presentation.

- In February 2025, according to the data published by the eCommerce Association of India (ECAI), the amount will rise to US$9.59 trillion by 2030. Retail e-commerce sales in the U.S. are predicted to reach US$1.37 trillion in 2024, up 10.6% from US$1.24 trillion in 2023. According to projections, retail e-commerce sales in the United States are expected to surpass US$2.5 trillion by 2030.

Restraint

Competition from Flexible Packaging & Shift Toward Alternative Materials

The key players operating in the rigid plastic packaging market are facing issue due to shift towards alternative materials and competition from flexible packaging which has restricted the growth of the market. Flexible packaging like pouches and sachets) is often cheaper, lighter, and uses less material than rigid packaging. For some products, companies prefer flexible options to save costs and shipping weight. Materials like biodegradable packaging, paper-based containers, and compostable plastics are becoming more popular. Companies aiming for greener branding are switching away from traditional rigid plastics. Growing public awareness and media attention on plastic waste is pressuring companies to find alternatives.

Growth of Rigid Paper Packaging Market

The rigid paper packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The rising sales done online shopping applications are absolutely inducing the demand for secondary and tertiary packing goods in the country. Growing changes towards sustainable packaging resolutions, joined with enlarged customer consciousness, are playing an important role in driving the rigid paper packaging market. Asia Pacific is dominating the rigid paper packaging industry due to its unique combination of rapid urban development and industrial advancement.

Opportunity

Sustainability and Eco-Friendly Innovations

There’s an opportunity to develop more recyclable and biodegradable rigid plastics. Companies that invest in closed-loop recycling systems or post-consumer recycled content can appeal to environmentally-conscious consumers. Growing demand for plant-based plastics or bio-based polymers (like PLA) offers a sustainable alternative to conventional plastics.

Asia-Pacific and Latin America are seeing rapid urbanization, changing lifestyles, and rising disposable incomes, leading to higher demand for packaged goods. Rigid plastic packaging is well-suited to meet the rising demand for convenient and safe packaging in these regions.

Segmental Insights

Bottles & Jars Segment Led the Market in 2024

The bottles & jars segment held a dominant presence in the rigid plastic packaging market in 2024. Plastic bottles and jars are more resilient to breakage compared to glass, making them ideal for products that need to withstand rough handling during shipping and everyday use. They provide barrier protection against moisture, air, and contaminants, preserving the integrity of the product inside. Compared to glass and metal, plastic bottles and jars are much lighter, which reduces shipping costs and makes them easier for consumers to handle. Reduced weight also benefits manufacturers as it lowers transportation expenses and reduces carbon emissions. The production cost of plastic bottles and jars is generally lower than alternatives like glass or metal, making them a more economical choice for mass production.

They are easy to mold into various shapes and sizes, and the molds are relatively inexpensive, leading to cost savings for manufacturers. Plastic bottles and jars can be easily customized in terms of shape, color, size, and printing options. Clear plastics, like PET, allow the product inside to be visible, which is ideal for branding and marketing. Many rigid plastic bottles and jars come with tamper-evident features, which help ensure product safety and integrity.

Child-resistant caps are commonly used for pharmaceutical and household products, enhancing safety. Plastic bottles and jars are extremely versatile and are used across a wide range of industries, including: food and beverages (e.g., sauces, jams, juices, snacks), pharmaceuticals (e.g., syrups, vitamins, ointments), cosmetics (e.g., lotions, creams, shampoos) and household products (e.g., cleaning agents, detergents)

More Accuracy of Injection: Significance of Molding to Remain Significant

The injection molding segment accounted for a significant share of the rigid plastic packaging market in 2024. Injection molding allows for rapid production of large quantities of packaging products, which is crucial for industries with high-volume demands (such as beverages, food, and pharmaceuticals). The process is highly automated, minimizing the demand for manual labor and speeding up production. Injection molding can develop intricate and complex designs, which is ideal for creating customized packaging with unique sizes, shapes and features.

Polyethylene Terephthalate (PET) Led the Market in 2024

The polyethylene terephthalate (PET) segment registered its dominance over the global rigid plastic packaging market in 2024. Polyethylene Terephthalate (PET) is known for its durability and resilience. It can withstand impact and rough handling, which is crucial for protecting the contents inside during shipping and handling. Unlike glass, PET is shatterproof, making it a safer alternative for packaging products, especially in situations where breakage could lead to contamination or injury. PET is significantly lighter than alternatives like glass and metal, which reduces transportation costs and makes it easier for consumers to handle.

The lighter weight also reduces the carbon footprint during transportation, aligning with sustainability goals. PET offers good barrier protection against moisture, gases, and oxygen, which helps in extending the shelf life of products, especially food and beverages. This barrier is essential for preserving the freshness and quality of items like juices, sauces, and snacks. Polyethylene Terephthalate (PET) is naturally clear, allowing consumers to easily see the product inside.

This is particularly important for beverages, cosmetics, and healthcare products where product visibility can influence purchasing decisions. The clarity of PET also contributes to the visual appeal of the packaging, enhancing branding and presentation. PET is one of the most recycled plastics globally. This makes it a popular choice for companies aiming to improve their sustainability efforts and reduce plastic waste.

PET can be recycled into new PET products, contributing to the circular economy and reducing the need for virgin plastic. PET is easily molded into various shapes and sizes, making it suitable for a wide range of packaging applications, from bottles and jars to containers and trays. PET is extensively used in containers, bottles, and jars for beverages, sauces, juices, and other food products due to its durability and excellent barrier properties.

Rigid Tray Market: Sturdy Tray Packaging

The rigid tray market size is predicted to expand from USD 11.93 billion in 2025 to USD 14.72 billion by 2034, growing at a CAGR of 2.37% during the forecast period from 2025 to 2034.

One kind of packaging that is robust, unyielding, and holds its shape even when empty is called rigid tray packaging. For a variety of products, its structural strength and longevity offer strong protection and preservation throughout their existence. Materials that are naturally rigid, including glass, metal, and some plastics like polyethylene terephthalate (PET) and High-Density Polyethylene (HDPE), are used to make rigid packaging. This type of packaging is extensively employed in many different industries to present and safeguard a wide variety of products while maintaining structural integrity all the way through the supply chain. It works especially well for products that need extra protection, like electronics, high-end consumer goods, fragile goods, and medications.

Rigid packaging provides a more substantial and secure containment for products than flexible packaging, which consists of materials like bags and pouches. In general, rigid packing materials have the following qualities: Glass: It can maintain the purity of its contents and has inert properties. finds a market niche for unique goods and high-end beverages. Metal: its durability and impermeability make it perfect for a range of foods, guaranteeing an extended shelf life.

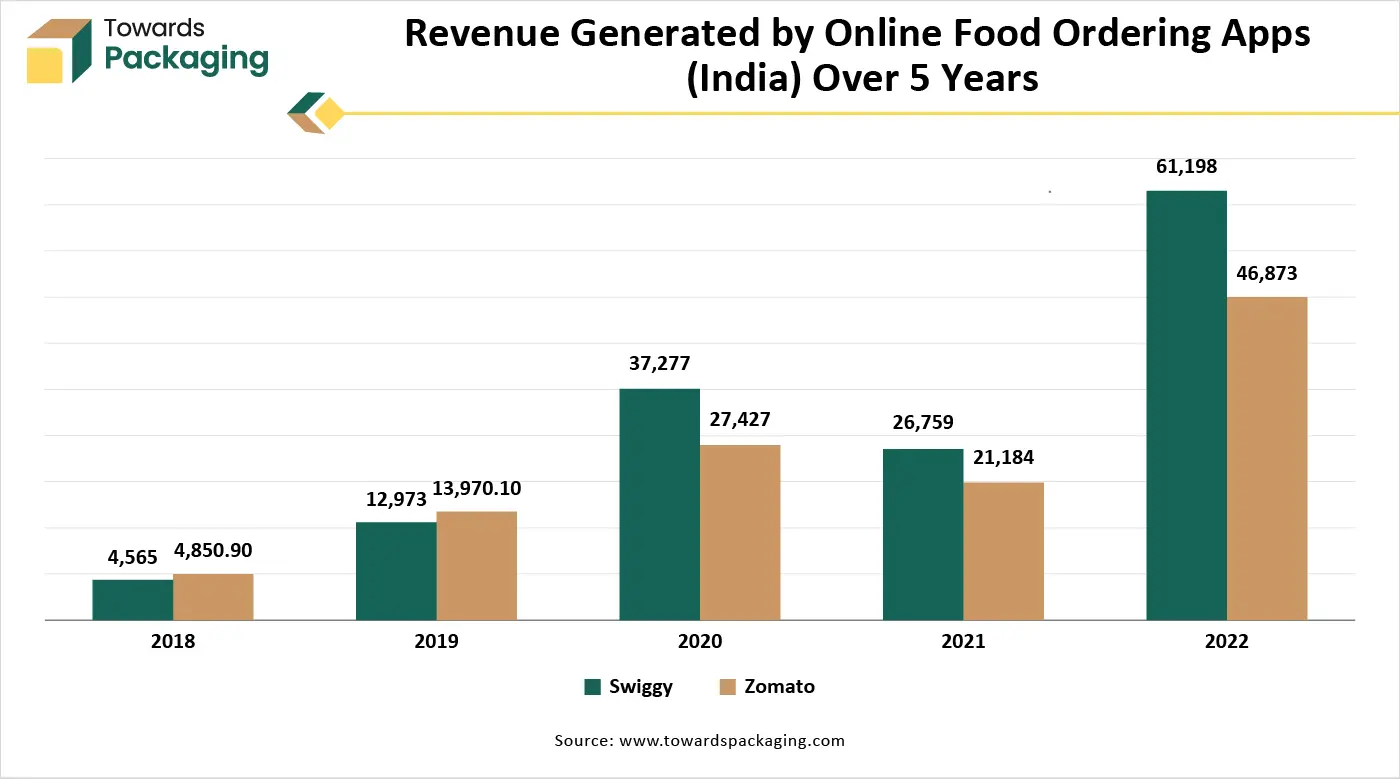

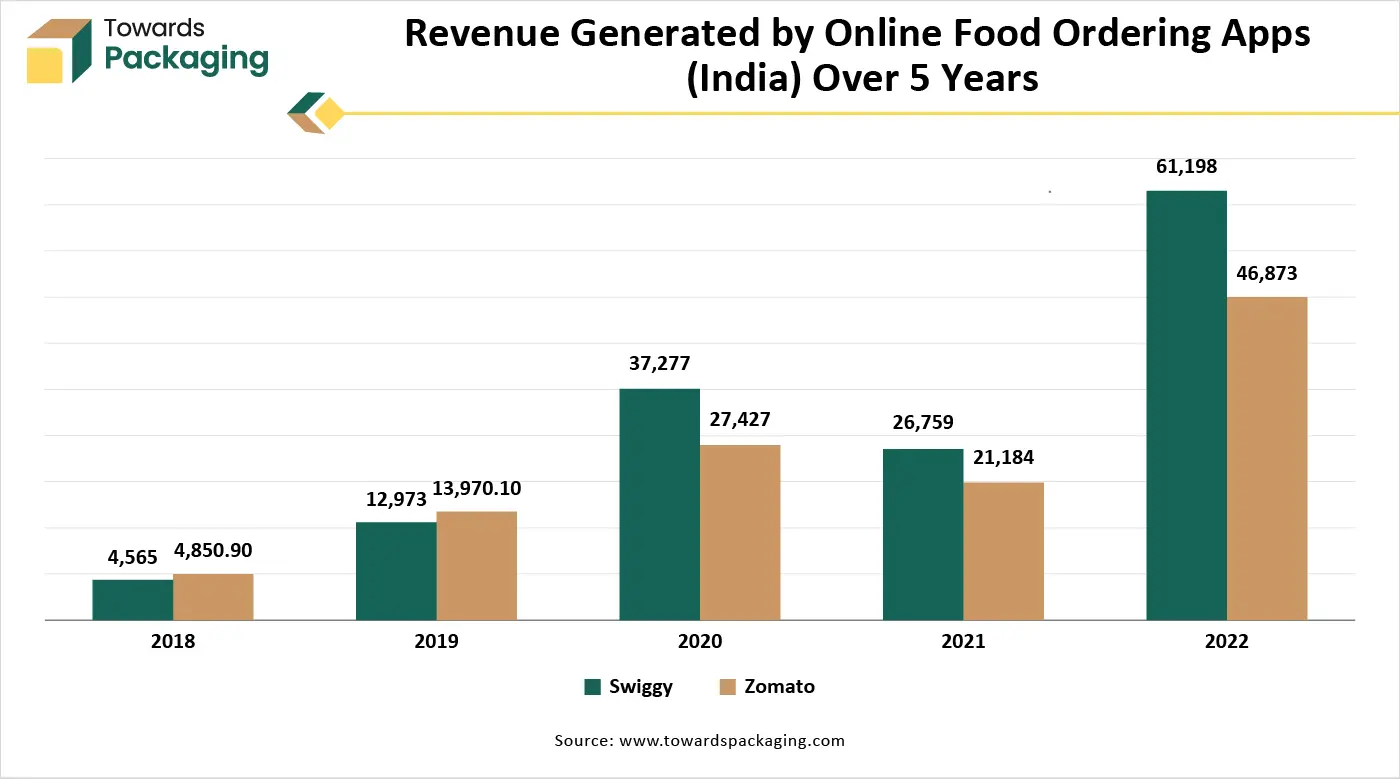

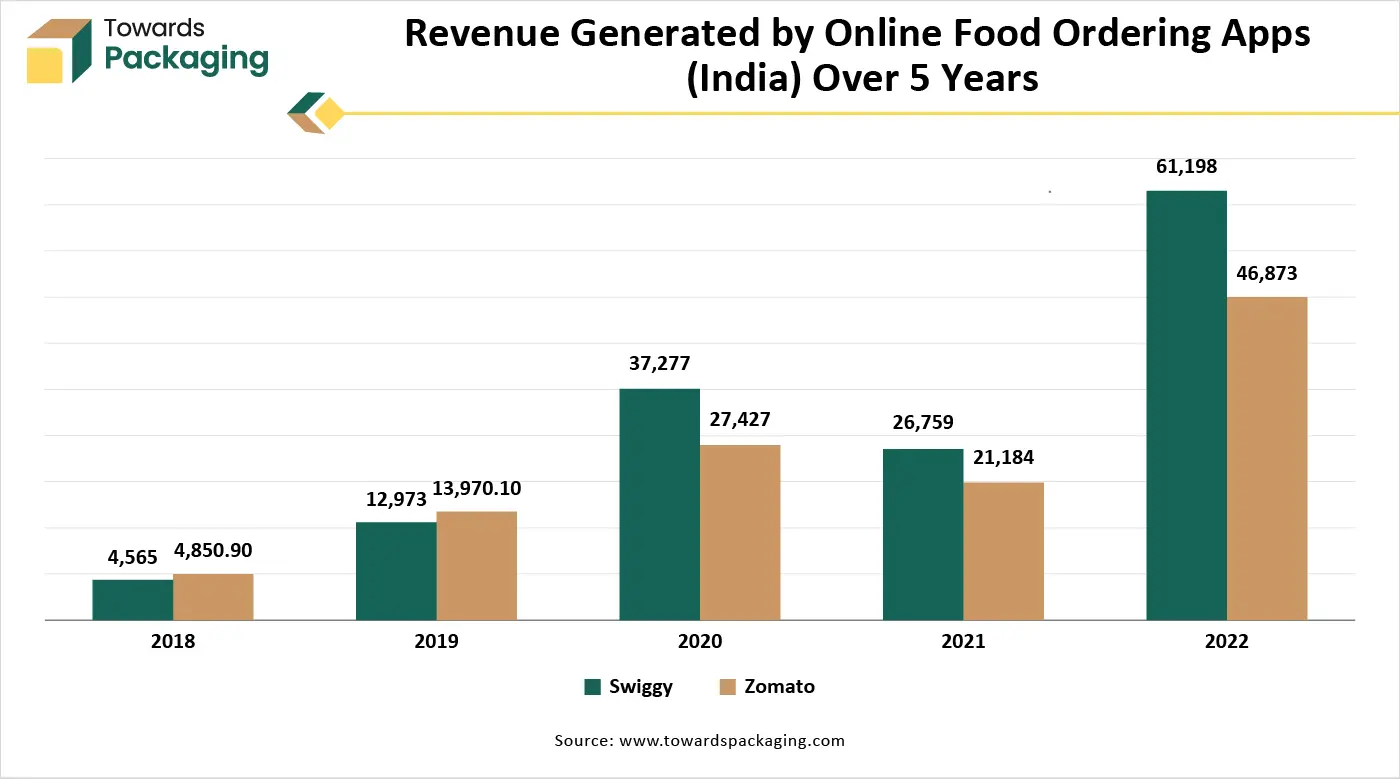

Rising Online Food Ordering Trend to Sustain Dominance

The food segment dominated the rigid plastic packaging market globally. Rigid plastic packaging (like HDPE and PET) offers excellent moisture and oxygen barriers, which are essential for maintaining the freshness and quality of food products. It prevents external contaminants like bacteria, dust and airborne particles from entering, which is crucial for preserving the safety of perishable food products.

Rigid plastic packaging offers convenient, portable solutions for ready-to-eat food items, snacks, and beverages. It is lightweight yet durable, which makes it easier for consumers to transport and consume products, especially in fast-paced lifestyles. Rigid plastic packaging offers protection and durability during the transportation of food from restaurants or food delivery services to consumers.

“Zomato boasts 12,000 restaurant partners and more than 1.4 million listed eateries. Additionally, it has more than 6500 Zomato Gold restaurant partners. About 285,000 delivery drivers and 3,50,000 restaurant listings were operating on its network in India as of December 2020. It had 25,440 Pro restaurant partners for the Indian market. With 8339 workers, it ranks as the 11th most popular website worldwide and the second most popular in India in terms of restaurant traffic as of March 2023.”

It prevents damage or contamination during delivery, ensuring that food arrives safely and intact. Rigid plastic containers, such as clamshells, jars, and bottles, are designed to be seal-tight, preventing spillage or leakage of liquids, sauces, or greasy foods, which is critical for food delivery. The growth of online food ordering is tied to an increase in demand for ready-to-eat meals, such as those delivered from restaurants, meal kits, and prepared food brands. Rigid plastic packaging is convenient for both consumers and food providers since it’s lightweight, easy to transport, and provides easy-to-open features.

Regional Insights

Asia’s Growing Online Food Ordering Trend to Promote Dominance

Asia Pacific region held the largest share of the rigid plastic packaging market in 2024, owing to growing trend of online food ordering in the region. Countries like China, India, Japan, and South Korea have seen rapid economic development over the past few decades, driving increased industrial activity. This growth leads to a surge in demand for packaged goods across various industries like food and beverages, pharmaceuticals, and consumer products. The rapid growth of urban populations in the Asia Pacific region has led to a shift in consumer lifestyles, with more people purchasing packaged goods and ready-to-eat meals, which require rigid plastic packaging for durability and convenience.

Asia Pacific region is home to over 4.5 billion people, representing a huge consumer base that is fueling demand for packaged products. Countries like China, India, and Indonesia have enormous populations that drive high-volume consumption of packaged food, beverages, and consumer goods. The expanding middle class in emerging economies, especially in China and India, is increasingly opting for packaged products, driving up the demand for rigid plastic packaging solutions in the region.

- The rise of e-commerce and online food delivery platforms (like Alibaba, Flipkart, and Amazon India) has significantly increased demand for safe, durable, and cost-effective packaging.

- As online sales continue to grow, especially for food, personal care, and household goods, the demand for rigid plastic packaging solutions also increases.

- Rigid plastic packaging provides a secure, lightweight solution that helps protect goods during transportation and last-mile delivery, which is crucial in the e-commerce sector.

Asia Pacific countries, especially China and India, have established themselves as global manufacturing hubs for plastic production. These countries have strong manufacturing infrastructures and low production costs, making rigid plastic packaging highly affordable and easily accessible. The Asia Pacific region has witnessed rapid growth in the food service and food delivery sectors, particularly in China, India, and Southeast Asia. This has led to an increase in the demand for food-safe packaging, such as rigid plastic containers and bottles, for takeout, delivery, and fast food.

Governments in countries like China, India, and South Korea offer support to local manufacturers through incentives and subsidies for industrial growth. Policies that encourage domestic production of packaging materials further bolster the regional market. Many Asia Pacific region countries, particularly China, India, and Vietnam, have low labor costs, which contribute to lower manufacturing costs for rigid plastic packaging. This makes the region an attractive destination for packaging production and exports to other parts of the world.

Several leading packaging companies and global brands have invested heavily in Asia Pacific region, setting up manufacturing plants and distribution networks. Companies like Amcor, Sealed Air, and SABIC are actively contributing to the region’s dominance in the rigid plastic packaging market. The influx of foreign direct investments (FDI) into the Asia Pacific region is driving technological upgrades and enhancing production capacity, further strengthening the market.

China Rigid Plastic Packaging Market Trends

China rigid plastic packaging market is growing owing to large number of investing in China for getting manufacturing guidance. China is investing heavily in innovative packaging solutions. Advances in materials, such as bioplastics and recycled PET (rPET), are driving the growth of sustainable rigid plastic packaging options that align with both eco-friendly goals and growing consumer demand for sustainability. Manufacturers in the China are focusing on offering customized and high-quality packaging solutions, allowing companies to create distinctive packaging for branding, safety, and convenience.

North America’s Advanced Manufacturing Technology to Support Growth

North America region is anticipated to grow at the fastest rate in the rigid plastic packaging market during the forecast period. The North American population increasingly prefers on-the-go and ready-to-eat meals, such as packaged snacks, beverages, and takeout food. Rigid plastic packaging provides the convenience, portability, and ease of storage required for such products, making it the preferred packaging choice for foodservice and retail markets. North America, particularly the United States and Canada, has a highly diversified manufacturing base, including industries such as food and beverages, personal care, pharmaceuticals, and consumer goods.

Each of these industries relies on rigid plastic packaging for its efficiency, cost-effectiveness, and ability to provide safe and secure packaging for their products. Manufacturers in North America continue to innovate by offering a wide variety of custom packaging solutions, such as custom shapes, sizes, and graphics. This offers food brands, consumer goods companies, and other industries the ability to enhance their brand identity and attract more customers. North American companies are at the forefront of developing sustainable packaging solutions, including recyclable plastics (such as rPET) and biodegradable plastic options, which cater to the growing eco-conscious consumer base in the region.

North America has seen a significant rise in the adoption of recycled plastics (rPET), bioplastics, and other eco-friendly packaging solutions. Companies are responding by using sustainable materials in rigid plastic packaging to reduce their environmental impact. North America is also seeing an increasing adoption of smart packaging technologies, which include QR codes, RFID tags, and temperature-sensitive indicators integrated into rigid plastic containers. These technologies help improve supply chain efficiency, ensure product safety, and enhance consumer interaction with brands. Companies in North America are leveraging these technologies to provide consumers with greater transparency about the origin, storage conditions, and expiration of products.

U.S. Rigid Plastic Packaging Market Trends

The U.S. rigid plastic packaging market is driven by the rising approval by regulatory bodies. The U.S. country a has stringent packaging standards and regulations to ensure product safety. Rigid plastic packaging, especially made from materials like PET, HDPE, and PVC, complies with these FDA and Health Canada standards, making it ideal for industries such as food and beverages, pharmaceuticals, and personal care.

Many North American companies are setting aggressive sustainability targets, including zero waste and recycling goals. This has driven the demand for packaging solutions that can be easily recycled and reused, further supporting the adoption of rigid plastic packaging. There is an increasing push from both consumers and regulators toward sustainable packaging.

Europe’s Stringent Regulatory Laws to Project Notable Growth

Europe region is seen to grow at a notable rate in the foreseeable future. Europe region has strong focus on creating a circular economy, with an emphasis on minimizing waste and promoting recycling. Rigid plastic packaging manufactured from recycled plastics is in high demand due to stringent EU regulations on plastic waste and recycling.

Countries like Germany, France, and the U.K. have well-established waste management and recycling systems that support the use of recyclable rigid plastic packaging. The European Union has implemented laws such as the European Plastic Strategy, which encourages the use of recyclable materials, the reduction of plastic waste, and the ban on single-use plastics. These regulations are pushing the market towards sustainable packaging solutions, where rigid plastic plays a key role in meeting these goals.

Italy & France are home to a significant and well-developed food and beverage industry, which includes major players like Nestle, Danone, and Unilever. The demand for rigid plastic packaging in food and beverage products including soft drinks, dairy products, snacks and confectionery, is growing as these companies require cost-effective, durable, and safe packaging solutions.

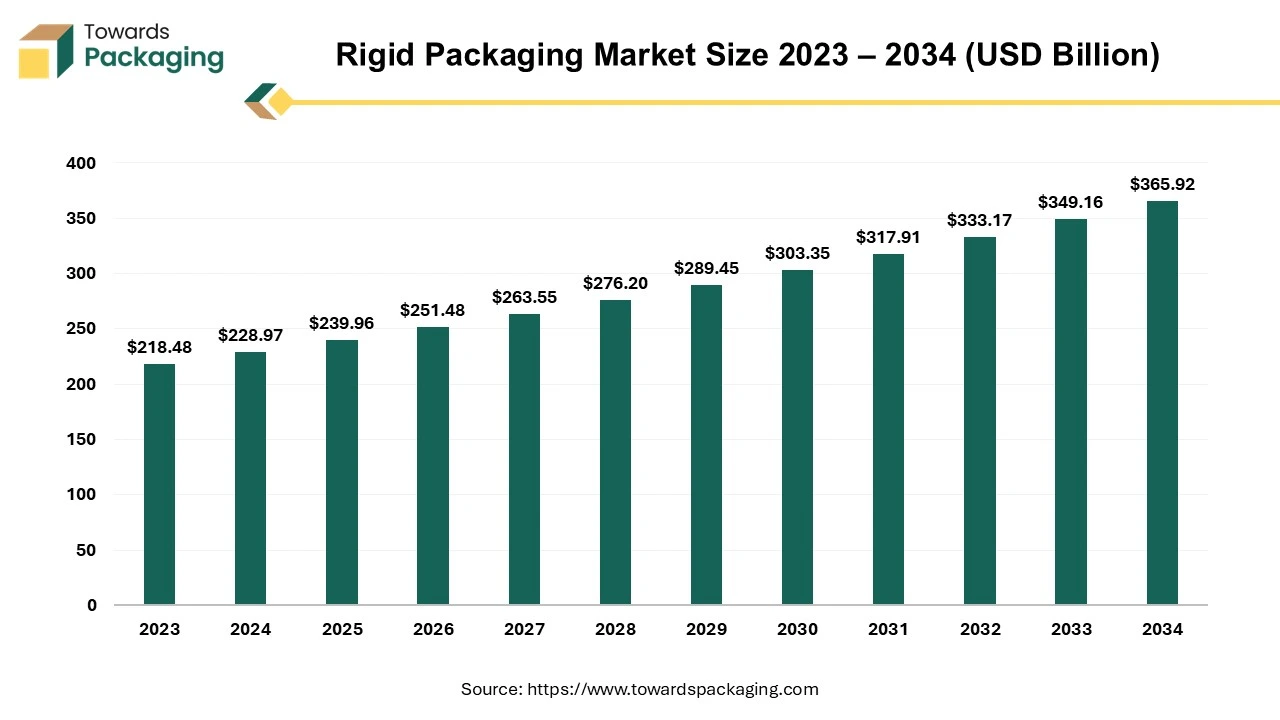

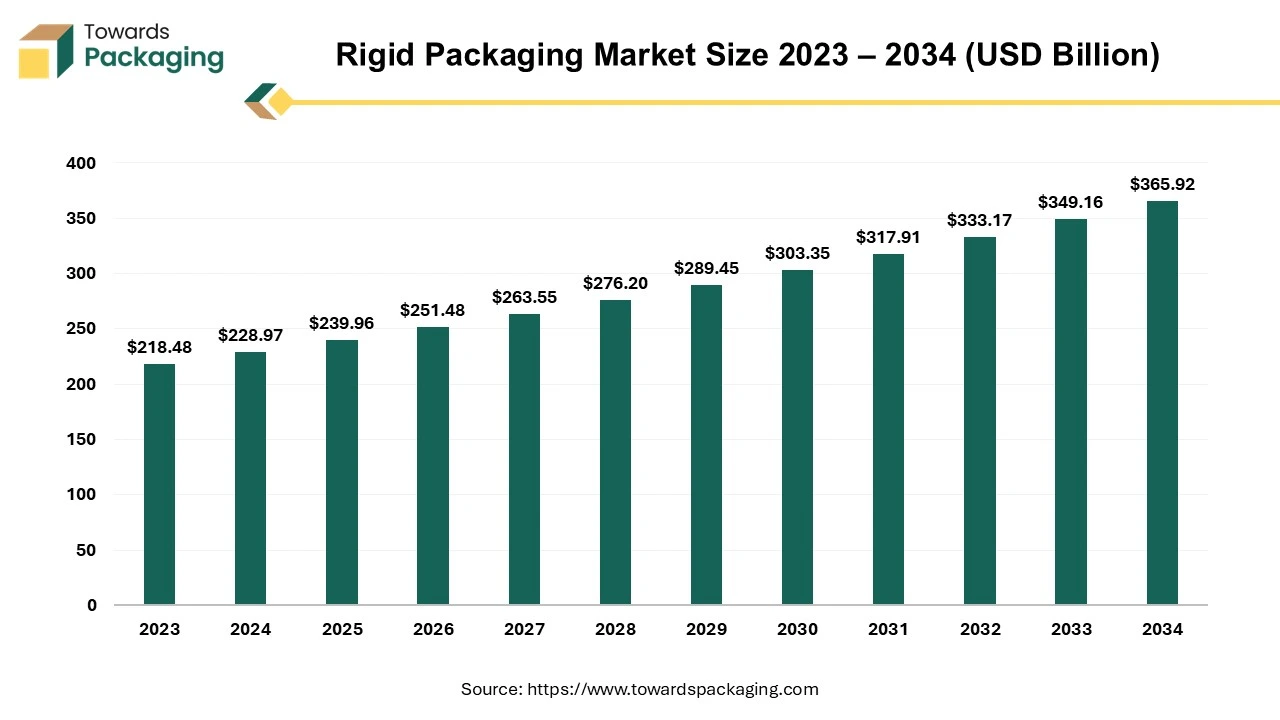

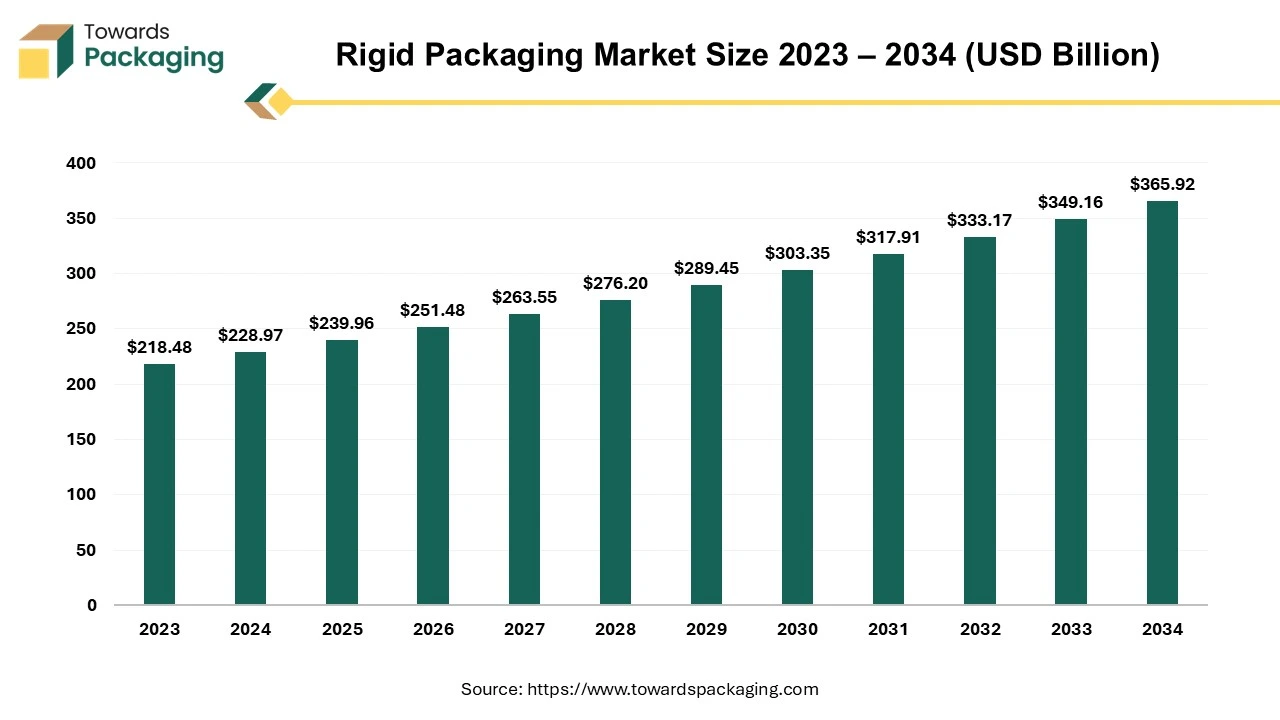

Growth of Rigid Packaging Market

The global rigid packaging market size reached US$ 228.97 billion in 2024 and is projected to hit around US$ 365.92 billion by 2034, expanding at a CAGR of 4.8% during the forecast period from 2024 to 2034.

The rigid packaging sector makes prominent use of plastic owing to their numerous advantages, include becoming durable, portable, chemically impermeable, and reasonably priced. Considering 31% of the world's plastic utilisation volume going to the packaging, the industry certainly is dominating with the manner when plastics are used. Comparing to other forms of packaging, rigid packaging is more lightweight. It also reduces food waste and spoiling, protects against breakage, and offers a host of other advantages. Rigid plastic widely used in various industries such as food and beverage, personal care, healthcare and others.

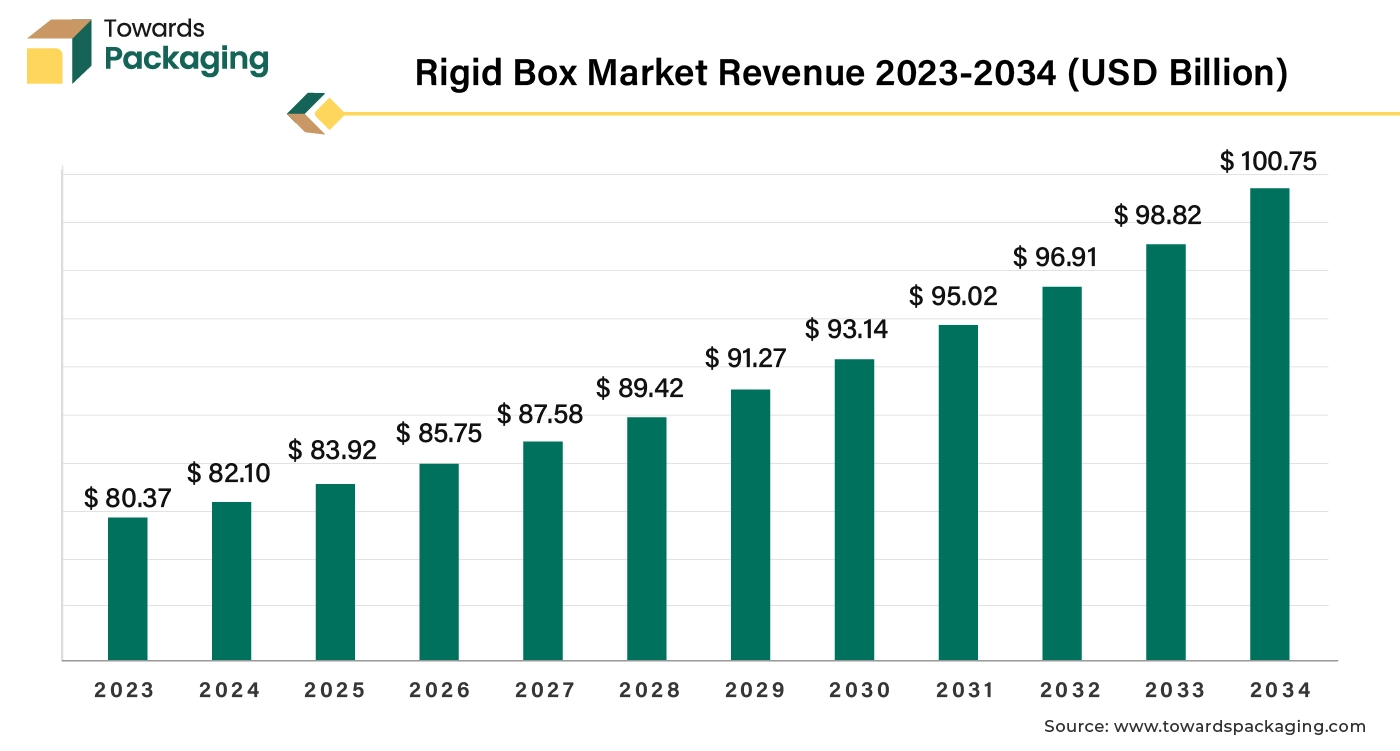

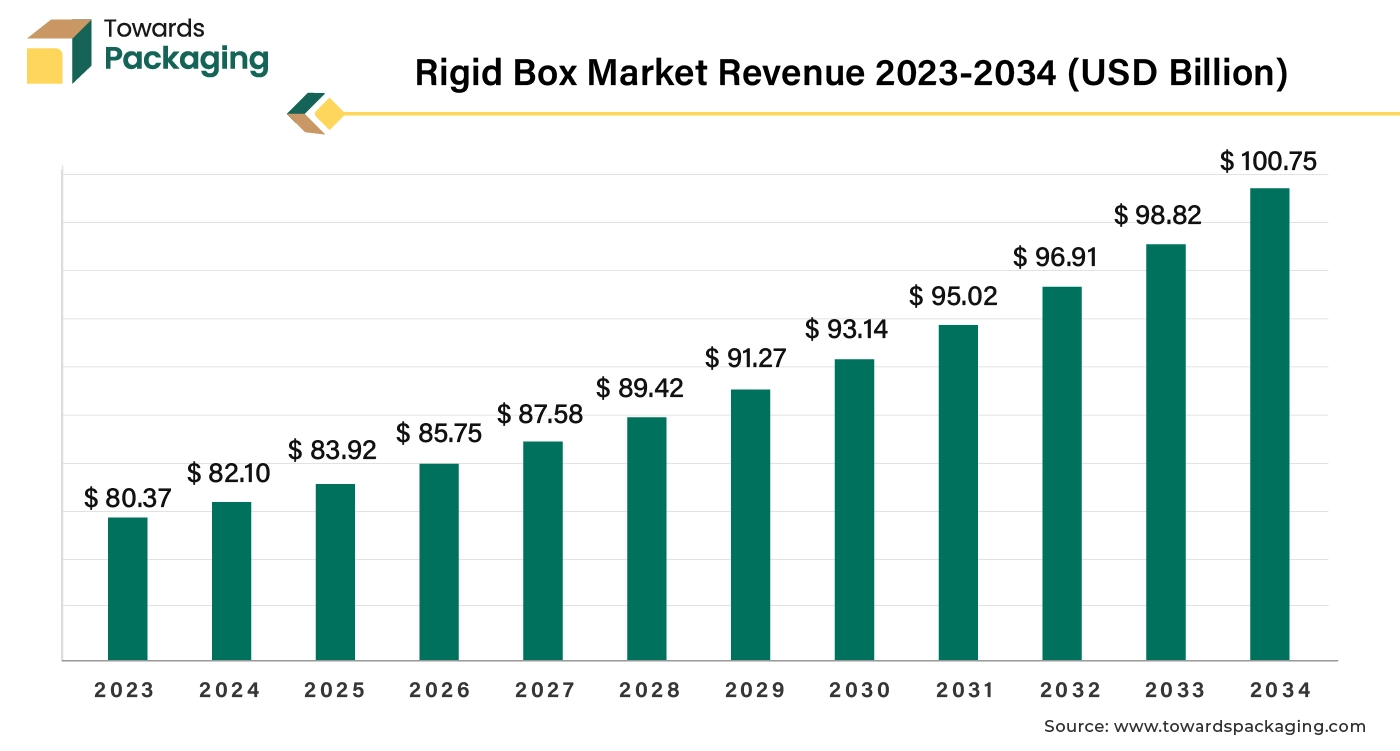

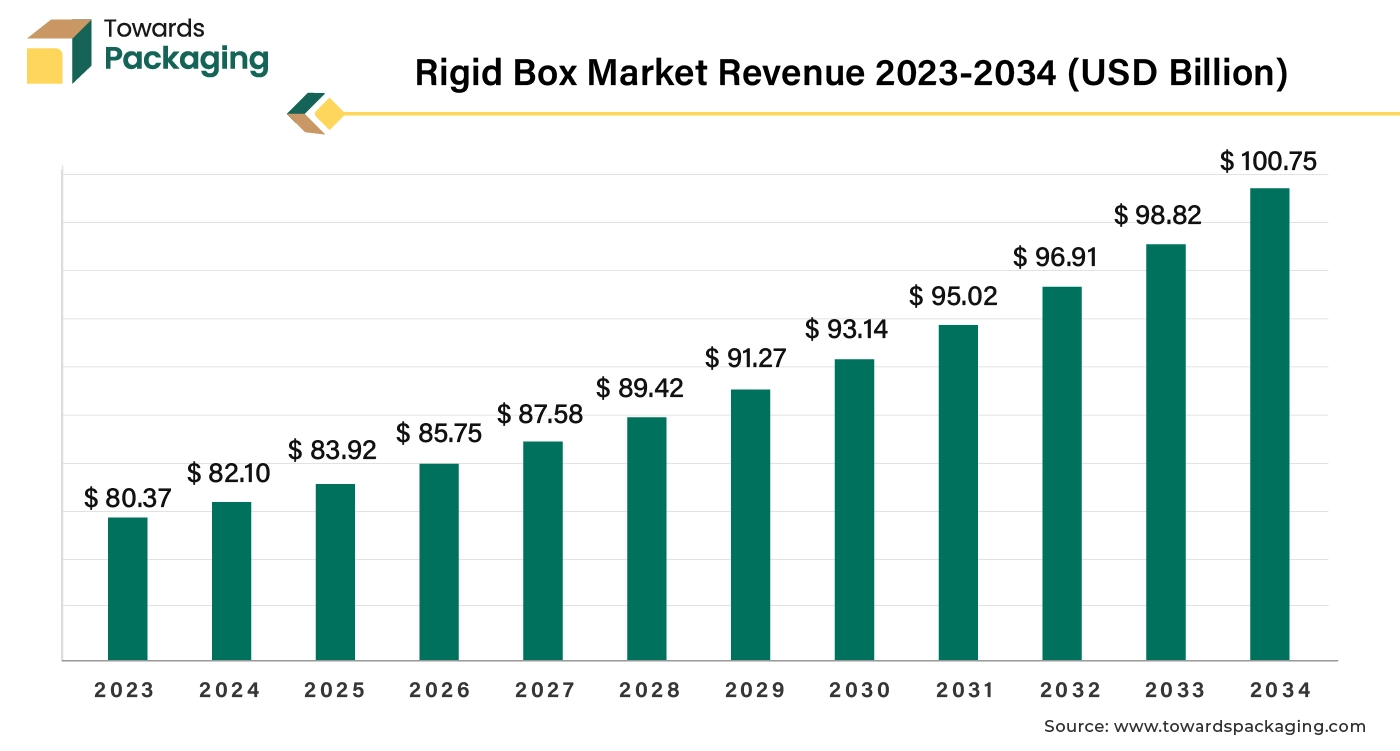

Rigid Box Market: Luxury Packaging Experience

The rigid box market is expected to increase from USD 83.92 billion in 2025 to USD 100.75 billion by 2034, growing at a CAGR of 2.08% throughout the forecast period from 2025 to 2034.

Rigid boxes are a type of packaging box manufactured of more durable, thicker cardboard, or paperboard material. They are made to be pre-assembled, which results in a strong, stable construction that is difficult to fold or collapse. High-end or luxury goods that require better protection and a superior presentation are usually packaged in rigid boxes. Products like electronics, jewellery, cosmetics, perfumes, and high-end consumer goods are frequently packaged in rigid boxes. Numerous printing and finishing choices, including as foil stamping, embossing, debossing, spot UV, and matte or gloss lamination, are available to customize them. As a result, the brand image is strengthened and increased brand recognition is possible.

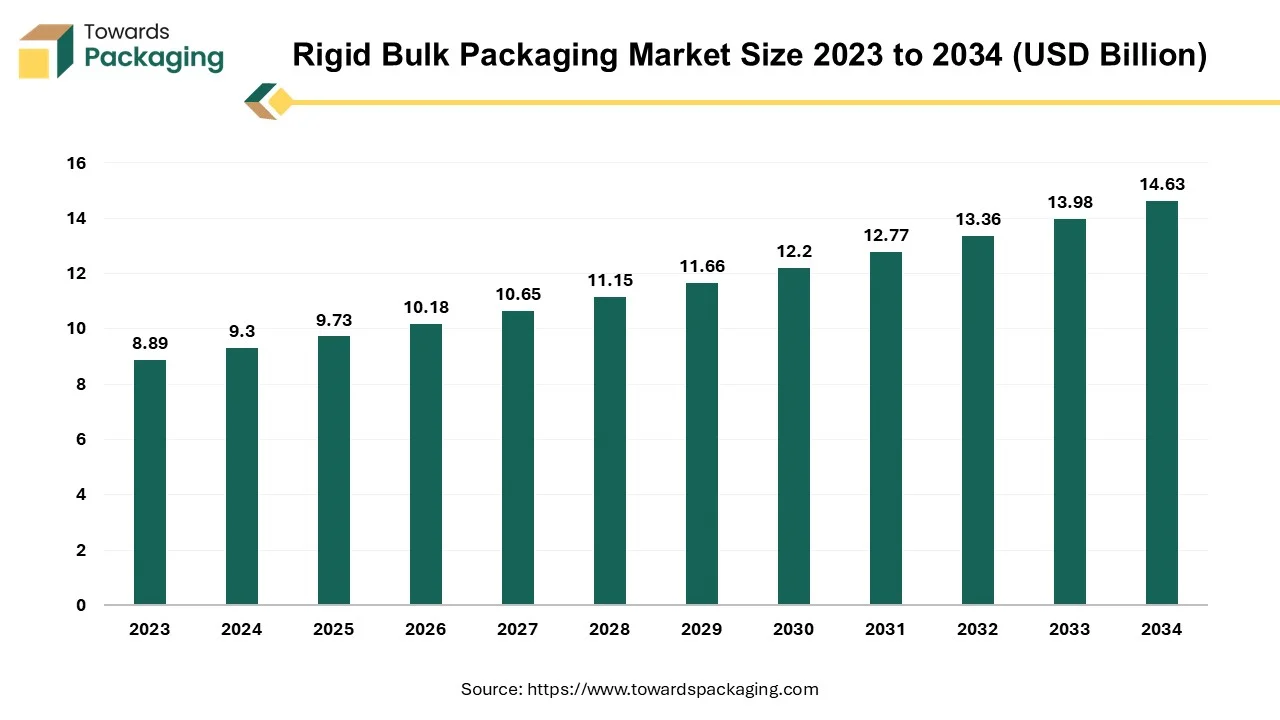

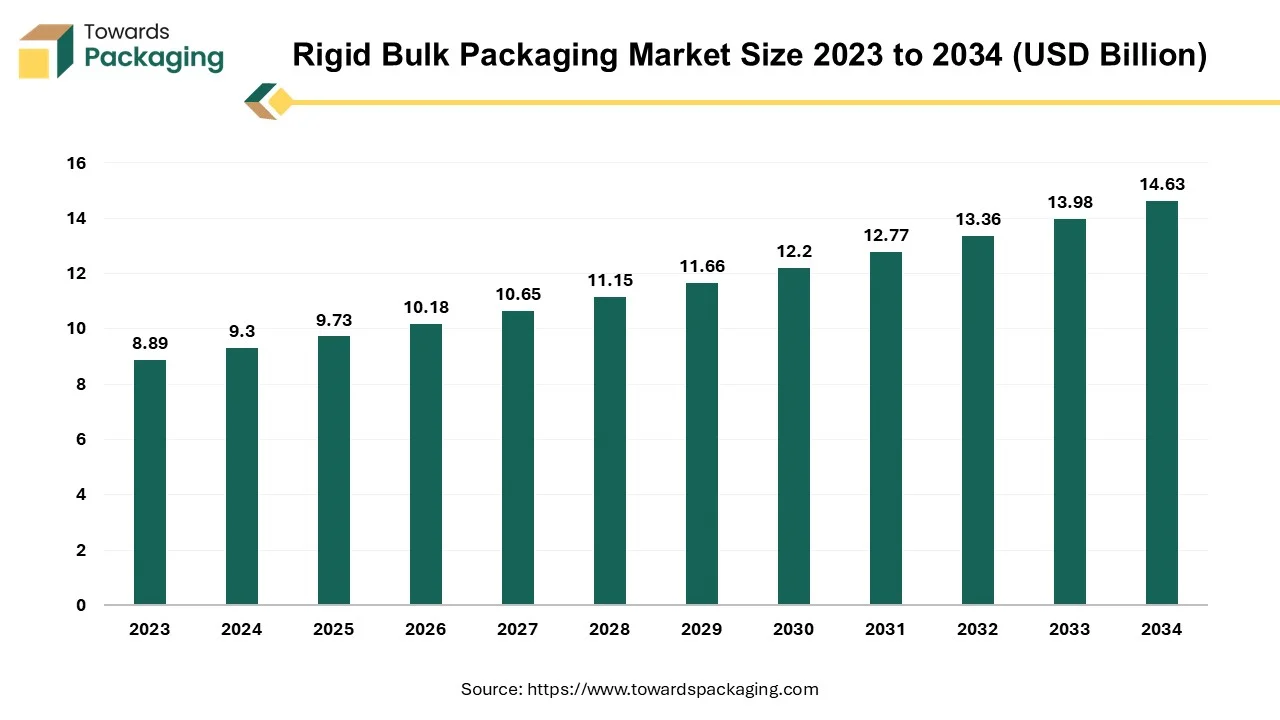

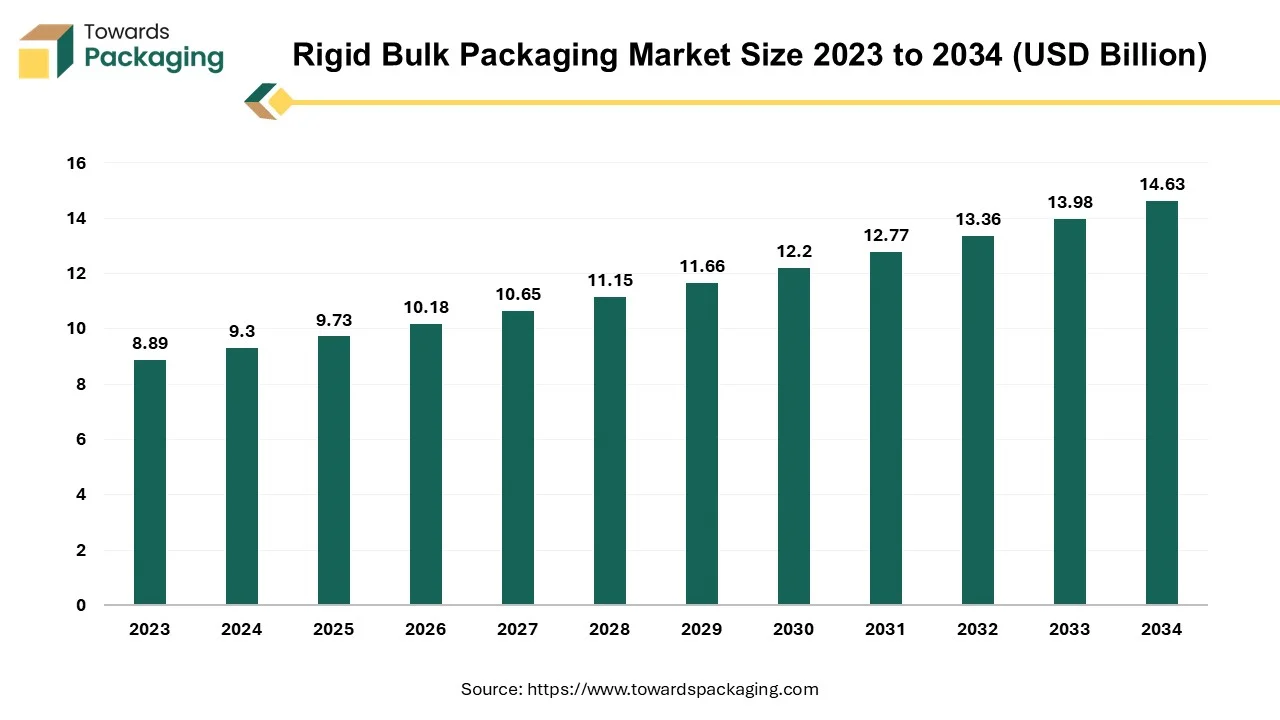

Growth of Rigid Bulk Packaging Market

The global rigid bulk packaging market projected at USD 9.3 billion in 2024, is expected to reach USD 14.63 billion by 2034, growing at a CAGR of 4.63% over the forecast period. The sustained growth in the rigid bulk packaging market is a result of rising demand in the food and beverage and pharmaceutical industries across the globe.

Rigid bulk packaging refers to high-strength packaging containers that are mainly used to transport perishable, delicate, and volatile products. This type of packaging ensures the safe transportation of sensitive products. Heavy-duty materials such as high-strength plastics, metals, and wood are generally used to manufacture rigid bulk packaging.

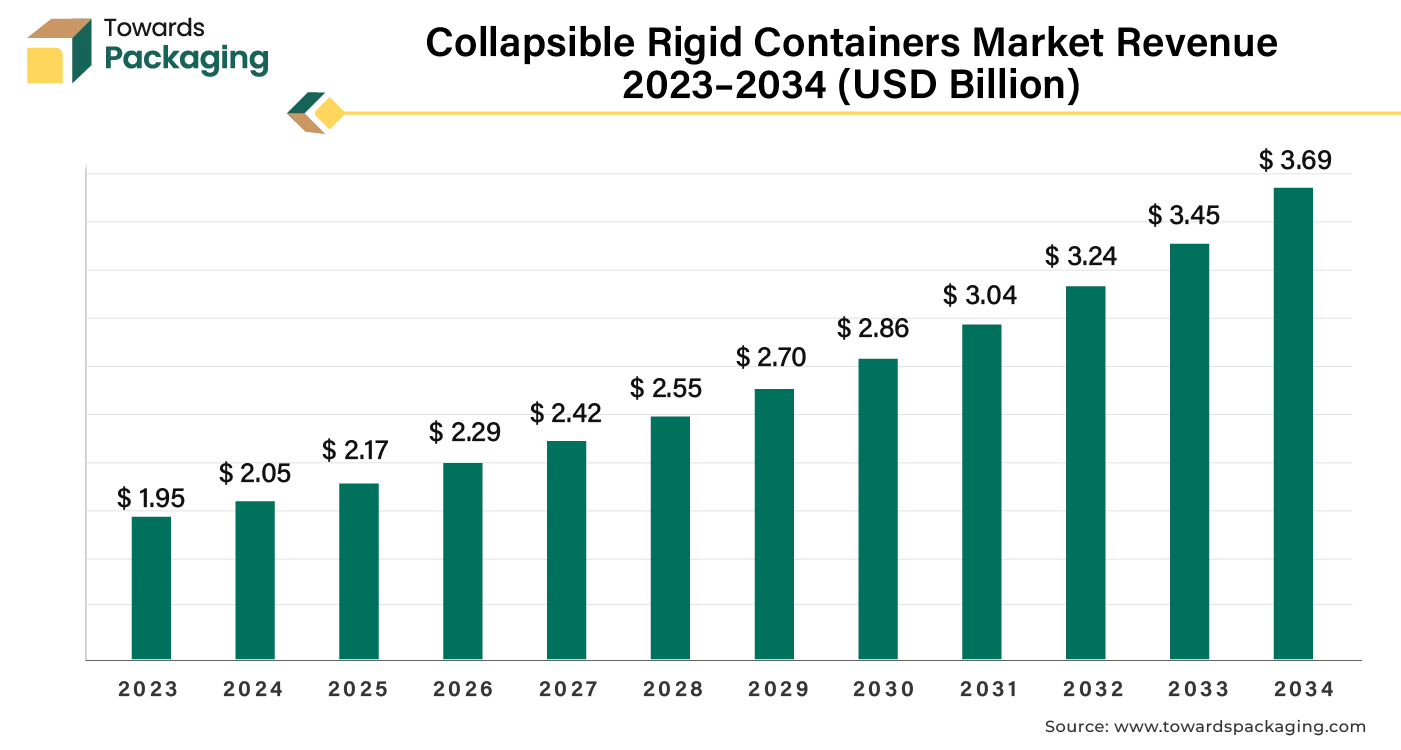

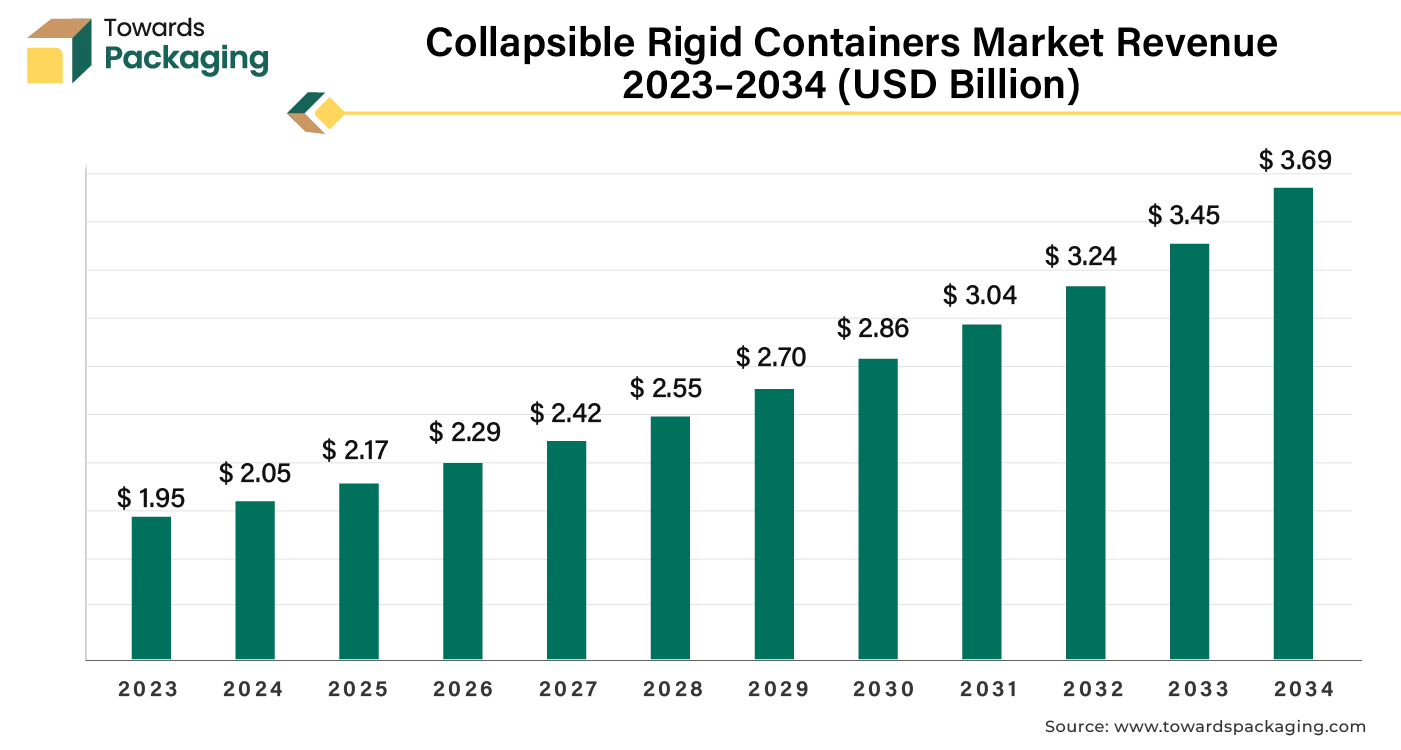

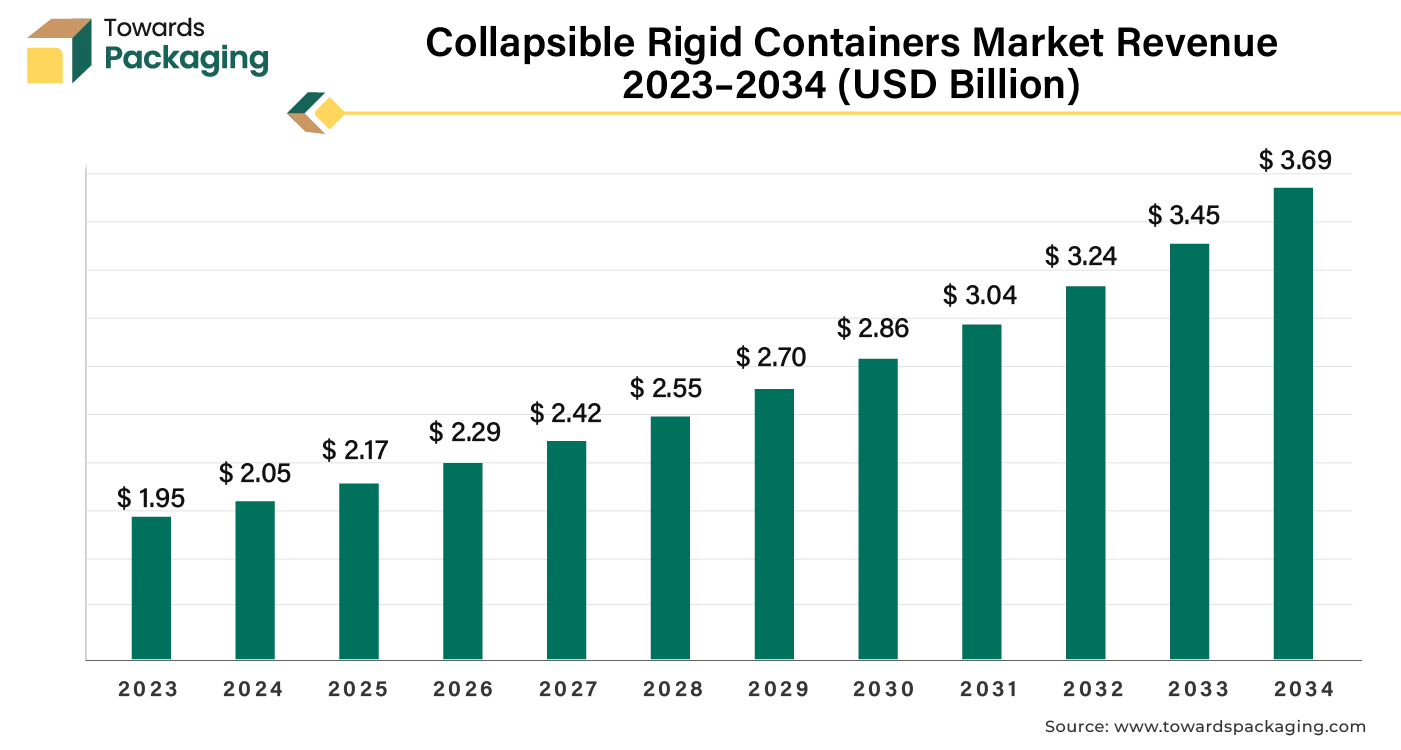

Growth of Collapsible Rigid Containers Market

The collapsible rigid containers market is predicted to expand from USD 2.17 billion in 2025 to USD 3.69 billion by 2034, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Packaging that combines the strength of rigid boxes with the flexibility of collapsible design is known as collapsible rigid boxing. Collapsible rigid containers are made of sturdy materials like cardboard or plastic, these boxes are able to hold their shape and offer strong protection for the contents inside. However, because they are made to be folded or collapsed when not in use, they take up less space in storage and during transportation. In summary, collapsible rigid boxes combine the strength and protection of rigid packaging with the practical benefits of lower storage and shipping costs because of their ability to collapse flat.

Global Rigid Plastic Packaging Market Players

- Berry Global Inc.

- Amcor plc

- Pactiv Evergreen Inc.

- Sonoco Products Company

- ALPLA

- WINPAK LTD

- Nuplas Industries

- DS Smith

- Genpak

- SILGAN PLASTICS

- Anchor Packaging LLC

- PLASTIPAK HOLDINGS, INC.

- Greif

- Gerresheimer AG

- Manjushree Technopack Ltd.

- Mold-Tek Packaging Ltd.

- Greiner Packaging

- Takween Advanced Industries

- Ladain Alyamamah Plastic Factory

- Arabian Plastic Industrial Company Co.

- Crown Packaging Int’l

- S.E.A. Global Pte. Ltd

- Dynapackasia

Latest Announcements by Rigid Plastic Packaging Industry Leaders

- In April 02, 2025, According to Ryan Yost, head of Avery Dennison's Materials Group, the white paper serves as a research-based reference guide for CPG companies currently making decisions about sustainable packaging. Packaging innovations are a component of PG firms' plans to meet stakeholder expectations as they face increasing pressure from customers, retailers, regulators, investors, and employees to prioritize the circular economy.

- In addition to acknowledged source materials and insights from Avery Dennison staff interacting with customers, recyclers, governmental agencies, and industry associations around the world where the firm works, the company’s white paper offers concrete facts based on independently conducted interviews with CPGs worldwide. The company see it as a fresh source of research data and a useful tool for CPGs to tackle circularity issues.

New Advancements in Rigid Plastic Packaging Industry

- In April 2025, LyondellBasell, leading global chemical company announced the introduction of Pro-fax EP649U, a novel polypropylene impact copolymer intended for the rigid packaging sector. This cutting-edge product is perfect for food packaging applications because it is specially made for thin-walled injection molding. The excellent flow characteristics and quick crystallization of Pro-fax EP649U allow for the effective manufacture of thin-walled containers while improving output and product quality.

- In April 2025, Spectrum Brands, Inc., a top provider of high-quality and reasonably priced pet supplies for dogs, cats, birds, fish, and small animals, will introduce a novel new distribution method for its FURminator line of grooming and shedding products. Developed in collaboration with AeroFlexx's liquid packaging experts, the FURminator deShedding Ultra Premium Shampoo squeeze packaging offers pet owners a self-sealing, spill-proof alternative in a cutting-edge container that consumes less plastic than traditional FURminator shampoo bottles.

Global Rigid Plastic Packaging Market Segments

By Product Type

- Bottles & Jars

- Rigid Bulk Products

- Trays

- Tubs, Cups, & Pots

- Pallets

- Drum & Barrels

- Crates

- Others

By Production Process

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

- Others

By Material

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Expanded Polystyrene (EPS)

- Bioplastics

- Others (PC, Polyamide)

By End User

- Food

- Meat, Seafood, and Poultry

- Ready to Eat Meals

- Dairy Products

- Bakery and Confectionery

- Other Food Products

- Beverages

- Alcoholic Beverages

- Non-alcoholic Beverages

- Healthcare

- Cosmetics & Toiletries

- Industrial

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait