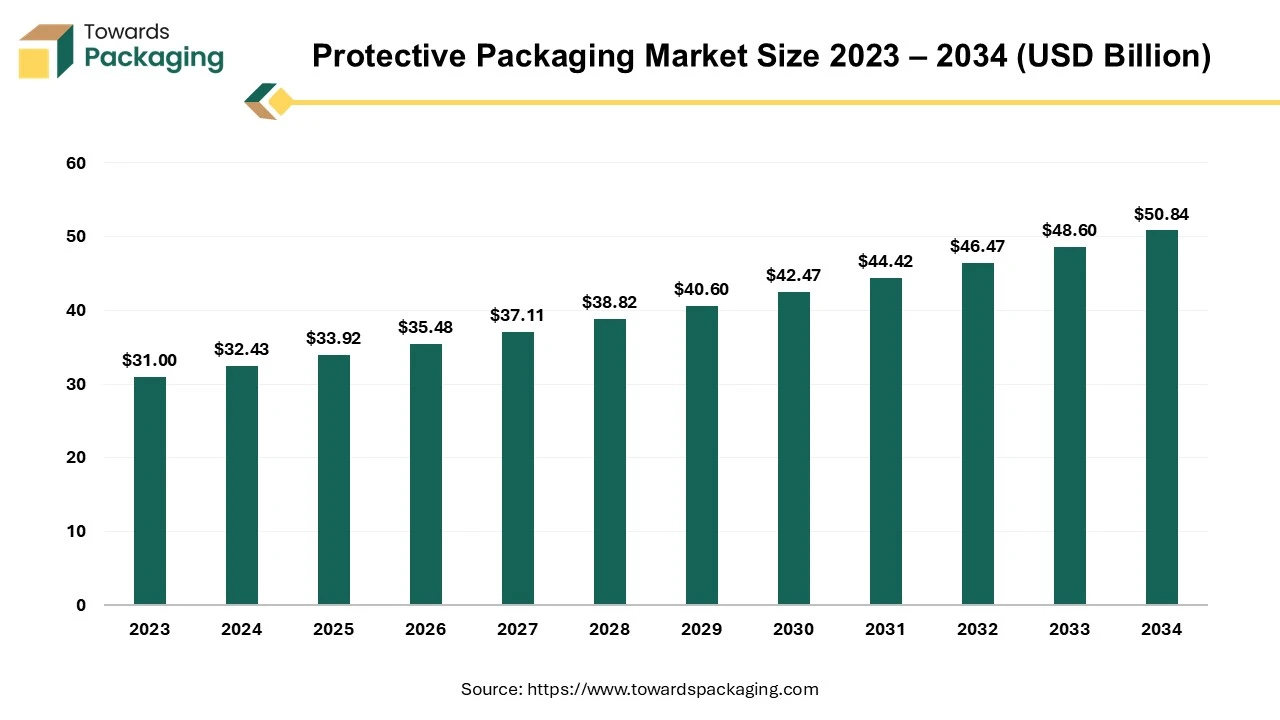

The protective packaging market is forecast to grow from USD 35.48 billion in 2026 to USD 53.19 billion by 2035, driven by a CAGR of 4.6% from 2026 to 2035. The report presents a full breakdown by type (flexible, foam, rigid), material (paper & paperboard, plastics, foams, others), and end-use industries such as food & beverage, healthcare, and electronics. It also offers regional insights across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, highlighting Asia Pacific’s dominance and North America’s accelerating growth.

The study covers leading manufacturers shares Sealed Air (19%), ProAmpac (8%), Smurfit Kappa (7%), Amcor (6%), and Mondi (5%) along with supplier EBITDA margins, value chain structure, and trade flow dynamics that define global competitiveness.

The materials or methods which are used to safeguard products from damage during storage, handling, and transportation is known as protective packaging. The main goal is to preserve the integrity, quality, and safety of the product until it reaches the end user. The main purpose of protective packaging is to prevent physical damage from vibrations, shocks, and impacts.

The protective packaging shield from environment factors like dust, moisture, heat and light. It ensures product security by providing resistance from tamper, pilferage protection. The protective packaging provides cushioning or insulation. The common examples of protective packaging are foam inserts, bubble wrap, air pillows, shrink wrap, corrugated boxes, and blister packs. It’s extensively utilized in industries like food, electronics, pharmaceuticals, and e-commerce.

| Manufacturer | Market Share (%) |

| Sealed Air Corporation | 19% |

| ProAmpac Holdings Inc. | 8% |

| Smurfit Kappa Group | 7% |

| Amcor Plc | 6% |

| Mondi Group | 5% |

| Others | 55% |

| Supplier | EBITDA Margin (%) |

| Sealed Air Corporation | 27.5% |

| Smurfit Kappa Group | 23.2% |

| Amcor Plc | 21.8% |

| ProAmpac Holdings Inc. | 19.5% |

| Mondi Group | 18% |

Businesses must invest in smart machinery, loT devices, and sophisticated software platforms that can handle big data analytics and machine learning in 2023 in order to apply such Al and robotics systems in protective packaging procedures. A competent team that can oversee, maintain, and optimize these systems must also be hired or trained. For Al and robotic systems to integrate with current supply chain management tools and provide end-to-end visibility and control, a significant level of customization is also required. Data-driven decisions and automated procedures are becoming commonplace in Industry 4.0 and smart manufacturing, which are supported by this type of integration.

Al and robotics integration in protective packaging procedures often yields encouraging results, including improved protection, lower material use, and higher efficiency.

Al improves customer relationship management by offering useful information about how customers behave. Al-powered advanced RM systems are able to evaluate data from a variety of sources, including sales records, emails, and social media, in order to better engage customers, customize marketing campaigns, and forecast future purchasing trends. A more individualized experience for customers is the end result, and this can boost sales and foster more customer loyalty.

Predictive analytics is one of the most popular business applications for Al. Al-powered algorithms are being used by packaging producers to predict demand for particular goods. Al is capable of making precise predictions about future demand by examining past sales data, consumer behaviour patterns, and even outside variables like market trends or prevailing economic situations. Manufacturers can guarantee sufficient packaging materials are available, minimize waste, and improve manufacturing schedules.

Rapid growth in online shopping requires secure, lightweight, and efficient packaging. The demand for packaging that protects goods from damage during shipping and returns. Electronics are fragile and expensive, requiring high-performance protective solutions like foam inserts, air cushions, and anti-static packaging.

Increased need for tamper-evident and insulated packaging to maintain product safety and shelf life. Rise in ready-to-eat and takeout meals also fuels packaging demand. Hence, the growth in sales of packaged food & beverage industry has increased the demand for the protective packaging, which has estimated to drive the growth of the protective packaging market in the near future.

The key players operating in the protective packaging market is facing issue due to lack of recycling infrastructure and volatile raw material prices which has estimated to restrict the growth of the protective packaging market in the near future. Eco-friendly materials like biodegradable foams or molded fiber are often more expensive than conventional options.

Smaller businesses may struggle with cost-effective adoption. In many regions, there is an absence of efficient recycling systems, making it difficult to manage post-consumer packaging waste. Globalized and fragmented supply chains increase logistical challenges in delivering protective packaging solutions on time. Prices of materials like plastic, paper, and foam are subject to fluctuations due to supply chain disruptions or geopolitical factors.

Rising demand for temperature-sensitive goods (e.g., vaccines, frozen food) is driving demand for insulated and thermal protective packaging. For instance, in February 2025, Elixia Inc., an innovations logistics technology SaaS platform, has revolutionized the transportation of temperature-sensitive goods throughout India with the launch of its innovative cold chain logistics marketplace.

With its on-demand, temperature-controlled vehicle placement, Elixia is revolutionizing cold chain logistics following the success of its dry cargo marketplace. This ensures firms efficiency, dependability, and real-time visibility. With a large network of shippers and transporters at its back, Elixia is in a unique position to tackle some of the most important issues facing the sector.

The flexible protective packaging segment held a dominant presence in the protective packaging market in 2024. Flexible packaging (like bubble wrap, air pillows, padded mailers) is light, reducing shipping costs. The protective packaging takes up less storage space compared to rigid packaging. The flexible protective packaging is generally cheaper to produce and transport. It requires less material than rigid options, making it budget-friendly for businesses. It can be used for a wide variety of products from electronics and cosmetics to food and pharmaceuticals. Flexible materials allow for custom sizes and shapes

The paper & paperboard segment accounted for a significant share of the protective packaging market in 2024. As paper and paperboard is recyclable, biodegradable and renewable it is ideal for eco-conscious consumers and companies. The paper materials help to meet government regulations and corporate sustainability goals. Generally, less expensive than plastic or foam alternatives. The protective packaging is easily available and low-cost to manufacture and transport. The paper and paperboard is easy to print on, allowing brands to add logos, product info, or QR codes.

The wrapping segment dominated the protective packaging market globally. Wrapping materials (like bubble wrap, stretch film, foam sheets, kraft paper) are used in almost every sector like e-commerce, furniture, electronics furniture, automotive, food, etc. They can be applied to products of all shapes and sizes, making them highly adaptable. Wrapping provides shock absorption, scratch resistance, and barrier protection hence used widely.

The food & beverage segment registered its dominance over the global protective packaging market in 2024. Food items are perishable and sensitive to contamination, temperature, and moisture. The protective packaging ensures safe transportation, extended shelf life, and reduced spoilage. Busy lifestyles have increased demand for on-the-go, packaged, and delivery-based meals. These require sturdy, insulated, and leak-proof packaging to maintain product integrity. Platforms like Swiggy, Zomato, Uber Eats, and online grocery services have skyrocketed. Growth in dairy, frozen foods, seafood, and pharmaceuticals demands temperature-sensitive packaging. Protective packaging is essential to maintain cold chain integrity during storage and shipping. Packaging also serves as a branding tool, especially in the premium and health food segments. The protective packaging can also include customized designs that enhance shelf presence and customer trust.

Asia Pacific region held the largest share of the protective packaging market in 2024, owing to major importer of electronic goods and vast area under pharmaceutical industry. As the Asia Pacific region is home to over half of the world’s population, with rapidly growing urban and middle-class consumers. Increased demand for consumer goods, electronics, food, and online shopping all requiring protective packaging. Countries like China, India, Indonesia, and Vietnam are experiencing explosive growth in e-commerce. Surge in online deliveries and logistics creates massive demand for cost-effective and scalable protective packaging.

Asia Pacific region is a global manufacturing hub, especially for electronics, automotive, pharmaceuticals, and textiles. High volumes of fragile and export-bound goods require protective packaging for safe shipping. Low labour costs and availability of raw materials make Asia Pacific region ideal for mass production of packaging materials. Asia is becoming a major producer of biodegradable and paper-based packaging, in response to global and local environmental concerns.

India Protective Packaging Market Trends

India protective packaging market is driven owing to expanding logistic services in the region. The logistics policy-2025 was introduced in Jaipur by the Rajasthan government with the goal of ensuring an industrial environment that is conducive to investment and turning the state into a US$ 350 billion economies by 2030. Chief Minister Bhajanlal Sharma introduced the proposal during the just-ended seven-day Rajasthan Day celebration.

North America region is anticipated to grow at the fastest rate in the protective packaging market during the forecast period. North American region holds a strong and dominant position in the protective packaging market due to a combination of technological, economic, and consumer-driven factors. North America, especially the United States, has one of the most mature and expansive e-commerce markets. The surge in online shopping, home deliveries, and subscription boxes drives constant demand for protective packaging to ensure safe delivery.

North American consumers are highly aware of environmental issues, driving demand for eco-friendly, recyclable, and minimalistic packaging. Growth in meal kits, frozen food, and beverages industry in North America region amplifies the need for temperature-controlled and contamination-resistant packaging.

U.S. Protective Packaging Market Trends

U.S. protective packaging market is growing owing to technology advancement and innovation of protection packaging technology in the region. Strong focus on research & development and automation in packaging processes. Regulatory bodies like the U.S.FDA (Food and Drug Administration) and EPA (Environmental Protection Agency) enforce strict packaging standards, especially in **food, healthcare, and electronics.

Europe region is seen to grow at a notable rate in the foreseeable future. Europe leads globally in eco-conscious legislation, such as the European Green Deal and Circular Economy Action Plan. Bans and restrictions on single-use plastics push companies to invest in eco-friendly protective packaging, including paper-based, compostable, and recyclable solutions. European consumers prefer environmentally responsible brands and packaging that is minimalist, recyclable, or reusable. Europe is home to many innovative packaging startups and R&D centers focused on biodegradable materials, fiber-based alternatives, and smart packaging solutions. Europe exports a large volume of electronics, luxury goods, food products, and pharmaceuticals which has driven the demand for the protective packaging.

By Type:

By Material:

By Function:

By End-Use:

By Region:

January 2026

January 2026

January 2026

January 2026