Returnable Transport Packaging Market Intelligence, Benchmarking, Consumer Insights & Growth Strategies

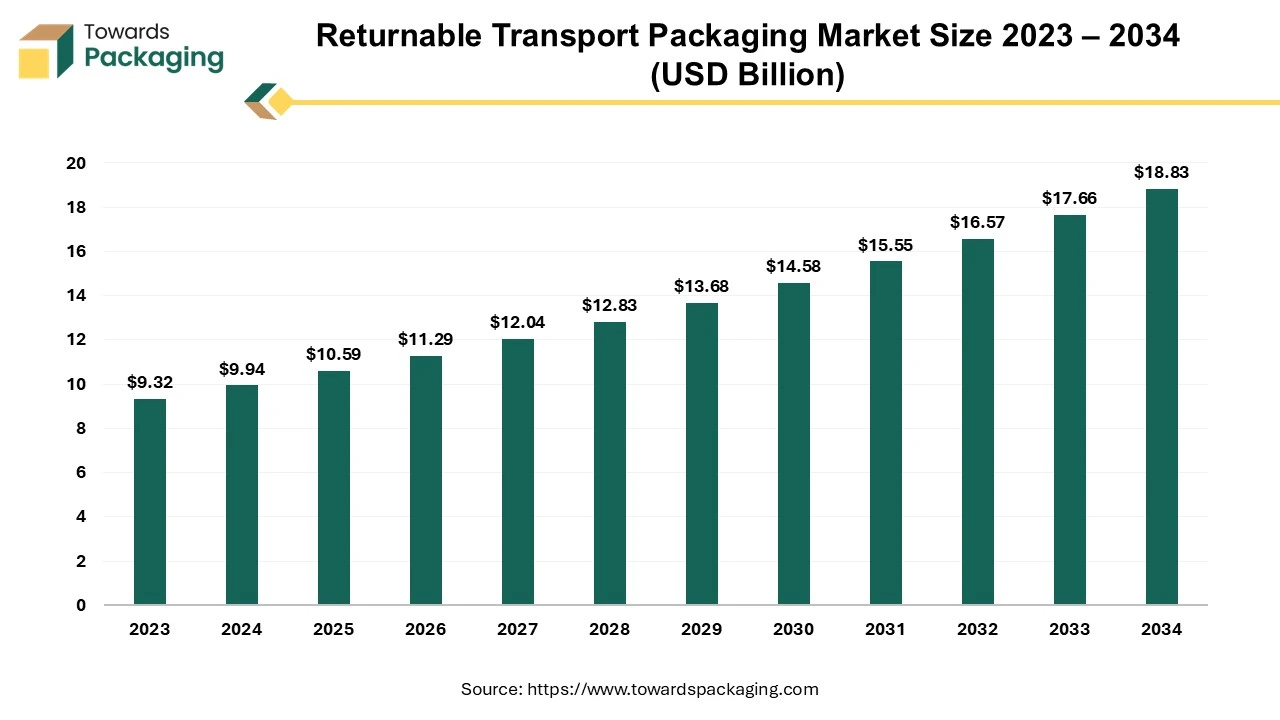

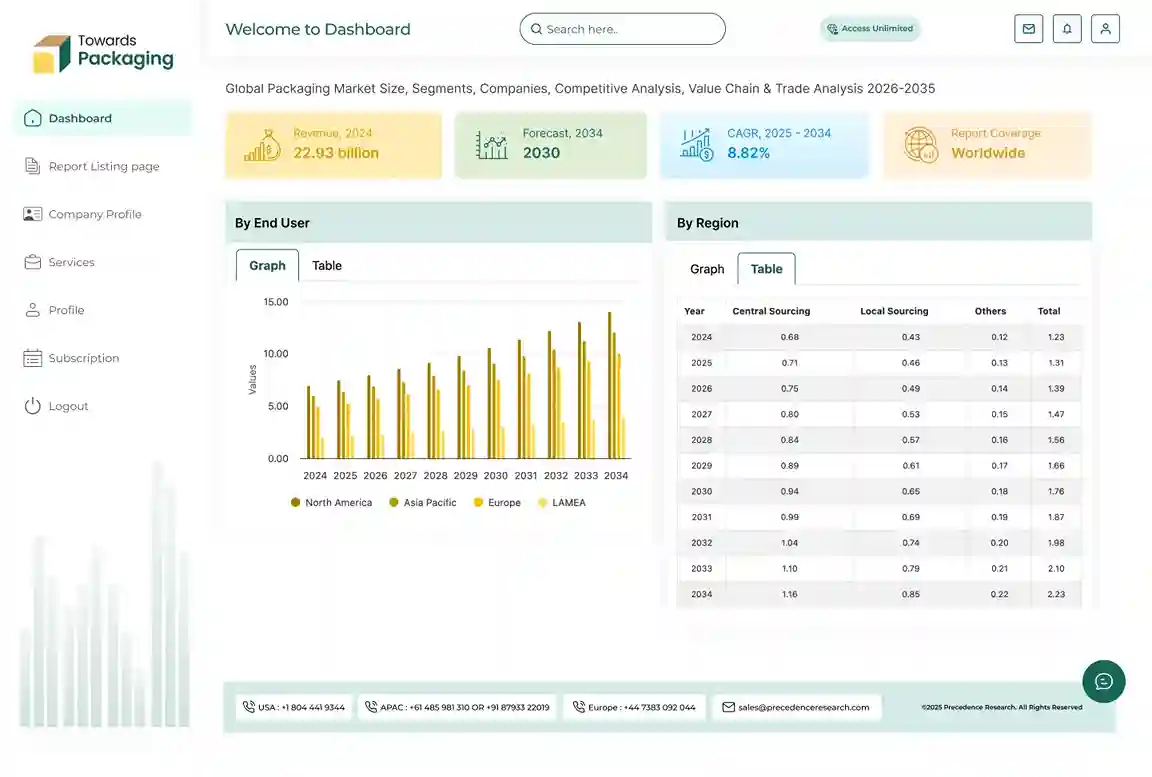

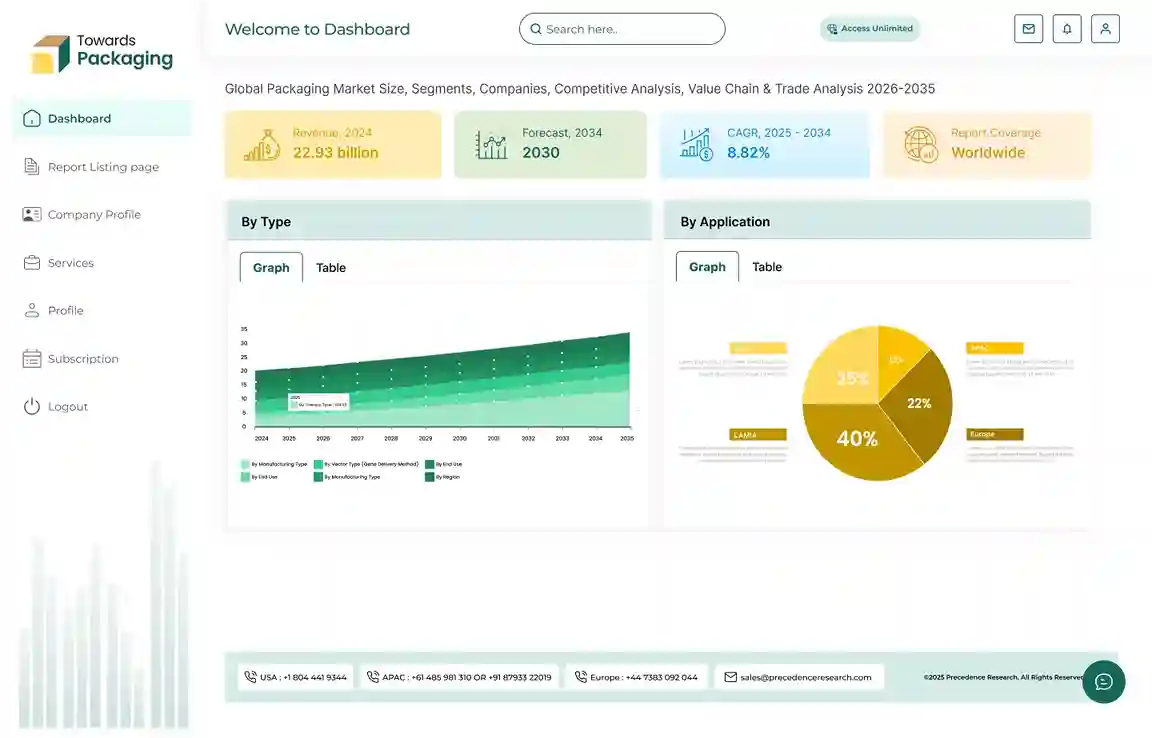

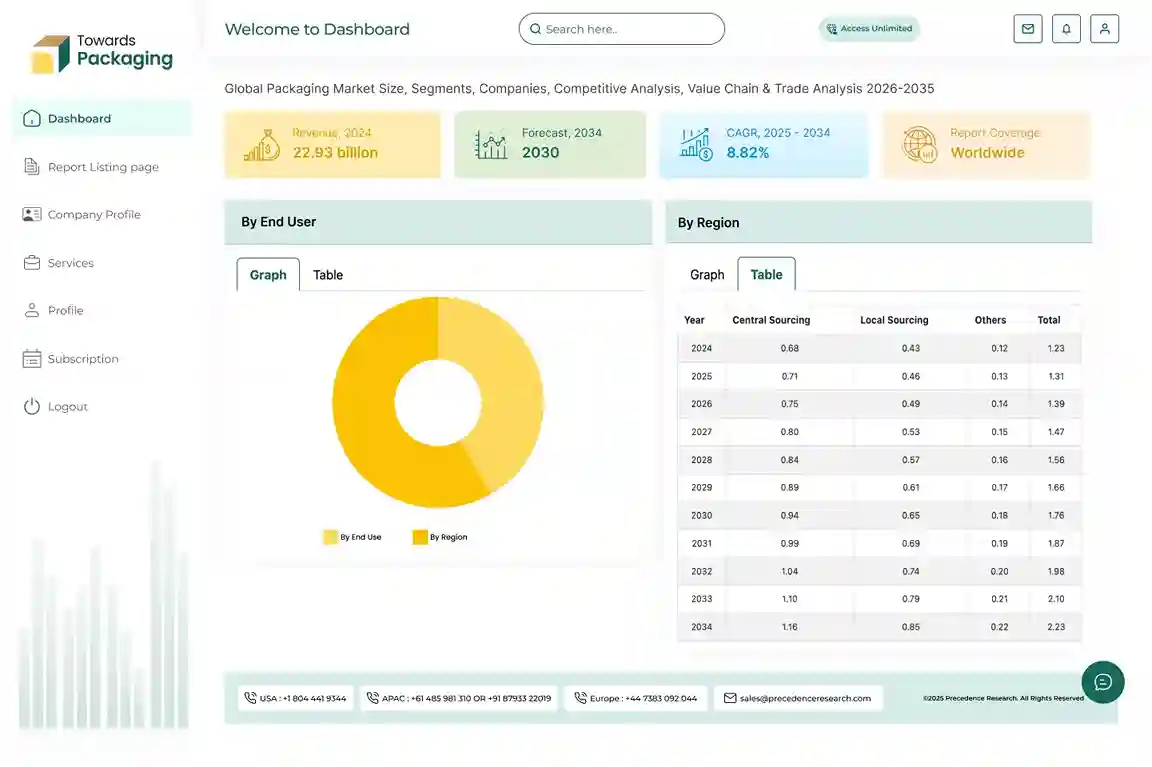

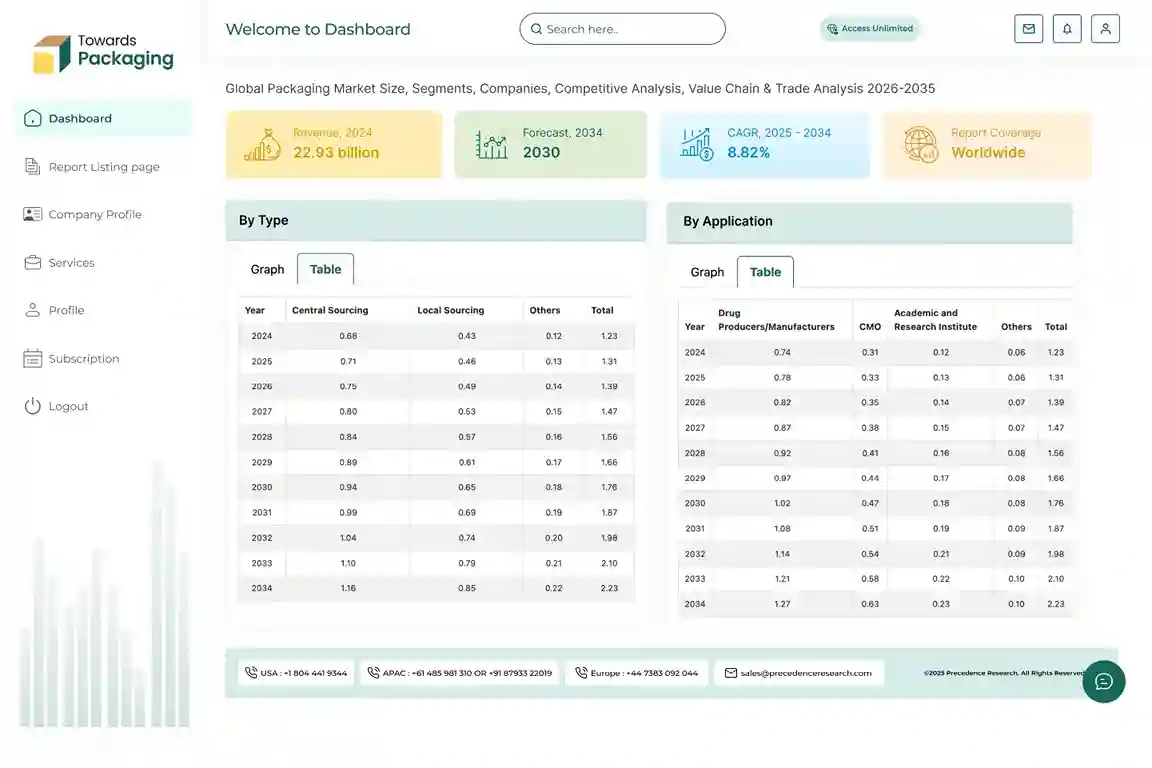

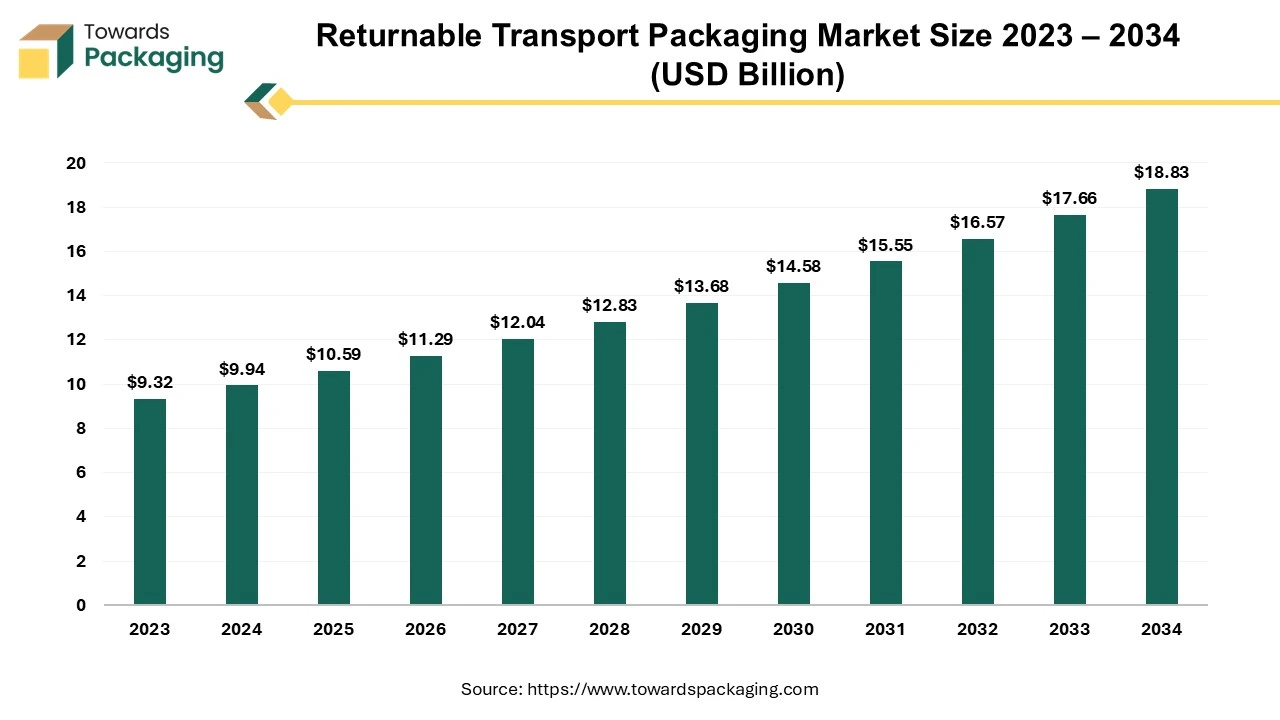

The returnable transport packaging market is forecasted to expand from USD 11.30 billion in 2026 to USD 20.08 billion by 2035, growing at a CAGR of 6.6% from 2026 to 2035. This report includes segmentation by material type (plastic, metal, wood), product type (pallets, containers, drums, and more), and end-use industries (industrial, automotive, food and beverages, and consumer goods).

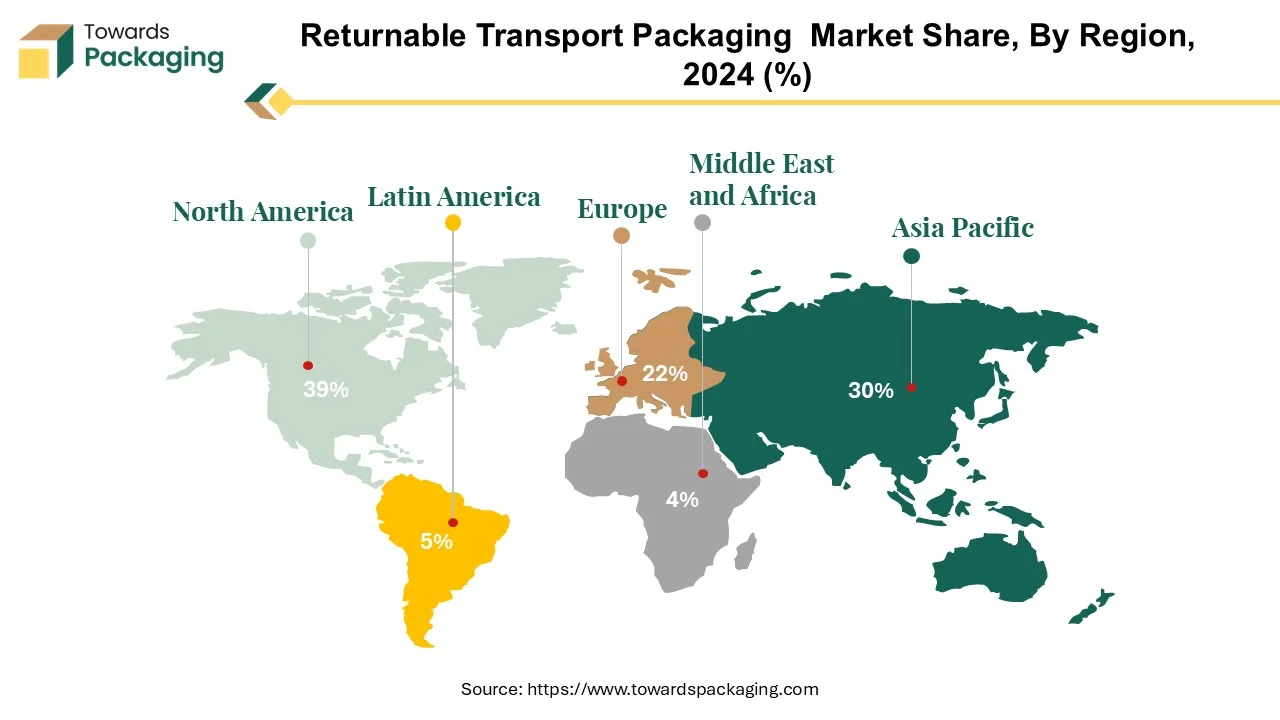

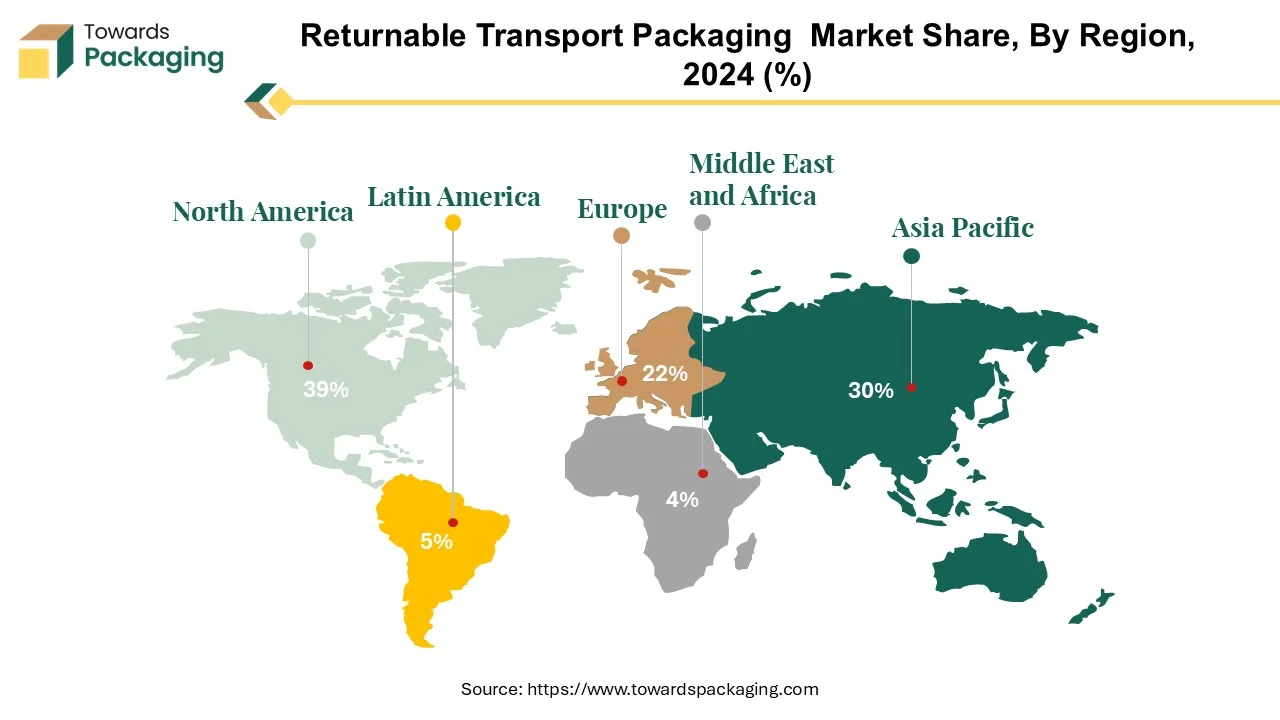

The market's regional data includes North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa, providing a detailed analysis of market share, growth trends, and regional dynamics. Leading manufacturers like Schoeller Allibert, Orbis Corporation, and IFCO SYSTEMS play a significant role in shaping the market landscape.

Report Highlights: Important Revelations

- North America's pre-eminence in returnable transport packaging.

- Ascendance of Asia Pacific in returnable transport packaging.

- Plastic's persistent advancement in the RTP sector.

- Unlocking the potential of pallets foundation of returnable transport packaging.

- Industrial supply chain gains from returnable transport packaging solutions.

The market for returnable transport packaging has expanded dramatically in recent years due to the growing need for economical and environmentally friendly shipping options. Packing supplies such as pallets, bins, totes, boxes, and containers that may be reused several times for transferring goods between suppliers and consumers are referred to as returnable transport packing or RTP. Organizations use returnable containers, pallets, and pallet pooling systems more frequently to enable repeated transport journeys in managed open-loop and closed-loop shipping systems. Because they are sturdy materials, these returnable packing options can be used repeatedly during reverse logistics.

The market for returnable transport packaging has grown considerably in recent years as there is a greater demand for cost-effective and ecologically friendly shipping choices. Returnable transport packing, or RTP, refers to packaging supplies such as pallets, bins, totes, boxes, and containers that can be reused numerous times when carrying goods between suppliers and consumers. Organizations increasingly use returnable containers, pallets, and pallet pooling systems to facilitate repeated transportation journeys in managed open-loop and closed-loop shipping systems. Because they are made of durable materials, these returnable packing choices can be reused throughout the reverse logistics process.

For Instance,

- In December 2021, Arcus Infrastructure Partners declared that it had successfully acquired 100% of HB Returnable Transport Solutions, a prominent supplier of rental, cleaning, and integrated logistics services for returnable transport products, through Arcus European Infrastructure Fund 2 SCSp.

Leading Worldwide Manufacturers Market Shares in 2024

| Manufacturer | Estimated Market Share (%) |

| Schoeller Allibert | 15–20% |

| Orbis Corporation | 10–15% |

| IFCO SYSTEMS | 10–15% |

| Greif Inc. | 5–10% |

| Mauser Packaging Solutions | 5–10% |

| DS Smith | 5–10% |

| Nefab Group | 5–10% |

| Rehrig Pacific Company | 3–5% |

| Schoeller Arca Systems | 3–5% |

| Myers Industries | 3–5% |

Manufacturer Insights

- Schoeller Allibert: A global leader in reusable plastic packaging, known for its extensive product range and commitment to sustainability.

- Orbis Corporation: Specializes in reusable plastic containers and pallets, serving industries like automotive and food processing.

- IFCO SYSTEMS: Focuses on reusable plastic containers for the fresh food supply chain, operating a pooling system across multiple regions.

- Greif Inc.: Offers a wide array of industrial packaging products, including reusable containers and drums, catering to diverse sectors.

- Mauser Packaging Solutions: Provides industrial packaging solutions, including reusable intermediate bulk containers (IBCs) and drums.

- DS Smith: Known for its sustainable packaging solutions, offering a range of reusable plastic containers and crates.

- Nefab Group: Specializes in protective packaging solutions, including reusable containers and dunnage, for various industries.

- Rehrig Pacific Company: Provides reusable plastic containers and pallets, focusing on the retail and foodservice industries.

- Schoeller Arca Systems: Offers a range of reusable plastic containers and pallets, serving industries like automotive and logistics.

- Myers Industries: Manufactures reusable plastic containers and pallets, catering to sectors such as automotive and consumer goods.

Leading Worldwide Suppliers EBITDA Percentages in 2024

| Supplier | Estimated EBITDA Margin (%) |

| Schoeller Allibert | 12–15% |

| Orbis Corporation | 10–12% |

| IFCO SYSTEMS | 8–10% |

| Greif Inc. | 7–9% |

| Mauser Packaging Solutions | 6–8% |

| DS Smith | 5–7% |

| Nefab Group | 5–7% |

| Rehrig Pacific Company | 4–6% |

| Schoeller Arca Systems | 4–6% |

| Myers Industries | 3–5% |

Supplier EBITDA Insights

- Schoeller Allibert: Demonstrates strong profitability due to its extensive product portfolio and operational efficiency.

- Orbis Corporation: Maintains healthy margins through innovative product designs and a broad customer base.

- IFCO SYSTEMS: Achieves solid EBITDA margins by leveraging its pooling system and global reach in the fresh food sector.

- Greif Inc.: Benefits from a diverse product range and global presence, contributing to consistent earnings.

- Mauser Packaging Solutions: Focuses on high-demand products like IBCs, supporting stable profitability.

- DS Smith: Emphasizes sustainable packaging solutions, aligning with market trends and maintaining profitability.

- Nefab Group: Specializes in protective packaging, catering to niche markets with tailored solutions.

- Rehrig Pacific Company: Operates efficiently within the retail and foodservice sectors, ensuring steady earnings.

- Schoeller Arca Systems: Focuses on reusable packaging, capitalizing on sustainability trends to maintain margins.

- Myers Industries: Offers a range of products with a focus on operational efficiency to support profitability.

Returnable Transport Packaging Market Trends

- Returnable transport packaging saves money for organisations by avoiding the need for regular replacement of single-use packaging materials.

- RTP helps to increase supply chain efficiency by optimising logistics operations, decreasing packing waste, and minimising product damage in transit.

- The use of track and trace technology like RFID tags, barcodes, and GPS tracking systems improves visibility and accountability in returnable transportation packaging systems.

- The packaging industry is placing a greater emphasis on sustainability, which has led to an increase in the use of returnable transport packaging solutions.

North America's Leadership in Returnable Transport Packaging

North America is a market leader in Returnable Transport Packaging (RTP) for various reasons. Its well-developed logistics and transportation infrastructure, which includes large highways, railways, ports, and distribution networks, enables efficient and cost-effective packaging solutions. This sturdy infrastructure allows for the smooth movement of commodities across long distances, promoting the use of RTP. The region strongly emphasizes sustainability and environmental responsibility, which has increased demand for returnable packaging. Legislation such as California's SB-54, which aims to reduce single-use plastics and promote recycling, reflects this determination. Such campaigns encourage businesses to use returnable packaging, allowing numerous trips and longer product life cycles.

North America is home to various businesses, including automotive, retail, food and beverage, and manufacturing, which rely substantially on reliable transportation. These industries require robust packaging solutions to ensure their product's safe and secure transit, contributing to the increased demand for RTP solutions. The presence of top manufacturers and suppliers of returnable packaging solutions strengthens North America's market position. These companies provide new products and services targeted to the specific demands of businesses in various industries.

North America leads the global returnable transport packaging market because of its sophisticated infrastructure, sustainability initiatives, various sectors, and vital market participants.

For Instance,

- In November 2022, The Coca-Cola Company intends to expand its use of Returnable packaging substantially, thereby creating a high industry standard. By 2030, the company plans to supply 25% of its beverages in returnable glass via classic fountain or Coca-Cola Freestyle devices.

Asia Pacific is developing as the fastest-growing area in the Returnable Transport Packaging (RTP) market due to several important factors. The region is rapidly industrializing and urbanizing, increasing the need for efficient transportation and logistics solutions. As businesses expand their operations and supply chains throughout Asia Pacific countries, there is an increasing demand for dependable and cost-effective packaging solutions to allow product transit.

In addition, there is a growing awareness in the Asia Pacific region of the importance of environmental sustainability and waste reduction. Governments and regulatory agencies are enacting regulations and programs to encourage returnable packaging solutions as part of more extensive efforts to prevent pollution and promote eco-friendly behavior. This emphasis on sustainability encourages firms to use RTP solutions that provide repeated trips and extended product lifecycles, lowering their environmental effect.

In Asia Pacific, the e-commerce business is expanding at a rapid pace, driven by rising internet penetration and customer demand for online shopping. This expansion has increased the volume of commodities across the region, increasing demand for efficient and long-lasting packaging solutions such as RTP.

For Instance,

- In January 2022, SIG has agreed to spend around $335 million for Pactiv Evergreen's carton packaging and filling machines companies in China, Korea, and Taiwan, which are called Evergreen Asia.propelling the RTP market in the Asia Pacific forward.

Returnable Transport Packaging Market, DRO

Demand:

- RTP offers strong protection for commodities throughout transportation, handling, and storage. Durable materials and structural designs keep products safely confined and protected from damage, lowering the risk of product loss, spoilage, and returns.

Restraint:

- Implementing RTP systems may present logistical problems, such as reverse logistics, cleaning, maintenance, and tracking of reused assets.

Opportunity:

- Offering value-added services like RTP management, cleaning, maintenance, and asset tracking allows businesses to distinguish their offerings and create value for their consumers.

Plastic's Continued Growth Trajectory in the RTP Industry

Plastic has emerged as the fastest-growing material in the Returnable Transport Packaging (RTP) industry for several reasons. For example, plastic-corrugated packaging uses extruded twin-wall plastic sheets produced from high-impact polypropylene, polyethylene, or other plastic resins. These materials have a corrugated fiberboard-like structure, with fluted ribs supporting upper and lower surfaces. This design uses solid panels and sleeves to manufacture a diverse range of returnable product types, including handheld boxes and bulk bins.

In 2023, 44% of Primary Users predicted that their companies' use of plastic-corrugated packaging will grow during the next five years. The advantages of plastic packaging, such as lightweight, recyclability, and durability, are driving its increasing popularity. Plastic pallets, for example, are lighter than other materials, making them more convenient to move and handle. Similarly, plastic trays, such as those offered by Euro Pool System, are ideal for use in the European fresh produce supply chain because of their lightweight design, simplicity of mobility, and high-quality plastic composition, which ensures lifespan.

Plastic materials' adaptability, durability, and recyclability make them particularly appealing for use in returnable transport packaging, resulting in their rapid adoption and becoming the fastest-growing material in the RTP industry.

For Instance, In January 2024, the introduction of Dora, a cutting-edge Returnable plastic pallet, throughout Europe was announced by IFCO, the world's foremost supplier of Returnable Packaging Containers (RPCs). Dora, which is offered through IFCO's circular model pooling system and was specifically created for RPC compatibility, integrates easily into the current fresh food supply chain operations, ensuring long-term improvements in logistical efficiency and sustainability for both suppliers and retailers.

Pallet Power Understanding the Backbone of Returnable Transport Packaging

The largest Returnable Transport Packaging (RTP) market segment consists of mobile, horizontal, rigid composite platforms utilized as a base for assembling, storing, stacking, handling, and transporting items as a unit load. This category includes both pooled and one-way wood transactions because all pallets—regardless of durability—must be repaired and reused for a more extended period. A 2023 survey indicates that 78% of Primary Users believe their organizations will utilize pallets more frequently over the next five years.

Pallet trends are constantly aimed towards lowering costs and increasing sustainability. Efforts have been made to investigate ways to reduce pallets' weight and material utilization per trip while enhancing performance and recyclability at the end of their lifespan. However, the lightest pallet may sometimes be the most sustainable or cost-effective alternative. A more robust and long-lasting pallet may eventually reduce mass per trip over its lifetime, making it more sustainable and cost-effective in the long run, assuming other criteria are met. As a result, the emphasis on pallet design and utilization is changing towards achieving a mix of durability, sustainability, and cost-effectiveness.

For Instance,

- In February 2024, the circular economy green pallets that The Pallet LOOP plans to introduce into the UK construction industry in the upcoming months will be made more accessible to roll out with the announcement of numerous vital modifications.

Returnable Transport Packaging Solutions Benefit the Industrial Supply Chain

The industrial sector is prominent among end users in the Returnable Transport Packaging (RTP) market. Electronics, manufacturing, and automobile industries rely primarily on effective logistics and transportation networks to move their goods. These sectors may ship their goods more affordably and sustainably while maintaining product security and safety using returnable packaging options. Industrial supply chains' large volume and repetitive nature are ideally matched with RTP systems' robust and returnable nature.

By implementing returnable packaging, industrial businesses can minimize waste production, cut total transportation costs, and lessen their dependency on single-use packaging materials. Because of this, there is still a high demand for returnable transport packaging solutions worldwide from the industrial sector.

For Instance,

- The Ecopack KIT is a new line of modular storage that may be returned, introduced by the conveyor. A more substantial, lightweight, one-stop waterproof storage box is the outcome of improvements made to the plastic container.

Key Players and Competitive Dynamics in the Returnable Transport Packaging Market

The competitive landscape of the returnable transport packaging market is dominated by established industry giants such Nefab AB, IFCO Systems., Rehrig Pacific Company, Schoeller Allibert Group BV, SSI Schaefer Group, CSI Sertapak Inc., Lamar Packaging Systems, Polymer Logistics NV, Mugele Group, Orbis Corporation and Brambles Limited (CHEP). These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Nefab provides a selection of returnable and disposable packaging options. These consist of steel containers, racks, export packaging, foam cushioning, ESD (Electro Static Discharge) materials, folding no-nail boxes, collapsible wooden crates, wooden pallet collars, VCI packaging, and a range of bespoke packaging choices.

For Instance,

- In January 2021, Nefab Group AB strengthened its global market presence and dedication to resource conservation in supply chains by acquiring PolyFlex Products, Inc., a well-known American industry leader specialising in ecologically friendly returnable solutions.

IFCO has the broadest product offering of pooled returnable packaging solutions of any provider. We offer Returnable Packaging Containers (RPCs) in various sizes to fit all types of fresh food. They offer optimized methods for fresh fruit and vegetables, bananas, animal products, and seafood such as shellfish, eggs, and baked.

For Instance,

- In February 2024, IFCO, the world's top manufacturer of Returnable packaging containers (RPCs), announced the successful purchase of BEPCO, a well-known Returnable packaging pooling firm headquartered in Tallinn, Estonia.

Returnable Transport Packaging Market Companies

Returnable Transport Packaging Market Segments

By Material

- Plastic

- Metal

- Wood

By Product

- Drums & Barrels

- Containers

- Pallets

- Crates, Totes, Trays & Bins

- Intermediate Bulk Containers (IBC's)

- Others

By End Use

- Industrial

- Automotive

- Food and Beverages

- Consumer Goods

- Others

By Region

- North America

- Asia Pacific

- Europe

- LA

- MEA

Tags

FAQ's

Select User License to Buy

Figures (3)