Uncoated Paperboard For Luxury Packaging Market Demand, Size and Growth Rate Forecast

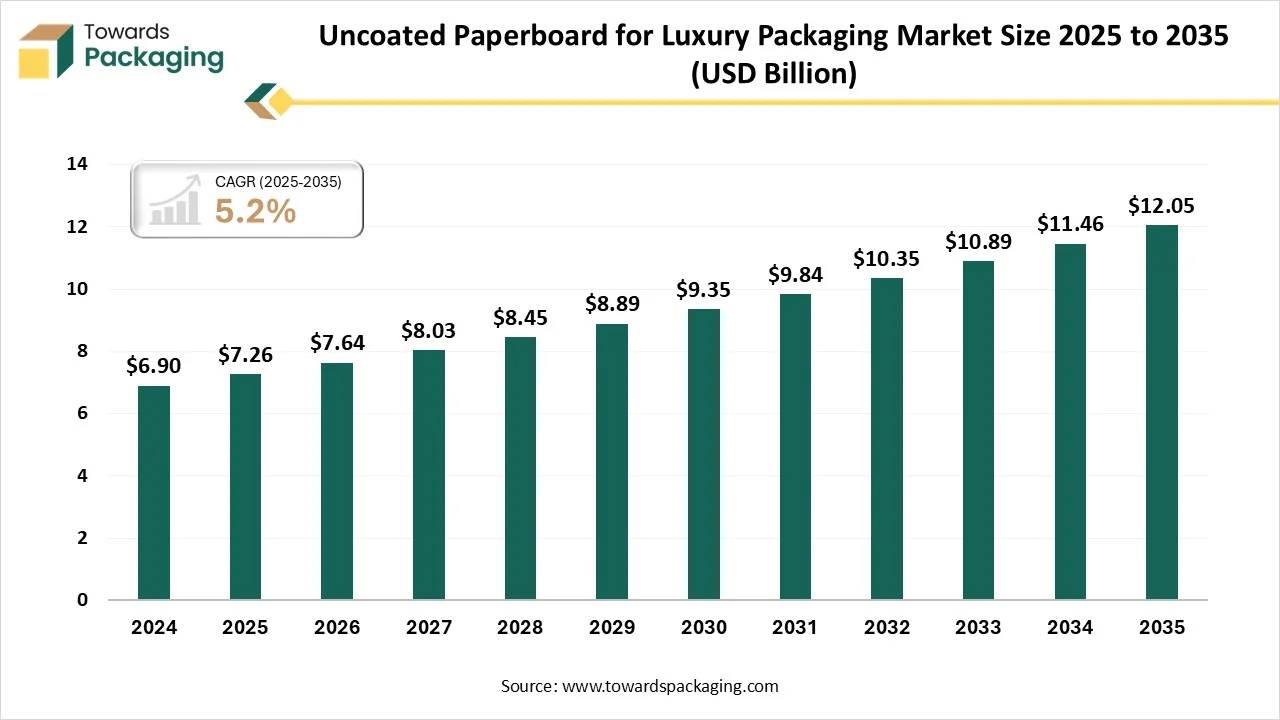

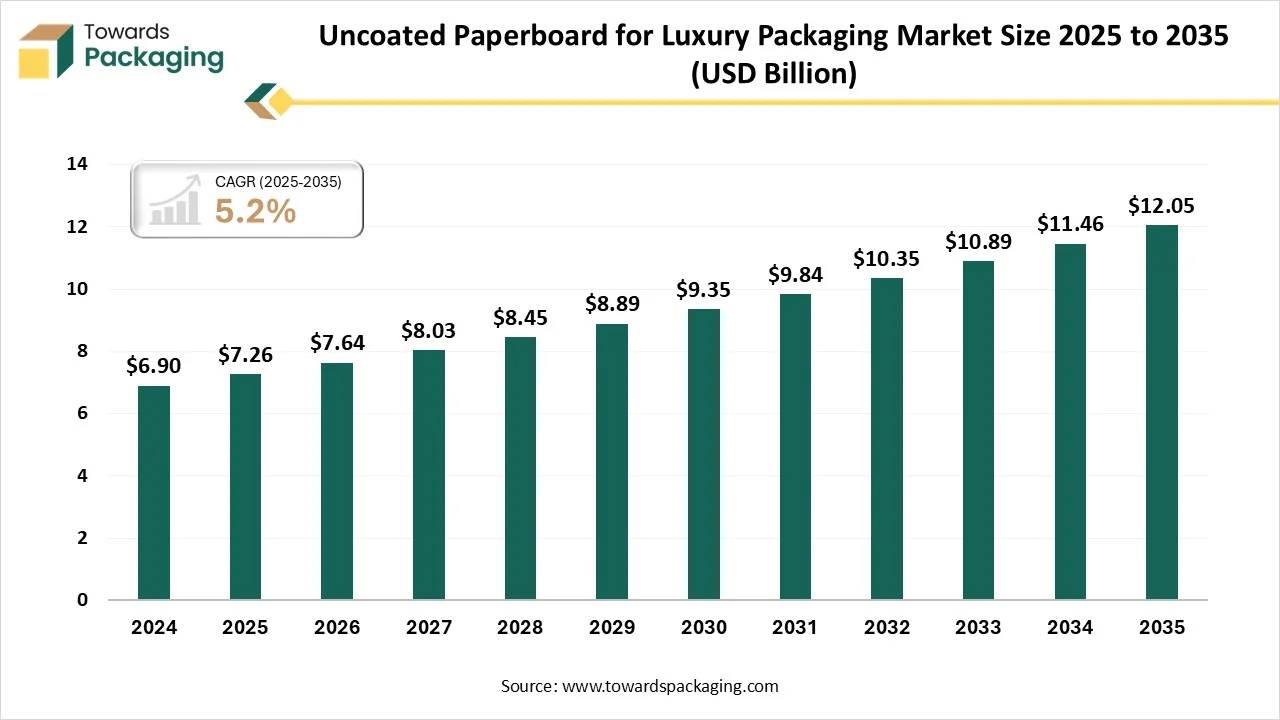

The uncoated paperboard for luxury packaging market is forecasted to expand from USD 7.64 billion in 2026 to USD 12.05 billion by 2035, growing at a CAGR of 5.2% from 2026 to 2035. The urge for uncoated paperboard is big due to the rising e-commerce sector and demand for strong and sustainable packaging in terms of corrugated boxes.

Major Key Insights of the Uncoated Paperboard For Luxury Packaging Market

- In terms of revenue, the market is valued at USD 7.64 billion in 2026.

- The market is projected to reach USD 12.05 billion by 2035.

- Rapid growth at a CAGR of 5.2% will be observed in the period between 2026 and 2035. will be expanding at a significant CAGR between 2026 and 2035.

- By region, Europe dominated the global market by holding the highest market share in 2025.

- By region, Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By paperboard grade/material type, the virgin fiber uncoated paperboard segment has contributed to the biggest market share in 2025.

- By paperboard grade/material type, the recycled uncoated paperboard segment will be expanding at a significant CAGR between 2026 and 2035.

- By product/packaging format, the rigid boxes (setup / magnetic boxes) segment has contributed to the biggest market share in 2025.

- By product type, the display & presentation packaging segment will be growing at a significant CAGR between 2026 and 2035.

- By end-use/luxury segment, the cosmetics & fragrances segment is expected to have the biggest market share in 2025.

- By end-use/luxury segment, the gourmet foods & confectionery segment will be growing at a significant CAGR between 2026 and 2035.

- By distribution channel, the direct sales to the luxury brands segment have contributed to the biggest market share in 2025.

- By distribution channel, the online / e-commerce packaging platforms segment will be growing at a significant CAGR between 2026 and 2035.

What is Uncoated Paperboard For Luxury Packaging?

The uncoated paperboard is a cellulosic fiber-dependent sheet material, generally thicker and stronger than standard paper, which is classified by the absence of the layer diagnosis, such as polymers, mineral clay, or the waxes used for barrier or gloss function. Such material opposes its natural fibrous design and the porous layer, which makes it intrinsic and accurate by mixing it, as compared to its covered counterparts. Its design directly encourages its discontinuation processing capability.

Trends in Uncoated Paperboard for Luxury Packaging Market

- Hyper-Personalization as a standard: Premium users now predict organizations to communicate directly to them through packaging as tailored monograms, tailored colour palettes are being tied to user profiles, and the restricted edition has seasonal patterns which are driven by insightful data.

- Sustainability becomes Standard: Luxury labels are using a high level of biodegradable plastics, mono-material packaging, and plant-based coatings, which are both premium and convenient to recycle. There’s also a growing importance for “honest sustainability,” which transfers communication about the life cycles and materials, instead of vague green claims.

- Smart Packaging Gets a Luxury Feel: Technology has finally converged with creativity, steering into a new era of smart packaging as QR codes have included in the latest near-invisible markers included in the design factors, enabling customers to properly identify products, unlock latest digital experiences, and view care instructions too.

- Tactile Luxury: Textures take the main platform: Touch has become a main space of the unboxing rule. In the current year, brands are giving importance to sensory richness with the assistance of embossed aim, velvety soft-touch coatings, hybrid textures, and stone-like finishes that invite communication. Such tactile surfaces assist in conveying heritage and craftsmanship, which classifies luxury items from mass-market offerings.

- Refillable and Keep-Forever Packaging: The circular luxury is gaining attention, not just for the simple recyclability, as brands are making the packaging pointed to be reused infinitely, which means that perfume bottles are recrafted as decor pieces, liquor containers, and refillable makeup compacts, which have become collectible art objects.

- Market Growth Overview: The uncoated paperboard for the luxury packaging is rising due to the urge for eco-friendly packaging solutions and the growing application of white paperboard in different end-use sectors, which are the main factors that drive the growth of the market.

- Global Expansion: The global expansion of the uncoated paperboard sector is expanding at a constant rate in the current year, which is initially driven by the big move towards sustainable and plastic-free packaging and continued growth in e-commerce logistics.

- Major Market Players: The main market players in uncoated paperboard for luxury packaging are ITC Limited, Cascades Inc, JK Paper Limited, Metsa Board, and Clearwater Paper Corporation, too.

- Startup Ecosystem: The startup ecosystem for the uncoated paperboard is initially driven by a global move towards plastic-free and highly recyclable packaging solutions. Alike coated paperboard, which frequently uses plastic or mineral-dependent top surfaces, the uncoated paperboard serves a tactile and natural aesthetic that is heavily favored by sustainable startups and luxury brands.

Technological Developments in the Uncoated Paperboard For Luxury Packaging Market

Immersive technologies work as high-level assistive technology as well as a substitute for regular paper-based designs. Augmented reality (AR) and virtual reality (VR) are found in developing different aspects of production, which include sales, product development, and marketing. Startups are utilizing immersive technologies to make virtual mock-ups of the latest paper products, which enables designers and engineers to test and update the design before it goes into manufacturing.

This speeds up the development procedure and lowers the costs. VR also searches for usage in training the employees on the latest machine and procedure, as well as to develop workplace safety. The application of immersive technologies in the paper and pulp sector thus assists in developing smoothness and lowering costs.

Trade Analysis of Uncoated Paperboard for Luxury Packaging Market: Import & Export Statistics

- As per the global data, the World has imported 19,341 shipments of the Uncoated Paperboard during the period June 2024 to May 2025.

- Such imports were being supplied by 1,235 exporters to 1,694 worldwide buyers, which marked a development rate of 14% as compared to the previous twelve months.

- During this period, in May 2025 alone, the World imported 1,159 uncoated paperboard shipments.

- The World imports most of its uncoated paperboard from Vietnam, Ukraine, and the United States.

- Worldwide, the leading three importers of uncoated paperboard are China, Ukraine, and Vietnam.

- Ukraine has topped the World in the uncoated paperboard imports with 15,674 shipments, which is being followed by China with 6,262 shipments, and Vietnam, which has taken the third position with 3,247 shipments.

Uncoated Paperboard for Luxury Packaging Market - Value Chain Analysis

Raw Material Sourcing

The initial raw material for paperboard is wood pulp. The pulp can be gained from wood chips, recycled paper, or an integration of both. If the wood chips are used, they experience a chemical pulping procedure in order to break down the fibers. So, recycled paper undergoes a de-inking procedure in order to remove an ink and other pollutants before being mixed with the fresh pulp.

- Key Players: International Paper, Sappi Limited, and Stora Enso.

Component Manufacturing

The uncoated paperboard is manufactured from 100% recovered paper, which is collected from paper manufacturing and transforming plants, and post-consumer sources, too. Instances of it are usage that counts composite cans, shoeboxes, and fiber drums, too.

- Key Players: Puyang Longfeng Paper Co., Ltd., UPM-Kymmene Corporation, and WestRock Company.

Logistics and Distribution

The logistics of the uncoated paperboard is a thick, fibrous material that is frequently used in strong packaging tubes, which are eco-friendly containers that depend on a smooth supply chain, that concentrates on heavy shifting and specialized sustainability and handling too.

- Key Players: Mondi Group, Domtar Corporation, Nippon Paper Industries Co., Ltd., and Nine Dragons Paper Holdings Limited.

Segmental Insights

Paperboard Grade / Material Type Insights

Why Virgin Fiber Uncoated Paperboard Segment Dominated the Uncoated Paperboard For Luxury Packaging Market in 2025?

The virgin fiber uncoated paperboard segment has dominated the market in 2025, as solid bleached board, which is being produced from 100% virgin unbleached chemical pulp, resulting in a bright white and extremely smooth surface, which is ideal for high-resolution printing. Its immaculate finish takes place with standard finishing like foil stamping, embossing, and spot varnishes. The materials have hygiene that makes it perfect for sensitive uses, and it is generally accessible in coated one-sided (C1S) and both sides (C2S0 variants, which have a weight series from 150 to 400+ GSm for versatility across the packaging designs.

The recycled uncoated paperboard segment is expected to experience the fastest CAGR during the forecast period. It is prevalently meant to be in the sector as URB (uncoated recycled paperboard), which is a thick and strong -paper -dependent material made completely or initially from recovered paper fibers. Alike coated boards, it lacks a soft or glossy surface diagnosis, such as clay or polyethylene that has a natural, tactile, and matte finish. Furthermore, it is well known for its structural rigidity, big ring crush opposition, and low density, too. It is usually thicker than the standard paper, which is usually defined as having a weight greater than 250-300 gsm.

Why did the Rigid Boxes (Setup / Magnetic Boxes) Segment Dominate the Uncoated Paperboard for Luxury Packaging Market in 2025?

The rigid boxes segment have dominated the market in 2025, also known as set-up boxes, which are a special kind of packaging created from thick paperboard or chipboard, making them strong and very rigid too. The materials of such boxes are much thicker than the materials used in the folding cartons. Rigid stock is generally covered with decorative paper, fabric, or other tailored materials that can be printed with different designs to develop the box’s aesthetic appearance.

The display and presentation packaging segment is predicted to witness the fastest CAGR during the forecast period. Presentation packaging points to the construction and design of the packaging materials, with a main focus on developing the visual look and aesthetic presentation of the product. It goes beyond the basic working of the packaging, which is to prevent the product from being damaged. Their goal is to make an attention-grabbing and memorable experience for the user. They are commonly utilized for gift products and luxury box products. Such packages are crafted to convey a perception of exclusivity and prestige, too.

End-Use / Luxury Insights

Why did the Cosmetics & Fragrances Segment Dominate the Uncoated Paperboard For Luxury Packaging Market in 2025?

The cosmetics and fragrances segment has dominated the market in 2025, as they are used for primary and secondary packaging to highlight sustainability and serve a different tactile experience. Same as coated variants which use clay or polymer surfaces for the glossy finish, as uncoated paperboard opposes its natural porous design that is highly valued by eco-conscious and luxury brands. Additionally, uncoated paperboard is frequently selected for labels in which matte and writable texture is a must or in which a handcrafted aesthetic is desired for the artisanal items.

The gourmet foods & confectionery segment is predicted to witness the fastest CAGR during the forecast period. In this space, uncoated paperboard is being awarded for its aesthetic and natural look, and its appearance with breathable or dry items. Alike coated boards which use the clay or plastic finishes, uncoated paperboards serve an organic and matte feel which appeals to the eco-conscious premium brands. Uncoated paperboards are greatly used for high-end chocolate boxes, gourmet cereal or pasta cartons, and artisanal tea and coffee canisters, too. Its constant purity from virgin fibers makes it secure for aroma-sensitive items.

Distribution Channel Insights

Why Direct Sales to Luxury Brands Dominated the Uncoated Paperboard For Luxury Packaging Market in 2025?

The direct sales to the luxury brands segment dominated the market in 2025 as they source this type of paper with the assistance of supply chains that give importance to circularity, aesthetics, and technical performance too. In the current year 202, direct sourcing from the main producers such as Mondi and Stora Enso has become a perfect fit for brands that seek to avoid plastic and also develop a “natural” and “luxury” appearance. Sourcing is excessively presented by eco-friendly certifications that brands use as marketing proof for their ESG (Environmental, Social, and Governance) aim.

The online / e-commerce packaging platform segment is predicted to witness the fastest CAGR during the forecast period. E-commerce brands largely depend on the mailers for smooth shipping. These boxes serve perfect protection as compared to the poly mailers or the standard crayons. They are designed to confidently stand with the hardship of current logistics chains. This lowers the product damage and lessens the return rates for the brands. The mailer boxes also deliver a professional presentation for items upon arrival. This mainly includes the user satisfaction and reiterates the business. Ultimately, they are a foundation for relative e-commerce operations.

Regional Insights

How is Europe Dominating the Uncoated Paperboard For Luxury Packaging Market?

Europe dominated the market in 2025, as it is dependent on different uses, each of which shows the different demands and choices of various sectors. One of the main uses of uncoated paperboard is in the publishing and printing industry. This paper type is being used for its good-quality printability and perfect ink absorption, which makes it perfect for generating newspapers, books, and magazines too. Its perfect performance makes sure that text and images look clear and sharp, which includes its huge spread usage in high-volume printing operations across Europe.

How is the Uncoated Paperboard for Luxury Packaging Market Growing in Germany?

Invention is the foundation of the German paper sector, as this industry has always invested in high-level technology in order to develop productivity, lower the effect on the environment, and align with the fast-growing world issues. The mixing of digital technologies, such as data analytics and automation, has made the production procedure smoother and more effective, while the growth of sustainable materials and methods has become a top priority. This loyalty to invention not only develops the sector's competitiveness, but also attracts it with an aim of overall stability.

Why is the Uncoated Paperboard For Luxury Packaging Market Growing Rapidly in the Asia Pacific?

Asia Pacific is the fastest-growing region in the uncoated paperboard for luxury packaging market in 2025, as the urge for uncoated paperboard in the Asia Pacific is driven by constant development, which is initially driven by the need for sustainable packaging and the e-commerce expansion. Developing regulatory pressure and the plastic bans in countries such as India and China have mainly moved the demand towards fiber-based and recyclable packaging solutions, such as uncoated recycled paperboard. Fast development in terms of online retail across Asian countries has made a big demand for eco-friendly packaging materials for shipping purposes.

Why is India using the Uncoated Paperboard for the Luxury Packaging Market Importantly?

The uncoated paperboard for the luxury packaging industry in India is experiencing big demand as the regulatory updates like Plastic Waste Management Rules have forced producers in the food, FMCG, and pharmaceutical industries to accept the paper-based alternatives. Also, the growth of online retail has developed the demand for strong and recyclable materials such as uncoated duplex and the kraft boards for the shipping boxes and the protective kind of packaging.

The Uncoated Paperboard for Luxury Packaging Market in the North America region is growing as there is a rising user choice for eco-friendly packaging, which is the main driver. An uncoated paperboard is heavily utilized for labels, tags, and product packaging in order to project a natural or rustic aesthetic. This sector is the biggest user of paperboard packaging, using it for products like ready-to-eat and dairy items, food containers, because of its developed barrier technologies.

Canada Uncoated Paperboard for Luxury Packaging Market Trend

The Uncoated Recycled Paperboard (URB) industry is experiencing fast traction across a wide range of industries, such as healthcare, automotive, telecommunications, industrial manufacturing, and electronics. This huge -ranging usage is pushing producers to personalize solutions to field-specific demands, which completes the invention and product classification. As the digital updates develop and the urge for connected and intelligent technologies develops, the cross- sector dependency of the Uncoated Recycled Paperboard (URB) continues to develop and ensure constant market momentum.

The Uncoated Paperboard For Luxury Packaging Market in the Middle East &Africa (MEA) region is developing as the food and beverage sector is one of the biggest users of paper packaging in the Middle East and Africa region, because of different factors. The online shopping for food, when integrated with the food delivery services, is predicted to develop the urge for uncoated paperboard, sacks, liquid cartons, and folding cartons too. Hardwood pulps are utilised in the outer surfaces due to their effect on layer characteristics, as softwood pulps are required to provide a lot of power to the paperboard product. Furthermore, the chemical pulps are more costly than mechanical pulps because of the lower yields in pulp manufacturing.

UAE Uncoated Paperboard for Luxury Packaging Market Trend

As worldwide sectors shift to sustainable practices and intelligent technologies, the UAE is quickly rising as a top player in terms of paper manufacturing. With its step-by-step geographic location, assistive government policies, and rising urge for eco-conscious items, the region is making the correct surroundings for the paper sector to thrive. UAE’s uncoated paperboard sector is experiencing rapid growth, driven by the development of online shopping, which increases the demand for protective and corrugated boxes packaging.

In South America, the uncoated paperboard for luxury packaging market is growing steadily, as there is a big agricultural industry, which is the initial user of paperboard. It has a containerboard urge which is heavily tied to exporting fresh meat, and big materials like fertilizers. There is constant development of online retail, which has grown the demand for reliable paperboard packaging and good-quality folding cartons for luxury unboxing experiences. Also, there is constant development of online retail, which has grown the demand for eco-friendly alternatives, and the government is making a compulsory ban on single-use plastics, which is driving organizations to transform to paper-based alternatives.

Brazil Uncoated Paperboard for Luxury Packaging Market Trend:

The Brazilian uncoated paperboard is ready for rigid development, which is fueled by stretching urbanization, government-assisted sustainability policies, and the incentives that assist circular economy practices. The National Solid Waste Policy makes a compulsion for producer responsibility, by analyzing the invention of recyclable materials and the closed -loop packaging machines. The E-commerce packaging is being personalized for the omnichannel logistics, which is another fast-growing industry, specifically in metro regions, where digital entry is biggest.

Recent Developments

- In September 2025, Stora Enso is developing its profile of premium packaging materials with the launch of Ensovelvet, which is the latest uncoated solid bleached sulfate board that has the velvet-like smoothness on both sides for the luxury uses such as perfumes, cosmetics, and other premium user goods.

- In October 2025, TNT Group has made two packaging solutions whose goal is to develop the luxury personal care experience. The containers count the hexagonal reveal box for perfume miniatures and a premium Advent calendar for the Christmas Season.

- In June 2025, Parfums Christian Dior collaborated with Axilone which is a top packaging producer in the luxury and prestige cosmetics industry, in order to introduce magnets that are created from 100% post-consumer recycled (PCR) into rare earths for its fragrance packaging.

Top Companies in the Uncoated Paperboard For Luxury Packaging Market

- ITC Limited: ITC Limited is an Indian conglomerate that is officially headquartered in Kolkata. It has its presence across six business sectors, namely agribusiness, FMCG, paper products, and information technology too.

- Amcor Ltd: Amcor is a top leader in terms of packaging solutions for users and healthcare items. With industry-leading invention potential, the overall scale, and the technical expertise, we assist our users in developing and aligning with the demands of millions of users each day.

- Graphic Packaging Holding Co: Graphic Packaging Holding Company is officially headquartered in Atlanta, Georgia, and crafts and makes user packaging that is created primarily from recycled or renewable materials. A sector leader in the invention, the organization is loyal to lowering the surrounding footprint of user packaging.

- Packaging Corporation of America: It is the third-largest manufacturer of paperboard in the United States and the third-biggest producer of uncoated freesheet in terms of North America, depending on manufacturing capacity.

- DS Smith Plc: DS Smith serves inventive packaging solutions, paper items, and recycling services with a loyalty to a circular economy and sustainability. Its main aim is to update packaging for an updated world, and we as expert teams work with like-minded partners to count renewable resources for items that lower every surrounding effect.

- Nippon Paper Industries Co, Ltd: It is a Japanese paper producing company, as its stock is being listed on the Tokyo Stock Exchange, as the company has 33 subsidiaries and a total of 11 linked organizations.

- Stora Enso Oyj: Stora Enso Oyj is a Finnish and Swedish forest sector company that makes and generates different materials, which are mostly dependent on wood that is sourced for various sectors and uses globally. It is headquartered in Helsinki, Finland, and Stockholm, Sweden.

- Mondi Plc: Mondi is a top leader in packaging and paper that leads to a perfect globe by creating inventive packaging and paper solutions that are sustainable by design.

- International Paper Company: International Paper is the top leader in terms of sustainable packaging solutions. It has a company which is headquartered in Memphis, Tennessee, EMEA (Europe, Middle East and Africa), and Tennessee, which is headquartered in London, UK, as it employs more than 65,000 team members and has many customers around the globe with operations in more than 30 countries.

- WestRock Company: Smurfit Westrock is the top leader of paper-based packaging solutions that has more than 100,000 employees with 500 transforming operations and 63 mills across 40 countries, as it gives every user a huge range of different and inventive items.

Uncoated Paperboard For Luxury Packaging Market Segments Covered

By Paperboard Grade / Material Type

- Virgin Fiber Uncoated Paperboard

- High-Quality Virgin Fiber Paperboard

- Medium-Quality Virgin Fiber Paperboard

- Luxury Virgin Fiber Paperboard

- Recycled Uncoated Paperboard

- Post-Consumer Recycled Paperboard

- Post-Industrial Recycled Paperboard

- Mixed-Recycled Paperboard

- Solid Bleached Sulfate (SBS)

- High-Grade SBS Paperboard

- Medium-Grade SBS Paperboard

- Folding Boxboard (FBB)

- Coated Folding Boxboard

- Uncoated Folding Boxboard

- White Lined Chipboard (WLC)

- High-Strength WLC Paperboard

- Standard WLC Paperboard

- Coated Unbleached Kraft (CUK)

- High-Strength CUK Paperboard

- Low-Strength CUK Paperboard

By Product / Packaging Format

- Rigid Boxes (Setup / Magnetic Boxes)

- Magnetic Closure Rigid Boxes

- Luxury Rigid Boxes

- Setup Boxes (Traditional Rigid Boxes)

- Folding Cartons

- Straight Tuck Folding Cartons

- Reverse Tuck Folding Cartons

- Side Tuck Folding Cartons

- Auto Lock Folding Cartons

- Sleeves & Wraps

- Paperboard Sleeves

- Paperboard Wraps

- Customizable Sleeves and Wraps

- Paper Bags

- Luxury Paper Bags (Custom Designs)

- Kraft Paper Bags

- Paper Shopping Bags

- Labels & Tags

- Luxury Labels (Embossed/Printed)

- Price Tags

- Branding & Informational Tags

- Display & Presentation Packaging

- Paperboard Display Boxes

- Presentation Trays

- Gift Boxes for Display

By End-Use / Luxury Segment

- Cosmetics & Fragrances

- Watches & Jewelry

- Premium Beverages (Spirits & Wine)

- Fashion & Accessories

- Consumer Electronics

- Gourmet Foods & Confectionery

By Distribution Channel

- Direct Sales to Luxury Brands

- Packaging Converters / OEM Partnerships

- Distributors & Wholesalers

- Online / E-commerce Packaging Platforms

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA