Rigid Packaging Market Size, Demand and Growth Rate

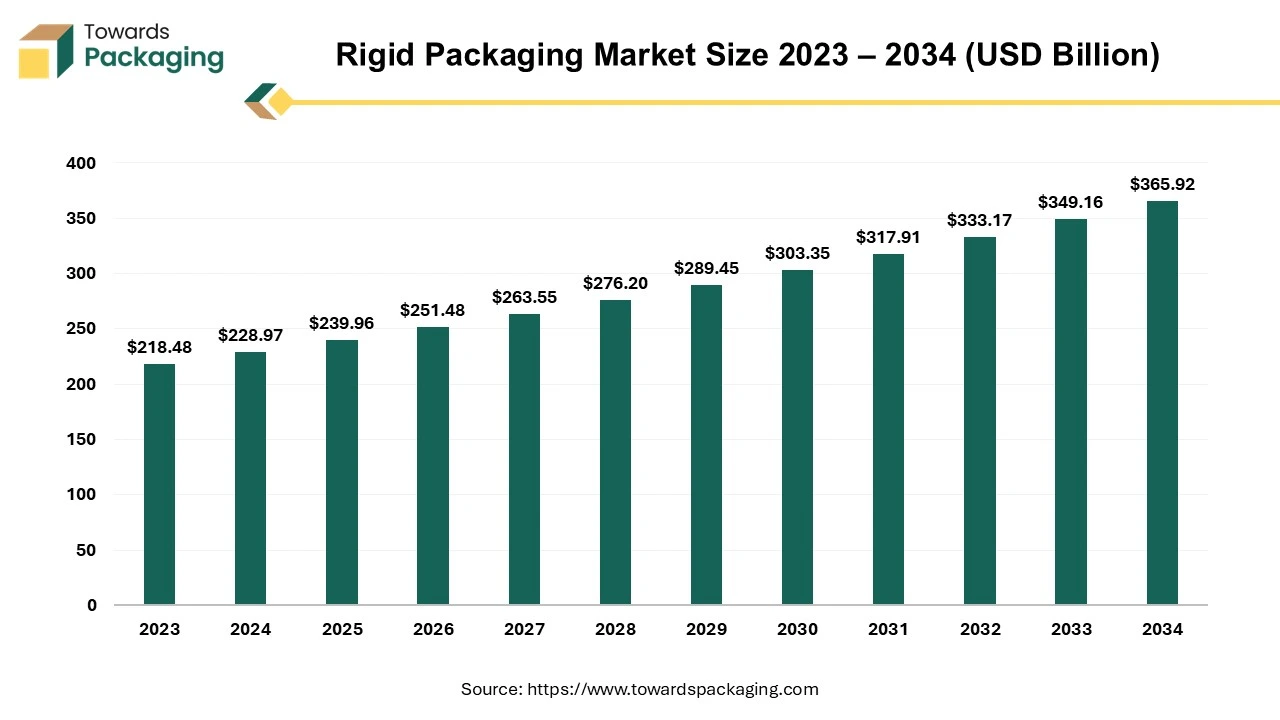

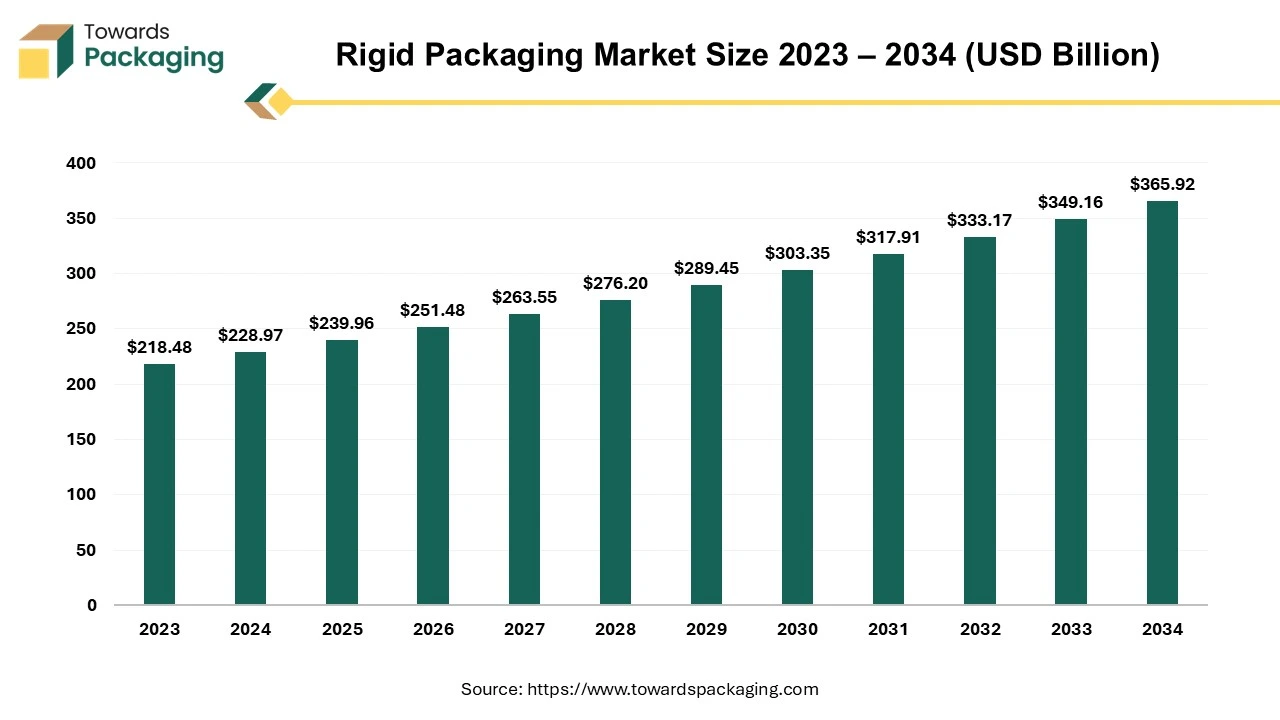

The rigid packaging market is forecasted to expand from USD 589.58 billion in 2026 to USD 1,093.07 billion by 2035, growing at a CAGR of 7.1% from 2026 to 2035. The market is segmented into plastic, glass, and metal materials, with food & beverages accounting for the largest share. Regional dynamics show that North America and Europe lead in market share, while Asia Pacific shows strong growth potential due to the rise of emerging economies.

The competitive landscape includes top players like Amcor, Sealed Air Corporation, and Berry Global, who are leading the shift toward sustainable and lightweight packaging solutions. The report covers regional market insights, trends, and trade data.

Report Highlights: Important Revelations

- Key influences on the rigid packaging sector in Asia Pacific.

- North America's impact on the global rigid packaging scene.

- Significance of rigid plastic packaging across different industries.

- Crucial function of rigid boxes in contemporary packaging methods.

- Wide-ranging uses of rigid packaging within the food and beverage industry

The rigid packaging sector makes prominent use of plastic owing to their numerous advantages, include becoming durable, portable, chemically impermeable, and reasonably priced. Considering 31% of the world's plastic utilisation volume going to the packaging, the industry certainly is dominating with the manner when plastics are used. Comparing to other forms of packaging, rigid packaging is more lightweight. It also reduces food waste and spoiling, protects against breakage, and offers a host of other advantages. Rigid plastic widely used in various industries such as food and beverage, personal care, healthcare and others.

Rigid packaging is often chosen since it is lightweight than components including glass or metal and consumes less electricity to transport. The carbon footprint of a product can be reduced by up to 40% by switching from glass bottles to plastic equivalents, according to recent research. This emphasises rigid plastic packaging's sustainability, which makes it a sensible option for both producers and customers.

Contrary to popular belief, flexible packaging is more eco-friendly than rigid packaging, while glass jars require more energy to produce than flexible pouches, glass has the benefit of being infinitely recyclable and reusable. Even though stiff plastic packaging requires more energy and materials to produce, the plastics used are frequently obtained domestically and can contain recycled content. A large amount of glass is manufactured globally, which increases the amount of energy required for transportation and leaves a larger carbon imprint. There are more considerations for sustainability in packaging decisions than just material type.

For Instance,

- In February 2024, Consolidated Container Company has been successfully acquired by Mauser Packaging Solutions, a global manufacturer of rigid packaging products and services.

Rigid Packaging Market Trends

- Sustainable and Eco-Friendly Packaging: The packaging industry is shifting towards recyclable, biodegradable, and reusable materials. Companies are increasingly adopting plant-based plastics, glass, and recycled PET to reduce environmental impact.

- Smart Packaging Technologies: Integration of QR codes, IoT, and RFID technology into rigid packaging enhances customer engagement and supply chain transparency, offering real-time authentication, tracking, and product information through smart labels.

- Lightweight Packaging Solutions: Manufacturers are focusing on lightweight yet durable packaging materials to lower costs and carbon footprints, with innovations in thin-wall plastic containers and lightweight glass bottles gaining traction.

- Customization and Personalization: Advances in digital printing and 3D packaging design enable brands to create tailored packaging that resonates with consumer preferences, including limited-edition and interactive designs.

- Regulatory Compliance and Circular Economy: Governments worldwide are enforcing stricter regulations on packaging waste and sustainability, promoting circular economy principles focused on reuse and recycling of packaging materials.

- Eco-friendly and Sustainable Packaging: Due to rising concerns about global warming the demand for rigid packaging solutions that are recyclable or manufactured from recycled materials has increased. This trend is driven by consumers' increased awareness of environmental issues, including plastic waste and pollution. Companies are investing in alternative materials like biodegradable plastics and plant-based polymers to reduce environmental impact. Packaging is being designed with reduced material usage and improved recyclability, focusing on minimalistic designs and less waste.

- Premiumization of Products: As consumers increasingly demand for higher-quality products, there is a rising trend towards premium packaging solutions. Rigid packaging, particularly glass and high-quality plastic, is utilized to convey freshness, luxury, and quality. This is particularly evident in the food and beverage sector, where glass bottles, jars, and rigid containers are being used to differentiate premium products.

- Shift from Plastic to Alternative Materials: There is a gradual shift away from single-use plastic in favour of alternative rigid packaging materials such as glass, metal, and paperboard. This trend is especially strong in consumer goods, food & beverages, and cosmetics industries. Glass is regaining popularity for its premium feel and sustainability attributes, though it remains heavy and costly compared to plastic.

- Customization and Personalization: Consumers are increasingly preferring personalized products, and packaging plays a role in this trend. Brands are focusing on offering customized packaging designs, whether through colors, shapes, or branding elements, to appeal to specific consumer groups.

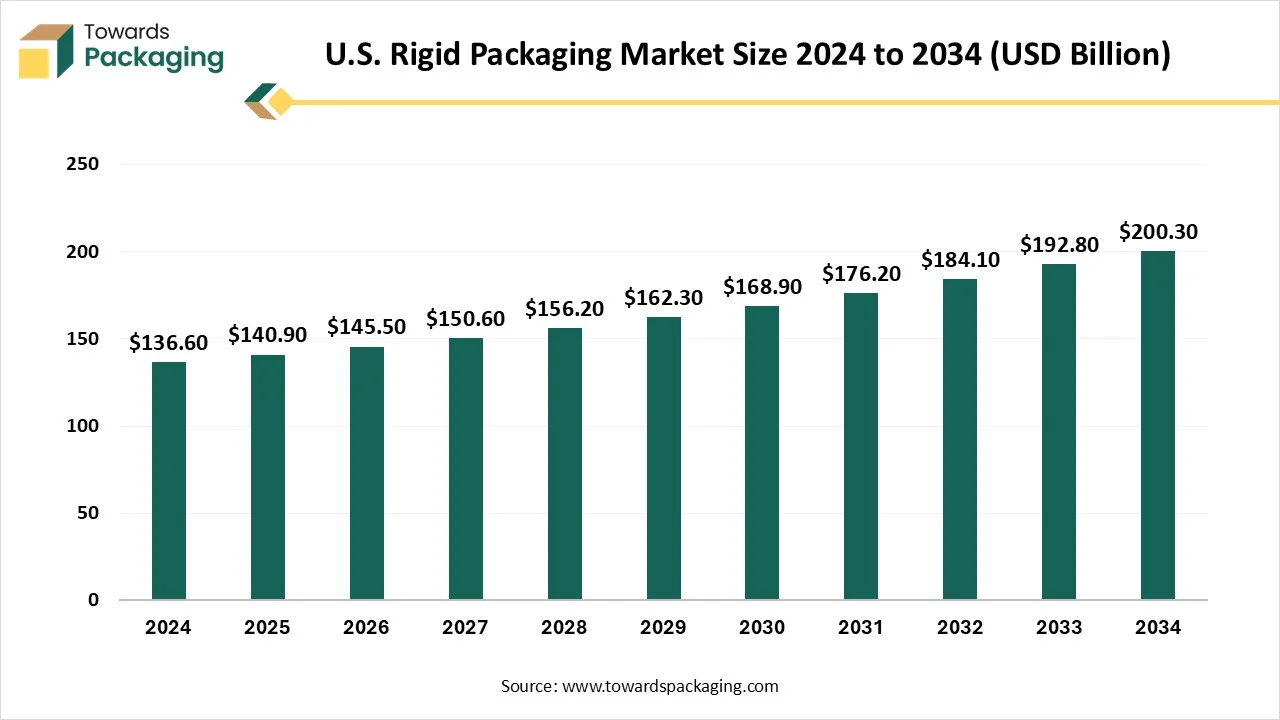

U.S. Rigid Packaging Market Size 2025-2030 (Value - USD Billion)

| Year/Market Size |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

| USD Billion |

140.9 |

145.5 |

150.6 |

156.2 |

162.3 |

168.9 |

U.S. Rigid Packaging Market Size By Material 2025-2030 (Value - USD Billion)

| By Material |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

| Plastic |

49.1 |

50.0 |

51.0 |

52.1 |

53.3 |

54.6 |

| Metal |

27.3 |

28.8 |

30.3 |

32.1 |

34.0 |

36.0 |

| Paper & Paperboard |

38.7 |

39.7 |

40.9 |

42.2 |

43.6 |

45.1 |

| Glass |

20.4 |

21.3 |

22.2 |

23.2 |

24.2 |

25.4 |

| Bioplastic |

5.3 |

5.8 |

6.3 |

6.7 |

7.2 |

7.8 |

U.S. Rigid Packaging Market Size By Product Type 2025-2030 (Value - USD Billion)

| By Product Type |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

| Boxes |

34.5 |

36.0 |

37.7 |

39.5 |

41.6 |

43.8 |

| Trays |

23.1 |

24.0 |

24.9 |

25.9 |

27.0 |

28.2 |

| Containers & Cans |

35.8 |

36.7 |

37.8 |

38.9 |

40.2 |

41.5 |

| Bottles & Jars |

38.9 |

40.1 |

41.4 |

42.8 |

44.4 |

46.1 |

| Others |

8.6 |

8.7 |

8.8 |

9.0 |

9.1 |

9.3 |

Driving Factors of Rigid Packaging Industry in Asia Pacific

The Asia Pacific region has become the leading global market for rigid packaging, primarily due to the expansion of firms in the cosmetics and food & beverage industries. The region dominates globally in rigid packaging to a significant degree as a result of this multitude of producers. The Asia Pacific region's enormous populace, particularly in developing countries like India and China, and their fast growth in economies are major factors driving the market. specifically, the emerging markets of China, India, Bangladesh, and other countries are major drivers of the rigid packaging industry.

In Asia Pacific, a growing middle class and a rising percentage of single-person families choosing smaller packing units are two of the causes driving the growing need for rigid packaging. Furthermore, the region's need for rigid packaging is fueled in part by urbanisation and the rise in e-commerce. The market is dynamic and producers must adapt and innovate to satisfy the demands of the changing consumer tastes and lifestyles reflected in these trends. Due to its enormous growth potential in the face of a quickly changing economic environment, the Asia Pacific area remains a major hub for manufacturers of rigid packaging.

For Instance,

- In Janaury 2024, Plas-Pak WA, a distributor and manufacturer of plastic packaging with its headquarters in Perth, Western Australia (WA), has been bought by TricorBraun, an American designer and distributor of rigid packaging.

North America's Role in Global Rigid Packaging Landscape

North America is expected to grow at a significant rate over the forecast period. The robust advancements in the rigid thermoform plastic packaging industry are responsible for this region's expansion. Numerous benefits of thermoforming include its lower cost and adaptability. The rigid thermoform plastic packaging industry has seen enormous growth in product manufacture, creating a sizable client base that is fueling the expansion of the North American rigid packaging market. The key players operating in the North America region are focused on adopting inorganic growth strategies like partnership/collaboration to develop rigid packaging, which is estimated to drive the growth of the rigid packaging market in the near future.

For instance, in April 2024, Eastman Chemical Company, chemical industry headquartered in Tennessee, U.S. collaborated with the Sealed Air Corporation, North Carolina, U.S., to introduce certified lightweight tray, innovated to replace typical polystyrene foam substitutes in protein packaging applications. Eastman's Aventa Renew material, which is composed of wood pulp and acetyl from a portfolio of recycled materials, is used to make the new tray. Eastman explains that the latter has up to 43% recycled content that has been approved by ISCC PLUS through a mass balance allocation procedure.

North America is the rigid packaging sector's second-greatest market. North America is acknowledged as the world's top region in packaging consumption and is home to major players in the industry, including International Paper, Tetrapak, Reynolds Group, Ball Corporation, and Owens-Illinois. In the course of the region, rigid materials are widely used in a variety of applications.

The US has the biggest market share for rigid packaging in North America. This dominance is a direct result of the nation's substantial consumer base, advanced technology, and strong industrial infrastructure. The food and beverage, pharmaceutical, personal care, and household product industries are just a few of the diverse industries that make up the U.S. rigid packaging market.

North America's standing as a major participant in the global rigid packaging scene is strengthened by the existence of top packaging companies, ongoing innovation, and research and development spending. Furthermore, producers in the region are compelled to implement eco-friendly practices and provide recyclable packaging solution due to strict restrictions pertaining to packaging materials and sustainability activities.

North America's leading position in the rigid packaging market underlines how important it is to the development of industry trends and innovation in response to changing consumer needs and legal regulations.

For Instance,

- In December 2023, the purchase of JWJ Packaging, a US-based provider of rigid container goods like as drums and pails, has been announced by Novvia Group, a global distributor of life sciences packaging.

Latin America

The demand for rigid packaging in Latin America is constantly growing, driven by development in the food and beverage, pharmaceuticals, and personal care industries. Rising urbanization, a growing middle-class population, and higher disposable incomes are boosting the demand for reliable and protective packaging. Users in the region choose rigid packaging, such as plastic containers, glass bottles, and metal cans, for their power, product safety, and extended shelf life. Additionally, the move towards sustainable and recyclable rigid materials is gaining momentum, as governments and boards emphasise eco-friendly packaging practices.

Middle East and Africa

The urge for rigid packaging in the Middle East and Africa is witnessing constant development, supported by the expansion of the food and beverage, cosmetic industries, and pharmaceuticals. Rising urbanization, population growth, and increasing disposable incomes are driving the selection for tamper-resistant, durable, and shelf-life extending packaging solutions such as plastic containers, metal cans, and glass bottles. The booming e-commerce and retail sectors are further fueling the acceptance of rigid packaging across the region. Additionally, a growing focus on sustainable and recyclable materials is encouraging manufacturers to accept eco-friendly rigid packaging solutions, meeting regional regulations and user awareness about environmental impact.

| Product |

Description |

Loading Port |

Unloading Port |

Country of Origin |

Quantity |

Weight (kg) |

Arrival Date |

| Paper and Paperboard |

Coated on one or both sides with kaolin (China clay) or other inorganic substances. |

Shanghai, China |

New York/Newark Area, Newark, NJ, USA |

Japan (JP) |

108 Rolls |

49,734 |

2024-09-27 |

| Plastic Packaging |

Plastic packaging. |

Liverpool, UK |

New York/Newark Area, Newark, NJ, USA |

United Kingdom (GB) |

542 Cartons |

15,664 |

2024-09-27 |

| Metal Packaging |

Metal packaging on 24 pallets. |

Genoa, Italy |

New York/Newark Area, Newark, NJ, USA |

Italy (IT) |

1,056 Packages |

3,147 |

2024-09-26 |

| Plastic Packaging |

Plastic packaging. |

Valencia, Spain |

Savannah, GA, USA |

Spain (ES) |

2,678 Boxes |

19,562 |

2024-09-25 |

| Plastic Packaging |

Plastic Packaging |

Liverpool, UK |

New York/Newark Area, Newark, NJ, USA |

United Kingdom (GB) |

1 Package |

93 |

2024-09-25 |

| Paper and Paperboard |

Coated on one or both sides with kaolin (China clay) or other inorganic substances. |

Pusan, South Korea |

New York/Newark Area, Newark, NJ, USA |

Japan (JP |

102 Rolls |

- |

2024-09-27 |

Rigid Packaging Market, DRO

Demand:

- Products are adequately safeguarded by rigid packaging against environmental elements like moisture, light, oxygen, and physical damage.

Restraint:

Growing Environmental Concerns and High Production Costs

The environmental impact of rigid packaging, particularly single-use plastics, has drawn increased scrutiny. Challenges in recycling and waste management are pushing the industry toward more sustainable alternatives. Modern consumers prioritize convenience, sustainability, and minimalist packaging, prompting brands to balance these preferences with maintaining product quality and integrity. Compared to flexible packaging, rigid packaging generally involves higher manufacturing costs and greater material usage, especially in metal and glass packaging.

- Rigid packaging, especially when made of non-biodegradable or non-recyclable materials, raises questions regarding its environmental impact even though it provides protection and durability.

Opportunity:

High Demand for Protective Packagingf

High demand for protective packaging across various industries creates immense opportunities in the rigid packaging market. One of the primary benefits of rigid packaging is its ability to provide superior protection to products. Materials such as hard plastics, metal, glass, and paperboard offer robustness that safeguards products from damage during storage and transportation. This is especially critical for sensitive and perishable goods like beverages, food, and pharmaceuticals.

Well-designed rigid packaging also enhances product visibility and brand recognition. Quality embossing, printing, and labeling enable brands to create attractive designs that capture consumer attention. Luxury items, such as cosmetics and perfumes, particularly benefit from premium rigid packaging materials like metal and glass.

Additionally, rigid packaging helps extend product shelf life by protecting contents from pollutants and preserving freshness. Plastic containers, glass bottles, and metal cans support the long-term storage of food and beverages. In the pharmaceutical sector, child-resistant and tamper-evident packaging further ensure consumer safety.

- Companies can use pooled resources, knowledge, and infrastructure to create creative rigid packaging solutions by working together with suppliers, technology providers, and industry players.

Role of Rigid Plastic Packaging In Various Sectors

A global market with a total worth of USD 310.65 billion is anticipated for rigid plastic packaging in 2023, attributed to its widespread adoption in a variety of sectors such as health care, food & beverage, electronics, and personal care. Rigid plastic bottles, especially in the food and beverage industry, are the main container for a wide range of goods, including water, carbonated soft beverages, juices, food items, cosmetics, personal hygiene products, and pharmaceuticals.

Despite an integrated stream containing additional components such as plastics, glass, paper/cardboard, steel, and aluminium, household rigid plastic packaging is usually collected in Australia. A Materials Recovery Facility (MRF) sorts this combined or commingled material so as to separate its several material streams.

Almost all, of the rigid plastic packaging is then automatically sorted using optical polymer sorting machinery once it has been separated from other materials. The various polymer kinds can be distinguished by this apparatus by the use of near-infrared (NIR) spectrum absorption. Several kinds of stiff plastics are recognised and distinguished for recycling or other suitable disposal techniques through this sorting procedure.

By using this method, hard plastic packaging may be recovered more effectively for recycling, and it also emphasises how important technology improvements are to waste management procedures. Reducing environmental impact and increasing recycling rates by diverting rigid plastics from landfills and supporting circular economy concepts are the goals of countries such as Australia that have implemented automated sorting processes.

PP is the leading plastic commodity in India, used for various applications. Rigid plastic packaging, often known as "rigids" in the industry, is mostly made of polypropylene (PP) or high-density polyethylene (HDPE) . These products include containers without open tops and instead have separate closures, lids, or covers. These are frequently used to package a variety of consumer goods, including beverages, personal care products, and food items.

For Instance,

- In May 2023, the world's first PET resin made from waste carbon is produced in collaboration between LanzaTech and Plastipak.

Integral Role of Rigid Boxes in Modern Packaging Systems

Boxes are a prominent product category in the rigid packaging market because of their adaptability, robustness, and broad industry applicability. Boxes are a fundamental component of packaging solutions, providing a wide range of items with protection, confinement, and organisation. To meet varied packaging needs, they are available in a variety of sizes, shapes, and materials, such as cardboard, corrugated board, plastic, and metal.

Specifically cardboard and corrugated boxes are very preferred because of their affordability, portability, and environmental friendliness. Their frequent applications include shipping, storing, and retail packing; they offer a reliable, lightweight way to move items with the least amount of environmental effect.

plastic boxes are transparent, resistant to moisture, and have designs that can be customised, which makes them perfect for product display and guaranteeing product exposure on store shelves. Contrarily, metal boxes offer unmatched strength and security, which is why they are frequently used to package expensive or delicate goods that need special protection while in transportation.

Because they can accommodate a wide range of packaging requirements from food and beverage to electronics, pharmaceuticals, and other industries, boxes are essential to the rigid packaging business. Their versatility, robustness, and efficiency render them essential constituents of contemporary packaging systems.

For Instance,

- In March 2023, Parksons purchased MK Printpack, a manufacturer of folding cartons with a footprint of production strategically placed and significant capabilities in fluted packaging.

Diverse Applications of Rigid Packaging in Food and Beverage Sector

The beverage and food sectors are the main users of rigid packaging, although it is also used for packaging domestic goods, medications, and personal care items. A number of variables, most notably the growing need for single-serve packaging in ready-to-eat foods and beverages, are driving the usage growth trend. Furthermore, continuing improvements in material qualities make it easier to replace conventional packaging materials like glass with plastic. Among rigid plastic beverage bottles, carbonated soda is the most common end use in the beverage industry. Though it only accounts for 3% of the market, there has been a noticeable uptick in the use of rigid plastic packaging in the alcohol sector. Due to growing customer preferences for healthier and "good for you" beverage options, this market is seeing substantial growth.

Rigid packaging is a preferred option in a variety of industries due to its adaptability and versatility, and its use is expected to continue growing as a result of changing consumer tastes and technology advancements.

The expected increase in global cereal production is forecasted to result from improved yields and optimized utilization of arable land resources. Wheat, rice, maize, and other grains are packaged in rigid containers for efficient transportation, exportation, and retail distribution. These commodities are enclosed in rigid packaging solutions, providing essential moisture protection and product safeguarding throughout the supply chain.

For Instance,

- In December 2023, the acquisition of JWJ Packaging, a US-based provider of rigid container products such as pails and drums, has been announced by Novvia Group.

Global Survey Reveals Strong Support for Reducing Plastic Production and Banning Single-Use Plastics

A survey conducted in 19 countries with over 19,000 people shows that the majority strongly support cutting plastic production. Specifically:

- 82% support reducing plastic production.

- 80% want to protect biodiversity and the climate by cutting plastic use.

- 90% favor switching from single-use plastic packaging to reusable options.

- 75% support a ban on single-use plastics.

Many people are also concerned about plastic’s impact on health:

- 80% worry about the effects of plastic on their loved ones’ health.

- 84% of parents are especially concerned about its impact on their children’s health.

This support is consistent across all countries surveyed, especially strong in Global South nations with higher plastic pollution levels. The lowest level of support was 60%, for preventing fossil fuel and chemical industry lobbyists from joining negotiations.

Key Players and Competitive Dynamics in the Rigid Packaging Market

The competitive landscape of the rigid packaging market is dominated by established industry giants such as Bemis Company, Inc., Amcor Limited, Coveris Holdings S.A, Reynolds Group Holding, Berry Plastics Corporation, Sonoco, Sealed Air Corporation, Silgan Holdings, Inc., Plastipak Holdings, Inc., Consolidated Container Company, DS Smith PLC and Ball Corporation. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Innovation and sustainability are Plastipak's two main strategic focuses. The business makes significant investments in R&D to produce innovative packaging solutions that satisfy changing customer needs and market trends. By utilising recycled materials in its packaging products and investigating environmentally friendly manufacturing techniques, Plastipak places a high priority on sustainability.

For Instance,

- In Janaury 2022, Plastipak, a producer and recycler of plastics, has finished growing its production facility in Bascharage, Luxembourg. Through the expansion, the facility will be able to produce more recycled polyethylene terephthalate (PET) annually.

Amcor uses a variety of strategies to hold onto its market-leading position in rigid packaging. Offering a wide range of rigid packaging solutions for a variety of industries, such as food and beverage, pharmaceuticals, personal care, and industrial applications, the company focuses on portfolio diversification.

For Instance,

- In August 2023, Amcor, a leader in the development and production of sustainable packaging solutions worldwide, said today that it has reached a deal to buy Phoenix Flexibles, increasing its presence in the rapidly expanding Indian market.

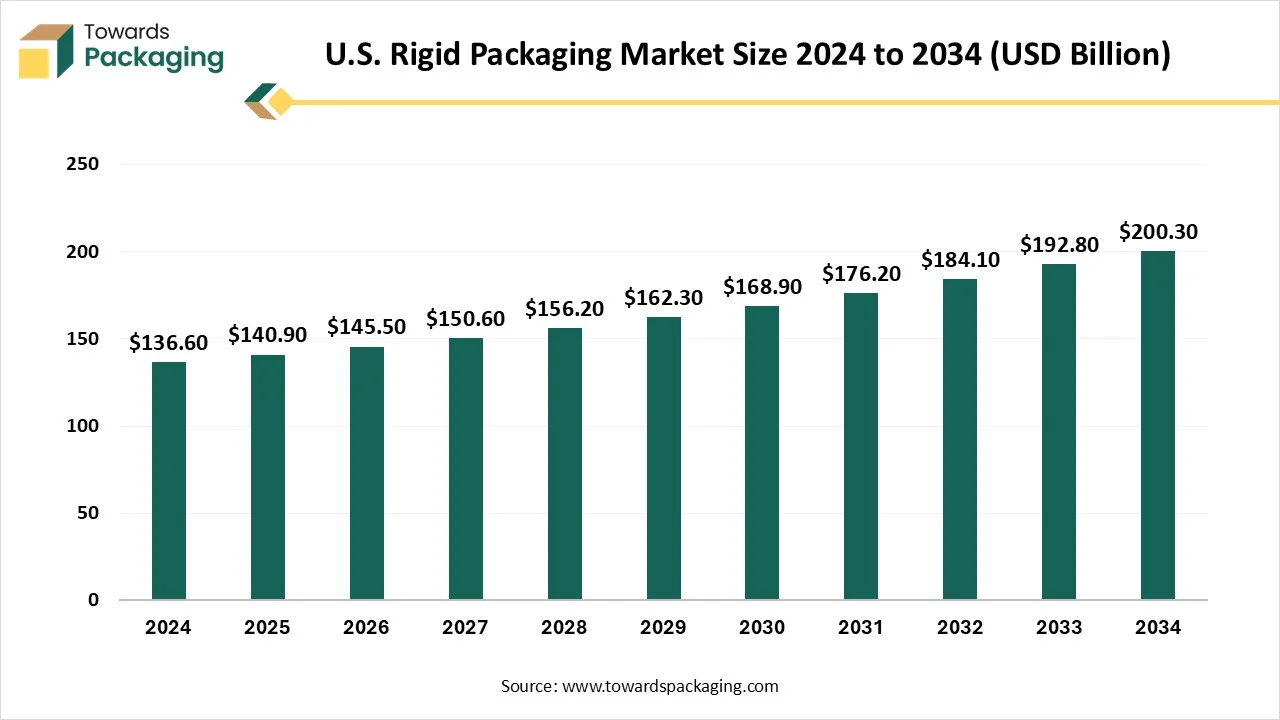

Future of U.S. Rigid Packaging Market

The U.S. rigid packaging market is set to grow from USD 140.9 billion in 2025 to USD 200.3 billion by 2034, with an expected CAGR of 3.9% over the forecast period from 2025 to 2034. The rising e-commerce sector, food & beverages, and pharmaceutical industry in the U.S. has enhanced the development of this market. The changing consumers demand and supervisory guidelines has influenced rapid innovation in the U.S. rigid packaging market. Growing demand for recyclable and sustainable packaging in various industries has raise the advancement in the rigid packaging technology in the U.S.

The U.S. rigid packaging market encompasses the segment of the packaging industry in the United States that involves the use of rigid materials such as plastics, metals, and glass to create containers and packaging solutions. These packaging solutions are characterized by their solid, inflexible structures, providing durability and protection for a wide range of products, including food and beverages, pharmaceuticals, personal care items, and industrial goods. The market is driven by factors such as consumer demand for convenience, advancements in packaging technologies, and the need for sustainable and eco-friendly packaging solutions.

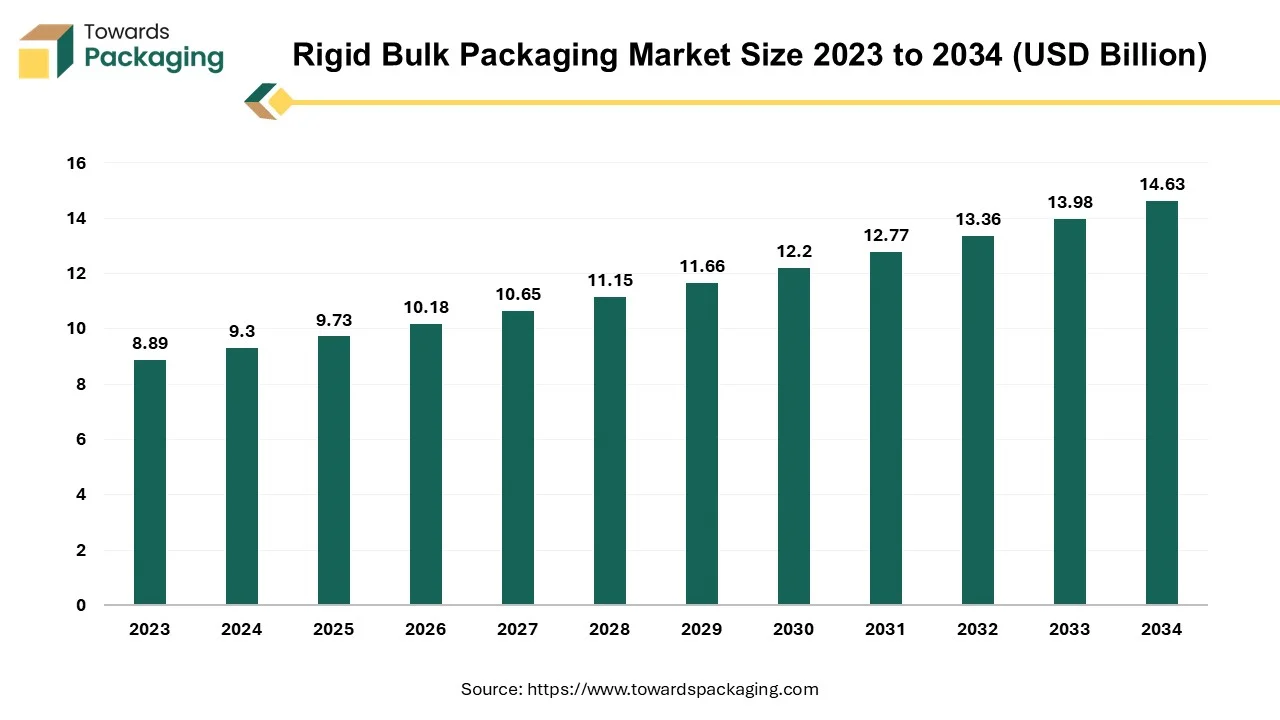

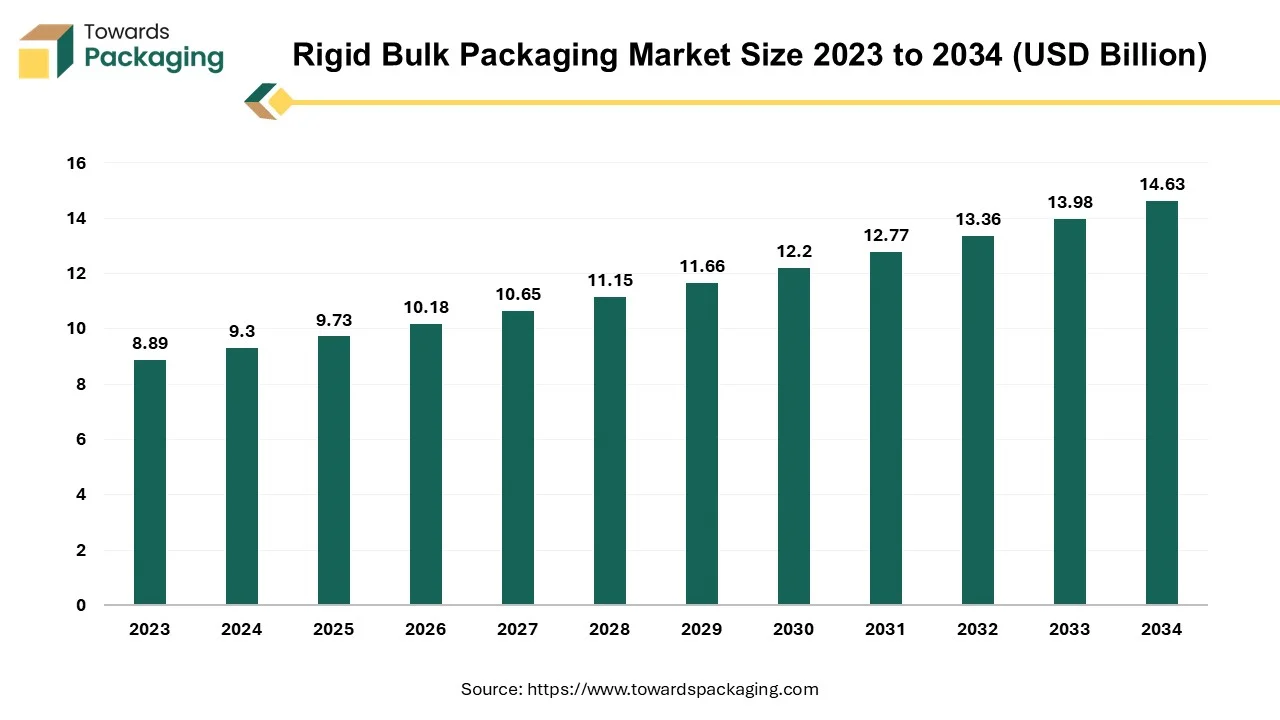

Future of Rigid Bulk Packaging Market

The global rigid bulk packaging market projected at USD 9.3 billion in 2024, is expected to reach USD 14.63 billion by 2034, growing at a CAGR of 4.63% over the forecast period. The sustained growth in the rigid bulk packaging market is a result of rising demand in the food and beverage and pharmaceutical industries across the globe.

Rigid bulk packaging refers to high-strength packaging containers that are mainly used to transport perishable, delicate, and volatile products. This type of packaging ensures the safe transportation of sensitive products. Heavy-duty materials such as high-strength plastics, metals, and wood are generally used to manufacture rigid bulk packaging.

Rigid bulk packaging is commonly used in the food and beverage, pharmaceutical, and industrial chemical transportation industries. These industries utilize rigid bulk packaging for the safe and efficient transportation of pharmaceutical drugs, perishables, and volatile chemicals. This type of packaging prevents leaks and contamination of products. The global push towards reusable forms of packaging is driving demand for bulk containers. These also have the added advantage of being highly cost-effective compared to smaller containers.

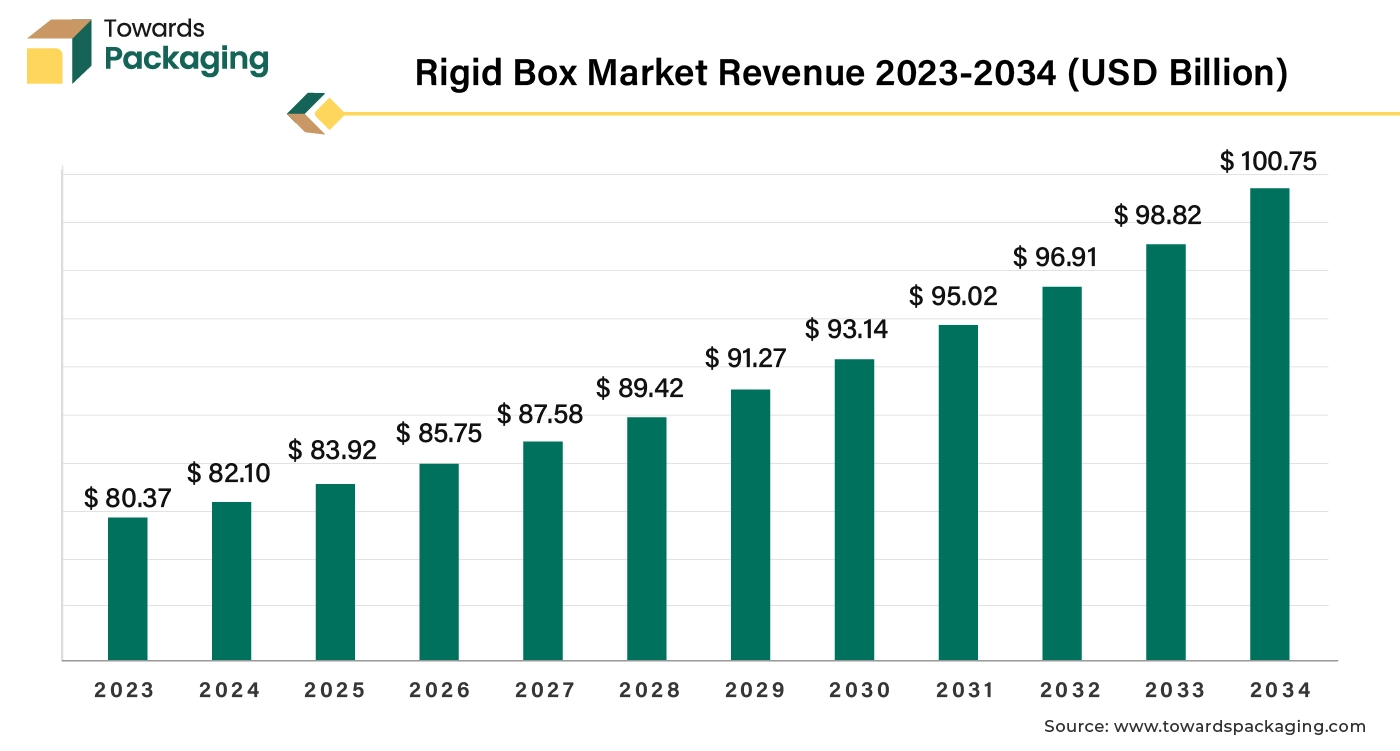

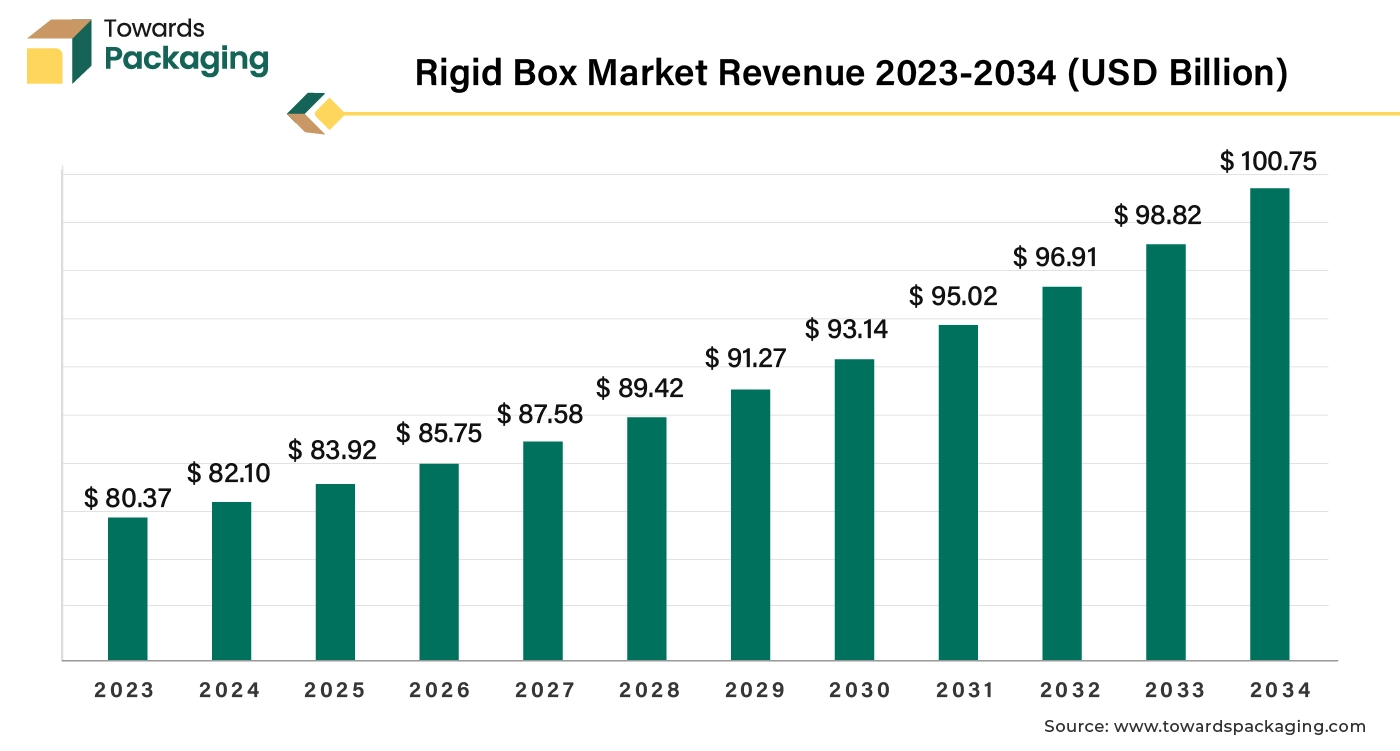

Future of Rigid Box Market

The rigid box market is expected to increase from USD 83.92 billion in 2025 to USD 100.75 billion by 2034, growing at a CAGR of 2.08% throughout the forecast period from 2025 to 2034.

Due to rapid industrialization and as the global robust economic growth has increased disposable income and purchasing power, the demand for luxury goods with premium packaging increased, which is estimated to drive the growth of the rigid box market over the forecast period.

Rigid boxes are a type of packaging box manufactured of more durable, thicker cardboard, or paperboard material. They are made to be pre-assembled, which results in a strong, stable construction that is difficult to fold or collapse. High-end or luxury goods that require better protection and a superior presentation are usually packaged in rigid boxes. Products like electronics, jewellery, cosmetics, perfumes, and high-end consumer goods are frequently packaged in rigid boxes. Numerous printing and finishing choices, including as foil stamping, embossing, debossing, spot UV, and matte or gloss lamination, are available to customize them. As a result, the brand image is strengthened and increased brand recognition is possible.

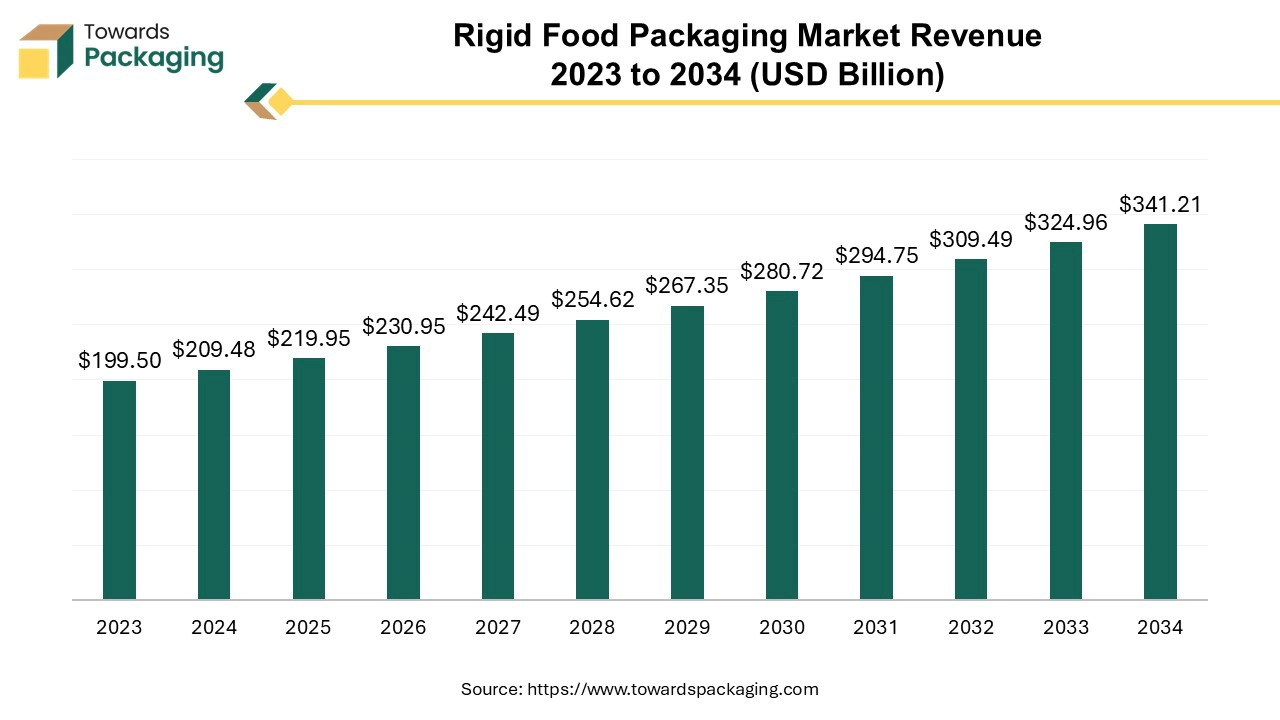

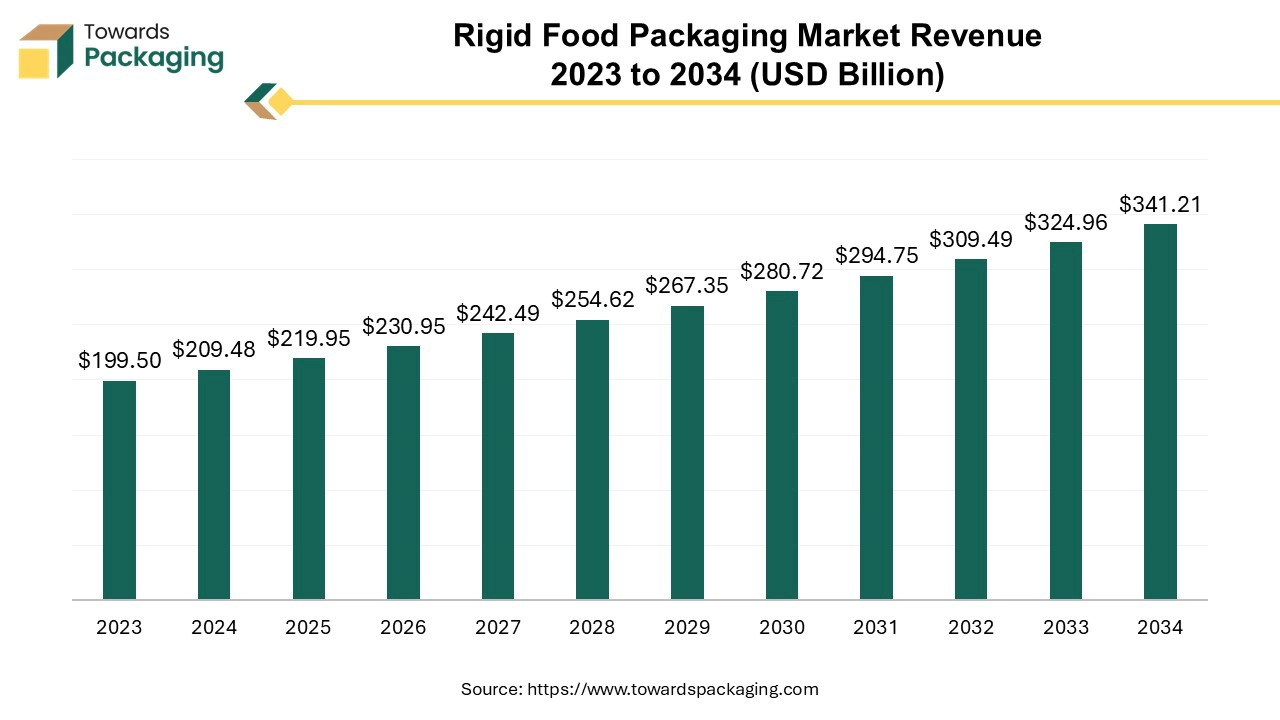

Future of Rigid Food Packaging Market

The global rigid food packaging market, valued at US$ 199.50 billion in 2023, is projected to reach approximately US$ 341.21 billion by 2034, growing at a CAGR of 5% from 2024 to 2034. This growth is driven by the increasing demand for ready-to-eat food and evolving consumer food preferences.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing rigid food packaging which is estimated to drive the global rigid food packaging market over the forecast period.

Rigid food packaging is a category of packaging designed to offer a solid, inflexible structure to protect food products. Unlike flexible packaging, which can be bent or folded, rigid packaging maintains its shape and provides a stable barrier to external factors. Rigid packaging maintains its shape and does not collapse or bend. This rigidity assists in safeguarding the food from physical damage and contamination.

Amcor Delivers Strong First Quarter Following Berry Acquisition

GAAP Results (Three Months Ended September 30)

| Metric |

FY 2024 |

FY 2025 |

Change (Reported) |

| Net Sales |

$3,353M |

$5,745M |

+71% |

| Net Income |

$191M |

$262M |

— |

| Diluted EPS (US cents) |

13.2 |

11.3 |

— |

Adjusted (Non-GAAP) Results

| Metric |

FY 2024 |

FY 2025 |

Change (Reported) |

Change (Constant Currency) |

| Net Sales |

$3,353M |

$5,745M |

+71% |

+68% |

| EBITDA |

$466M |

$909M |

+95% |

+92% |

| EBIT |

$365M |

$687M |

+88% |

+85% |

| Net Income |

$234M |

$448M |

+91% |

+88% |

| Diluted EPS (US cents) |

16.2 |

19.3 |

+20% |

+18% |

| Free Cash Flow |

-$395M |

-$343M |

— |

— |

Segment-Level Performance

Global Flexible Packaging Solutions

| Metric |

FY 2024 |

FY 2025 |

Reported Change |

Constant Currency Change |

| Net Sales |

$2,552M |

$3,257M |

+28% |

+25% |

| Adjusted EBIT |

$329M |

$426M |

+29% |

+28% |

| EBIT Margin |

12.9% |

13.1% |

— |

— |

Global Rigid Packaging Solutions

| Metric |

FY 2024 |

FY 2025 |

Reported Change |

Constant Currency Change |

| Net Sales |

$801M |

$2,488M |

+211% |

+205% |

| Adjusted EBIT |

$62M |

$295M |

+377% |

+365% |

| EBIT Margin |

7.7% |

11.9% |

— |

— |

Synergies & Integration

| Category |

Amount |

| Total Q1 Synergies |

~$38M |

| Impact to EBIT |

~$33M |

| Impact to Interest Expense |

~$5M |

| Expected Total FY26 Synergies |

≥ $260M |

| Total Identified Synergies by FY28 |

$650M |

Dividend Details

| Detail |

Value |

| New Quarterly Dividend |

13.0 cents per share |

| Prior Year Q1 Dividend |

12.75 cents |

| ASX Holder Payment |

19.78 AUD cents |

| Ex-Dividend Dates |

Nov 27 (ASX), Nov 28 (NYSE) |

| Record Date |

Nov 28, 2025 |

| Payment Date |

Dec 17, 2025 |

Fiscal 2026 Outlook (Reaffirmed)

| Metric |

FY26 Guidance |

| Adjusted EPS |

80–83 cents (12–17% growth) |

| Free Cash Flow |

$1.8–$1.9B |

| Capex |

$850–$900M |

| Net Interest Expense |

$570–$600M |

| Effective Tax Rate |

19–21% |

| Expected FY26 Synergies |

≥ $260M |

Rigid Packaging Market Companies

Latest Announcements by Industry Leaders

- David Clark, Vice President at Amcor plc., stated that the company has reducing waste and improving sustainability by 2025, by working with consumers and carrying out research and development for innovation rigid sustainable material. The Amcor plc. Putforth the Catalyst program which the company’s technical experts in direct contact with customers. In order create an extraordinary pipeline of innovations that address the largest practical and technical obstacles to packaging, Amor invests US$100 million annually in research and development (R&D). This dedication to research and development has yielded outstanding outcomes: This year, Amite Recyclable is brand-new, metal-free, recyclable packaging for a variety of food and medical uses. There have been notable advancements in the use of post-consumer recycled (PCR) content in rigid packaging, including the commercialization of numerous 100% PC solutions and the usage of over 100 million pounds of recycled content yearly.

Recent Developments in the Rigid Packaging Market

- In March 2025, LyondeBasell, a top company in the chemical sector, revealed the disclosure of Pro-fax EP649U, a latest polypropylene affected copolymer crafted for the rigid packaging industry. This kind of cutting-edge product is particularly formulated for thin-walled injection moulding, which is perfect for food packaging uses.

- In September 2025, the rigid packaging space of Cosmo Films, named Cosmo Plastech, a leading company in specialty films, is displaying its innovations at the current World of Ice Cream Expo 2025, which is being held from 7-9 September at Science City, Ahmedabad.

- In February 2025, Avantium, which is a top company in circular polymer and renewable materials, officially partnered with Amcor Rigid Packaging USA, LLC, a leader in responsible packaging solutions. This merger goal is to discover the usage of Avantium’s plant-based polymer PEF, which is branded as relief in the rigid containers for different products, including beverages, food, pharmaceuticals, home, medical, and home care too.

- In October 2024, Tesco, multinational groceries and general merchandise retailer company and Zespri, kiwi fruit producer have launched a linerless lid solution and kerbside recyclable tray for kiwi packaging as part of a cross-industry partnership with the goal of reducing carbon emissions and doing away with the conventional plastic flow wrap.

- In April 2024, The Saber Corporation, food packaging solutions maker has unveiled a new range of biodegradable trays made specifically for fruit and proteins. Foodservice providers can now use this line of certified commercially compostable trays as a sustainable substitute for conventional foam trays, meeting the growing demand for environmentally friendly goods. Designed to satisfy the hybrid cooking trend, the Pulp 2S Produce Tray combines meal kits, meal planning, and prepared foods.

- In November 2024, Berry Global, packaging solutions providing company, has introduced a new 10ml "easy-squeeze" ophthalmic bottle that is compatible with Aptar Pharma's Ophthalmic Squeeze Dispenser (OSD), a solution for eye treatments and other preservative-free goods.

Rigid Packaging Market Segment

By Material

- Plastic

- Metal

- Paper & Paperboard

- Glass

- Bioplastic

By Product Type

- Boxes

- Trays

- Containers & Cans

- Bottles & Jars

- Others

By Application

- Food & Beverages

- Healthcare

- Cosmetics and Personal Care Product

- Household Care Products

- Others

By Geography

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait