Returnable Transit Packaging (RTP) Market Growth Drivers, Regional Insights (NA, EU, APAC, LA, MEA), Manufacturers Database & Competitive Assessment

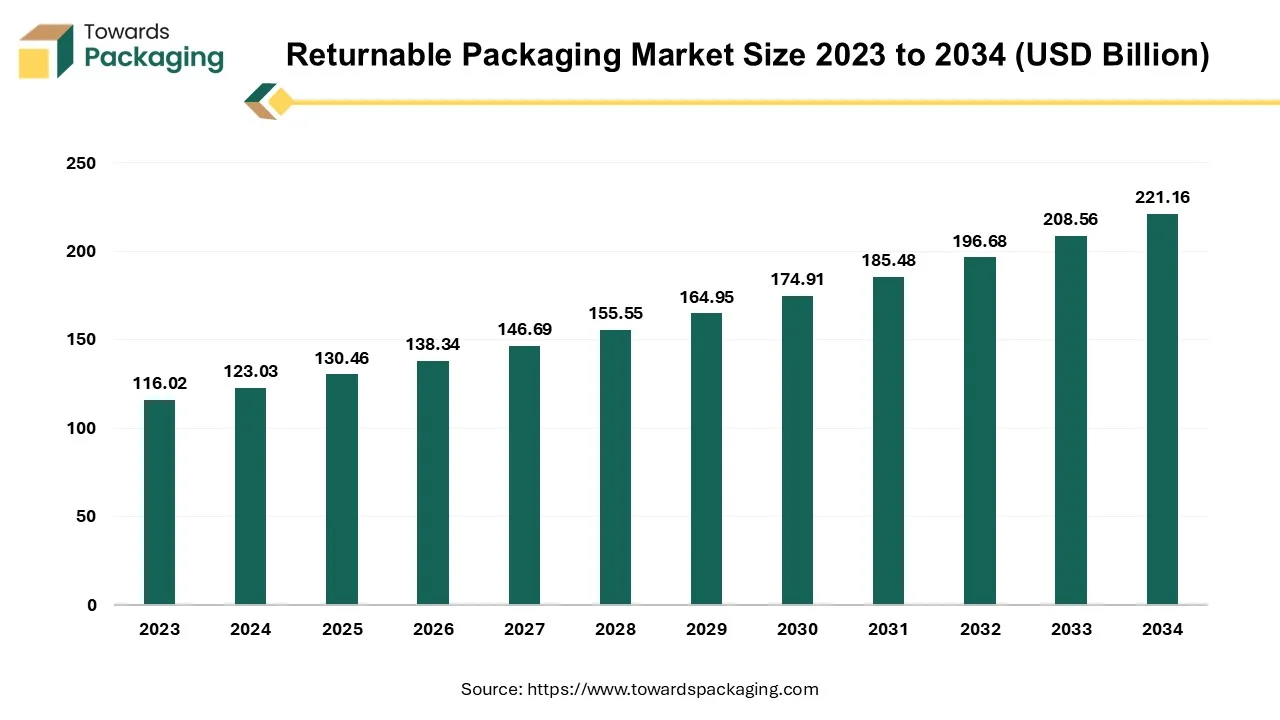

The Returnable Transit Packaging (RTP) market is expanding rapidly, expected to grow from USD 10.59 billion in 2025 to USD 18.83 billion by 2034, at a CAGR of 6.6%, driven by rising sustainability initiatives and cost-efficient logistics. The market analysis covers detailed segmentation by product type (pallets, crates, IBCs, bins), material (plastic, metal, wood, composites), applications (automotive, retail, pharma, F&B), and distribution channels. It provides regional coverage across North America, Europe, Asia Pacific, Latin America, and MEA, highlighting Europe’s dominance in 2024 and APAC’s fastest growth trajectory up to 2034.

The report also includes value chain analysis, trade flow data, competitive benchmarking, and profiles of leading companies such as Schoeller Allibert, Brambles, ORBIS, DS Smith, Nefab, Rehrig Pacific, and others.

Key Takeaways

- By region, Europe dominated the global market with the largest revenue share in 2024.

- By region, Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By product type, the pallets segment contributed the largest share in 2024.

- By product type, the intermediate bulk containers segment will expand at a significant CAGR between 2025 and 2034.

- By material type, the plastic segment dominated the market in 2024.

- By material type, the composite materials segment expected to expand at a significant CAGR between 2025 and 2034.

- By application, the automotive segment dominated the returnable transit packaging market in 2024

- By application, the retail and e-commerce segment expected to expand at a significant CAGR between 2025 and 2034.

- By distribution channel, direct sales segment have contributed the biggest share in 2024.

- By distribution channel, the online sales channel segment expected to expand at a significant CAGR between 2025 and 2034.

- By end-user, manufacturers segment have dominated and contributed the biggest share in the year 2024.

- By end-user, third-party logistics (3PLs) segment expected to expand at a significant CAGR between 2025 and 2034.

Market Overview: Acceptance Of Returnable Transit Packaging

Returnable Transit Packaging (RTP) refers to durable packaging solutions designed for multiple uses throughout a supply chain. These include containers, pallets, crates, and dunnage that are built to be reused for transporting goods across manufacturing, warehousing, and distribution processes. RTP helps reduce waste, lower packaging costs over time, and enhance supply chain sustainability. These systems are widely adopted in sectors such as automotive, food and beverages, pharmaceuticals, and retail.

Collaboratively, disposable packaging creates landfill waste and demands constant restocking. RTP Systems are crafted to be rigid, long-lasting, and reusable. Returnable containers are prevalent tools for these sectors -beginning from automotive all the way down to electronics, in which the only need is to shift product from one place to another without damage.

The material utilised for returnable packaging is huge, linked to the size of the product to enclose for shipping. Such materials can count not only the containers but also the dunnage, which are kept in the container to work as protective materials, any other piece of secondary packaging, and pallets, which can be returned. Flexibility, which returnable packaging enables, allows us to enable its usage in a variety of industries.

Returnable Transit Packaging Market Trends

- Cost savings: One of the main benefits of returnable packaging is that it saves money in the long term, which is a one-time investment. As compared to single-use packaging, which is used once and can be returned several times, it results in a lower material cost. Despite the primary cost being higher, long-term investment is quite significant; long-term savings on investment may be huge.

- Enhanced Product Protection: Returnable packaging is secure for products during transit. This is resistant to regular disposable items, which are created strictly for a single use. Returnable items, on the other hand, are crafted to return trips and main types of carrying with precision that the products will reach their destination in accurate condition. The majority of the returnable packaging can be tailored depending on the particular product, which further develops protection and reduces damage possibilities.

- Environmental benefits: Returnable packaging solutions are ideal business decisions for environmentally concerned organizations. The regular procedure of packaging is wasteful and has a detrimental effect on the environment. Returnable packaging restrains these effects. With the help of returnable packaging, companies generate the minimum waste possible, and most of the returnable packaging is from products that are naturally recyclable in themselves, hence lowering their carbon footprint.

- Improved brand image and customer satisfaction: Utilising returnable packaging during a period where users nurture sustainability grows the reputation of a company by carrying out environmentally friendly practices. Brand reputation has various stories in attracting the correct attention and receiving customer honesty. Usage of returnable packaging has user conceive companies as being loyal to minimizing their effect on the environment.

AI Integration in the Returnable Transit Packaging Market

Invention is at the core of returnable packaging solutions, as organisations discover the latest materials and pattern concepts, which further grow the lifespan and use of their packaging solutions. Growth in lightweight, composite materials and high durability materials is allowing the creation of containers that are not only rigid but also convenient to carry and more cost-effective in transportation. Additionally, the mixing of digital tracking systems and real-time data analytics is changing inventory management, enabling businesses to track operations and lower labor costs linked with manual management.

As technological development increases, a huge shift toward complete automated returnable packaging solutions is predicted, serving enhanced traceability, visibility, and overall operational efficiency.

Market Dynamics

Market Driver

Skills of Returnable Transit Packaging

Returnable packaging solutions are arising as a changed solution in the supply chain, serving outstanding economic and environmental advantages. Returnable packaging is quickly gaining mainstream attention because of its potential to reduce waste while assisting the circular economy initiative. Organizations are finding a way to achieve an optimal balance between cost efficiency and sustainability, and cost effectiveness seeks to reuse packaging, not only lowering environmental effects but also making long-term savings. Their returnable nature ensures the contents in the container, whether sensitive electronics, consumer goods, or automotive, are safe from damage in transit. More so, they enhance space-saving designs that leave ample avenues for businesses to develop efficiency in transport and storage.

Market Restraint

Lack of Knowledge

Despite significant advantages., the counting of returnable packaging solutions is not without limitation. One of the main barriers is tracking real-time visibility of packaging assets across the supply chain, as a lack of knowledge can lead to operational deficiencies. High-level technologies such as IoT sensors, RFID, and GPS tracking are being heavily mixed into the packaging systems to alleviate these problems by serving accurate, up-to-date data on the condition and location of returnable containers. Conquering these logistical limitations is essential for making sure that packaging assets are efficiently tracked and calculated throughout the network without incurring unnecessary losses or delays.

Market Opportunity

Eco-friendly Benefits Drives Returnable Transit Packaging

The returnable transit packaging market is witnessing significant development driven by both a huge move toward sustainability and regulatory pressures. Industry forecasts show that the returnable packaging field is ready to develop rigidly over the next year, motivated by growing eco-friendly issues and growing operational cost pressures on organisations. Companies in fields as different as food and beverage, automotive, and consumer goods are starting to capitalize on these trends by contributing to reusable packaging solutions, which serve financial and environmental returns. Additionally, growth in automation technology and material science is drawing even more attention to returnable packaging as they grow.

Segmental Insights

Product Type Insights

How Did The Pallet Product Segment Dominate The Returnable Transit Packaging Market in 2024?

The pallets segment dominated the market in 2024. Returnable pallets have dominated the market as they are a reusable packaging solution designed to carry goods smoothly in the supply chains. Returnable pallets are crafted to resist different trips, and thus, they become a crucial part of returnable packaging approaches with the aim of developing sustainability, just like single-use pallets. As compared to regular packaging, the primary investment in returnable transit packaging can be higher, but the long-term savings are huge. Organizations can make use of the containers several times, which means lowering packaging costs.

intermediate bulk container segment expects the fastest-growth in the returnable transit packaging market during the forecast period. They are large, reusable storage and transport units designed for handling bulk quantities of liquids, semi-solids, and powders. In the context of returnable transit packaging, IBCs play an important role in developing supply chain efficiency, sustainability, and cost-effectiveness. It is typically made from high-density polyethylene or composite materials with a strong outer cage (often steel). IBCs have a potential range of 500-1,250 litres. Their design allows for stacking, easy forklift handling, and effective space utilization during storage and transport. Growing demand for closed-loop logistics, IoT-enabled tracking, and collapsible IBCs is making them even more effective in RTP systems. Additionally, global sustainability regulations are encouraging industries to switch from single-use drums to reusable IBCs to cut carbon footprints.

Material Insights

How Did The Plastic Material Segment Dominate The Returnable Transit Packaging Market in 2024?

The plastic material segment dominated the market in 2024. Plastic is one of the most prevalently used packaging materials. It differentiates for its resistance, lightness, and high protection against exterior factors such as temperature, humidity, and micro-organisms. All these elements have made it an important packaging material for agricultural, food, and pharmaceutical products. Plastic returnable are even stackable, detachable, and reliable. They can be moulded, which results in less storage area. They save 85% in return storage and transport. There is the capability of delivering the box with a lock, protecting the goods, which are produced in polypropylene and polyethylene. They are ideal for food usage and are available in different shapes and sizes.

The composite materials segment expects the fastest growth in the market during the forecast period. Composite material is an efficient kind of packaging that integrates several materials. Materials utilised are specifically corrugated cardboard, foams, and timber, but can also include plastics, Correx, barrier bags, and other prevalently used packaging materials. The mixture of materials enables composite packaging to receive much higher levels of transit security. Composite packaging is created when we integrate two or more materials to make one, which can be utilised for packaging products. The goal is to collect the different characteristics of unique materials in one common product, resulting in developed elasticity, durability, and versatility.

Application Insights

How Did The Automotive Application Segment Dominate The Returnable Transit Packaging Market in 2024?

Automotive segment dominated the market in 2024, Returnable automotive packaging includes crates, boxes, inserts, containers, pallets, and inserts that can be utilised several times. Reusable packaging is ideal for handling, storage, and transportation of parts and assemblies, offering numerous advantages. This includes improved protection, reduced costs, and lowered environmental effects. Returnable automotive packaging for parts serves as developed protection from elements with the assistance of tailored fittings, moisture-resistant seals, and shock-absorbing materials. Its reusability and durability lower the risk of toxicity during shipping. So overall, utilising returnable transit packaging ensures safer transportation, delivers long-term cost savings from manufacturers, and preserves part quality.

Retail and e-commerce segment expects the fastest growth in the market during the forecast period. The retail and e-commerce industry growth into reusable 'shelf-ready' packaging includes the usage of a RTP into the retail store showcase, nullifying the demand for transferring the product and vanishing disposable packaging, while lowering handling costs. Prevalent instances of this are the plastic soft drink bottles, which are showcased in the store and chosen by the user from plastic folded trays often moved on wheeled dollies, and also the reused vac-formed trays are found on shelf trays which carry yogurt posts and similar items.

Distribution Channel Insights

How Did The Direct Sales Segment Dominate The Returnable Transit Packaging Market in 2024?

The direct sales segment dominate the market in 2024. Direct sales of returnable transit packaging refer to the producer-to-end-user or distributor-to-end-user sales model, without multiple intermediaries. In this strategy, producers of RTP products, such as reusable pallets, totes, crates, intermediate bulk containers, and roll cages, sell directly to sectors like automotive, retail, food and beverage, agriculture, and pharmaceutical. The direct sales channel is increasing due to e-commerce-enabled B2B transactions and the encouragement for sustainability, as organizations want long-term, reusable packaging to lower environmental impact.

The online sales channel segment expects the fastest growth in the market during the forecast period. It refers to selling RTP products, such as reusable pallets, crates, intermediate bulk containers, roll cages, and bulk bins, through digital platforms instead of regular face-to-face transactions. This includes B2B e-commerce marketplaces, company-owned online stores, and personalised packaging platforms. The online sales are rising due to digital transformation in supply chains and the growing adoption of e-procurement platforms by sectors like automotive, retail, food processing, and pharmaceuticals. Large B2B platforms and direct manufacturer websites are becoming major sources for RTP sales.

End-User Industry Insights

How Did The Manufacturers Segment Dominate In The Returnable Transit Packaging Market in 2024?

The manufacturers segment dominated the market in 2024. Manufacturers of returnable transit packaging design and produce durable, reusable solutions that protect goods during transport and storage while lowering the use of single-use plastic. They serve and deliver products such as pallets, plastic crates, foldable boxes, and intermediate bulk containers for multiple industries. They are heavily integrating IoT and RFID tracking into RTP Products, allowing real-time monitoring in logistics. They are also expanding production in Asia Pacific to align with growing demand from e-commerce, retail, and manufacturing hubs.

The third party logistics (3PLs) segment expects the fastest growth in the market during the forecast period. Logistics packaging is utilised by third-party logistics that serve to fulfil orders. 3PL logistics is specifically single-trip corrugated boxes utilised for e-commerce, but also applies to heavy-duty options for uses. .3PL packaging must be fast to track and pack, secure items in transit, and be cost-effective. It is also beneficial to assist their operations. They carry out tasks like packaging orders, storing inventory, and shipping products to users. Organizations collaborate with 3PL to develop efficiency, concentrate on the main goals, reduce costs, and grow sales or make new products.

Region Insights

How Did The Europe Dominate The Returnable Transit Packaging Market in 2024?

Europe dominated the market in 2024. The region has dominated the region as the opportunities found in sectors such as pharmaceuticals, automotive, FMCG, and semiconductors, in which scalability and accuracy are important. The effect on the workforce is dual-edged, in which daily jobs are being phased out, while the latest roles centered around AI management, robotic programming, and data analytics are on the rise. The industry is also poised for regulatory debates and ethical concerns as the demand for explainable AI is huge in European countries.

Asia Pacific Returnable Transit Packaging Market Trends

Asia Pacific is predicted to register the largest market share in terms of revenue in the upcoming years. The presence of different manufacturing companies like India, China, Vietnam, and Indonesia is the main driver of the regional industry. Furthermore, the fast industrialization of the Asia Pacific region is expected to assist the market growth due to the low production costs. Furthermore, the Asia RTP industry is predicted to grow at a high CAGR due to growing industrialization and increased cross-border trade within the region. Local manufacturers are inventing stackable, lightweight, and RFID-enabled RTP to meet logistics and automation needs.

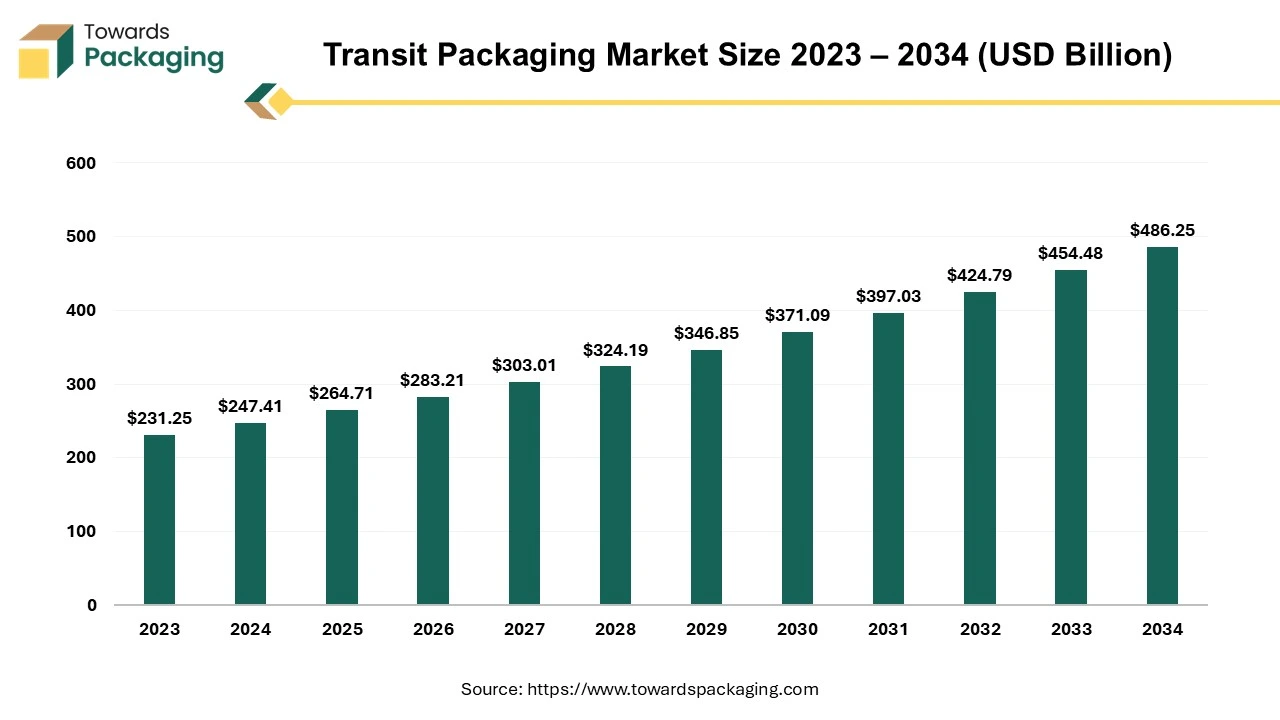

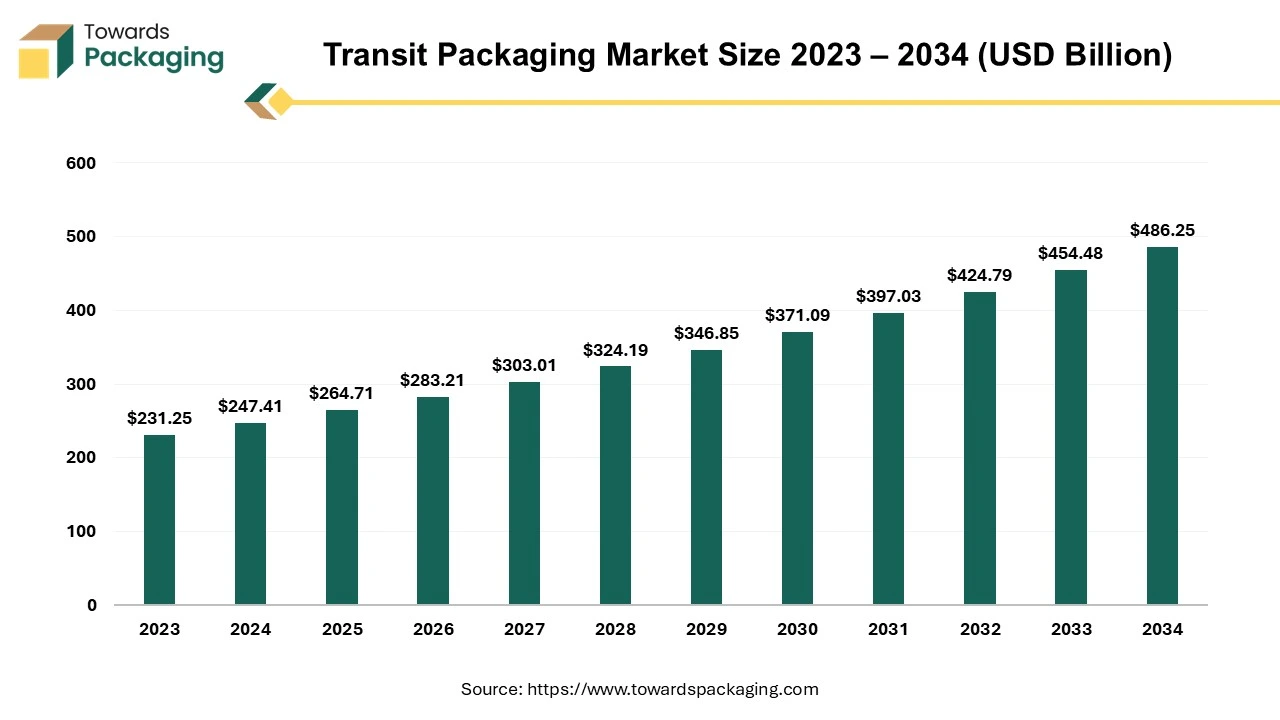

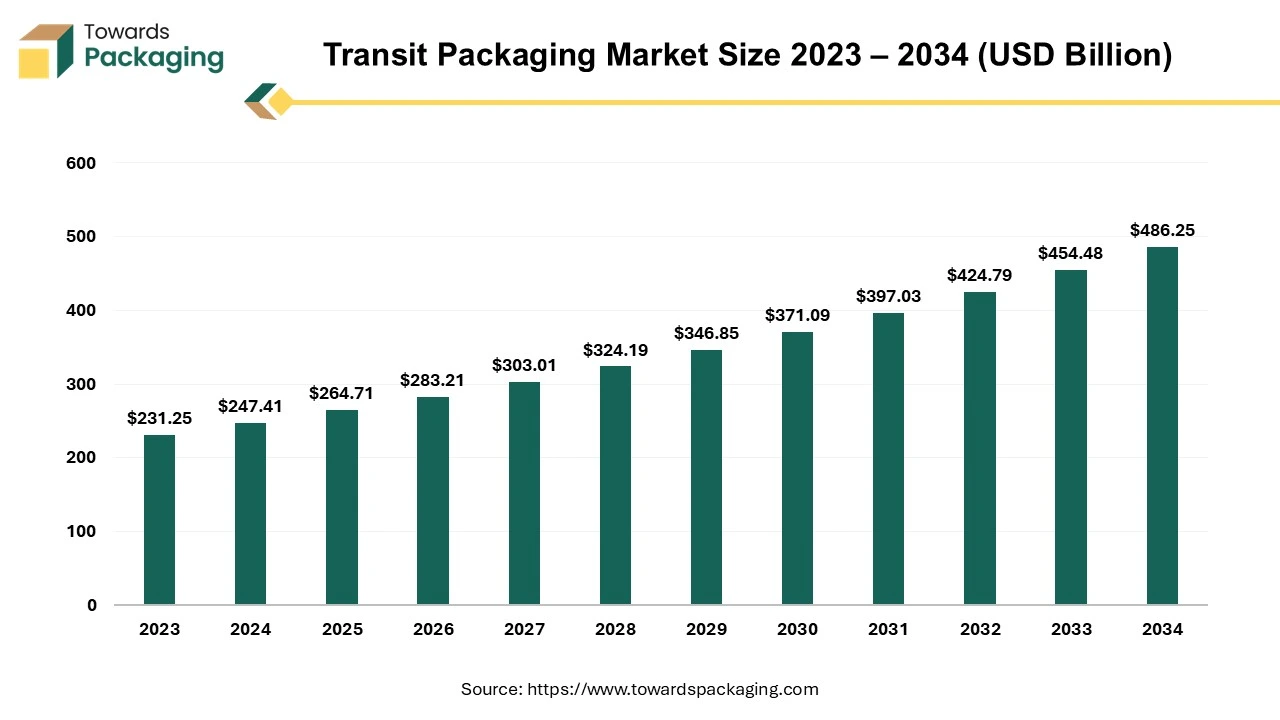

Future of Transit Packaging Market

The transit packaging market is projected to reach USD 486.25 billion by 2034, growing from USD 264.71 billion in 2025, at a CAGR of 6.99% during the forecast period from 2025 to 2034. The rising demand for automobile parts has significantly boosted the need for transit packaging, driving market growth worldwide.

Packaging can take many different forms. Depending on the items or materials shipping and the level of protection needed, consumers need different types of transit packing. "Transit Packaging" is something that's frequently disregarded in packaging. Transit packaging is designed to endure several transit stressors including moisture, vibration, compression, etc. and is mostly used for business-to-business transactions. Additionally, transit packaging differs greatly from retail packaging. While transit packaging puts the protection and durability of the goods first, retail packaging places greater emphasis on the presentation and advertising of the products.

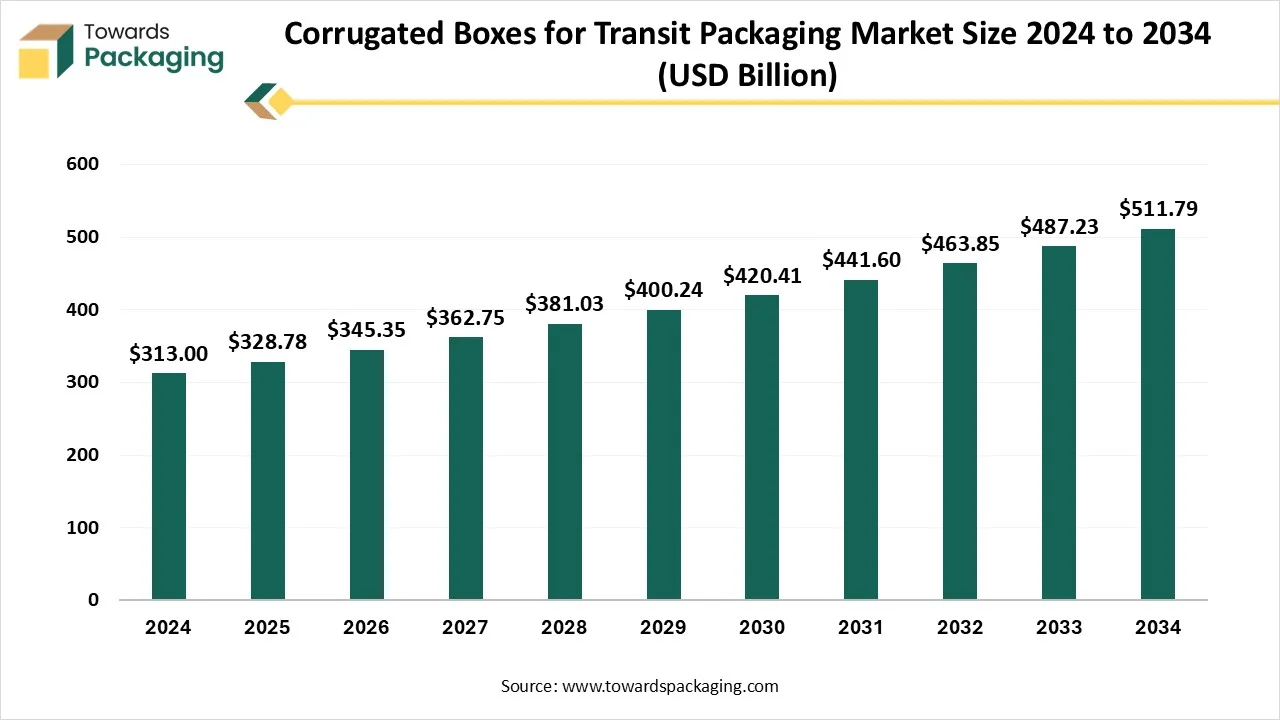

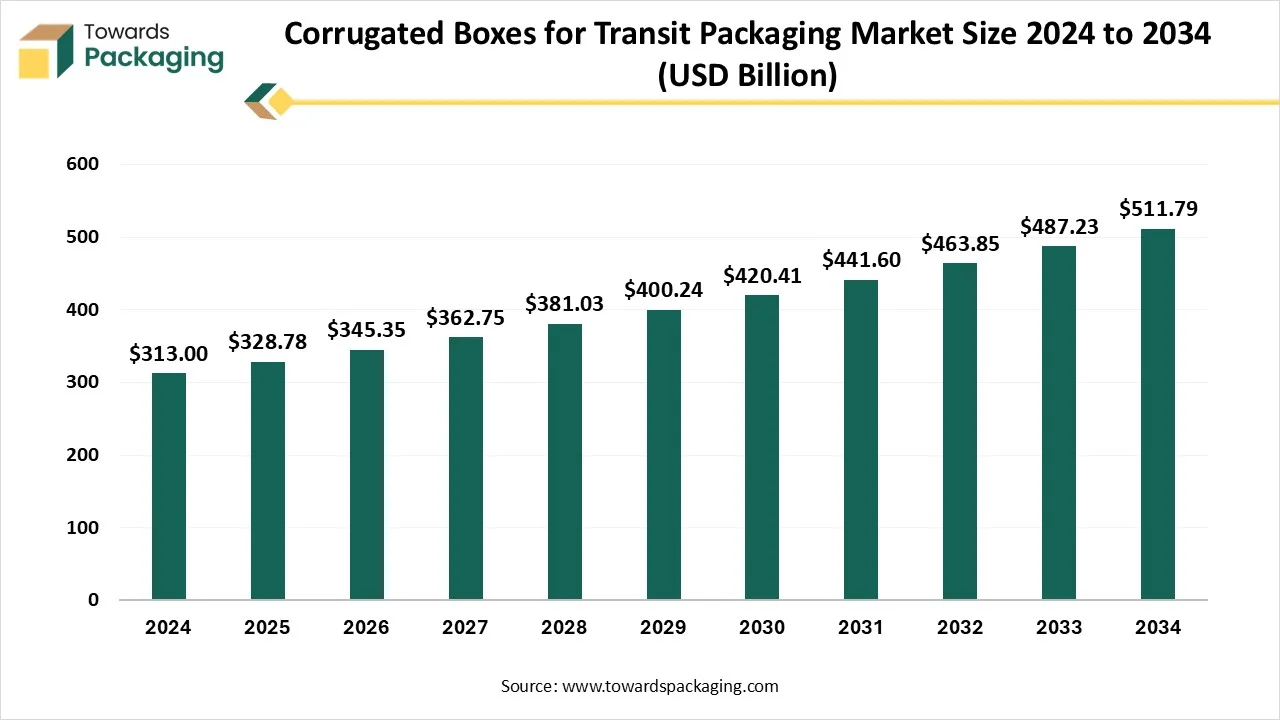

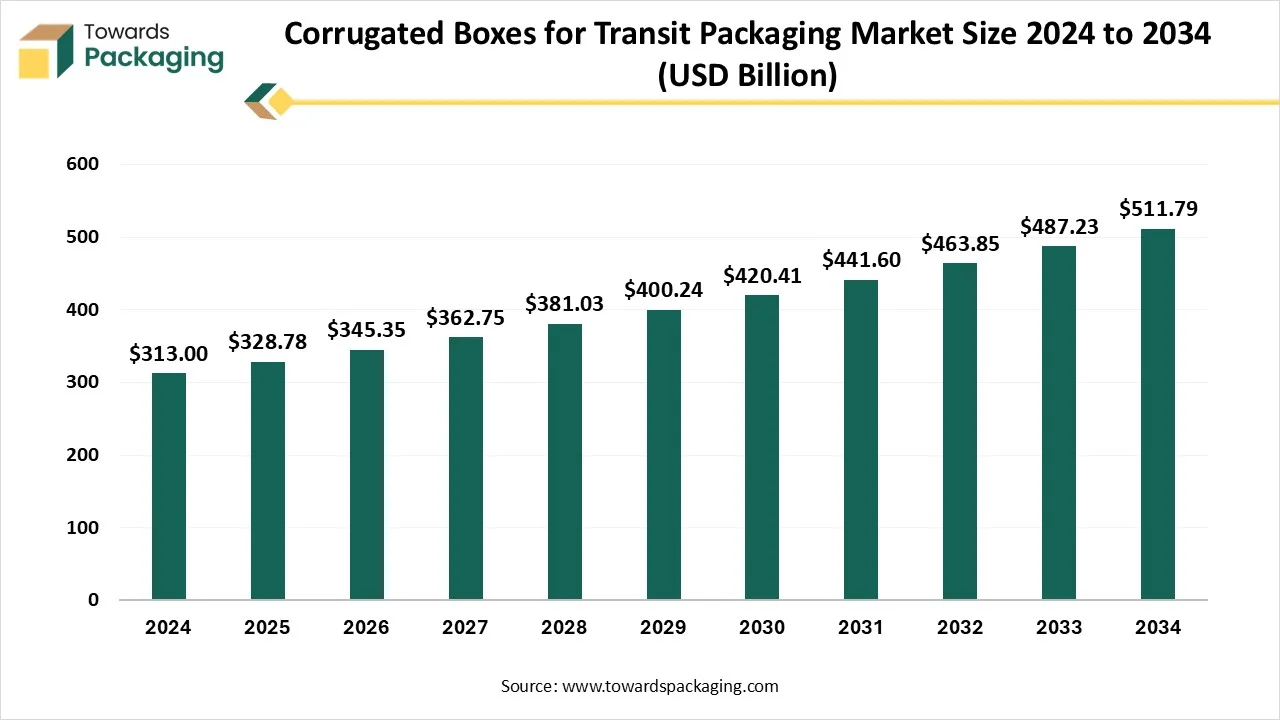

Future of Corrugated Boxes for Transit Packaging Market

The corrugated boxes for transit packaging market is projected to reach USD 511.79 billion by 2034, expanding from USD 328.78 billion in 2025, at an annual growth rate of 5.04% during the forecast period from 2025 to 2034. The rising e-commerce activities and requirement for sustainable packaging resolution.

The rising food delivery facility boosts the production of high-quality corrugated boxes for safe transportation of food products. Continuous advancement in the technology has also fuelled the expansion of the market. This market is dominating in Asia Pacific region due to rising ecological awareness and increasing export business.

The global corrugated boxes for transit packaging market includes the production, sale, and distribution of corrugated boxes specifically designed for shipping and transportation of goods. These boxes are made from fluted corrugated sheets that provide strength, durability, and protection for products during transit. They are widely used across industries such as e-commerce, food & beverage, consumer goods, pharmaceuticals, electronics, and industrial goods. Growth is driven by increasing e-commerce shipments, global trade expansion, sustainable packaging trends, and rising demand for lightweight and recyclable packaging solutions.

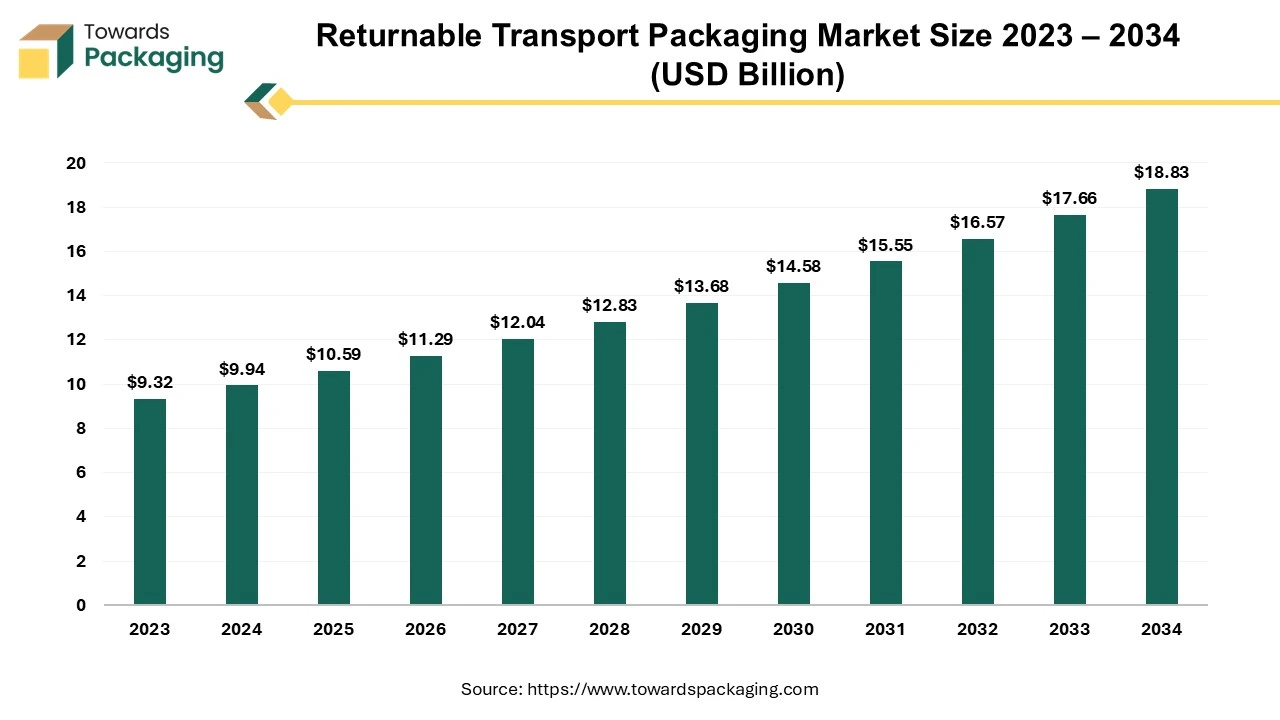

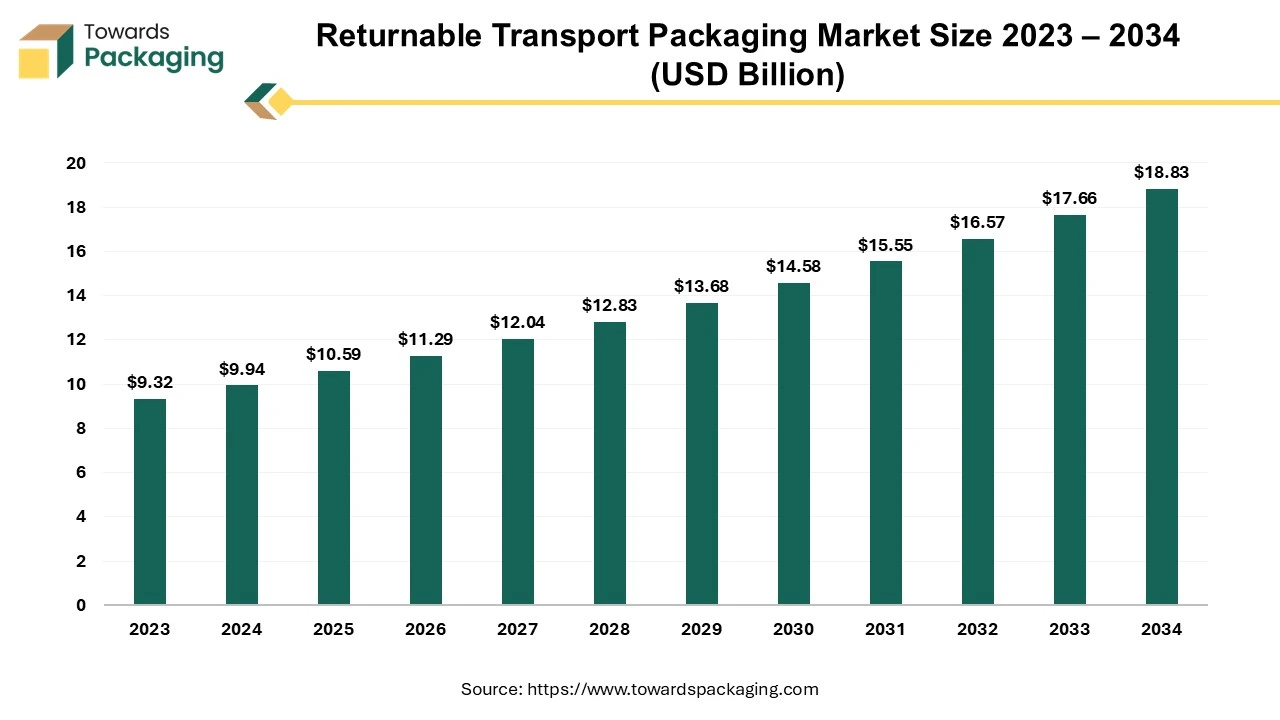

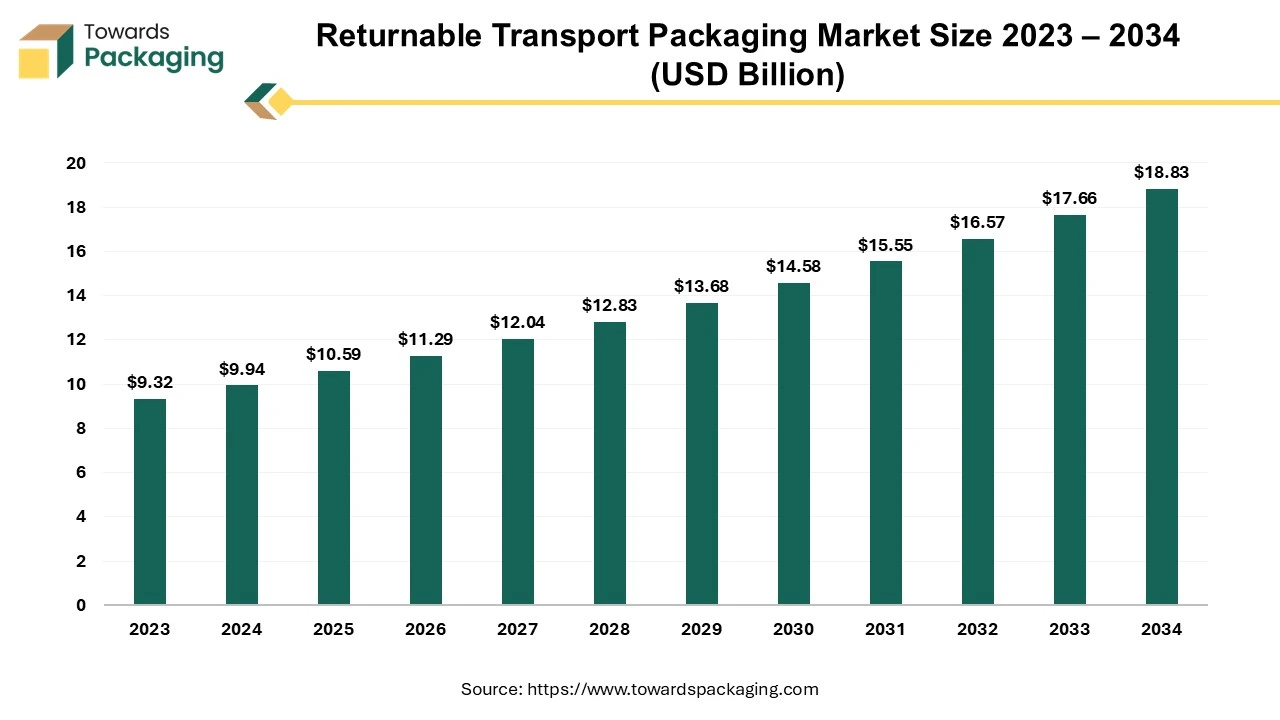

Future of Returnable Transport Packaging Market

The returnable transport packaging market is projected to reach USD 18.83 billion by 2034, expanding from USD 10.59 billion in 2025, at an annual growth rate of 6.6% during the forecast period from 2025 to 2034.

The market for returnable transport packaging has expanded dramatically in recent years due to the growing need for economical and environmentally friendly shipping options. Packing supplies such as pallets, bins, totes, boxes, and containers that may be reused several times for transferring goods between suppliers and consumers are referred to as returnable transport packing or RTP. Organizations use returnable containers, pallets, and pallet pooling systems more frequently to enable repeated transport journeys in managed open-loop and closed-loop shipping systems. Because they are sturdy materials, these returnable packing options can be used repeatedly during reverse logistics.

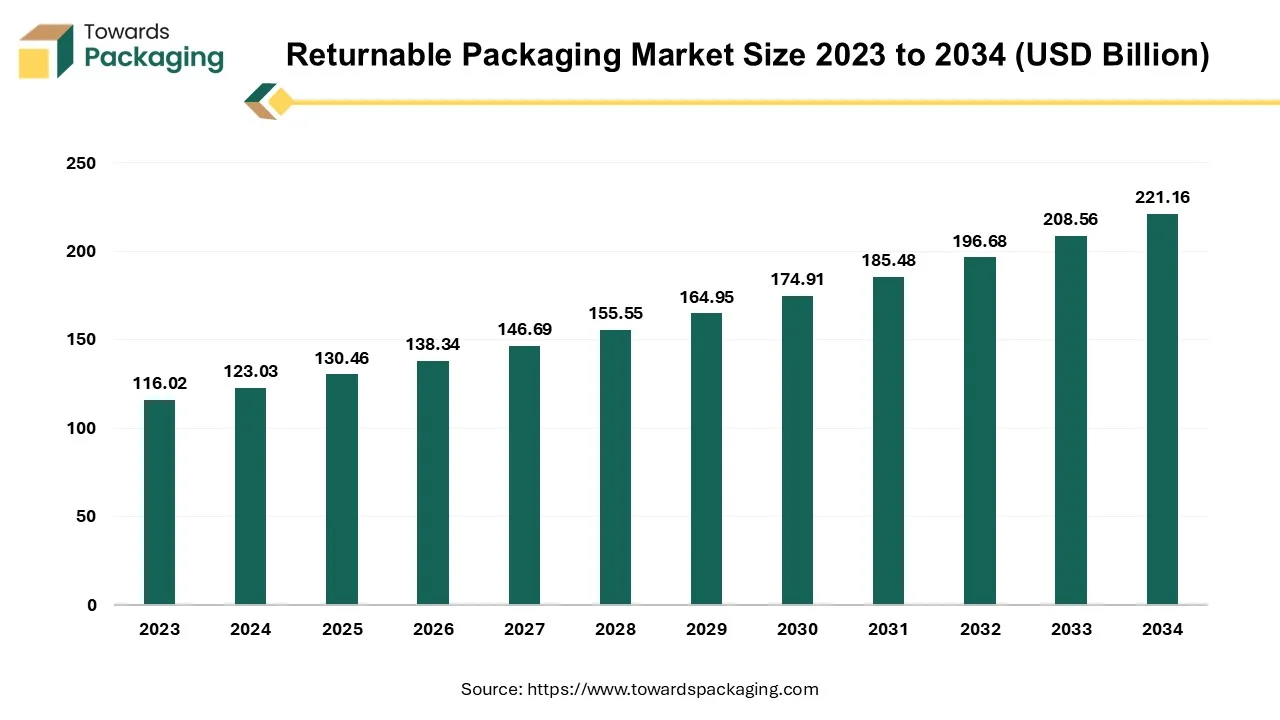

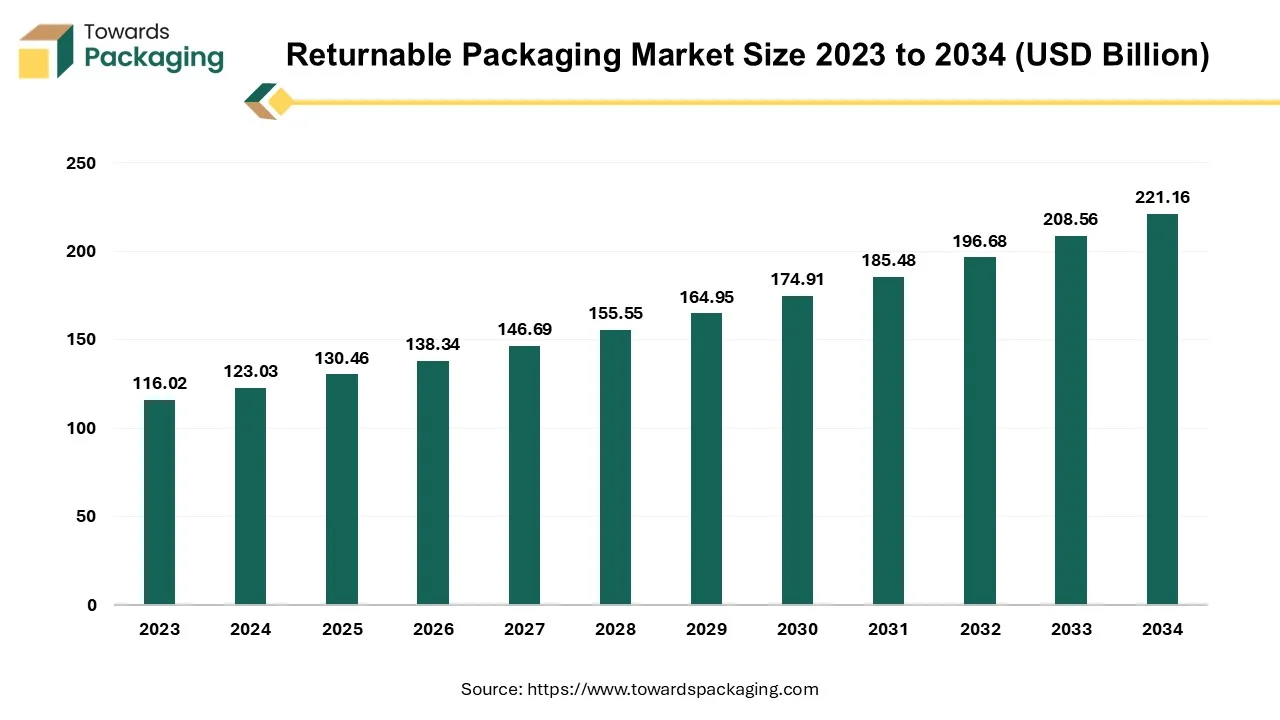

Future of Returnable Packaging Market

The returnable packaging market is projected to reach USD 221.16 billion by 2034, growing from USD 130.46 billion in 2025, at a CAGR of 6.04% during the forecast period from 2025 to 2034.

Government initiatives towards environmental protection in the form of stringent regulations and a global shift towards eco-friendly packaging by prominent sectors are the major drivers of the returnable packaging market.

Packaging the goods is one of the major aspects of any developing and established firm, and thus, it creates a higher manufacturing rate for developing an innovative packaging solution. Returnable packaging is the method used by many end users to increase their brand reputation as well as to comply with stringent regulations set by the respective country's Ministry of Health and Environment for legitimate business tactics, which eventually aid in the proliferation of the business in the global market.

Returnable Transit Packaging Market Top Companies

Industry Leader Announcement In The Returnable Transit Packaging Market

- In April 2025, IPL and Schoeller Allibert revealed the landmark formation to create a top leader in reusable plastic packaging, with an integrated pro forma annual income of more than USD 1.4 million in 2024. This latest company, which is yet to be designated, will be headquartered in Dublin, Ireland, and led by IPL CEO Alan Walsh.

Recent Developments

- In October 2024, Tri-wall circular revealed the launch of its returnable packaging solution, which is YOYOBin Adjustable, stated to have a main c, as compared to the regular metal and plastic industry, whose goal is to increase efficiency in the automotive sector.

- In December 2024, Nippon Express Ltd, a group company named NIPPON EXPRESS HOLDINGS, has collaborated with the Otsuka Pharmaceutical Co. Ltd to lower CO2 emissions and waste through an international air freight service which utilises eco-friendly isothermal containers.

Returnable Transit Packaging (RTP) Market Segments

By Product Type

- Pallets

- Crates

- Intermediate Bulk Containers (IBCs)

- Drums & Barrels

- Dunnage

- Totes & Bins

- Trays

- Cages

By Material

- Plastic (HDPE, PP, etc.)

- Metal (Steel, Aluminum)

- Wood

- Glass

- Textiles (for dunnage & sleeves)

- Composite Materials

By Application

- Automotive

- Food & Beverage

- Pharmaceuticals

- Retail & E-commerce

- Electronics

- Agriculture

- Chemical Industry

- Logistics & Warehousing

By Distribution Channel

- Direct Sales

- Distributors & Retailers

- Online Sales Channels

By End-User

- Manufacturers (OEMs)

- Third-Party Logistics Providers (3PLs)

- Wholesalers & Distributors

- Retailers

By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia