E-Commerce Packaging Market Research Insight: Industry Insights, Trends and Forecast

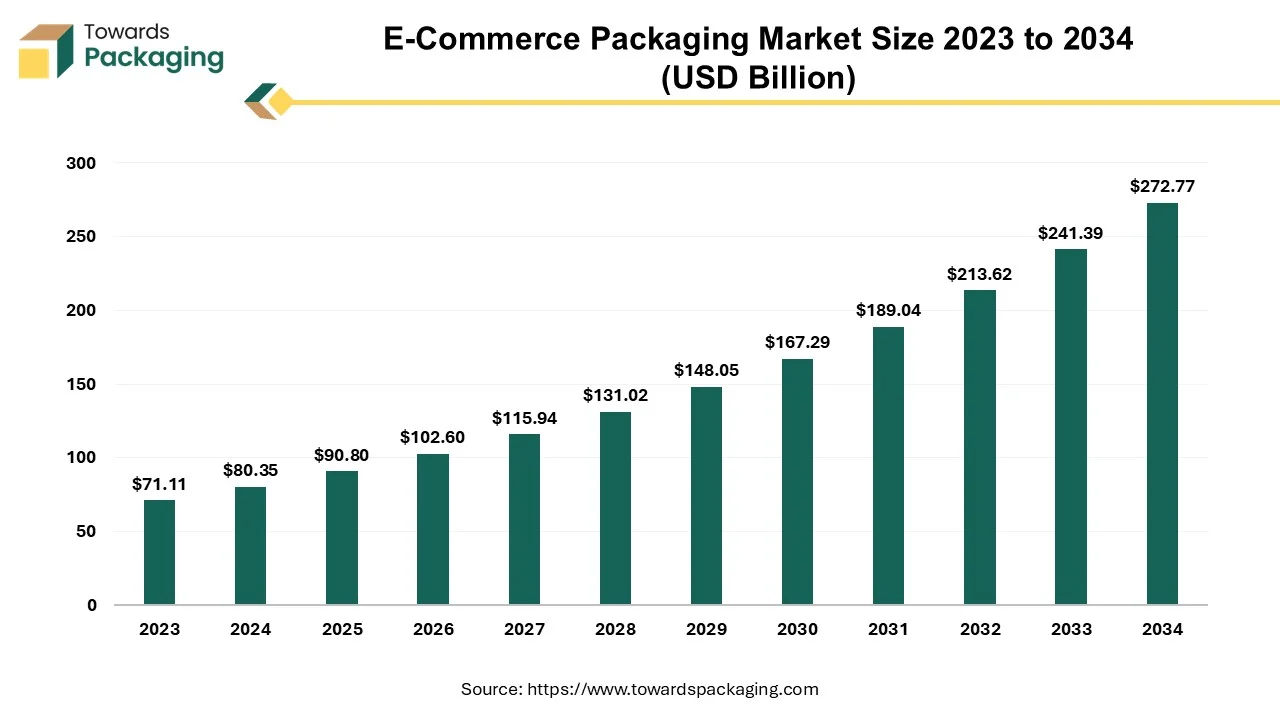

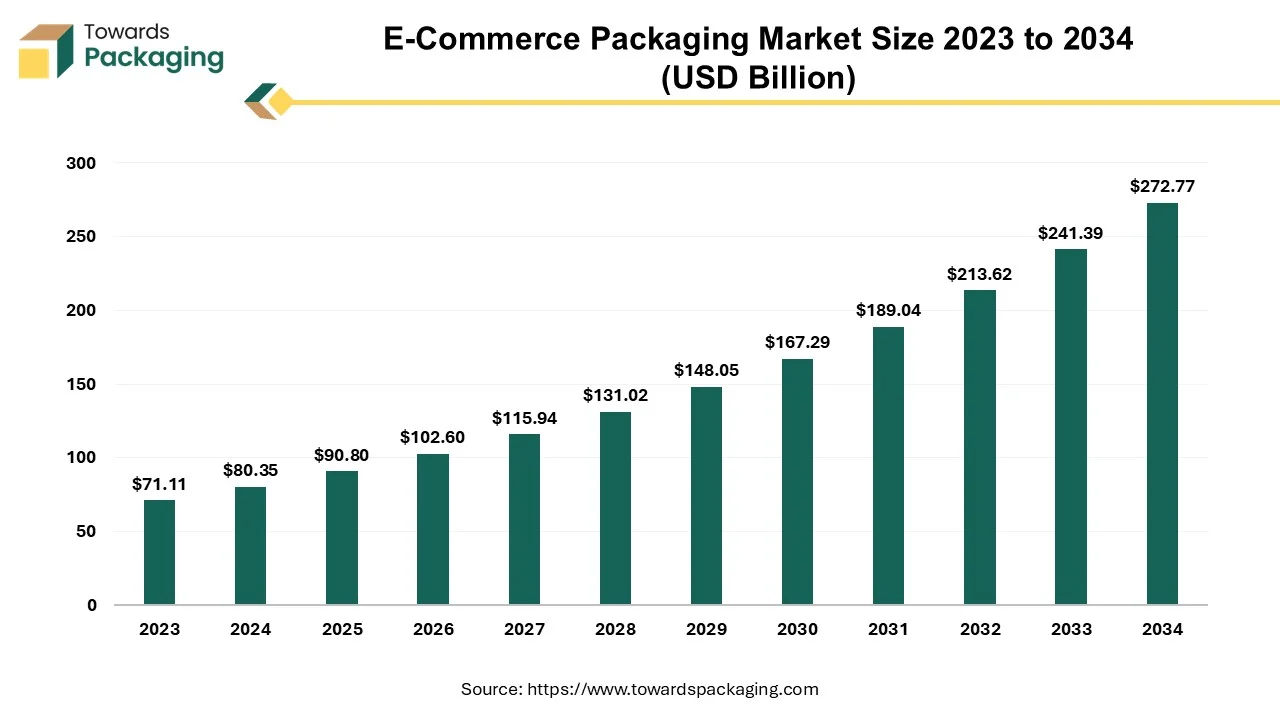

The e-commerce packaging market is forecasted to expand from USD 102.60 billion in 2026 to USD 308.21 billion by 2035, growing at a CAGR of 13% from 2026 to 2035. The report provides detailed insights into material, product, and application segments, along with comprehensive regional data covering North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. It includes an in-depth competitive analysis, value chain assessment, trade flow statistics, and key manufacturers and suppliers’ profiles such as Amcor plc, Berry Global Inc., Mondi, DS Smith, and Sealed Air.

Major Key Insights of the E-Commerce Packaging Market:

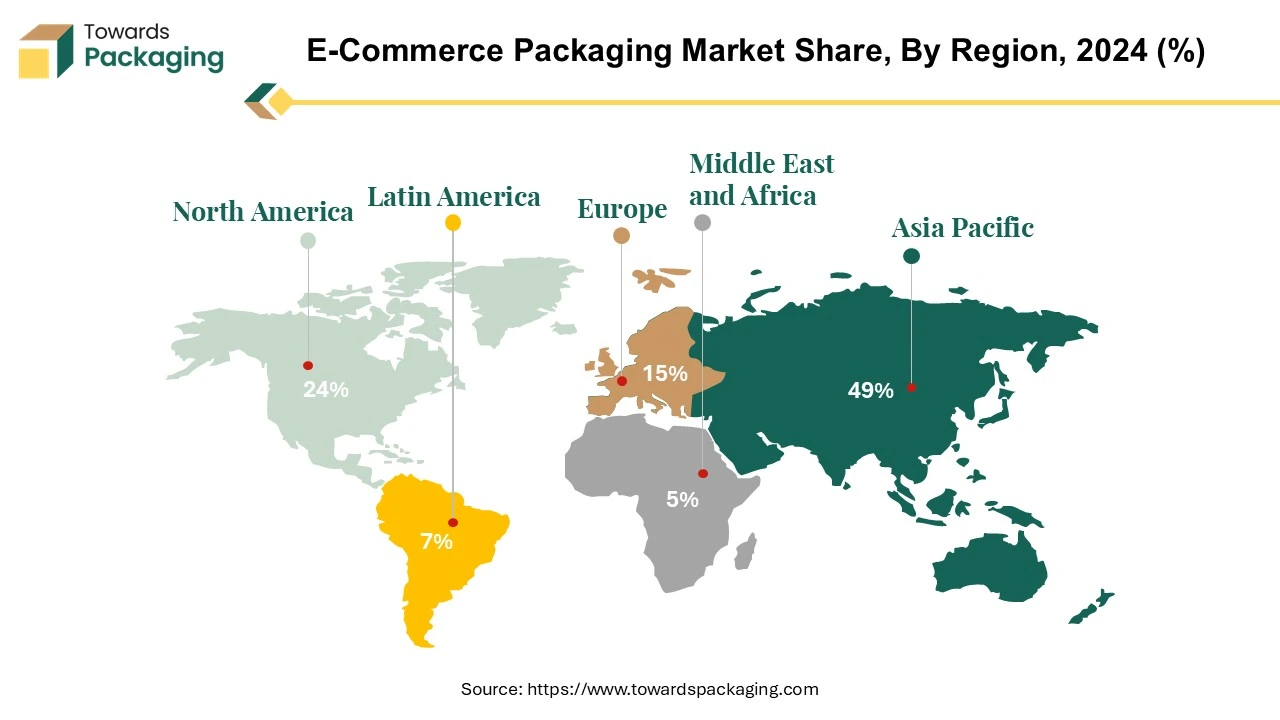

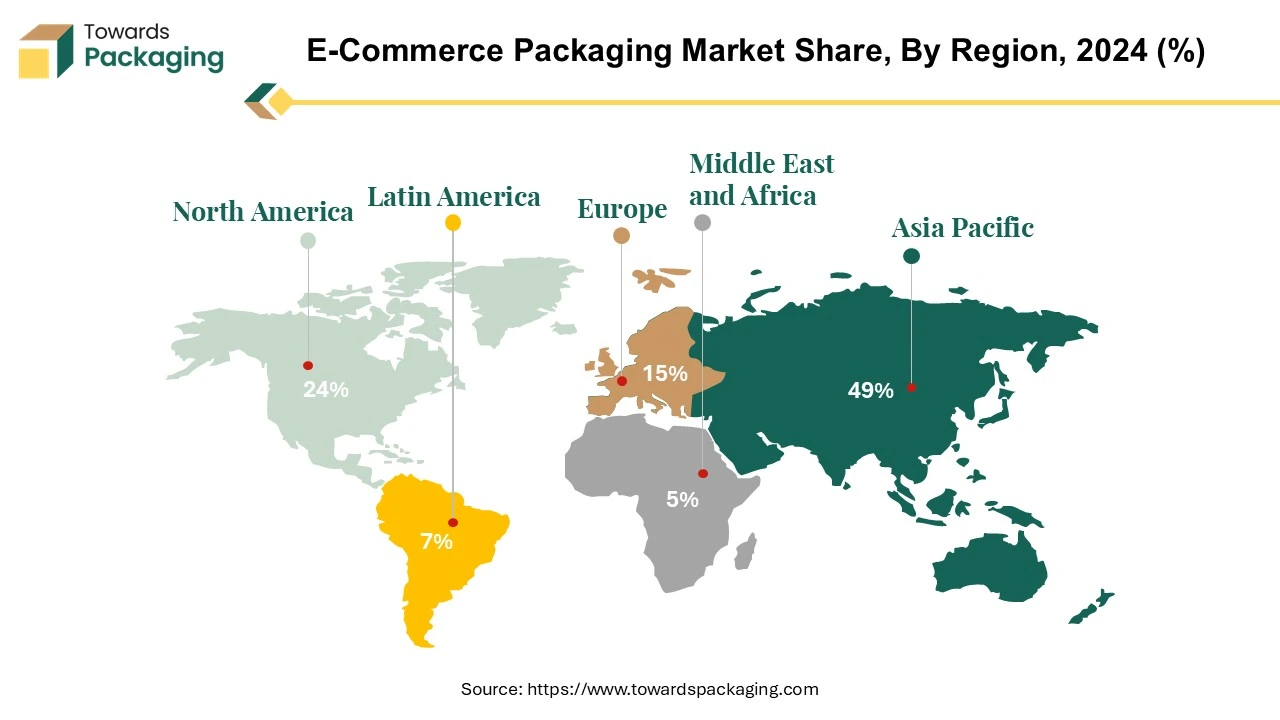

- Asia Pacific dominated the e-commerce packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By product, the corrugated boxes segment dominated the market with the largest share in 2024.

- By material, the corrugated board segment registered its dominance over the global e-commerce packaging market in 2024.

- By application, the food & beverages segment dominated the e-commerce packaging market in 2024.

E-Commerce Packaging Market: Sturdy & Durable Packaging

The packaging specifically designed and used for products sold and shipped through online platforms. It’s tailored to protect products during shipping, enhance customer experience, and reflect brand identity in the digital retail environment is known as e-commerce packaging. The e-commerce packaging must withstand rough handling, stacking, and long-distance shipping. The E-commerce packaging includes padding, void-fill materials, and sturdy outer boxes.

Increasingly manufactured with compostable, recyclable, or minimal materials to reduce environmental impact. Brands often use eco-friendly alternatives to attract conscious consumers. The E-commerce packaging includes seals, tapes, or indicators to show if the package has been tampered with. Optimized to reduce shipping costs and environmental footprint without compromising product safety.

Companies use custom designs, inserts, and messaging to enhance the customer’s unboxing experience and encourage social sharing (e.g., on Instagram or TikTok). Designed for convenience, with resealable or reversible packaging for hassle-free returns. For instance, a branded cardboard box with bubble wrap for a tech gadget. A flexible insulated pouch for food delivery. A compostable mailer bag used by sustainable fashion brands.

Market Trends

Eco-Friendly and Sustainable Packaging

- One of the top responsibilities for an e-commerce business owner should be working to rid the earth of pollution and other environmental threats. Making eco-friendly packaging choices can help you make a good impression on clients who care about the environment. Seek out recyclable and biodegradable packaging options, such as kraft, corrugated, and cardboard boxes. Brands are replacing plastic with recyclable, biodegradable, or compostable materials (e.g., paper mailers, mushroom packaging). Reusable packaging systems are gaining traction, especially in apparel and cosmetics. Minimalist packaging (less waste, fewer materials) is becoming a standard expectation.

Undercover Packaging for Private Goods

- It is preferable to discreetly transport products like CBD, vapes, and adult items to customers. It might be a simple box with no indication of what kind of product it contains. For branding purposes, the client can, however, place company's logo underneath the lids of these packages.

Customization and Branded Unboxing Experience

- Custom-printed boxes, tissue paper, stickers, and thank-you notes enhance brand identity. The trend of “Instagrammable” packaging boosts social sharing and customer loyalty. Even small businesses use affordable branded packaging to stand out online.

Smart Packaging Technologies

- QR codes, NFC chips, and augmented reality (AR) elements offer interactive customer experiences. Track-and-trace features improve logistics and build consumer trust. Smart labels can monitor freshness for food and temperature-sensitive products.

Automation and Right-Sizing

- Use of AI and automation tools to create packaging that exactly fits the product. Minimizes material waste and shipping costs while improving protection. Auto-boxing machines are being adopted by large e-commerce warehouses.

Return-Friendly Packaging

- E-commerce packaging now often includes resealable and reversible features to make returns easy. Especially critical for electronics, fashion, and other high-return sectors.

Rise of Frustration-Free Packaging

- Designed for easy opening without scissors or knives, using tear strips or tabs. Amazon and other platforms require sellers to use packaging that eliminates excess and improves user convenience.

Growth of Subscription Box Packaging

- Tailored packaging for subscription-based models (e.g., food kits, skincare, pet supplies) that emphasize branding, protection, and customer engagement. Often incorporates compartments and interior dividers.

Thermal and Cold Chain Packaging

- With the rise in online grocery and meal delivery, there’s increased demand for temperature-controlled and insulated packaging (e.g., gel packs, thermal liners).

How Can AI Improve the E-Commerce Packaging Industry?

The integration of artificial intelligence has revolutionized the e-commerce packaging by making it more sustainable, efficient, personalized and cost-effective. AI algorithms analyse product dimensions, weight, and fragility to recommend the perfect packaging size and material. The AI integration minimizes void space, minimizes packaging waste, and lowers shipping costs.

Commerce companies can enhance their targeted advertising with the aid of artificial intelligence. Al makes it simpler and more affordable to gather and examine real-time customer data, such as past purchases and online surfing patterns. Gaining insights from generated consumer data improves the efficacy of your marketing, which raises conversion rates and profitability.

PWC estimates that by 2030, corporate applications of Al could boost the world economy by up to US$15.7 trillion. Businesses can produce packaging that not only shines out on the store but also establishes a deeper connection with customers by incorporating Al into the design and branding process. In the end, this boosts sales and fosters brand loyalty by creating a more memorable consumer experience and a stronger brand identity.

Fast iteration and experimentation are made possible by Al-powered design platforms, which let designers rapidly test out several possibilities and hone their ideas. This quickness and adaptability guarantee that packaging ideas are timely and creative. Al can also analyse consumer preferences and design trends, offering insightful information that helps guide the design process and guarantee that the finished product is both aesthetically beautiful and profitable.

Driver

Rapid Expansion of E-commerce Platform

The surge in online retail, especially post-COVID-19, has created a massive demand for durable, efficient, and branded packaging. Sectors like fashion, electronics, groceries and beauty heavily depend on specialized e-commerce packaging. Eco-conscious consumers are pushing brands to adopt recyclable, reusable, and biodegradable packaging solutions. Sustainable packaging has become a key purchase influencer in many mistakes.

- For instance, in December 2024, according to the data by published by the National E-commerce Association, 48.8% of consumers began purchasing on general store websites or apps, such as Walmart or Amazon, between the beginning and middle of 2024.

- According to 86% of respondents, these sites are where they most commonly make their online purchases. With 23.2% of consumers utilizing search engines like Google or Bing, they were the second most common place to start. About 18% of consumers started on social networking sites like Facebook or Instagram, while 4.8% went straight to the brand's website or app.

- Online advertisements, price comparison tools, product review websites, and other sources accounted for the remaining 5.2%. Furthermore, in 2025, commerce sales will total $2.51 trillion, a 21.25% rise over the $2.07 trillion in sales reported the year before. It is anticipated that mobile commerce will expand at a faster rate than the 15.3% average annual growth rate predicted between 2018 and 2027.

Restraint

Complexity in Reverse Logistics & Volatility in Raw Material Prices

The key players operating in the e-commerce packaging market are facing issue due to regulatory compliance across borders, volatility in raw material prices and complexity in reverse logistics which has estimated to restrict the growth of the market. Returns are common in e-commerce, and packaging must be durable and return-friendly, adding design and material challenges.

Improperly handled returns can lead to product damage and increased costs. Fluctuations in the cost of packaging materials such as cardboard, plastics, and inks can affect profit margins and pricing stability. International e-commerce involves navigating varied regulations on packaging, labelling, and materials across countries. This complexity increases operational burdens and can delay market entry.

Market Opportunity

Innovations of Sustainable Packaging & Smart Packaging

There’s a growing demand for eco-friendly packaging (e.g., recyclable, reusable, compostable materials). Companies that develop affordable, scalable green alternatives have major growth potential. Government regulations and consumer preferences are also pushing brands in this direction. Opportunities are present in technologies like RFID, QR codes, NFC chips, and smart sensors that improve product tracking, authentication, and customer engagement. Especially valuable in food, healthcare, and luxury goods sectors.

Segmental Insights

Corrugated Boxes Segment Led the Market in 2024

The corrugated boxes segment held a dominant presence in the e-commerce packaging market in 2024. Corrugated boxes provides excellent protection against impact, pressure, and rough handling during shipping. The fluted inner layer adds rigidity and cushioning, making them ideal for fragile or valuable items. Despite their strength, they are lightweight, which helps reduce shipping costs. Corrugated boxes are easily customized in shape, size, and print, which is perfect for branded unboxing experiences.

Corrugated Board Witnessed Significant Share in 2024

The corrugated board segment accounted for a considerable share of the e-commerce packaging market in 2024. Corrugated boards are lightweight yet extremely strong due to their fluted (wavy) inner layer. This structure absorbs shocks and resists compression, protecting products during shipping and handling. Corrugated boards are ideal for long-distance shipping and frequent handling across distribution center.

Expanding Food & Beverages Sector to Projected Dominance in 2024

The food & beverages segment registered its dominance over the global e-commerce packaging market in 2024. With growing environmental awareness, both consumers and brands are prioritizing eco-friendly packaging options. The food & beverages sector is responding by adopting recyclable, biodegradable, and reusable packaging materials, aligning with broader sustainability goals and driving innovation in packaging solutions.

Shipping perishable and temperature-sensitive items like meats, dairy products, and beverages requires specialized packaging that maintains product integrity. This includes insulated materials, moisture-resistant coatings, and tamper-evident features, thereby expanding the scope and innovation within the e-commerce packaging industry.

Asia’s Growing E-commerce Platform to Promote Dominance

Asia Pacific region held the largest share of the e-commerce packaging market in 2024, owing to booming e-commerce platform. Countries like China, India, Vietnam, and Indonesia have experienced unpredictable growth in online shopping, fuelled by increased smartphones penetration and improved internet infrastructure. The Asia Pacific region, particularly China, boasts a strong manufacturing base with advanced packaging infrastructure. Investments in automated packaging facilities, smart logistics center, and research into new materials have positioned the Asia Pacific region as a key supplier of packaging materials to both domestic and international markets.

China E-commerce Packaging Market Trends

China e-commerce packaging market dominates global e-commerce sales, with platform such as JD.com and Alibaba handling billions of packages annually, creating massive demand for packaging solutions. China’s advanced logistics infrastructure and innovative packaging solutions provide an added boost to the market presence of the Asia Pacific region. The swift online retail expansion in countries like China has driven by increasing internet penetration and an expanding middle class, leads to soaring demand for e-commerce packaging.

North America’s Rising Industrialization to Support Growth

North America region is anticipated to grow at the fastest rate in the e-commerce packaging market. As the North America region has well equipped machinery and infrastructure for e-commerce packaging, it has observed to drive the growth of the e-commerce packaging market in the region. The integration of technology in packaging, including smart packaging solutions with NFC tags, QR codes, and RFID chips, enhances customer engagement and offers real-time tracking. Automation and robotics are also streamlining packaging processes in e-commerce warehouses.

U.S. E-commerce Packaging Market Trends

U.S. e-commerce packaging market is driven owing to large consumer base via social media platform has taken raise within teenagers. The surge in online shopping across the U.S. has significantly increased the demand for e-commerce packaging solutions. The convenience and accessibility of online platforms have led to a higher volume of packages requiring efficient and protective packaging.

Europe’s Strict Government Regulations to Project Notable Growth

Europe region is seen to grow at a notable rate in the foreseeable future. The European Union (EU) has implanted rigorous environmental policies, such as the Packaging and Packaging Waste Directive, which mandates the use of recyclable materials and promotes waste reduction. Initiatives like the European Green Deal and the Circular Economy Action Plan further encourage businesses to adopt sustainable packaging solutions.

These regulations compel companies to innovate and align their packaging practise with environmental standards. European consumers exhibit a strong preference for eco-friendly products, influencing companies to prioritize sustainable packaging.

How are government initiatives boosting the e-commerce packaging market?

Governments are driving growth in the commerce packaging market through regulations and incentives that promote sustainable packaging standards, extended producer responsibility, and the reduction of single-use plastics. Recyclability and low-waste requirements are being mandated in many nations, which is pushing companies to use environmentally friendly e-commerce packaging. Further encouraging the use of circular materials is public funding for waste management initiatives and recycling infrastructure. Furthermore, investments in logistics infrastructure and policies that facilitate digital trade improve packaging efficiency in supply chains for international e-commerce.

How are regulatory changes shaping the e-commerce packaging market?

| Regulatory Area | Key Changes | Impact on Market |

| Single-Use Plastic Bans | Governments worldwide are restricting or banning single-use plastics in packaging | Pushes e-commerce companies to adopt recyclable, biodegradable, or reusable packaging solutions |

| Extended Producer Responsibility (EPR) | EPR mandates require brands to manage end-of-life packaging waste | Increases the adoption of sustainable materials and circular packaging models |

| Waste Management & Recycling Standards | Updated national and regional recycling requirements for packaging | Drives investment in recyclable packaging and alignment with waste-processing infrastructure |

| Material & Labeling Regulations | New laws enforce material composition disclosures and eco-labeling | Enhances transparency and encourages eco-friendly packaging design |

| Cross-Border Compliance | Regulations on import/export packaging standards for global shipments | Requires e-commerce businesses to adapt packaging for multiple regulatory frameworks |

Value Chain Analysis

Raw Materials Sourcing

E-commerce packaging uses corrugated boxes, paperboard, flexible plastics, and protective fillers sourced from global paper and polymer suppliers, with a growing focus on sustainable materials.

Key Players: International Paper, WestRock, Smurfit Kappa, Mondi, and Amcor

Logistics and Distribution

Packaging supply is closely linked with fulfillment centers and last-mile delivery networks to support fast and high-volume shipments.

Key Players: DHL Supply Chain, FedEx, UPS, DB Schenker, and XPO Logistics.

Retail Sales and Financing

Online platforms offer integrated packaging procurement and financing to support seller operations and inventory management.

Key Players: Amazon Packaging Services, Shopify Fulfillment Network, Walmart Fulfillment Services, and Alibaba Cainiao.

Global E-commerce Packaging Market Top Players

- Amcor plc

- Berry Global; Inc.

- CCL Industries

- Coveris

- Sealed Air

- Sonoco Products Company

- Winpak Ltd.

- Alpha Packaging

- Constantia Flexibles

- Mondi

- Gerresheimer AG

- Silver Spur Corp.

- Grief

- Transcontinental Inc.

- ALPLA

Latest Announcements by E-Commerce Packaging Industry Leaders:

- The CEO and co-founder of Movopack, Tomaso Torriani, stated: This fundraising round shows the increasing interest in Movopack's potential to revolutionize the e-commerce sector with circular, sustainable packaging solutions. The company revealed about this investment because it allows us to enter the U.K. market at a time when there is a greater need than ever for sustainable solutions. Both brands and consumers are looking for meaningful ways to help create a world where economies and societies can develop and prosper without endangering the environment, and we are here to help.

New Advancements in E-Commerce Packaging Industry

- In November 2024, Movopack, a firm that offers circular and sustainable packaging for e-commerce platforms, has raised £2 million in a seed investment round led by early-stage investor 360 Capital.

- In January 2025, D Smith has introduced its TapeBack solution, which uses a single glue strip for two e-commerce shipments, doing away with the requirement for single-use plastic tear strips in e-commerce packaging. It features a return strip that enables customers to utilize the original packing for returns, reducing the need for extra materials in an effort to decrease waste and guarantee providers can provide "seamless and sustainable" returns. According to DS Smith, the new approach aims to make recycling at home simple by avoiding component mixing. Additionally, it has been adjusted to use the least amount of corrugated board, silicon tape, and hot melt possible, which is said to double the product's score on the circular design measure.

-

In October 2025, Ranpak Holdings Corp. announced the launch of FillPak Mini, a compact, automated paper-based void-fill solution for e-commerce. The company described it as a plug-and-play system for high-speed dispensing and easy integration without technical support. Ranpak stated that the system uses 100% curbside-recyclable paper to help retailers eliminate plastic air pillows and meet sustainability goals

-

In October 2024, Eco-Products announced the launch of its sustainable packaging line in the UK market. The company debuted over 30 items, including Verge sugarcane containers and plant-based PLA cold cups, supported by a new Stoke-on-Trent distribution hub

Global E-commerce Packaging Market Segments

By Material

- Plastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Bio-based Plastics

- Stretch Films

- Shrink Films

- Corrugated Board

- Single Wall Corrugated Board

- Double Wall Corrugated Board

- Triple Wall Corrugated Board

- Printed Corrugated Board

- Unprinted Corrugated Board

- Paper & Paperboard

- Kraft Paper

- Recycled Paperboard

- Coated Paperboard

- Solid Bleached Sulfate (SBS)

- Folding Cartons

- Molded Pulp

- Paper Bags

- Woods

- Plywood

- Wooden Crates

- Wooden Pallets

- Wood Packaging Boxes

- Wooden Dunnage (for protection during shipment)

By Product

- Corrugated Boxes

- Regular Slotted Cartons (RSC)

- Full Overlap Slotted Cartons (FOL)

- Half Slotted Cartons (HSC)

- Telescope Boxes

- Folder Boxes

- Poly Bags

- Polyethylene (PE) Bags

- Bubble Wrap Bags

- Ziplock Bags

- Mailer Bags

- Anti-static Bags

- Tapes

- Pressure-Sensitive Tapes

- Kraft Paper Tapes

- Bubble Wrap Tapes

- Stretch Tapes

- Gummed Paper Tapes

- Protective Packaging

- Bubble Wrap

- Foam Inserts

- Air Cushions

- Packing Peanuts

- Molded Pulp

- Protective Paper

- Mailer

- Poly Mailers

- Paper Mailers

- Padded Mailers

- Envelope Mailers

- Shipping Envelopes

- Others

- Labels & Stickers

- Packaging Sleeves

- Custom Printed Boxes

- Stretch Film Rolls

- Edge Protectors

- Foam Sheets

By Application

- Food & Beverages

- Electronics & Electrical

- Apparel & Accessories

- Personal Care

- Household

- Pet Food

- Pharmaceutical

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (3)