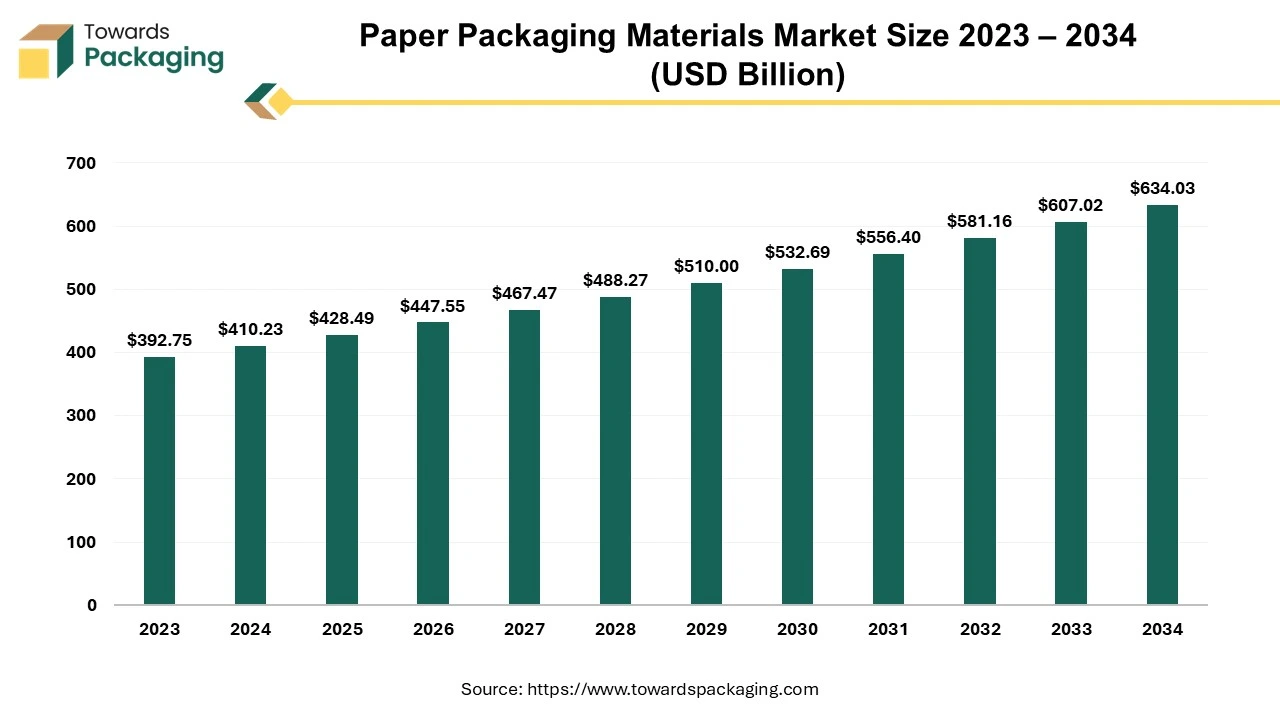

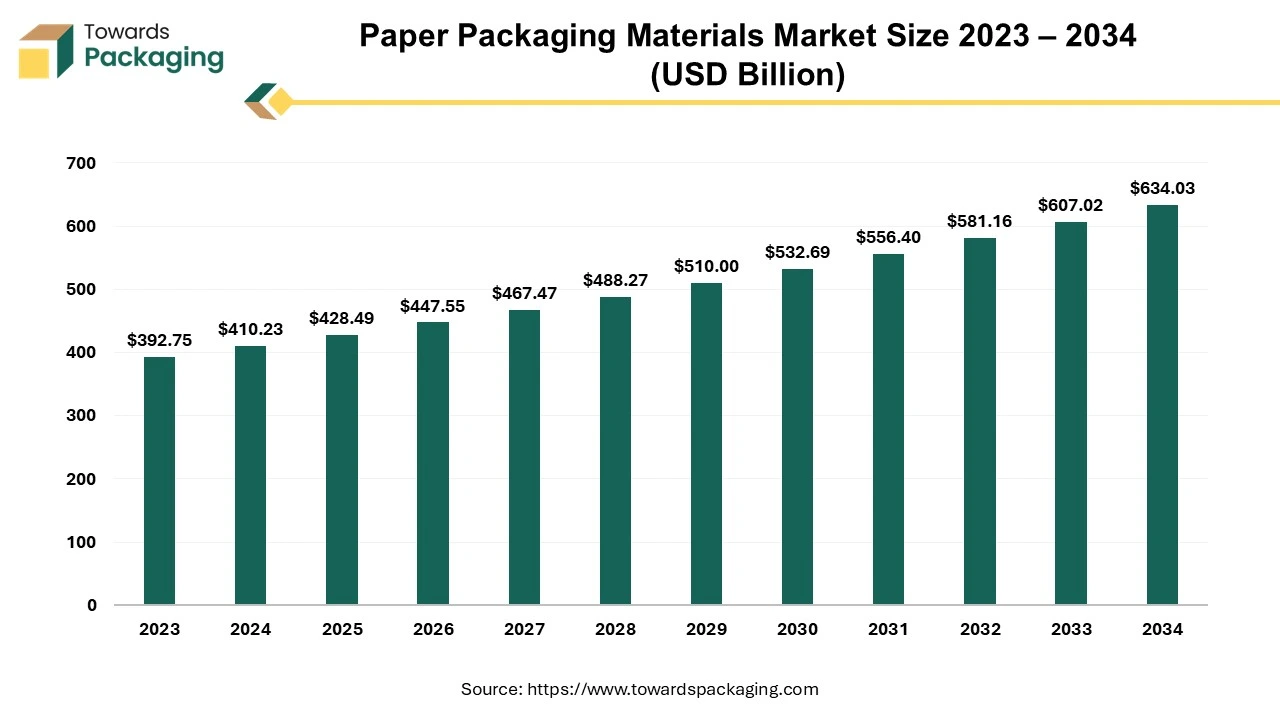

The paper packaging materials market is forecasted to expand from USD 447.55 billion in 2026 to USD 662.25 billion by 2035, growing at a CAGR of 4.45% from 2026 to 2035.

The market is driven by booming e-commerce sector and shift of consumers towards sustainable packaging solution. The paper packaging material is utilized in the transportation of products due to its cost-effective, sustainable, and durable properties. Along with these qualities, preserving the freshness and providing an easy opening maneuver of the product to the consumer are the leading objectives of the market. The awareness among the consumers has increased the environmental consciousness and the consequence demands sustainability, that is, paper-based solutions.

Each sector has its own unique way of packaging, given the reason they want to present their product in an aesthetic appearance and also want to ensure its preservation and protection using eco-friendly packaging material. The paper packaging materials market offers it to them, and this fuels market growth.

Urbanization interconnects many factors together which are the food and beverages industry, personal care market, and pharmaceuticals, and all these indsutriesuse paper material for packaging their products which should be environmentally sustainable and should also follow strict government regulations.

All these sectors fulfil all the features required by the market customers. E-commerce is also another driving factor for the demand of shipping boxes and other paper-based packaging market.

Here, e-commerce is the result of rising incomes of the middle class which heightens the consumption of packaged products. The plant-based fibre and combinations of biochemicals can also contribute towards market growth.

| Metric | Details |

| Market Size in 2025 | USD 428.49 Billion |

| Projected Market Size in 2035 | USD 662.25 Billion |

| CAGR (2026 - 2035) | 4.45% |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Product, By Application and By Region |

| Top Key Players | DS Smith PLC (U.K.), Georgia-Pacific Corporation (U.S.), WestRock Company (U.S.), Mondi Group Plc (U.K.), Hood Packaging Corporation (U.S.). |

Paper being a recycled and biodegradable-based material is a magnum opus for the paper packaging materials market. The eco-friendly and sustainability demand has paved the way for the market to use materials like recycled paper, bagasse, and bamboo as a resource to maintain and respect the initiative and awareness of consumers and the government.

According to the American Forest and Paper Association, the data illustrates that in 2022, paper was recycled by 68% wherein half was used in manufacturing cardboard. The portion was used in making boxboards, tissues, and other packaging material. The e-commerce growth, food and beverage industry, personal care and cosmetics, and pharmaceutical and healthcare industry are the groundbreaking factors that present multiple opportunities for the paper packaging materials market.

The paper packaging material which is made from wood pulp is the product of trees and excessive reliance on this can lead to environmental hazards and deforestation. An additional factor, water, whose consumption is necessary for the energy source to produce the packaging material will lead to water problems, in general scarcity. Although the purchase of paper packaging material seems cost-effective to the common consumer, it is the opposite for the other sectors. Apart from this, opposite alternative packaging materials are the intense competitive hindrances for the paper packaging materials market. Materials like plastic and aluminum are the competitors where the price and profit margins are affected.

Asia-Pacific is the leading region for the paper packaging materials market. The market in this region is driven by food and beverages, sustainable packaging rapid urbanization, increasing incomes, and the emerging e-commerce sector. The E-commerce sector is also contributing to the growth rate of the market. The increasing consumer base that prefers online shopping has increased the requirement for paper packaging due to its reliable and sturdy nature. The recyclable feature of paper packaging types like cardboard, paper bags has increased its use and has become a significant base for the sustainability drive as the Asia-Pacific region focuses on the use of sustainable packaging solutions.

China Market Trends

China paper packaging materials market is driven by the large domestic manufacturing ecosystem in the country. China's e-commerce market is the largest in the world, with companies like Alibaba, JD.com, and Pinduoduo driving explosive demand for packaging especially sustainable and recyclable paper-based packaging for last-mile delivery. China has implemented strict plastic reduction policies and bans on single-use plastics, especially in cities. This shift has accelerated the adoption of paper as an eco-friendly alternative.

Policies like the “Green Packaging” initiative support and incentivize the use of biodegradable and recyclable paper materials. China’s massive manufacturing and export industries (electronics, consumer goods, food, pharma) rely heavily on secondary and tertiary packaging much of it now transitioning to paperboard and corrugated paper to meet green goals. Availability of local raw materials (like pulp and bamboo) supports production. Chinese companies have made huge strides in paper strength, coating technology (e.g., waterproofing without plastic), and automation of packaging production lines.

Global brands outsourcing to or selling in China prefer paper packaging to meet international environmental standards, especially in Europe and North America. China's ability to meet large-volume, customizable, and cost-effective paper packaging orders makes it a global supplier.

| Country | Trade Value (US$) | Net Weight (kg) |

| China (Hong Kong SAR) | 135,701,959 | 17,627,822 |

| China (Macao SAR) | 3,839 | 1,431 |

| India | 321,795,607 | 191,810,012 |

| Indonesia | 168,502,081 | 76,320,824 |

| Japan | 50,554,684 | 9,833,858 |

| Kazakhstan | 31,747,817 | 8,993,699 |

| Korea, Republic of | 195,092,423 | 84,525,733 |

| Kyrgyzstan | 1,571,574 | 2,971,510 |

| Malaysia | 207,363,482 | 0 |

| Other Asia, nes | 127,820,144 | 45,276,807 |

| Pakistan | 17,988,443 | 12,120,052 |

| Philippines | 37,584,094 | 13,251,110 |

| Singapore | 131,378,428 | 32,852,622 |

| Thailand | 303,375,936 | 0 |

| Türkiye | 808,828,969 | 416,609,138 |

| Uzbekistan | 5,726,836 | 3,308,575 |

| New Zealand | 21,012,304 | 8,189,913 |

| Mongolia (not included) | — | — |

North America is the fastest-growing region in paper packaging material with a focus on sustainability, given the reason it has developed infrastructure as its support system. In addition, the recycling and reuse system has given them the advantage of the circular economy. Consumers are ready to purchase green packaging products that come with recyclable ability and it is achievable, given the reason that packaging converters and value-chain partners focus on sustainable packaging solutions.

Customization also increases the purchase of boxes since it adds new innovative designs and shapes according to the manufacturer's preferences. The sustainable focus drives the adoption of sustainable options like paper bags and boxes and the government initiatives supporting eco-friendly packaging have skyrocketed the market growth.

U.S. Market Trends

U.S. paper packaging materials market is driven by the advanced logistics and automation. The U.S. has a well-developed consumer goods market, with strong demand across food, beverages, healthcare, e-commerce, and retail all of which require vast amounts of paper-based packaging. The U.S. has one of the most established paper recycling systems, ensuring a steady supply of recycled paper and cardboard, which supports sustainable packaging solutions.

U.S. companies are global leaders in packaging design, printing technologies, and sustainable materials. Innovations include coatings for water resistance, fiber-based molded packaging, and smart packaging solutions. Driven by giants like Amazon, Walmart, and Target, U.S. e-commerce fuels massive demand for corrugated cardboard boxes, padded mailers, and lightweight paper packaging. Strong environmental awareness among U.S. consumers has driven a shift toward biodegradable and recyclable packaging. Companies adopt ESG (Environmental, Social, and Governance) goals, which include reducing plastic and increasing paper use.

The U.S. is rich in forest resources and is one of the top producers of paper pulp, ensuring availability of raw materials for both virgin and recycled paper products. U.S.-based packaging manufacturers use automated, data-driven production systems, enabling high-speed, high-quality, and customizable output.

| Country | Trade Value (US$) | Net Weight (kg) |

| USA | 2,300,965,655 | 0 |

| Mexico | 721,959,085 | 0 |

| Country | Trade Value (US$) | Net Weight (kg) |

| Costa Rica | 62,335,922 | 30,711,636 |

| Dominican Republic | 56,596,504 | 31,393,031 |

| Ecuador | 18,487,374 | 11,680,068 |

| El Salvador | 111,269,221 | 56,863,435 |

| Guatemala | 202,677,349 | 206,482,985 |

| Honduras | 64,933,755 | 70,111,442 |

| Nicaragua | 1,128,800 | 995,161 |

| Panama | 3,753,795 | 2,319,730 |

| Paraguay | 1,745,597 | 1,166,069 |

| Peru | 17,847,687 | 0 |

| Suriname | 18,891 | 10,322 |

| Uruguay | 14,440,707 | 5,361,886 |

| Argentina (not included) | — | — |

| Brazil (not included) | — | — |

Europe region is seen to grow at a notable rate in the foreseeable future. The EU Green Deal, Circular Economy Action Plan, and Single-Use Plastics Directive are pushing industries away from plastic and toward recyclable, compostable paper packaging. sExtended Producer Responsibility (EPR) laws make companies financially accountable for the lifecycle of their packaging, encouraging sustainable alternatives like paper. European consumers are highly eco-conscious, driving demand for plastic-free, biodegradable, and recyclable packaging.

Europe leads in design and material innovation, including: molded fiber and pulp-based trays, plastic-free coatings for paper and renewable or compostable paper composites. Countries like Germany, the Netherlands, and Scandinavia invest heavily in research and development for sustainable materials. Many European brands (like Unilever, Nestlé, Danone) have committed to 100% recyclable or compostable packaging by specific target years (often 2025). Europe's design-focused culture and industry clusters (e.g., in Germany, Scandinavia, Benelux) allow quick scaling of sustainable packaging prototypes and solutions. Though smaller than in the U.S. or China, Europe’s e-commerce sector is growing steadily, and platforms are under regulatory and consumer pressure to use eco-friendly packaging typically paper-based.

| Country | Trade Value (US$) | Net Weight (kg) |

| Croatia | 143,735,117 | 75,369,869 |

| Cyprus | 1,875,226 | 764,632 |

| Czechia | 728,281,304 | 0 |

| Denmark | 312,585,130 | 0 |

| Estonia | 42,663,571 | 23,392,080 |

| Finland | 38,926,872 | 10,112,763 |

| France | 739,473,962 | 0 |

| Germany | 3,453,648,291 | 1,502,849,918 |

| Greece | 157,332,010 | 51,768,631 |

| Hungary | 426,776,081 | 0 |

| Iceland | 655,865 | 193,876 |

| Ireland | 180,752,969 | 45,838,424 |

| Italy | 1,503,887,683 | 0 |

| Latvia | 43,224,253 | 0 |

| Lithuania | 106,618,215 | 46,343,304 |

| Luxembourg | 3,876,956 | 2,051,411 |

| Malta | 1,253,867 | 711,731 |

| Netherlands | 1,212,058,132 | 544,743,538 |

| Norway | 28,362,283 | 16,425,823 |

| Poland | 1,795,863,577 | 778,523,634 |

| Portugal | 274,519,723 | 117,656,326 |

| Romania | 229,725,203 | 0 |

| Serbia | 150,940,161 | 73,051,799 |

| Slovakia | 161,924,356 | 0 |

| Slovenia | 97,564,584 | 30,701,666 |

| Spain | 795,779,870 | 370,239,822 |

| Sweden | 227,377,500 | 76,218,083 |

| Switzerland | 179,143,818 | 49,584,504 |

| United Kingdom | 445,495,973 | 0 |

By product, the liquid packaging cartons segment dominated the paper packaging materials market in 2023. Liquid packaging cartons, commonly used for beverages such as juice, milk, soft drinks, and ready-to-drink products, are highly convenient for consumers seeking portable, lightweight packaging. The demand for ready-to-consume beverages continues to grow globally, especially in emerging markets, driving the popularity of liquid cartons.

By application, the beverages segment dominated the paper packaging materials market in 2023. Many consumers prefer paper-based packaging due to its natural, eco-friendly image. The rise in conscious consumerism has led people to seek out products with packaging that reflects environmental responsibility. As a result, beverage companies are increasingly adopting paper cartons to appeal to environmentally conscious buyers, further driving the dominance of the beverages segment in the paper packaging market.

On the other hand, the fast-food segment is observed to grow at the fastest rate during the forecast period. With growing consumer awareness of environmental issues, many fast-food brands are shifting towards eco-friendly packaging. Paper is perceived as more sustainable compared to plastic, as it is made from renewable resources, is biodegradable, and is often recyclable. Fast-food chains are increasingly using paper straws, paper bags, and paperboard containers to cater to the eco-conscious consumer and to comply with stricter environmental regulations.

By Product

By Application

By Region

February 2026

February 2026

February 2026

February 2026